5

Statement of Profit and Loss

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Understand the contents of statement of profit and loss in depth.

- Appreciate the issues involved with accrual of expenses.

- Prepare the statement of profit and loss as per the requirements of the Companies Act, 2013.

- Differentiate various measures of profits—gross profit, operating profit, pre-tax profit and

- net profit.

- Calculate and interpret basic earnings and diluted earnings per share.

- Appreciate the requirements of applicable accounting standards—Ind AS 12 (income taxes), Ind AS 19 (employees benefits), Ind AS 23 (borrowing costs), Ind AS 33 (earnings per share), Ind AS 102 (share based payment) and Ind AS 105 (discontinuing operations).

5.1 INTRODUCTION

To ensure the uniformity in the presentation of the statement of profit and loss, the format for the same has been prescribed in the Schedule III of the Companies Act, 2013. The information is presented in a vertical format—income followed by expenses.

As discussed in the Chapter 4, the statement of profit and loss is divided into two sections:

- Profit or loss for the period;

- Other Comprehensive Income for the period.

The sum of (1) and (2) above is called total comprehensive income. Profit or loss is defined as ‘the total of income less expenses, excluding the components of other comprehensive income’. Other comprehensive income is defined as ‘comprising items of income and expense (including reclassification adjustments) that are not recognized in profit or loss as required or permitted by other Ind ASs.

Other comprehensive income shall further be presented as:

- Items that will not be reclassified to profit or loss and its related income tax effects.

- Items that will be reclassified to profit or loss and its related income tax effects.

Reclassification adjustments are amount reclassified to profit or loss in the current period that were recognized in other comprehensive income in the current or previous periods. Total comprehensive income comprises all components of profit or loss and of ‘other comprehensive income’. The statement of profit and loss is a single statement which presents profit or loss and other comprehensive income in two sections.

5.1.1 GAAP Revisited

Let us recall some of the relevant accounting principles having a direct bearing on the information presented in the statement of profit and loss.

- Accounting period: The statement of profit and loss concerns only the income and expenses incurred during the given accounting period. Income and expenses pertaining to earlier or subsequent accounting period are not considered.

- Separate entity principle: The statement of profit and loss shows the income and expenses of the business entity as a unit. Any transaction between the business entity and others—including owner—will be recorded as an accounting transaction.

- Money measurement principle: The income, gains, expense and losses that can be expressed in terms of money only are shown in the statement of profit and loss. Income earned and expenses incurred in a currency other than the reporting currency are converted in the reporting currency for incorporating in the statement of profit and loss.

- Accrual principle: The income is recorded when earned and expenses are recorded when incurred. The statement of profit and loss is not based on cash basis but on accrual basis.

- Matching principle: Income is matched against the expenses incurred to earn that income to ascertain profit.

- Conservatism principle: It is better to understate the profit rather that overstate. Accordingly, incomes and gains are recorded when reasonably certain but expenses and losses are recorded even when reasonably probable.

- Materiality principle: In deciding the level of details to be given in the statement of profit and loss, we are guided by materiality principle. Any information relevant for the user, must be disclosed but, at the same time, irrelevant details can be avoided.

5.2 FORMAT OF STATEMENT OF PROFIT AND LOSS

The Schedule III prescribes the vertical format to be followed. The format of the statement of profit and loss is shown in Table 5.1 and related instructions for preparation of the statement are given in Appendix I to this chapter.

Table 5.1 Format for the Profit and Loss Statement for the Year Ended

It may be noted that the Schedule II sets out the minimum requirements for disclosure in financial statements. If any act or regulation requires specific disclosures to be made, such disclosure are required to be made in addition to the requirements of the schedule and it must be ensured that such additional disclosures are made in the notes or as additional statements. Financial Statements shall disclose all material items. Each item mentioned in statement of profit and loss is cross-referenced to any information in the notes.

5.3 REVENUE

The revenue represents income earned by an enterprise by sales of goods, provision of services or by permitting others to use sources owned by the enterprise. The terms revenue or income are often used interchangeably. The revenue earned is split into two subheads—operating revenue and other income. The definition of income encompasses both revenue and gains. Revenue arises in the course of the ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends, royalties and rent. Gains represent other items that meet the definition of income, and may or may not arise in the course of the ordinary activities of an entity, for example, those arising on the disposal of non-current assets1.

5.3.1 Revenue from Operations

This heading includes the income earned by the enterprise from its main operating activities. The revenue from operations must be disclosed separately under the following headings:

- Sale of products

- Sale of services

- Other operating revenues

Companies engaged in manufacturing and trading activities derive majority of their income from sales of products. The revenue from sales of products is recognized using accrual basis of accounting when the sale is complete and the ownership of goods have been transferred to the buyer. On the other hand, companies in the service sector earn their income by providing services. The revenue in such cases is recognized upon a proportionate basis. Besides income from sales of goods and provisions of services, the enterprise may earn ‘other operating revenue’. For example, income from sale of scraps by a manufacturing organization is shown as ‘other operating income’.

For entities engaged in financing activities, interest earned will be a part of operating revenue. Likewise for an investment company, trading gains are part of operating revenue. Again the revenue is recognized using accrual basis of accounting irrespective of timing of receipt.

Revenue includes the gross inflow of benefits to the entity on its own account. Amount collected, if any, on behalf of third parties are therefore excluded from revenue. For example, most of the indirect taxes, e.g., Goods and Services Tax (GST). Value Added Tax (VAT), sales tax, service tax, etc., are collected from the customer on behalf of the government. The business enterprise is merely collecting the tax as an agent and passing on the same to the government, and therefore, the same should not be recorded as revenue.

However, if the indirect tax is collected by the enterprise on its own account as a principal and it pays the tax to the government on its own account, the revenue will be taken on gross basis. For example, an entity pays excise duty to the government on production of goods and built in the same in the sale price. In such a case, the revenue will be shown on gross basis (inclusive of excise duty) and excise duty paid will be shown separately under expenses.

5.3.2 Other Income

In addition to earning revenue from its main operating activity, a business enterprise may also earn revenue from other sources—sources incidental to its operations. Income derived from other such activities is classified as other income. The purpose of separating other income from operating income is to convey the users as to what extent the revenue is being earned from main operations of the enterprise. Other income is classified as:

- Interest income

- Dividend income

- Other non-operating income (net of expenses directly attributable to such income)

Whether an income should be classified as ‘other operating income’ or ‘other income’ depends upon the source of income and to what extent it is related to the main revenue generating activity of the business. To illustrate rental income for a pharmaceutical company from letting out a part of its premises is classified as ‘other income’ whereas rental income for a real estate company engaged in construction and sale of real estate is classified as ‘other operating income’. Similarly, gain on sale of assets is better classified as ‘other income’ whereas sale of manufacturing scrap is classified as ‘other operating income’.

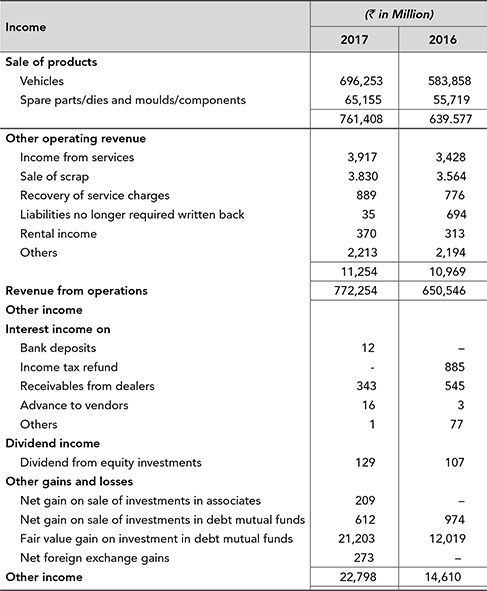

The break-up of income earned by Maruti Suzuki India Limited for the years 2016 and 2017 is given in Table 5.2.

Table 5.2 Income break-up of Maruti Suzuki India Limited2

It may be observed that the major portion of the total income of Maruti Suzuki India Limited is derived from sale of products and other operating income. The contribution of other income in the total income is proportionately small.

The timing and quantum of revenue to be recognized is one of the most critical aspects in accounting. The issues relating to revenue recognition have been covered in detail in Chapter 7. Income received during an accounting period is adjusted to arrive at income to be recognized in the statement of profit and loss in the following manner:

Income received during the year

Add: Income earned during the year but not received

Add: Income received in earlier years but pertains to the current year

Less: Income received in advance in the current year

Less: Income earned in earlier years but received in the current year.

■ Illustration 5.1

Diamond Real Estate Limited has two office premises which are given on rent. During the year 2016–17, it received rent of ₹ 4,300,000 in respect of these two premises. The following additional information is available:

Premises 1

Amount of ₹ 200,000 towards rent was outstanding to be received as on 31st March 2016, the same was duly received in the year 2016–17. As on 31st March 2017 rent amounting to ₹ 300,000 is yet to be received.

Premises 2

It was let out on 1st July 2016 at an annual rent of ₹ 2,400,000. The entire rent was paid by the tenant in advance for the period 1st July 2016 to 30th June 2017.

| How much will be recognized as rent income for the year 2016–17? | ( ₹) |

| Rent received during the year | 4,300,000 |

| Less: Outstanding rent of premises 1 for 2015–16 received during 2016–17 | 200,000 |

| Less: Rent received in advance for premises 2 (April–June 2017) | 600,000 |

| Add: Rent receivable for premises 1 for 2016–17 | 300,000 |

| Rent income in the statement of profit and loss | 3,800,000 |

The sum total of revenue from operations and other income is the total income of the entity for the accounting period.

5.4 EXPENSES

Expense represents the cost of inputs consumed for the purpose of generating revenue. Expenses result in either an outflow of cash or decline in asset or increase in liability. Expenses considered in the statement of profit and loss are called operating expenses or revenue expenses as distinguished from capital expenditure.

Applying accrual basis of accounting, expenses are recorded when incurred and not necessarily when paid. The expenses paid during a year are adjusted for expenses incurred but not paid and expenses paid in advance. The following adjustments are required to be made:

Expenses paid during the year

Add: Expenses outstanding (incurred but not paid)

Less: Paid in advance (paid but not incurred)

Add: Paid in earlier years but pertain to the current year

Less: Expenses of earlier years (outstanding) paid in the current year

■ Illustration 5.2

On the basis of the following information, find the expenses to be recognized in the statement of profit and loss for the year 2016–17.

Salary paid during the year: ₹ 5,300,000. Salary for the month of March 2017 is outstanding amounting to ₹ 450,000.

Insurance premium paid during the year: ₹ 350,000. The company bought a new machine on 1st December 2016 which was insured on the same date by paying an annual premium of ₹ 60,000.

Interest paid during the year: ₹ 1,000,000. The company had borrowed a sum of ₹ 10,000,000 from SBI on 1st October 2015 @ 10% per annum. The loan amount with interest was repaid on 30th September 2016.

The expenses will be recognized as follows:

The salary will be recorded at ₹ 5,750,000 including salary outstanding.

Insurance premium will be recorded at ₹ 310,000. The premium paid on the new machine covers a period of 12 months including eight months of 2016–17. Accordingly, the proportionate premium paid is advance in deducted from the premium paid.

Interest expense will be shown at ₹ 500,000. Though the interest paid is ₹ 1,000,000, on time proportionate basis interest for six months will be recognized in the year 2016–17.

Expenses are classified under various heads based on the nature of expense. Expenses encompasses losses as well expenses that arise in the ordinary activities of the company. The level of details is decided keeping in mind the materiality of the disclosures. It is necessary to strike a balance between too much aggregation and providing too much details.

The classification of expenses as given is Part II of Schedule III is discussed below.

5.4.1 Cost of Material Consumed

In case of manufacturing companies, this may constitute the biggest share of expenses. For the purpose of disclosure under this heading, the followings points must be noted:

- Materials consumed would consist of raw materials and other materials, such as purchased intermediates and components which are ‘consumed’ in the manufacturing activities of the company. These materials physically enter into the composition of the finished product.

- Materials, such as stores, fuel and spare parts for machinery are not shown under this heading as they do not form part of the finished product.

- Packing material may or may not be taken as a part of this heading. If the packing is of essential nature, it may be included under this heading whereas packing material for publicity purposes may not be so included.

- The amount to be disclosed relates to material consumed and not material purchased. This is consistent with the matching principle. The actual consumption of material may be compiled from the internal records of the company. Alternatively, the material consumed is derived by making suitable adjustments with respect to the opening stock and closing stock of raw material using Equation 5.1.

5.4.2 Purchase of Stock-in-Trade

This heading deals with purchase of goods with the intention to resell without further processing. An enterprise which is engaged in trading activity, i.e., buying and selling of goods will disclose the goods purchased under this heading. Likewise, a manufacturing company may also be buying certain goods for reselling without further processing. Such purchases need to be distinguished from the material purchased for processing which are reported under the previous heading. If the enterprise is buying semi-finished goods to be processed further before selling, they should not be included under this heading rather treated as material consumed in the previous heading.

5.4.3 Change in Inventories of Finished Goods, Work-in-progress and Stock-in-trade

At the year-end, the business may have some finished goods and stock-in-trade which are remaining unsold. The business may also have inventory of semi-finished goods at various stages of completion. Similarly, inventory of finished goods, stock-in-trade, and work in progress may be available in the beginning of the year. To give proper effect to the matching principle, suitable adjustment in respect of change in inventories is required to be made. As observed from Equation 5.1, opening stock is added and the closing stock in subtracted. If the closing stock is more that the opening stock (i.e., there is an increase in inventory of finished goods, stock-in-trade, and work-in-progress compared to the opening stock), the increase will be shown as a negative adjustment. However, if the closing stock is less than the opening stock (i.e., there is a decrease in inventory of finished goods, stock-in-trade, and work-in-progress compared to the opening stock), the decrease will be shown as a positive adjustment.

Apportioning the cost of inventory available for sale between closing stock and cost of goods sold requires well thought out accounting policy and can have significant impact on the reported profits. The accounting and valuation of inventories have been covered in detail in Chapter 8.

■ Illustration 5.3

How will you show the following information relating to inventories in the statement of profit and loss for the year 2016–17.

Material purchased during the year: ₹ 6,450,000.

Stock in trade purchased during the year: ₹ 1,780,000.

The information will be disclosed in the statement of profit and loss as follows:

- Cost of material consumed:

₹ 7,068,000

(₹ 2,455,000 + ₹ 6,450,000 – ₹ 1,837,000 = ₹ 7,068,000)

- Purchase of stock in trade:

₹ 1,780,000

- Change in inventories of work in progress

Stock in trade and finished goods:

₹ 297,800

Opening stock = ₹ 2,032,000

Closing stock = ₹ 1,734,200

Decrease in stock = ₹ 297,800

5.4.4 Employee Benefits Expenses

This head covers cost associated with salaries and wages of the employees and other expenses incurred on employees’ welfare. For service organization, this is usually the largest head of expense. As per Ind AS 19, employees’ benefits include:

- Short-term employee benefits—wages, salaries, social security contributions, paid annual leave, paid sick leave, profit sharing and bonuses, and non-monetary benefits for current employees;

- Post-employment benefits—retirement benefits, e.g., pensions and lump-sum payment on retirement and other post-employment benefits, e.g., medical care and life insurance;

- Other long-term employee benefits—long-term paid absences, jubilee or other long-service benefits and long-term disability benefits;

- Termination benefits

Payments made as consultancy fees or advisory fees to consultants and advisors should not be included under this head and there is no employer-employee relationship with such persons. Likewise sitting fees paid to directors for attending the board meeting is also not included under this head.

Recurring and regular payments, like salary, allowances, benefits in kind, etc., are expensed in the profit and loss statement as and when incurred. In addition to regular payroll, an employer may also contribute a fixed sum to certain funds maintained for the benefits of the employees. The employer’s contribution to defined contribution plans for the benefits of employees, like provident fund, superannuation fund, employees state insurance, labour welfare fund, etc., are also recognized on accrual basis.

As per Schedule III of Companies Act, 2013, the following components of employees benefits to be disclosed separately (i) salaries and wages, (ii) contribution to provident and other funds, (iii) share-based payment to employees and (iv) staff welfare expenses.

The enterprise may also provide some deferred benefits to the employee at the time of retirement or post retirement, e.g., gratuity, leave encashment, post-retirement medical facility, etc. In respect of such long-term defined benefits plans, liability is estimated using actuarial valuation considering the age of employee, remuneration, average increment, iteration rate and other such variables. The cost so arrived at, using actuarial valuation is charged to the statement of profit and loss in the current period to ensure matching of cost and benefits.

Share-based payment to employees: In the knowledge economy, employees are the most valuable asset for any business enterprise. A number of companies are offering stock options to their employees as a part of compensation benefits. This also serves as a retention strategy since the options generally are exercisable after a deferment period. As these benefits are being given to the employees in lieu of the services rendered, the value attached to such options shall be treated as another form of employee compensation in the financial statements of the company. The option value is ascertained as the fair value using option pricing method. The option value is normally amortized over the vesting period. (Ind AS 102: Share-based Payment)

■ Illustration 5.4

On 1st April 2015, Nav Bharat Hitech Limited granted 100,000 stock options to its employees. The employees have a right to exercise the options after three years at an exercise price of ₹ 100 each. The market price per share at the time of granting the option is ₹ 160 each. The fair value of each option is ascertained to be ₹ 90. The company estimates that 80% of the employees will remain with the company and will exercise the options. Show the effect of ESOPs on employee cost.

The fair value of each option at the time of grant is ₹ 90. The total value of the options granted therefore is ₹ 9,000,000. 80% of ₹ 9,000,000 will be amortized over the vesting period of three years on a straight line basis. Accordingly, each year ₹ 2,400,000 will be included in employees benefits expenses in the statement of profit and loss for the year 2015-16 to 2017–18.

5.4.5 Finance Cost

A business enterprise may meet a part of its funding requirements from borrowings. The amount may be borrowed from a bank or other financial institution. Alternatively, the firm may issue instruments like debentures to raise funds. The cost associated with such borrowings is classified under this heading. The interest cost is charged in the accounts using accrual principle even if the interest has not been paid. In addition to interest cost, other costs that are associated with borrowing include:

- Interest component of assets taken under a finance lease.

- Commitment fees on bank loan.

- Amortization of cost incurred in connection with the arrangement of borrowings.

- Amortization of discount on issue of debentures.

- Net gain/loss on foreign currency transactions and translation on foreign currency borrowings to the extent they are regarded as an adjustment to interest cost.

Dividend on redeemable preference shares will also be classified as finance cost if the company has no discretion over the payment of dividend. Dividend as well as dividend distribution tax in such a case will be classified as finance cost. However, if the entity has discretion over the payment of dividend, the dividend and tax on distribution will be treated as a distribution of profit and presented in the Statement of Change in Equity.

As per Ind AS 23, borrowing costs should be recognized as expenses in the period it is incurred. However, borrowing costs directly attributable to acquisition, construction or production of an asset shall be capitalized.

Obviously companies that are relying more on borrowed funds for financing will have higher finance cost whereas companies with lower level of borrowed funds will incur less under this heading.

5.4.6 Depreciation and Amortization

In addition to revenue expenses, a business enterprise also incurs capital expenditure that is expected to benefit the enterprise over a long period of time. Such an expenditure results in recognition of a noncurrent asset. Since a non-current asset is expected to be used and benefit the enterprise over a period of time, the matching principle requires that the cost of such an asset should be appropriated over its useful life. The process of apportioning the cost of a non-current asset over its useful life is called depreciation. The term depreciation is associated with tangible assets, e.g., plant and machinery, furniture, building, vehicles, etc. When the cost of an intangible asset, e.g., patent rights, software license, copy rights, etc., is apportioned over its useful life the same is called amortization. Depreciation on property plant and equipment, investment property and amortization of intangible assets is shown under this heading.

Depreciation may be calculated under various assumptions. If the asset is depreciated equally over its useful life it is called a straight line method of depreciation. On the other hand, if higher depreciation is charged in the initial years and lower depreciation in the later years, this is called an accelerated method of depreciation. Ascertaining the amount of deprecation to be charged to the statement of profit and loss requires assumptions about the useful life of the asset and the residual value of asset after its useful life is over. These estimates coupled with the choice of method of depreciation can have significant effect on the reported profit as well as the book value of the asset. The basic principles relating to depreciation are the subject matter of Ind AS 16, whereas amortization of intangible assets is provided in Ind AS 38. The same have been discussed in detail in Chapter 9.

It may be noted that depreciation, unlike other expenses, is a non-cash expense. It does not involve an outflow of cash. It merely represents an accounting adjustment whereby the cost of a non-current asset is written off over its useful life. Business enterprises engaged in highly capital intensive operations and therefore with large investments in non-current assets, e.g., manufacturing sector, are likely to have higher depreciation expenses. On the other hand, companies in service sector, e.g., information technology, consulting etc., are likely to have lower depreciation expense.

5.4.7 Other Expenses

This heading includes a large number of operating expenses not covered in the earlier headings. Many companies break this heading into ‘Manufacturing Expenses’ ‘General and Administration Expenses’ and ‘Selling and Marketing Expenses’ to differentiate based upon the nature of expenses incurred. Any item of expenditure which exceeds one percent of the revenue from operations or ₹ 10,00,000, whichever is higher is required to be disclosed separately. Payments to auditors for taxation matters, for company law matters, for other services and for reimbursement of expenses are required to be disclosed separately. Amount of expenditure incurred on corporate social responsibility activities, in pursuant of Section 135 of the Companies Act 2013, is also required to be disclosed separately.

Research and Development Expenses: Business enterprises engaged in R&D activities (for example pharmaceutical companies) may be spending substantial amounts under this head. As the amount involved may be significant, R&D cost may be reported separately. As a principle, cost incurred on research (searching a new product or new application of an existing product) is expensed out by charging to the statement of profit and loss of the year when such a cost is incurred. However development cost (cost incurred on developing the outcome of research for commercial exploitation) can be capitalized. Development cost so capitalized is amortized in a systematic manner. Expenses incurred on research which are recognized in the statement of profit and loss are included in the other expenses.

Provisions: A provision may be created in respect of a liability where the timing or amount is uncertain. If the entity recognizes that there is a present obligation as a result of a past event and it will require an outflow of economic benefits to settle the obligation, a provision is required to be made based upon the estimated amount.

■ Illustration 5.5

Pee Tee Heavy Engineering Limited sells customized machines to its customers. These machines are covered by one year manufacturer warranty. The company estimates that cost of repair would be ₹ 1,00,000 if a minor defect is detected and it would cost ₹ 5,00,000 to repair in case of major defect. At the year-end, there are 200 machines sold which are covered by the warranty. The company estimates that 80% of the machines would need no repair, 15% would need minor repair and only 5% would need major repairs. Ascertain the amount of provision to be made.

As there a present obligation as a result of past event, it would need outflow of economic benefits and reliable estimates can be made, the company needs to make provision towards the same. The amount of provisions would be 80% × 200 × 0 + 15% × 200 × ₹ 100,000 + 5% × 200 × ₹ 500,000 = ₹ 80,00,000

Ind AS 37 further provides that where the effect of the time value of money is significant, the amount of provision shall be arrived at by finding the present value of the expected expenditure.

■ Illustration 5.6

XYZ Limited is expected to incur some expenses after 2 years in pursuant of a past agreement. The expenses are estimated to be ₹ 20,00,000. The appropriate discount rate is 8% per annum. Determine the amount of provision to be made in the current year’s financial statements.

As the effect of time value of money is significant, the amount of provision will be equivalent to the present value of expected expenditure.

Where K = discount rate (8%) and n = time when expenditure is expected to be incurred (2 years)

Accordingly the provision would be made at ₹ 17,14,677

The break-up of expenses of Maruti Suzuki India Limited for the year 2016 and 2017 is given in Table 5.3:

Table 5.3 Expense break-up of Maruti Suzuki India Limited

Maruti Suzuki India Limited has classified expenses in the nature of manufacturing, selling and general administration as other expenses with break-up being provided in the relevant notes to accounts. The company, engaged in manufacturing of cars, has significant cost of material consumed. It has also undertaken trading in a small way as evidenced by purchase of stock in trade. The business being capital intensive, depreciation and amortization is significantly high. Finance costs are relatively less indicating that the company is not using high amount of borrowed funds. It may be noted that the company has disclosed excise duty as a separate line item, though the same is not prescribed in the format of the statement of profit and loss. As the amount of excise duty is significant, the company has disclosed that separately in pursuant of the materiality principle. The company has used some of the vehicles and dies internally, therefore, the cost of such vehicles and dies has been deducted from the total expenses for the period.

The total of all the expenses recognized under the above headings are deducted from the total income, to arrive at the profit before exceptional items and tax.

5.5 EXCEPTIONAL ITEMS

This heading, as the term suggest, deals with those incomes and expenses which do not arise in the normal course of the business activities of the enterprise and may be non-recurring in nature. Such items need to be disclosed separately. Such a disclosure enables the readers of the financial statements to identify the impact of activities which are not likely to repeat in future.

After the adjustment made for the exceptional items, we arrive at the Profit Before Tax or (PBT).

5.6 TAX EXPENSES

The profit earned by an enterprise is subject to income tax in accordance with the income tax laws. Tax is calculated on the taxable income calculated as per the provisions of the Income Tax Act. The tax expense is comprised of current tax and deferred tax.

The current income tax is calculated as the tax payable in respect of the taxable profit for a period. Any excess or short payment relating to the earlier years need to be disclosed separately.

Due to various provisions in the tax laws, a company may be able to reduce tax in the current year but the same will result in higher tax liability in future years. Such a temporary difference is recognized as deferred tax liability. On the other hand, an enterprise may have paid higher tax in the current year but the same may get reversed in future years and reduce tax liability in the future year. The temporary difference in such a case is called deferred tax asset. Deferred tax assets may also be recognized due to carry forward of unused tax losses and unused tax credits.

There is an underlying assumption that these temporary differences will get reversed in future. Deferred tax assets and liabilities are reviewed at every balance sheet date. Such an accounting of deferred tax is mandated by Ind AS 12. The accounting entries for tax aspects are discussed below:

- Advance payment of tax: Companies are required to pay advance tax on their estimated income. The tax is payable in four instalments as given in Table 5.4 below:

Table 5.4 Due Dates for Advance Payment of Tax3

At the end of the year, the company will estimate its taxable income and make the appropriate provision for tax—both current and deferred.

At the time of making payment of the advanced tax, the following journal entry is passed:

Advance Payment of Tax Account Dr. To Bank Account The amount of advance tax paid during the year will appear in the trial balance as a debit balance. When the provision for tax is made, the following entries are made:

- To make provision for the current year tax expenses:

Current Tax Account Dr. To Provision for Tax Account - To recognize deferred tax liability:

Deferred Tax Account Dr. To Deferred Tax Liability Account - To recognize deferred tax assets:

Deferred Tax Assets Account Dr. To Deferred Tax Account

The current tax account and deferred tax account will appear in the statement of profit and loss as a deduction from the profit before tax. The provision for tax account, advance payment of tax account, deferred tax assets account and deferred tax liabilities account are carried to the balance sheet.

Profit before tax minus tax expenses (current tax and deferred tax) is presented as the profit or loss for the period from continuing operations.

5.7 PROFIT/LOSS FROM DISCONTINUED OPERATIONS

Ind AS 105 requires that the profit or loss from discontinued operations should be disclosed separately in the statement of profit and loss. Discontinued operations includes non-current assets that have been disposed of or are being held for sale. Profit or loss from discontinued operation include profit or loss of discontinued operations and gain or loss recognized on the measurement of fair value less cost to sell or on the disposal of assets constituting the discontinued operations.

Profit/Loss from discontinued operations is adjusted for the tax expenses or tax credits in respect of such operations to arrive at the post-tax profit/loss from discontinued operations.

5.8 PROFIT/LOSS FOR THE PERIOD

Post-tax profit/loss from continuing operations plus post-tax profit/loss from discontinued operations are added to arrive at the profit/loss for the period.

5.9 OTHER COMPREHENSIVE INCOME (OCI)

This heading presents items of incomes and expenses (including reclassification adjustments) that are not recognized in profit or loss as required or permitted by other Ind ASs. It may be noted that classification of items between profit or loss and OCI is rule based rather than principle based. Whether an item of income or expense would be classified in profit and loss or in OCI is provided in the relevant Ind AS. If an item is required to be recognized in OCI, it should be so classified. Generally, items in OCI arise out of revaluation or re-measurement of various assets or liabilities especially financial assets and liabilities.

Some of the items of OCI are subsequently reclassified to profit or loss as per the relevant Ind AS. Accordingly, OCI is classified into (a) items that will not be reclassified to profit or loss and its related income tax effects; and (b) items that will be reclassified to profit or loss and its related income tax effects. The classification is rules based rather that principles based and is dictated by the relevant Ind ASs.

5.9.1 Items that will Not be Reclassified to Profit or Loss and Its Related Income Tax Effects

This heading includes:

- Changes in revaluation surplus.

- Re-measurements of the defined benefit plans.

- Fair value changes on equity instruments through other comprehensive income.

- Fair value changes relating to own credit risk of financial liabilities designated at fair value through profit or loss.

- Share of other comprehensive income in associates and joint ventures, to the extent not to be classified into profit or loss.

- Gains and losses on hedging instruments that hedge investments in equity instruments measured through OCI.

- Others (specify nature).

5.9.2 Items that will be Reclassified to Profit or Loss and Its Related Income Tax Effects

This heading includes:

- Exchange differences in translating the financial statements of a foreign operation.

- Fair value changes in debt instruments through other comprehensive income.

- The effective portion of gain and loss on hedging instruments in a cash flow hedge.

- Share of other comprehensive income in associates and joint ventures, to the extent to be classified into profit or loss.

- Changes in time value of options when separating the intrinsic value and time value of an option contract and designating only intrinsic value changes as the hedging instrument.

- Changes in the value of the forward elements of forward contracts when separating the forward element and spot element of a forward contract and designating only spot element changes as hedging instrument.

- Changes in the value of the foreign currency basis spread of a financial instrument when excluding it from the designation of that financial instrument as the hedging instrument.

- Others (specify nature).

The aggregate of the profit/loss for the period and other comprehensive income is presented as the Total Comprehensive Income for the Period.

5.10 EARNINGS PER SHARE

Earnings Per Share (EPS) is one of the most widely used indicators of profitability of a business enterprise from shareholders’ perspective. As per Ind AS 33, an enterprise is required to present both basic and diluted earnings per share on the face of the statement of profit and loss. Such a disclosure will ‘improve performance comparison between different entities for the same reporting period and between different accounting periods for the same entity.’4

5.10.1 Basic EPS

The basic EPS is calculated by dividing the profits attributable to ordinary equity shareholders by the number of equity shares outstanding. Basic EPS may be calculated by using Eq. 5.2.

If the number of equity share has undergone a change during the year; for example, because of fresh issue of capital, buy-back of shares, conversion of debenture into equity, etc., the denominator will be taken as weighted average number of equity shares outstanding during the year. For the purpose of calculating the weighted average, the number of days for which the shares have been outstanding will be considered. However, if the number of shares have increased due to issue of bonus shares or due to stock split (i.e., where no new resources are availed by the enterprise), the denominator will be number of shares outstanding at the year-end irrespective of the timing of bonus issue or stock split.

5.10.2 Diluted EPS

In addition to basic EPS, companies are also required to report diluted EPS. An enterprise might have issued financial instruments that may get converted into equity shares in future. For example, an enterprise may have an employee stock option plan (ESOP) which entitles the holders of stock option to get certain number of equity shares in future. Likewise, convertible debentures may get converted into equity in future. In such cases, the EPS needs to be adjusted for the effects of all dilutive potential equity shares. For calculation, both the numerator and denominator may need to be adjusted. The difference between the basic EPS and diluted EPS will indicate the presence of potential equity shares that may arise on conversion of existing instruments in future.

■ Illustration 5.7

High Profile Software Limited reported a profit after tax of ₹ 56 million for the year 2016–17. The capital structure of the company as on 31st March 2017 is given as follows:

| (Amount in ₹) | |

| 5,000,000 equity shares of ₹ 10 each | 50,000,000 |

| 1,000,000, 10 per cent preference shares | 10,000,000 |

The company also has 50,000 stock options outstanding. Assume dividends attract a distribution tax at the rate of 15 per cent of dividends paid.

- Calculate the basic and diluted EPS for the company.

- Assuming that out of the above, 2,000,000 equity shares were issued on 1st January 2017 for cash. Calculate the basic EPS.

- What will be the basic EPS if 2,000,000 equity shares were issued as bonus shares on 1st January 2017 rather than for cash?

Solution:

- Basic EPS= ( ₹ 56,000,000 − ₹ 1,000,000 − ₹ 150,000)/5,000,000 = ₹ 10.97

Diluted EPS = ( ₹ 56,000,000 − ₹ 1,000,000 − ₹ 150,000)/5,050,000 = ₹ 10.86

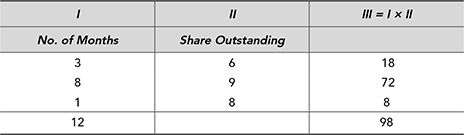

- Weighted average number of shares: As the number of shares outstanding stood at 3,000,000 for nine months and 5,000,000 for the next three months, the weighted average will be calculated as follows:

= 3,000,000 × 9/12 + 5,000,000 × 3/12 = 3,500,000

Basic EPS = ₹ 54,850,000/3,500,000 = ₹ 15.67

- As the change in equity is because of bonus shares, the year end equity will be considered in denominator. The basic EPS will still be ₹ 10.97 per share.

The basic and diluted EPS for Bicon Limited is given in Table 5.5.

Table 5.5 EPS Calculations for Biocon Limited5

Schedule III requires earnings per equity share to be reported separately in respect of continuing operations, for discontinued operations and combined for continuing and discontinued operations.

5.11 VARIOUS MEASURES OF PROFIT

After heaving discussed different heads of income and expenses, we can now look at the concept of profit as well. Some of commonly used expressions are discussed below:

- Gross Profit: The excess of operating income over cost of goods sold or services provided is called gross profit. This represents the inherent profitability of an enterprise before charging other operating and non-operating expenses.

- Cash Operating Profit: Earnings before interest, tax, depreciation and amortization (EBITDA) is often called the cash operating profit. As depreciation and amortization are non-cash expenses and tax and interest are non-operating expenses, profit before charging these four heads of expenses is called cash operating profit.

- Operating Profit: Earnings before interest and tax (EBIT) is a measure of operating profit. Depreciation and amortization (non-cash expenses) are deducted from EBITDA to arrive at EBIT or operating profit.

- Pre-Tax Profit: This is also called profit before tax (PBT) and is arrived at by deducting Interest and finance expenses from EBIT. This indicates the profitability of the enterprise after charging all cost and expenses other than tax.

- Net Profit: The net profit or profit after tax (PAT) is the most popular measure of profit of a business enterprise. From PBT we deduct the net tax expenses to arrive at the PAT. It is popularly called the bottom line.

A business enterprise may or may not disclose all of the above measures on the face the profit and loss statement. However, it is possible to arrive at these measures of profitability by working backwards in the following manner:

■ Illustration 5.8

The summary of the profit and loss statement of Rishabh Limited for the year ended 31st March is given below:

Please calculate the gross profit, cash operating profit (EBITDA), operating profit (EBIT) and pre-tax profit for Rishabh Limited.

Solution:

Pre-tax profit = PAT + Tax expense = ₹ 68.52 + ₹ 19.84 = ₹ 88.36 crore

Operating profit (EBIT) = Pre-tax profit + Finance and interest cost = ₹ 88.36 + ₹ 42.20 = ₹ 130.56 crore

Cash operating profit (EBITDA) = EBIT + Depreciation and amortization = ₹ 130.56 + ₹ 53.25 = ₹ 183.81 crore

Gross profit = EBITDA + Other operating expenses = ₹ 183.81 + ₹ 60.26 = ₹ 244.07 crore

5.12 APPROPRIATION OF PROFIT

After determining the PAT of the enterprise the same needs to be appropriated. The balance carried forward from the earlier year is added to the current year profit to ascertain the profit available for appropriation. The appropriation is usually done under the following heads:

5.12.1 Dividend

A part of the profit available for distribution is given out to the shareholders as dividend. Dividend represents a fraction of profit of the enterprise that is paid to the shareholders. Dividend may be paid on the preference capital or equity capital. A company might have paid an interim dividend, i.e., dividend declared and paid during the year. The final dividend is proposed by the directors and paid to the shareholders after obtaining their approval in the general meeting of the shareholders. Both interim and final dividend represents appropriation of profit. The accounting entries in respect of dividends are discussed below:

- Payment of interim dividend:

Interim Dividend Account Dr. To Bank Account The interim dividend account appears in the trial balance as a debit balance and is transferred to the profit and loss appropriation at the end of the year.

- Proposed dividend:

Dividend Account Dr. To Proposed Dividend Account

The dividend account is closed by transferring it to the statement of profit and loss. The proposed dividend account is in the nature of a provision and is carried to the balance sheet as a current liability.

5.12.2 Dividend Distribution Tax

The payment of dividend attracts a tax called corporate dividend tax or dividend distribution tax at the prescribed rate. It may be noted that this tax is in addition to the tax paid by the company on its income. Since the distribution tax is incidental to the payment of dividend, this is also treated as an appropriation of profit.

As interim dividend has already been paid during the year, no provision is required to be made in respect thereof. Whereas at the time of preparing profit and loss statement, the proposed dividend is in the nature of a liability for which appropriate provision is required to be made.

It may be noted that as per Ind AS 10 if the dividends are declared after the reporting period but before the financial statements are approved, then the dividends are not recognized as a liability. In such a case, dividends are only disclosed in the notes as no obligation exists at the date of the financial statements.

5.12.3 Transfer to Reserves

A part of the profits may be transferred to various reserves, e.g., general reserve. Transfer to reserve is also an appropriation of profit. The amount transferred to reserves is added to the shareholders’ funds in the balance sheet. The journal entry for transfer to reserve is given below:

| Profit and Loss Appropriation | Dr. |

| To General Reserve Account |

Here, it is pertinent to make a distinction between reserve and provision. A provision is a charge on profit, and for all practical purposes is treated as a part of operating expenses. A provision is created for meeting an anticipated fall in the value of asset or for an uncertain but probable liability. For example, a business enterprise selling goods on credit may decide to create a provision for doubtful debts to meet likely defaults in collection. Likewise, provision may be created for fall in the market value of investments. Such provisions are included in other expenses. Reserves, on the other hand, are general purpose retention of profits and are created after ascertaining profits.

Any balance left in the profit and loss statement after all the appropriations is also taken to the shareholders’ funds in the balance sheet. In case of a loss the same is carried to the balance sheet and adjusted from reserves and surplus from the earlier years.

As per the Schedule III of the Companies Act, 2013, the appropriation of profit is not shown in the statement of profit and loss rather the total comprehensive income for the period is taken to the statement of change in equity and added to the carried forward balance of the profit from earlier years. Necessary appropriations are disclosed in the statement of change in equity alongwith other items that have an impact of equity.

Summary

- The statement of profit and loss or the income statement is the primary statement for knowing about the profitability of an enterprise. It provides a summary of revenue earned from different sources and expenses incurred on various heads.

- Statement of profit and loss is based on various accounting principles notably accounting period, separate entity, money measurement, accrual, matching, conservatism and materiality.

- To ensure uniformity and comparability, the format of the statement of profit and loss has been prescribed by Schedule III of the Companies Act, 2013. It is mandatory to disclose previous year’s figures against current number figures as well.

- The statement of profit and loss is presented in two sections—profit or loss and other comprehensive income. The total of profit or loss and other comprehensive income is called the total comprehensive income.

- Revenue earned during a year is broken in operating income and other income. The former represent income earned from the main operating activities of the business enterprise. The later includes incomes earned from sources incidental to the main business. The income is accounted for using accrual basis of accounting.

- Expenses incurred during an accounting period are broken into various heads using materiality principle. Material consumed, stock-in-trade purchased, change in inventory, employee cost, finance expenses, depreciation and amortization and other expenses are the prescribed classification.

- Cost of material consumed shows the cost of raw material and components consumed in the manufacturing process. Material purchased during the year is adjusted for the change in inventory.

- Purchase of stock-in-trade represents the goods purchased for the purpose of reselling without further processing.

- Change in inventory is the adjustment required due to increase or decrease in inventories of work in progress, stock-in-trade or finished goods compared to the beginning of the year. If the closing inventory of work in progress, stock-in-trade or finished goods is greater than the opening, the increase is deducted and vise versa.

- Employee cost includes the regular payments to employees towards salaries and allowances, company’s contribution to defined contribution plans and also cost towards defined benefits plans. The cost of defined benefits plan is ascertained using actuarial valuation.

- Interest and finance cost represents the cost of borrowed funds. The cost is ascertained using accrual basis of accounting considering the amount of borrowing, period of use and the rate of interest. Interest incurred on borrowing for acquisition or construction of a fixed asset is capitalized till the asset is ready for its intended use.

- Depreciation and amortization are non-cash expenses. The cost of tangible asset when appropriated over its useful life, the same is called depreciation. Amortization refers to apportionment of cost of an intangible asset like software license, patents, etc.

- Other expenses includes a number of expenses incurred for day to day running of the business. Expenses are accounted for using accrual basis of accounting and using matching principle. The expenses under this head may be further classified as manufacturing, selling, general and administration expenses.

- Business enterprises engaged in research and development activities may disclose these costs separately. The research costs are expensed as and when incurred, whereas development costs are capitalized and amortized systematically.

- The profit earned by a business enterprise is subject to income tax. The income tax is broken in current tax and deferred tax. The current tax is the tax on current year’s taxable income as per the provisions of the income tax act. Deferred tax represents the impact of timing difference between taxable income and reported profit. The tax expenses are deducted from the PBT to arrive at the net profit or net income or simply the profit after tax (PAT). This is also referred to as the bottom line.

- Other comprehensive income for the period is added to the profit or loss to arrive at the total comprehensive income

- Whether an item of income or expenses shall be classified as profit and loss or OCI is as required by the relevant Ind AS.

- The PAT along with any balance of profit carried from the previous year is available for appropriation. A part of it gets distributed to the shareholders as dividends and another is transferred to various reserves. The balance available after appropriations is carried to the Balance Sheet under the heading reserves and surplus.

- Earnings Per Share (EPS) is an important measure of profitability for equity shareholders. On the face of the statement of profit and loss, basic EPS and diluted EPS are reported. Basic EPS is calculated by dividing profits available for equity shareholders by number of equity shares outstanding. Whereas diluted EPS takes into account the effect of potential equity shares that may be issued against financial instruments already issued by the company, e.g., convertible bonds, ESOP, etc.

- EPS is reported separately in respect of continuing operations, discontinued operations and combined for continuing and discontinued operations.

Assignment Questions

- Identify the main accounting principles having a bearing on the preparation of the statement of profit and loss.

- ‘Interest paid is an expense whereas dividend paid is an appropriation of profit’. Explain.

- Explain the accounting for different types of employees’ cost.

- Differentiate between basic earnings per share and diluted earnings per share.

- ‘Deferred tax assets and deferred tax liabilities arise due to timing difference between taxable income and reported income’. Explain the statement with suitable examples.

- Explain the different measures of profit.

- What is the basic principle behind accounting for research and development expenses?

Problems

- Accrual of Expenses: In each of the following cases ascertain the amount to be charged as expenses in the statement of profit and loss for the year 2016–17:

- Premises taken on rent on 1st August 2016 by paying a deposit of ₹ 10 million. Quarterly rent of ₹ 300,000 paid on 1st August and 1st November each. Rent due on 1st February not paid till 31st March 2017.

- Paid towards salaries to employees ₹ 60.30 million. It includes a sum of ₹ 4.85 million as advance to employees against salary.

- Debtors outstanding as on 31st March 2017 amounted to ₹ 305 million. Based upon the past trend the company estimates that 2% of the debtors will default on payment.

- Goods bought during the year 2015–16 amounting to ₹ 12.23 million were actually paid for in the year 2016–17.

- Special goods were ordered on 15th December 2015 with advance payment of ₹ 3 million. The same were received and consumed during 2016–17.

- Preparation of statement of profit and loss: The details of income and expenses of SDTV Limited for the year 2017 is given below:

You are required to prepare the statement of profit and loss for the company using suitable heads for income and expenses. Also, indicate the cash operating profit, operating profit and pre-tax profit separately.

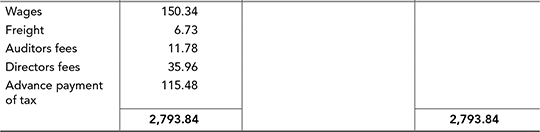

- Preparation of statement of profit and loss from a given trial balance: Based upon the given Trial Balance and the additional information, prepare the statement of profit and loss of Shivam Industries Limited for the year ended 31st March 2017:

Trial Balance of Shivam Industries Limited as on 31st March 2017

Additional Information

- Stock in hand on 31st March 2017

₹ 297,360

- Provide depreciation on the fixed assets at original cost at the following rates:

Plant and machinery 10% Motor vehicles 20% Furniture 10% Buildings 2% - Interest accrued on investments

₹ 5,500

- Provision for doubtful debts to be made

2%

- Provision for tax for the current year to be made

₹ 120,000

- Salary for the month of March 2017 is outstanding

₹ 4,800

- General expenses include insurance paid amounting to ₹ 8,000 for the period from 1st January 2017 to 31st December 2017.

- Stock in hand on 31st March 2017

- Calculation of basic and diluted EPS: Mahaveer Limited earned a PAT of ₹ 33.80 million for the year 2017. The share capital of the company is made up of eight million equity shares of ₹ 2 each and one million preference shares of ₹ 100 each carrying dividend at the rate of 10%. The company had six million equity shares outstanding in the beginning of the year and issued three million additional shares on 1st April 2017. It bought back one million shares on 1st December 2017 from the market for cancellation.

- Calculate the weighted average number of equity shares outstanding.

- What is the basic EPS of the company for the year?

- Assuming that each preference share is convertible into two equity shares in the future, calculate the diluted EPS?

Solutions to Problems

-

- The deposit of ₹ 10 million is not an expense and hence will not appear in the profit and loss account. The rent for the period of eight months (from August 2016 to 31st March 2017) amounting to ₹ 800,000 will be shown in the profit and loss statement on accrual basis.

- Advance salaries are not to be expensed during the year 2016–17. Accordingly, an amount of ₹ 55.45 million (₹ 60.30 less ₹ 4.85 million) will appear in the profit and loss statement.

- Provision for doubtful debts will be created at ₹ 6.10 million (2% of ₹ 305 million) and the same will appear in the profit and loss account as an expense.

- Purchases of ₹ 12.23 million will be included in the profit and loss statement of 2015–16 even if paid in the next year using the accrual basis of accounting.

- Purchase of ₹ 3 million will be included in the profit and loss statement of 2016–17 even if paid in advance in the previous year.

- The profit and loss account of SDTV Limited for the year ended 31st December 2017

- The profit and loss statement of Shivam Industries Limited for the year ended 31st March 2017

-

- Weighted average number of equity shares

Weighted average = 98/12 = 8.17 million shares

- Basic EPS = (PAT − Dividend on preference shares)/Weighted average number of equity shares outstanding

= (₹ 33.80 − ₹ 10)/8.17 = ₹ 2.91 per share

- Diluted EPS: The preference shares outstanding are convertible into two million equity shares in the future. Upon conversion, they will not be entitled to get dividend at the fixed rate of 10%. Accordingly, both the denominator and numerator need to be adjusted to calculate the diluted EPS as follows:

Diluted EPS = PAT/(Number of equity shares outstanding + Dilutive shares)(₹ 33.80)/(8.17 + 2) = ₹ 3.32 per share

- Weighted average number of equity shares

Try It Yourself

- Expense recognition in the statement of profit and loss: Ascertain the impact of the following transaction on the profit and loss statement for the financial year 2016–17:

- The company borrowed ₹ 100 crore from the State Bank of India the rate of 12% per annum on 1st July 2016. The interest is payable quarterly on the first day of October, January, April and July respectively. The interest due on 1st October 2016 was duly paid but the interest due on 1st January 2017 has not been paid till date of the balance sheet.

- During the year, the company spent ₹ 13 million towards buying various stationary items. As on 31st March 2017, the store department still has stationary items costing ₹ 1.8 million with it whereas stationary items in hand on 1st April 2016 amounted to ₹ 2.3 million.

- The company paid employee cost of ₹ 134.75 million during the year including an advance of ₹ 2 million to one of the employees. Salaries for the month of March 2017 amounting to ₹ 15.35 million were paid on 5th April 2017. The company would also like to create a provision of ₹ 2.35 million towards retirement benefits for the employees.

- Nature of income: Classify the following incomes into operating income, other income, exceptional income or extra-ordinary income:

- Interest earned by a bank.

- Interest earned by a manufacturing company on the fixed deposits it kept with the bank.

- Sale of scrap arising out of manufacturing process.

- Fees earned by the manufacturer of computer by providing annual maintenance services to its customers.

- Profit on sale of machine.

- Profit on sale of shares in a subsidiary company.

- Premium received on the issue of new shares.

- Amount received on one time settlement of a court case.

- Provisions no longer required written back.

- Rent received by a trading company by letting out its premises.

- Classification of expenses: Classify the following expenses under various heads of statement of profit and loss as per Schedule III of the Companies Act, 2013:

- Staff welfare expenses

- Interest paid

- Payment to contract labour

- Goods purchased for trading

- Auditors’ fees

- Depreciation on property, plant and equipment

- Bank charges in relation to obtaining loan

- Contribution to provident fund

- Raw material purchased

- Directors’ fees

- Income tax

- Consumable stores purchased

- Various measures of profits: Tech Mahindra Limited made a profit of ₹ 743 crore for the year 2009–10 after making a provision of ₹ 131 crore towards taxes and ₹ 130 crore towards depreciation and amortization. The company also incurred ₹ 160 crore as interest and finance charges. Calculate the pre-tax profit, operating profit and cash operating profit for the company.

- Preparation of the profit and loss account: On the basis of the following information, prepare the profit and loss account for the Jack Paints Limited for the year 2016–17. Show EBITDA, EBIT and PBT separately.

- Computing earnings per share: The share capital of the Jack Paints Limited consists of 96 million equity shares of the face value ₹ 10 each. In addition, the company also has given stock options to its employees which can be converted into 5.80 million equity shares on exercise. Based upon the profits arrived in Problem 5 above, calculate the basic earnings per share and diluted earnings per share for the company.

- Preparing of statement of profit and loss from a trial balance: From the following balance extracted from the books of accounts of Solid Steels Limited as on 31st March 2017, prepare the statement of profit and loss.

The closing stock as on 31st March 2017:

– Raw material 662 – Work-in-progress 432 – Finished goods 156 - Preparation of the profit and loss statement from a trial balance: Star Limited has an authorized capital of ₹ 600 million divided into 60 million equity shares of ₹ 10 each. The trial balance of the company for the year ended 31st March 2017 is as follows:

Trial Balance of Star Limited as on 31st March 2017

Additional Information

( ₹ in Million) a. Outstanding wages: 2.59 b. Outstanding salaries: 1.64 c. Interest accrued on investments: 3.43 d. Closing stock: 171.03 e. Provide depreciation at original cost on: i. Premises 2% ii. Machinery 7.5% iii. Furniture 10% f. Make provision for income tax at 30% g. The board of directors of companies has proposed a dividend of 7.5% after transferring 5% of the profits to general reserves. The dividend attracts a distribution tax at 15% of the dividends.

You are required to prepare the profit and loss statement for the year ended 31st March 2017.

Hint: Not all the balances appearing in the trial balance are relevant for the purposes of the profit and loss statement.

Cases

Case 5.1: Preparation of the Statement of Profit and Loss for Asian Paints Limited6

Asian Paints was set up in the year 1942 and is India’s leading paint company with a group turnover of ₹ 170.85 billion. The group has an enviable reputation in the corporate world for professionalism, fast track growth, and building shareholder equity. Asian Paints operates in 16 countries and has 24 paint manufacturing facilities in the world servicing consumers in over 65 countries. Besides Asian Paints, the group operates around the world through its subsidiaries Berger International Limited, Apco Coatings, SCIB Paints, Taubmans and Kadisco. Asian Paints manufactures wide range of paints for decorative and industrial use.

Based upon the following particulars prepare the statement of profit and loss of the company for the year 2016–17.

Case 5.2: Preparation of the Statement of Profit and Loss for HCL Tech Limited7

HCL Technologies Limited is a leading IT solution provider company with operations is 32 countries and 116,000 employees. The global revenue of the company exceeded USD 7.2 billion. HCL Technologies provides solutions built around digital, IoT, cloud, automation, cybersecurity, analytics, infrastructure management and engineering services. Using the following particulars, prepare the statement of profit and loss of the company for the year 2016–17.

Case 5.3: Preparation of the Statement of Profit and Loss for Cipla Limited8 from the Trial Balance

Cipla is a leading global pharmaceutical company, dedicated to high-quality, branded and generic medicines. We are trusted by healthcare professionals and patients across geographies. Cipla was founded in the year 1935 and has presence in 80 countries. The company has over 23,000 employees and a global revenue exceeding USD 2.2 billion.

From the following trial balance and the additional information for the company, you are required to prepare the statement of profit and loss for the company for the year ended 31st March 2017.

Additional Information

- Closing inventories as on 31st March 2017 consists of:

( ₹ in Crore) a. Raw material and packing material 1,112 b. Work in progress 545 c. Finished goods 680 d. Stock-in-trade 282 e. Consumable Stores 34 - Provide depreciation on property, plant and equipment: ₹ 465 crore

- Amortise intangible assets: ₹ 35 crore.

- Make provision for doubtful trade receivables : ₹ 33 crore

Case 5.4: Preparation of the Statement of Profit and Loss for Hindustan Unilever Limited9 from the Trial Balance

Hindustan Unilever Limited (HUL) is India’s largest Fast Moving Consumer Goods company. HUL has over 35 brands spanning 20 distinct categories such as soaps, detergents, shampoos, skin care, toothpastes, deodorants, cosmetics, tea, coffee, packaged foods, ice cream, and water purifiers. The Company has about 18,000 employees.

From the following Trial Balance of the company and additional information, you are required to prepare the Statement Profit and Loss for the company for the year ended 31st March 2017.

Additional Information

- Closing inventories as on 31st March 2017 consists of:

( ₹ in Crore) a. Raw material and packing material 879 b. Work in progress 205 c. Finished goods and stock-in-trade 1,214 d. Stores and spares 64 - Provide depreciation on property, plant and equipment: ₹ 384 crore.

- Amortise intangible assets: ₹ 12 crore.

Case 5.5: Comparison of the Statement of Profit and Loss of Hero Honda Motors Limited and Tech Mahindra Limited for the year 2016–17

Hero MotoCorp Ltd. (Formerly Hero Honda Motors Ltd.) is the world’s largest manufacturer of two-wheelers, based in India. In 2001, the company had achieved the coveted position of being the largest two-wheeler manufacturing company in India and also, the ‘World No.1’ two-wheeler company in terms of unit volume sales in a calendar year. Hero MotoCorp Ltd. continues to maintain this position till date.It derives its income from manufacturing and sale of motorcycles. Tech Mahindra Limited is engaged in the IT solutions and services, business process services and IT platforms. The company is present in 90 countries with over 115,000 associates.

The statements of profit and loss of two companies for the year ended 31st March 2017 are reproduced below:

Questions for Discussion

- Comment upon the key differences in the composition of expenses for the two companies.

- Hero Motocop has reported excise duty as a separate line item. Likewise, Tech Mahindra reported subcontracting expense as a separate line item rather than clubbing them with other expenses. What accounting principle in involved?

Appendix I: General Instructions for the Preparation of the Statement of Profit and Loss

- The provisions of this part shall apply to the income and expenditure account, in like manner as they apply to a statement of profit and loss.

- The statement of profit and loss shall include:

- Profit or loss for the period

- Other comprehensive income for the period

The sum of (a) and (b) above is total comprehensive income.

- Revenue from operations shall disclose separately in the notes

- sale of products (including excise duty)

- sale of services

- other operating revenues.

- Finance costs: finance costs shall be classified as

- interest

- dividend on redeemable preference shares

- exchange differences regarded as an adjustment to borrowing costs; and

- other borrowing costs (specify nature).

- Other income: other income shall be classified as

- interest Income

- dividend Income

- other non-operating income (net of expenses directly attributable to such income).

- Other comprehensive income shall be classified into

- Items that will not be reclassified to profit or loss

- Changes in revaluation surplus

- Remeasurements of the defined benefit plans

- Equity instruments through other comprehensive income

- Fair value changes relating to own credit risk of financial liabilities designated at fair value through profit or loss

- Share of other comprehensive income in associates and joint ventures, to the extent not to be classified into profit or loss

- Others (specify nature).

- Items that will be reclassified to profit or loss

- Exchange differences in translating the financial statements of a foreign operation

- Debt instruments through other comprehensive income

- The effective portion of gains and loss on hedging instruments in a cash flow hedge

- Share of other comprehensive income in associates and joint ventures, to the extent to be classified into profit or loss

- Others (specify nature).

- Items that will not be reclassified to profit or loss

- Additional information: A Company shall disclose by way of notes, additional information regarding aggregate expenditure and income on the following items:

- employee Benefits expense [showing separately (i) salaries and wages, (ii) contribution to provident and other funds, (iii) share based payments to employees, (iv) staff welfare expenses]

- depreciation and amortisation expense

- any item of income or expenditure which exceeds one per cent of the revenue from operations or ₹ 10,00,000, whichever is higher, in addition to the consideration of ‘materiality’

- interest Income

- interest Expense

- dividend income

- net gain or loss on sale of investments

- net gain or loss on foreign currency transaction and translation (other than considered as finance cost)

- payments to the auditor as (a) auditor, (b) for taxation matters, (c) for company law matters, for other services, (e) for reimbursement of expenses

- in case of companies covered under section 135, amount of expenditure incurred on corporate social responsibility activities

- details of items of exceptional nature.

- Changes in regulatory deferral account balances shall be presented in the statement of profit and loss in accordance with the relevant indian accounting standards.

Endnotes

- ICAI: Exposure Draft—Framework for the Preparation and Presentation of Financial Statements, 2010.

- Annual Report of Maruti Suzuki India Limited for the year 2017.

- Section 209 of Income Tax Act 1961.

- ICAI: Ind AS 33 ‘Earnings Per Share’

- Annual Report of Biocon Limited for 2016–17

- Annual Report of Asian Paints Limited for the year 2016–17 and the official website of the company https://www.asianpaints.com/more/about-us.html

- Annual Report of HCL Technologies Limited for the year 2016–17 and the official website of the company https://www.hcltech.com/about-us

- Annual Report of Cipla Limited for the year 2016–17 and the official website of the company http://www.cipla.com/en/corporate-information/at-a-glance.html

- Annual Report of Hindustan Unilever Limited for the year 2016–17 and the official website of the company https://www.hul.co.in/about/who-we-are/introduction-to-hindustan-unilever/

- Annual Reports of Hero Motocop Limited and Tech Mahindra Limited for the year 2016–17; the official websites of the companies; http://www.heromotocorp.com/en-in/about-us.php; and https://www.techmahindra.com/company/default.aspx