ISO 50001 as Certified Management System

The International Organization for Standardization (ISO) issues a large number of mostly technical standards with a global reach. In the 1980s, ISO expanded its scope to include management systems and their certification, mainly concentrating on quality, environment, energy, and greenhouse gases (GHGs). ISO prescribes which elements an organization has to implement, for example, procedures to measure the quality of products, indicators to alert if environmental regulation could be violated, or targets to improve energy performance. To confirm that all elements of the respective ISO standard are implemented adequately, a third-party company conducts an audit and grants a certificate. Thus, stakeholders of the organization may be sure that the management system performs. This section helps to convey how ISO certification works in detail and explains the specifics of energy management systems (EnMS).

Definition of Energy

Unfortunately, a simple definition for energy is not possible, because the term has many diverse meanings. So let us try to avoid confusion by beginning with the definition from physics: Energy can be defined as the capacity of a system to produce external activity or perform work (ISO 50001:2011, 2). This means, for example, that a car with a filled tank can drive for hundreds of miles. This book will expand on the definition from natural sciences to include aspects relevant to the accounting function and general management of a firm. In business life, energy is used to convey a variety of distinct meanings: We have to energize our sales means to put (financial) resources into marketing. An energetic person refers to social skills like vigor and determination.

The etymology of energy opens up an interesting perspective. The Greek word energeia means the power to lift mere possibilities into reality an essential, even spiritual, understanding that corresponds harmoniously to the vital role energy holds for humankind.

Energy Management

In literature, the term energy management generally refers to technical disciplines (based on the definition of natural science). The focus is on detailed technical problems like the energy management of electric grids, of air conditioning, and so on. Hence, although management is originally a business term, business matters have be neglected in the energy field. ISO 50001 supports an organizational, cost- and benefit-oriented view of energy. It is high time that business administration plays its role as a partner of engineering by implementing energy management into every function of business, both in academia and in companies.

Business and Energy Not Yet Perceived As One Field of Interest

Attending a conference, I met an innovation manager of Hoffmann LaRoche, a global pharmaceutical company. As an educated person reporting to the board of directors, he had an interdisciplinary view. When I described my field of interest, he answered with astonishment: “Energy management as part of business administration—does that even exist?”

Here are three approaches to a business-oriented definition of energy management:

- The common, easily remembered definition based on the etymology of management may help. The word management is derived from the Latin root manus agere, with manus meaning hand and agere to act. Thus, management means the handling of everything and anything. This interpretation corresponds to the widely used (and sometimes misused) term management. Therefore, when energy is the object of any effort in an organization, the term energy management is appropriate.

- The second definition is my favorite one, because it is precise and describes what actually has to be done: Energy management is the proactive, organized and systematic coordination of procurement, conversion, distribution and use of energy to meet the requirements, taking into account environmental and economic objectives (Guideline 4602 of the German Association of Engineers VDI, 3).

- ISO 50001s definition of energy management is embedded in the definition of EnMS. It can be concluded that energy management encompasses all that has to be done to implement an energy management system to meet the requirements of the standard (see next chapter).

Energy management can be defined on different levels, focusing on different objects:

- Communal, state, federal, or global level

- Organizational (corporate) level, which is the focus of this book

- Household level (as a side note, many ideas of the book may be helpful for the readers in their private lives)

- Energy management for technical systems—corresponding to the still-prevailing interpretation of the term in engineering

EnMS and the PDCA Cycle

Energy management focuses on action. In contrast, an energy management system constitutes the rules for setting and achieving a companys energy performance goals. Focusing on the organizational interpretation and level, an energy management system according to ISO 50001 (2011, 2) is a set of interrelated or interacting elements to establish an energy policy and energy objectives, and processes and procedures to achieve those objectives. This definition reads like a summary of the standard; it is not very colorful, and the terms are lacking definition (which will be provided in the course of this book). So let us conclude in easy words: Energy management on a corporate level is the handling of energy, while EnMS determine the rules of how this has to be done.

The standard supports the plan, do, check, and act cycle (PDCA or Denim cycle). However, it is quite hard to assign the elements of the standard to PDCA. Most activities will be part of the planning process (ISO 50001:2011, 16) with the following planning outputs:

- Energy baseline

- Energy performance indicators

- Objectives and targets

- Action plan

A strong emphasis on verification reveals the roots of the whole system coming from quality management (QM).

Significance of ISO Standards

ISO acts globally with the support of national standardization institutions who are member bodies of the ISO federation. ISO and its members are nonprofit associations and non governmental authorities. Consequently, the standards issued do not have legal relevance unless a governmental law or court decision refers to them, and they become effective. Nevertheless, ISO standards do have ongoing significance; it doesnt make sense to ignore technical definitions for fasteners or valves in international business. The standards are based on a broad process of legitimation through formal discussions organized globally. The discussion process is institutionalized in technical committees, with the broad participation of experts on an international basis. Draft versions (Draft International Standards [DIS]) are issued for the discussion the overall process, however, takes years.

Every five years, ISO reviews the standards. Since the ISO committees know how difficult it is for many organizations to adapt to new rules, the alterations, in most cases, pertain to details easy to implement.

Importance of Management-Oriented Standards by ISO

Management-oriented standards make up only a small part of the norms, but ISO promotes their significance intensively. This was spotlighted on the ISO homepage, www.iso.org, where the featured “popular standards” are mostly management-oriented, as on March 17, 2014:

- ISO 9000 Quality management

- ISO 14000 Environmental management

- ISO 3166 Country codes

- ISO 26000 Social responsibility

- ISO 50001 Energy management

- ISO 31000 Risk management

- ISO 22000 Food safety management

- ISO 27001 Information security management

- ISO 20121 Sustainable events

Certification of the EnMS

An organization (e.g., company) striving to improve its management system may decide to undergo certification. In doing so, they should present their achievement to the stakeholders. A third-party auditor (certifier) verifies that all requirements of the standard are met and grants a certificate.

- The first party is the company itself.

- The second party is the stakeholder who should be impressed.

- The third party is the independent, accredited auditor.

- In a way, a fourth party enters the game, because a public authority has to accredit the certifying company.

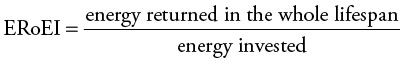

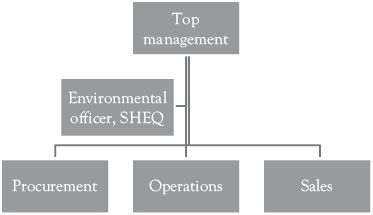

Thus, an outward credibility disclosing internal organizational performance is attained, as Figure 1.1 shows.

Figure 1.1 Institutions of certification

An Example of Practical Benefits

An example showing the importance of process orientation and cooperation between departments: Compressed air is produced by the energy or facility management department of a company, which is led by hundreds of pipelines into the workshops. If a leak of 0.5 cm in some hidden basement fails to be discovered, 30 L of compressed air will be lost per second, representing 27,000 kWh of energy and several thousand dollars in costs per year (depending on the local price). What’s the role of ISO 50001?

- ISO requires businesses to look at this process of energy supply holistically. Therefore, they must plan, conduct, and document regular leakage checks.

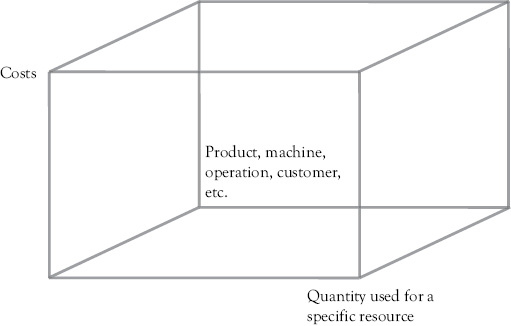

- Costs and benefits of management systems are often scattered throughout the energy supply process. It’s important to establish consumption, distribution, and possible leakages by measuring consumption and assigning usages to cost-centers. This provides an incentive for efficient energy use, for example, by reducing the pressure and switching the system off at night.

- The established management rules have to be considered as a starting point of improvement.

EnMS Certification in Addition to Quality and Environment

ISO 50001 EnMS complements the 9000 series, concerning QM, and the ISO 14000 series, dealing with environmental management. In Europe, the Environmental Management and Audit Scheme represents a comparable system to ISO 14000 with only slight differences. Currently, global warming concerns are intensifying interest in EnMS targeting reductions in carbon-dioxide emissions from fossil-fired power sources. Figure 1.2 shows scopes of the different management systems.

QM looks at everything of relevance according to the organizations own requirements. Of course, environmental issues have to be included in this scope because they do have relevance, but QM does not address this requirement. Consequently, environmental management was developed as an own field of action covering stand alone ISO management systems (ISO 14001), separate internal documentation, own staff departments, and so on.

The same happened to the field of environmental management, not really meeting the energy challenge. Experts found that the ISO standard did not cover the intrinsic energy aspect thoroughly enough, which led them to build up the line of EnMS standards. Although closely related to EnMS, the important question of GHGs is addressed only partly by reducing carbon-dioxide emissions, because nonenergy-related GHGs also exist. Global warming pushes the problem of GHGs to a paramount position in the agenda, causing ISO to open up another field of regulation and business. To provide an overview, the most important standards of the series mentioned earlier are assembled at the end of the book, following the references.

Figure 1.2 Scope of the standards for the management of quality, environment, energy, and GHGs

The following are some comments on the abbreviations: A very good QM approach may be called total quality management (TQM), overlapping other approaches like Six Sigma. Sometimes, one also refers to the entire system of QM as QMS. Environmental and energy management could be both abbreviated to EM (with or without S for system). Therefore, in this book, environmental management is written out, and EnMS follows the ISO 50001 terminology.

What does this distinction mean for organizations thinking about going for certification? They are somewhere in between the following situations:

- Some companies already have a certified management system according to quality, environmental, or other aspects, which are possibly subject to certification systems like safety or good laboratory practice.

- Other organizations, however, have no formalized, third-party audited rules and management systems.

In the first case, the energy aspect has to be added to the existing rules and documentation, taking into account that terminology must be adapted or introduced. This is the great advantage of ISO 50001. Standing in a tradition with quality and environment, the formal integration of energy should be easy in this case.

Company Example SCA

While writing this book, Uwe Rothermel, the energy manager of SCA in Mannheim, Germany, asked me if I have a graduate student interested in introducing ISO 50001 to the company as his or her thesis project. The SCA group, based in Sweden, is one of the world’s largest providers of hygienic products. The Mannheim plant, with its own power generation, would be sufficient to supply the whole city of 400,000 inhabitants. Since 1995, SCA already had a certified environmental management system, the goal of the master’s thesis was to “fathom the gap that has to be bridged covering the additional requirements of ISO 50001 and prepare a plan for implementation.”

A short note on the title “energy manager”: Uwe Rothermel has filled this position for many years, being responsible for the whole energy supply of production, namely, the power plant. Energy manager will also be defined in ISO 50001 (see Chapter 10).

At the editorial deadline of this book, the project was not yet finished; however, the student seems to do fine.

Appendix B of ISO 50001 offers a cross-reference list comparing the table of contents of quality (ISO 9001), environmental (ISO 14001), and food safety management systems (ISO 22000). Those comparisons are abundantly available from environmental or other specialized governmental or (semi)public agencies, associations of branches of companies, consulting companies revealing part of their expertise, or literature (Welch 2011).

For companies that have no certified management systems yet, a comprehensive approach is recommended. It does not make sense to erect the solemn pillar of a certified EnMS without designing the complete architecture of an overall integrated management system. But what if energy presents itself as a pressing problem? Tackle this problem with the methods and tools provided in this book, and consider the certification option according to the requirements of the market you are acting in. However, many companies just want to get some tips on how to reduce energy costs and, therefore, formalized management systems are not advisable.

Advantages and Disadvantages of an EnMS Certification

Is it necessary to attain a certification for the EnMS? The concepts of ISO 50001 systemize a whole bundle of good ideas for organizations positioning for a future with energy as a critical resource. So every company should look at the standard 50001 and get inspired, even those with little energy demand. Whether a company should pursue certification depends on many factors. Table 1.1 displays the most important pros and cons in the style of a balance sheet of arguments.

Table 1.1 Pros and cons of going for a certificate

|

Pros |

Cons |

|

|

It is important to stress that small and medium enterprises benefit from lesser requirements.

Energy as Part of Integrated Management and of Sustainability

Approaching Integrated Management

To understand an energy management system (EnMS) thoroughly, it has to be incorporated into the framework of integrated management and sustainability. In a broad understanding of sustainability, it is hard to find any management activity that is not touched by it. Sustainability means to make money (economic pillar), to improve environmental performance (ecologic pillar), or to improve the situation of people (social pillar), according to the triple bottom line concept (TBL or 3BL). Thus, it seems to be justified to discuss integrated management and the approach of sustainable management here.

Unfortunately, again, the terms are not as precise as would be desirable. Let us define integrated management (systems) as comprising all relevant management aspects in organizational structure, procedures, and documentation, following a consistent and harmonized hierarchy of objectives. This is a very far-reaching definition because relevant includes every issue and field of activity that managers and organizations decide to tackle. This all-encompassing understanding seems to be ahead of its time because, in the practical use of the term, integrated management mostly includes only quality management (QM), environmental management, EnMS, and other safety or risk-oriented perspectives. Following our broad view, here are some sample aspects and subsystems in order to demonstrate the scope that integrated management has to cover:

- The ISO-supported certification of QM, environmental management, EnMS, and greenhouse gases (GHGs, including carbon), as shown in Figure 1.2.

- Further aspects focusing mainly on risk reduction, for example, Occupational Health and Safety Management Systems (OHSAS 18001), Internet Security Management System (ISO 27000), Risk Management (ISO 31000), or the organizational enforcement of nondiscrimination according to national law.

- Regulatory systems for branches such as Good Manufacturing Practices (GMPs) for food, drug products, and active pharmaceutical products; Good Laboratory Practice (GLP); Good Transportation Practice (GTP); and some more summed up as GxP. ISO/TS 16949 contains “Particular requirements for the application of ISO 9001 for automotive production and relevant service part organizations.” ISO 50001 refers to the ISO 22000 Food Safety Certification in Appendix B.

- The number of designations linked to sustainability is quickly increasing (e.g., Energy Star, fair trade, organic food, etc.). The good idea of integration may get easily lost because of a confusing variety of certifications for management systems that have to be supported and endowed with resources.

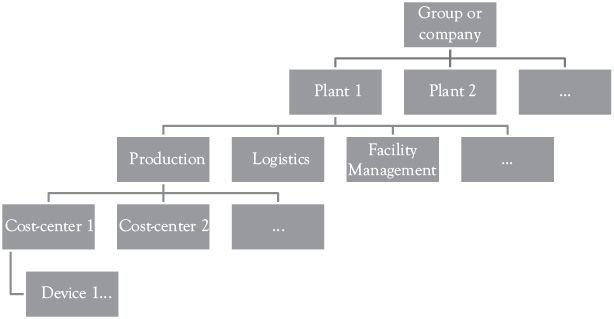

It should not be forgotten that integrated management has to cover the primary operations through which a company earns income. This central aspect seems to be overlooked sometimes and will be explained now.

In most cases, employees on any hierarchy level do not consider QM, EnMS, or other facets of sustainability as core to their work; rather, these are important but additional requirements. Developing recipes in chemical industry, casting metal in a foundry, and conducting projects in the construction industry are examples of the daily work for which employees are paid. EnMS and other systems can be easily perceived as a hindrance to perform. It is the common belief that they only add to complexity in the workplace, with the result that the employees sometimes have to work overtime. Here are some ideas for how to integrate energy management in a lean way without demotivating employees:

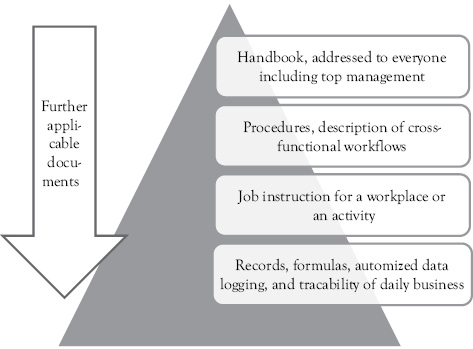

- Most important are an intelligent structural organization (Chapter 10) and a stringent architecture of documentation (Chapter 18).

- Management accounting, which relies on new IT options, plays another key role, showing the financial benefits of energy conservation and efficiency (Chapters 7 and 14).

- The EnMS implementation project has to be interpreted as a process of change management (Chapter 29). Accordingly, the company members are respected and they take pride in their work, becoming more influential and effective. It is a win–win situation for the organization as a whole since it makes use of the know-how of the employees and they, in turn, feel involved, respected, and appreciated.

Integrated Sustainability Management

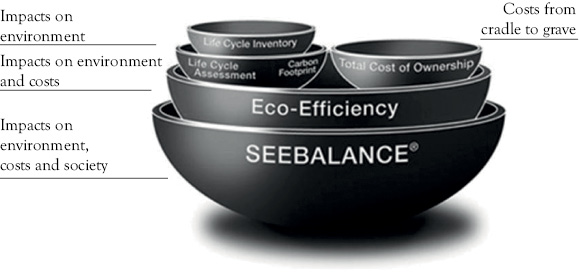

According to the most commonly cited definition, from the United Nations, sustainable development is “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” The triple bottom line, TBL or 3Ps, describes the taking and giving between companies and their economic, natural, and social environment through integrated (sustainability) management, balances, reporting, and disclosure. Based on this interpretation, Figure 2.1 shows different types of reviews or balances that will integrate EnMS into this concept.

- Accountants have always tackled the first aspect, the economic pillar, to keep companies profitable. The methods and tools of economic balance sheets are widely covered by business administration according to national and international legislation. In this book, we will take this as a basis and proceed to the second pillar in order to integrate physical energy.

- In ecological dimension, business meets natural sciences. Here, considerable methodology is needed to understand the ecological or environmental balance and how energy and carbon balances may evolve. The next section will elaborate on this.

Figure 2.1 Integrated sustainability management and balance sheets

- The third dimension, the social pillar, is—at first sight—not a very demanding challenge from the perspective of accountancy. The key performance indicators (KPIs) are relatively easy to determine, for example, percentage of women in leading positions, donations to local communities, or expenditures for training employees. Eventually, it is not enough to report some isolated KPIs. Social sustainability should be defined and measured within a consistent and all-inclusive framework. Here, an ongoing discussion can be observed.

From Environment to Energy to Carbon

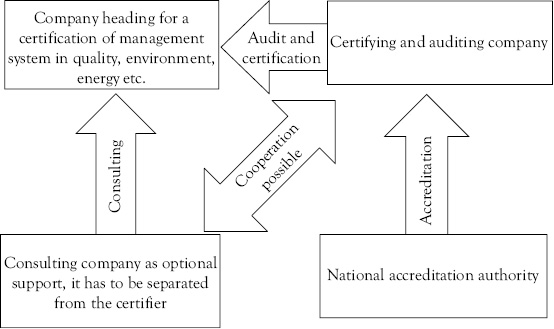

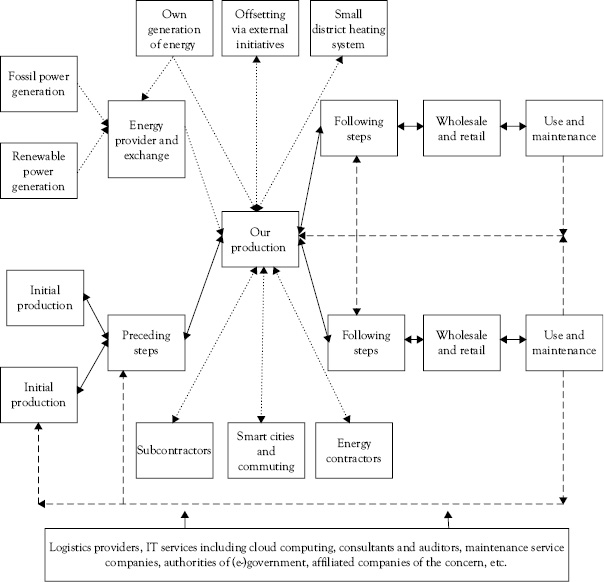

Focusing on the second column of integrated sustainability management, it’s important to understand how environment, energy, and carbon are linked. An overall environmental balance sheet of a plant describes every physical input and output, as Figure 2.2 demonstrates.

Figure 2.2 Environmental balance of a production plant

The easiest level for which to develop such a sheet is a plant or a factory building. If plants are aggregated, entire activities of concern can be displayed. This balance should include every aspect of ecological significance. Consequently, such an analysis constitutes the basis to derive balances for specific environmental aspects like water, energy, organic substances, and so on. An energy balance may be extracted by taking out every energy-related flow (or omitting the rest). An example is displayed in the Figure 2.3 . Here, the input side shows in greater detail what the arrow “Energy” indicates in the previous figure.

Figure 2.3 Energy balance of a plant

The established term balance can be a bit misleading. Mostly, only the energy input is captured, because it may be very challenging to calculate the energy losses. This is the reason why many companies only concentrate on the energy efficiency of crucial assets.

The next step would be to derive a carbon balance as part of an overall GHG balance (which is not elaborated here). The quantity of energy applied is known and has to be multiplied by the corresponding carbon emission factor. Here is an example: If we burn one liter of diesel or heating oil (which is chemically the same), 2.6 kg of carbon dioxide are immediately emitted.

Before the diesel is at our disposal, raw oil has to be mined, refined, and transported. The energy needed in those steps is called gray energy or cumulated energy demand (CED). Electricity is a very special case, because of its zero emissions when used and the strongly differing gray energy depending on the generation and procurement. Table 2.1 presents some important emission factors, including aspects of gray energy.

When working on a draft version of this table, it was my hope to present one single and ultimate emission factor for each energy form. Unfortunately, this is not possible. Many energy carriers are natural products varying considerably in quality. Furthermore, the gray energy has to be traced according to individual procurement; the invoice of the utility is a valuable information source.

Table 2.1 Carbon emission factors of selected energy carriers

| Energy | Emissions of carbon dioxide carbon emission factors |

|---|---|

| Electric energy in kilowatt-hours (kWh) | Zero when used because the gray energy of generation varies considerably: 1.2 kg/kWh for generation with brown coal, 0.04 kg (40 g or less) per kWh for wind energy |

| Heating oil or diesel (liter) (specific weight is 0.820 to 0.860 kg/L) | 2.5 to 2.7 kg carbon dioxide per liter when burned plus gray energy |

| Gasoline (liter) (specific weight 0.720 to 0.775 kg/L) | 2.3 to 2.4 kg carbon dioxide per liter when burned, plus gray energy |

| Kerosene-based jet fuel for airplanes (liter) | 2.4 to 2.8 kg carbon dioxide per liter plus gray energy. When emitted in great height, an additional factor up to 2.7 necessary |

| Natural gas not compressed (cubic meter) | 1.8 to 2.0 kg carbon dioxide per cubic meter plus gray energy |

| Bioethanol and biodiesel (liter) | Far differing numbers, from 70% savings compared with fossil fuel to negative effects because of deforestation of jungle and monocultures. One tank consumes the corn needed as food for one person for one year |

| Compressed natural gas (CNG), liquefied natural gas (LNG), liquefied propane gas (liter) | 2.3 to 2.7 kg carbon dioxide per liter plus gray energy |

| Coal | 2.5 to 3.7 kg carbon dioxide per kilogram plus gray energy |

A Little Excursion into Chemistry

It seems strange that one liter of diesel with a specific weight of less than 1.0 kg will lead to an emission of 2.6 kg CO2. When fuel is burned, each atom of carbon released will react with two atoms of oxygen coming from the surrounding air. This adds to mass. We don’t feel the weight of gas, because we are surrounded by the atmosphere of the earth with a constant pressure from all sides. If we try to weigh the heaviness of water being submerged, it would not work either.

Do you want to know how to experience CO2 in daily life (and no longer only as the abstract notion of being part of the surrounding air)? Just open a bottle of sparkling water—the sparkles are CO2.

The total carbon emissions caused by a company in a specific period can be called company carbon footprint (CCF); the calculation methodology is the subject of ISO 14064. To get a better picture of a company’s carbon impact, the boundaries of the balance have to be defined thoroughly. Are only the direct emissions included? And which part of the gray energy is taken into account? Are there any offset activities involved?

There are many useful calculation tools available on the Internet (e.g., www.carbonfootprint.com,carboncalculator.direct.gov.uk/index.html,www.co2-calculator.eu). Large business software providers offer modules that support the balances mentioned previously. The methodology of carbon calculation and the emission factor are not visible at first sight when using the tools. Consequently, quick first steps are easy, but if a company wants to establish a carbon accounting, the methodological aforementioned questions have to be answered.

Carbon accounting captures the flows of this GHG; carbon management improves carbon efficiency and conservation. Both are important parts of ecological, or green, management and the greening of organizations. Industrial ecology as a buzz word expresses the aim of developing companies according to the model of ecological systems in harmony with nature.

Physical Forms

For an accountant in industry, energy is measured in costs or sometimes revenues. For a better understanding of operations, we should also take a look at the scientific and technological side. Team-working professionals with different educational backgrounds need a sufficient overlap in their terminology to cooperate efficiently. As physical energy is the ability of a system to deliver work (see Chapter 1), Table 3.1 shows different forms of energy and practical examples of company-related work.

Energy is transformed when used at a company. Some examples are already included in the preceding table; the internal energy flow in companies and value networks will be explained in Chapter 13 (Accounting—Energy Reviews).

The first law of thermodynamics, the conservation of energy, states that energy cannot be destroyed or created, it can only be transformed. This energy theorem provides a beautiful parallel to the idea of an economic account that has to be counterbalanced. The commonly used terms energy production and energy generation can also be found in this book, but being strict, they should be avoided. The term energy losses builds upon models showing that it does not make (economic) sense to expend energy at the output side (e.g., thermal radiation of a building).

Watt and Watt-Hour

Energy has to be measured, and the most commonly used unit in companies is watt-hour (Wh). Without a basic knowledge of the energy capacity or wattage of an energy-consuming asset, this term cannot really be understood. Therefore, let us choose simple, everyday examples that are understandable for a nonengineer. The energy capacity or wattage of an asset describes the rate (or strength) at which energy is used. It is measured in watt (W). A standard hair blower, fan heater, water boiler, or lawn mower can draw between 1,000 and 2,000 W of power. The physical definition is:

Table 3.1 Forms of energy and examples of company-related work

|

Forms of energy |

Examples and explanation |

|

Chemical energy |

Everything that can be burned contains chemical energy with the option to transform it into thermal energy (heat) and other forms. Fossil energy carriers like coal, oil, and gas are nonrenewable chemical energy resources; wood, the battery of nature, is a renewable one. |

|

Mechanical energy (subcategories are kinetic energy; potential, elevation, or position energy; wave energy; elastic energy; sound energy) |

Lifting a sledgehammer increases the potential, elevation, or position energy. Letting it down produces kinetic energy, for example, used to forge a metal sheet into a car wing. An example that should be avoided: a car with kinetic energy transmits this energy into the guardrail and accordingly creates a sudden stop. Consequently, the guardrail and the car wing are damaged. |

|

Electric and magnetic energy |

Electric pump transporting a fluid, electric heating, e-mobility in all its forms, and so forth. An electric drive of a conveyor makes use of magnets to produce kinetic energy. |

|

Thermal energy |

Heat from a furnace hardening metal or of a steam cracker refining raw oil. Every item with a temperature above absolute zero (above -459.67°F and -273.15°C) contains thermal energy from a physical point of view. In engineering and business, implicitly, the desired temperature of a process (for example, to achieve an appropriate temperature in a room) becomes the zero-point of the scale: If it is cold outside, heating energy has to be provided. Given high temperatures outside, air conditioning has to deliver cooling energy. |

|

Nuclear |

Uranium or other nuclear elements can be used to transform solid material into heat (thermal energy). Recurrent accidents in nuclear power plants remind us of the risks of this technology; furthermore, the problem of disposal of nuclear waste has not been solved and the residues can be used to produce nuclear weapons. It is the author’s position that humankind should go the renewable way of energy generation and phase out nuclear power. As this is a political topic and nuclear power has near to no relevance for nonutility companies, nuclear power is excluded in the following. |

The wattage is mostly indicated on the device itself or in a manual. It says how much energy is consumed in a given period of time at full power. If the time is exceeded, more energy will be consumed proportionally. The energy input (or input energy) for one hour of lawn-mowing can be calculated by multiplying the wattage by the amount of time:

Watt-hour is the short form of “watt multiplied with hour.” Thus, the energy consumption of a lawn mower, in use for two hours, can be calculated as follows:

2,000 W × 2 h = 4,000 Wh

The current wattage of a device while being used depends on a regulation if there are more grades than on and off. The wattage in the operations manual refers to the energy input. The energy output involves the difficulty of calculating the energy efficiency and energy losses.

The Bathtub Comparison

Imagine preparing a bath, the quantity of water streaming into the tub represents energy (here without considering the temperature). If you want to be quick, you will open the water-tap as far as possible. This symbolizes the full wattage or capacity of an energy-consuming device. The water running into the tub stands for the energy already consumed, and the longer the tap is opened, the more water (energy) runs through it. Closing the tap partly is similar to lowering down the wattage and energy consumption.

In order to avoid confusing high decimal places in the measurements, the watt unit can be converted into kilo (for thousand ):

4,000 Wh = 4 kWh

Table 3.2 Levels of energy capacity measurement units

|

Measurement unit of energy capacity or wattage |

Abbreviation and dimension |

Examples |

|

Watt |

W |

An amount representing a 20th of the capacity of a typical halogen light bulb |

|

Kilowatt |

kW 1,000 W thousand, 10 3 |

Electric capacity of a small hair dryer or lawn mower |

|

Megawatt |

MW 1,000,000 W million, 10 6 |

3 MW: electric locomotive 500 MW: wattage of a mid-sized power plant, which is enough to operate 500,000 small hair dryers at the same time or to supply a city of about hundred thousand inhabitants with electricity. |

|

Gigawatt |

GW 1,000,000,000 W billion, 10 9 |

Capacity of a large power plant, which is sufficient to supply a large region or a city of one million inhabitants in an industrialized country with electricity (depends on the individual energy demand of the people and their lifestyle, e.g., New York and Dhaka are very different.) |

|

Terawatt |

TW 1,000,000,000,000 W trillion, 10 12 |

Big countries need some large power plants to generate hundreds of gigawatt, however, countries have to be combined to reach the level of terawatt. Here, the dimension of continents is reached. |

|

Petawatt |

PW 1,000,000,000,000,000 W quadrillion, 10 15 |

The gulf stream in northern Atlantic has an energy capacity of some petawatt and influences the climate in Europe by transporting warm water from the Caribbean to Scandinavia and Great Britain. |

For industrial applications, the unit has to be raised to the levels of mega, giga, and tera. Tables 3.2 and 3.3 give the abbreviations and provide examples for energy capacity in watt, as well as for energy in watt-hour.

Sometimes, the abbreviations are written with different capitalizations. Here, a common version is chosen. This pertains to the abbreviations of energy-measurement units as shown in Table 3.3 . Just as energy capacity or wattage in the previous table refers to one moment or an average over a longer period, the energy consumed has to be indicated for a given period of time.

Table 3.3 Levels of units for energy consumption

|

Energy measurement unit |

Abbreviation and dimension |

Examples |

|

Watt-hour |

Wh |

If a halogen bulb of 20 W is switched on for 1 h, the energy needed sums up to 20 Wh. If it is switched on for less than 1 h, the energy consumption has to be measured in watt-seconds with the complication that an hour consists of 3,600 sec. |

|

Kilowatt-hour |

kWh 1,000 Wh thousand, 10 3 |

Let us assume the halogen bulb is part of an emergency lighting system and switched on constantly, 8,760 h a year. The energy consumed would add up to 20 W × 8,760 h = 175,200 Wh. This equals 175.2 kWh. A typical electrical energy consumption of a household can be 10 kWh per day. |

|

Megawatt-hour |

MWh 1,000,000 Wh million, 10 6 |

The electrical energy consumption per year of the typical household has to be calculated as 10 kWh × 356 = 3,560 kWh. This can be written as 3.56 MWh. |

|

Gigawatt-hour |

GWh 1,000,000,000 Wh billion, 10 9 |

Most industrial companies can conveniently express their energy demand in terms of gigawatt-hours. |

|

Terawatt-hour |

TWh 1,000,000,000,000 Wh trillion, 10 12 |

Very large companies and small countries are on the level of terawatt-hours. |

|

Petawatt-hour |

PWh 1,000,000,000,000,000 Wh quadrillion, 10 15 |

The energy consumption of the OECD countries in Europe is about 20 PWh |

Kilowatt-hours are the most commonly used energy measuring unit in companies, but many other units exist and are applied in different branches or for specific purposes, among them are:

- Joule

- Calories

- Ton of oil equivalent (TOE) or barrel of oil equivalent (BOE)

- British thermal unit (BTU)

- Ton of coal equivalent (TCE)

It may not always be easy to find the right conversion factor, because some units exist in many variants. Furthermore, temperature, humidity, or other natural and technical conditions may be factors.

Energy Content of Different Energy Carriers

Business people should be able to shift between

- Quantities of energy carriers (e.g., liters);

- Energy measuring units (kWh or other measuring units according to the foregoing table); and

- Costs or revenues (as monetary units).

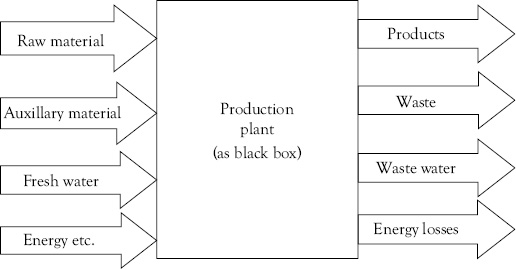

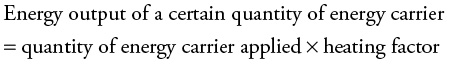

While energy procurement deals with liters of heating oil or cubic meters of gas, traditional accounting looks mainly at the cost side of the invoice. The missing link between quantities of energy carriers and energy in kilowatt-hours is provided by the heating factor. It shows how many kilowatt-hours the energy quantity may deliver:

This formula can be used for business purposes:

The heating factor can also be interpreted as an energy content or density of an energy carrier or storage unit. This is important, for example, in logistics, because energy has to be taken along with a car or a truck. As diesel (heating oil) has a high energy density in comparison to batteries, the weight is lower and permits a higher useful load and reach for a carrier.

Common heating factors (depending on the exact chemical definition) for heating oil are 10.08 kWh/L or 10.45 kWh/m2 for natural gas. Oil, gas, and coal are natural products and—although refined—have slight differences in their chemical attributes. With this background information, an accountant may easily understand and transfer energy input into kilograms, cubic meters into energy balances in kilowatt-hours, and carbon balances into kilograms. Many utilities include this information in their invoices.

An Example of Application

If the consumption of natural gas in an office building of 1,000 m2 is, for example, 10,000 m3 a year, the heating factor with a range of 8.8 to 11.4 has to be multiplied with 10,000 L to calculate the kilowatt-hours used for heating. That equals 88,000 to 114,000 kWh for the whole building and 88 to 114 kWh for a square meter.

Since the heating factors of 1 L of heating oil and 1 m3 of natural gas are approximately 10, a quick estimation can be made when renting a flat or buying a house.

Again the initial intention in providing a comprehensive table with heating factors had to be revoked: Some variations of the definition of the factors due to different technical premises would have to be explained. Furthermore, the variations for energy carriers like coal can be considerable. If coal absorbs moisture, experiments have to be conducted to get a correct value. This could make sense if the lot of coal is large enough and the contract with the provider sets a minimum of energy content or a maximum percentage of water.

Energy Performance and Efficiency

ISO 50001 (2011, 14) presents a model of energy performance, with definitions that are scattered throughout the standard ( Figure 3.1).

Figure 3.1 ISO definition of energy performance

The core of the model consists of energy use (the manner or kind of application of energy, like ventilation, lighting, heating, cooling, transportation, processes, production lines) and energy consumption (quantity of energy applied). These are absolute, stand-alone indicators that cannot be interpreted without further information. It is an interesting observation that the positive connotation of the term performance could be turned into a negative one by looking at use and consumption. The terms do not match well, as it could be assumed that the higher the consumption, the higher the performance.

The other components of energy performance are relative indicators offering a ratio. Energy intensity and efficiency open up the way to consider which achievements per unit can be reached by a specific energy input:

The degree of efficiency or effectiveness makes a difference between useful (effective or net) energy and energy losses regarding a single process or a whole system. To calculate energy losses, the previous formula has to be varied:

![]()

To give some examples of application:

- Conventional car engines have an efficiency of 30 to 45 percent (with diesel having a tendency to beat gasoline); the balance adding up to 100 percent consists of energy losses from heat radiation or friction.

- Electric drives have an efficiency of 60 to 95 percent, a major reason to promote e-mobility and comparison to combustion engines.

- Wind turbines reach an efficiency of 40 percent, so this percentage of the kinetic energy of streaming air is converted into electricity.

- Thermal solar panels can convert a remarkable 60 percent of solar radiation into heat.

- Conventional coal energy plants operate with 40 percent energy efficiency and sometimes below, while combined heat and power plants can reach about 90 percent. (I met the energy plant manager of Freudenberg in Weinheim, Germany. He calculated that his facility achieves up to 95 percent.) These numbers are a massive hint to inefficiencies worldwide.

The efficiency of a technical system (a single operation or a whole plan) is difficult to measure. For practical and business uses, the inverse ratio referring to an object or purpose of consumption is established. Some examples:

Or the other way round:

Many more applications will be introduced in Chapter 14 on energy performance indicators and in other chapters dealing with different business domains.

Megatrends and Background Theory

Scarcity of Energy Resources and Global Warming

In 1972, the Club of Rome’s report, Limits to Growth, brought the insight that natural resources are becoming increasingly scarce. Although it is beyond our scope to cover this whole area, two main energy-related questions should be considered here:

- The scarcity of important fossil energy carriers (in particular, peak oil); and (of even greater relevance)

- The limited ability of the atmosphere to absorb greenhouse gases (GHGs, global warming).

This second aspect has to be interpreted as a natural resource even though nothing is extracted. Both contribute to the three dominant aims of every nation’s energy policy: To cover the energy demand in an economic, reliable, and ecological way.

Availability of Fossil Energy Resources

Let us begin with the stocks of fossil energy in a geological sense. The indicator reach measures the scarcity here:

To assure the actuality for many years, this book only contains some rough estimates. Furthermore, the driving variables for interpretation are explained.

Raw oil has got a reach in the range of decades—but this indicator has been constant already for decades! At first sight, in spite of the increasing oil consumption worldwide, the stocks did not seem to be diminished. The reason for this seeming paradox lies in the definition of stocks: They comprise the minable quantities at the current prices. As prices went up, more and more geological deposits were exploited. Between they year 2000 and the beginning of the financial crisis in the year 2008, the raw oil price for one barrel Brent Oil (159 L) went up from below $30 to $146 peak. As prices are strongly influenced by speculation and political conditions, considerable market volatility can be observed. (Current prices are easy to view at commodity exchanges or in the economic press; please pay attention to the considerable differences due to raw oil qualities.)

Coal is globally available for hundreds of years, and some countries with great importance for global warming like China may cover their demand from their own mines. Traditional growth may be attained without having to prepare for rising mining costs. Consequently, global warming has to be prevented by willful action.

Natural gas has a reach between coal and oil. Rising prices make fracking as a technology to extract gas profitable. This shale gas technology leads to falling prices in the United States. Improved technology, the political will, and rising prices brought about this unexpected development.

Nevertheless, energy is a sensitive topic even for hard-nosed managers who are maximizing profits in countries with currently cheap energy, as it deeply correlates with political, economical, and ecological crises:

- The former Saudi oil minister Sheikh Zaki Yamani stated that “[t] Stone Age did not end for the lack of stones, and the Oil Age will end long before the world runs out of oil.” Technological advances will take us beyond the oil age, bringing about advantages not primarily linked to energy. For example, video conferences are helping to conserve fuel, but they are done mostly because they are quick and convenient.

- Energy markets reflect the rise or decline of the world economy immediately and significantly. Furthermore, energy can serve as a weapon in conflicts. About 20 percent of the world’s oil demand has to pass the Strait of Hormuz in the Middle East, a region of considerable political unrest.

- Governmental regulations fighting global warming may have a sharp impact. The Fukushima nuclear disaster led to the temporary switching off of all Japanese nuclear power plants.

- Technological innovations like fracking, solar panels, or passive houses can make the breakthrough. Renewable energy carriers like sunbeams, wind, or waves have unlimited reach. The following chapters will explain how we may tap this potential energy, leaving the fossil fuels buried in the ground.

Global Warming

What are we actually doing digging out the carbon hidden in the ground since the times of the dinosaurs? Dinosaurs needed a strong greenhouse effect, because they were hematocryal reptiles adapting to the temperature of their environment. High temperatures were necessary to keep their massive bodies warm. A high concentration of CO2 in the atmosphere brought about a strong greenhouse effect. Extended swamps buried trunks and other plant material that transformed into turf, one layer after the other pressed down on the previous ones over hundreds of millions of years. Thus, turf became brown coal, fat coal, raw oil, and natural gas. The concentration of CO2 in the air went down and the greenhouse effect was reduced, determining our current climate. If we continue releasing the buried carbon, we spoil our climatic conditions risking becoming the dinosaurs of the future—being extinct.

The Intergovernmental Panel on Climate Change (IPCC) comprises hundreds of top ranked scientists advising the United Nations. They issue reports concerning global warming (see www.ipcc.ch). Their results are clear: A manmade climate change is occurring and its consequences will be catastrophic for humanity and the earth. We have to prepare for rising sea levels, extreme climate events, droughts, and inundations. The social, economic, and political impact will be hunger, climate refugees, and wars.

The ice bear of Figure 4.1 on a melting sheet of ice symbolizes the threatened natural resources of our existence.

Figure 4.1 Ice bear on dwindling sheet of ice as a symbol for the hazards of global warming

Source: Polar Bears International.

Additionally, tipping points pose a massive risk for climate models. Developments of complex systems (as the climate) are not linear but may be disruptive; an ecological system may topple. A lake can absorb a considerable quantity of nitrate, but with a small additional exposure exceeding the limits, it may die biologically. The world economic crisis in 2008 may be interpreted this way as well, as foul credits in the U.S. housing market seemingly did not have any effect at first, but eventually they triggered an economic earthquake. In the context of climate change, tipping points also take place; for example, the effects of methane gas released by unfreezing permafrost soils, or the loss of glaciers in Greenland changing the flow of the Gulf Stream.

A Social Comparison

Let us compare our children’s and grandchildren’s way of life to a boat trip. There are two vessels available: a speedboat anchoring right at the pier—and it will be fun, we can jump right on it—and a sailboat still sitting at the wharf, needing some work and effort before it can be put into the water. If they take the sailboat, the travelers may not reach their destinations in a short time. The speedboat, however, also has a disadvantage: There may be an obstacle in the water and the travelers—approaching at high speed—could lose their lives. This can be transferred to our society’s way of life with the speedboat standing for an economy based on conventional growth while the sailboat reflects an economy based on sustainable growth. The IPCC warns: If we continue to exploit conventional energy carriers and other environmental resources, many people might die. In this example, no one would accept that a beloved person enters the speedboat; the rational choice is to invest into finishing the sailboat, ensuring a safe trip. But under the condition of “the tragedy of the commons,” the world is currently deciding otherwise.

In 2006, the so-called Stern Review on the Economics of Climate Change demonstrated with great clarity that avoiding climate change would be much cheaper than mitigating its consequences (2006). The consequences for companies are less obvious than those for politics in our global village:

- Managers should observe how climate change and corresponding regulations are perceived by policy makers.

- Companies are advised to account for energy, being able to realize profitable investments to prevent GHGs.

- A long-term strategy has to be formulated and followed. It is prudent for companies to join the technologies, branches, and regions of the world that are succeeding.

- Managers should consider the ethical side of the problem.

- Additionally, every reader of the book is a voting citizen and can exercise his influence as a consumer.

The next chapter will outline which political actions are necessary to countervail climate change.

Core Idea

In a free market economy, entrepreneurs are realizing profits by optimizing costs and revenues. Competition is leading to technological progress and growth; the “benefit of the greatest number” is attained, speaking in the words of the classics. According to utilitarianism, self-interest leads to the greatest benefit and welfare for the majority in the short and long run. Unfortunately, the long-term costs of climate change are not assigned a price, markets fail in the use and allocation of so called free environmental goods. If an environmental good causes no cost, everybody uses this free resource to saturation level—a tragedy of the commons. There is only one reasonable way for the global village in a market system to overcome this failure: External (social) costs have to be internalized. External costs are imputed to others and not to the one benefiting from an economic action. The principle of causation is basic for internal accountancy and should also be integrated into the economy on national and global levels. Figure 5.1 demonstrates what happens to the market when external costs are included. The figure describes the market of any good causing carbon emissions. Thus, every material good is included; only the costs and prices for services like haircuts (without electric hairdryers afterwards) would not be changed.

Figure 5.1 Market diagram including external costs

As the supply curve becomes steeper, the market equilibrium is found at a higher price and lower quantity. At first, this may sound like abandonment, but in the long run, and with several markets involved, it will turn out to be the contrary. The additional money representing the external costs can be invested, leading to growth in other markets with less environmental impact.

We now have to take a closer look at what legislation can do to bring about this internalization of external costs. There are three principal ways of pricing priceless goods to correct this market failure. They will be discussed in the following sections:

- Direct control of behavior

- Regulation of prices through charges, fees, tolls, or Pigovian (also Pigouvian) taxes

- Regulation of quantities through a certificate trading systems and emission allowances (cap and trade)

On this basis, some further discussions have to be mapped to cover the field; we dedicate a section to each of them:

- An appropriate price for carbon has to be found.

- Taxes and certificate trading systems may lead to funds that could be redistributed to the citizens per capita (energy money), an ingenious idea with great advantages.

- Many countries grant subsidies for renewable energy sources to help them into the market. Although economic theory is suspicious of this approach, it has its practical impact and advantages.

- Summing up, embracing renewable energy and a sustainable economy could bring about the next industrial revolution.

Direct Control of Behavior

It does not fit to the concept of a free economy when governmental authorities and legislation prescribe how participants of markets have to act. Nevertheless, it is a quick and sometimes effective way to mend the discussed market failure. Making use of this instrument, authorities have two options to urge companies into a cleaner production: Either they prescribe which technology has to be applied or they define threshold values for emissions. Eventually, the effect will be the same, since the regulating authority has to make sure that an appropriate technology is available before defining thresholds. In some cases, setting threshold values provides more flexibility, by allowing companies to find creative ways in how to reach them.

Here are some practical examples for direct control of energy technology:

- The threshold values for the maximum energy demand a building may have per surface unit.

- The ban on conventional light bulbs, which are only 5 percent energy efficient.

- The European Union’s (EU) energy-efficiency guideline for production technology.

- The limits of CO2 emissions per distance that a car or a fleet of cars, which a car manufacturer has to meet.

Furthermore, a whole bundle of supplemental measures can be taken up by legislation in the form of:

- Information obligations (informing the customer about key energy indicators of the goods which they intend to purchase);

- Organizational duties (chimney sweeping once a year);

- Label initiatives (classification system for energy-consuming devices like refrigerators);

- Tax relief on the basis of nongovernmental certifications and initiatives (tax reductions for ISO 50001 certified companies).

Prescribing or banning a technology aims to enforce progress relatively quickly. On the negative side, various problems concerning competition arise because cost relations are distorted between business branches and countries. Once a technology is established in this way, it could become a hindrance to the breakthrough of advanced options. The following boxed example illustrates how difficult it can be to implement the clean technology—available for a long time now—in the global car market.

The VW 1 L Car

In 2002, VW presented a car consuming only 1 L of gasoline per 100 km. (Since 1 gal. equals 3.78 L, one could drive about 378 km/gal. with this car. As a mile covers 1.609 km, one can with 1 gal. reach a distance of 378/1.609 = 235 miles.) Members of the VW board drove some hundred miles on public highways proving that they trusted this technology. Actually, the fuel consumption was as low as expected. Still, this standard-setting car was not produced and offered to the customers. The firm probably wanted to avoid a market cannibalization with other models. Ten years later, in 2012, an advanced model was presented to the public (see Figure 5.2).

Figure 5.2 1 L-car

Source: Volkswagen AG.

Again this car was not meant for mass production; only some hundred selected customers were offered a leasing contract.

What one can learn from this story:

- The technology for energy-efficient cars has been mature for many years. Regrettably, VW used this prototype only for marketing purposes. Yet, our focus should, of course, not solely lie on VW; every car-producing company should be able to construct such a vehicle.

- It is a stunning example of how far away market mechanisms are from tapping the potential of available energy technologies for a sustainable economy. The inefficiency of the market is reflected by the comparison of the consumption of the 1 L car to that of an average car on our roads.

- The existing market system prevents innovations of this kind. Companies are looking at their revenue and not at the greatest long-term benefit for all. This seems to be their interpretation of their role in the system.

- E-mobility is a rivaling technology, energy-efficient and not dependent on fossil fuels. Finally, a democratically elected legislator could act to encourage its development over the prevailing technology.

There are good reasons as well as grave principal objections to direct legal interference in a company’s energy technology and product policy. Again advances in global governance would be a key to avoid distortions when enforcing what is obviously reasonable on a global scale.

Pigovian Tax

Arthur Cecil Pigou was a British economist and Nobel laureate who published The Economics of Welfare in 1920, proposing a tax for market activities that create negative externalities (Pigovian or Pigouvian tax). The expression tax does not fit well because taxes are intended to cover the expenses of countries or other administrative authorities. This is not the intention in the case of externalities; thus, a charge, toll, fee, or royalty for greenhouse gases (GHGs) would be a better expression. Furthermore, the negative connotation of the term tax would be avoided. As the denomination carbon tax is established, we consent here to use the term as well.

The effect of introducing a carbon tax has already been demonstrated in the Figure 5.1 This simple idea contributes to a healthy market system, with allocation of resources and technological advances leading to the creation of value. Prices should speak the (ecological) truth, as expressed by Ernst Ulrich von Weizsacker, a leading scientist teaching in California and Germany. Without internalization, profits of companies and the gross national product (GNP) are not necessarily indicators for value created, but they possibly indicate the destruction of resources that are excluded from the accounting system.

Certification Trading System

Economic theory criticizes the fixing of prices by taxing external effects, because the reaction of market participants and the quantity of carbon eventually emitted cannot be predicted exactly. A certification trading system works the other way around: The overall quantity of emissions is determined based on the capacity of the atmosphere to absorb carbon. The overall sum of emissions is divided into emission allowance units (EAUs) and sold in an auction. So—in theory—the Intergovernmental Panel on Climate Change (IPCC) could determine the emissions appropriate to maintain global warming within two degrees, as targeted. This is the theoretical foundation of the Kyoto Protocol, and subsequent agreements. According to economic theory, it is the most elegant and effective way.

Unfortunately, some difficulties arise when one looks at the design of emission allowance trading systems in reality:

- Although a global approach is needed, important countries are not participating.

- The amount of EAUs was set so generously that prices became insignificant, ranging to below $10 (check the exchange index CARBIX for the current price).

- In order to introduce the system at all, the EAUs were first assigned to the companies without costs. Hence, only EAUs of no relevance were really traded.

- Only industries with high emissions are included.

One can only hope that this tool of environmental policy is increasingly applied in a more effective way.

Carbon Trading Scheme in China

At the beginning of GHG emission certificate trading according to the Kyoto-Protocol, China hesitated to participate. In the last years, environmental problems coming from the extensive use of coal in Chinese megacities triggered a national certificate trading scheme. It is growing rapidly and will eventually outpace the volume of Europe’s system (currently the largest in the world). In 2014, some 24 million tons of carbon dioxide equivalent were traded by 2,000 companies with a value of 123 million euros (Darby 2015, according to Thomson Reuters). In 2015, the volume will rise to 40 million tons. The regional authorities are setting the price of 1 ton within the range of three to seven euros, and the trading scheme contributes to reaching the peak GHG emissions around 2030.

A Price for Carbon

What do the low prices for EAUs mean in practice? One liter fuel oil or diesel causes 2.6 kg of carbon dioxide. Given a price of $10 per EAU, a liter would cost $0.026 or 2.6 cent more (see the carbon emission factors in Chapter 2). Thus, what would be an appropriate price for one ton of carbon dioxide emissions, enforced by the economic instruments outlined before? The threshold for a real impact on the behavior of companies is generally assessed at $40 (about 30 euros) per ton. The renowned German Center for Aerospace (DLR), in its numerous studies for the Ministry of Environment, sets the price of CO2 at $90 (70 euros). Summing up several investigations, the price range is between $12 and $360 (15 and 280 euros) per ton.

Let us contribute to the discussion by applying the willingness-to-pay method: Climate change will, in all probability, lead to rising sea levels causing inundation of extended regions of Bangladesh and to the desertification of the Sahel zone in Africa. This will cost the lives of many people. What is their value? On a humanitarian basis, and seen through the eyes of relatives, every single life has an unlimited value. Thus, GHGs should have such a high price that no person gets lost. Now let us assume that the threatened Bangladeshis and Africans were billionaires. They would be willing to pay a fortune to avoid their death or the deaths of their children. This little willingness-to-pay model serves as a reminder to drive the price as high as possible. Following this line of thought, the price for carbon would trigger a stringent energy turnaround.

Contemplating the monetary value of a human seems to be cynical, as every person is unique and of unlimited value for his or her loving family, and according to self-assessment. From an economic viewpoint, the argument may be turned around: Not asking for the economic value of persons is cynical since many public decisions are based on implicitly assigning a value to (statistical) lives. Examples can be found in the context of public health care, fire fighters, admittance or prohibition of hard drugs, alcohol, smoking, or humanitarian decisions about helping refugees or abandoning them. Here are some randomly selected examples of valuations taken from different backgrounds:

- An insurance company values the life, or death, of working people in industrial countries roughly within the range of $100,000 to $1 million.

- National income accounting for GNP implicitly proposes the value of a person to be the financial contribution to the economy within the expected lifespan.

- About 30,000 children per day are dying from the consequences of malnutrition, dirty water, and the lack of basic medical care. Only a few dollars could save each of their lives.

Redistribution of Energy Money to the Citizens

Liberal economists mistrusting additional public funds raise objections to an internalization tax and the certification trading system. Their suspicionis that if a public authority gets money, a useful purpose to spend it will be found, leading to a rise of the public expenditure quota (e.g., the still existing tax for sparkling wine in Germany was introduced to fund the navy for World War I). Consequently, the funds raised by a new tax or by selling EAUs should be tied to one of the following purposes.

The original idea of Pigou and the welfare economics is to repair the damage caused by an environmental effect or to indemnify the affected party. Global warming cannot be repaired in the sense of cooling the earth down again and stabilizing the climate. To adopt the idea, mitigating the consequences would mean building dams and providing financial means for future generations, especially in developing countries of the Southern Hemisphere. In a broader sense, the idea should be applied by helping developing and emerging countries into a sustainable economy (leapfrogging). This means providing green energy technology, supporting education to speed up demographic transition, facilitating access to markets, and ceasing to dominate the food market in the Southern Hemisphere with subsidized agricultural products from the North. In practical politics, this idea ties in with an overall international development partnership. The feasibility of those ideas is often hindered by the well-known problems of bad governance, corruption, and national egoism on any side.

Redistributing energy moneyaims to distribute an equal part of the funds collected from an internalization tax or from EAU auctions to everyone, from babies to the elderly. The effect would be that people with a higher economic power and with intensified activities causing emissions would have to pay more. Yet, they have the means to invest in energy efficiency and will do so because it pays off. People with a substandard income causing emissions below average will also benefit. Consequently, energy poverty could be avoided. Furthermore, people with low income will also get the financial means and the incentive to replace inefficient devices.

What would this mean for an economy as a whole and for companies? Returning to the previous market diagram, the skimmed demand capital does not disappear. It is just converted into goods and services with lower energy intensity and, hence, into green energy technology itself. Thus, economic transition and resource-efficient growth are stimulated.

Subsidizing Renewables

This widely used instrument of environmental politics does not possess the theoretical elegance of Pigovian taxes and certificates. Here the core idea of supporting renewable energy technologies lies in supporting them until they reach market parity. Market parity means that wind energy, solar energy, and other renewables become competitive with fossil energy (even without charging conventional energy with social costs). Green energy technology becomes cheaper according to the experience or learning curve. In empirics and economic theory, costs per unit are going down 25 to 33 percent when the cumulated production doubles. In practice, this effect can be observed very clearly looking at the development of solar cells (see Figure 5.3 ).

Low prices for renewable energies can, of course, also be explained by the fact that their extraction is free (costless sun, wind, growth of biomass), while coal, oil, or gas have to be mined with increasing expenditures. Consequently, subsidies for renewables will not last forever. Hence, as an additional public task, it is necessary to provide the infrastructure for smart grids.

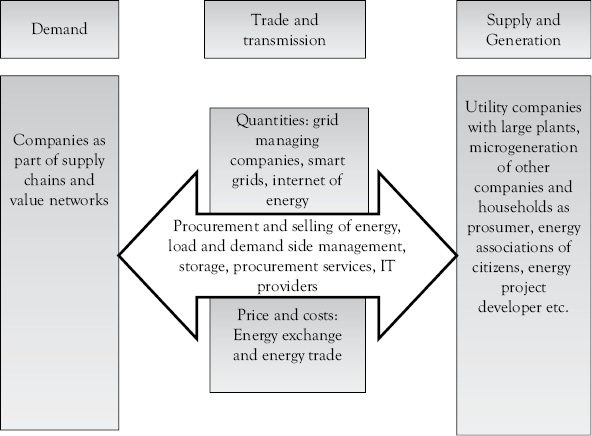

How exactly might subsidizing renewables work? The German Renewable Energy Act was the first law of this type, with variations adopted by dozens of countries. Any investor gets a fixed price for every kilowatt-hour fed into the grid; the focus is on the amount of electricity generated. An investor could be a household with photovoltaic modules on the roof or a farmer operating a biomass power plant. These are examples of microgeneration of energy in contrast to large-scale power plants operated by utilities. Cooperative associations of citizens invest in their own, local energy supply; some rural communities have even reached energy autonomy. Every electricity user pays the subsidy; exemptions are made for energy-intensive industries facing international competition. Based on efficiencies arising from the learning curve, the subsidy is reduced step by step before finally fading out completely.

Figure 5.3 Price of solar panels as realization of the learning curve

In countries doing it this way, the borders between utility companies producing energy and other companies consuming energy become blurred. All companies and even the private sector are merging into the role of prosumers (producer and consumer at the same time).

Triggering the Next Industrial Revolution

Long-range phases of economic growth occurring over decades are called Kondratiev waves, according to a Russian economist. Such industrial revolutions are triggered by inventions that lead to global innovations. The first industrial revolution was triggered by the steam engine, invented by Thomas Newcomen and significantly improved by James Watt in 1769. The proliferation of this new technology brought about economic growth and contributed to fundamental changes in society, politics, culture, and so forth. In brief, people’s entire lives changed from being part of an agricultural society to becoming members of an industrialized world. Figure 5.4 gives an overview of various Kondratiev waves, each marking—in chronological order—different industrial revolutions. Unfortunately, there is no consensus on how many waves have to be counted, and on their exact period of time.

If a wave phases out, its contributions to wealth, business, and lifestyle persist, but the new inventions and innovations have to take over the role of bringing about a new burst of growth. An energy turnaround has the potential needed now. Taking this important step, one is once more reminded of the first industrial revolution, where steam engines were burning coal as a fossil energy carrier. More than 200 years later, we are confronted with global warming as the price we pay for living in our industrialized world. Nevertheless, let us now look at our future opportunities. The previous sections tried to outline what needs to be done, and the advantages of an energy turnaround are absolutely convincing:

- Consequences of climate change can be mitigated.

- New sustainable economic growth is possible.

- Independence from energy imports (autarky) with resulting political and economic effects may be attained.

- Decentralization will help to reduce the vulnerability of cyber attacks and sabotage.

- Cheap (when investments are made), sustainable, reliable energy for future generations is provided (here the three key energy objectives—“triangle of energy policy objectives”—are addressed).

- The investment in decentralized supply with relatively small devices may be organized in a way that citizens control their energy supply. Ultimately, sustainable consciousness and social cohesion are strengthened.

Figure 5.4 Industrial revolutions

Helping the developing countries to leapfrog outmoded paradigms brings about a win–win–win situation: Industrialized countries strengthen their innovative abilities, the Southern Hemisphere gets the chance to grow, and nature can be preserved.

Global Governance

Let us assume a carbon tax is introduced on a global scale and fossil energy is phasing out. Is it possible to maintain the industrial way of life without warming up the earth? In a word: Yes. The technology is available for all people to live in (post)industrialized economies. Hence, the Western way of life may be maintained in most parts with some adaptations. Some (few) compromises have to be made, especially concerning air traffic, but life could be much more pleasant in a sustainable economy. The nominal standard of living could even go up, replacing material goods by services and information; the quality of life could surge immensely. This is the way visionaries such as Jeremy Rifkin (2011) and Jeffrey D. Sachs (2014) promote it.

The dominant obstacle to put the stringent approach into practice can be found in a lack of global governance. We are living in a globalized world; actions taken in one part of the world are bringing about consequences in another region. Consequently, the inhabitants of the global village form a community and have to take responsibility for one another. Thus, the globalized world needs globalized rules. Climate chance confronts us with the tragedy of the commons, the individual rationality exploiting cost-free resources to the point of saturation. The community, a democratically legitimized authority has to establish rules to enforce rationality and fairness. Besides energy, there are many other fields suffering from a lack of global governance: other environmental standards, the tax system (without havens for large fortunes or black money), or human rights.

Green Energy Technology and New Markets

Volatility of Green Energy

What are the inventions and necessary innovations for the next industrial revolution? Technology is needed, but a new energy market design is needed allowing technological options to unfold their power. The reason lies in the green energy technology itself, which can be subdivided into two categories:

- Power plants of different scales are generating energy from renewable sources (sun, wind, water, biomass, geothermal). Figure 6.1 illustrates the current global energy demand in comparison to the potential. Some examples for specific technologies are provided in the next section.

- Technology of energy efficiency. Examples are provided throughout this book covering business domains such as –facility management, logistics, and so forth.

Figure 6.1 Potential of renewable energy sources in comparison to world energy demand

The energy transition is a challenge because of a growing volatility. Wind and sun are the most important pillars of a carbon-free energy supply and they don’t deliver given a “dark dead calm” when the sun isn’t shining and the wind isn’t blowing. Smart energy grids have to be established, and companies and households are part of them.

Electricity has to be considered as the key energy form of a transition. It is most flexible, being able to operate a steel furnace, a conveyor, or a coffee machine. Fortunately, green energy technology produces mostly electricity. And furthermore, gas, coal, oil, and most other energy forms can be transformed into electricity. The other way around is possible too, but most applications are costly and not very efficient. Transforming electricity into other forms of energy offers possibilities for storage. This is important, because a major disadvantage of electricity is that it cannot be stored simply like a fuel, which just fills a tank. Technological options are power-to-gas (producing hydrogen with surplus electricity), power-to-heat (warmed up water used later), or pumped-storage hydropower plants. That means to pump up water from a lower water reservoir into a higher one when abundant electricity is available, and then regenerating the power later.

Renewable Energy Generation Technology

Energy technology is a broad engineering field pertaining primarily to utilities. Here, the opportunities for industrial companies in their roles as prosumers are taken into focus, as this chapter structured according to the source of renewable energy: sun, wind, biomass, water, thermal energy, and heat pumps (for detailed explanations see Capehart et al. 2012, Jeffs 2012, or Li 2011, and also Figure 6.2 ).

Solar power takes the form of thermal and photovoltaic energy (electricity). Thermal energy is used to heat up a medium, typically water or glycol (used to avoid freezing in winter), to provide heated tap water or to support a heating system. This simple technology can be applied for a single building or on a district-level basis. The heat energy may be stored overnight or for some days, depending on the size and insulation of the tank. The potential for tropical and subtropical regions of the world is enormous.

Figure 6.2 Examples of renewable energy sources

Source: www.nrel.gov