The years 1940 to 1980 were good times for workers in general and American manufacturing. During this period, the United States experienced tremendous economic growth that built the middle class and launched the notion of the American Dream, where every generation expected to exceed their parents. Wages followed productivity gains and workers realized continuous gains in their income. In the America of the 1950s, a blue-collar worker could have a mortgage, support a wife and two kids, buy a car, and be the only worker in the family.

From 1948 to 1973, the corporations were sharing profits with labor and were paying people for the productivity they created. I think it reflects the fact that unions were very strong and workers had strong collective bargaining power. It was also during a time when corporations were not as driven by quarterly profits and were still supportive of their employees and communities.

But Things Began to Change

By the 1970s, America had 25 years of postwar growth, but the nation was facing rising global competition and corporate profits were being squeezed. The multinational corporations (MNCs) could have responded by improving product quality, protecting their technologies, and avoiding trade agreements that would sacrifice jobs, factories, communities, and manufacturing industries. But instead, they decided to reinvent their organizations, and the new emphasis was on reducing costs and short-term profits.

It began with the Milton Friedman doctrine in a 1978 article which said “An entity’s greatest responsibility lies in the satisfaction of the shareholders.” In the 1980s, the Business Roundtable translated this into shareholder value or “the point of a business enterprise is to generate economic returns to its owners, period.” And so, shareholder value and short-term profits became the driving force at the expense of employees, communities, the economy, and country.

The Immediate Answer Was Outsourcing

To achieve their new profit goals, America’s MNCs adopted a new business model that would do the R&D, engineering, and marketing in the United States, but do the manufacturing in a foreign country. The new model did provide better short-term profits and shareholder value but ran the risk of eventually giving the foreign contractors their technologies and markets. After 40 years of outsourcing to low-cost countries, America has lost 7.5 million manufacturing jobs since 1979, lost many supply chains, and closed 91,000 manufacturing plants.1

Outsourcing also led to the economic deserts in the Midwest. Cities such as Muncie, IN; Danville, VA; Dayton, OH; Bruceton, TN; Flint, MI; Johnstown, PA; Galesburg, IL; and Youngstown, OH, have lost thousands of jobs, businesses, and tax revenue and have never been able to come back.

The Decline of Wages

The knee-jerk reaction of most corporations was to cut labor costs anywhere possible. This meant the beginning of layoffs, frozen wages, temporary labor, moving employees to part-time status, and imposing two-tier pay systems in many of industries.

After Ronald Reagan was elected in 1980, the government sided with the big corporations and began to adopt policies that effectively forced workers to accept wage concessions, discredited the trade union movement, and reduced regulation of most industries which allowed most corporations to reduce labor costs even more dramatically. The Reagan administration also helped corporations by terminating the air traffic control employees and crushing their union, which began a lengthy period of union busting by the big corporations.

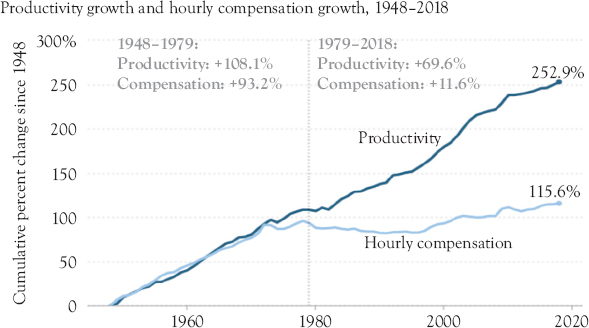

This was the beginning of a period where the U.S. workers compensation would not keep up with the growth in productivity. “During the last 40 years, the median weekly pay for Americans working full time has increased by just one-tenth of 1 percent per year and for men it has actually gone down 4 percent.” The median income of full-time male workers is lower today than it was in 1975, while the costs of housing, health care, and education have increased by 50 to 100 percent. Average wages declined, employment at low wage service jobs increased, and inequality rose to the highest of all Western Nations (Figure 1.1).

The graph shows in the late 1970s, wages began to stagnate which were just a forerunner of some massive changes to the American economy.

Figure 1.1 The gap between productivity and a typical worker’s compensation has increased dramatically since 1979

Notes: Data are for compensation (wages and benefits) of production/nonsupervisory workers in the private sector and net productivity of the total economy. “Net productivity” is the growth of output of goods and services less depreciation per hour worked.

Source: EPI analysis of unpublished Total Economy Productivity data from Bureau of Labor Statistics (BLS) Labor Productivity and Costs program, wage data from the BLS Current Employment Statistics, BLS Employment Cost Trends, BLS Consumer Price Index, and Bureau of Economic Analysis National Income and Product Accounts. Updated from Figure A in Raising America’s Pay: Why It’s Our Central Economic Policy Challenge (Bivens et al. 2014).

The Pursuit of Free Trade Agreements

The biggest promoters of free trade agreements have always been MNCs. When they wanted Congress to pass a free trade bill, they always promised it would boost overall trade, create jobs, and give the United States access to more foreign markets. But in retrospect, FTAs such as the North American Free Trade Agreement (NAFTA) and the United States–Korea Free Trade Agreement (KORUS) have eliminated jobs and increased the trade deficit. The only real beneficiaries were American MNCs and their shareholders at the expense of American jobs, suppliers, and communities.

Free trade agreements have devastated our country’s industrial base and the economic security of millions of Americans. Republican and Democratic leaders have systematically traded away manufacturing industries and the income and job security of American workers in exchange for promoting the interests of American international investors and the MNCs. In the 1992 Presidential Election against Bill Clinton, Ross Perot warned that that there would be a giant sucking sound as jobs and plants moved south of the border if NAFTA was passed and that is exactly what happened.

Loss of Manufacturing Industries and Jobs

Employment and establishments in 38 North American manufacturing industries from 2002 to 2020 continued to decline. The slow but relentless loss of manufacturing, technologies, and supply chains was bleeding America dry and helping all of our trading competitors to grow.

Financial Speculation

Instead of investment in plants, equipment, and jobs, MNCs invested in investments, many of them speculative for short-term financial gains. Wall Street guided hostile takeovers, mergers, and investments in foreign financial organizations. This became popularly known as the casino society. An example was that the volume of futures trading in stocks and bonds rose ninefold between 1973 and 1985.

Business decided in the late 1970s that if they were going to find ways to increase profits and decrease their costs, they knew that they had to buy access to Congress with lobbying money. Sector by sector, they began to build up large funds to pay lobbyists to get the crucial votes they needed.

Associations such as the National Association of Manufacturers, Chamber of Commerce, National Federation of Independent Businesses, and the Business Roundtable began by increasing membership and member donations. In 1975, only 175 corporations had lobbyists, but by 2011, they had 12,929 lobbyists who were dispensing an impressive $3.5 billion per year on lobbying. Political Action Committees (PACS) increased from 300 in 1976 to 12,000 in 1985.

None of these MNC accomplishments could have been achieved without the help of politicians—Democrats and Republicans. From the late 1970s on, lobbying was the key to get Congress and the executive to both get rid of New Deal laws and support all of the laws that would give MNCs, their shareholders, and the 1 percent, the increases in wealth they felt they deserved.

Transition to a Service Economy

In 1973, Daniel Bell wrote a book, The Coming of Post-Industrial Society, in which he described how the U.S. economy was transitioning from being a manufacturing-based economy to becoming a service-based economy. Bell’s projection came true and we are now in the postindustrial service economy. The transition has been rationalized by most economists and academics who said that America can transition to a service economy and provide good jobs and living standards for the middle class. But it isn’t happening. The new service economy is not producing enough livable wage jobs to maintain living standards. About 50 percent of the working citizens are being left behind.

Tax Reduction for the MNCs

The first part of the MNC plan to increase profits and wealth was to lobby Congress to reduce their taxes. The MNCs and their lobbyists were very successful in getting four tax reduction laws for corporations and their shareholders since 1981. They got another tax cut (The Tax Cuts and Jobs Act (TCJA)) in 2017 that reduced corporate taxes from 35 to 21 percent. In order to get the TCJA passed in Congress, the authors of the bill promised that the MNCs would invest the new savings in domestic capital investments and new jobs, but it did not happen. The MNCs used most of their new profits to buy back shares of their own stock to increase the share price and realize more short-term profits. To make matters worse, tax receipts have declined $160 billion since 2016 and $92 billion since the tax cut.

Monopolies and Oligopolies

Since 1999, the United States has undergone an enormous number of mergers and acquisitions (M&A), mostly by large corporations. There were 8,000 corporations in 1996, and by 2015 there were less than 5,000.2 In most cases, the reduction was due to M&A, which has led to market concentrations. MNCs have formed monopolies and oligopolies that give them the power to control employment, wages, supply chains, consumer pricing, and market share.

Capitalism is supposed to be based on ubiquity of markets and competition, but since there have been few antitrust efforts to stop them, the MNCs have formed hundreds of monopolies and oligopolies in industries such as airlines, big banks, hospitals, meat packers, media companies, beer, autos, and oil and gas.

Losing Our Technologies

The MNC decisions to outsource production and build manufacturing plants in Asia, rather than in the United States, have given foreign competitors our technologies almost as fast as we invent them. New technologies and innovation are our only hope of competing in the world economy, but in signing technology transfer agreements and outsourcing, the MNCs are giving their competitors the products and know-how to take away their markets. It is a self-defeating and short-term strategy.

The Problem of Wall Street

The shift to shareholder value, stock prices, and stock buybacks by the MNCs is driven by Wall Street. The current financial philosophy of Wall Street is extractive not productive. They are not producing wealth by investing in goods, but they are producing wealth by financial engineering. Wall Street makes money by financing the trade deficit, from stock buybacks, and by investing in foreign capital markets which fund our biggest foreign competitors. Andy Grove from Intel said “the result is a high-profit, low prosperity nation.”

Shortage of Skilled Workers

A 2018 study by Deloitte and the Manufacturing Institute predicted that U.S. manufacturing would have 2.1 million unfilled jobs by 2030. It is not well known that instead of investing in training, American MNCs are still opting for the short-term solutions of relying on immigration (H-1B Visas), outsourcing, and automation; but not investing in advanced training like apprenticeship to create the skilled workforce now needed in U.S. manufacturing.

Allowing China Into the WTO in 2001

The decision to allow China into the World Trade Organization (WTO) in 2001 was driven by the MNCs who wanted to build plants and move production to China. They wanted access to the growing China consumer markets, and they agreed to technology transfer agreements that would give Chinese competitors their technologies with the additional proviso to ship their products back to the United States. Allowing China into the WTO was all about cost reduction by importing rather than making products in the United States, and it was supported by the Clinton administration and free trade Democrats and Republicans. It accelerated the outsourcing of jobs and production and has resulted in a huge increase in imports, and a runaway trade deficit.

Trade Deficits, Currency Manipulation, and the Strong Dollar

The real score card that shows what is happening to the American economy is the trade deficit which exceeded $1 trillion in 2021. The MNCs ignore trade deficits and expect the government and taxpayers to continue to finance them ad infinitum.

The leading cause of U.S. trade deficits is currency manipulation and misalignment by China and 15 other trading countries. Currency manipulation happens when one of our trading partners buys up U.S. assets such as treasury notes, stocks, and bonds, which make the value of the dollar artificially high. Currency manipulation is illegal under the rules of the International Monetary Fund, but the rules are never enforced.

By making the dollar more expensive, it makes our exports more expensive and makes the foreign country’s products cheaper. All treasury secretaries since 1994 believe a strong dollar is in our national interest because they believe that the benefits of a strong dollar are lower interest rates, more liquid financial markets, cheaper funding for American banks, and the ability to run large trade deficits.

Large corporations that import do not want the government to stop currency manipulation or to devalue the dollar because they want to keep import prices low. This keeps U.S. export prices artificially high and makes American products uncompetitive.

Shift in Wealth and Growing Inequality

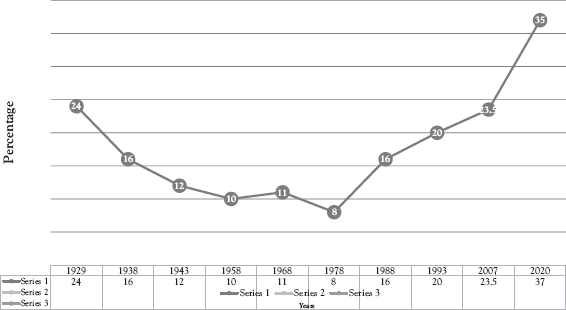

Figure 1.2 shows that in 1929, before the Depression, the 1 percent owned 24 percent of total income of the country. By 1978, their share had declined to 8 percent of the total income because of tax increases on corporations and the wealthy along with comprehensive New Deal legislation.

However, in the late 1970s, the 1 percent and the corporations developed strategies to increase their share of the total income of the country. Figure 1.2 is based on a new estimate by the economist Edward N. Wolff in 2017. He showed that the 1 percent had increased their total share of wealth to around 37 percent, which is even higher than their share in the Gilded Age. The 1 percent have become $21 trillion richer, a sum almost the size of the U.S. economy.

Figure 1.2 Top 1 percent share of total income

Source: 1929 to 2007, Capital in the 21st Century, Thomas Picketty, Belknap Press, 2014.

Source: 2007 to 2020, Wealth Distribution by Wealth Group, USA FACTS, Federal Reserve, September 21, 2020.

What seems to stoke anger is that the tremendous gains in wealth by the 1 percent were at the expense of the middle class, which has led to the growth of inequality. Most taxpayers think that both the 1 percent and the MNCs have not paid their fair share of the economy.

Decline of Productivity and GDP Growth and the Increase in Debt

There are signs that show the American economy may be in decline. First, labor productivity, defined as output per labor hour, has grown at an average annual growth rate of 1.3 percent since 2005—well under the average of 2.1 percent going back to 1947.

There were several decades where the United States enjoyed 3 to 4 percent gross domestic product (GDP) growth, but since 2000, it has been an anemic 1.8 percent.

Another serious economic indicator since the 1980s has been the incredible increase in personal and business debt. In the face of falling incomes, consumers attempted to maintain their living standards by borrowing unprecedented amounts of revolving credit. According to Kevin Phillips in his book Bad Money, between 1987 and 2007, “the credit market debt quadrupled from nearly $11 to $48 trillion.”

At the same time, government began to amass trillions of dollars of new debt, and the United States went from the largest creditor nation to the leading debtor nation in a matter of decades. This shift to a casino economy is a house of cards.

Conclusions

This book shows how the economy has been restructured to fit the needs of MNCs and their investors, resulting in huge gains in wealth for the few. These gains have led to rising inequality while tens of millions of Americans find themselves unable to attain the standard of living of previous generations. More importantly, it shows how the growing power and control of MNCs have destroyed communities, industries and manufacturing and have put the future of the U.S. economy in jeopardy.

In the Preface of this book, I noted that 181 U.S. CEOs signed a commitment letter to lead their companies not just for the benefit of their investors, but “for the benefit of all stakeholders: customers, employees, suppliers, and communities.” This book provides them with a chapter-by-chapter assessment of what has gone wrong for all of the stakeholders and what the MNCs can do to begin correcting the situation.

What has been good for them has turned out to be not good for employees, American manufacturing, communities, suppliers, or the middle class. MNC strategies for the last 40 years have led to the deindustrialization of America, which is slowly killing the economy and the American Dream. We are at a “now or never moment.” It is time to find out if they can walk their talk.

1 R.E. Scott. August 10, 2020. Trump’s Trade Policies Have Cost Thousands of U.S. Manufacturing Jobs (Economic Policy Institute).

2 L. Borsen, D. Brown, J. Grabow, and J. Kelly. May 18, 2017. Looking Behind the Declining Number of Public Companies (Harvard Business Review).