3

Accounting Cycle

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Understand the accounting process leading to the preparation of the profit and loss account, and the balance sheet.

- Differentiate between real accounts, personal accounts and nominal accounts.

- Apply the rules for debiting or crediting different types of accounts.

- Understand the process of ledger posting, balancing of accounts and preparation of trial balance.

- Prepare the profit and loss account, and the balance sheet from a given trial balance and year-end adjustment entries.

3.1 INTRODUCTION

Financial statements—the profit and loss account and the balance sheet—convey useful information about the financial health of a business enterprise. Every manager is expected to have the necessary skills to be able to read, understand and analyze the information contained in these statements. These statements are the end result of a well-structured accounting process, which is the responsibility of the accounts department of the enterprise. However, to fully appreciate the information contents of these financial statements, it is important for other functional managers also to have a basic understanding of accounting cycle. In this chapter we will discuss the process of accounting that culminates into preparation of financial statements.

As discussed in Chapter 2, the modern day accounting is based upon the dual aspect concept, i.e., each transaction affects at least two accounts in such a way that the basic accounting equation,

is always true. The accounting system based upon the dual aspect concept is called double-entry book keeping system.

3.2 ACCOUNTING PROCESS

Various steps in the accounting process are depicted in Figure 3.1:

Figure 3.1 Accounting Cycle

- Recording: At this stage, the accounting transactions are identified on the basis of the supporting documents called vouchers. A voucher is an evidence of an accounting transaction having taken place. The transaction is analysed to decide which of the accounts are to be affected and the amounts involved. The transaction is then recorded by way of a journal entry. Journal entries are recorded in a chronological order.

- Classification: The accounting entries recorded at the first stage are then grouped under different heads called ledger accounts. The purpose of this stage is to ensure that all entries of similar nature are grouped together. It may be noted that no new accounting entry is passed at this stage; rather the journal entries recorded earlier only are classified by way of ledger posting.

- Summarization: When the enterprise wants to ascertain the results for an accounting period, it needs to first find the balance in each ledger account. Once the balance in each account has been ascertained, it is put in a statement called trial balance to ensure that the equality of debits and credits has been observed.

- Financial statements: At this stage, balances in various accounts are arranged to prepare the profit and loss account, and the balance sheet. All accounts relating to income or gains and losses or expenses are transferred to the profit and loss account, whereas accounts representing assets, capital and liabilities are arranged in the Balance Sheet.

The various steps in the accounting cycle have been discussed in detail in the following sections.

3.3 JOURNAL ENTRY

Accounting entries are recorded by a system of debits and credits. As a rule, every accounting transaction affects atleast two accounts, one or more of which are debited and the others credited in such a way that sum of amounts debited is equal to amounts credited. This process of recording is called the journal entry.

Journal entry—all accounting transactions are originally recorded by way of journal entries in a chronological order.

3.3.1 Types of Accounts

For this purpose, accounts are classified under three heads:

- Real accounts: Accounts relating to assets owned by the enterprise. For example—cash, machinery, land and building, furniture and fixture, etc.

- Personal accounts: Accounts relating to the persons—both natural as well as legal—with whom the enterprise has business transactions. They represent the amount receivable or payable by the enterprise. For example, capital account, loan from banks, receivables for goods sold on credit, payables for goods and services bought on credit, expenses outstanding, etc.

- Nominal accounts: Accounts relating to incomes or gains and losses or expenses. For example, sales, purchase of goods, rent earned, interest earned, wages and salaries, power and electricity charges, and audit fees, etc.

3.3.2 Rules for Debits and Credits

To determine whether an account has to be debited or credited, we follow certain rules for each category of accounts. Rules for the same are described in Table 3.1.

Table 3.1 Rules for Debits and Credits

The expressions ‘debit’ or ‘credit’ have no definitive meaning—it is just a way of recording accounting transactions.

3.3.3 Transaction Analysis

Once an accounting transaction has taken place, the same is analysed to pass the necessary journal entry. The following questions need to be answered by the accountant:

- Which accounts are getting affected?—two or more accounts will need to be identified.

- What is the nature of these accounts—real, personal or nominal?

- Which account or accounts are to be debited or credited and by how much—in such a way that the total of debits is equal to the total of credits?

To illustrate: On 1st April 2017, an amount of ₹ 5,000 was paid to the watchman in cash towards his salary. The transaction will be analysed and journalized as follows:

- Accounts affected—Cash Account and Salary Account.

- Type of accounts—Cash is an asset therefore the Cash Account is a real account whereas Salary is an expenses and therefore the Salary Account is a nominal account.

- Debit or Credit—As cash is going out (real account) it will be credited, salary is an expense (nominal account) it will get debited. Both the accounts will be recorded at ₹ 5,000.

After having analysed the transaction, the following journal entry will be passed:

As a convention, account to be debited is shown first and a prefix ‘To’ is added before the account head to be credited. A brief narration is added along with the journal entry about the nature of the transaction.

■ Illustration 3.1

Analyse the following transactions and pass the necessary journal entries:

- Paid rent to the landlord by cash: ₹ 60,000

- Sold goods to Ramesh on credit: ₹ 100,000

- Cash withdrawn from the bank: ₹ 35,000

The transactions will be analysed as follows:

- Rent Account and Cash Account are two accounts getting affected. Rent is an expense (nominal account); Cash account (real account) has decreased. Expenses are always debited whereas real accounts are credited when decreased. The journal entry accordingly will be:

Rent A/c Dr. ₹60,000 To Cash A/c ₹60,000 - Sales account (income) and Ramesh Account (personal) will be affected. As income is increasing, Sales Account will be credited whereas Ramesh is a receiver (he has received goods) without paying for them so he will be debited. The journal entry will be:

Ramesh A/c Dr. ₹ 100,000 To Sales A/c ₹ 100,000 - Accounts affected are Cash Account (real) and Bank Account (personal). Cash has come in, therefore will be debited whereas bank is a giver so will be credited. The journal entry will be:

Cash A/c Dr. ₹ 35,000 To Bank A/c ₹ 35,000

3.4 CLASSIFICATION

Journal entries as aforesaid are recorded in a chronological order, i.e., as and when they occur. In an accounting period, a number of transactions affecting the same head of account might take place. On the basis of journal entries alone, it is not readily possible to know all the transactions that might have affected a particular account during an accounting period. Therefore, we need to classify these transactions under suitable heads called ‘ledger accounts’ or simply ‘accounts’. An account is a T-shaped statement in which the left-hand side is called the debit side and the right-hand side is called the credit side. For example, all the journal entries where Cash Account has been debited will be shown on the left-hand (Debit) side of the Cash Account and wherever cash has been credited will be shown on the right-hand (Credit) side of Cash Account. So by looking at the Cash Account, one can easily ascertain all the transactions affecting cash that have taken place in an accounting period. The process of classification is called ‘ledger posting’. It may be noted that no new entries are recorded at this stage. Transaction recorded earlier by way of journal entries only are posted in the accounts.

Ledger posting—is a process by which a journal entry is transferred to a ledger.

■ Illustration 3.2

Classify the transactions in Illustration 3.1 under relevant accounts.

There are five different accounts to be opened—Rent Account, Cash Account, Sales Account, Ramesh’s Account and Bank Account. The entries will be posted as follows:

The first journal entry has been posted in two accounts—debit side of Rent Account and credit side of Cash Account. While posting in the rent account, cross reference to other account affected (i.e. Cash Account) is made. Likewise, while posting in the Cash Account, cross reference to Rent Account is made. As a convention, while posting on the debit side of the account, a prefix ‘To’ is added whereas on the credit side posting, a prefix ‘By’ is added. It may also be noted that both the entries affecting cash have been posted in the same Cash Account. By looking at the Cash Account, one can observe all the transactions affecting cash and by comparing the two sides, it is also possible to ascertain the cash balance at any point of time.

The classification or ledger posting is a mechanical process requiring no analysis at all. In computerized accounts this mapping is done by the accounting software using the codification system used to identify various accounts.

3.5 SUMMARIZATION

Steps described above—recording and classification—are followed for all accounting transactions throughout the accounting period. At the end of the accounting period, each of these ledger accounts are summarized by ascertaining the balance in each account and putting balance in a statement called the Trial Balance.

3.5.1 Balancing of Accounts

As discussed earlier, each account has a debit side and a credit side and may have entries posted on both sides. At the end of the accounting period, these accounts are required to be balanced. For balancing an account, the totals of debit side and credit side are ascertained. If the sum of the entries on the debit side is greater than the credit side, the difference is posted on the credit side as the balancing figure. Such a balance representing excess of debit side over credit side is called a ‘debit balance’ though posted on the credit side of the account. If the sum of the entries on the credit side is greater than the debit side, the difference is posted on the debit side as the balancing figure. Such a balance representing excess of credit side over debit side is called a ‘credit balance’ though posted on the debit side of the account. This process is repeated for all the accounts.

Debit balance—excess of the total of debit side of an account over credit side.

Credit balance—excess of the total of credit side of an account over debit side.

■ Illustration 3.3

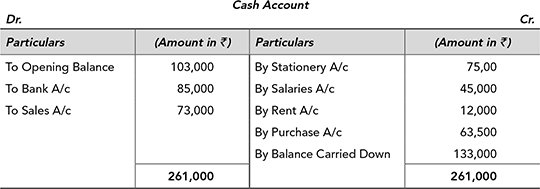

The Cash Account of Strong Bull Limited for the month of December 2017 is given below. You are required to ascertain the balance is cash account as on 31st December 2017.

The total of the debit side of the Cash Account ( ₹ 261,000) is more than the total of the credit side ( ₹ 128,000) by ₹ 133,000 so the Cash Account has a debit balance (excess of debit over credit) of ₹ 133,000. The closing balance will be shown as follows:

The balancing figure in the Cash Account (₹ 133,000) is also called the closing balance. In the next accounting period, the same balance will appear on the debit side as the Opening Balance or Balance brought down.

3.5.2 Trial Balance

Once balances of all accounts have been ascertained, they are placed in a Trial Balance. The Trial Balance is again a T-shaped statement with the left-hand side called the Debit side and the right-hand side being called the Credit side. All accounts with debit balances are placed on the debit side of the Trial Balance with the closing balance amount. Accounts with credit balances are placed on the credit side of the Trial Balance. The total of the debit side of the Trial Balance and the total of credit side must tally, reflecting the nature of the double entry book keeping system. Because of the accounting rules discussed earlier, all real accounts (assets) and expenses and losses will necessarily have debit balances, whereas income and gains will always have credit balances. The personal accounts may have either a debit or credit balance. A personal account with debit balance represents a receivable and a personal account with credit balance represents a payable. The format of Trial Balance is given in Table 3.2.

Trial balance—T-shaped statement separately showing all the debit and credit balances at the end of the accounting period.

The Trial Balance serves three basic purposes.

- It ensures that the dual aspects concept has been properly followed, i.e., for every debit there is an equal and corresponding credit.

- It gives an overview of balances in various ledger accounts.

- It forms the basis for the next step, i.e., preparation of financial statements.

Table 3.2 Format of Trial Balance

■ Illustration 3.4

Satya Paul started a new business on 1st April 2017. For the first quarter, his transactions are listed below.

- Started business with ₹ 1,000,000 capital in cash.

- Opened a bank account and deposited ₹ 990,000 in the bank.

- Paid towards rent ₹ 60,000 by cheque.

- Bought stationary for ₹ 7,000 paid in cash.

- Invested ₹ 100,000 in government bonds through bank account.

- Bought machinery for ₹ 250,000 paid through bank account.

- Bought furniture for ₹ 150,000 from M/s Furniture Mart on credit.

- Bought goods for ₹ 400,000 paid by cheque.

- Bought goods for ₹ 200,000 from X Limited on credit.

- Sold goods for cash ₹ 550,000.

- Made part payment to X in cash ₹ 150,000.

- Sold goods to Y on credit for ₹ 250,000.

- Received part payment from Y by cheque for ₹ 175,000, allowed him discount of ₹ 5,000 for prompt payment.

- Received interest on investment ₹ 1,000 by cheque.

- Paid salary to employees by cheque ₹ 110,000.

You are required to do the following:

- Analyze the above transactions and pass necessary journal entries.

- Post the transactions in the Ledger Accounts.

- Prepare a Trial Balance as on 30th June 2017.

- Analysis and Journal Entries

- Ledger Posting and Balancing of Accounts

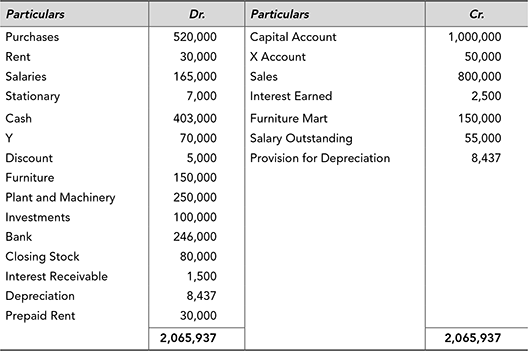

- Trial Balance

Trial Balance as on 30th June 2017

3.6 ADJUSTMENT ENTRIES

Journal entries as discussed above are recorded on a continuous basis throughout the accounting period. The trial balance prepared reflects the effect of all those accounting transactions. At the end of the accounting period, some adjustment entries may be required to be made to give effect to accrual principle and matching principle. These adjustments entries are again recorded by way of journal entries. As a result of these adjustments, balances appearing in the trial balance get altered. Some of the common adjustments that are made at the end of accounting periods are discussed below.

Adjustment entries are passed at the end of accounting period to give effect to accrual and matching principles and for rectifying errors that might have happened earlier.

3.6.1 Outstanding Expenses

Expenses paid during the year under various heads get recorded during the year and are reflected in the Trial Balance. If however some expense incurred during the year remains outstanding at the end of the period, the same need to be adjusted. The adjustment will lead to an increase in the expense account and recoding the outstanding amount as a liability. For example, Salary Expenses as per trial balance is ₹ 1,250,000. At the year-end, it is realized that salaries amounting to ₹ 150,000 are still to be paid. We need to increase salary expenses by the outstanding amount and also record the same as a liability. The adjustment entry to be made is:

| Salary A/c | Dr. | ₹ 150,000 |

| To Salary Outstanding A/c | ₹ 150,000 |

As a result of the above adjustment, the Salary A/c will go up by ₹ 150,000 to ₹ 1,400,000 and at the same time a liability of ₹ 150,000 towards outstanding salary will appear in the books. Similar adjustments may be made for other heads of expenses which have been incurred but remain outstanding at the end of the accounting period.

3.6.2 Pre-paid Expenses

In case a part of the expenses paid during the year actually pertain to the next accounting period, a suitable adjustment needs to be made. For example, insurance on machinery paid during the year amounted to ₹ 600,000. It covers a period of 12 months including three months of the next year. Accordingly, one fourth of the amount paid will be treated as pre-paid expense and the expense for the year will be reduced by the same amount. The adjustment entry will be:

| Pre-paid Insurance A/c | Dr. | ₹ 150,000 |

| Insurance Expenses A/c | ₹ 150,000 |

As a result of this entry, the insurance expense for the year will get reduced by ₹ 150,000 to ₹ 450,000 and the Pre-paid Insurance will be recorded as a receivable in the books of the company. Similar adjustment may be made for any other head of expenses which has been paid in advance.

3.6.3 Income Earned But Not Received

It may be possible that an income has been earned but not received by the enterprise during the accounting period. As a result, no entry has been passed in respect of such income. To give effect to the accrual principle, such income needs to be recorded. For example, interest amounting to ₹ 60,000 on investments have accrued but has not been received during the accounting period. The adjustment entry for the same will be:

| Interest Receivable A/c | Dr. | ₹ 60,000 |

| To Interest Earned A/c | ₹ 60,000 |

As a result of this entry, the Interest Earned will get recorded as an income in accounts and the Interest Receivable will get recorded as a receivable by ₹ 60,000. Similar adjustments may have to be made for other heads of incomes which have accrued but not record.

3.6.4 Income Received in Advance

An enterprise might have received some income in advance, i.e., which pertains to the next accounting period. Due to accrual principle, only the income for the current year should be accounted for in the current accounting period and the advance portion will appear as a liability. For example, an enterprise received an annual fee of ₹ 1,200,000 towards annual maintenance contract which was credited to AMC Fees A/c as an income. The AMC covers a period of 12 months out of which 9 months fall in the next year. The following adjustment entry will be made:

| AMC Fees A/c | Dr. | ₹ 900,000 |

| To AMC Fees Received in Advance A/c | ₹ 90,000 |

As a result of this entry, the income from AMC Fees to be recognized during the period will get reduced by ₹ 900,000 to ₹ 300,000. At the same time, the advance received amounting to ₹ 900,000 will get recorded as a liability for which services are yet to be rendered.

3.6.5 Depreciation

Fixed assets of an enterprise need to be written off over their useful life by charging depreciation. Depreciation is nothing but the process of appropriating the cost of a fixed asset over its useful life. Depreciation is recorded at the end of the accounting period by suitable adjustment entry. It has two ways affect—firstly, depreciation amount gets recorded as an expense and secondly, the book value of the asset gets reduced to that extent. Accordingly, the adjustment entry for depreciation is passed as follows:

| Depreciation Account | Dr. |

| To Asset Account |

Alternatively, an enterprise may like to disclose the asset at its gross value (or cost of acquisition) showing depreciation written off separately as a deduction. In that a case, we open another account as ‘Accumulated Depreciation’ or ‘Provision for Depreciation’. The adjustment entry for depreciation accordingly will be:

| Depreciation Account | Dr. |

| To Accumulated Depreciation A/c |

The ‘Accumulated Depreciation A/c’ is a contra-asset account. While presenting the information about the asset in financial statements, the balance in this account will be shown as a deduction from the gross value of the asset as follows:

| Assets—Cost of Acquisition |

| Less: Accumulated Depreciation |

| Book Value of Asset |

3.6.6 Provisions for Doubtful Debts

Following conservatism principle, the enterprise may decide to create a provision for anticipated losses due to non-recovery from its customers to whom goods or services have been provided on credit. The adjustment entry for such a provision is done on the same basis as discussed above for accumulated depreciation. The following entry is passed:

| Bad Debts Expenses A/c | Dr. |

| To Provision for Bad and Doubtful Debts A/c |

The Bad Debts Expenses A/c will be treated as an expense in the profit and loss account of the enterprise and the provision for bad and doubtful debts account will be shown as a deduction from the gross value of debtors or trade receivables in the Balance Sheet as follows:

| Sundry Debtors/Accounts Receivables |

| Less: Provision for Bad and Doubtful Debts |

3.6.7 Provision for Expenses

At the end of the accounting period, the enterprise may estimate that certain cost or expenses might have to be incurred in the future as a result of past events and it would like to provide for such expenses. The effect of such provisioning will be to record the same as an expense and at the same time create a liability based upon the estimated amount of the expense. For example, the enterprise may like to make a provision for warranty cost in respect of goods sold during the year. The adjustment entry will be:

| Warranty Cost A/c | Dr. |

| To Provision for Warranty Cost A/c |

The Warranty Cost account will be included with other costs in the profit and loss account, whereas provision for warranty cost will be taken as a liability.

3.6.8 Closing Stock

When goods are purchased, the entire cost is recorded as an expense in the purchase account. If at the end of the period some of these goods are remaining unsold, the cost of inventories need to be adjusted. The closing stock (or ending inventory) will have two affects—firstly, the cost of material consumed will go down to that extent and secondly, the inventory will be treated as an asset to be consumed in the next accounting period. The adjustment inventory for the same will be:

| Closing Stock A/c | Dr. |

| To Purchases A/c |

As a result, the Closing Stock will get recorded as an asset to be shown in the Balance Sheet and the Purchase account has been adjusted downwards to reflect cost of goods sold.

After making the necessary adjustment entries, the ledger balances get adjusted and a revised trial balance is prepared. The final trial balance will form basis of financial statements.

3.7 FINANCIAL STATEMENTS

The updated trial balance after passing the necessary adjustments entries forms the basis of preparing the financial statements. All nominal accounts, i.e., those pertaining to expenses, losses, income and gains are temporary accounts. They are closed out at the end of the accounting period by transferring their respective balances to the profit and loss account. In the next accounting period, these accounts will start with zero balances. Real accounts, i.e., those pertaining to assets and personal accounts are permanent accounts. Balances in these accounts are shown in the Balance Sheet and are carried forward to the next accounting period. In the next accounting period, these accounts will show the Opening Balance, i.e., the balance carried from the earlier period.

Nominal accounts are temporary accounts whereas Real accounts and personal accounts are permanent accounts.

3.7.1 Transfer Entries

Journal entries at the end of the accounting period for transferring the balances in nominal accounts to the profit and loss account are called transfer entries. As they result in closing the nominal accounts by reducing their balance to zero, they are also referred to as closing entries.

Closing Income and Gain Accounts

An income or a gain account necessarily has a credit balance. The account balance can be brought to zero by debiting it by equivalent amount and crediting the same to the profit and loss account. This way an income account is ‘closed’ and the balance gets ‘transferred’ to the credit of the profit and loss account. All accounts pertaining to income and gains are closed by debiting them and crediting the same to the profit and loss account at the end of the accounting period.

Closing Expenses Accounts

An expense account by nature will have a debit balance. The account can be closed by crediting it by the balance amount and simultaneously debiting the profit and loss account. All the accounts relating to expenses and losses will get closed by these entries.

■ Illustration 3.5

As per the Trial Balance of Bright Shine Limited, the Sales Account has a credit balance of ₹ 232.45 million and the Purchase Account has a debit balance of ₹ 163.02 million. Pass the necessary closing entries.

The sales account will be closed by debiting it by ₹ 232.45 million and crediting the same amount to the profit and loss account. The purchase account will be closed by crediting it by ₹ 163.02 million and debiting profit and loss account by the same amount. The necessary entries will be as follows:

| Sales A/c | Dr. | ₹ 232.45 million |

| To Profit and Loss A/c | ₹ 232.45 million | |

| Profit and Loss A/c | Dr. | ₹ 163.02 million |

| To Purchases A/c | ₹ 163.02 million |

3.7.2 Profit and Loss Account

By means of the transfer entries as discussed above, all nominal accounts have been closed and their respective balances transferred to the profit and loss account. The credit side of the profit and loss account will have balances of all accounts pertaining to incomes and gains. The balances of expenses and losses will appear on the debit side of the profit and loss account. If the sum of credit side (incomes) is greater than the debit side (expenses), the balancing figure is profit and is shown on the debit side of the profit and loss account. On the other hand, if the sum of debit side exceeds the credit side, the balancing figure will be shown on the credit side representing the loss for the period.

Profit and loss account is a summary of all the nominal accounts for a particular period. Income and gains are shown on one side and expenses and losses on the other.

The profit and loss account is also a temporary account and is closed down by transferring the balance to the Capital Account. The transfer entries are given below:

In case of a profit:

| Profit and Loss A/c | Dr. |

| To Capital A/c (By the amount of profit) |

In case of a loss:

| Capital A/c | Dr. |

| To Profit and Loss A/c (By the amount of loss) |

By this transfer entry, the owner’s capital gets adjusted by the profit or loss for the period and the profit and loss account balance is reduced to zero.

3.7.3 Balance Sheet

This is the last stage in the accounting cycle. By this time, all nominal or temporary accounts have been closed and we are left with only real accounts and personal accounts. Real accounts pertain to assets and by nature have debit balances. A Personal account may have a debit balance or a credit balance. A personal account with credit balance represents liability or payable whereas a personal account with debit balance represents receivable. Accordingly, permanent accounts with credit balances (capital and payables) will be shown on the Liability side of the Balance Sheet whereas accounts with debit balances (assets and receivables) will appear on the Assets side of the Balance Sheet. Because of the double-entry book keeping system, the total of both the sides of the Balance Sheet will be equal.

Balance sheet is a summary of real accounts (assets) and personal accounts (receivables and payables) at the end of the accounting period.

The relationship between the different types of accounts and the financial statements is depicted in Figure 3.2.

Figure 3.2 Type of Accounts and Financial Statements

■ Illustration 3.6

Please refer to the Trial Balance in illustration 3.4. After preparing the Trial Balance, Satya Paul identified the following additional information:

- Salary for one month amounting to ₹ 55,000 is yet to be paid.

- Interest on investment accrued to the extent of ₹ 1,500 is yet to be received.

- Rent paid is for a period of six months.

- Goods costing ₹ 80,000 are unsold at the end of the quarter.

- Depreciation to be provided @ 10% per annum on Furniture and @ 7.5% per annum on Machinery.

You are required to do the following:

- Pass necessary adjustment entries.

- Prepare the revised Trial Balance incorporating the above adjustments.

- Pass the necessary transfer entries.

- Prepare the profit and loss account for the quarter ended 30th June 2017 and the Balance Sheet as on that date.

Adjustment Entries

As rent has been paid for six months amounting to ₹ 60,000, half of it will be treated as prepaid. Depreciation on Plant and Machinery ( ₹ 4,687) and Furniture ( ₹ 3,750) has been charged.

After passing the above entries, the revised Trial Balance as on 30th June 2017 will appear as follows:

Trial Balance as on 30th June 2017 (₹)

Transfer Entries for Incomes

Transfer Entries for Expenses

Financial Statements

Profit and Loss Account for the Quarter Ended 30th June 2017 (₹)

Transfer Entry for Profit

| Profit and Loss A/c | Dr. | ₹ 67,063 |

| To Capital A/c | ₹ 67,063 |

Balance Sheet as on 30th June 2017

Summary

- Understanding of accounting process helps is developing a better appreciation of the financial statements which are the end product of the accounting cycle.

- Accounting process begins with the vouchers. Vouchers are the supporting documents providing evidence that an accounting transaction has taken place and also the amounts involved.

- Accounting process is made up of recording, classification and summarization. All the transactions recoded at the first stage are later classified and summarized to prepare the financial statements.

- A chart of accounts shows the list of all accounts in which the accounting transactions are recorded.

- Accounts are of three types—real, personal and nominal. Real accounts pertain to assets, personal accounts pertain to receivables and payables and nominal accounts pertain to incomes and expenses.

- Accounting transactions are recorded by way of journal entries. While recording an accounting transaction, one or more accounts are debited and others are credited in such a way that the sums of debits and credits in a transaction are the same.

- In respect of real accounts the recording rule states ‘debit what comes in and credit what goes out’. For personal account we ‘debit the receiver and credit the giver’. For nominal accounts ‘incomes and gains are credited whereas losses and expenses are debited’.

- Journal entries are passed in a chronological order, i.e., in the order in which they take place.

- Accounting transactions recorded by way of journal entries are classified under different accounts. An account is a T-shaped statement with the left-hand side called Debit Side (Dr.) and the right-hand side being Credit Side (Cr.). The process of classification is called ledger posting.

- At the end of the accounting period, all accounts are balanced to find the closing balances. An account where the sum of debit side is greater than the sum of credit side is said to be having a debit balance whereas an account having higher credits than debits will have a credit balance.

- The balance in each account are put in a T-shaped statement called the Trial Balance. The debit side of the Trial Balance will have all accounts with debit balances whereas accounts with credit balances are placed on the credit side of the Trial Balance. Because of double-entry bookkeeping system, both the sides of the Trial Balance will be equal.

- At the end of the accounting period, some adjustment entries may have to be passed to give effect to the accrual and matching principles, e.g., outstanding expenses, prepaid expenses, income accrued but not received, income received in advance, depreciation, closing stock, etc.

- After passing necessary adjustment entries, a revised trial balance is prepared which forms the basis of the preparation of financial statements.

- Nominal accounts are temporary accounts. They are closed at the end of the accounting period by transferring their balances to the profit and loss account by passing transfer entries or closing entries.

- Nominal accounts representing incomes or gains are closed by transferring them to the credit side of the profit and loss account. Accounts relating to expenses and losses are closed by transferring their balances to the debit side of the profit and loss account.

- If the credit side of the profit and loss account is greater than the debit side, the difference is called profit. The profit is transferred to the Capital account of the owner by debiting profit and loss account and crediting Capital account. In case the debit side is greater, the resultant loss is transferred to the Capital account by crediting profit and loss account and debiting Capital account.

- Permanent accounts—real and personal—are arranged in the Balance Sheet of the enterprise at the end of the accounting period. The Liability side of the Balance Sheet will have all personal accounts with credit balances—representing either capital or liabilities. The Asset side of the Balance Sheet will have real accounts (assets) and personal accounts with debit balances representing receivables. Because of the double entry bookkeeping system, the sum of the two sides will be equal.

- The closing balances of real accounts and personal accounts will be carried forward to the next accounting period as opening balances.

Assignment Questions

- Describe various stages in accounting process.

- Identify different categories of accounts and the rules for debits and credits.

- What is the purpose of preparing Trial Balance? Explain its structure.

- Nominal accounts are closed out at the end of the accounting period whereas personal accounts and real accounts are carried forward to the next accounting period. Why?

Problems

- Types of accounts:

Classify the following accounts as real, personal or nominal:

- Bank Account

- Furniture Account

- Salary Account

- Cash Account

- Rent Outstanding

- Bank Overdraft

- Capital Account

- Sales

- Accounts Receivables

- Sundry Creditors

- Transaction analysis and journal entries: Analyze the following transactions and pass necessary journal entries:

- 1st October 2016: Goods sold on credit to SM & Sons for ₹ 1,250,000.

- 1st December 2016: Payment received from SM & Sons by cheque ₹ 500,000.

- 15th January 2017: It was decided to write off the amount due from SM & Sons.

- 1st June 2017: Payment received from SM & Sons towards full and final settlement ₹ 300,000.

- Preparation of trial balance: The followings balances were extracted from the books of Snow White & Co on 31st December 2017. You are required to arrange them in a Trial Balance.

- Adjustment entries and adjusted trial balance: After preparing the above trial balance, the following adjustments were identified. You are required to pass the necessary adjustment entries, prepare a revised Trial Balance and close the accounts.

- Make provision for depreciation @ 7.5% on machinery on the original cost.

- Stock in hand on 31st December 2017 amounted to ₹ 2,875,000.

- 3% of the trade receivables are to be provided as doubtful.

- Salaries amounting to ₹ 175,000 are outstanding.

- Preparation of profit and loss account and balance sheet: Based upon the revised Trial Balance, prepare the profit and loss account of Snow White & Co for the year ended 31st December 2017 and the Balance Sheet as on that date.

Solutions to Problems

-

- Personal A/c (Receivable or payable)

- Real A/c (Asset)

- Nominal A/c (Expense)

- Real A/c (Asset)

- Personal A/c (Payable)

- Personal A/c (Payable)

- Personal A/c (Payable to the Owner)

- Nominal A/c (Income)

- Personal A/c (Receivable)

- Personal A/c (Payable)

-

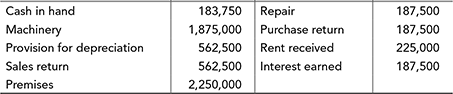

- Trial Balance of Snow White & Co as on 31st December 2017

- Adjustment Entries

Revised Trial Balance

Trial Balance of Snow White & Co as on 31st December 2017

Transfer Entries

Only nominal accounts will be closed by transferring to profit and loss account as follows:

Transferring Nominal Accounts with Credit Balances

Transferring Nominal Accounts with Debit Balances

- Profit and Loss Account of Snow White & Co for the Year Ended 31st December 2017

The profit for the year amount to ₹ 2,326,875 will be transferred to the Capital A/c by the following journal entry:

Profit and Loss A/c Dr. ₹ 2,326,875 To Capital A/c ₹ 2,326,875 Balance Sheet of Snow White as on 31st December 2017

Try It Yourself

- Transaction analysis and journal entries: Analyze the following transactions and pass necessary journal entries:

- Goods sold to RS & Company for ₹ 450,000 on credit on 10th April 2017. 50% of goods returned by them on 18th April 2017 being defective.

- SR & Company from whom an amount of ₹ 925,500 was due made a payment of ₹ 900,000 as full and final settlement.

- An asset with a book value of ₹ 225,000 was destroyed by fire.

- Made investment of ₹ 400,000 in government securities on 28th February 2017. The market value of these investments has fallen to ₹ 320,000 on the date of the Balance Sheet.

- Make provision towards warranty cost at ₹ 850,000.

- Impact on financial for statements: Kong Fuser Ltd prepares its financial statements on financial year basis. How would the following transactions during the year 2017–18 affect the Profit and Loss Account and Balance Sheet of the company:

- Purchased computer on 1st April 2017 to be used in the office for ₹ 100,000. The useful life of the computer is estimated to be 3 years with zero residual value.

- Purchased stationary items for ₹ 20,000 during the year. At the end of the year inventory in hand amounted to ₹ 1,800.

- Purchased land for ₹ 3,000,000 on 31st October 2017 for setting up office building.

- Paid annual fire insurance premium amounting to ₹ 22,000 on the office car on 1st October 2017.

- Received an advance payment of ₹ 1,500,000 from a customer on 28th February 2017, the goods were not yet delivered to him by 31st March 2017.

- Salary paid during the year amounted to ₹ 2,400,000 including an advance of ₹ 100,000 paid to one of the employee. Salaries for the month of March 2017 amounting to ₹ 185,000 were paid in April 2017.

- Preparation of financial statements: Dare Devil & Co is a small scale manufacturing unit. It procures semi-finished goods and sells them after further processing. The trial balance and additional information as on 31st March 2017 are given below. You are required to prepare the Profit and loss A/c for the year and the Balance Sheet as on that date.

Trial Balance of Dare Devil & Co as on 31st March 2017

Additional Information

- Commission accrued to be received: ₹ 24,500

- Insurance expenses include premium paid amounting to ₹ 15,000 on a machine covering the period from 1st October 2016 to 30th September 2017.

- Loan from the bank attracts interest @ 10%.

- Write off ₹ 15,000 as bad debts and make a provision for doubtful debts @ 3%.

- The stock in hand at the end of the year is valued at ₹ 1,387,250.

- Depreciate machinery @ 15% and computer @ 25%.

- Expenses outstanding at the year-end amounted to ₹ 32,150.

- Correcting the given trial balance: Roney, a fresh management graduate has recently joined Seven Wonders & Company. He was asked by the Chief Accountant of the firm to prepare the Trial Balance for the year ended 31st March 2017. Roney extracted the balances from the ledger accounts of the company and put them in the Trial Balance. He is pleased with himself that the total of both the sides of the Trial Balance has almost tallied. The Chief Accountant however is not satisfied because the Trial Balance has to exactly match due to double-entry bookkeeping system being followed. You are requested to help Roney in recasting the Trial Balance. The Trial Balance prepared by Roney is given below:

Trial Balance of Seven Wonders & Company as on 31st March 2017

- Adjustment entries and financial statements: Thanks to your help Roney is able to present the re-casted and duly tallied Trial Balance to the Chief Accountant. The Chief Accountant informed him some additional transactions that need to be recorded.

- Stock in hand as on 31st March 2017: ₹ 988,500.

- Depreciation to be provided at the following rates:

Machinery 7.5% Furniture 12.5% Building 2.5% - Loan from the bank attracts interest at 10%. The loan was outstanding for the whole year.

- There is a pending court case against the firm. It is decided to make a provision towards possible claim for ₹ 100,000.

Please help Roney in making the necessary adjustment entries and also in preparation of the profit and loss account for the year ended 31st March 2017 and the Balance Sheet on that date.

- Financial statements from a trial balance: Eighth Wonder & Co is engaged in cosmetics business. The trial balance and additional information as on 31st March 2017 are given below. You are required to prepare the profit and loss account for the year and the Balance Sheet as on that date.

Trial Balance of Eighth Wonder & Company as on 31st March 2017

Additional Information:

- Closing stock in hand as on 31st March 2017 is ₹ 625,000.

- Goods costing ₹ 90,000 have been sold on approval basis for ₹ 120,000 and included in sales. The approval from the customer is yet to be received.

- Provision for doubtful debts to be created at 2%.

- 7. Financial Statement from a Trial Balance: From the following Trial Balance of SSS Limited, prepare the profit and loss account for the year ended 31st March 2017 and a Balance Sheet on that date:

Trial Balance of SSS Limited as on 31st March 2017

Additional Information:

- Goods costing ₹ 5,000 were distributed as free samples during the year. Goods costing ₹ 45,000 were destroyed by accident and the insurance company has admitted a claim for ₹ 35,000. These transactions were not recorded in the accounts.

- Closing stock as physically verified on 31st March 2017 amounted to ₹ 50,000.

- Provide depreciation on land and building @ 2%, plant and machinery @ 20% and on furniture and fixtures @ 10% p.a.

- Make a provision for doubtful debtors @ 5%.