TO:

Name of Consignee: _____________________________ (the "Consignee")

1. the [authorized officer/agent of the Consignee]/[the Consignee (if an individual)], hereby certify and acknowledge [on behalf of the Consignee (if agent or officer of a corporation)] as follows:

1. (a)The Consignee has or will receive physical possession of [describe tangible personal property in sufficient detail to identify specific shipment of tangible personal property] (the "Property") ordered from you by [name of unregistered non-resident]; OR

(b)During the period from ________ to ___________ the Consignee has or will receive physical possession of [describe tangible personal property in sufficient detail to identify specific shipment of tangible personal property] (the "Property") ordered from you by unregistered non-residents.

2. The Consignee is acquiring possession of the Property for the purpose of supplying a commercial service(s) (as defined in the Excise Tax Act and the Québec Sales Tax Act) in respect of the Property, or for consumption, use or supply in the course of its commercial activities.

3. If the Consignee subsequently transfers physical possession of the Property to a person who is not registered for the purposes of the Goods and Services Tax, otherwise than for export, or to another person who is registered for purposes of the Goods and Services Tax who does not provide to the Consignee a drop-shipment certificate under subsection 179(2) of the Excise Tax Act, and section 327.1 of the Québec Sales Tax Act, the Consignee will be required to account for the Goods and Services Tax and the Québec Sales Tax on the fair market value of the Property at that time.

4. If the Consignee is not acquiring the Property for consumption, use or supply exclusively in the course of its commercial activities, or if the Property is a passenger vehicle that is acquired for use as capital property, where the cost of the vehicle exceeds the vehicle's capital cost for income tax purposes, the Consignee is required to self-assess the Goods and Services Tax and the Québec Sales Tax.

NOTE: Part 1(a) is for use in the case of one or more deliveries relating to orders by the same unregistered non-resident.

Part 1(b) is for general use in the case of shipments, over a specified period of time, of tangible personal property of a particular description or class — not necessarily restricted to orders placed by the same unregistered non-resident.

CERTIFICAT DE LIVRAISON DIRECTE

À: (Nom du fournisseur)

Nom du consignataire : ____________________________ (le “consignataire”)

Je. [le mandataire ou le représentant du consignataire]/[le consignataire (s'il s'agit d'un particulier)], certifie et reconnaît par le présent certificat [au nom du consignataire (s'il est le mandataire ou le représentant d'une personne morale)] ce qui suit :

1. a)le consignataire a ou aura la possession matéríelle du [décrire le bien meuble corporel avec suffisamment de détails pour que puisse être identifiée une livraison précise de ce bien] (le “bien”) commandé auprès de vous par [nom de la personne non résidante qui n'est pas inscrite]; OU

b)pendant la période du _______ au ___________, le consignataire a ou aura la possession matérielle du [décrire le bien meuble corporel avec suffisamment de détails pour que puisse être identifiée une livraison précise de ce bien] (le “bien”) commandé auprès de vous par des personnes non résidantes qui ne sont pas inscrites.

2. Lc consignataire acquiert la possession du bien en vue de fournir un service commercial (défini dans la Loi sur la taxe de vente du Québec) à l'égard de ce bien, ou pour le consommer, l'utiliser ou le fournir dans le cadre de ses activités commerciales.

3. Si le consignataire transfère par la suite la possession matérielle du bien à une personne qui n'est pas inscrite sous le régime de la taxe de vente du Québec, sauf en ce qui concerne l'exportation, ou à une autre personne qui est inscrite sous le régime de la taxe de vente du Québec et qui ne fournit pas au consignataire un certificat de livraison directe aux termes du paragraphe 327.1 de la Loi sur la taxe de vente du Québec, le consignataire est tenu de déclarer la taxe de vente du Québec sur la juste valeur marchande du bien à ce moment.

4. Si le consignataire n'acquiert pas le bien pour le consommer, l'utiliser ou le fournir exclusivement dans le cadre de ses activités commerciales, ou si le bien est une voiture de tourisme achetée pour servir d'immobilisation, si le coût de la voiture dépasse le coût en capital de la voiture aux fins de l'impôt sur le revenu, le consignataire est tenu d'établir lui-même le montant de la taxe de vente du Québec en application de la Loi sur la taxe de vente du Québec.

NOTE : La partie la) sert lorsqu'il y a une ou plusieurs livraisons relatives à des commandes effectuées par la même personne non résidante qui n'est pas inscrite.

La partie lb) sert à des fins plus générales dans le cas de livraisons, au cours d'une période précise, d'un bien meuble corporel d'une description ou d'une catégorie particulière - sans être nécessairement limitée aux commandes passées par la même personne non résidante qui n'est pas inscrite.

NORTH AMERICAN FREE TRADE AGREEMENT CERTIFICATE OF ORIGIN INSTRUCTIONS

For purposes of obtaining preferential tariff treatment, this document must be completed legibly and in full by the exporter and be in the possession of the importer at the time the declaration is made. This document may also be completed voluntarily by the producer for use by the exporter. Please print or type:

FIELD 1: State the full legal name, address (including country) and legal tax identification number of the exporter. Legal taxation number is: in Canada, employer number or importer/exporter number assigned by Revenue Canada; in Mexico, federal taxpayer's registry number (RFC); and in the United States, employer's identification number or Social Security Number.

FIELD 2: Complete field if the Certificate covers multiple shipments of identical goods as described in Field # 5 that are imported into a NAFTA country for a specified period of up to one year (the blanket period). "FROM" is the date upon which the Certificate becomes applicable to the good covered by the blanket Certificate (it may be prior to the date of signing this Certificate). "TO" is the date upon which the blanket period expires. The importation of a good for which preferential treatment is claimed based on this Certificate must occur between these dates.

FIELD 3: State the full legal name, address (including country) and legal tax identification number, as defined in Field #1, of the producer. If more than one producer's good is included on the Certificate, attach a list of additional producers, including the legal name, address (including country) and legal tax identification number, cross-referenced to the good described in Field #5. If you wish this information to be confidential, it is acceptable to state Available to Customs upon request’. If the producer and the exporter are the same, complete field with "SAME". If the producer is unknown, it is acceptable to state "UNKNOWN".

FIELD 4: State the full legal name, address (including country) and legal tax identification number, as defined in Field #1, of the importer. If the importer is not known, state "UNKNOWN"; if multiple importers, state "VARIOUS".

FIELD 5: Provide a full description of each good. The description should be sufficient to relate it to the invoice description and to the Harmonized System (H.S.) description of the good. If the Certificate covers a single shipment of a good, include the invoice number as shown on the commercial invoice. If not known, indicate another unique reference number, such as the shipping order number.

FIELD 6: For each good described in Field #5, identify the H.S. tariff classification to six digits. If the good is subject to a specific rule of origin in Annex 401 that requires eight digits, identify to eight digits, using the H.S. tariff classification of the country into whose territory the good is imported.

FIELD 7: For each good described in Field #5, state which criterion (A through F) is applicable. The rules of origin are contained in Chapter Four and Annex 401. Additional rules are described in Annex 703.2 (certain agricultural goods), Annex 300-B, Appendix 6 (certain textile goods) and Annex 308.1 (certain automatic data processing goods and their parts). NOTE: In order to be entitled to preferential tariff treatment, each good must meet at least one of the criteria below.

Preference Criteria

A.)The good is "wholly obtained or produced entirely" in the territory of one or more of the NAFTA countries as referenced in Article 415. Note: The purchase of a good in the territory does not necessarily render It "wholly obtained or produced". If the good is an agricultural good, see also criterion F and Annex 703.2. (Reference: Article 401(a) and 415)

B.)The good is produced entirely in the territory of one or more of the NAFTA countries and satisfies the specific rule of origin, set out in Annex 401, that applies to its tariff classification. The rule may include a tariff classification change, regional value-content requirement, or a combination thereof. The good must also satisfy all other applicable requirements of Chapter Four. If the good is an agricultural good, see also criterion F and Annex 703.2. (Reference: Article 401(b))

C.)The good is produced entirely in the territory of one or more of the NAFTA countries exclusively from originating materials. Under this criterion, one or more of the materials may not fall within the definition of "wholly produced or obtained", as set out in Article 415. All materials used in the production of the good must qualify as "originating" by meeting the rules of Article 401 (a) through (d). If the good is an agricultural good, see also criterion F and Annex 703,2. (Reference: Article 401(c)).

D.)Goods are produced in the territory of one or more of the NAFTA countries but do not meet the applicable rule of origin, set out in Annex 401, because certain non-originating materials do not undergo the required change in tariff classification. The goods do nonetheless meet the regional value-content requirement specified in Article 401 (d). This criterion is limited to the following two circumstances:

1.The good was imported into the territory of a NAFTA country in an unassembled or disassembled form but was classified as an assembled good, pursuant to H.S. General Rule of Interpretation 2(a), or

2.The good incorporated one or more non-originating materials, provided for as parts under the H.S., which could not undergo a change in tariff classification because the heading provided for both the good and its parts and was not further subdivided into subheadings, or the subheading provided for both the good and its parts and was not further subdivided.

NOTE: This criterion does not apply to Chapters 61 through 63 of the H.S. (Reference: Article 401(d))

E.)Certain automatic data processing goods and their parts, specified in Annex 308.1, that do not originate in the territory are considered originating upon importation into the territory of a NAFTA country from the territory of another NAFTA country when the most-favored-nation tariff rate of the good conforms to the rate established in Annex 308.1 and is common to all NAFTA countries. (Reference: Annex 308. 1)

F.)The good is an originating agricultural good under preference criterion A. B, or C above and is not subject to a quantitative restriction in the importing NAFTA country because it is a "qualifying good" as defined in Annex 703.2, Section A or B (please specify). A good listed in Appendix 703.2B.7 is also exempt from quantitative restrictions and is eligible for NAFTA preferential tariff treatment if it meets the definition of "qualifying good" in Section A of Annex 703.2. NOTE 1: This criterion does not apply to goods that wholly originate In Canada or the United States and are imported Into either country. NOTE 2: A tariff rate quota is not a quantitative restriction.

FIELD 8: For each good described in Field #5, state "YES" if you are the producer of the good. If you are not the producer of the good, state "NO" followed by (1), (2), or (3), depending on whether this certificate was based upon: (1) your knowledge of whether the good qualifies as an originating good; (2) your reliance on the producers written representation (other than a Certificate of Origin) that the good qualifies as an originating good; or (3) a completed and signed Certificate for the good, voluntarily provided to the exporter by the producer.

FIELD 9: For each good described in field #5, where the good is subject to a regional value content (RVC) requirement, indicate "NC" if the RVC is calculated according to the net cost method; otherwise, indicate "NO". If the RVC is calculated over a period of time, further identity the beginning and ending dates (DD/MM/YY) of that period. (Reference: Articles 402.1, 402.5).

FIELD 10: Identify the name of the country ("MX" or "US" for agricultural and textile goods exported to Canada; "US" or "CA" for all goods exported to Mexico; or "CA" or "MX" for all goods exported to the United States) to which the preferential rate of customs duty applies, as set out in Annex 302.2, in accordance with the Marking Rules or in each party's schedule of tariff elimination.

For all other originating goods exported to Canada, indicate appropriately "MX" or "US" if the goods originate in that NAFTA country, within the meaning of the NAFTA Rules of Origin Regulations, and any subsequent processing in the other NAFTA country does not increase the transaction value of the goods by more than seven percent; otherwise "JNT" for joint production. (Reference: Annex 302.2)

FIELD 11: This field must be completed, signed, and dated by the exporter. When the Certificate is completed by the producer for use by the exporter it must be completed, signed, and dated by the producer. The date must be the date the Certificate was completed and signed.

Customs form 434 (040397) (Back)

A. Under the Export Admiministration Regulations of the United States you are required to:

1. |

At the time of making each shipment under the attached license, send to your foreign importer a written request for delivery verification. Include in your request the import certificate number shown on the front of this form and ask the foreign importer to make sure that this Import certificate number appears on the delivery import verfication he receives from his government. Where possible, you shall submit this request together with the related shipping documents. |

|

The foreign importer shall be advised of the terms of the commodity description as shown on the export license, including the unit of measure (I.e., pounds, number, etc.) and/or value of commodities (as applicable) and should be requested to make sure that these same terms are used on the delivery verification. If the Office of Export Licensing is unable to relate the terms shown on the completed delivery verification with the terms on the export license, the delivery verification may be returned to you for clarification. |

2. |

Obtain from the foreign importer a delivery verification which has been issued to him by his government for the commodities described in the attached export license. |

|

Where the full amount licensed has not been or will not be exported, the delivery verification shall be obtained for the amount actually shipped. |

|

If the commodities are exported in partial shipments, you are required to obtained a delivery verification for each partial shipment. Delivery verifications covering partial shipments shall be retained in your files until you have received delivery verification for all partial shipments made against the attached license. |

3. |

Send the original copies of all delivery verifications covering shipments made under the attached license together with the signed completed original of this Form BXA-648P, in one parcel, to the U.S. Department of Commerce, Bureau of Export Administration, Office of Export Licensing, P.O. Box 273, Washington, D.C. 20044. |

|

If you are unable to obtain a delivery verification within 60 days after the last shipment under this license, immediately notify the Offic of Export Licensing, by letter, giving a full explanation and the approximate date you expect to submit the document to the Office of Export Licensing. |

B. Please note the following provisions and requirements of the Export Administration Regulations:

1. |

Paragraph 375.7(a) requires that documents in a foreign language shall be accompanied by an accurate English translation. |

2. |

Paragraph 375.3(i) contains the delivery verification requirement provisions. |

|

A list of addresses where foreign importers may obtain import Certificates and Delivery verifications is included in Supplement No. 1 to Part 375 of the Export Administration Regulations. |

* The U.S. Department of Commerce Export Administration Regulations is a complication of offical regulations and policies governing the export loaning of commodities and mechanical data. This publication and supplementary Export Administration Bulletins may be examined free of change at any ITA District Office, U.S. Department of Commerce. Paid subscriptions may be placed with the Superintendent of Documents, U.S. Government Printing Office, D.C. 20402

FORM BXA-648P (REV. 2-83)

U.S. DEPARTMENT OF COMMERCE |

|

FROM APPROVED: OMB NO. 0694-0088,0694-0089 |

Bureau of Export Administration |

MULTIPURPOSE APPLICATION FORM

GENERAL INSTRUCTIONS

A. USE OF THIS FORM. Use this form to submit either a Classification request or an application for a license to Export or Reexport Items subject to the export licensing authority of the U. S. Department of Commerce.

B. WHO MAY APPLY. Anyone may submit a classification request or a license application for the reexport of commodities, software, or technology. License applications for the export of items from the United States may be made only by a person subject to the jurisdiction of the United States. An application may be made on behalf of a person not subject to the jurisdiction of the United States by an authorized agent in the United States. Refer to $748.5 of the Export Administration Regulations (EAR) for additional Information.

C. WHAT TO SUBMIT. Consult part 748 of the EAR for Instructions on documentation that you may need to submit with your application. Remove this cover page along with the last page of this application and firmly attach any required support documentation. (Do not separate the remaining pages In this package and note the Application Control Number on all attached support documents.) This last page contains your Application Control Number, necessary to track your application during processing at the Bureau of Export Administration (BXA). Refer to $750.5 of the EAR for additional Information on these services.

D. DUPLICATE APPLICATIONS. You may not submit a second application for a license covering the same proposed transaction while your first application Is pending with BXA.

E. ASSISTANCE AND ADDITIONAL COPIES. To order small quantities of this form, or to request assistance on this or other export control matters, contact the Exporter Counseling Division on (202) 482-4811 or BXA’s Western Regional Office in Newport Beach, California on (714) 680-0144 or Santa Clara, California on (408) 748-7450. Copies may also be obtained from any U.S. Department of Commerce, International Trade Administration District Office. To order large quantities of this form, write BXA’s Operations Support Division. P.O. Box 273, Washington, D.C. 20044. telephone (202) 482-3332. or fax (202) 219-9179.

F. COMPLIANCE WITH THE EAR. Additional Information necessary to properly complete and file this application is contained in the EAR, codified at 15 CFR 730 et seq, with changes published in the Federal Register. BXA also publishes a looseleaf version of the EAR, with changes issued in the form of supplements titled Export Administration Bulletins and offers the EAR on-line. If you wish to subscribe to the print or electronic version of the EAR, contact the United States Government Information, Superintendent of Documents, P.O. Box 371954, Pittsburgh, PA 15250-7954; or by telephone (202) 512-1800; or by facsimile (202) 512-2250.

SPECIFIC INSTRUCTIONS

This application will be processed using an Optical Character Recognition (OCR) System. Type using 10 or 12 pitch. Do not use script type faces. Information must be placed within the space provided. Do not go through or outside lines. Failure to complete the form as requested will significantly delay processing of the form and could result in the return of your application. If a Block or Box does not apply to your application, leave It blank.

All information must be legibly typed within the lines for each Block or Box except where a signature is required. Enter only one typed line of text per block or line. Where there is a choice of entering telephone numbers or facsimile numbers, and you wish to provide a facsimile number instead of a telephone number, identify the facsimile number with the letter “F” immediately after the number (e.g., 011-358-0-123456F).

If you are completing this form to request classification of your item, you must complete Blocks 1 through 5, 14, 22(a), (b), (c), (d), and (I), 24 and 25 only.

Block 1: |

CONTACT PERSON. Enter the name of the person who can answer questions concerning the application. |

Block 2: |

TELEPHONE. Enter the telephone number of the person who can answer questions concerning the application. |

Block 3: |

FACSIMILE. Enter the facsimile number. If available, of the person who can answer questions concerning the application. |

Block 4: |

DATE OF APPLICATION. Enter the current date. |

Block 5: |

TYPE OF APPLICATION. Export, if the items are located within the United States, and you wish to export those Items, mark the Box labeled “Export” with an (X). Reexport. If the items are located outside the United States, mark the Box labeled “Reexport” with an (X). Classification. It you are requesting BXA to classify your item against the Commerce Control List (CCL), mark the Box labeled “Classification Request” with an (X). Special Comprehensive License. If you are submitting a Special Comprehensive License In accordance with procedures described in part 752 of the EAR, mark the Box labeled “Special Comprehensive License” with an (X). |

Block 6: |

DOCUMENTS SUBMITTED WITH APPUCATION. Review the documentation you are required to submit with your application in accordance with the provisions of part 748 of the EAR, and mark all applicable Boxes with an (X). |

|

Mark the “Foreign Availability” Box with an (X) if you are submitting en assertion of foreign availability with your licanse application. See part 768 of the EAR for instructions on foreign availability submissions. |

|

Mark the “Tech. Specs.” Box with an (X) if you are submitting descriptive literature, brochures, technical specifications, etc. with your application. |

Block 7: |

DOCUMENTS ON FILE WITH APPLICANT. Certify that you have retained on file all applicable documents as required by the provisions of part 748 of the EAR by placing an (X) In the appropriate Box(es). |

Block 8: |

SPECIAL COMPREHENSIVE LICENSE. Complete this Block only if you are submitting en application for a Special Comprehensive License in accordance with part 752 of the EAR. |

Block 9: |

SPECIAL PURPOSE. Complete this Block for certain items or types of transactions only if specifically required in Supplement No. 2 to part 748 of the EAR. |

Block 10: |

RESUBMISSION APPLICATION CONTROL NUMBER. If your original application was returned without action (RWA), provide the Application Control Number and complete Blocks 1 through 25. This does not apply to applications returned for additional information. |

Block 11: |

REPLACEMENT LICENSE NUMBER. If you have received a license for identical items to the same ultimate consignee, but would like to make a modification that is not excepted in §750.7(c) of the EAR. to the license as originally approved, enter the original license number and complete remaining Blocks 12 through 25, whichever applicable. |

Block 12: |

ITEMS PREVIOUSLY EXPORTED. This Block should be completed only If you have marked the “Reexport” box in Block 5. Enter the License number, License Exception symbol (for exports under General Licenses, enter the appropriate General License symbol), or other authorization under which the items were originally exported, if known. |

Block 13: |

IMPORT/END-USER CERTIFICATE. Enter the name of the country and number of the Import or End-user Certificate obtained in accordance with the provisions of part 748 of the EAR. |

Block 14: |

APPLICANT. Enter the applicant’s name, street address, city, state/country, and postal code. Provide a complete street address. P.O. Boxes are not acceptable. Refer to $748.5(a) of EAR for a definition of “Applicant”. If you have marked “Export” in Block 5. you must include your company’s Employer Identification Number unless you are filing as an individual or as an agent on behalf of the exporter. The Employer Identification Number is assigned by the internal Revenue Service for tax identification purposes. Accordingly, you should consult your company’s financial officer or accounting division to obtain thie number. |

Block 15: |

OTHER PARTY AUTHORIZED TO RECEIVE LICENSE. If you would like BXA to transmit the approved license to another party designated by you, complete ell Information in this Block, including name, street address, city, state/country, postal code and telephone number. Leave this space blank if the license is to be sent to the applicant. Designation of another party to receive the license does not alter the responsibilities of the applicant. |

Block 16: |

PURCHASER. Enter the purchaser’s complete name, complete street address, city, country, postal code and telephone or facsimile number. Refer to $748.5(c) of the EAR for a definition of “purchaser”. If the purchaser is also the ultimate consignee, enter complete name and address. |

INTERMEDIATE CONSIGNEE. Enter the Intermediate consignee’s name, street address, city, country, postal code and telephone or facsimile number. Refer to §748.5(d) of the EAR for a definition of “Intermediate consignee”. If this party is identical to that listed in Block 16, enter complete name and address. If your proposed transaction involves use of more than one intermediate consignee, provide the same information in Block 24 for each additional intermediate consignee. |

|

Block 18: |

ULTIMATE CONSIGNEE. This Block must be completed if you are submitting a license application. Enter the ultimate consignee’s complete name, street address, city, country, postal code and telephone or facsimile number. Provide a complete street address. P.O. Boxes are not acceptable. The ultimate consignee is the party who will actually receive the material for the end-use designated in Block 21. Refer to §748.5(e) of the EAR for the definition of “ultimate consignee”. A bank, freight forwarder, forwarding agent, or other intermediary may not be identified as the ultimate consignee. Government purchasing organizations are the sole exception to this requirement. This type of entity may be identified as the government entity that is the actual ultimate consignee in those instances when the items are to be transferred to a government entity that is the actual end-user, provided the actual end-use and end-user is clearly identified In Block 21 or in additional documentation attached to the application. |

|

If your application is for the reexport of items previously exported, enter the new ultimate consignee’s complete name, street address, city, country, postal code and telephone or facsimile number. Provide a complete street address. P.O. Boxes are not acceptable. If your application involves a temporary export, or reexport, the applicant should be shown as the ultimate consignee in care of (i.e.C/O) a person or entity who will have control over the items abroad. |

Block 19: |

END-USER. Complete this Block only if the ultimate consignee identified in Block 18 is not the actual end user. If there will be more than one end-user, use Form BXA-748-P-B to identify each additional end-user. Enter each end-user’s complete name, street address, city, country, postal code and telephone or facsimile number. Provide a complete street address. P.O. Boxes are not acceptable. |

Block 20: |

ORIGINAL ULTIMATE CONSIGNEE. If your application involves the reexport of items previously exported, enter the original ultimate consignee’s complete name, street address, oountry, postal code and telephone or facsimile number. Provide a complete street address. P.O. Boxes are not acceptable. The original ultimate consignee is the entity identified in the original application for export as the ultimate consignee or the party currently in possession of the items. |

Block 21: |

SPECIFIC END-USE This Block must be completed if you are submitting a license application. Provide a complete end detailed description of the end-use intended by the ultimate consignee and/or end-user(s). If you are requesting approval of a reexport, provide a complete and detailed description of the end-use intended by the new ultimate consignee or end-user(s) and indicate any other countries for which resale or reexport is requested. If additional space is necessary, use Block 21 on Form BXA-748P-A or B. Be specific. Such vague descriptions as “research”, “manufacturing”, or “scientific uses” are not acceptable. |

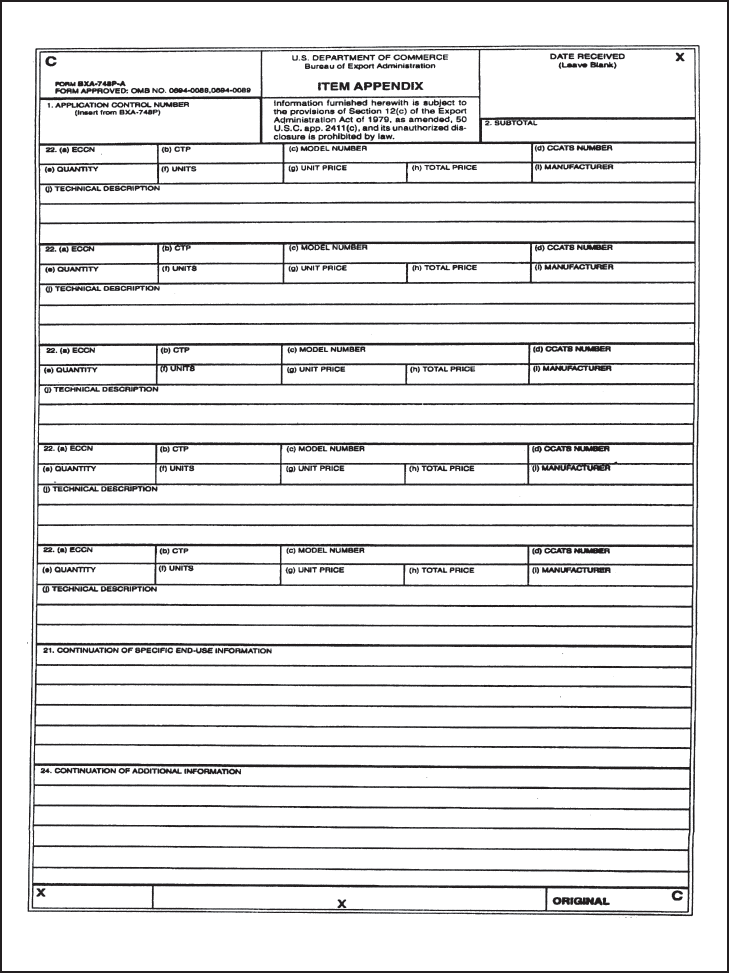

Block 22: |

FOR A LICENSE APPUCATION YOU MUST COMPLETE EACH OF THE SUB-BLOCKS CONTAINED IN THIS BLOCK. If you are submitting a classification request, you need not complete Blocks (e), (f), (g), end (h). If you wish to export, reexport or have BXA classify more than one item, use Form, BXA-748P-A for additional items. |

(a) |

ECCN. Enter the Export Control Classification Number (ECCN) that corresponds to the item you wish to export or reexport. If you are asking BXA to classify your item, provide a recommended classification for the item in this Block. |

(b) |

CTP. You must complete this Block if your application involves a digital computer or equipment containing a digital computer as described in Supplement No. 2 to part 748 of the EAR. Instructions on calculating the CTP are contained in a Technical Note at the end of Category 4 in the CCL. |

(c) |

MODEL NUMBER. Enter the correct model number for the item. |

(d) |

CCATS NUMBER. If you have received a classification for this item from BXA, provide the CCATS number, shown on the classification issued by BXA. |

(e) |

QUANTITY. Identify the quantity to be exported or reexported, in terms of the “Unit” identified for the ECCN entered In Block 22(a). If the “Unit for an item is “$ Value”, enter the units commonly used in trade. |

(f) |

UNITS. The “Unit of Measure” paragraph within each ECCN will list a specific “Unit” for those items controlled by the entry. The “Unit” must be entered on all license applications submitted to BXA. If an item is licensed in terms of “$ Value”, the unit of quantity commonly used in the trade must also be shown on the license application. This may be left blank on license applications only if the “Unit” for the ECCN entered in Block 22(a) is shown as “N/A” on the CCL. |

(g) |

UNIT PRICE. Provide the fair market value of the items you wish to export or reexport. Round all prices to the nearest whole dollar amount. Give the exact unit price only if the value is less than $0.50. If normal trade practices make it impractical to establish a firm contract price, state in Block 24 the precise items upon which the price is to be ascertained and from which the contract price may be objectively determined. |

(h) |

TOTAL PRICE. Provide the total price of the item(s) described in Block 22(j). |

(i) |

MANUFACTURER. Provide the name only of the manufacturer. If known, for each of the items you wish to export, reexport, or have BXA classify, if different from the applicant. |

(j) |

TECHNICAL DESCRIPTION. Provide a description of the item(s) you wish to export, reexport, or have BXA classify. Provide details when necessary to identify the specific item(s), and include all characteristics or parameters shown in the applicable ECCN using measurements identified in the ECCN (e.g., basic ingredients, composition, electrical parameters, size gauge, grade, horsepower, etc.). These characteristics must be identified for the items in the proposed transaction when they are different from the characteristics described in a promotional brochure. |

Block 23: |

TOTAL APPLICATION VALUE. Enter the total value of all items contained on the application in U.S. Dollars. The use of other currencies is not acceptable. |

Block 24: |

ADDITIONAL INFORMATION. Enter additional data pertinent to the application as required in the EAR. Include special certifications, names of parties in interest not disclosed elsewhere, explanation of documents attached, etc. Do not include information concerning Block 22 in this space. |

|

If your application represents a previously denied application, you must provide the Application Control Number from the original application. |

|

If you are asking BXA to classify your product, use this space to explain why you believe the ECCN entered in Block 22(a) is appropriate. This explanation must contain an analysis of the item in terms of the technical control parameters specified in the appropriate ECCN. If you have not identified a recommended classification in Block 22(a), you must state the reason you cannot determine the appropriate classification, identifying any ambiguities or deficiencies in the regulations that precluded you from determining the correct classification. |

|

If additional space is necessary, use Block 24 on Form BXA-748P-A or B. |

Block 25: |

SIGNATURE. You as the applicant, or a duly authorized agent of the applicant, must manually sign in this Block. Rubber-stamped or automated signatures are not acceptable. If you are an agent of the applicant, in addition to providing your name in this Block you must enter your company’s name in Block 24. Type both your name and title in the spaces provided. |

MAIL APPLICATION TO: |

COURIER DELIVERIES TO: |

OFFICE OF EXPORTER SERVICES |

OFFICE OF EXPORTER SERVICES |

P.O. BOX 273 |

ROOM 2706 |

WASHINGTON, D.C. 20044 |

14TH & PENNSYLVANIA AVE., N.W. |

|

WASHINGTON. D.C. 20230 |

Public reporting burden for this collection of information is estimated to average 45 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to Roben F. Kugleman. Director of Administration, U.S. Department of Commerce, Bureau of Export Administration, Room 3859, Washington, D.C. 20230 |

|

INCOMPLETE APPLICATIONS WILL BE RETURNED FOR THE NECESSARY INFORMATION AND/OR DOCUMENTATION. DETACH THIS SHEET AT PERFORATION.

INSTRUCTIONS STATEMENT OF REGISTRATION

1. |

Complete all items. If "none" applies to an item, so state. If more space is required to complete an item, use plain white paper. |

2. |

Item 1. Show the business name, home office address and telephone number of the parent company, as it appears on federal income tax forms. |

3. |

Item 2. If you have been in the past, or are currently registered with the Directorate of Defense Trade Controls (DDTC), give your DDTC registrant code number. |

4. |

Item 3. Circle the number of years required and enter the amount of fee enclosed. Fee schedule: |

1 year |

$ 600 |

2 years |

$ 1,200 |

3 years |

$ 1,800 |

4 years |

$ 2,200 |

|

You are encouraged to register for the maximum period of four years to reduce administrative overhead and take advantage of the reduced fees. Do Not Send Cash. Make your check or money order payable to "U.S. Department of State." |

5. |

Item 4. Give the most applicable organizational description. |

6. |

Item 5. Indicate the nature of your business. |

7. |

Item 6. Enter the date (mm-dd-yyyy), city, county and state where your organization commenced doing business. |

8. |

Item 7. Enter the name, title, date (mm-dd-yyyy) and place of birth (city & state), social security number, residential address, and country of citizenship for all directors, officers, partners and owners. |

9. |

Item 8. Enter U.S. Munitions List (USML) category (part 121 of the International Traffic In Arms Regulations (ITAR)), generic name, and U.S. Government agency (if applicable) for which manufactured. |

10. |

Item 9. List U.S. subsidiaries, wholly or partially owned byregistrant, manufacturing and/or exporting USML articles or services. |

11. |

Item 10. List foreign subsidiaries, wholly or partially owned by registrant, that manufacture, export, and/or broker USML articles, technical data or services. |

12. |

Item 11. Give complete name, address, and telephone number of parent company. |

13. |

Item 12. Is the registrant owned and/or controlled by foreign person(s)? See § 122.2(2)(c) of the ITAR for definition of ownership or control. |

14. |

Item 13. Company or corporate divisions or subsidiaries may not register separately unless they are required by law to file separate federal tax returns. |

15. |

Item 14. The individual signing this form must be a senior official empowered by the intending registrant. Violations and penalties are explained in Part 127 of the ITAR. |

16. |

DTC will acknowledge in writing receipt of your application and fee, and assign a new registrant code number. |

17. |

IMPORTANT: Changes in the information contained in this application by law must be reported promptly to: (See § 122.4 of the ITAR). |

Office of Defence Trade Controls Compliance (Registration)

Directorate of Defense Trade Controls,

SA-1, Suite H1300

U.S. Department of State

Washington, DC 20522-0112

PRIVACY ACT AND PAPERWORK REDUCTION ACT STATEMENTS

AUTHORITIES: U.S. Department of State's authorities to register persons engaged in the business of manufacturing, exporting, or importing any defense article or defense service are 22 U.S.C. 2778 (b) (1) (A) (i) and 22 CFR Part 122. The authorities to register brokers are 22 U.S.C. 2778 (b) (1) (A)(ii) (I) and 22 CFR 129.3 and 129.4

PURPOSE: The purpose of registration is to provide the U.S. Government with necessary information on individuals and entities engaged in certain manufacturing, exporting and brokering activities.

ROUTINE USES: The information solicited on this form is made available as a routing use to appropriate agencies whether federal, state, local or foreign, for intelligence, law enforcement and administrative purposes or pursuant to a court order. It may also be used to send required reports to Congress about certain defense trade transactions.

SOCIAL SECURITY NUMBER: Disclosure of the social security number(s) is voluntary and for the purpose of facilitating coordination with the Department of Treasury to review the registration statement for law enforcement concerns in accord with 22 U.S.C. 2778 (b) (1) (B). Refusal to provide requested social security number, by itself, will not result in registration being denied, but may result in delays in the processing of a registration request.

*Public reporting burden for this collection of information is estimated to average 2 hours per response, including time required for searching existing data sources, gathering the necessary data providing the information required, and reviewing the final collection. Send comments on the accuracy of this estimate of the burden and recommendations for reducing it to: U.S. Department of State (A/RPS/DIR) Washington, DC 20520.

DS-2032