Introduction

Small businesses are vital to the U.S. economy. They employ nearly half of the country's private sector workforce and contribute more than half of the nation's gross national product. Small businesses created 64% of all new jobs over the past 15 years.

For the 2015 tax year (the most recent year for statistics), there were more than 24.7 million sole proprietorships in the United States. About one out of every 6 Form 1040 filers had a sole proprietorship that year. Another 7.8 million filers reported income from partnerships and S corporations. And the numbers of small businesses are growing.

Small businesses fall under the purview of the Internal Revenue Service's (IRS) Small Business and Self-Employed Division (SB/SE). This division services approximately 57 million tax filers, including 9 million small businesses (partnerships and corporations with assets of $10 million or less), more than 41 million of whom are full-time or partially self-employed, and about 7 million filers of employment, excise, and certain other returns. The SB/SE division accounts for about 40% of the total federal tax revenues collected. The goal of this IRS division is customer assistance to help small businesses comply with the tax laws.

Toward this end, the Small Business Administration (SBA) has teamed up with the IRS to provide small business owners with help on tax issues. The SBA provides tax information for start-ups at www.sba.gov; search “taxes.”

There is also an IRS Tax Center devoted exclusively to small business and self-employed persons at www.irs.gov/Businesses/Small-Businesses-&-Self-Employed. Here you will find special information for your industry—agriculture, automotive, child care, construction, entertainment, gaming, manufacturing, real estate, restaurants, retailers, veterinarians, and even tax professionals are already covered, and additional industries are set to follow. You can see the hot tax issues for your industry, find special audit guides that explain what the IRS looks for in your industry when examining returns, and links to other tax information.

As a small business owner, you work, try to grow your business, and hope to make a profit. What you can keep from that profit depends in part on the income tax you pay. The income tax applies to your net income rather than to your gross income or gross receipts. You are not taxed on all the income you bring in by way of sales, fees, commissions, or other payments. Instead, you are essentially taxed on what you keep after paying off the expenses of providing the services or making the sales that are the crux of your business. Deductions for these expenses operate to fix the amount of income that will be subject to tax. So deductions, in effect, help to determine the tax you pay and the profits you keep. And tax credits, the number of which has been expanded in recent years, can offset your tax to reduce the amount you ultimately pay.

Special Rules for Small Businesses

Sometimes it pays to be small. The tax laws contain a number of special rules exclusively for small businesses. But what is a small business? The average size of a small business in the United States is one with fewer than 20 employees with annual revenue under $2 million. The SBA usually defines small business by the number of employees—size standards range from 500 employees to 1,500 employees, depending on the industry or the SBA program. The SBA also uses revenue for certain business size standards (e.g., average annual gross receipts for many nonmanufacturing industries). Size matters because only “small businesses” can qualify for SBA-guaranteed loans and for special consideration with federal contracting.

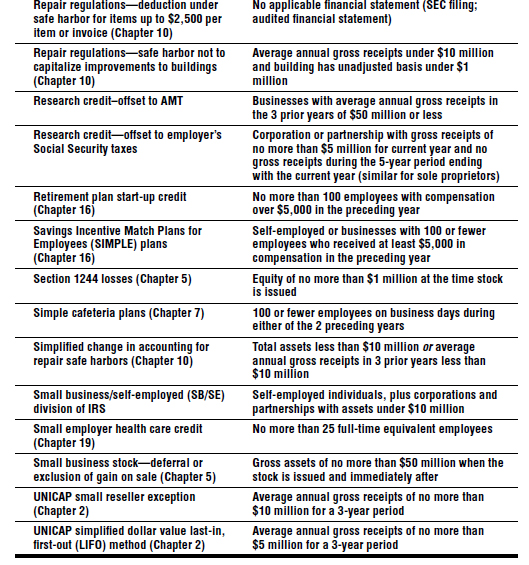

For tax purposes, however, the answer varies from rule to rule, as explained throughout this book. Sometimes, it depends on your revenues, the number of employees, or total assets. In Table I.1 are more than 2 dozen definitions from the Internal Revenue Code on what constitutes a small business. You may be a small business for some tax rules but not for others.

Table I.1 Examples of Tax Definitions of Small Business

Reporting Income

While taxes are figured on your bottom line—your income less certain expenses—you still must report your income on your tax return. Generally, all of the income your business receives is taxable unless there is a specific tax rule that allows you to exclude the income permanently or defer it to a future time.

When you report income depends on your method of accounting. How and where you report income depends on the nature of the income and your type of business organization. Over the next several years, the possibility of declining tax rates (clarified in the Supplement) for owners of pass-through entities—sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations—require greater sensitivity to the timing of business income.

The IRS reported a “tax gap” (the spread between revenues that should be collected and what actually is collected) of $450 billion a year and that $122 billion of this can be traced to entrepreneurs who underreport or don't report their income, or overstate their deductions. While audit rates have recently been at historic lows, the IRS continues to look carefully at self-employed individuals in an attempt to detect intentional or unintentional reporting errors.

Claiming Deductions

You pay tax only on your profits, not on what you take in (gross receipts). In order to arrive at your profits, you are allowed to subtract certain expenses from your income. These expenses are called “deductions.”

The law says what you can and cannot deduct (see below). Within this framework, the nature and amount of the deductions you have often vary with the size of your business, the industry you are in, where you are based in the country, and other factors. The most common deductions for businesses include car and truck expenses, utilities, supplies, legal and professional services, insurance, depreciation, taxes, meals and entertainment, advertising, repairs, travel, rent for business property and equipment, and in some cases, a home office.

Are your deductions typical? Back in January 2004, the Government Accountability Office (formerly the General Accounting Office) compiled statistics on deductions claimed by sole proprietors for 2001 (no data more current is available). These numbers showed the dollars spent on various types of deductions, the percentage of sole proprietors who claimed the deductions, and what percentage of total deductions each expense represented. For example, 25% of sole proprietors with business gross receipts under $25,000 claimed a deduction for advertising costs. This percentage rose to 65% when gross receipts exceeded $100,000. You can view these old statistics at www.gao.gov/new.items/d04304.pdf.

What Is the Legal Authority for Claiming Deductions?

Deductions are a legal way to reduce the amount of your business income subject to tax. But there is no constitutional right to tax deductions. Instead, deductions are a matter of legislative grace; if Congress chooses to allow a particular deduction, so be it. Therefore, deductions are carefully spelled out in the Internal Revenue Code (the Code).

The language of the Code in many instances is rather general. It may describe a category of deductions without getting into specifics. For example, the Code contains a general deduction for all ordinary and necessary business expenses, without explaining what constitutes these expenses. Over the years, the IRS and the courts have worked to flesh out what business expenses are ordinary and necessary. “Ordinary” means common or accepted in business and “necessary” means appropriate and helpful in developing and maintaining a business. The IRS and the courts often reach different conclusions about whether an item meets this definition and is deductible, leaving the taxpayer in a somewhat difficult position. If the taxpayer uses a more favorable court position to claim a deduction, the IRS may very well attack the deduction in the event that the return is examined. This puts the taxpayer in the position of having to incur legal expenses to bring the matter to court. However, if the taxpayer simply follows the IRS approach, a good opportunity to reduce business income by means of a deduction will have been missed. Throughout this book, whenever unresolved questions remain about a particular deduction, both sides have been explained. The choice is up to you and your tax adviser.

Sometimes, the Code is very specific about a deduction, such as an employer's right to deduct employment taxes. Still, even where the Code is specific and there is less need for clarification, disputes about applicability or terminology may still arise. Again, the IRS and the courts may differ on the proper conclusion. It will remain for you and your tax adviser to review the different authorities for the positions stated and to reach your own conclusions based on the strength of the different positions and the amount of tax savings at stake.

A word about authorities for the deductions discussed in this book: There are a number of sources for these write-offs in addition to the Internal Revenue Code. These sources include court decisions from the U.S. Tax Court, the U.S. district courts and courts of appeal, the U.S. Court of Federal Claims, and the U.S. Supreme Court. There are also regulations issued by the Treasury Department to explain sections of the Internal Revenue Code. The IRS issues a number of pronouncements, including Revenue Rulings, Revenue Procedures, Notices, Announcements, and News Releases. The IRS also issues private letter rulings, determination letters, field service advice, and technical advice memoranda. While these private types of pronouncements cannot be cited as authority by a taxpayer other than the one for whom the pronouncement was made, they are important nonetheless. They serve as an indication of IRS thinking on a particular topic, and it is often the case that private letter rulings on topics of general interest later get restated in revenue rulings.

What Is a Tax Deduction Worth to You?

The answer depends on your tax bracket. The tax bracket is dependent on the way you organize your business. If you are self-employed and in the top tax bracket of 39.6% in 2017, then each $100 deduction will save you $39.60. Had you not claimed this deduction, you would have had to pay $39.60 of tax on that $100 of income that was offset by the deduction. If you have a personal service corporation, a special type of corporation for most professionals, the corporation pays tax at a flat rate of 35%. This means that the corporation is in the 35% tax bracket. Thus, each $100 deduction claimed saves $35 of tax on the corporation's income. Deductions are even more valuable if your business is in a state that imposes income tax. The impact of state income tax and special rules for state income taxes are not discussed in this book. However, you should explore the tax rules in your state and ascertain their impact on your business income.

When Do You Claim Deductions?

Like the timing of income, the timing of deductions—when to claim them—is determined by your tax year and method of accounting. Your form of business organization affects your choice of tax year and your accounting method.

Even when expenses are deductible, there may be limits on the timing of those deductions. Most common expenses are currently deductible in full. However, some expenses must be capitalized or amortized, or you must choose between current deductibility and capitalization. Capitalization generally means that costs can be written off ratably as amortized expenses or depreciated over a period of time. (Capitalized costs, such as for the purchase of machinery and equipment, are added to the balance sheet as company assets.) Amortized expenses include, for example, fees to incorporate a business and expenses to organize a new business. Certain capitalized costs may not be deductible at all, but are treated as an additional cost of an asset (basis).

Credits versus Deductions

Not all write-offs of business expenses are treated as deductions. Some can be claimed as tax credits. A tax credit is worth more than a deduction since it reduces your taxes dollar for dollar. Like deductions, tax credits are available only to the extent that Congress allows. In a couple of instances, you have a choice between treating certain expenses as a deduction or a credit. In most cases, however, tax credits can be claimed for certain expenses for which no tax deduction is provided. Business-related tax credits, as well as personal credits related to working or running a business, are included in this book.

Tax Responsibilities

As a small business owner, your obligations taxwise are broad. Not only do you have to pay income taxes and file income tax returns, but you must also manage payroll taxes if you have any employees. You may also have to collect and report on state and local sales taxes. Some businesses, such as farms, may have excise tax responsibilities. Finally, you may have to notify the IRS of certain activities on information returns.

It is very helpful to keep an eye on the tax calendar so you will not miss out on any payment or filing deadlines, which can result in interest and penalties. You might want to view the IRS's Tax Calendar for Businesses and Self-Employed (go to https://www.irs.gov/Businesses/Small-Businesses-%26-Self-Employed/IRS-Tax-Calendar-for-Businesses-and-Self-Employed). You can use IRS CalendarConnector to filter the calendar to view dates that apply to you (go to https://www.irs.gov/pub/irs-pdf/p1518a.pdf).

You can obtain most federal tax forms online at www.irs.gov. Nonscannable forms, which cannot be downloaded from the IRS, can be ordered by calling toll free at 800-829-4933 during normal business hours.