CHAPTER 2

Case 2: Check Fraud, Debit Card Fraud, Cash Larceny

2-1 ANDERSON INTERNAL MEDICINE: PREPARING A BANK RECONCILIATION AND SPREADING/ANALYZING TRANSACTIONS ON MONTHLY STATEMENTS FROM FINANCIAL INSTITUTIONS

Learning Objective

After completing and discussing this case, you should be able to:

- Prepare a bank reconciliation between the bank records and company's accounting records to determine the existence of unaccounted transactions that have not been recorded in the:

- Bank statements (but have been recorded in the company's point‐of‐sale [POS] computer program), deposits in transit (i.e., deposits recorded on the company's books but not presented to the bank), and outstanding checks (i.e., checks recorded on the company's books but not presented to the bank); and/or,

- Company's accounting records (but may have been recorded in the bank statements), including unrecorded fees (e.g., insufficient funds charges, monthly account fees, and other debit memorandums) and unrecorded income (e.g., interest earned and other credit memorandums).

- Enter into a spreadsheet debits and credits from financial institution monthly statements, identify the payee, maker, and endorsee on checks, read the transaction information on the back of checks, read the coding associated with debit (or ATM) card charges listed on the statements, read deposit slips, and then analyze the information.

- Vouch transactions on the monthly statements to accounting records (e.g., cash receipts and cash disbursement journals).

- Identify irregularities in payee, maker, and endorsee on checks, coding associated with debit (or ATM) card charges (e.g., when and where charged, timing) and the amount and type of deposits.

Introduction

This case teaches you to prepare: (1) a bank reconciliation and (2) a spreadsheet with transactions listed on monthly statements. You will also examine the front and back of checks, the coding associated with debit card transactions, deposit tickets, as well as vouch the checks and debit card transactions to the cash disbursements journal and the deposits to the cash receipts journal.

Bank reconciliations account for the differences between the month‐end balance shown on the financial institution statement and the corresponding total shown in the company's books of record (i.e., cash and related accounts). Completion of the bank reconciliation requires a number of adjustments for timing differences and items found on the statement or books of record (e.g., checks or deposits listed on the books but yet to be received by the bank, and interest earned at the financial institution that has yet to be recorded on the books). When all adjustments have been made, there might still be a yet‐to‐be‐explained difference. When two or more bank reconciliations (e.g., prior and current reconciliation) result in large unaccounted‐for differences, the differences might be larceny, lapping, another type of cash fraud, or material accounting error. Such large unaccounted‐for differences require additional fraud examination work (e.g., interviewing those who handle cash, examination of individual receivable accounts, reviewing adjusting journal entries and account edits).

Monthly statements from financial institutions (e.g., bank, credit unions, savings and loan associations, and stock brokerage firms) offer a great deal of information, some of which reflects how the alleged fraudster or company spent its money (e.g., personal as opposed to business expenses). It can also detect such illegal activities as unauthorized use of debit (or ATM) cards, check kiting, money laundering, and so on.

Balances in the general ledger and trial balance accounts are not always what they seem. Through the following analyses, you will detect receipts and disbursements that do not agree with the cash receipts and disbursement journal descriptions, unauthorized use of debit cards, and the possibility of larceny.

Background

Greg and Tonya Larsen are being investigated by law enforcement and Southern Appalachian Insurance Company, the company that insured Anderson Internal Medicine (AIM).

Early on Friday, April 1, 2016, the branch manager of the Bank of Lawrenceville called Jennifer Anderson, MD, the CEO of Anderson Internal Medicine, to inform her that the medical practice's checking account was overdrawn by $5,945.43. Late last night, the bank paid as a courtesy four charges that overdrew the account ($2,339.50, $2,501.66, $2,497.89, and $280.00). In addition, it returned four checks totaling $6,159.75 ($1,534.73, $1,783.83, $1,341.19, and $1,500.00). Dr. Anderson spoke with Tonya Larsen when she arrived. Tonya quickly performed a bank reconciliation and announced that the shortage was the result of several missing deposits because she had not deposited some receipts, which were in her credenza. Tonya promised to track down and deposit the missing deposits and personally cover the insufficient funds (NSF) charges. The two agreed to go over the books early on Monday morning. Tonya Larsen spent the remainder of the day in her office with her door closed and stayed behind after the last patient and all employees left for the day.

Dr. Anderson arrived early on Monday and went straight to Ms. Larsen's desk. She found a wastebasket overflowing with shredded paper. She immediately went to the file room, where she found a giant trash bag also overflowing with shredded paper and empty patient file folders tossed haphazardly all around the file room. Dr. Anderson attempted to access the point‐of‐sale, accounting, and payroll systems, but could not get into either computer system—none of the passwords worked. She called in a forensic computer examiner, who successfully unlocked the computer, but found that much of the data on the hard drive had been erased. Over several days, he was able to un‐erase some of the data.

Late on Monday, a lawyer emailed Dr. Anderson and left a voice message on her personal cell phone that he represented Greg and Tonya Larsen and left instructions that no one was allowed to talk with either of them. Any inquiries that she or anyone else had MUST go through him.

AIM's new office manager spent two weeks attempting to make sense out of the mess and file an employee dishonesty claim with Southern Appalachian Insurance Company. She found $260.00 in cash, $2,210.00 in patient and insurance company checks, and two business debit cards in Tonya Larsen's file cabinet. She also confirmed that the ending balance in the cash account for the point‐of‐sale system was $901.47 in the general ledger. After getting a copy of an order form from the Bank of Lawrenceville, the new office manager discovered that Tonya Larsen obtained the two debit cards without the authorization of Dr. Anderson. She also obtained facsimiles of canceled and dishonored checks and deposit tickets for March 2016.

The special agents with the insurance company's Special Investigative Unit (SIU) found that:

Tonya previously worked for Absolute Orthopedics, Marietta, Georgia, as the office manager. She resigned at the end of March 2015 after the practice started bouncing checks. Absolute Orthopedics' CPA determined that over $30,000.00 was missing. The practice filed an employee dishonesty claim with its insurance company (not Southern Appalachian Insurance Company), but could not definitively determine who caused the loss. The case was referred to the Cobb County Sheriff's Office. Their investigation is still open.

Notes

- AIM uses a point‐of‐sale (POS) computer program to record the cash receipts, debit card, credit card (e.g., AMEX, Discover, MasterCard, VISA), and insurance charges (e.g., Blue Cross Blue Shield, Medicare, Medicaid, Tricare) for patient services. Only the daily cash receipts are deposited to the checking account at Sharptop Bank. The deposits of subsequent settlement payments for credit card charges and insurance charges are deposited in a separate bank lock box that monitors charge transactions.

- Dr. Anderson owns a Lexus RX 350, which she finances with Sharptop Bank.

Summary Requirements

You have been retained by Alexander Z. Boone, Esq., the independent attorney hired by Southern Appalachian Insurance Company, to examine an employee dishonesty claim filed by Anderson Internal Medicine. You work under attorney‐client privilege (i.e., your work is not made available to opposing counsel until authorized by Alexander Boone).

Before proceeding, read the documents in Chapter 7, section 7‐2, “Anderson Internal Medicine.” As with the prior case, you will have to read and reread the documents to fully understand the evidence.

On your own, research how to prepare a bank reconciliation. It can easily be found online. Study sections 2-3 and 2-4, How to Read Checks and Decode Debit Card Transactions and How to Spread and Analyze Check and Debit Card Transactions before conducting the specific requirements of this case.

The results of your assignment will be used by the attorney. Your assignment (in general) is, as follows:

- Determine the types of employee dishonestly frauds allegedly perpetrated by Tonya Larsen on Anderson Internal Medicine. Determine how the alleged fraud could have occurred at the medical practice (e.g., weak internal controls) and what Anderson Internal Medicine needs to do to deter future frauds.

- Determine the amount of verifiable loss from alleged employee dishonesty at Anderson Internal Medicine.

- Determine what additional steps need to be taken to examine the yet‐to‐be‐determined difference detected by the bank reconciliation.

- Prepare a report and associated schedules using the sample report and schedules.

- Prepare audiovisuals (e.g., charts, summary schedules, and/or graphs of your choice) to simplify these complex accounting issues.

The initial steps (see exercises) are to be completed individually. You may confer online about examination strategy, but must do your own work. In particular, each student is to perform the various fraud examination steps and submit their Excel working papers (e.g., schedules) for grades. These steps will be performed as a series of graded exercises designed to walk you through the process.

The final exercise is a team project. Each team will submit a final examination report addressed to the attorney for Southern Appalachian Insurance Company, accompanying set of schedules, and audiovisuals for a grade. Each team is to select a team leader, assign various tasks to each member of the team, and email a list of each student's assignment. Pick your team leader wisely, as he/she is responsible for quality control and should not take on any additional tasks. The team leader makes sure that deliverables are received in a timely manner (i.e., schedules, audiovisuals, and report in that order) and proofreads the report before submission.

Look Closer at Repeating Debit Card Transactions at Big Box Stores and Chain Grocery Stores

If you examine checking accounts of persons suspected of money laundering and find small, repeating debit card transactions (say $25 to $75) at big‐box stores or chain grocery stores, you might be witnessing the 5 percent fee charged by customer service for loading prepaid cards valued from $500 to $1,500. Similarly, large dollar transactions at grocery stores (say $1,575 or $2,337) may not be for groceries. Yes, persons might spend $400 or more for the monthly groceries, but not $2,337. Something else is transpiring. You might be witnessing the conversion of cash to stored value cards for shipment outside the United States. What is a 5 percent fee to a fraudster if they can convert it to an easily transportable medium that does not come under the U.S. Treasury Cash Transaction Regulations (CTR). Explore those transactions further. Call or visit the big‐box store or chain grocery store and get their policies concerning converting cash to stored value cards. Also, inquire about the store's retention of electronic records of these transactions, which can be obtained by subpoena. Some stores also have video cameras that surveil customer service.

2-2 HOW TO PERFORM A BANK RECONCILIATION

Learning Objective

After reading this synopsis, you should be able to:

- Better understand the purpose of a bank reconciliation.

- Be able to complete a bank reconciliation.

Introduction

Bank reconciliations are an accounting tool used to schedule differences between the company's books and records and the bank's books and records on a specific day (e.g., last day of the month) for an individual account held by a financial institution. Where the company owns more than one account at a financial institution, bank reconciliations must be performed for each account. To a large degree, the differences between the two sets of records involve timing (e.g., items in transit between the company and financial institution) and unrecorded transactions (e.g., interest earned in a bank account that has yet to be recorded on the company's books and records).

When a bank reconciliation detects an unknown difference, that difference is a red flag, which must be investigated further. An unexplained difference might be a timing difference, recording a transaction in the wrong ledger, or fraud. Example #1, a bank reconciliation, detects a $100,000 undetermined shortage where deposits involve only checks and clerks regularly scan and electronically deposit checks. Further investigation reveals that an envelope of checks is found in a clerk's desk drawer. It initially appears that the clerk failed to timely deposit customer checks. However, when the checks are scanned and electronically deposited, customers scream that their checks were processed twice. You conduct a second bank reconciliation of another ending date that results in a similar $100,000 undetermined shortage. Interview the clerk involved and those working around the clerk as you might have uncovered some form of lapping. Example #2, a bank reconciliation, detects a $7,000 undetermined shortage where deposits involve both cash and checks and undeposited cash and checks are found in a drawer. Further review of deposit slips reveals little or no cash being deposited or round dollar amounts of cash being deposited on a routine basis. Interview the clerk and those working around the clerk. You might have uncovered some form of cash larceny.

In both examples, ask the following: Who handles deposits? How are the deposits handled? What are the internal controls, if any?

Steps in Performing a Bank Reconciliation

Performing a bank reconciliation is a multistep process. There are several standard formats. Often, the format is located on the back of the monthly bank statement.

| Ending Balance on Bank Statement Dated | Step 1 | $ ‐ |

| Adjustments to Bank Statement | ||

| Add: Deposits in Transit (list below) | Step 2 | |

| Step 2 | ‐ | |

| ‐ | ||

| Subtract: Outstanding Checks (list below) | Step 2 | |

| Step 2 | ‐ | |

| Step 2 | ‐ | |

| Adjusted Balance on Bank Statement | TOTAL | $ ‐ |

| Balance per Books and Records as of | Step 1 | $ ‐ |

| Adjustments to Books and Records | ||

| Add: Transactions on Bank Statement Not in Books and Records | ||

| Interest Earned from Bank | Step 3 | ‐ |

| Other | Step 3 | ‐ |

| Other | Step 3 | ‐ |

| Subtract: Transaction on Bank Statement Not in Books and Records | ||

| Bank Charges | Step 3 | ‐ |

| NSF Checks | Step 3 | ‐ |

| NSF Fees | Step 3 | ‐ |

| Other | Step 3 | ‐ |

| Other | Step 3 | ‐ |

| Unexplained Difference (If Any)—Needed to Balance | Step 4 | |

| Adjusted Balance on Books and Records | $ ‐ | |

STEP 1: On the section of the bank reconciliation involving the bank, input the ending balance from the financial institution statement. Similarly, on the section for the books and records (accounting records), insert the ending balance shown in the books of record.

STEP 2: Review the bank statement against the accounting records and determine the deposits in transit and outstanding checks. To identify the deposits in transit (deposits in the accounting records but not listed on the bank statement), vouch the transactions shown in the cash receipts journal against those listed in the bank statement. List the deposits that have yet to clear the financial institution on the reconciliation. To determine the outstanding checks (checks written and reflected in the accounting records but have not cleared the bank), vouch the checks shown in the cash disbursements journal against those listed in the bank statement. List the checks that have not been cashed. If there are too many for the reconciliation, schedule the outstanding checks separately.

Pay special attention to checks that overdraw the account. Occasionally, financial institutions will pay checks that overdraw an account as a courtesy (e.g., pay the monthly mortgage check or the annual real estate taxes). Overdrawn checks clear the bank, but usually result in an insufficient funds (NSF) charge.

Pay close attention to ATM and debit card transactions that have cleared the financial institution but have not been listed in the accounting records. You will have to list them separately under Balance per Books and Records (see Step 4) and the company will need to make an adjustment to its accounting records. In the age of ATM and debit cards in the hands of many employees (e.g., company purchasing cards), there may be unrecorded transactions.

STEP 3: On the bank statement, identify transactions that may be on the bank statement but are yet to be entered into the accounting records (e.g., credits not recorded, like interest earned on deposit balances, and debits not recorded, like bank charges for account servicing fees, periodic loan interest payments, and NSF fees). Those often take place on the last day of the month and have not been entered into the accounting records. You also may have debits not recorded like ATM and debit card transactions. On the section of the bank reconciliation involving the books and records, input those transactions and alert the company of the need to make an adjustment to its accounting records.

STEP 4: After making the above adjustments, the adjusted balance on the bank statement and adjusted balance on the Books and Records should agree. If the unexplained difference is large you might have a timing difference, recording a transaction in the wrong ledger, or fraud. You will have to investigate further.

2-3 HOW TO READ CHECKS AND DECODE DEBIT CARD TRANSACTIONS

Learning Objective

After reading this synopsis, you should be able to:

- Better understand the information on the front and back of canceled checks.

- Be able to understand debit card transactions found on the bank statement.

Introduction

Essential to spreading canceled checks is the ability to read and decipher the information located on the front and back of checks.

Initially, all the fraud examiner may only have is a quick printout of the front of the check. This will suffice to get the analysis started until the front and back of the cancel checks are obtained. Like the front, the back of a canceled check contains a wealth of information.

How to Read a Canceled Check

Each canceled check contains a number of specific identifiers that describe the check as shown in the following example. The payee is the person or company to whom the check is payable. The payee name must agree with the first endorsee name on the back of the check. The check routing symbol and American Bankers Association (ABA) bank code (or ABA transit symbol) appears at the upper‐right‐hand corner and lower‐left‐hand corner of the check. The maker is the person who signs/makes the check. The account number, check number, and check amount appear at the bottom of the check under the signature. The check amount at the right‐hand bottom of the check is entered by the bank proofreaders after matching and agreeing with the customer's handwritten and hand‐numbered amounts.

Signatures and Endorsements

The fraud examiner is not a handwriting expert. However, the fraud examiner can flag maker and endorsee signatures that obviously appear to have been written by another person. These flagged maker and endorsee signatures should be examined and opined by a certified handwriting expert.

Endorsements are signatures on the back of a check. It is suggested that you review a business law textbook on endorsements. There are restricted and unrestricted endorsements that affect the negotiability of the checks. One well‐known restricted endorsement is “For Deposit Only” followed by the payee's endorsement. If the payee does not restrict the endorsement, anyone else can sign a second, third, and so on time. As fraud examiners, list all secondary endorsements. Fraudsters use secondary endorsements to convert checks. Although the secondary endorsements may be perfectly legal, you need to track those endorsements for subsequent analysis.

How to Decode a Debit Card Transaction

Each financial institution has its own method of listing debit card transactions. The following are example of coding found on bank statements.

3/28 $398.56 POS DEB 16:53 3/26/16 Grocery‐City 21108888 Marietta, GA

This represents a point of service debit at a Grocery City store located in Marietta, Georgia, at 4:53 p.m. on Saturday, March 26, 2016. The transaction cleared the bank on Monday, March 28, 2016.

3/28 Check Crd Purchase 03/26 Chevron 3699 Ellijay GA 5678 473722xxxxxx1269 173064695279267 ?McC=3793

The above point of service debit took place at a Chevron gas station located in Ellijay, Georgia, on Saturday, March 26, 2016, using a MasterCard debit card ending in 3793. The transaction cleared the bank on Monday, March 28, 2016.

03/28 Mach ID 0377D 17622 3/27 Hwy 41 Kennesaw GA 4730 0007207

This debit card coding shows a debit withdrawal using a debit card at a debit machine located in Kennesaw, Georgia, on Sunday, March 27, 2016. The transaction cleared the bank on Monday, March 28, 2016.

NOTE: The actual transaction date and bank statement clearing date may not be the same. The normal bank day, as set by the Federal Reserve System, is from 4:01 p.m. until 4:00 p.m. the following day. Accordingly, a transaction taking place after 6:21 p.m. (e.g., on Wednesday) will be shown as a cleared transaction on the bank statement on the following banking day (e.g., Thursday). Weekends are even longer (i.e., from 4:01 p.m. on Friday through 4:00 p.m. on Monday). When viewing your online bank statement, the debit card transactions are shown as “Pending” until actually cleared.

2-4 HOW TO SPREAD AND ANALYZE CHECK AND DEBIT CARD TRANSACTIONS

Learning Objective

After reading this synopsis, you should be able to:

- Input data from bank, credit card, or investment accounts.

- Add categories for subsequent analysis.

- Sort data based on categories, names, dates, and more.

Introduction

One of the most frequent forensic accounting procedures is analyzing canceled checks, debit card transactions, and deposits to a checking or savings account. The procedure can similarly be applied to analyzing debits and credits to credit card and investment account statements.

When you must input and analyze numerous different accounts or numerous months of the same account, request not only hard copies of the monthly statements, but request the information in .csv (comma separated value) file format, which can be imported into popular programs like Excel, Access, and IDEA. Importing vast data using .csv will save your hands and hours of boring data input.

Steps in Spreading and Analyzing Check and Debit Card Transactions

Performing an analysis of check and debit card transactions is a multistep process.

STEP 1: Input the Data

Schedule the data. There are a number of formats. Based on what you want to analyze, determine a format before scheduling the data. This way, you can set column formats (e.g., date format for the dates column, dollar format with decimals for dollars, text format for descriptions, and so on). Keep the check, debit, and deposit columns separate for quick identification.

Depending on the purpose of the analysis (e.g., analyzing all the sources and uses of all transactions, identifying kited funds, or money laundering), you may want to input all transactions or set a threshold (e.g., record only transactions over a limit that you set, say over $500 or $2,500).

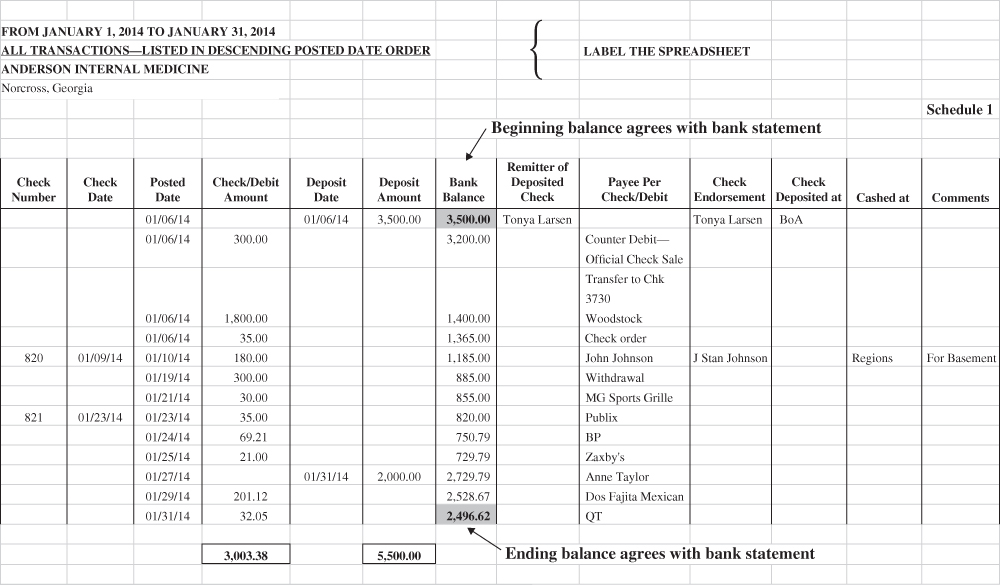

On page 43 is an example of a simple checking account analysis. Be sure to clearly label your spreadsheet/analysis so a user knows what you have done.

STEP 2: Add a Category Column

To be able to sort, you may want to add a category column (or some other means of logically sorting the spreadsheet). You are limited only by your lack of imagination. Each time you sort, save the new spreadsheet as a separate tab at the bottom of the spreadsheet. That way you will have numerous, readily available sorts. Each sort is a different analysis.

To get quick totals, use the PivotTable function under the Data tab. See page 44 for an example of adding a category column.

STEP 3: Add a Numbers Column to Re‐sort to Original Order and Then Sort

You will almost always have to go back to the original input. So, add another column, add the numbers in chronological order (e.g., 1, 2, 3, and so on), and then perform a custom sort (e.g., on Category, Payee Name, or Remitter). Later, you might want to hide the Number column to avoid confusion by a subsequent readers (you can always unhide that column at a later date). Note that the ending bank balance has not changed—the ending bank balance is your control total. See page 46 for an example of adding a numbers column.

2-5 EXERCISES—CHECK FRAUD, DEBIT CARD FRAUD, AND CASH LARCENY (ANDERSON INTERNAL MEDICINE)

Exercise 1: Individual Assignment

- Perform a bank reconciliation as of April 1, 2016, using the bank statement for March 2016, cash receipts journal, and cash disbursements journal.

- Compare the front and back of checks and the deposit slips to the cash receipts and cash disbursement journals and identify:

- Checks where payees do not match

- Irregular disbursements

- Irregular signatures

- Irregular endorsements

- Review the bank statements for disbursements not involving checks and trace to the cash disbursements journal.

- What are these transactions?

- Where and when (date and day of the week) were these noncheck transactions actually made (not when recorded)?

- How far is the distance between the location of these noncheck transactions and Anderson Internal Medicine?

- Where does Tonya Larsen live?

- What part did Tonya Larsen play in making these noncheck disbursements?

- Did Tonya Larsen benefit from these noncheck transactions?

- Review the deposits.

- How often and when were the deposits made?

- Is anything missing from the deposits?

- How do deposits relate to the bank reconciliation?

Exercise 2: Individual Assignment

- List the items (e.g., check numbers, transaction dates, and individual amounts) and totals of each category of fraud.

- What are the alleged frauds (e.g., accounts receivable skimming, disbursement fraud, embezzlement, larceny, payroll fraud, skimming, other)? Discuss each one.

- How were each of the frauds concealed?

- What circumstances allowed the frauds to happen (e.g., internal control failures, lack of background checks, missing policies and procedures)? Discuss and be specific.

- What would you recommend (e.g., controls, monitoring) to deter future frauds from happening? Discuss and be specific.

- Is there anyone you would like to interview? If so, what do you want to learn from them?

- Are there any additional steps you would like to take with respect to the fraud examination?

Exercise 3: Group Assignment—Writing Report and Associated Schedules

- Prepare a final examination report to the attorney for Southern Appalachian Insurance and an accompanying set of schedules

- Prepare associated audio‐visuals (e.g., one‐page chart of talking points, summary schedule of the categories of the loss, simplified schedule of the details of each category, bar/pie/or line chart). Note: Do not put the schedules and audiovisuals in a PowerPoint or similar presentation. The schedules and audiovisuals are addendums to the report and MUST be referenced in the report.

2-6 EXERCISE TEMPLATES

Anderson Internal Medicine—Exercise #1

Check Fraud, Debit Card Fraud, Cash Larceny Case, Exercise #1 Template

Bank Reconciliation ‐ Anderson Internal Medicine (4‐1‐16) (REVISED)

-

Balance per bank Balance per books Add: Deposits in transit Add: Credits not recorded Less: Outstanding checks Subtract: Debits not recorded __________ Less: unknown difference (if any) __________ Reconciled balance $ ‐ Reconciled balance $ ‐ Comments (if any):

Compare the front and back of checks and the deposit slips to the cash receipts and cash disbursement journals and identify:

- Check numbers of the checks where payees do not match on check and cash disbursements journal CDJ

- Check numbers of the checks with irregular disbursements—not listed as vendors in CDJ

- Check numbers of the checks with irregular maker signatures—different from known signature

- Check numbers of the checks with irregular endorsements

Review the bank statements for disbursements not involving checks and trace to the cash disbursements journal

- What are these transactions (e.g., cash withdrawals, ewithdrawals, debit card withdrawals)?

- Where and when (date and day of the week) were these noncheck transactions actually made (may not be the same as the date when recorded)?

- What is the distance between the location of these noncheck transactions and Anderson Internal Medicine?

- Where does Tonya Larsen live?

- What part did Tonya Larsen play in making these noncheck disbursements?

- Did Tonya Larsen benefit from these noncheck transactions? If yes, how did she benefit?

Review the deposit slips

- How often and when were the deposits made?

- Is anything missing from the deposits?

- How do the deposits relate to the bank reconciliation?

Anderson Internal Medicine—Exercise #2

Check Fraud, Debit Card Fraud, Cash Larceny Case, Exercise #2 Template

- List the items (e.g., check numbers, transaction dates, and individual amounts) and totals of each category of fraud.

Check Number Amount Total Checks $ ‐ Trans. Date Total Debit Card Transactions $ ‐ Cash ‐ unknown difference Total $ ‐ - What are the alleged frauds (e.g., accounts receivable skimming, disbursement fraud, embezzlement, larceny, payroll fraud, skimming, other)? Discuss each one.

- How were each of the frauds concealed?

- What circumstances allowed the frauds to happen (e.g., internal control failures, lack of background checks, missing policies and procedures)? Discuss and be specific.

- What would you recommend (e.g., controls, monitoring) to deter future frauds from happening? Discuss and be specific.

- Is there anyone you would like to interview? If so, what do you want to learn from them?

- Are there any additional steps you would like to take with respect to the fraud examination?

2-7 REVIEW QUESTIONS—CHECK FRAUD, DEBIT CARD FRAUD, AND CASH LARCENY (ANDERSON INTERNAL MEDICINE)

- In the case scenario, it states that when two or more bank reconciliations (e.g., prior and current reconciliation) result in large unaccounted for differences, the differences might be what?

- Cash larceny.

- Material accounting errors.

- Some other type of cash‐related fraud.

- Any of the above.

- If a lawyer for the suspect in a fraud examination states that he/she represents the suspect and no one will be allowed to talk with their client, can you interview the suspect or his/her spouse?

- Yes, you can interview either the suspect or his/her spouse.

- No, you cannot interview either the suspect or his/her spouse.

- You cannot interview the suspect, but can interview his/her spouse.

- You can subpoena the suspect and compel them to answer your questions under oath.

- Who is a payee on a check?

- The person(s) who signs the front of the check.

- The person(s) who signs the back of the check.

- The person(s) named on the front of the check who is to receive the funds.

- The financial institution that pays the funds specified by the check.

- In the case, the new office manager found cash, patient and insurance company checks, and two business debit cards in Tonya Larsen's file cabinet. When preparing the bank reconciliation, where do you put the cash and checks—under balance per bank or balance per books?

- Balance per bank because the items represent deposits in transit.

- Balance per books because the items have not been recorded and an adjustment needs to be made to the books of record.

- Neither A nor B.

- Both A and B.

- 3/28 $398.56 POS DEB 16:53 3/26/16 Grocery‐City 21108888 Marietta, GA on the bank statement means?

- $398.56 was paid by a point‐of‐sale use of a debit card.

- Grocery City in Marietta, Georgia, was the location of the transaction.

- The transaction took place on March 26, 2016 (a Saturday), but the financial institution posted the transaction on March 28, 2016 (a Monday).

- All of the above.

- When scheduling checking account transactions for subsequent analysis you perform all of the following except?

- Input the dates on the check.

- Schedule the dollar amounts, including decimals.

- Limit the checks input into the schedule to only those over a certain dollar amount (say, $500.00).

- List the payee name as found on each individual check.

- When you analyze the checking account disbursement paid by a financial institution, what should you do?

- Compare the names and dollar amounts on the front and back of the checks to the cash disbursements journal.

- Review the bank statements for disbursements not involving checks (e.g., debit card or ATM transactions and cash withdrawals made at the teller window or ATM) and trace those transactions to the cash disbursements journal.

- For debit card transactions where you do not recognize the payee (e.g., person or business name), you look the payee up on the Internet to determine the person (e.g., accountant, financial adviser, or lawyer) and/or type of business.

- All of the above.