Chapter 29

Tax Savings for Residence Sales

You may avoid tax on gain on the sale of a principal residence if you owned and used it for at least two years during the five-year period ending on the date of sale. If you are single, you may avoid tax on up to $250,000 of gain, $500,000 if you are married and file jointly. However, gain attributable to nonqualified use after 2008 is not excludable (29.2).

If you used the residence for less than two years, you may avoid tax if you sold because of a change of job location, poor health or unforeseen circumstance (29.4).

You may not deduct a loss on the sale of a personal residence. Losses on the sale of property devoted to personal use are nondeductible (29.8). However, there are circumstances under which you may claim a loss deduction on the sale of a residence (29.9–29.10).

If you rent out a residential property and you or family members also use the residence during the year, rental expenses are subject to special restrictions (9.7).

29.1 Avoiding Tax on Sale of Principal Residence

If you sell (or exchange) your principal residence at a gain (29.5), up to $250,000 of the gain may be excluded from income if you owned and occupied it as a principal residence for an aggregate of at least two years in the five-year period ending on the date of sale and did not claim an exclusion on another sale within the prior two years. See the discussion of the two-out-of-five-year ownership and use tests in the following section (29.2). If you are married filing jointly, you may be able to exclude up to $500,000 of gain (29.3). Even if you do not meet the two-out-of-five-year ownership and use tests, you are entitled to a reduced maximum exclusion limit if the primary reason for your sale was a change in the place of employment, health reasons, or unforeseen circumstances (29.4).

Caution: If you use a residence as a vacation home or rental property after 2008, an allocable part of your gain may not qualify for the exclusion, even if you meet the two-out-of-five-year ownership and use tests (29.2).

Frequency of exclusion. If you meet the ownership and use tests for a principal residence (29.2), you may claim the exclusion when you sell it although you previously claimed the exclusion for another residence, provided that the sales are more than two years apart. If you claim the exclusion on a sale and within two years of the first sale you sell another principal residence, an exclusion may not be claimed on the second sale even if you meet the ownership and use tests for that residence. There is an exception if the second sale was due to a change in employment, health reasons, or unforeseen circumstances. In that case, a prorated exclusion limit is allowed (29.4).

Principal residence. A principal residence is not restricted to one-family houses but includes a mobile home, trailer, houseboat, and condominium apartment used as a principal residence. An investment in a retirement community does not qualify as a principal residence unless you receive equity in the property. In the case of a tenant-stockholder of a cooperative housing corporation, the residence ownership requirement applies to the ownership of the stock and the use requirement applies to the house or apartment that the stockholder occupies (29.2).

If you have multiple homes. If you have more than one home, you may exclude gain only on the sale of your principal residence and only if you meet the ownership and use tests (29.2) for that residence. Your “principal residence” is determined on a year-to-year basis, based primarily on where you live most of the time. However, the IRS may also consider such factors as the primary residence of your family members, your place of employment, mailing address, the address listed on your tax returns, driver’s license and automobile and voter registration, and the location of your bank.

Vacant land. Vacant land owned and used as part of a taxpayer’s principal residence may qualify for the exclusion. The vacant land must be adjacent to the residence and the sale of the residence must be within two years before or after the sale of the land. Qualifying sales of land and residence are treated as one sale, so the $250,000 exclusion limit ($500,000 for qualifying joint filers) applies to the combined sales. If the sales occur in different years, the exclusion limit applies first to the residence sale.

Business or rental use. If part of your home was rented out or used for business, see the rules for determining whether you can exclude all or some of the gain on a sale (29.7). Also see the rules for deducting a loss where your residence was converted to rental property (29.9).

Home destroyed or condemned. If your home is destroyed or condemned, this is treated as a sale, so any gain realized on the conversion may qualify for the exclusion. If vacant land used as part of your home is sold within two years of the conversion, the sale of the land may be combined with the sale of the residence for exclusion purposes; see the vacant land rule earlier. Any part of the gain that may not be excluded (because it exceeds the limit) may be postponed under the rules explained in 18.19.

Sale of remainder interest. You may choose to exclude gain from the sale of a remainder interest in your home. If you do, you may not choose to exclude gain from your sale of any other interest in the home that you sell separately. Also, you may not exclude gain from the sale of a remainder interest to a related party. Related parties include your brothers and sisters, half-brothers and half-sisters, spouse, ancestors (parents, grandparents, etc.), and lineal descendents (children, grandchildren, etc.). Related parties also include certain corporations, partnerships, trusts, and exempt organizations.

Expatriates. You cannot claim the home sale exclusion if the expatriation tax (1.20) applies to you. The expatriation tax applies to U.S. citizens who have renounced their citizenship (and long-term residents who have ended their residency) if one of their principal purposes was to avoid U.S. taxes.

The exclusion is not mandatory. You do not have to apply the exclusion to a particular qualifying sale. For example, you are unable to sell a residence when you acquire a new residence. When you finally are able to find a buyer for the first home, you also decide to sell the second residence. Assume both sales may qualify for the exclusion, but the potential gain on the first house will be less than the potential gain on the sale of the second home. You will not want to apply the exclusion to the sale of the first home if doing so will prevent you from applying the exclusion to the second sale because of the rule allowing an exclusion for only one sale every two years.

Federal subsidy recapture. If your home was financed with the proceeds of a tax-exempt bond or a qualified mortgage credit certificate (15.1) and you sell or dispose of the home within nine years of the financing, you may have to recapture the federal subsidy received even if the sale qualifies for the home sale exclusion. Use Form 8828 to figure the amount of the recapture tax, which is reported on Form 1040 as a separate tax.

29.2 Meeting the Ownership and Use Tests for Exclusion

To qualify for the up-to-$250,000 exclusion, you must have owned and occupied a home as your principal residence for at least two years during the five-year period ending on the date of sale. The periods of ownership and use do not have to be continuous. The ownership and use tests may be met in different two-year periods, provided both tests are met during the five-year period ending on the date of sale (as in Example 3 below). You qualify if you can show that you owned the home and lived in it as your principal residence for 24 full months or for 730 days (365 × 2) during the five-year period ending on the date of sale. However, even you meet the two-out-of-five-year ownership and use tests, some of your gain will be taxable if you use the residence after 2008 as a second home or rental property, unless an exception applies; see the discussion of the nonqualified use rule at the end of this section.

If you or your spouse serve on qualified official extended duty as a member of the uniformed services, Foreign Service of the United States, intelligence community, or Peace Corps, you can suspend the five-year test period for the years of qualified service; see below.

If you are a joint owner of the residence and file a separate return, the up-to-$250,000 exclusions applies to your share of the gain, assuming you meet the ownership and use tests.

If you are married and file a joint return, you may claim an exclusion of up to $500,000 if one of you meets the ownership test and both of you meet the use test (29.3).

If the ownership and use tests are not met but the primary reason for the sale was a change in the place of employment, health reasons, or unforeseen circumstances, an exclusion is allowed under the reduced maximum exclusion rules (29.4).

Even if the ownership and use tests are met, the exclusion is not allowed for a sale if within the two-year period ending on the date of sale, you sold another principal residence for which you claimed the exclusion. However, a reduced exclusion limit may be available (29.4).

Military and Foreign Service personnel, intelligence officers, and Peace Corps workers can suspend five-year period. You may elect to suspend the running of the five-year ownership and use period while you or your spouse is on qualified official extended duty as a member of the uniformed services or Foreign Service of the United States. The suspension can be for up to 10 years. It is allowed for only one residence at a time. By making the election and disregarding up to 10 years of qualifying service, you can claim an exclusion where the two-year use test is met before you began the qualifying service and after your return; see the Example below. Qualified official extended duty means active duty for over 90 days or for an indefinite period with a branch of the U.S. Armed Forces at a duty station at least 50 miles from your principal residence or in Government-mandated quarters. Members of the Foreign Service, commissioned corps of the National Oceanic and Atmospheric Administration, and commissioned corps of the Public Health Service who meet the active duty tests also qualify.

Similarly, the five-year testing period is suspended for up to 10 years for intelligence community employees (specified national agencies and departments) and Peace Corps workers. The suspension rule for Peace Corps workers applies to Peace Corps employees, enrolled volunteers, or volunteer leaders for periods during which they are on qualified official extended duty outside the United States.

Cooperative apartments. If you sell your stock in a cooperative housing corporation, you meet the ownership and use tests if, during the five-year period ending on the date of sale, you:

- Owned stock for at least two years, and

- Used the house or apartment that the stock entitles you to occupy as your principal residence for at least two years.

Incapacitated homeowner. A homeowner who becomes physically or mentally incapable of self-care is deemed to use a residence as a principal residence during the time in which the individual owns the residence and resides in a licensed care facility. For this rule to apply, the homeowner must have owned and used the residence as a principal residence for an aggregate period of at least one year during the five years preceding the sale.

If you meet this disability exception, you still have to meet the two-out-of-five-year ownership test to claim the exclusion.

Previous home destroyed or condemned. For the ownership and use tests, you may add time you owned and lived in a previous home that was destroyed or condemned if any part of the basis of the current home sold depended on the basis of the destroyed or condemned home under the involuntary conversion rules (18.19).

No Exclusion for Nonqualified Use After 2008

Even if the two-out-of-five-year test for an exclusion is met, gain attributable to “nonqualified” use after 2008 is not eligible for the exclusion. The primary intent of the rule is apparently to deny an exclusion for some of the gain realized by taxpayers who convert a vacation home or rented residence to their principal residence and live in it for a few years before selling. However, the law as written is broader, generally treating any period after 2008 in which the home is not used as a principal residence by you, your spouse, or former spouse as “nonqualified use.” Despite the broad wording of the law, there are exceptions ( below) that lessen the potential impact of the nonqualified use rule. In particular, exception 1 allows many home sellers to avoid nonqualified use treatment where they move out and rent the home before selling it; see Example 2 below.

Exceptions to nonqualified use. There are exceptions that limit the impact of the nonqualified use rule. The law specifically exempts the following from the definition of post-2008 “nonqualified use”: (1) the period after you, or your spouse, last use the home as your principal residence, so long as it is within the five years ending on the date of sale; see Example 2 below, (2) temporary absences from the residence, not to exceed two years in total, due to a change in employment, health reasons (such as time in a hospital or nursing home), or other unforeseen circumstances to be specified by the IRS, and (3) periods of up to 10 years (in aggregate) during which you, or your spouse, are on qualified official extended duty (duty station at least 50 miles from residence) as a member of the uniformed services, as a Foreign Service officer, or as an employee of the intelligence community.

The IRS has not released formal guidelines on “nonqualified use,” including any other possible exceptions, such as whether short-term rental periods will be disregarded. However, in Publication 523 it takes the position that where rental or business space is physically part of the living area of your home, such as a home office or a spare bedroom that you rent out as part of a bed-and-breakfast business, that use is treated as residential use. Although the IRS does not specifically say so, such home office or rental space within the home is apparently not considered “nonqualified use” in applying the fractional computation below.

Figuring the excludable and nonexcludable gain. To figure the exclusion on a sale where there is nonqualified use after 2008, the gain equal to post–May 6, 1997 depreciation (allowed or allowable (29.7)) is taken into account first. No exclusion is allowed for this depreciation amount (29.7); this is a long-standing rule that is not changed by the nonqualified use calculation.

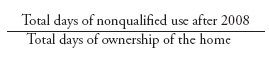

After taking into account post-May 6, 1997 depreciation, the portion of the remaining gain that is allocable to nonqualified use must be figured; this amount also is not eligible for the exclusion. The allocation is made by multiplying the gain by the following fraction:

You can use Worksheet 29-3 later in this chapter to make the allocation and figure your excludable and taxable gain.

29.3 Home Sales by Married Persons

Where a married couple owned and lived in their principal residence for at least two years during the five-year period ending on the date of sale, they may claim an exclusion of up to $500,000 of gain on a joint return. Under the law, the up-to-$500,000 exclusion may be claimed on a joint return provided that during the five-year period ending on the date of sale: (1) either spouse owned the residence for at least two years, (2) both spouses lived in the house as their principal residence for at least two years, and (3) neither spouse is ineligible to claim the exclusion because an exclusion was previously claimed on a sale of a principal residence within the two-year period ending on the date of this sale. If Tests 1 and 3 are met but only one of you meets Test 2, your exclusion limit on a joint return is $250,000. However, even if the two-out-of-five-year use test is met, “nonqualified use” after 2008 may limit the exclusion you can claim; see 29.2.

Death of spouse before sale. If your spouse died and you inherit the house and later sell it, you are considered to have owned and used the property during any period of time when your spouse owned and used it as a principal home, provided you did not remarry before your sale. This rule can enable you to satisfy the two-out-of-five-year ownership and use tests where your spouse met the tests but you on your own did not. It may also enable you to claim the $500,000 exclusion if you sell the house in the year your spouse died or within the next two years, as discussed in the next two paragraphs.

If you and your spouse each met the use test and at least one of you met the ownership test as of the date of your spouse’s death, and you sell the residence in the year he or she dies, you may use the $500,000 exclusion limit, assuming you file a joint return for the year of your spouse’s death and neither of you claimed the exclusion for another home sale in the two years before your spouse died.

You are also entitled to use the $500,000 exclusion limit on a sale that is within two years of your spouse’s death, provided you have not remarried and you and your spouse would have qualified for the $500,000 limit on a sale immediately before his or her death under Tests 1–3 at the beginning of 29.3.

Divorce. If a residence is transferred to you incident to divorce, the time during which your former spouse owned the residence is added to your period of ownership. If pursuant to a divorce or separation decree or agreement you move out of a home that you own or jointly own with your spouse or former spouse, you are treated as having used the home for any period that you retain an ownership interest in the residence while the other spouse or former spouse continues to use it as a principal residence under the terms of the divorce or separation agreement.

Separate residences. Where a husband and wife own and live in separate residences, each spouse is entitled to a separate exclusion limit of $250,000 on the sale of his or her residence. If both residences are sold in the same year and each spouse met the ownership and use test for his or her separate residence, two exclusions may be claimed (up to $250,000 each), either on a joint return or on separate returns.

29.4 Reduced Maximum Exclusion

Generally, no exclusion is allowed on a sale of a principal residence if you owned or used the home for less than two of the five years preceding the sale (29.2). Similarly, an exclusion is generally disallowed if within the two-year period ending on the date of sale, you sold another home at a gain that was wholly or partially excluded from your income.

However, even if a sale of a principal residence is made before meeting the ownership and use tests or it is within two years of a prior sale for which an exclusion was claimed, a partial exclusion is available if the primary reason for the sale is: (1) a change in the place of employment, (2) health, or (3) unforeseen circumstances. If the sale is for one of these qualifying reasons, you are entitled to a prorated portion of the regular $250,000 or $500,000 exclusion limit. The employment change, health problem, or unforeseen circumstance can be attributable to you or another “qualified individual,” as defined below.

You automatically qualify for the reduced exclusion if your sale is within a safe harbor established by the IRS. If a safe harbor is not available, you may qualify by showing that the “facts and circumstances” of your situation establish that the primary reason for the sale was a change in the place of employment, health problem or unforeseen circumstances.

When you fall within a safe harbor or meet the primary reason test, you are allowed an allocable percentage of the regular $250,000 or $500,000 exclusion limit, depending on how much of the regular two-year ownership and use test was satisfied, or the time between this sale and a sale within the prior two years. For example, if you owned and lived in your home for 438 days before selling it to take a new job, you are entitled to 60% of the regular exclusion limit, which is based on 730 qualifying days (438/730 = 60%). Use Worksheet 29-1 to figure your reduced exclusion limit. Although the maximum exclusion is reduced, this may not disadvantage you. If the reduced exclusion limit equals or exceeds your gain, none of your gain is subject to tax.

Qualified individual. In addition to yourself, the following persons are considered qualified individuals for purposes of qualifying for the reduced maximum exclusion: your spouse, a co-owner of the residence, or any person whose main home was your principal residence.

For purposes of the “health reasons” category, qualified individuals include not only the above individuals but also their family members: parents or step-parents, grandparents, children, stepchildren, adopted children, grandchildren, siblings (including step- or half-siblings), in-laws (mother/father, brother/sister, son/daughter), uncles, aunts, nephews, or nieces.

Sale due to change in place of employment. The reduced exclusion limit applies if the primary reason for your sale is a change in the location of a qualified individual’s employment; see the above definition of qualified individual. “Employment” includes working for the same employer at a different location or starting with a new employer. It also includes the commencement of self-employment or the continuation of self-employment at a new location.

The IRS provides a safe harbor based on distance. If a qualified individual’s new place of employment is at least 50 miles farther from the sold home than the old place of employment was, the reduced exclusion limit is allowed so long as the change in employment occurred while you owned and used the home as your principal residence. If an unemployed qualified person obtains employment, the safe harbor applies if the sold home is at least 50 miles from the place of employment.

If the 50-mile safe harbor cannot be met, the facts and circumstances may indicate that a change in the place of employment was the primary reason for the sale, thereby allowing the reduced exclusion limit.

Sale due to health problems. The reduced exclusion limit applies if a principal residence is sold primarily to obtain or facilitate the diagnosis, treatment, or mitigation of a qualified person’s disease, illness or injury, or to obtain or provide medical or personal care for a qualified individual suffering from a disease, illness, or injury. A sale does not qualify if it is merely to improve general health. Note that for “health sales,” the definition of qualified individual is broadened to include family members; see above.

A physician’s recommendation of a change in residence for health reasons automatically qualifies under an IRS safe harbor.

Sale due to unforeseen circumstances. A sale of a principal residence due to any of the following events fits within an IRS safe harbor for unforeseen circumstances and automatically qualifies for a reduced maximum exclusion:

(1) The involuntary conversion of the home (condemnation or destruction of house in a storm or fire);

(2) Damage to the residence from a natural or man-made disaster, war, or act of terrorism;

(3) Any of the following events involving a qualified individual (see above): death, divorce or legal separation, becoming eligible for unemployment compensation, a change in employment or self-employment status that left the qualified individual unable to pay housing costs and reasonable basic household expenses, or multiple births resulting from the same pregnancy.

The IRS may expand the list of safe harbors in generally applicable revenue rulings or in private rulings requested by individual taxpayers.

Sales not covered by a safe harbor can qualify if the facts and circumstances indicate that the home was sold primarily because of an event that could not have been reasonably anticipated before the residence was purchased and occupied. The IRS in private letter rulings has been quite liberal in allowing the reduced maximum exclusion for unforeseen sales; see the examples below. Even the birth of a second child has been held to be an unforeseen circumstance (Example 5). However, an improvement in financial circumstances does not qualify under IRS regulations, even if the improvement is the result of unforeseen events, such as receiving a promotion and a large salary increase that would allow the purchase of a bigger home.

29.5 Figuring Gain or Loss

To figure the gain or loss on the sale of your principal residence, you must determine the selling price, the amount realized, and the adjusted basis. Worksheet 29-3 may be used to figure gain or loss on the sale of a principal residence.

Gain or loss. The difference between the amount realized and adjusted basis is your gain or loss. If the amount realized exceeds the adjusted basis, the difference is a gain that may be excluded (29.1). If amount realized is less than adjusted basis, the difference is a loss. A loss on the sale of your main home may not be deducted (29.8).

Foreclosure or repossession. If your home was foreclosed on or repossessed, you have a sale. See Chapter 31.

Selling price. This is the total amount received for your home. It includes money, all notes, mortgages, or other debts assumed by the buyer as part of the sale, and the fair market value of any other property or any services received. The selling price does not include receipts for personal property sold with your home. Personal property is property that is not a permanent part of the home, such as furniture, draperies, and lawn equipment.

If your employer pays you for a loss on the sale or for your selling expenses, do not include the payment as part of the selling price. Include the payment as wages on Line 7 of Form 1040. (Your employer includes the payment with the rest of your wages in Box 1 of your Form W-2.)

If you grant an option to buy your home and the option is exercised, add the amount received for the option to the selling price of your home. If the option is not exercised, you report the amount as ordinary income in the year the option expires. Report the amount on Line 21 of Form 1040.

Amount realized. This is the selling price minus selling expenses, including commissions, advertising fees, legal fees, and loan charges paid by the seller (e.g., loan placement fees or “points”).

Adjusted basis. This is the cost basis of your home increased by the cost of improvements and decreased by deducted casualty losses, if any (29.6). Cost basis is generally what you paid for the residence. If you obtained possession through other means, such as a gift or inheritance, see the special basis rules for gifts and inheritances (5.17).

Seller-paid points. If the person who sold you your residence paid points on your loan, you may have to reduce your basis in the home by the amount of the points. If you bought your residence after 1990 but before April 4, 1994, you reduce basis by the points only if you chose to deduct them as home mortgage interest in the year paid. If you bought the residence after April 3, 1994, you reduce basis by the points even if you did not deduct the points.

Settlement fees or closing costs. When buying your home, you may have to pay settlement fees or closing costs in addition to the contract price of the property. You may include in basis fees and closing costs that are for buying the home. You may not include in your basis the fees and costs of getting a mortgage loan. Settlement fees also do not include amounts placed in escrow for the future payment of items such as taxes and insurance.

Examples of the settlement fees or closing costs that you may include in the basis of your property are: (1) abstract fees (sometimes called abstract of title fees), (2) charges for installing utility services, (3) legal fees (including fees for the title search and preparing the sales contract and deed), (4) recording fees, (5) survey fees, (6) transfer taxes, (7) owner’s title insurance, and (8) any amounts the seller owes that you agree to pay, such as certain real estate taxes, back interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

Examples of settlement fees and closing costs not included in your basis are: (1) fire insurance premiums, (2) rent for occupancy of the home before closing, (3) charges for utilities or other services relating to occupancy of the home before closing, (4) any fee or cost that you deducted as a moving expense before 1994, (5) charges connected with getting a mortgage loan, such as mortgage insurance premiums (including VA funding fees), loan assumption fees, cost of a credit report, and fee for an appraisal required by a lender, and (6) fees for refinancing a mortgage.

Construction. If you contracted to have your residence built on land you own, your basis is the cost of the land plus the cost of building the home, including the cost of labor and materials, payments to a contractor, architect’s fees, building permit charges, utility meter and connection charges, and legal fees directly connected with building the home.

Cooperative apartment. Your basis in the apartment is usually the cost of your stock in the co-op housing corporation, which may include your share of a mortgage on the apartment building.

29.6 Figuring Adjusted Basis

Adjusted basis in your home is cost basis (29.5) adjusted for items discussed below. Worksheet 29-2 may be used to figure adjusted basis.

Increases to cost basis include: improvements with a useful life of more than one year, special assessments for local improvements, and amounts spent after a casualty to restore damaged property.

Decreases to cost basis include: gain you postponed from the sale of a previous home before May 7, 1997, deductible casualty losses not covered by insurance, insurance payments you received or expect to receive for casualty losses, itemized deductions claimed for general sales taxes on the purchase of a houseboat or a mobile home, payments you received for granting an easement or right-of-way, depreciation allowed or allowable if you used your home for business or rental purposes, any allowable tax credit after 2005 for a home energy improvement (25.15) that increases the basis of the home, residential energy credit (generally allowed from 1977 through 1987) claimed for the cost of energy improvements added to the basis of your home, adoption credit you claimed for improvements added to the basis of your home, nontaxable payments from an adoption assistance program of your employer that you used for improvements added to the basis of your home, District of Columbia first-time homebuyers credit (allowed to qualifying first-time homebuyers for purchase after August 4, 1997 and before 2012 ), and an energy conservation subsidy excluded from your gross income because you received it (directly or indirectly) from a public utility after 1992 to buy or install any energy conservation measure. An energy conservation measure is an installation or modification that is primarily designed either to reduce consumption of electricity or natural gas or to improve the management of energy demand for a home.

Improvements. Improvements add to the value of your home, prolong its useful life, or adapt it to new uses. You add the cost of improvements to the basis of your property.

Examples of improvements include: bedroom, bathroom, deck, garage, porch, and patio additions, landscaping, paving driveway, walkway, fencing, retaining wall, sprinkler system, swimming pool, storm windows and doors, new roof, wiring upgrades, satellite dish, security system, heating system, central air conditioning, furnace, duct work, central humidifier, filtration system, septic system, water heater, soft water system, built-in appliances, kitchen modernization, flooring, wall-to-wall carpeting, attic, walls, and pipes.

Adjusted basis does not include the cost of any improvements that are no longer part of the home.

Recordkeeping. Ordinarily, you must keep records for three years after the due date for filing your return for the tax year in which you sold your home. But you should keep home records as long as they are needed for tax purposes to prove adjusted basis. These include: (1) proof of the home’s purchase price and purchase expenses, (2) receipts and other records for all improvements, additions, and other items that affect the home’s adjusted basis, (3) any worksheets you used to figure the adjusted basis of the home you sold, the gain or loss on the sale, the exclusion, and the taxable gain, and (4) any Form 2119 that you filed to postpone gain from a home sale before May 7, 1997.

29.7 Personal and Business Use of a Home

If in 2017 you sold a home that was used for business or rental as well as residential purposes, you may be able to exclude part or all of any gain realized on the sale. The excludable amount depends on whether the non-residential and residential areas were part of the same dwelling unit, whether the ownership and use tests (29.2) were met, whether depreciation was allowable after May 6, 1997, and whether the non-residential use was before 2009 or after 2008.

Nonqualified use after 2008. Gain allocable to periods of “nonqualified” use (not used as principal residence) after 2008 is not excludable from income (29.2), but certain nonresidential periods are excluded from the definition of nonqualified use. For example, renting your home after you (and your spouse) move out is not nonqualified use if the rental occurs within the five-year period ending on the date of sale (see Example 2 (Andrea) at the end of 29.2).

The IRS does not treat home office use or rental of a spare room after 2008 as nonqualified use; see below.

Home office or rental space within your principal residence. The IRS takes the position that gain does not have to be allocated between the residential and business use portions of your home where both are within the same dwelling unit. This rule allows a home office to be considered part of your residential property for purposes of the home sale exclusion. Similarly, the IRS considers renting a spare room as a bed-and-breakfast bedroom to be residential use. If the two-out-of-five-year ownership and use test (29.2) is met for the regular residential portion, you are also treated as meeting the two-year residential use test for the home office or rental space, even if you used the area as a business office or rented room for your entire period of ownership. As a result, the gain on the entire residence is eligible for the exclusion, except for the gain equal to depreciation for periods after May 6, 1997. The gain equal to post–May 6, 1997, depreciation is never excludable; it must be reported on Schedule D (Form 1040) as unrecaptured Section 1250 gain (5.3).

Depreciation allowed or allowable. Under IRS rules, you must reduce your basis (29.6) in the home for purposes of figuring gain on a sale by any depreciation you were entitled to deduct, even if you did not deduct it. Furthermore, you cannot exclude the gain equal to the depreciation allowed or allowable for periods after May 6, 1997. This means that if you were entitled to take depreciation deductions for periods after May 6, 1997, but did not do so, the gain equal to the allowable depreciation is generally not excludable. However, if you have records showing that you claimed less depreciation than was allowable, the IRS will reduce the excludable gain only by the claimed (allowed) depreciation.

Business or rental area separate from your dwelling unit. If you sell property that was partly your home and partly business or rental property separate from your dwelling unit, and the business/rental use of the separate part exceeded three years during the five years before the sale, the gain allocable to the separate part is not eligible for an exclusion (since the two-year use test (29.2) has not been met for that part) and must be reported as taxable income on Form 4797. This could be the case if you lived in one apartment and rented out other apartments in the same building, you rented out an unattached garage or building elsewhere on your property, your apartment was upstairs from your business, you operated a business from a barn or other structure separate from your business, or your home was located on a working farm. See IRS Publication 523 for reporting details.

29.8 No Loss Allowed on Personal Residence

A loss on the sale of your principal residence is not deductible. You do not have to report the sale on your return unless you received a Form 1099-S. If you received Form 1099-S, you must report the sale on Form 8949 (5.8) even though the loss is not deductible. Code “L” must be entered in column (f) of Form 8949 to indicate that the loss is not deductible, and the nondeductible loss must be entered as a positive adjustment in column (g). These are the same reporting rules as for a second home or vacation home discussed below.

If part of your principal residence was used for business in the year of sale, treat the sale as if two pieces of property were sold. Report the personal part on Form 8949 and the business part on Form 4797. A loss is deductible only on the business part.

Second home or vacation home. If you sell at a loss a second home or vacation home that was used entirely for personal purposes and the sale was reported on Form 1099-S, you report the sale on Form 8949 and Schedule D, even though the loss is not deductible. On Form 8949 (5.8), report the proceeds in column (d) and your basis in column (e). The loss (excess of basis over proceeds) is not deductible, so code “L” must be entered in column (f) and the amount of the loss entered as a positive amount in column (g). The positive adjustment in column (g) negates the loss, so the gain or loss in column (h) will be “0” (5.8). If in the year of sale part of the home was rented out or used for business, allocate the sale between the personal part and the rental or business part; report the personal part on Form 8949 (5.8) and the rental or business part on Form 4797.

29.9 Loss on Residence Converted to Rental Property

You are not allowed to deduct a loss on the sale of your personal residence. If you convert the house from personal use to rental use you may claim a loss on a sale if the value has declined below the basis fixed for the residence as rental property.

To determine if you have a loss for tax purposes, you need to know the conversion date basis. This is the lower of (1) your adjusted basis (29.6) for the house at the time of conversion or (2) the fair market value at the time of conversion. Add to the lower amount the cost of capital improvements made after the conversion, and subtract depreciation and casualty loss deductions claimed after the conversion. To deduct a loss, you have to be able to show that this basis exceeds the sales price. For example, if you paid $200,000 for your home and convert it to rental property when the value has declined to $150,000, your conversion date basis for the rental property is $150,000. If the property continues to decline in value, and you sell for $125,000 after having deducted $10,000 for depreciation, you may claim a loss of $15,000 ($140,000 (conversion date basis of $150,000 reduced by $10,000 depreciation) – $125,000 sales price). Your loss deduction will not reflect the $50,000 loss occurring before the conversion.

Partially rented home. If you rented part of your home for over three years during the five years preceding the sale, you must allocate the basis and amount realized between the portion used as your home and the rented portion (29.7). A loss on a sale is allowable on the rented portion, which is reported on Form 4797.

Profit-making purposes. Renting a residence is a changeover from personal to profit-making purposes. If a house is merely put up for rent such as by listing it with a realty company but little else is done to obtain tenants and the property is in fact not rented, the IRS is likely to conclude that it was not converted to property held for the production of income and a loss on the sale will be treated as a nondeductible personal loss; see Example 1 in 9.10.

Similarly, where a house is only rented for several months prior to a sale, the IRS may not treat this as a conversion to rental property and may disallow a loss deduction claimed on the sale.

Loss allowed on house bought for resale. A loss deduction may also be allowed where you acquired the house as an investment with the intention of selling it at a profit, even though you occupied it incidentally as a residence prior to sale. In an unusual case, an owner bought a house with the intention of selling it. He lived in it for six years, but during that period it was for sale. The Tax Court allowed him to deduct the loss on its sale by proving he lived in it to protect it from vandalism and to keep it in good condition so that it would attract possible buyers.

In another case, an architect and builder built a house and offered it for sale through an agent and advertisements. He had a home and no intention to occupy the new house. On a realtor’s advice, he moved into the house to make it more saleable. Ten months later, he sold the house at a loss of $4,065 and promptly moved out. The loss was allowed on proof that his main purpose in building and occupying the house was to realize a profit by a sale; the residential use was incidental.

Gain on rented residence. You have a gain on the sale of rental property if you sell for more than your adjusted basis at the time of conversion, plus subsequent capital improvements, and minus depreciation and casualty loss deductions. The sale is subject to the rules in Chapter 44 for depreciable property.

29.10 Loss on Residence Acquired by Gift or Inheritance

You may deduct a loss on the sale of a house received as an inheritance or gift if you personally did not use it and offered it for sale or rental immediately or within a few weeks after acquisition.