Chapter 5

Decentralized Assets

IN THIS CHAPTER

![]() Exploring the many types of decentralized assets

Exploring the many types of decentralized assets

![]() Discerning truly decentralized assets from centrally managed assets

Discerning truly decentralized assets from centrally managed assets

![]() Distinguishing native versus non-native tokens

Distinguishing native versus non-native tokens

As a decentralized yet secure method of recordkeeping, blockchain technology provides a vehicle by which to implement and deliver many different types of asset classes. Much like how a piece of paper can be used to print money, a stock certificate, or a car title, crypto can be used to represent a number of things. It all depends on the intent of the developers and what they are choosing to keep a record of.

The general groupings of asset types are not mutually exclusive, and tokens don’t all fit neatly into a single category. Still, crypto assets all share one defining feature: the distributed ledger technology on which they are secured. From decentralized currencies to security tokens to memes, the range of what a crypto asset can represent is vast.

Moreover, not all crypto assets are truly decentralized; many are monitored and controlled by a central authority after issuance. For instance fiat-backed stablecoins, such as Tether (USDT) and USD Coin (USDC), are issued by an institution that is entrusted with keeping sufficient U.S. dollars or other reserves to back the supply of stablecoins that it issues. Similarly, security tokens are centrally issued by institutions that are responsible for providing the promised cash-flow claims, such as profits from the underlying business or investments made by the management team.

This chapter provides an overview of the broad range of crypto assets whose ownership and transaction records are secured in a decentralized fashion on a public blockchain. I’ve chosen to start the chapter with a description of native tokens. Although native tokens span numerous categories, they mostly function as decentralized currencies and utility tokens. I then proceed to describe many types of non-native tokens that are issued on existing blockchains.

Understanding Native Tokens

Native tokens share the common characteristic of serving as the base token or inherent currency of their own proprietary blockchains.

Some native tokens, such as bitcoin (BTC), were designed to serve as disintermediated currencies. The purpose of a disintermediated currency is to provide a global medium of exchange that is independent of a central authority, such as a bank or a government. Other examples in this category include Litecoin (LTC) and Bitcoin Cash (BCH).

Most other native tokens were designed to serve as utility tokens. A utility token provides access to a service or good within a given platform. For instance, ether (ETH) serves as the native token that fuels transactions on the Ethereum smart-contract platform. You need to pay ETH to transfer funds, deploy smart contracts, or access functions in an existing smart contract. Other examples in this category include ada (ADA) for Cardano and TRONIX (TRX), often simply called TRON, for the TRON Protocol.

Coins can shift categories and even straddle more than one category. For instance, ETH became so popular that it’s also used as a disintermediated currency outside the Ethereum platform. Think of Walmart gift certificates, which are like utility tokens. The gift certificates are designed to be used to access goods and services within the Walmart platform. However, if Walmart becomes so popular that restaurants and movie theatres begin to accept Walmart gift certificates in place of cash, these gift certificates will have become a global medium of exchange that is now accepted outside the Walmart platform.

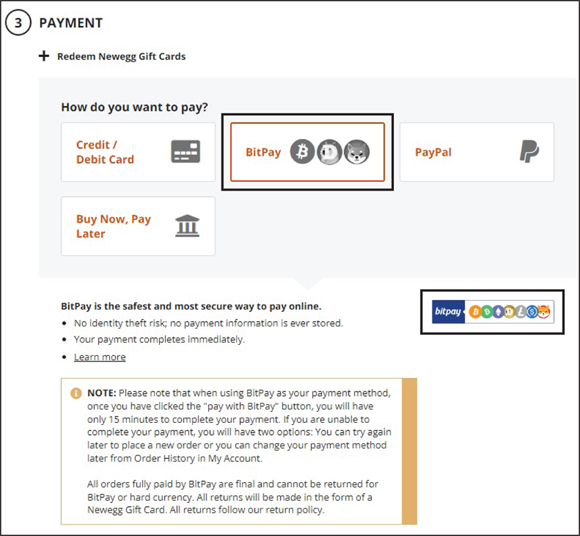

Figures 5-1 and 5-2 present examples of online vendors that accept BTC, LTC, and ETH, among other crypto, as forms of payment.

FIGURE 5-1: Using crypto to purchase a flight on CheapAir.com.

FIGURE 5-2: Using crypto to purchase hardware on Newegg.com.

Exploring Non-Native Tokens

Close to 21,000 exchange-traded cryptocurrencies were listed on CoinMarketCap as of the end of August 2022. Most crypto assets are not native tokens. Instead, they are built on and secured by an existing blockchain. After all, we really don’t need 20,000 different blockchains that essentially provide the same recordkeeping function. Also, having so many distinct blockchains would compromise the safety of each system, which depends on the size of the network.

Although there are now many serious contenders to be the number-one smart-contract platform, Ethereum remains the predominant blockchain on which to issue crypto assets, either as ERC-20 fungible tokens or as ERC-721 non-fungible tokens. Much like how you can have numerous tabs in an Excel spreadsheet to keep records of different things, Ethereum allows developers to carve out their own recordkeeping systems on a reliable and tamper-proof platform.

The following sections, from “Stablecoins” to “Meme coins,” provide examples of non-native fungible tokens.

Stablecoins

So-called stablecoins derive their name from the soft one-to-one peg they seek to maintain with a chosen fiat currency, such as the U.S. dollar. (A soft peg allows some flexibility in the exchange rate, whereas a hard peg requires strict one-to-one adherence.)

Some stablecoins, such as Tether (USDT), are centrally controlled by a trusted party that controls the supply and is responsible for holding sufficient collateral — such as U.S. dollars or gold — to maintain the public’s faith in its stablecoin. With a total market cap in excess of $180 billion, USDT is the largest stablecoin and the third largest cryptocurrency. It began as an ERC-20 token for use on Ethereum and later expanded to other blockchain platforms, such as TRON, Solana, and EOS.

Other stablecoins, such as Dai (DAI), are really decentralized loans backed by collateral (other crypto assets) that are locked in smart-contract accounts, known as vaults, to secure the DAI. These vaults are liquidated to burn some of the outstanding DAI if the collateral value sinks below a certain threshold. DAI is implemented as an ERC-20 token on the Ethereum blockchain. With a total market cap close to $7 billion, DAI is the largest decentralized (algorithmic) stablecoin and the twelfth largest cryptocurrency. (See Chapter 7 for more technical details on how DAI and other decentralized loans work.)

Regulators are increasingly concerned about the seeming Wild West environment in which stablecoins have been operating. Their concerns were heightened by the recent catastrophic implosion of TerraUSD (UST), an algorithmic stablecoin that plummeted to just a few cents and has remained de-pegged from the U.S. dollar since May 2022. Overall, lawmakers are in favor of imposing capital requirements on stablecoin issuers like Tether Limited Inc. (for USDT) and Circle (for USDC). Perhaps the next move will be to require algorithmic stablecoins to undergo a formal credit rating process!

Wrapped tokens

Wrapped tokens allow for the synthetic use and trading of a native token from another blockchain. Much like how stablecoins are pegged to a fiat currency, wrapped tokens are pegged to a particular token.

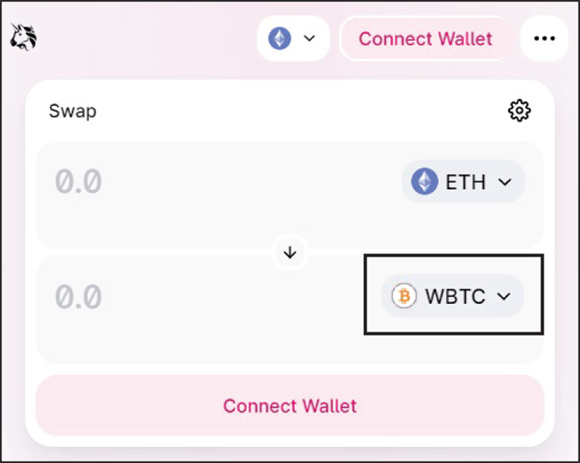

For instance, you can’t swap ETH for actual bitcoins (BTC) on the Ethereum blockchain, but you may have noticed that you can swap ETH for Wrapped Bitcoin (WBTC), which is issued as an ERC-20 token, via a DEX like Uniswap, as shown in Figure 5-3.

FIGURE 5-3: Trading Wrapped Bitcoin (WBTC) on Uniswap, a liquidity protocol on Ethereum.

Governance tokens

Governance tokens have become a popular way for development teams to elicit community participation in the ongoing management of a DeFi protocol after it has been deployed.

For instance, the Uniswap token (UNI) is an ERC-20 token that allows its holders to vote on various features of the Uniswap DEX protocols. Similarly, the SushiSwap token (SUSHI) is an ERC-20 token that allows its holders to vote on various features of the SushiSwap DEX protocols.

- Specifically, you don’t need UNI to execute a trade on a Uniswap liquidity pool, and you don’t need SUSHI to execute a trade on a SushiSwap liquidity pool (unless, of course, you are planning to swap UNI or SUSHI).

- The Uniswap and SushiSwap protocols are built on the Ethereum blockchain, and thus, you need ETH, the native utility token of Ethereum, to transact on these DEXs.

In addition to voting rights, governance token holders also receive a portion of the fees earned on the protocol. SUSHI holders receive a portion of the 0.30 percent swap fee charged for trading in the SushiSwap liquidity pools, and UNI holders are expected to soon begin receiving a portion of the 0.30 percent swap fee charged for trading in the Uniswap liquidity pools.

Despite their uncanny resemblance to equity securities (which also provide voting and cash-flow rights), governance tokens have thus far managed to stay out of the SEC’s crosshairs. The implications, though, would be huge — requiring their removal from any crypto exchange not registered as an Alternative Trading System (ATS).

Security tokens

Security tokens are tokenized securities, which represent equity ownership or other types of cash-flow claims in tokenized form. BCAP, an ERC-20 token issued by Blockchain Capital in 2017, is reportedly the first security token offering (STO) and was used to raise funds for its Blockchain Capital III Digital Liquid Venture Fund.

Other examples of security tokens include OSTKO, an ERC-20 token representing preferred equity shares in Overstock.com, and ArCoin, an ERC-20 token representing shares in the Arca U.S. Treasury Fund.

Meme coins

Some coins are simply meme coins that have no explicit monetary value or practical use associated with the coin at creation.

Dogecoin (DOGE), the most famous meme coin, is actually a native token with its own blockchain that was originally designed as a joke. DOGE is the largest meme coin and tenth largest cryptocurrency, with a total market cap close to $8.5 billion as of the end of August 2022.

Inspired by the success of DOGE, other meme coins followed in its wake. Shiba Inu (SHIB), launched as an ERC-20 token on Ethereum, is another runaway success with a total market cap in excess of $6.5 billion, making it the second largest meme coin and 14th largest cryptocurrency. Baby Doge Coin, launched as a BEP-20 token on the Binance Smart Chain, is far from its aspirational predecessors but has an impressive valuation nonetheless, with a total market cap in excess of $150 million!

Of course, meme coins can also shift or straddle other categories. Refer to Figures 5-1 and 5-2 (presented earlier) to see that both DOGE and SHIB are also accepted as forms of payment on CheapAir.com and Newegg.com.

Other intriguing (though far less successful) meme coins include FOMO Coin (accessed at https://fomocoin.org/ and shown in Figure 5-4), and Jesus Coin (accessed at https://www.jesuscoin.live/ and shown in Figure 5-5), both of which were also launched as ERC-20 tokens on the Ethereum blockchain.

FIGURE 5-4: FOMO Coin.

Much like the rise (and fall) of Beanie Babies in the 1990s, it’s hard to predict whether a meme coin is destined for DOGE-like greatness (though, it certainly helps if vendors adopt the meme as a form of payment and Elon Musk tweets about it!).

FIGURE 5-5: Jesus Coin.

Differentiating Non-Fungible Tokens (NFTs)

Finally, I would be remiss to ignore the category of non-fungible tokens (NFTs)!

Although NFTs also fall under the category of non-native tokens, I’ve assigned this group its own header to clearly demarcate it from the tokens covered previously, which are all fungible tokens.

NFTs are still relatively young, and thus far have mostly been designed to represent ownership of digital collectibles and gaming assets. However, many nascent projects are in various stages of planning and development. From NFT-izing the ownership records of luxury goods to event tickets to real estate, the possibilities are seemingly endless. Already, NFTs are being used to secure ownership and transaction records of digital property in decentralized metaverses, such as Decentraland and Sandbox, which are covered in Chapter 8. Perhaps more real-world analogues will soon follow!

The stability of a stablecoin depends critically on the management (or mismanagement) of the stablecoin and ongoing public faith in the system. Whether the stablecoin is centrally managed and backed by traditional collateral or is algorithmically maintained by a nexus of smart contracts, stablecoins are not immune to a classic run on the bank.

The stability of a stablecoin depends critically on the management (or mismanagement) of the stablecoin and ongoing public faith in the system. Whether the stablecoin is centrally managed and backed by traditional collateral or is algorithmically maintained by a nexus of smart contracts, stablecoins are not immune to a classic run on the bank. Note that UNI and SUSHI are purely governance tokens and do not serve as utility tokens on the respective protocols.

Note that UNI and SUSHI are purely governance tokens and do not serve as utility tokens on the respective protocols.