CHAPTER |

8 |

How Finance Views Procurement Savings

Professional buyers have a clear view of their importance within the organization. They know that every single penny saved is not just a savings to the available budgets, but brings manifold benefits to the organization. In this chapter, we will have a look at the benefits of procurement savings from the finance perspective.

8.1 Benefits of Procurement Savings

Around the globe, there are many ongoing debates for capturing the exact procurement savings and their short-term and long-term impacts for the organization.

Even mature organizations compare savings with respect to the budgeted value. Procurement savings have the following impacts on an organization's financials (depicted in Figure 8.1):

- Working capital

- Bottom line

- Balance sheet

8.1.1 Working Capital

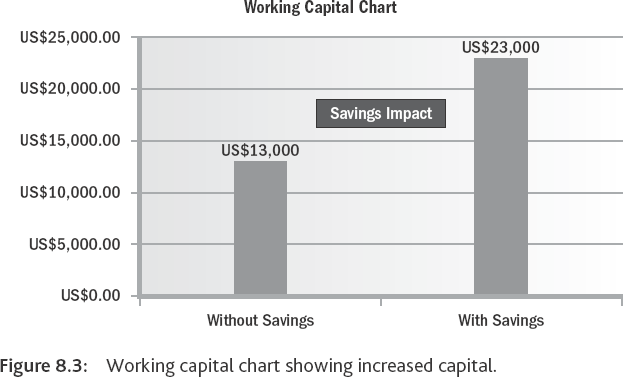

Working capital is the amount of a company's current assets minus the amount of its current liabilities. For example, if a company's balance sheet dated June 30 reports total current assets of US$323,000 and total current liabilities of US$310,000, the company's working capital on June 30 is US$13,000. Therefore, it is obvious that a majority of expenses are incurred via the procurement cell of any organization, and in the case that procurement could save, say, an additional US$10,000, the organization's working capital will increase, which will lead to higher working capital. Furthermore, this means that the organization has to depend less on taking loans from banks and hence, saves on interest payments. In such a case, the organization's working capital will be US$23,000, which is shown in Figure 8.2.

From Figure 8.3, it is clear that the organization will have more spending power or operating money, which will be freely available and without any interest liability.

8.1.2 Bottom Line

A company's bottom line is its net income. The bottom line is a company's income after all expenses have been deducted from revenues. These expenses include interest charges paid on loans, general and administrative costs, and income taxes.

A company's bottom line can also be referred to as net earnings or net profits. The best thing about procurement savings is that they are a direct stream of revenue for the organization, which has been generated without investing any efforts or resources, and above all, no taxes have to be paid on savings. Any organization has this as one of the main key performance indicators (KPIs) of their business, apart from sales revenue and collection of payments from the customer. So, the organization's performance will be measured on the following three parameters:

- Sales revenue

- Payment collection

- Bottom line

While bidding for any project, the tendering and business development team has to have the maximum hit rate, which is the number of orders received against the number of offers submitted by them (see Figure 8.4).

The sales team will keep pushing the tendering team for reducing costs in the offers because sales performance depends on the value of orders booked in a particular year. Think of the following: If the sales team keeps bringing inquiries, but the value of orders received is not as per sales targets, who is responsible for this failure? Is it the sales team or the tendering/cost estimation team? In this scenario, where markets for orders are decided on competitive prices, the costing team would be responsible. Therefore, a key performance indicator for the tendering team is the hit rate. The tendering manager has to be accountable for correct estimations; therefore, the organization should define a red line below which orders cannot be taken. For example, if the red line is defined as 15%, the organization will not bid on a project where profit margins are below 15%.

It is interesting to know where these costs are flowing to the tendering manager from. The tendering manager is responsible for considering all the costs going to the execution of projects, such as:

- Direct costs for material and manpower

- Costs for unforeseen risks

- Project management costs

- Costs for tax and statutory liabilities

- Profit margins after all costs

Every organization focuses on increasing sales revenue, as sales revenue is the first item on the income statement—and then all expenses are deducted from this figure. Therefore, organizations attempt to increase sales while trying to keep the expenses minimal, which is, again, a tough task to perform. The attention is on minimizing the expenses again, and this is possible by procurement in a more effective way, as procurement professional buyers are the ones who can control expenses. The procurement function is responsible for buying goods and/or services at the best rates, and hence, having direct savings from what is budgeted during the bidding stage will become the direct revenue stream and will contribute to a better bottom line.

Another way of looking at the bottom line is that it is the company's ability to pay back dividends to its shareholders over a specific period. However, dividend payout will depend on the dividend payout ratio. For example, if the dividend payout ratio is 60% and the organization has made a net income of US$100, then the organization distributes US$60 to its shareholders, and US$40 will be retained as the organization's retention income.

8.1.3 Balance Sheet

A balance sheet is an instrument or report on the financial health of a company. Every procurement professional knows the importance of the balance sheet, as they need to deeply study the potential vendors’ financial health and, at the same time, they need to control and contribute to improving the balance sheet of their own organization. We will see how procurement savings helps the balance sheet; but first, let's look at what a balance sheet is.

A balance sheet is a statement of assets, liabilities, and capital at a particular point in time. In short, the balance sheet is prepared annually and can be correlated to a snapshot of a moving train. The balance sheet reflects the following equations (see Figures 8.5 and 8.6).

It is known that any organization either includes the owner's funds, borrowed money, or both; we can rewrite the equation as:

Assets maybe understood as the amount invested by the company to run different activities like procurement of machinery, land and building, fixtures, patents, and so on. Assets also include the money payable to the company by customers who have purchased goods and/or services on credit. The right-hand side of the equation shown in Figure 8.6 refers to the liabilities, which refers to the amount taken by the company from other owners/shareholders who invest in the company with the intention to earn profits. Such amounts invested by the owners and/or shareholders are referred to as owner/shareholder equity.

Let us try to further understand what balance sheets look like for a new company that has just started in manufacturing activities and needs to buy machinery for carrying out these activities. The cost of the machinery is US$15,000. The owner has US$10,000 in available equity. The company needs additional funds of US$5,000, which the company will borrow from the bank. The balance sheet at this point is shown in Figure 8.7.

After the company has started operations and is making profits, all the money it makes after paying expenses, taxes, and interest to the bank will belong to the shareholders. Therefore, whatever money the company makes will become part of the liabilities side of the balance sheet. On the liability side, the owner's equity will go up, whereas on the asset side, cash will go up, keeping the liability and asset equation balanced.

Now, consider a scenario in which the procurement team of this company negotiated the prices for the machinery, and procurement managed to buy the machinery at US$12,000. The revised balance sheet will be as shown in Figure 8.8.

The revised balance sheet shows that interest on US$3,000 has been saved, and then the company has the option to either reduce the owner's equity, pay the bank loan, or retain this cash for future use. This shows that procurement savings improves the balance sheet.