13

Disclosures in Annual Reports

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Develop understanding about the disclosure requirements under the Companies Act.

- Differentiate between a qualified audit report and a clean report.

- Appreciate the disclosure requirements as per the listing agreement.

- Get familiar with the disclosure requirements under accounting standards relating to segment reporting (Ind AS 108), related party transactions (Ind AS 24), interest in other entities (Ind AS 112) and financial instruments disclosures (Ind AS 107).

- Understand the voluntary disclosure practices relating to value added statement, economic value added, human resource accounting and brand valuation.

13.1 INTRODUCTION

In addition to the financial statements discussed in the earlier chapters, the annual report of a company contains a number of other useful reports. These reports give further insight into the financial performance and position of the company. Some of these reports are mandatory in nature, whereas some are purely voluntary. Management of progressive companies uses their annual reports to communicate with various stakeholders on voluntary basis. The information contained in the annual report may be classified under four categories:

- Disclosure required under the Companies Act, 2013: The companies registered in India are regulated in terms of the provisions of the Companies Act, 2013. The Act requires a number of disclosures to be incorporated in the annual report of the company. These disclosures are applicable to all companies and are mandatory in nature.

- Disclosure required under the listing agreement: A company that has raised money by inviting public to subscribe for its shares is required to sign a listing agreement with the stock exchange where it wants its shares to be traded. The listing agreement imposes a number of disclosure requirements on such publicly held companies. As these requirements are originating from the listing agreement, they apply only to listed companies.

Table 13.1 Other Disclosures in Annual Reports

- Disclosures required under the relevant accounting standards: Most of the accounting standards, in addition to providing guidance for accounting, also impose certain disclosure requirements. These disclosures are in addition to the requirements under the provisions of the Companies Act, 2013.

- Voluntary disclosures: To ensure transparency, companies are making additional disclosures in their annual reports which go beyond the mandatory requirements as aforesaid. As these disclosures are voluntary in nature, there is no uniformity in the type of reports or content of reports across various companies.

A brief overview of the above disclosure is given in Table 13.1.

13.2 DISCLOSURES UNDER THE COMPANIES ACT, 2013

13.2.1 Auditor’s Report

The accounts of the company are required to be audited by an external auditor. Such an audit is called a statutory audit or an independent audit or an external audit. The statutory audit is performed by a Chartered Account holding a certificate of practice issued by the Institute of Chartered Accountants of India. Based upon their audit, the auditors are required to make a report to the shareholders of the company. In accordance with the provisions of Section 143 (2) of the Companies Act, the auditors are required to state in their report their opinion on the accounts audited by them. The auditors’ report states the following:

Auditor Report is addressed to the members (shareholders) of the company and is required to be read out the Annual General Meeting of the shareholders.

- They have sought and obtained all the information and explanation necessary for the audit work.

- Proper books of accounts as required by law have been kept by the company.

- Financial statements are in compliance with the applicable accounting standards.

- The balance sheet gives a true and fair view of the state of affairs of the company at the end of the financial year and the profit and loss statement gives a true and fair view of the profit or loss of its financial year.

- Report on the accounts of branch office of the company audited by a person other than the company’s auditor has been sent to him.

- Observations or comments on financial transactions or matters having any adverse effect on the functioning of the company.

- Any qualification, reservation or adverse remarks relating to maintenance of accounts and other matters connected thereto.

- Adequacy of internal financial control system and operating effectiveness of such controls.

- Any other specified matter.

If auditors’ opinion on all of the above is affirmative, the auditors’ report is said to be a clean report. In an extreme case, if on the basis of the information available the auditors are not able to form an opinion, they may issue a disclaimer. However, such instances are rare. If the auditors are of the opinion that the financial statements do not represent a ‘true & fair view’, they may issue an adverse opinion. Again such instances are really rare. If the auditors have any reservation but such reservations do not warrant a disclaimer or an adverse opinion being given, a qualified report may be given by the auditor. In a qualified report the auditors state that the financial statements present a true and fair view but subject to certain reservations or qualifications stated in the audit report.

It may be noted that auditors’ report is merely an opinion and not a certificate. For forming their opinion the auditors perform such audit test as may be appropriate with the size and complexity of the business. The audit is usually based upon sample testing and therefore a clean report does not ensure that the accounts are error free. However, while analyzing the financial statements of a company, qualifications in the audit report must be considered. Repeated qualified reports by the auditors also diminish the reliability of the numbers presented in the financial statements. Some examples of qualification in the auditors’ report are given in Box 13.1.

Box 13.1 Auditors’ Qualifications

‘No provision has been made for interest relating to earlier years aggregating to ₹ 74.71 million on the outstanding inter-corporate deposit of ₹ 50.0 million. Had the impact of same been considered, the net profit (after tax) for the year ended 31st March 2011 would have been ₹ 951.73 million instead of the reported profit of ₹ 1,011.55 million and the accumulated losses as at 31st March 2011 would have been ₹ 7,272.02 million instead of the reported accumulated loss of ₹ 7,212.20 million. The audit report of the preceding auditors for the year ended 31st March 2010 was also qualified in respect of the above matter’.*

—Spicejet Limited

‘During the year, the company received a demand notice for income tax and interest thereon aggregating ₹ 405,614,101 in relation to an earlier year. The matter pertains to short deduction of tax at source on certain payments and interest thereon for delayed period. The Company has disputed the above-said demand and has filed an appeal against the same with the tax authorities. The Company, based on a legal view obtained in the matter, has not made any provision in the financial statements and has not assessed the impact of the above position on the subsequent years. Pending final conclusion, we are unable to comment on the matter and its consequent impact on the Profit and Loss Account for the year and debit balance in the Profit and Loss Account at the end of the year’.**

—Dish TV Limited

13.2.2 Directors’ Report

In pursuant of Section 134 of the Companies Act, 2013, every year a report by the Board of Directors of the company is required to be attached to the financial statements. It is the formal communication from the board of directors to the shareholders. The board’s report carries out a review of the company’s affairs for the year gone by and also covers any significant developments that might have happened between the end of the financial year and the date of the report. Some of the important particulars to be included in the Directors’ Report are stated below:

- Directors’ Responsibility Statement stating that they had laid down internal financial controls to be followed by the Company and that such internal financial controls are adequate and were operating effectively. The statement also confirms that the proper systems to ensure compliance with the provisions of all applicable laws are in place and are adequate and operating effectively.

- A statement on declaration given by independent directors that they meet the criteria of independence.

- Company’s policy on directors’ appointment and remuneration including criteria for determining qualifications, positive attributes, independence of a director, etc.

- Explanations or comments by the board on every qualification, reservation or adverse remark or disclaimer made—

- By the auditor in his report.

- By the company secretary in practice in his secretarial audit report.

- Particulars of contracts or arrangements with related parties.

- The state of the company’s affairs highlighting business performance and financial overview.

- The amounts which it proposes to carry to any reserves.

- The amount which it recommends should be paid by way of dividend.

- Material changes and commitments affecting the financial position of the company which have occurred between the end of the financial year of the company to which the financial statements relate and the date of the report.

- The conservation of energy, technology absorption and foreign exchange earnings and outgo.

- A statement indicating development and implementation of a risk management policy for the company including identification therein of elements of risk which in the opinion of the Board may threaten the existence of the company.

- The details about the policy developed and implemented by the company on corporate social responsibility initiatives taken during the year.

- A statement indicating the manner in which formal annual evaluation has been made by the Board of its own performance and that of its committees and individual directors.

13.2.3 Details Regarding Subsidiary Companies

As per Section 129 of the Companies Act, 2013, a statement containing the salient features of the financial statements of subsidiary or subsidiaries is required to be attached with the financial statements of the folding company. This is, in addition, to the requirement of preparing and presenting consolidated financial statements.

13.3 DISCLOSURES UNDER LISTING AGREEMENT

The key disclosures under this category are discussed below. These disclosure requirements are applicable only to listed companies.

13.3.1 Management Discussion and Analysis

Clause 34 of the Listing Agreement requires that a management discussion and analysis report should form part of the annual report to the shareholders. This report may either be given separately or may be included in the directors’ report as discussed earlier. In this segment, the management (Board of Directors) discusses the following:

- Industry structure and developments

- Opportunities and threats

- Segment-wise or product-wise performance

- Outlook

- Risks and concerns

- Internal control systems and their adequacy

- Financial performance with respect to operational performance

- Material developments in human resources/industrial relations front, including number of people employed.

MDA and directors’ report are useful to get an insider’s view on the performance of the company.

13.3.2 Corporate Governance Report

The listing agreement prescribes certain mandatory and non-mandatory requirements under Clause 34. A separate report in the annual report of the company covering the mandatory requirements is required to be included. The corporate governance report dwells upon matters relating to composition of board of directors, functioning of various committees of the board of directors like remuneration committee, audit committee, etc. The company is also required to obtain a certificate regarding compliance with the corporate governance requirements from a chartered accountant or a company secretary.

Some of the mandatory requirements for corporate governance report are discussed below:

- A brief statement on company’s philosophy on code of governance

- Details of the board of directors and committees thereof

- Specific disclosures

- Disclosures on materially–significant related party transactions that may have potential conflict with the interests of company at large.

- Details of non-compliance by the company, penalties and strictures imposed on the company by Stock Exchange or SEBI or any statutory authority, on any matter related to capital markets, during the last three years.

- Whistle-blower policy and affirmation that no personnel has been denied access to the audit committee.

- Market price data: High, low during each month in last financial year, performance in comparison to broad-based indices such as BSE Sensex, CRISIL index, etc.

- Distribution of shareholding.

- Outstanding GDRs/ADRs/warrants or any convertible instruments, conversion date and likely impact on equity.

Table 13.2 Shareholding Pattern of Mahindra & Mahindra Limited

These details coupled with financial data as disclosed in the financial statements can help an analyst in forming a view about the company.

Composition of board of directors, their qualification and experience, frequency of meetings of board and its subcommittees are important qualitative variables that cannot be ignored. Likewise, an increase or decrease in the promoters’ holding in the company as disclosed in the shareholding distribution may indicate promoters’ confidence in the company. In case the promoters have pledged their shares for raising loans, in a declining market there is a real possibility of the lender selling these shares to recover their loans. An investors needs to look at these aspects closely to understand the motives behind increase or decrease in promoters’ holding.

The shareholding pattern of Mahindra & Mahindra Limited is given in Table 13.2.

It could be seen from the above that there is a marginal decline in the percentage shareholding of promoters, institutional investors and custodians for GDRs and ADRs. The shareholding of noninstitutional investors has increased by 1.30% during the year.

13.3.3 Business Responsibility Report

Large corporations use a vast amount of societal resources, and therefore, they are accountable not merely to their shareholders but also to the larger society which is also its stakeholder. To fulfil their obligations to the larger body of stakeholders, they must adopt responsible business practices. The Ministry of Corporate Affairs, Government of India, laid down the ‘national voluntary guidelines on social, environmental and economic responsibilities of business’. These guidelines contain comprehensive principles to be adopted by companies as part of their business practices. In order to ensure a structured Business Responsibility Reporting (BRR), the listing agreement was amended by SEBI. Listed companies accordingly are required to disclose a structured BRR in their annual reports. The report demonstrates the steps taken by the company to implement the nine principles enumerated in the guidelines. The principles are:

P1 Businesses should conduct and govern themselves with ethics, transparency and accountability.

P2 Businesses should provide goods and services that are safe and contribute to sustainability throughout their life cycle.

P3 Businesses should promote the well-being of all employees.

P4 Businesses should respect the interests of, and be responsive towards all stakeholders, especially those who are disadvantaged, vulnerable and marginalized.

P5 Businesses should respect and promote human rights.

P6 Businesses should respect, protect, and make efforts to restore the environment.

P7 Businesses, when engaged in influencing public and regulatory policy, should do so in a responsible manner.

P8 Businesses should support inclusive growth and equitable development.

P9 Businesses should engage with and provide value to their customers and consumers in a responsible manner.

13.4 DISCLOSURES UNDER ACCOUNTING STANDARDS

In addition to the disclosures discussed in the earlier chapters which directly relate to specific area of accounting, there are certain other disclosures mandated by accounting standards. These disclosures are usually included in the notes to accounts.

13.4.1 Segment Reporting (Ind AS 108)

The financial statements are prepared using entity concept, and accordingly they represent the results and financial position of the enterprise as a whole. A large enterprise usually operates in multiple business segments and in various geographies. The statement of profit and loss does not reveal the performance of different business or geographical segments. Likewise, the balance sheet also does not provide the detail of funds deployed in different segments. To better appreciate the performance of the business enterprise and the risk associated, information about segment-wise performance is essential. Information about significant components of an entity in contrast to its financial statements for the entity as a whole is very important to the users of financial statements, specifically, where an entity is engaged in different business activities or operates in different economic environments.

Ind AS 108: An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates

An operating segment is defined as a component of an entity:

- That engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity).

- Whose operating results are reviewed regularly by the entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance.

- For which discrete financial information is available.

Ind AS 108 lays down the basic principles for reporting financial information about various operating segments. The approach under Ind AS 108 is to align business reporting with internal reporting. Accordingly, the segments identified for reporting purposes are based on the structure of an entity’s internal organization and segment-wise reports are prepared on the same basis as are reported for internal purposes.

Reportable segments are identified based upon the business activities in which it engages and economic environments in which it operates. The factors to be considered for business activities may include the nature of product and services, nature of customers, method of distribution, regulatory environment, etc. Economic environment consist of a number of factors that may have an impact on the working of any business, for example, geography, political and economic macro-systems, trade cycles, economic resources, statutory environment, income levels, currency risk and industrial growth rates, etc.

An operating segment is identified on the basis or revenue, profit or assets. Accordingly, separate information about an operating segment needs to be provided if any of following quantitative criteria is met:

- It contributes more than 10% of the combined revenue (both external and internal) of the enterprise.

- Its profit or loss constitutes more then 10% of the combined reported profit of all operating segments that did not report loss or 10% of the combined reported loss of all operating segments that reported a loss.

- It deploys assets exceeding 10% of the total assets of all operating segments identified as a reportable segment.

An operating segment that does not meet any of the quantitative thresholds may still be reportable and separately disclosed if management believes that information about the segment would be useful to users of financial statement. Two segments can be combined to produce operating segments only if the operating segments have similar economic characteristics and share a majority of the aggregation criteria listed above.

If the total external revenue reported by operating segments constitutes less than 75 per cent of the entity’s revenue, additional operating segments need to be identified as reportable segments until at least 75 per cent of the entity’s revenue is included in reportable segments. Information about other business activities and operating segments, that are not reportable, is combined and disclosed in ‘all other segments’category.

An enterprise should disclose the following for each reportable segment:

- General information about factors used to identify reportable segments and the types of products and services from which each reportable segment derives its revenues.

- Information about

- The reported segment profit or loss, including specified revenues and expenses included in reported segment profit or loss reviewed by the chief operating decision maker or otherwise regularly provided to chief operating decision maker even if not included in segment profit or loss.

- Segment assets and segment liabilities, if such amounts are regularly reported or provided to the chief operating decision maker.

- The basis of measurement.

- Reconciliations of the totals of segment revenues, reported segment profit or loss, segment assets, segment liabilities and any other material items to corresponding items in the entity’s financial statements.

Table 13.3 Segment Reporting by TCS Limited

If a financial report contains both the consolidated financial statements of a parent, that is, within the scope of this Indian Accounting Standard as well as the parent’s separate financial statements, segment information is required only in the consolidated financial statements.

Excerpts from segment reporting by Tata Consultancy Services Limited (TCS) for the year 2016–17 are given in Table 13.3.

One can observe that banking, financial services and insurance is the largest business segment for TCS contributing over 40% of the total revenue and profits. Geographically, TCS generates the largest shares from America followed by Europe. Obviously, such kinds of observations are not possible by simply looking at the statement of profit and loss.

13.4.2 Related Party Disclosure (Ind AS 24)

A business enterprise may enter into commercial transactions with its related parties. For example, an enterprise may sell or purchase goods to or from a subsidiary company or lend money to a joint venture, etc. In normal business transactions, there is a presumption that commercial transactions are entered on an arm’s length basis and the terms and conditions have been determined on commercial considerations. In a related party transaction, such a presumption is violated. Related party disclosure aims at identifying and reporting such transactions. Armed with such details, the user of the financial statement is in a better position to understand and sometime question the genuineness of such transactions and also their impact on the financial results and financial position of an enterprise.

The objective of Ind AS 24 is to ensure that an entity’s financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions and outstanding balances, including commitments, with such parties.

Ind AS 24 requires that an enterprise must identify and disclose its related parties. The definition of related parties is quite wide and includes key managerial personnel and their relatives, holding company, subsidiary company, joint ventures, associate company, fellow subsidiary company, etc.

If any transaction has taken place between the related parties during the reporting period, appropriate disclosure need to be made in the annual report. Such a disclosure is usually made in the ‘notes to accounts’ segment of the annual report. The following disclosure regarding related party transactions is required to be made under Ind AS 241:

- The name of the transacting related party and a description of the relationship between the parties.

- A description of the nature of transactions.

- The amount of transactions.

- The amount of outstanding balances including commitments; their terms and conditions, including whether they are secured, and the nature of the consideration to be provided in settlement and details of any guarantees given or received.

- The amount of provisions for doubtful debts due from such parties at that date and amounts written off or written back in the period in respect of debts due from or to related parties.

- Any other elements of the related party transactions necessary for an understanding of the financial statements.

13.4.3 Interest in Other Entities

Ind AS 112 requires an entity to disclose information that enables users of its financial statements to evaluate the nature of, and risks associated with, its interests in other entities; and also the effects of those interests on its financial position, financial performance and cash flows. The prescribed information is required to be disclosed regarding subsidiaries, joint arrangements, associates and structured entities that are not controlled by the entity.

13.4.4 Disclosure Regarding Financial Instrument

Ind AS 107 requires an entity to make adequate disclosures in their financial statements that enable users to evaluate the significance of financial instruments for the entity’s financial position and performance and the nature and extent of risks arising from financial instruments to which the entity is exposed during the period and at the end of the reporting period, and how the entity manages those risks.

Disclosures relating to the nature and extent of risks arising from financial instruments include:

- Qualitative Disclosures—relating to each type of risk arising from financial instruments:

- The exposures to risk and how they arise.

- Its objectives, policies and processes for managing the risk and the methods used to measure the risk.

- Any changes in (a) or (b) from the previous period.

- Quantitative Disclosures—relating to each type of risk arising from financial instruments:

- Summary quantitative data about its exposure to that risk at the end of the reporting period.

- Disclosures about credit risk, liquidity risk and market risk.

- Concentration of risk, if not apparent from the disclosures made in accordance with (a) and (b).

- Credit Risk

- Maximum exposure to credit risk at the end of the reporting period without taking account of any collateral held or other credit enhancements.

- A description of collateral held as security and other credit enhancements and their financial effect.

- Information about the credit quality of financial assets that are neither past due nor impaired.

- An analysis of the age of financial assets that are past due as at the end of the reporting period but not impaired.

- An analysis of financial assets that are individually determined to be impaired as at the end of the reporting period, including the factors the entity considered in determining that they are impaired.

- When an entity obtains financial or non-financial assets during the period by taking possession of collateral it holds as security or calling on other credit enhancements, disclosures regarding the nature and carrying amount of the assets and when the assets are not readily convertible into cash, its policies for disposing of such assets or for using them in its operations.

- Liquidity Risk

- Maturity analysis for financial liabilities that shows the remaining contractual maturities.

- A description of how it manages the liquidity risk.

- Market Risk

- Sensitivity analysis for each type of market risk to which the entity is exposed at the end of the reporting period, showing how profit or loss and equity would have been affected by changes in the relevant risk variable that were reasonably possible at that date.

- The methods and assumptions used in preparing the sensitivity analysis.

- Changes from the previous period in the methods and assumptions used, and the reasons for such changes.

13.5 VOLUNTARY DISCLOSURES

13.5.1 Value Added Statement

The profit and loss statement essentially has a shareholders’ focus. The profit after tax (PAT) or net profit depicts the reward for the shareholders after all other stakeholders have been paid out. The value added statement, on the other hand, has a stakeholders’ focus. Value added is defined as the value of output produced minus cost of inputs. After ascertaining the value added, the distribution of the value added to various stakeholders is disclosed. By observing the value added statement over a period of time the reader can see the trends in value added as well as how the value added is being distributed amongst the various stakeholders.

The value added statement of Steel Authority of India Limited (SAIL) is given in the Table 13.4.

Table 13.4 Value Added Statement of Steel Authority of India Limited

It could be observed that the total value added by SAIL during the year 2016–17 amounted to ₹ 9,305 crore which was almost entirely consumed by the establishment cost (₹ 8,948 crore). After meeting financing cost, there was nothing left to be given as tax to government or dividends to shareholders.

13.5.2 Human Resource Accounting

In the knowledge economy, one of the most valuable assets of any enterprise is its human resources. However, human resources do not appear in the conventional financial statements prepared using cost principle. Assets are usually recognized in the balance sheet based upon the ownership criteria—assets owned by an enterprise through purchase or grant are recognized at the cost of acquisition. Accordingly, human resources are not recorded as assets as being not owned by the enterprise. To overcome this limitation, many companies are providing information about their human resources in the annual report. The information may include number of employees, age profile, revenue, profit or value added per employee, etc. Many companies try to put value to their human resources by using various models. The valuation of human resources is usually done at the present value of future earnings of the employees. Though there is no uniformity in the valuation or disclosure about human resources, such information does give an insight about the employee cost and productivity. Human resources accounting reported by Hindustan Petroleum Corporation Limited (HPCL) in their annual report is given in Box 13.2.

13.5.3 Economic Value Added

While arriving at the profit after tax all costs including cost of borrowed funds is deducted. However, no cost is imputed towards cost of shareholders’ funds. It may be possible that the cost of shareholders’ funds may far exceed the profits earned by the enterprise in an accounting period. Economic value added or EVA®2 is a measure of the profitability of an enterprise after meeting the cost of capital employed. The EVA may be represented by the following equations:

Box 13.2 Human Resource Accounting by HPCL

HPCL considers human dimension as the key to organization’s success. Several initiatives for deployment of human resources to meet new challenges in the competitive business environment have gained momentum. HPCL recognizes the value of its human assets who are committed to achieve excellence in all spheres. The Human resource profile given below shows that HPCL has a mix of energetic youth and experienced seniors who harmonize the efforts to achieve the Corporation’s goals.

Accounting for Human Resource Assets

The Lev & Schwartz model is being used by our company to compute the value of human resource assets. The evaluation as on 31st March 2017 is based on the present value of future earnings of the employees on the following assumptions.

- Employees’ compensation represented by direct and indirect benefits earned by them on cost to company basis.

- Earnings up to the age of superannuation are considered on incremental basis taking the corporation’s policies into consideration.

- Such future earnings are discounted at 7.26%.

Source: Annual Report of HPCL for the year 2016–17

Source: Annual Report of HPCL for the year 2016–17

Thus, if the NOPAT for an enterprise is greater that the COCE, it is said to have created economic value and if the COCE is more that the NOPAT the enterprise has destroyed value. It is possible that a business enterprise has declared positive profits but the EVA is still negative because the COCE is higher than the profits earned. EVA to that extent reflects the efficiency in capital utilization. Capital employed for this purpose includes both borrowed funds and shareholders’ funds. Additionally many companies report another measure called market value added or MVA. MVA is the excess of market capitalization of the company over the shareholders’ funds and can be calculated as follows:

The EVA statement of Marico Limited is given in Table 13.5

From the above description, it is clear that an enterprise may enhance its EVA by improving NOPAT or bringing down WACC or by reducing the average capital employed by more efficient utilization of resources. In case of Marico, the EVA has improved from ₹ 174.8 crore in 2010–11 to ₹551.7 crore in 2016–17. The NOPAT of the company has increased from ₹ 300.9 crore to ₹ 810.3 crore during the same period. The company has been able to increase its NOPAT with less than proportionate increase in capital employed, resulting in substantial improvement in EVA. However, the weighted average cost of capital from the company has increased from 8.90% to 10.40%.

Table 13.5 Economic Value Added reporting by Marico Limited

Box 13.3 Brand Valuation by Infosys Limited

The methodology followed by Infosys Limited to value their corporate brand ‘Infosys’ is as follows:

- Determine brand profits by eliminating the non-brand profits from the total profits

- Restate the historical profits at present-day values

- Provide for the remuneration of capital to be used for purposes other than promotion of the brand

- Adjust for taxes

- Determine the brand strength or brand-earnings multiple

Brand Valuation

Ratios

13.5.4 Brand Valuation

A business enterprise over a period of time develops a brand equity whereby it is recognized by its customers, employees, suppliers and other stakeholders. The brand equity so developed indeed is a valuable asset for the company in question. Brand names like Amul, Bata, Microsoft, Apple, Infosys, Tata, etc., are household names. However, the relevant accounting standard (Ind AS 38) does not permit recognition of self-generated brands in the accounting records. A strong brand does help the business enterprise in getting a better price for its goods and services and thereby in generating ‘super profit’ or excess profit compared to the peer group without such brand equity. As the formal financial statements do not recognize self-generated brands, many companies value and report their brands and report the same in the annual reports.

The brand valuation is based upon the existence of ‘excess profit’, that is, profit over and above the remuneration for capital and the brand strength. The brand strength is denoted by a multiple–stronger the brand, higher the multiple to be used. The brand valuation reported by Infosys Limited is set out in Box 13.3

Summary

- Besides the financial statements—balance sheet, profit and loss statement and cash flow statement—the annual report of a company includes a number of other reports which are useful for analysing the affairs of the company.

- Additional disclosures may be grouped under four headings—mandatory under Companies Act, 2013, required under listing agreement for publicly traded companies, required under the relevant accounting standards and voluntary disclosures.

- Auditor’s report expresses the opinion of the ‘independent auditors’ on the financial statements audited by them. Any reservations or observations that the auditors may have are stated as ‘qualifications’ in the audit report.

- Directors’ report gives an analysis of the affairs of the business and also includes the proposal by the board for amounts to be transferred to reserves and to be distributed as profits. Explanation to any reservations in the audit report is also provided in the directors’ report.

- In respect of listed companies, directors’ report is further supplemented by management discussion and analysis which contains a detailed SWOT analysis of the company.

- The listing agreement also mandates a separate corporate governance report detaining the corporate governance philosophy and governance structure of the company including functioning of various committees of the board.

- The business responsibility report demonstrates the steps taken by the company to implement the nine principles laid down by the ‘national voluntary guidelines on social, environmental and economic responsibilities of business’.

- Ind AS 108 requires segment reporting based the business activities in which the company engages and economic environments in which it operates.

- Ind AS 24 mandate related party disclosures to be made in the annual reports. Likewise, Ind AS 112 prescribes information to be disclosed regarding subsidiaries, joint arrangements, associates and structured entities that are not controlled by the entity.

- Ind AS 107 disclosures regarding the nature and extent of risks arising from financial instruments to which the entity is exposed and how the entity manages those risks.

- In addition to the mandatory disclosures, many companies are making additional disclosures on voluntary basis. These disclosures enhance transparency and are being used by management to communicate with their stakeholders. Some of the popular voluntary disclosures include value added statement, economic value added, human resources accounting and brand valuation.

Assignment Questions

- What are the different sources of disclosures in the annual reports of companies?

- What are the different types of audit reports?

- How is ‘segment reporting’ helpful in understanding the financial performance of a company?

- How is Economic Value Added different from the reported profit?

- ‘Value added statement has a stakeholders’ focus rather than stock holders’ focus’. Do you agree?

- Human resources are the most valuable assets for a knowledge based business, still they are not treated as assets in the balance sheet. Why?

Problems

- Ascertaining EVA and MVA: Based upon the following information calculate the economic value added (EVA) and market value added (MVA) for Hot & Spice Limited.

Profit and loss statement for the year ended 31st March 2017 (₹ in Crore) Earnings before interest and tax (EBIT) 465.23 Less: Interest expenses 120.20 Profit before tax (PBT) 345.03 Less: Provision for tax 103.51 Profit after tax (PAT) 241.52 The detail of capital employed by the company in the last two years is given as follows:

(₹ in Crore) 2016 2017 Shareholders’ funds 680.55 470.65 Borrowed funds 902.68 786.44 The company estimates that the pre-tax cost of borrowed funds is 10%, whereas cost of equity is estimated to be 14%. Tax rate applicable to the company is 30%. The current market capitalization of the company is ₹ 2,304.80 crore.

Solutions to Problems

= ₹ (2304.80 – 680.55) crore = ₹ 1624.25 crore

Notes:

- NOPAT can be calculated as

NOPAT = PAT + Interest × (1 – Tax rate)

or

NOPAT = EBIT × (1 – Tax rate) - Post tax cost of borrowed funds = Interest rate × (1 – Tax rate)

Try It Yourself

- EVA Comparison: On the basis of the following information and assumption, determine which of the two companies have a higher economic value added:

The applicable tax rate is 30%.

The applicable tax rate is 30%.

Cases

Case 13.1: Segment Reporting of Engineers India Limited3

Engineers India Limited was set up in 1965 to provide engineering and related technical services for petroleum refineries and other industrial projects. Its range of services includes project management consultancy (PMC), project implementation services (PMS), engineering, procurement and construction (EPC) and lump sum turnkey (LSTK) contracts. The company has experienced a decline in revenue as well as profits in the last 5 years.

For the purpose of ‘segment reporting’ under Ind AS, the company has segmented its activities into two segments—consultancy and engineering projects and lump sum turnkey projects—taking into account the organizational structure and internal reporting system as well as different risk and rewards of these segment. Segment revenue and results are set out below:

Questions for Discussion

- Which segment is more profitable?

- Using the segment information, comment upon the decline in the revenue and profit of EIL. To what extent the segment reporting is helpful in analyzing the past performance of EIL?

- How will the segment reporting be useful is making projections about the future?

Case 13.2: EVA Reporting by Hindustan Unilever Limited4

What is EVA?

Traditional approaches to measuring ‘Shareholder’s Value Creation’ have used parameters such as earnings capitalization, market capitalization and present value of estimated future cash flows. Extensive equity research has established that it is not earnings per se, but value that is important. A measure called ‘Economic Value Added’ (EVA) is increasingly being applied to understand and evaluate financial performance.

*EVA = Net Operating Profit after taxes (NOPAT) − Cost of Capital Employed (COCE), where,

NOPAT = Profits after depreciation and taxes but before interest costs. NOPAT thus represents the total pool of profits available on an ungeared basis to provide a return to lenders and shareholders, and

COCE = Weighted Average Cost of Capital (WACC) × Average Capital Employed

*Cost of debt is taken at the effective rate of interest applicable to an ‘AAA’ rated company like HUL for a short-term debt, net of taxes. We have considered a pre tax rate of 7.42% for 2016–17 (8.22% for 2015–16).

*Cost of equity is the return expected by the investors to compensate them for the variability in returns caused by fluctuating earnings and share prices.

Cost of Equity = Risk free return equivalent to yield on long-term government bonds (taken at 6.68% for 2016–17)

(+)

Market risk premium (taken at 8.69%) (x) Beta variant for the company, (taken at 0.710) where Beta is a relative measure of risk associated with the company’s shares as against the market as a whole.

Thus HUL’s cost of equity = 6.68% + 8.69% (x) 0.710 = 12.85%

What does EVA show?

EVA is residual income after charging the company for the cost of capital provided by lenders and shareholders. It represents the value added to the shareholders by generating operating profits in excess of the cost of capital employed in the business.

When will EVA increase?

EVA will increase if:

- Operating profits are made to grow without employing more capital, that is, greater efficiency.

- Additional capital is invested in projects that return more than the cost of obtaining new capital, that is, profitable growth.

- Capital is curtailed in activities that do not cover the cost of capital, that is, liquidate unproductive capital.

EVA in practice at Hindustan Unilever Limited

In Hindustan Unilever Limited, the goal of sustainable long-term value creation for our shareholders is well understood by all the business groups. Measures to evaluate business performance and to set targets take into account this concept of value creation.

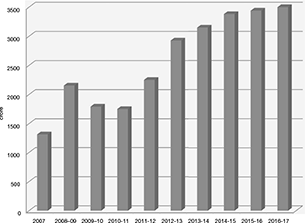

EVA Tends: 2007–2017 (Unaudited)

Economic Value Added (EVA) ( ₹ in Crore)

Questions for Discussion

- How is EVA different from the conventional profit after tax (PAT)?

- HUL’s EVA has increased over the years. Identify the main contributory factors towards improvement in EVA of the company?

- How do you relate profitability, asset turnover and financial leverage with EVA?

Endnotes

- Ind AS 24, Related Party Disclosures.

- EVA is the registered trade mark of Stern Stewarts & Co.

- Annual Reports of Engineers India Limited for the year 2012–13 to 2016–17.

- Annual Report of Hindustan Unilever Limited for the year 2016–17.