For employees, coverage in a qualified employer retirement plan is a valuable fringe benefit, as employer contributions are tax free within specified limits. Certain salary-reduction plans allow you to make elective deferrals of salary that are not subject to income tax. An advantage of all qualified retirement plans is that earnings accumulate tax free until withdrawal.

Along with tax savings opportunities come technical restrictions and pitfalls. For example, retirement plan distributions eligible for rollover are subject to a mandatory 20% withholding tax if you receive the distribution instead of asking your employer to make a direct trustee-to-trustee transfer of the distribution to an IRA or another qualified employer plan.

This chapter discusses tax treatment of annuities and employer plan distributions, including how to avoid tax penalties, such as for distributions before age 59½. These distribution rules also generally apply to plans for self-employed individuals; retirement plans for self-employed individuals are discussed further in Chapter 41.

IRAs are discussed in Chapter 8.

A tax credit is available to low-to-moderate income taxpayers who make traditional or Roth IRA contributions, electives deferrals to a 401(k) or other employer plan, and voluntary after-tax contributions to a qualified plan. The credit is discussed in Chapter 25.

Table 7-1 Key to Tax-Favored Retirement Plans

Type— |

General Tax Considerations— |

Tax Treatment of Distributions— |

Company qualified plan |

A company qualified pension or profit-sharing plan offers these benefits: (1) You do not realize current income on your employer’s contributions to the plan on your behalf. (2) Income earned on funds contributed to your account compounds tax free. (3) Your employer may allow you to make voluntary after-tax contributions. Although these contributions may not be deducted, income earned on the voluntary contributions is not taxed until withdrawn. |

If you collect your retirement benefits as an annuity over a period of years, the part of each payment allocable to your investment is tax free and the rest is taxable (7.25). If you receive a lump-sum payment from the plan, the distribution is generally taxable except to the extent of after-tax contributions you made. Taxable distributions before age 59½ are generally subject to penalties, but there are exceptions (7.13). However, you can avoid immediate tax by making a rollover to a traditional IRA or to another company plan (7.5). If the lump-sum distribution includes company securities, unrealized appreciation on those securities is not taxed until you finally sell the stock (7.8). If you were born before January 2, 1936, and receive a lump sum, tax on employer contributions and plan earnings may be reduced by a special averaging rule (7.3). |

Plans for self-employed |

You may set up a qualified self-employed retirement plan if you earn self-employment income through your performance of personal services. You may deduct contributions up to limits discussed in Chapter 41; income earned on assets held by the plan is not taxed. You must include employees in your plan under rules explained in Chapter 41. Other retirement plan options, such as a SEP or SIMPLE plan, are also discussed in Chapter 41. |

You may not withdraw plan funds until age 59½ unless you are disabled or meet other exceptions at 7.13. Qualified distributions to self-employed persons or to beneficiaries at death may qualify for favored lump-sum treatment (7.2). Distributions from a SEP are subject to traditional IRA rules (8.8). Distributions from a SIMPLE-IRA also are subject to traditional IRA rules, but a 25% penalty (instead of 10%) applies to pre-age-59½ distributions in the first two years (8.18). |

IRA and Roth IRA |

Anyone who has earned income may contribute to a traditional IRA, but the contribution is deductible only if certain requirements are met. Your status as a participant in an employer retirement plan and your income determine whether you may claim a deduction up to the annual contribution limit (for 2017, $5,500, or $6,500 if age 50 or older), a partial deduction, or no deduction at all. See Chapter 8 for these deduction limitations. Income earned on IRA accounts is not taxed until the funds are withdrawn. This tax-free buildup of earnings also applies where you make nondeductible contributions to a Roth IRA under the rules in Chapter 8. |

Traditional IRA distributions are fully taxable unless you have previously made nondeductible contributions (8.9). A taxable withdrawal before age 59½ is subject to a 10% penalty, but there are exceptions if you are disabled, have substantial medical expenses, pay medical premiums while unemployed, or receive payments in a series of substantially equal installments; see the details on these and other exceptions (8.12). Starting at age 70½, you must receive minimum annual distributions to avoid a 50% penalty (8.13). Distributions from a Roth IRA of contributions are tax free. Distributions of earnings are also tax free after you are over age 59½ and have held the account for at least five years (8.24). |

Simplified Employee Plan (SEP) |

Your employer may set up a SEP and contribute to an IRA more than you can under regular IRA rules (8.15). You are not taxed on employer contributions of up to 25% of your compensation (but no more than $54,000 for 2017). Elective deferrals of salary may be made to qualifying plans set up before 1997 (8.16). |

Withdrawals from a SEP are taxable under the rules explained above for IRAs. |

Deferred salary or 401(k) plans |

If your company has a profit-sharing or stock bonus plan, the tax law allows the company to add a cash or deferred pay plan that can operate in one of two ways: (1) Your employer contributes an amount for your benefit to your trust account. (2) You agree to take a salary reduction or to forego a salary increase. The reduction is placed in a trust account for your benefit and is treated as your employer’s contribution, which is tax free within an annual limit (7.18). Income earned on your trust account accumulates tax free until it is withdrawn. |

Withdrawals are penalized unless you have reached age 59½, become disabled, or meet other exceptions (7.13). If you were born before January 2, 1936, and receive a qualifying lump sum (7.3), or you receive a qualifying lump sum as the beneficiary of a plan participant born before January 2, 1936 (7.4), tax on the lump sum may be computed using a special averaging rule. |

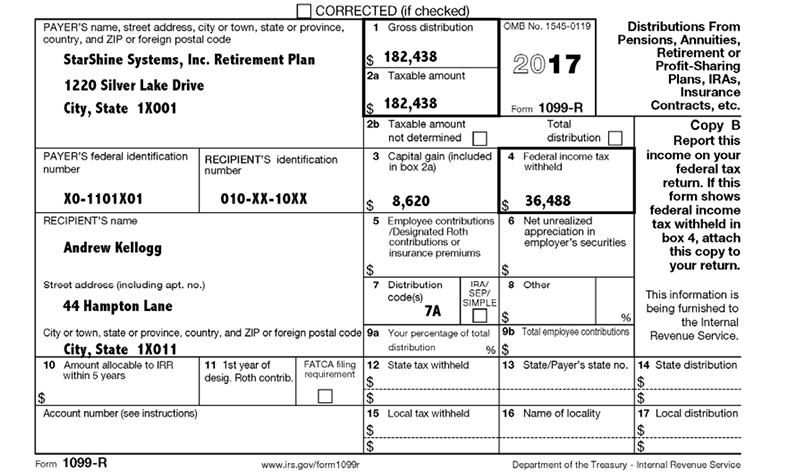

7.1 Retirement Distributions on Form 1099-R

On Form 1099-R, payments from pensions, annuities, IRAs, Roth IRAs, SIMPLE IRAs, insurance contracts, profit-sharing, and other qualified corporate and self-employed plans are reported to you and the IRS. Social Security benefits are reported on Form SSA-1099; see Chapter 34 for the special rules to apply in determining the taxable portion of Social Security benefits.

Here is a guide to the information reported on Form 1099-R. A sample form is on the next page.

Box 1. The total amount received from the payer is shown here without taking any withholdings into account. If you file Form 1040, report the Box 1 total on Line 15a if the payment is from an IRA, or on Line 16a if from a pension or an annuity. However, if the amount is a qualifying lump-sum distribution for which you are claiming averaging, use Form 4972 (7.3).

If you file Form 1040A, report the Box 1 total on Line 11a if from an IRA or on Line 12a if from a pension or an annuity.

If an exchange of insurance contracts was made, the value of the contract will be shown in Box 1, but if the exchange qualified as tax free, a zero taxable amount will be shown in Box 2a and Code 6 will be entered in Box 7.

Boxes 2a and 2b. The taxable portion of distributions from employer plans and insurance contracts may be shown in Box 2a. The taxable portion does not include your after-tax contributions to an employer plan or insurance premium payments.

If the payer cannot figure the taxable portion, the first box in 2b should be checked (“Taxable amount not determined”); Box 2a should be blank. You will then have to figure the taxable amount yourself. A 2017 payment from a pension or an annuity is only partially taxed if you contributed to the cost and you did not recover your entire cost investment before 2017. See the discussion of commercial annuities (7.21) or employee annuities (7.25) for details on computing the taxable portion if you have an unrecovered investment.

The payer of a traditional IRA distribution will probably not compute the taxable portion, and in this case, the total distribution from Box 1 should be entered as the taxable portion in Box 2a, with a check in Box 2b for “Taxable amount not determined”. The total distribution amount is fully taxable unless you have made nondeductible contributions, in which case Form 8606 is used to figure the taxable portion of the distribution (8.9). Form 8606 is also used to figure the taxable part, if any, of a Roth IRA distribution (8.24).

If the payment is from an employer plan and the “total distribution” box has been checked in 2b, see the discussion of possible rollover options (7.2, 7.5). If you were born on or before January 1, 1936,10-year averaging is available for a lump sum (7.2). The taxable amount in Box 2a should not include net unrealized appreciation (NUA (7.8)) in any employer securities included in the lump sum or the value of an annuity contract included in the distribution.

Box 3. If the payment is a lump-sum distribution, you were born before January 2, 1936, and you participated in the plan before 1974, or if you are the beneficiary of such a person, you may treat the amount shown in Box 3 as capital gain subject to a 20% rate (7.3).

Box 4. Any federal income tax withheld is shown here. Do not forget to include it on Line 64 of Form 1040 or Line 40 of Form 1040A. If Box 4 shows any withholdings, attach Copy B of Form 1099-R to your return.

Box 5. If you made after-tax contributions to your employer’s plan, or paid premiums for a commercial annuity or insurance contract, your contribution is shown here, less any such contributions previously distributed. IRA or SEP contributions (see Chapter 8) are not shown here.

Box 6. If you received a qualifying lump-sum distribution that includes securities of your employer’s company, the total net unrealized appreciation (NUA) is shown here. Unless you elect to pay tax on it currently (7.8), this amount is not taxed until you sell the securities. If you did not receive a qualifying lump sum, the amount shown here is the net unrealized appreciation attributable to your after-tax employee contributions, which are also not taxed until you sell the securities (7.8).

Box 7. In Box 7, the payer will indicate if the distribution is from a traditional IRA, SEP, or SIMPLE and enter codes that are used by the IRS to check whether you have reported the distribution correctly, including the penalty for distributions before age 59½.

If you are at least age 59½, Code 7 should be entered; this indicates that you received a “normal” distribution not subject to the 10% early distribution penalty (7.13). If Code 1 is entered, this indicates that you were under age 59½ at the time of the distribution and, as far as the payer knows, no exception to the early distribution penalty applies. However, the fact that Code 1 is entered does not mean that a penalty exception is not available. For example, you may qualify for the medical expense exception (7.13) or you may have made a tax-free 60-day rollover instead of having your employer make a direct rollover (7.5).

Code 2 will be entered in Box 7 if you are under age 59½ and the payer knows that you do qualify for an exception to the early distribution penalty, such as the exception for separation of service after age 55 for an employer-plan distribution, or the distribution is part of a series of substantially equal payments. Code 3 will be used if the disability exception applies. If you are the beneficiary of a deceased employee, the early distribution penalty does not apply to your distribution; Code 4 should be entered to indicated that the exception for beneficiaries applies.

If the employer made a direct rollover, Code G will be entered; however, Code H is used for a direct rollover from a designated Roth account to a Roth IRA.

If an annual IRA contribution was recharacterized from one type of IRA to another (8.21), either Code N or R will be entered. For example, on Form 1099-R for 2017, Code N is entered if the original contribution and recharacterization were both made in 2017, and Code R is entered if the original contribution was for 2016 and the recharacterization was in 2017.

If you contributed to a 401(k) plan and are a highly compensated employee, your employer may have made a corrective distribution to you in 2017 of contributions (and allocable income) that exceed allowable nondiscrimination ceilings. In this case, the employer will enter Code 8 if the corrective distribution is taxable in 2017, Code P if taxable in 2016.

If you receive a lump-sum distribution that qualifies for special averaging, Code A will be entered. See the sample Form 1099-R below and the discussion of the special averaging rules (7.3).

Box 8. If the value of an annuity contract was included as part of a lump sum you received, the value of the contract is shown here. It is not taxable when you receive it and should not be included in Boxes 1 and 2a. For purposes of computing averaging on Form 4972, this amount is added to the ordinary income portion of the distribution (7.3).

Box 9. If several beneficiaries are receiving payment from an employer plan total distribution, the amount shown in Box 9a is your share of the distribution. Box 9b may show your after-tax contributions to your employer’s plan

Box 10. A distribution from a designated Roth account allocable to an in-plan Roth rollover is reported here.

Boxes 12–15. The payer may make entries in these boxes to show state or local income tax withholdings.

See the Andrew Kellogg Example (7.3)

7.2 Lump-Sum Distributions

If you are entitled to a lump-sum distribution from a qualified company or self-employed retirement plan, you may avoid current tax by asking your employer to make a direct rollover of your account to an IRA or another qualified employer plan. If the distribution is made to you, 20% will be withheld, but it may still be possible to make a tax-free rollover within 60 days (7.5).

If you receive a lump sum and do not make a rollover, the taxable part of the distribution (shown in Box 2a of Form 1099-R) must be reported as ordinary pension income on your return unless you were born before January 2, 1936, and qualify for special averaging, as discussed in 7.3. Your after-tax contributions and any net unrealized appreciation (NUA (7.8)) in employer securities that are included in the lump sum are recovered tax free; they are not part of the taxable distribution.

A taxable distribution before age 59½ is subject to a 10% penalty in addition to regular income tax, unless you qualify for an exception (7.13).

Spousal consent to lump-sum distribution. If you are married, you may have to obtain your spouse’s consent to elect a lump-sum distribution (7.9).

Withholding tax. An employer must withhold a 20% tax from a lump-sum distribution that is paid to you and not rolled over directly by the employer to a traditional IRA or another employer plan (7.5).

Beneficiaries. If you are the surviving spouse of a deceased plan participant (employee or self-employed) and receive a lump-sum distribution from his or her account, you can roll over the distribution to another qualified employer plan or to your own IRA. If you are a nonspouse beneficiary of a lump-sum distribution, you may instruct the plan to make a direct trustee-to-trustee transfer to an IRA that must be treated as an inherited IRA (7.6).

If you are the beneficiary of a deceased employee who was born before January 2, 1936, you may elect special averaging or capital gain treatment for a lump-sum distribution of the account (7.4), unless the distribution is disqualified.

Court ordered lump-sum distribution to a spouse or former spouse. If you are the spouse or former spouse of an employee and you receive a distribution under a qualified domestic relations order (QDRO), you may be eligible for a tax-free rollover or, in some cases, special averaging treatment (7.10).

7.3 Lump-Sum Options If You Were Born Before January 2, 1936

If you were born before January 2, 1936, and receive a qualified lump-sum distribution (defined below) from your employer’s plan, you may be able to figure your tax on the distribution using the 10-year averaging method. If you participated in the plan before 1974, you may be able to apply a 20% capital gain rate to the pre-1974 part of a qualifying lump-sum distribution if 20% is lower than the averaging rate or your regular rate. The averaging and capital gain elections are allowed only once; if you previously used averaging (10-year or prior law 5-year averaging) for a lump-sum distribution received as a plan participant after 1986, you are barred from electing averaging again for a current lump-sum distribution. You may also be disqualified from making the averaging and capital gain elections because you did not participate in the plan for more than five years or because rollovers were previously made to or from the same employer plan; see “Disqualified distributions” below.

If you receive a lump-sum distribution as the beneficiary of a deceased plan participant who was born before January 2, 1936, you generally may elect averaging or capital gain treatment for the distribution unless it is disqualified as discussed below. Note that although a distribution made in the first five years of plan participation is a disqualification event for the participant while alive, this does not prevent a beneficiary from electing averaging or capital gain treatment that is otherwise available.

Lump-sum distribution defined. A lump-sum distribution is the payment within a single taxable year of a plan participant’s entire balance from an employer’s qualified plan. If the employer has more than one qualified plan of the same kind (profit-sharing, pension, stock bonus), you must receive the balance from all of them within the same year. A series of payments may qualify as a lump-sum distribution provided you receive them within the same tax year.

The account balance does not include deductible voluntary contributions you made after 1981 and before 1987; these are not treated as part of a lump-sum distribution and thus are not eligible for 10-year averaging (7.4) or the 20% capital gain election; see below.

If you receive more than one lump sum during the year that is eligible for averaging, you must make the same choice for all of them. If you deferred tax for one lump sum in 2017 by rolling it over, you may not claim averaging on your 2017 return for another lump sum.

If you make a rollover to an IRA, you cannot change your mind and cancel the IRA account in order to apply special averaging. The rollover election is irrevocable, according to an IRS regulation that has been upheld by the Tax Court. If an IRA rollover account is revoked, the entire distribution is taxable as ordinary income.

Disqualified distributions. Even if you receive a lump-sum distribution and meet the age test, averaging and capital gain treatment are not allowed if any of the following are true: (1) you rolled over any part of the lump-sum distribution to an IRA or an employer qualified plan; (2) you received the distribution during the first five years that you participated in the plan; (3) you previously received a distribution from the same plan and you rolled it over tax free to an IRA or another qualified employer plan; (4) you elected 10-year or five-year averaging or capital gain treatment for any other lump-sum distribution after 1986; (5) after 2001, you rolled over to the same plan a distribution from a traditional IRA (other than a conduit IRA, an IRA that held a only a prior distribution and earnings on the distribution), a 403(b) plan (7.19), or a governmental 457 plan (7.20); or (6) after 2001 you rolled over to the same plan a distribution that you received as a surviving spouse from the qualified plan of your deceased spouse.

Electing averaging for a qualifying lump sum. If you were born before January 2, 1936, and you received a lump-sum distribution that is not disqualified from averaging as discussed above, you may elect on Form 4972 to compute the tax on a lump-sum distribution received using a 10-year averaging method based on 1986 tax rates for single persons. Follow the IRS instructions to Form 4972 for applying the 10-year averaging method. If you received more than one qualified lump sum, you may elect averaging for one of the distributions only if you elect averaging for all.

If you were born after January 1, 1936, you may not elect averaging for a lump-sum distribution of your account balance. However, you may elect averaging as the beneficiary of a deceased plan participant who was born before January 2, 1936.

The amount eligible for averaging is the taxable portion of the distribution shown in Box 2a of Form 1099-R. You may also elect to add to the Box 2a amount any net unrealized appreciation in employer securities (shown in Box 6) included in the lump sum. If you are receiving the distribution as a beneficiary of a plan participant who died before August 21, 1996, follow the instructions to Form 4972 for claiming a death benefit exclusion that reduces the Box 2a taxable portion.

If the distribution includes capital gain (Box 3 of Form 1099-R) and you want to apply the special 20% capital gain rate (see below), you should subtract the capital gain in Box 3 from the taxable amount in Box 2a and apply averaging to the balance of ordinary income.

The tax computed on Form 4972 is reported on Form 1040, Line 44, as an additional tax. It is completely separate from the tax computed on your other income reported on Form 1040.

See the Andrew Kellogg Example and the Sample Form 4972 below.

Capital gain treatment for pre-1974 participation. The portion of a qualifying lump-sum distribution attributable to pre-1974 participation is eligible for a 20% capital gain rate if you were born before January 2, 1936, and the distribution is not disqualified.

If you were born after January 1, 1936, you may not treat any portion of a lump-sum distribution as capital gain. You may not apply the flat 20% rate to the pre-1974 portion of the lump-sum distribution on Form 4972, or include any part of it as capital gain on Schedule D.

On Form 1099-R, the plan paying the lump-sum distribution shows the capital gain portion in Box 3. The ordinary income portion is Box 2a (taxable amount) minus Box 3. If you elect to treat the pre-1974 portion as capital gain subject to a flat rate of 20% on Form 4972, the tax on the balance of the distribution may be figured under the averaging method, or it may be reported as regular pension income on Form 1040, Line 16b. The 20% rate for the capital gain portion is fixed by law, and applies regardless of the tax rate imposed on your other capital gains. Alternatively, you may elect to treat the capital gain portion as ordinary income eligible for averaging on Form 4972. You may not elect to report any portion of the pre-1974 portion of the lump-sum distribution as long-term capital gain on Schedule D.

Under the one-time election rule, if you elect to apply the averaging and/or 20% capital gain rule for a current distribution, you may not elect averaging or capital gain treatment for any later distribution.

Community property. Only the spouse who has earned the lump sum may use averaging. Community property laws are disregarded for this purpose. If a couple files separate returns and one spouse elects averaging, the other spouse is not taxed on the amount subject to the computation.

7.4 Lump-Sum Payments Received by Beneficiary

If you receive a qualifying lump-sum distribution as the beneficiary of a deceased employee or self-employed plan participant who was not your spouse, you may instruct the plan to make a direct trustee-to-trustee transfer to an IRA that must be treated as an inherited IRA . If you are the surviving spouse, you can roll over the distribution to another qualified employer plan or to your own IRA.

Was the plan participant born before January 2, 1936? If you are the beneficiary of a deceased employee who was born before January 2, 1936, and receive a qualifying lump-sum distribution of that person’s account, you may elect special averaging or capital gain treatment for the lump-sum unless the distribution is disqualified as discussed in 7.3. Your age is irrelevant. If the deceased employee was in the plan for less than five years, you may still elect averaging as his or her beneficiary, although less than five years of participation would have disqualified (7.3) the distribution from lump-sum treatment had the distribution been received by the employee. If the participant was born before January 2, 1936, and had participated in the plan before 1974, you may elect a 20% capital gain rate for the pre-1974 portion of the distribution and apply the averaging method to the balance (7.3). You may not claim averaging or capital gain treatment for a lump-sum distribution if the plan participant was born after January 1, 1936.

Form 4972 is used to compute tax under the averaging method or to make the 20% capital gain election (7.3). Follow the Form 4972 instructions to claim the up-to-$5,000 death benefit exclusion where the plan participant died before August 21, 1996. Any federal estate tax attributable to the distribution reduces the taxable amount on Form 4972.

A lump sum paid because of an employee’s death may qualify for capital gain and averaging treatment, although the employee received annuity payments before death.

An election may be made on Form 4972 only once as the beneficiary of a particular plan participant. If you receive more than one lump-sum distribution as beneficiary for the same participant in the same year, you must treat them all the same way. Averaging must be elected for all of the distributions on a single Form 4972 or for none of them.

Payment received by a second beneficiary (after the death of the first beneficiary) is not entitled to lump-sum treatment.

Distribution to trust or estate. If a qualifying lump sum is paid to a trust or an estate, the employee, or, if deceased, his or her personal representative, may elect averaging.

7.5 Tax-Free Rollovers From Qualified Plans

A rollover allows you to make a tax-free transfer of a distribution from a qualified retirement plan to another qualified plan that accepts rollovers or to a traditional IRA. For rollover purposes, a 403(b) plan (7.19), or a state or local government 457 plan (7.20) is treated as a qualified retirement plan. If a rollover is made to a traditional IRA, later distributions received from the IRA are taxable under the IRA rules (8.8). A tax-free rollover can be made from a qualified retirement plan to a SIMPLE IRA after the first two years of participation in the SIMPLE IRA (8.18).

The rollover rules below and in 7.6 apply whether you are an employee or are self employed.

Eligible rollover distributions. Almost all taxable distributions received from a qualified corporate or self-employed pension, profit-sharing, stock bonus, or annuity plan are eligible for tax-free rollover. Exceptions include substantially equal periodic payments over your lifetime or over a period of at least 10 years, hardship distributions, and minimum distributions (7.11) required after age 70½; see below for the list of ineligible distributions.

Rollover of after-tax contributions. When you are entitled to take distributions, after-tax contributions that you have made to the plan may be rolled over to a traditional IRA or to a Roth IRA. A trustee-to-trustee transfer of after-tax contributions may also be made to a qualified defined contribution plan, a defined benefit plan, or a 403(b) tax-sheltered annuity that separately accounts for the after-tax amount.

The IRS has provided a method for making a direct rollover of after-tax contributions to a Roth IRA while directly rolling the pre-tax portion of the account (pre-tax contributions plus the earnings on all contributions) to a traditional IRA; see “Allocating a direct rollover between pre-tax and after-tax contributions” in 7.6.

Rollover options: direct rollover or personal rollover. If you want to make a tax-free rollover of an eligible rollover distribution, you should instruct your employer to directly roll over the funds to a traditional IRA you designate or to the plan of your new employer. You could also choose to have the distribution paid to you, and within 60 days you could make a tax-free rollover yourself. However, to avoid the 20% mandatory withholding tax, you must elect to have the plan make a direct rollover. If an eligible rollover distribution is paid to you, the 20% withholding tax applies. Before a distribution is made, your plan administrator must provide you with written notice concerning the rollover options and the withholding tax rules. See 7.6 for further details on the direct rollover and personal rollover alternatives.

Rollover of distribution from designated Roth account. An eligible rollover distribution from a designated Roth account may be rolled over to a Roth IRA. A qualified (nontaxable) distribution from a designated Roth account may be rolled over to another designated Roth account in a different plan, but only in a direct rollover (7.6). For further details on distributions from designated Roth accounts, including rollovers, see 7.18.

Rollover from qualified retirement plan to traditional IRA after age 70½. Starting with the year you reach age 70½, you may no longer make contributions to a traditional IRA. However, if you are over age 70½ and you expect to receive an eligible rollover distribution from your employer’s plan (including a plan for self-employed participants), you may avoid tax on the distribution by instructing your plan administrator to make a direct rollover of the distribution to a traditional IRA (7.6). If you receive the distribution from the employer, a 20% tax will be withheld. You may then make a tax-free rollover within 60 days of the distribution; see the discussion of “personal rollovers” (7.6). After the year of the rollover, you must receive a required minimum distribution from the IRA (8.13).

Beneficiaries. See the discussion of rollover options open to beneficiaries (7.6).

Distributions that are not eligible for rollover. Any lump-sum or partial distribution from your account is eligible for rollover except for the following:

- Hardship distributions from a 401(k) plan or 403(b) plan (7.17).

- Payments that are part of a series of substantially equal payments made at least annually over a period of 10 years or more or over your life or life expectancy (or the joint lives or joint life and last survivor expectancies of you and your designated beneficiary).

- Minimum required distributions after attaining age 70½ or retiring (7.11).

- Corrective distributions of excess 401(k) plan contributions and deferrals.

- Dividends on employer stock.

- Life insurance coverage costs.

- Loans that are deemed to be taxable distributions because they exceed the limits discussed in 7.14.

For all of the above taxable distributions that are ineligible for rollover, you may elect to completely avoid withholding on Form W-4P (26.9).

7.6 Direct Rollover or Personal Rollover

If you are an employee or a self-employed person entitled to an eligible rollover distribution (7.5) from a qualified plan, you may choose a direct rollover, or if you actually receive the distribution you may make a personal rollover within 60 days. To avoid withholding, choose a direct rollover. You must receive a written explanation of your rollover rights from your plan administrator before an eligible rollover distribution is made.

Rollover to Roth IRA. An eligible rollover distribution from a qualified employer plan, 403(b) plan, or governmental 457 plan may be rolled over to a Roth IRA,but the rollover is not tax free. A rollover to a Roth IRA, like a conversion from a traditional IRA, is a taxable distribution except to the extent it is allocable to after-tax contributions (8.23).

Direct Rollover From Employer Plan

If you choose to have your plan administrator make a direct rollover of an eligible rollover distribution to a traditional IRA or another eligible employer plan, you avoid tax on the payment and no tax will be withheld. If you are changing jobs and want a direct rollover to the plan of the new employer, make sure that the plan accepts rollovers; if it does not, choose a direct rollover to a traditional IRA.

When you select the direct rollover option, your plan administrator may transfer the funds directly by check or electronically to the new plan, or you may be given a check payable to the new plan that you must deliver to the new plan.

In choosing a direct rollover to a traditional IRA, the terms of the plan making the payment will determine whether you may divide the distribution among several IRAs or whether you will be restricted to one IRA. For example, if you are entitled to receive a lump-sum distribution from your employer’s plan, you may want to split up your distribution into several traditional IRAs, but the employer may force you to select only one. After the direct rollover is made, you may then diversify your holdings by making tax-free trustee-to-trustee transfers to other traditional IRAs.

You may elect to make a direct rollover of part of your distribution and to receive the balance. The portion paid to you will be subject to 20% withholding and is not eligible for special averaging. Withholding is generally not required on distributions of less than $200.

A direct rollover will be reported by the payer plan to the IRS and to you on Form 1099-R, although the transfer is not taxable. The direct rollover will be reported in Box 1 of Form 1099-R, but zero will be entered as the taxable amount in Box 2a. In Box 7, Code G should be entered.

Allocating a direct rollover between pre-tax and after-tax contributions. If you have made after-tax contributions as well as pre-tax elective deferrals to the plan, the IRS has provided guidelines that allow you to transfer only the after-tax contributions to a Roth IRA, in what amounts to a tax-free conversion, while moving the pre-tax portion of the account to a traditional IRA in a tax-free rollover. These rules, in IRS Notice 2014-54, apply to distributions from 401(k) plans, 403(b) plans, and governmental Section 457 plans. Final regulations apply the Notice 2014-54 allocation rules to distributions from designated Roth accounts (T.D. 9769, 2016-23 IRB 1020).

The guidelines allow you to make a direct rollover to more than one plan and to select which funds (pre-tax or after-tax) are going into which plan, provided both of these conditions are met: (1) all the transfers are scheduled to be made at the same time, apart from reasonable delays to facilitate plan administration, and (2) you inform the plan administrator of your allocation prior to the time of the direct rollovers.

Personal Rollover After Receiving a Distribution

If you do not tell your plan administrator to make a direct rollover of an eligible rollover distribution, and you instead receive the distribution yourself, you will receive only 80% of the taxable portion (generally the entire distribution unless you made after-tax contributions); 20% will be withheld. Withholding does not apply to the portion of the distribution consisting of net unrealized appreciation from employer securities that is tax-free (7.8). Remember to include the withheld 20% on your tax return as federal income tax withheld (in the “Payments” section of Form 1040), so that it can be treated as a credit against the tax otherwise owed.

Although you receive only 80% of the taxable eligible rollover distribution, the full amount before withholding will be reported as the gross distribution in Box 1 of Form 1099-R. To avoid tax you must roll over the full amount within 60 days to a traditional IRA or another eligible employer plan. However, to roll over 100% of the distribution you will have to use other funds to replace the 20% withheld. If you roll over only the 80% received, the 20% balance will be taxable; see the John Anderson Example below. For the taxable part that is not rolled over, you may not use special averaging or capital gain treatment even if you meet the age test (7.3). In addition, if the distribution was made to you before you reached age 59½, the taxable amount will be subject to a 10% penalty unless you are disabled, separating from service after reaching age 55, or have substantial medical expenses; see the full list of exceptions below (7.13).

If a distribution includes your voluntary after-tax contributions to the qualified plan, they are tax free to you if you keep them. However, after-tax contributions may be rolled over to a qualified plan or a 403(b) plan that separately accounts for the after-tax amounts.

A rollover may include salary deferral contributions that were excludable from income when made, such as qualifying deferrals to a 401(k) plan. The rollover may also include accumulated deductible employee contributions (and allocable income) made after 1981 and before 1987. A qualified retirement plan may invest in a limited amount of life insurance which is then distributed to you as part of a lump-sum retirement distribution. You may be able to roll over the life insurance contract to the qualified plan of a new employer, but not to a traditional IRA. The law bars investment of IRA funds in life insurance contracts.

You may not claim a deduction for your rollover.

Multiple rollover accounts allowed. You may wish to diversify a distribution in different investments. There is no limit on the number of rollover accounts you may have. A lump-sum distribution from a qualified plan may be rolled over to several traditional IRAs.

Reporting a personal rollover on your return. When you receive a distribution that could have been rolled over, the payer will report on Form 1099-R the full taxable amount before withholding, although 20% has been withheld. However, if you make a rollover yourself within the 60-day period, the rollover reduces the taxable amount on your tax return. For example, if in 2017 you were entitled to a $100,000 lump-sum distribution and received $80,000 after mandatory 20% withholding and then within 60 days you rolled over the full $100,000 into a traditional IRA, report $100,000 on Line 16a (pensions and annuities) of Form 1040 for 2017 or Line 12a of Form 1040A, but enter zero as the taxable amount on Line 16b or Line 12b and write “Rollover” next to the line. If you roll over only part of the distribution, the amount of the lump sum not rolled over is entered as the taxable amount. Remember to include the 20% withholding on the line for federal income tax withheld.

IRS may waive 60-day deadline for personal rollover on equitable grounds. Generally, a personal rollover must be completed by the 60th day following the day on which you receive a distribution from the qualified plan. However, the IRS has discretion to waive the 60-day deadline and permit more time for a rollover where failure to complete a timely rollover was due to events beyond your reasonable control.

You may be able to use a self-certification procedure provided by the IRS to obtain a waiver of the 60-day deadline if you have one or more of 11 acceptable reasons for being late. The self-certification guidelines, which also apply to rollovers from traditional IRAs, as well as the other IRS waiver guidelines, are discussed in 8.10.

Extension of 60-day rollover period for frozen deposits. If you receive a qualifying distribution from a retirement plan and deposit the funds in a financial institution that becomes bankrupt or insolvent, you may be prevented from withdrawing the funds in time to complete a rollover within 60 days. If this happens, the 60-day period is extended while your account is “frozen.” The 60-day rollover period does not include days on which your account is frozen. Further, you have a minimum of 10 days after the release of the funds to complete the rollover.

Rollover by Beneficiary

Surviving spouse. If you are your deceased spouse’s beneficiary, you have the same rollover options that your spouse would have had for a distribution. You may choose to have the plan make a direct rollover to your own traditional IRA. The advantage of choosing the direct rollover is to avoid a 20% withholding tax. If the distribution is paid to you, 20% will be withheld. You may make a rollover within 60 days, but to completely avoid tax, you must include in the rollover the withheld amount, as illustrated in the John Anderson Example above. If you receive the distribution but do not make the rollover, you will be taxed on the distribution, except for any amount allocable to after-tax contributions. If your spouse was born before January 2, 1936, you may be able to use special averaging (7.4) to compute the tax on the distribution. You are not subject to the 10% penalty for early distributions (7.13) even if you are under age 59½.

You can roll over the distribution to a Roth IRA but the rollover is taxable under the rules for conversions from traditional IRAs (8.22).

You may also roll over a distribution from your deceased spouse’s account to your own qualified plan, 403(a) qualified annuity, 403(b) tax-sheltered annuity, or governmental section 457 plan. However, if you were born before January 2, 1936, are still working, and want to preserve the option of electing averaging or capital gain treatment (for pre-1974 participation) for a later distribution from your employer’s qualified plan (7.3), you should not roll over your deceased spouse’s account to your employer’s qualified plan. If the rollover is made to your employer’s qualified plan, a lump-sum distribution from the plan will not be eligible for averaging or capital gains treatment.

Rollover of distribution received under a divorce or support proceeding. In a qualified domestic relations order (QDRO) meeting special tax law tests, a state court may give you the right to receive all or part of your spouse’s or former spouse’s retirement benefits. If you are entitled to receive an eligible rollover distribution, you can instruct the plan to make a direct rollover (see above) to a traditional IRA or to your employer’s qualified plan if it accepts rollovers. If the distribution is paid to you, 20% withholding will apply. You may complete a rollover within 60 days under the rules for personal rollovers discussed earlier. If you do not make the rollover, the distribution you receive is taxable. If only part of the distribution is rolled over, the balance is taxed as ordinary income in the year of receipt. In figuring your tax, you are allowed a prorated share of your former spouse’s cost investment, if any. If your spouse or former spouse was born before January 2, 1936, and you receive a lump-sum distribution that would have been eligible for special averaging (7.3) had he or she received it, you may use the averaging method to figure the tax on the distribution. You are not subject to the 10% penalty for early distributions (7.13) even if you are under age 59½.

Nonspouse beneficiaries. If you are entitled as a nonspouse beneficiary to receive a distribution from a qualified plan, 403(b) plan, or governmental 457 plan, the plan must allow you to roll it over to an IRA in a trustee-to-trustee transfer. The IRA must be treated as an inherited IRA subject to the required minimum distribution (RMD) rules for nonspouse beneficiaries (8.14). This means that you will have to begin receiving RMDs from the inherited IRA by the end of the year following the year of the plan participant’s death (8.14).

7.7 Rollover of Proceeds From Sale of Property

A lump-sum distribution from a qualified plan may include property, such as non-employer stock; see 7.8 for employer securities. If you plan to roll over the distribution, you may find that a bank or other plan trustee does not want to take the property. You cannot get tax-free rollover treatment by keeping the property and rolling over cash to the new plan. If you sell the property, you may roll over the sale proceeds to a traditional IRA as long as the sale and rollover occur within 60 days of receipt of the distribution. If you roll over all of the proceeds, you do not recognize a gain or loss from the sale; the proceeds are treated as part of the distribution. If you make a partial rollover of sale proceeds, you must report as capital gain the portion of the gain that is allocable to the retained sale proceeds.

If you receive cash and property, and you sell the property but only make a partial rollover, you must designate how much of the rolled-over cash is from the employer distribution and how much from the sale proceeds. The designation must be made by the time for filing your return (plus any extensions) and is irrevocable. If you do not make a timely designation, the IRS will allocate the rollover between cash and sales proceeds on a ratable basis; the allocation will determine tax on the retained amount.

7.8 Distribution of Employer Stock or Other Securities

If you are entitled to a distribution from a qualified plan that includes employer stock (or other employer securities), you may be able to take advantage of a special exclusion rule. If you withdraw the stock from the plan as part of a lump-sum distribution and invest the stock in a taxable brokerage account instead of rolling it over to a traditional IRA, tax on the “net unrealized appreciation,” or NUA, may be deferred until you sell the stock. To defer tax on the full NUA, the employer stock must be received in a lump-sum distribution, as discussed below. If the distribution is not a lump sum, a less favorable NUA exclusion is available, but only if you made after-tax contributions to buy the shares; see below.

Lump-sum distribution. If you receive appreciated stock or securities as part of a lump-sum distribution, net unrealized appreciation (increase in value since purchase of securities) is not subject to tax at the time of distribution unless you elect to treat it as taxable.

For purposes of the NUA exclusion, a lump-sum distribution is the payment within a single year of the plan participant’s entire balance from all of the employer’s qualified plans of the same kind (all of the employer’s profit-sharing plans, or all pension or stock bonus plans). The distribution must be paid to: (1) a participant after reaching age 59½, (2) an employee-participant who separates from service (by retiring, resigning, changing employers, or being fired), (3) a self-employed participant who becomes totally and permanently disabled, or (4) a beneficiary of a deceased plan participant. If there is any plan balance at the end of the year, there is no lump sum and the NUA exclusion is not available.

Assuming you do not waive the NUA exclusion, you are taxed (at ordinary income rates) only on the original cost of the stock when contributed to the plan. Tax on the appreciation is delayed until the shares are later sold by you at a price exceeding cost basis and the gain attributable to the NUA will be taxed at long-term capital gain rates (5.3).

The NUA in employer’s securities is shown in Box 6 of the Form 1099-R received from the payer. It is not included in the taxable amount in Box 2a.

If, when distributed, the shares are valued at below the cost contribution to the plan, the fair market value of the shares is subject to tax. If you contributed to the purchase of the shares and their value is less than your contribution, you do not realize a loss deduction on the distribution. You realize a loss only when the stock is sold for less than your cost or becomes worthless (5.32) at a later date. If a plan distributes worthless stock, you may deduct your contributions to the stock as a miscellaneous itemized deduction subject to the 2% of adjusted gross income floor.

Election to waive tax-free treatment. You may elect to include the NUA in employer stock or securities as ordinary income. You might consider making this election when the NUA is not substantial or you want to accelerate income to the current year by taking into account the entire lump-sum distribution. Make the election to include the unrealized appreciation as ordinary income by reporting it on Line 16b (taxable pensions and annuities) of Form 1040 or Line 12b of Form 1040A. If you were born before January 2, 1936, and are claiming averaging or capital gain treatment on Form 4972 (7.3), follow the form instructions for adding the unrealized appreciation to the taxable distribution.

Distribution not a lump sum. If you receive appreciated employer securities in a distribution that does not meet the lump-sum tests above, you report as ordinary income the amount of the employer’s contribution to the purchase of the shares and the appreciation allocated to the employer’s cost contribution. You do not report the amount of appreciation allocated to your own after-tax contribution to the purchase. In other words, tax is deferred only on the NUA attributable to your after-tax employee contributions. Net unrealized appreciation is shown in Box 6 of Form 1099-R. Cost contributions must be supplied by the company distributing the stock.

7.9 Survivor Annuity for Spouse

If you have been married for at least a year as of the annuity starting date, the law generally requires that payments to you of vested benefits be in a specific annuity form to protect your surviving spouse. All defined benefit and money purchase pension plans must provide benefits in the form of a qualified joint and survivor annuity (QJSA) unless you, with the written consent of your spouse, elect a different form of benefit. A qualified joint and survivor annuity must also be provided by profit-sharing or stock bonus plans if you elect a life annuity payout or the plan does not provide that your nonforfeitable benefit is payable in full upon your death either to your surviving spouse, or to another beneficiary if there is no surviving spouse or your spouse consents to the naming of the non-spouse beneficiary.

Under a QJSA, you receive an annuity for your life and then your surviving spouse receives an annuity for his or her life that is at least 50% of the amount payable during your joint lives. Most plans allow you to choose among several options that will provide your surviving spouse with more than 50% of your lifetime benefit after your death. You may waive the QJSA only with your spouse’s consent. Without the consent, you may not take a lump-sum distribution or a single life annuity ending when you die. A single life annuity pays higher monthly benefits during your lifetime than the qualified joint and survivor annuity, and a larger QJSA benefit for your surviving spouse means a greater reduction to your lifetime benefit. If benefits begin under a QJSA and you divorce the spouse to whom you were married as of the annuity starting date, that former spouse will be entitled to the QJSA survivor benefits if you die unless there is a contrary provision in a QDRO (7.13).

The law also requires that a qualified pre-retirement survivor annuity (QPSA) be paid to your surviving spouse if you die before the date vested benefits first become payable or if you die after the earliest payment date but before retiring. The QPSA is automatic unless you, with your spouse’s consent, agree to a different benefit.

Your plan should provide you with a written explanation of these annuity rules within a reasonable period before the annuity starting date, as well as the rules for electing to waive the joint and survivor annuity benefit and the pre-retirement survivor annuity.

Plan may provide exception for marriages of less than one year. The terms of a plan may provide that a QJSA or QPSA will not be provided to a spouse of the plan participant if the couple has been married for less than one year as of the participant’s annuity starting date (QJSA) or, if earlier, the date of the participant’s death (QPSA).

Cash out of annuity. If the present value of the QJSA is $5,000 or less, your employer may “cash out” your interest without your consent or your spouse’s consent by making a lump-sum distribution of the present value of the annuity before the annuity starting date. After the annuity starting date, you and your spouse must consent to a cash-out. Written consent is required for a cash-out if the present value of the annuity exceeds $5,000. Similar cash-out rules apply to a QPSA.

7.10 Court Distributions to Former Spouse Under a QDRO

As a part of a divorce-related property settlement, or to cover alimony or support obligations, a state domestic relations court can require that all or part of a plan participant’s retirement benefits be paid to a spouse, former spouse, child, or other dependent. Administrators of pension, profit-sharing, or stock bonus plans are required to honor a qualified domestic relations order (QDRO) that meets specific tax law tests. For example, the QDRO generally may not alter the amount or form of benefits provided by the plan, but it may authorize payments after the participant reaches the earliest retirement age, even if he or she continues working. A QDRO may provide that a spouse is entitled to all, some, or none of the spousal survivor benefits payable under the plan.

QDRO distributions to spouse or former spouse. If you are the spouse or former spouse of an employee or self-employed plan participant and you receive a distribution pursuant to a QDRO, the distribution is generally taxable to you. However, if the distribution would have been eligible for rollover by your spouse or former spouse, you may make a tax-free rollover to a traditional IRA or to a qualified plan (7.5).

To create a valid QDRO, the court order must contain specific language. The recipient spouse (or former spouse) must be assigned rights to the plan participant’s retirement benefits plan, and must be referred to as an “alternate payee” in the court decree. The decree must identify the retirement plan and indicate the amount and number of payments subject to the QDRO. Both spouses must be identified by name and address. If the required information is not clearly provided in the decree, QDRO treatment may be denied and the plan participant taxed on the retirement plan distributions, rather than the spouse who actually receives payments.

If you do not make a rollover, and your spouse or former spouse (the plan participant) was born before January 2, 1936, a distribution to you of your entire share of the benefits may be eligible for special averaging, provided the distribution, if received by your spouse (or former spouse), would satisfy the lump-sum distribution tests (7.3). If the distribution qualifies, you may use Form 4972 to claim 10-year averaging, and possibly the 20% capital gain election (7.3). Transfers from a governmental or church plan pursuant to a qualifying domestic relations order are also eligible for special averaging or rollover treatment.

Distributions to a child or other dependent. Payments from a QDRO are taxed to the plan participant, not to the dependent who actually receives them, where the recipient is not a spouse or former spouse.

7.11 When Retirement Benefits Must Begin

The longer you can delay taking retirement distributions from your company plan or self-employed plan, the greater will be the tax-deferred buildup of your retirement fund. To cut off this tax deferral, the law requires minimum distributions to begin no later than a specified date in order to avoid an IRS penalty. The required beginning date rules apply to distributions from all qualified corporate and self-employed qualified retirement plans, qualified annuity plans, and Section 457 plans of tax-exempt organizations and state and local government employers. The rules also apply to distributions from tax-sheltered annuities (7.19) but only for benefits accrued after 1986; there is no mandatory beginning date for tax-sheltered annuity benefits accrued before 1987.

You do not have to figure your required minimum distributions (RMDs). If you are not receiving an annuity, your plan administrator will determine the minimum amount that must be distributed each year from your account balance, based upon IRS regulations. The rules are similar to the traditional IRA rules (8.13).

If you do not receive your RMD for a year, a penalty tax applies unless the IRS waives it. The penalty is 50% of the difference between what was received and what should have been received. The IRS may waive the penalty tax if you file Form 5329 and on an attached statement explain that a reasonable error caused the underpayment and the shortfall was or will be corrected.

Required beginning date. Unless you are a more-than-5% owner for the plan year ending in the calendar year in which you reach age 70½, your required beginning date is generally the later of these dates: (1) April 1 following the year in which you reach age 70½ or (2) April 1 following the year in which you retire. For example, if you retired in 2012 and reached age 70½ in March 2017, you must receive your first RMD (the RMD for 2017) from the plan by April 1, 2018, and you must receive the RMD for 2018 by December 31, 2018. A more-than-5% owner must begin distributions by April 1 following the year in which he or she reaches age 70½, and an IRS regulation permits a plan to apply this deadline to all employees. That is, the plan may require all employees, and not just more-than-5% owners, to begin required minimum distributions no later than April 1 of the year after the year in which age 70½ is attained, even if they are still working. Being a more-than-5% owner means that you own over 5% of the capital or profits interest in the business.

If you reach age 70½ in 2018, are not a more-than-5% owner in 2018, and do not retire until 2020, your first RMD from the plan will not have to be received until April 1, 2021, the year after the year of retirement, assuming the plan does not require all employees to take the first RMD by April 1 of the year after the year of reaching age 70½.

7.12 Payouts to Beneficiaries

As the beneficiary of a qualified plan account (corporate or self-employed plan), including a 403(b) tax-sheltered annuity or Section 457 plan, your distribution options depend on the terms of the plan. You may prefer the option of receiving payments over your life expectancy, but the plan may require that you receive a lump-sum distribution or allow installment payments over only a limited number of years.

Although IRS final regulations generally allow beneficiaries to use a life expectancy distribution method, the IRS rules represent the longest permissible payment period. Qualified plans are allowed to require a shorter period and most do.

If you receive a lump-sum distribution, you generally may make a tax-free rollover to another plan, but the rollover options are more restricted for nonspouse beneficiaries than for surviving spouses as discussed below.

If the plan participant was born before January 2, 1936, and you receive a qualifying lump sum, you may be able to claim special averaging (7.4).

Surviving spouse. If you are a surviving spouse and receive a distribution that would have been eligible for rollover had your spouse received it, you may make a tax-free rollover to the qualified plan of your employer or to your own traditional IRA. If you make a rollover to a traditional IRA, subsequent withdrawals are subject to the regular IRA distribution rules (8.8).

If you do not make a rollover and the payer plan gives you the option of taking distributions over your life expectancy as allowed by the IRS rules, you may be able to delay the commencement of distributions for several years. If your spouse died before the year in which he or she attained age 70½, and you are the sole designated beneficiary of the account as of September 30 of the year following the year of death, you do not have to begin receiving required minimum distributions (RMDs) until the end of the year in which your spouse would have attained age 70½. This is an exception to the general rule that requires RMDs under the life expectancy method to begin by the end of the year following the year in which the plan participant died.

Nonspouse beneficiary. If you are the designated beneficiary of a deceased plan participant who was not your spouse, you are allowed to roll over a distribution, but only by means of a direct trustee-to-trustee transfer to an IRA that is set up as an inherited IRA (7.6). If the transfer is to a Roth IRA, you are taxed as if you made a conversion from a traditional IRA (8.22). If you do not make such a trustee-to-trustee transfer, you must receive distributions as required under the terms of the deceased participant’s plan. Most plans allow distributions to be received over the beneficiary’s life expectancy, with the first distribution due by December 31 of the year following the year of the plan participant’s death.

7.13 Penalty for Distributions Before Age 59½

A 10% penalty (the IRS calls this an “additional tax”) generally applies to taxable distributions made to you before you reach age 59½ from a qualified corporate or self-employed retirement plan, qualified annuity plan, or tax-sheltered annuity plan (403(b) plan (7.19)), but there are several exceptions. For example, the penalty does not apply to distributions made to you after separation from service if the separation occurs during or after the year in which you reach age 55. A full list of exceptions is shown below.

If no exception applies, the penalty is 10% of the taxable distribution. If you make a tax-free rollover (7.5), the distribution is not taxable and not subject to the penalty. If a partial rollover is made, the part not rolled over is taxable and subject to the penalty.

The penalty generally does not apply to Section 457 plans of tax-exempt employers or state or local governments (7.20). However, if a direct transfer or rollover is made to a governmental Section 457 plan from a qualified plan, 403(b) annuity, or IRA, a later distribution from the Section 457 plan is subject to the penalty to the extent of the direct transfer or rollover.

If you make an in-plan rollover to a designated Roth account (7.18) from your 401(k) plan, 403(b) plan or governmental 457 plan, the 10% penalty may apply to a distribution received from the designated Roth account within five years of the rollover.

A similar 10% penalty applies to IRA distributions before age 59½ (8.12). The penalty is 25% if a distribution before age 59½ is made from a SIMPLE IRA in the first two years of plan participation (8.18). The 10% penalty generally applies to pre–age 59½ distributions from nonqualified annuities (7.21).

There are a few differences between the penalty exceptions shown below for qualified corporate and self-employed plan distributions and the exceptions for IRA distributions (8.12). There is no qualified plan exception for higher education expenses as there is for IRAs. On the other hand, the exception for distributions after separation from service at age 55 (or over) applies only to qualified plans and not to IRAs.

Exceptions to the penalty. The following distributions from a qualified employer plan are exempt from the 10% penalty, even if made to you before age 59½. If the plan administrator knows that an exception applies, a code for the exception will be entered in Box 7 of Form 1099-R on which the distribution is reported.

- Rollovers. Distributions that you roll over tax free under the “direct rollover” or “personal rollover” rules (7.6) are not subject to the early distribution penalty.

- Disability. Distributions made on account of your total disability do not subject you to the early distribution penalty.

- Separation from service at age 55 or older. The early distribution penalty does not apply to distributions after separation from service if you are age 55 or over in the year you retire or leave the company. If you reach age 55 in the same year you separate from service, the distribution must be received after the separation from service but you do not have to turn age 55 before receiving the distribution; the exception applies so long as the distribution is received after the separation from service and you reach age 55 before the end of the same year. You cannot separate from service before the year you reach age 55, wait until the year you reach age 55, and then take a distribution; the penalty will apply because in the year of separation you were not at least age 55.

As discussed below, the age test is reduced from 55 to 50 for qualified public safety employees (police, fire fighting, emergency medical services).

Note that the age 55 separation from service exception does not apply to IRA distributions. If you separate from service after age 55 and rollover a distribution to an IRA, the penalty exception will not apply to a distribution received before age 59½ from that IRA. This happened to an attorney who left his law firm at age 56 and rolled over funds from the law firm’s pension plan to an IRA. The next year he withdrew about $240,000 from the IRA and was hit with the 10% penalty by the IRS. The Tax Court upheld the 10% penalty and also imposed a penalty for substantially understating tax (48.6). The Seventh Circuit affirmed. The appeals court was sympathetic to the taxpayer’s argument that it made no sense to impose the 10% early distribution penalty on the IRA distribution when he could have taken the distribution from his law firm’s plan at age 56 with no penalty, but that is how Congress wrote the law. The Courts cannot change the rules that allow the age 55 exception only for qualified plan distributions and not IRAs. The Seventh Circuit also upheld the substantial understatement penalty; the taxpayer had no authority for claiming that the penalty exception applied to his IRA distribution.

- Public safety employees separated from service at age 50 or later. The early distribution penalty does not apply to distributions received by public safety officers who separate from service in or after the year of reaching age 50. The penalty exception applies to state and local public safety officers (police, fire, emergency medical), as well as to federal law enforcement officers, customs and border protection officers, federal firefighters, and air traffic controllers. The exception applies whether the distribution is from a defined benefit pension plan or a defined contribution plan such as the federal Thrift Savings Plan (TSP).

For distributions before 2016, the penalty exception only applied to state or local public safety officers in a defined benefit pension plan.

- Medical costs. Distributions are not subject to the early distribution penalty to the extent that you pay deductible medical expenses exceeding the threshold for medical expense deductions (17.1), whether or not an itemized deduction for medical expenses is actually claimed for the year.

- Substantially equal payments. The early distribution penalty does not apply to distributions received after your separation from service that are part of a series of substantially equal payments (at least annually) over your life expectancy, or over the joint life expectancy of yourself and your designated beneficiary. If you claim the exception and begin to receive such a series of payments but then before age 59½ you receive a lump sum or change the distribution method and you are not totally disabled, a recapture penalty tax will generally apply. The recapture tax also applies to payments received before age 59½ if substantially equal payments are not received for at least five years. The recapture tax applies the 10% penalty to all amounts received before age 59½, as if the exception had never been allowed, plus interest for that period. However, the IRS allows taxpayers who have been receiving substantially equal payments under the fixed amortization or fixed annuitization method to switch without penalty to the required minimum distribution method; see Revenue Ruling 2002-62 for details. In private rulings, the IRS has allowed the annual distribution amount to be reduced without penalty after the account is divided in a divorce settlement.

- Beneficiaries. If you are the beneficiary of a deceased plan participant, you are not subject to the 10% penalty, regardless of your age or the participant’s age.

- Qualified reservist distribution. If you are a member of the reserves called to active military duty for over 179 days, or indefinitely, distributions received during the active duty period that are attributable to elective deferrals (401(k) or 403(b) plan) are not subject to the early distribution penalty. Furthermore, a qualified reservist distribution may be recontributed to an IRA within two years after the end of the active duty period; a recontribution is not deductible.

- IRS levy. Involuntary distributions that result from an IRS levy on your plan account are not subject to the early distribution penalty.

- QDRO. Distributions paid to an alternate payee pursuant to a qualified domestic relations court order (QDRO) are not subject to the early distribution penalty.

- TEFRA designations. Distributions made before 1984 pursuant to a designation under the 1982 Tax Act (TEFRA).

Financial hardship distributions or distributions used for college or home-buying costs are subject to the penalty. The 10% penalty generally applies to a hardship distribution that you receive before age 59½ from a 401(k) plan (7.17) or 403(b) tax-sheltered annuity plan (7.19). For example, there is no penalty exception for distributions you take to deal with a casualty loss, to pay tuition costs or to buy a principal residence. However, as noted above, a hardship distribution used to pay medical costs may qualify for an exception if your medical expenses exceed the floor for claiming an itemized deduction (17.1).

Note that for IRA distributions, a penalty exception may apply for a distribution used to pay tuition costs or buy a principal residence (8.12).

Corrective distributions from 401(k) plans. If you are considered a highly compensated employee and excess elective deferrals or excess contributions are made on your behalf, a distribution of the excess to you is not subject to the penalty.

Filing Form 5329 for exceptions. If your employer correctly entered a penalty exception code in Box 7 of Form 1099-R, you do not have to file Form 5329 to claim the exception. You also do not have to file Form 5329 if you made a tax-free rollover of the entire taxable distribution. You must file Form 5329 if you qualify for an exception, other than the rollover exception, that is not indicated in Box 7 of Form 1099-R.

7.14 Restrictions on Loans From Company Plans

Within limits, you may receive a loan from a qualified company plan, annuity plan, 403(b) plan, or government plan without triggering tax consequences. The maximum loan you can receive without tax is the lesser of 50% of your vested account balance or $50,000, but the $50,000 limit is subject to reductions where there are other loans outstanding; see below. Loans must be repayable within five years, unless they are used for buying your principal residence. Loans that do not meet these guidelines are treated as taxable distributions from the plan. If the plan treats a loan as a taxable distribution, you should receive a Form 1099-R with Code L marked in Box 7.

If your vested accrued benefit is $20,000 or less, you are not taxed if the loan, when added to other outstanding loans from all plans of the employer, is $10,000 or less. However, as a practical matter, your maximum loan may not exceed 50% of your vested account balance because of a Labor Department rule that allows only up to 50% of the vested balance to be used as loan security. Loans in excess of the 50% cap are allowed only if additional collateral is provided.

If your vested accrued benefit exceeds $20,000, then the maximum tax-free loan depends on whether you borrowed from any employer plan within the one-year period ending on the day before the date of the new loan. If you did not borrow within the year, you are not taxed on a loan that does not exceed the lesser of $50,000 or 50% of the vested benefit.

If there were loans within the one-year period, the $50,000 limit must be further reduced. The loan, when added to the outstanding loan balance, may not exceed $50,000 less the excess of (1) the highest outstanding loan balance during the one-year period (ending the day before the new loan) over (2) the outstanding balance on the date of the new loan. This reduced $50,000 limit applies where it is less than 50% of the vested benefit; if 50% of the vested benefit was the smaller amount, that would be the maximum tax-free loan.

Repayment period. Generally, loans within the previously discussed limits must be repayable within five years to avoid being treated as a taxable distribution. However, if you use the loan to purchase a principal residence for yourself, the repayment period may be longer than five years; any reasonable period is allowed. This exception does not apply if the plan loan is used to improve your existing principal residence, to buy a second home, or to finance the purchase of a home or home improvements for other family members; such loans are subject to the five-year repayment rule.

Level loan amortization required. To avoid tax consequences on a plan loan, you must be required to repay using a level amortization schedule, with payments at least quarterly. According to Congressional committee reports, you may accelerate repayment, and the employer may use a variable interest rate and require full repayment if you leave the company.

Giving a demand note does not satisfy the repayment requirements. The IRS and Tax Court held the entire amount of an employee’s loan to be a taxable distribution since his demand loan did not require level amortization of principal and interest with at least quarterly payments. It did not matter that the employee had paid interest quarterly and actually repaid the loan within five years.

If required installments are not made, the entire loan balance must be treated as a “deemed distribution” from the plan under IRS regulations. However, the IRS allows the plan administrator to permit a grace period of up to one calendar quarter. If the missed installment is not paid by the end of the grace period, there is at that time a deemed distribution in the amount of the outstanding loan balance.

Under IRS regulations, loan repayments may be suspended for up to one year (or longer if you are in the uniformed services) if you take a leave of absence during which you are paid less than the installments due. However, the installments after the leave must at least equal the original required amount and the loan must be repaid by the end of the allowable repayment period (five years if not used to buy a principal residence). For example, on July 1, 2017, when his vested account balance is $80,000, Joe Smith takes out a $40,000 non–principal residence loan, to be repaid with interest in level monthly installments of $825 over five years. He makes nine payments and then takes a year of unpaid leave. When he returns to work he can either increase his monthly payment to make up for the missed payments or resume paying $825 a month and on June 30, 2022, repay the entire balance owed in a lump sum.

If loan payments are suspended while you are serving in the uniformed services, the loan payments must resume upon returning to work and the loan repayment period (five years from the date of the loan unless the loan was used to buy your principal residence) is extended by the period of suspension.

Spousal consent generally required to get a loan. All plans subject to the joint and survivor rules (7.11) must require spousal consent in order to use your account balance as security for the loan in case you default. Check with your plan administrator for consent requirements.

Interest deduction limitations. If you want to borrow from your account to buy a first or second residence and you are not a “key” employee (3.4), you can generally obtain a full interest deduction by using the residence as collateral for the loan (15.2). Your account balance may not be used to secure the loan. Key employees are not allowed any interest deduction for plan loans.

If you use a plan loan for investment purposes and are not a key employee, and the loan is not secured by your elective deferrals (or allocable income) to a 401(k) plan or tax-sheltered annuity, the loan account interest is deductible up to investment income (15.10). Interest on loans used for personal purposes is not deductible, unless your residence is the security for the loan.

7.15 Tax Benefits of 401(k) Plans

If your company has a profit-sharing or stock bonus plan, it has the opportunity of giving you additional tax-sheltered pay. The tax law allows the company to add a cash or deferred pay plan, called a 401(k) plan.

Your company may offer to contribute to a 401(k) plan trust account on your behalf if you forego a salary increase, but in most plans, contributions take the form of salary-reduction deferrals. Under a salary-reduction agreement, you elect to contribute a specified percentage of your wages to the 401(k) plan instead of receiving it as regular salary. In addition, your company may match a portion of your contribution. A salary-reduction deferral is treated as a contribution by your employer that is not taxable to you if the annual contribution limits are not exceeded.

Employers have the option of amending their 401(k) plans to allow employees to designate part or all of their elective contributions as Roth contributions (7.18).

Salary-reduction deferrals. Making elective salary deferrals allows you to defer tax on salary and get a tax-free buildup of earnings within your 401(k) plan account until withdrawals are made.