Preface

With the development of digital wealth management (“WealthTech”), including robo-advisory platforms and virtual advice, the global investment management industry is facing huge disruption. In addition to successful digital wealth management solutions, customer preferences are changing and the millennial generation often prefers a “do it yourself” approach via apps instead of meeting a financial advisor in person. Considering that trillions of pounds will be inherited by this tech-inspired generation from their wealthy baby boomer parents, and the general trend that consumers are used to a great digital experience, most asset managers and private banks will need to closely review their product, distribution and marketing strategies over the next decade to stay in business.

In addition, the pressure to lower fees and achieve higher returns has allowed WealthTech solutions to shine, helping to generate higher alpha, reduce risk and significantly lower the costs of money management, financial planning and advice, while at the same time delighting their customers with a superior user experience.

Some emerging business models – such as robo-advisors – were initially focused on servicing customer segments which could not be serviced profitably by traditional players, before moving upstream and competing with incumbents. Other propositions are focused on empowering existing financial advisors and private bankers with the latest digital innovation and technologies, or supporting portfolio managers to fight information overload through solutions leveraging the latest artificial intelligence and big data analytics intelligence.

Overall, the WealthTech sector is booming globally, with FinTech entrepreneurs and investors across the world working on the most cutting-edge solutions. In order to share with our readers the best content globally, we have followed the same approach as with The FinTech Book – the first globally crowdsourced book on the financial technology revolution, which was published by Wiley in 2016 and has become a global bestseller.

The FinTech Book exceeded all our expectations: the book is available in five languages across 107 countries, as a paperback, e-book and audiobook. More than 160 authors from 27 countries submitted 189 abstracts to be part of the book. About 50% of all contributors were chosen to write for the final book. When we launched The FinTech Book across the world during 2016, our authors and readers had many opportunities to meet us in person, get their books signed at global book launch events and deepen their FinTech friendships worldwide.

In 2017 we decided to extend our FinTech book series by writing three new books on how new business models and technology innovation will change the global asset management and private banking sector (“WealthTech”), the insurance sector (“InsurTech”) and regulatory compliance (“RegTech”). We followed our approach of crowdsourcing the best experts, to give the most cutting-edge insight into the changes unfolding in our industry.

The WealthTech Book is the first global book on this subject – a book that provides food for thought to FinTech newbies, pioneers and well-seasoned experts alike. The reason that we decided to reach out to the global FinTech community in sourcing the book's contributors lies in the inherently fragmented nature of the field of financial technology applied to investment management, financial advisors and private banks globally. There was no single author, group of authors or indeed region in the world that could cover all the facets and nuances of WealthTech in an exhaustive manner. What is more, with a truly global contributor base, we not only stayed true to the spirit of FinTech and WealthTech, making use of technological channels of communication in reaching out to, selecting and reviewing our would-be contributors, but also made sure that every corner of the globe had the chance to have its say. Thus, we aimed to fulfil one of the most important purposes of The WealthTech Book, namely – to give a voice to those who would remain unheard, those who did not belong to a true FinTech community in their local areas, and spread that voice to an international audience. We have immensely enjoyed the journey of editing The WealthTech Book and sincerely hope that you will enjoy the journey of reading it at least as much.

More than 240 authors from 25 countries submitted 236 abstracts to be part of the book. We asked our global FinTech community for their views regarding which abstracts they would like to have fully expanded. Out of all the contributions, we selected the best and asked our selected authors to write the 71 chapters in this book. We conducted a questionnaire among all our selected authors to further understand their background and expertise. 80% of our authors have postgraduate university degrees and strong domain expertise across many fields; 74% of our final authors had had their articles published before. See Tables 1 and 2.

Table 1: What is the highest educational qualification of our authors?

Table 2: List of all areas our authors have domain expertise in (multiple choices possible)

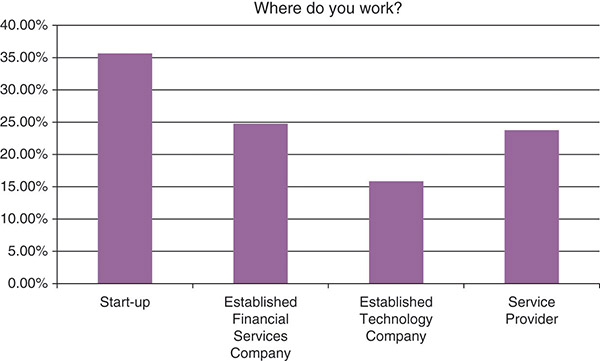

Tables 3 and 4 show that more than 35% of our authors are entrepreneurs working for FinTech start-ups (many of them part of the founding team), 40% come from established financial and technology companies and another quarter from service providers such as consulting firms or law firms servicing the FinTech sector.

Table 3: The types of company our authors are working in

Table 4: The size of companies our authors work for

More than 25% of our authors work for start-ups with up to 5 people and another 28% for start-ups/SMEs (small and medium-sized enterprises) with up to 50 people. More than a quarter of our authors are employed by a large organization, with more than 1000 employees.

In summary, we are very proud of our highly qualified authors, their strong expertise and passion for FinTech, either being entrepreneurs or often “intrapreneurs” in large established organizations committed to playing a significant role in the global FinTech and WealthTech revolution. These remarkable people are willing to share their insights with all of us over the following pages.

This project would not have been possible without the dedication and efforts of all contributors to The WealthTech Book (both those who submitted their initial abstracts for consideration by the global FinTech community, and the final authors whose insights you will be reading shortly). In addition, we would like to thank our editors at Wiley, whose guidance and help made sure that what started off as an idea, became the book you are now holding in your hands.

Finally, I would like to thank my fantastic co-editor Thomas Puschmann, Head of the Swiss FinTech Innovation Lab. Editing a crowdsourced book naturally takes several months, and Thomas was always a pleasure to work with, given his strong domain expertise and vision for the future of WealthTech!

Susanne Chishti

Co-Founder, The FINTECH Book Series

CEO & Founder FINTECH Circle & the FINTECH Circle Institute

www.FINTECHCircle.com