Accrual and Deferral Timing Differences

The measurement of net income requires that revenue be reported as it is earned, and that expenses offset revenue as incurred, regardless of when cash is received or disbursed. Dividing the life of an enterprise into arbitrary reporting periods—such as quarters or years—makes income measurement challenging, given that many revenue and expense transactions span multiple reporting periods. Thus, it is common for revenue and expenses to occur prior to, or following, the collection or payment of cash. These timing differences give rise to revenue and expense deferrals and accruals.

When cash collections occur before earning revenue, or cash disbursements occur before incurring expenses, the cash flow effects on net income must be deferred (postponed). Conversely, when revenue is earned before collecting cash, or expenses are incurred before disbursing cash, the income statement effects must be accrued immediately, even though related cash flows will not occur until a future reporting period.

Timing Differences

Figure 3.1 summarizes the effects of four common timing differences involving cash flows and income measurement:

Figure 3.1 Deferral and accrual timing differences

- Cash collections in prior periods affect revenue earned in the current period.

- Cash payments in prior periods affect expenses incurred in the current period.

- Revenues earned in the current period affect cash collections in future periods.

- Expenses incurred in the current period affect cash payments in future periods.

In the first and second timing differences, revenue and expenses were deferred (postponed) in a prior period, even though cash had been collected or paid. In the third and the fourth timing differences, revenue and expenses are accrued and reported immediately in the current period, even though cash will not be collected or paid until future periods. Each of these timing differences is discussed separately in the following sections.

Deferred Revenue Timing Differences

Deferred revenue timing differences occur when cash is received from customers prior to revenue being earned. Revenue was defined in Chapter 2 as increases in assets that result from providing goods and services to customers. In most situations, revenue should be recognized and reported in the income statement whenever all of the following conditions have been met:

- A contract has been established between the seller and the customer.

- The seller’s obligation is clearly identified.

- The contract price is measurable.

- The seller’s obligation has been satisfied, thereby completing the earnings process.

If one or more of these criteria is not satisfied, the recognition of revenue must be deferred.

In many industries, it is common for companies to receive cash from customers before completing the earnings process. For instance, airlines and cruise companies sell tickets well in advance of providing travel services; concert halls sell season tickets prior to performances being given; newspapers sell annual subscriptions before delivering papers; and health spas sell memberships in advance of patrons using their facilities.

Assume that an airline had received $50 million from advance ticket sales in a prior period. At the time these bookings were made, contracts had been established, the airline’s obligation was clearly identified, and contract prices were measurable. Nevertheless, the earnings process was not complete because travelers had not received any flight services.

Thus, the airline deferred reporting these advance sales as revenue in the prior period. Instead, it reported a $50 million liability in its balance sheet signifying a future obligation to either provide flight services or return the money. This obligation appears in the balance sheet as a current liability called unearned ticket revenue.1 As flight services for prior period bookings are provided in the current period, the $50 million liability in the balance sheet converts to revenue reported in the airline’s income statement.

Figure 3.2 illustrates the financial statement effects of a deferred revenue timing difference over multiple periods. Notice that as revenue is earned in the current period, the liability—unearned revenue—converts into earned revenue. The revenue increases net income reported in the income statement, which in turn increases retained earnings reported in the shareholders’ equity section of the balance sheet. Thus, what was a liability claim to assets in the prior period is converted to an equity claim in the current period as revenue is earned.

Figure 3.2 Deferred revenue

Deferred Expense Timing Differences

Deferred expense timing differences occur when cash is paid prior to expenses being incurred. Expenses were defined in Chapter 2 as decreases in assets that result from consuming resources to generate revenue. Until certain assets lose their potential to generate revenue, expenses associated with their acquisition costs are deferred.

As their revenue-generating potential expires over time, these assets convert to expenses, and their costs are matched with revenue in the measurement of net income.

Three common activities give rise to deferred expense timing differences: (1) prepaying expenses; (2) acquiring inventory; and (3) investing in fixed assets, such as buildings and equipment.

It is not uncommon for companies to pay for certain expenses before matching their costs with revenue in the income statement. For instance, television advertising is usually purchased prior to ads being aired; insurance is purchased prior to a policy’s start date; and rent is often paid at the beginning of a rental contract.

Assume that a company paid $12,000 in a prior period for a dozen television ads to be aired in a future period. Thus, the company initially deferred reporting any of this payment as advertising expense. Instead, the entire amount was reported in the balance sheet as a current asset with the potential to help generate future revenue. As the ads are aired in the current period, the asset—prepaid advertising—converts to advertising expense in the company’s income statement.

Figure 3.3 illustrates the financial statement effects of timing differences from prepaid expense deferrals over multiple periods. As expenses are incurred in the current period, an asset—prepaid expenses—converts into various expenses. The expenses decrease net income, which in turn decreases retained earnings reported in the shareholders’ equity section of the balance sheet. Thus, as prepaid expenses provide benefit in the current period, equity claims to assets decrease as various expenses are matched with revenue.2

Figure 3.3 Prepaid expense deferrals

Inventory Acquisition Deferrals

When companies acquire inventory, they do not immediately deduct its cost from sales revenue reported in the income statement. Instead, the inventory is reported as a resource—a current asset—in the balance sheet.3 Much like the prepaid expenses discussed previously, the income statement effect of acquiring inventory is deferred until it can be matched with revenue.

Assume that a company purchased inventory in a prior period for $5 million, and that none of it was initially sold. Thus, the company deferred reporting the cost of this inventory in its prior period income statement. Instead, it reported the inventory in its balance sheet as a current asset with the potential to help generate future revenue. As the inventory is sold in the current period, the $5 million asset converts to cost of goods sold and is subtracted from sales revenue reported in the income statement.

Figure 3.4 illustrates the financial statement effects of timing differences from inventory acquisition deferrals over multiple periods. As merchandise is sold in the current period, inventory converts to cost of goods sold. Cost of goods sold decreases net income, which in turn decreases retained earnings reported in the shareholders’ equity section of the balance sheet. Thus, as merchandise is sold in the current period, equity claims to assets decrease as cost of goods sold is matched with sales revenue.

Figure 3.4 Inventory acquisition deferrals

Fixed Asset Investment Deferrals

When companies make investments in fixed assets—such as buildings and equipment—they do not immediately report the cost of these assets in the income statement as deductions from revenue. Instead, they report these investments in the balance sheet as noncurrent assets.4 As discussed in Chapter 2, the income statement effects of fixed asset acquisitions are initially deferred, and subsequently matched with revenue over their estimated useful lives.

Assume that in a prior period a company acquired equipment costing $4 million. At the time of the purchase, the equipment’s estimated useful life was 20 years. Thus, the company initially deferred reporting any of the $4 million cost in its income statement. Instead, the entire amount was reported in the balance sheet as a noncurrent asset. Each year, as the equipment is used to help generate revenue, $200,000 of its cost in the balance sheet converts to depreciation expense in the income statement ($4 million ÷ 20 years = $200,000 per year).

Figure 3.5 illustrates the financial statement effects of timing differences from fixed asset investment deferrals over multiple periods. Each year, a portion of the investment’s historical cost converts to depreciation expense. Depreciation expense decreases net income reported in the income statement, which in turn decreases retained earnings reported in the shareholders’ equity section of the balance sheet. Thus, as fixed assets are depreciated in the current period, equity claims to assets decrease as depreciation expense is matched with revenue.

Figure 3.5 Fixed asset investment deferrals

Accrued Revenue Timing Differences

Accrued revenue timing differences occur when revenue is earned prior to cash being collected. When credit sales are made to customers, revenue is accrued and reported in the income statement, and an account receivable is reported in the balance sheet. As discussed in Chapter 2, revenue from credit sales is considered earned when a contract has been established between a seller and a customer, the seller’s obligation is clearly identified, the price is measurable, the seller’s obligation has been satisfied, and cash has been received or the likelihood of receiving cash is high.5

Many companies make all of their sales on credit. For instance, credit sales are commonplace for most wholesalers and manufacturers. These companies often ship large orders to customers worldwide, so collecting cash as deliveries are made is not feasible. In fact, cash sales exceed credit sales in only a few industries—examples include retail establishments such as restaurants, grocery stores, and gas stations.6

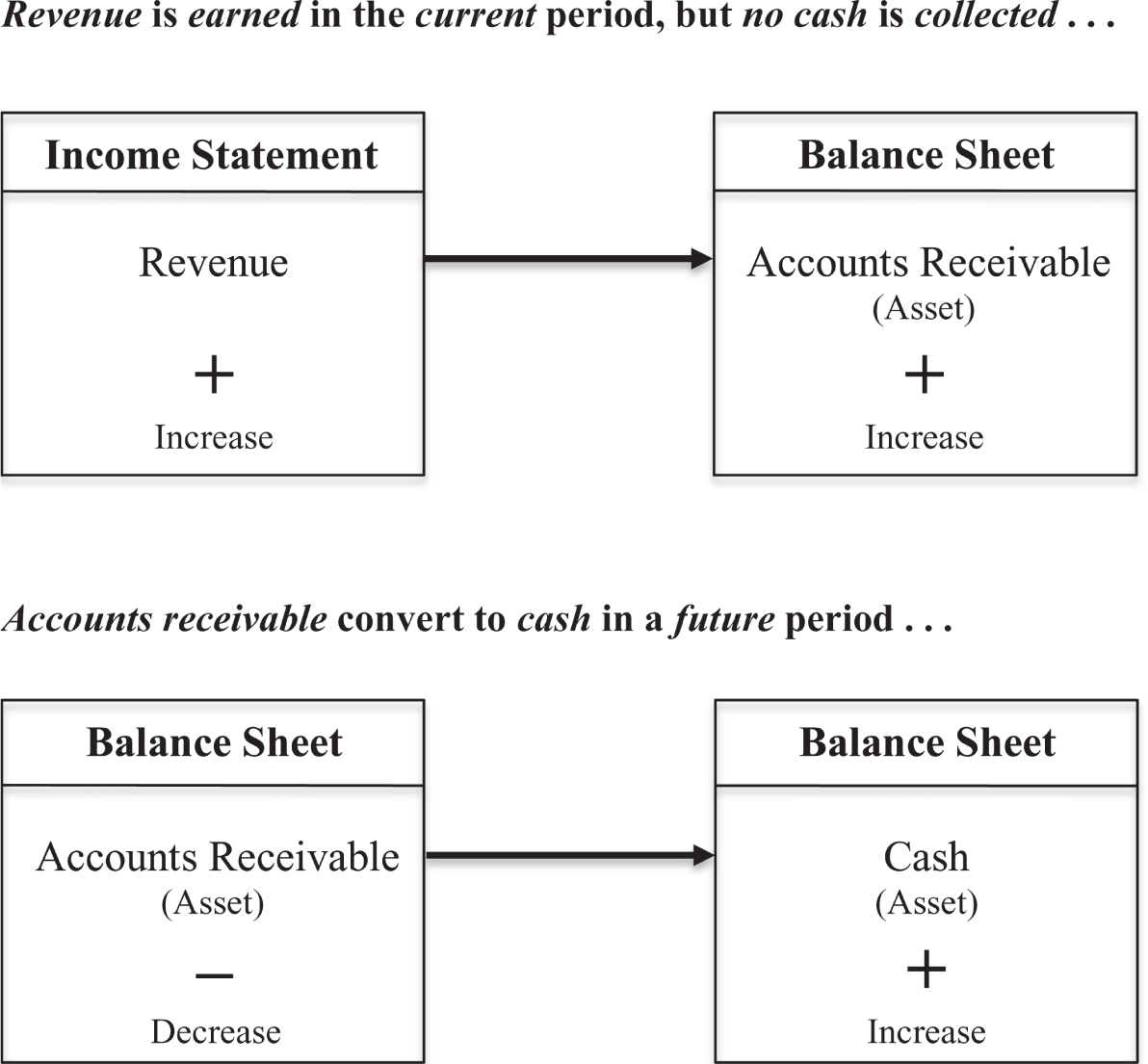

Assume that a company makes credit sales of $10 million in the current period, and that no cash will be collected until the following period. Thus, revenue of $10 million is reported in its current period income statement, and an account receivable of the same amount is reported in its balance sheet. As collections are made in the following period, cash replaces the $10 million accounts receivable in the balance sheet.

Figure 3.6 illustrates the financial statement effects of accrued revenue timing differences over multiple periods. As revenue is earned and accrued in the current period, accounts receivable—an asset—increases in the balance sheet. The accrued revenue increases net income in the income statement, which in turn increases retained earnings in the shareholders’ equity section of the balance sheet. Thus, as revenue is accrued, equity claims to assets increase. As collections are received in a future period, cash simply replaces accounts receivable in the balance sheet.

Figure 3.6 Accrued revenue

Accrued Expense Timing Differences

Accrued expense timing differences occur when expenses are incurred prior to cash being paid. As unpaid expenses are accrued, they are matched with revenue in the income statement, and a liability for the unpaid amount owed is reported in the balance sheet. There are many situations that give rise to accrued expenses. Three of the most common are accrued payroll expenses, accrued interest expense, and accrued income tax expenses.

Assume that a company processes payroll checks in the middle of each month. If its fiscal year ends on December 31, its last payroll distribution for the year will be on or around December 15. Thus, on December 31, it will owe its employees for approximately two weeks of work that will not be paid until mid-January of the upcoming year. If on December 31 employees have earned $2 million since being paid on December 15, the company will accrue payroll expenses of $2 million to be included in the current year’s income statement and report a current liability—accrued salaries and wages payable—in the balance sheet for the same amount.

Figure 3.7 illustrates the financial statement effects of accrued expense timing differences over multiple periods. As various expenses are incurred and accrued in the current period, various payables—liabilities—increase in the balance sheet. The accrued expenses decrease net income in the income statement, which in turn decreases retained earnings in the shareholders’ equity section of the balance sheet. Thus, as expenses are accrued, equity claims to assets decrease. As payments are made in a future period, various accounts payable and cash decrease in the balance sheet.

Figure 3.7 Accrued expenses

Summary

If revenue were defined as cash inflow, and expenses were defined as cash outflow, the income statement and the statement of cash flows would be very similar. Such is not the case.

For financial reporting purposes, the income statement reports revenue when it is earned and expenses when they are incurred regardless of when cash is received or paid. Thus, timing differences exist between the components of net income reported in the income statement, and the components of net cash flow reported in the statement of cash flows. The balance sheet holds these timing differences until they reverse.

Most assets in the balance sheet are either previously accrued revenue that will increase future cash flow, or previously deferred expenses that will decrease future net income. Likewise, most liabilities reported in the balance sheet are either previously accrued expenses that will decrease future cash flow, or previously deferred revenue that will increase future net income.

Figure 3.8 illustrates how assets and liabilities in the balance sheet hold accrual and deferral timing differences examined throughout this chapter. Accrual timing differences reported as assets include various receivables that will become future cash collections, whereas the accrual timing differences held as liabilities include various payables that will become future cash disbursements. Deferral timing differences reported as assets include inventory, prepaid expenses, and depreciable fixed assets that will decrease future net income, whereas the deferral timing differences reported as liabilities include various unearned revenues that will become future increases in net income.

Figure 3.8 The balance sheet holds all timing differences

Timing differences play a key role in the coverage of financial statement analysis in Chapter 4. An understanding of deferrals and accruals makes it easy to see how profitable companies can sometimes experience cash flow problems, or how companies with healthy cash flows can sometimes be unprofitable.

____________

1A health spa might refer to this liability as unearned membership dues, whereas a newspaper might refer to it as unearned subscription revenue. Regardless of what the obligation is called, it represents a timing difference resulting from a deferral of revenue.

2For reporting purposes, most companies combine all of their prepayments together (such as prepaid advertising, prepaid insurance, and prepaid rent), and report the total amount in the balance sheet as prepaid expenses. As these assets convert to expenses (such as advertising expense, insurance expense, and rent expense), these expenses are often combined and appear in the income statement as part of selling, general, and administrative expenses.

3Inventory is initially reported as an asset regardless of whether it is purchased in ready-to-sell condition or manufactured, in-house.

4Intangible assets—such as patents, copyrights, and trademarks—are accounted for in similar fashion.

5Not all accrued revenue results from credit sales to customers. Revenue can also accrue on certain fixed-income investments. For instance, interest revenue can be earned before receiving any interest payments.

6Most retail businesses accept credit cards such as VISA and Discover; however, credit card sales are considered cash sales because they provide immediate payments to merchants.