Chapter 12

Preferred Stock

Steven V. Mann, Ph.D.

Professor of Finance The Moore School of Business University of South Carolina

Frank J. Fabozzi, Ph.D., CFA

Adjunct Professor of Finance School of Management Yale University

Preferred stock is an equity security, not a debt instrument, but it combines features of both common stock and debt. The preferred stockholder is entitled to cash dividends paid by the issuing corporation. Unlike the cash dividends paid to common shareholders, however, cash dividends paid to preferred shareholders are fixed by contract, usually at a specified dollar amount or percentage of their par or face value. So, in its most basic form, a share of preferred stock can be thought of as a perpetuity—an endless stream of cash dividends. The specified percentage is called the dividend rate; it need not be fixed, but may float over the life of the issue.

Almost all preferred stock limits the payments to be received by the security holder to a specified amount. Historically, there have been issues entitling the preferred stockholder to participate in earnings distribution beyond the specified amount (based on some formula). For instance, a preferred stock may pay additional cash dividends after all common dividends have been paid. A preferred stock with this feature is referred to as participating preferred stock. However, most preferred stock issued today is nonparticipating in that the cash flows received will never exceed those specified in the contract and may be less.

Failure to make preferred stock dividend payments cannot force the issuer into bankruptcy. Should the issuer not make the preferred stock dividend payment, usually made quarterly, one of two things can happen, depending on the terms of the issue. The dividend payment can accrue until it is fully paid. Preferred stock with this feature is called cumulative preferred stock. If a dividend payment is missed and the security holder must forgo the payment, the preferred stock is said to be noncumulative preferred stock. Failure to make dividend payments may result in the imposition of certain restrictions on management. For example, if dividend payments are in arrears, preferred stockholders might be granted voting rights and elect some number of directors. This is called contingent voting because their preferred shareholders’ right to vote is contingent on their dividends not being paid.

Preferred stock has some important similarities with debt, particularly in the case of cumulative preferred stock: (1) the returns to preferred stockholders promised by the issuer are fixed, and (2) preferred stockholders have priority over common stockholders with respect to dividend payments and distribution of assets in the case of bankruptcy. (The position of noncumulative preferred stock is considerably weaker.) Because of this second feature, preferred stock is called a “senior security” in that it is senior to common stock. On a balance sheet, preferred stock is classified as equity. It is important to note that the claim of preferred shareholders to the issuer’s assets in the event of bankruptcy differs when there is more than one class of preferred stock outstanding. For instance, first preferred stock’s claim to dividends and assets has priority over other preferred stock. Correspondingly, second preferred stock ranks below at least one other issue of preferred stock.

Almost all preferred stock has a sinking fund provision and these are structured similarly to those associated with debt issues. A sinking fund is a provision allowing for a preferred stock’s periodic retirement over its life span. Most sinking funds require a specific number of shares or a certain percentage of the original issue to be retired periodically, usually annually. Sinking fund payments can be satisfied by either paying cash and calling the required number of shares, usually at par, or delivering shares purchased in the open market. Most sinking funds give the issuer a noncumulative option to retire an additional amount of preferred stock equal to the mandatory requirement. This is called a “double-up” option. Preferred shares acquired to satisfy a sinking fund requirement are usually called “by lot.” This is, essentially, the random selection of preferred shares with computer programs.

EXHIBIT 12.1 Total Amount of Preferred Stock, Corporate Debt, and Common Stock Issued in U.S. (1999–2001)

| Year | U.S. Preferred Stock (000s $) | U.S. Corporate Debt (000s $) | U.S. Common Equity (000s $) |

| 1999 | 25,194,063 | 868,348,969 | 173,998,791 |

| 2000 | 8,535,606 | 839,746,371 | 213,446,398 |

| 2001 | 33,634,742 | 1,004,705,535 | 136,506,464 |

Source: Bloomberg Financial Markets

PREFERRED STOCK ISSUANCE

Of the three major types of securities used by corporations to finance their operations (common stock, debt, and preferred stock), preferred stock runs a distant third in terms of total dollars issued. Exhibit 12.1 presents the total amount (in thousands of dollars) in the United States of preferred stock, corporate debt, and common stock issued annually for the years 1999-2001. In Exhibit 12.2, we present the top 25 underwriters of preferred stock for 2001 and give the amount issued by each as well as the number of deals underwritten.

Since the early 1980s, there have been two fundamental shifts in the issuance pattern of preferred stock. First, historically, utilities have been the major issuers of preferred stock, accounting for more than half of each year’s issuance. Since 1985, major issuers have become financially oriented companies-finance companies, banks, thrifts, and insurance companies. Utilities now account for less than 30% of annual preferred stock issuance. Second, in the past, all preferred stock paid a fixed dividend. Today, the majority of preferred stock issued carries an adjustable-rate dividend.

Types of Preferred Stock

There are three types of preferred stock: (1) fixed-rate preferred stock, (2) adjustable-rate preferred stock, and (3) auction and remarketed preferred stock.

Fixed-Rate Preferred Stock

With fixed-rate preferred stock, the dividend rate is fixed as long as the issue is outstanding. Prior to 1982, all publicly issued preferred stock was fixed-rate preferred stock. As an illustration of this type, Exhibit 12.3 presents a Bloomberg “Preferred Security Display” screen of a Fannie Mae fixed-rate preferred stock. These shares were issued on September 30, 1998 with an issue price of $50 per share and carry a 5.25% dividend that is delivered quarterly or $0.65625 per share. Exhibit 12.4 presents the “Call Schedule” for this issue that indicates it can be called in whole or in part at any time on or after September 30, 1999 at a price of $50 per share. Fannie Mae must give notice of at least 30 days prior to a call.

EXHIBIT 12.2 Top 25 Underwriters of Preferred Stock for 2001

| Underwriter | Amount (000s $) | Deal Count | |

| 1 | Salomon Smith Barney | 11, 931,655 |

62 |

| 2 | Morgan Stanley | 7,676,900 |

36 |

| 3 | Merrill Lynch & Co. | 4,664,583 |

38 |

| 4 | Lehman Brothers | 2,852,250 |

20 |

| 5 | UBS Warburg | 1,916,687 |

22 |

| 6 | Bear Stearns & Co., Inc. | 762,500 |

3 |

| 7 | Bank of America | 575,000 |

1 |

| 8 | Goldman Sachs & Co. | 564,583 |

5 |

| 9 | J. P. Morgan | 350,000 |

2 |

| 10 | Bank One | 250,000 |

1 |

| 11 | Stifel, Nicolaus & Co., Inc. | 234,700 |

7 |

| 12 | Wachovia Corp. | 208,750 |

4 |

| 13 | Credit Suisse First Boston | 207,188 |

3 |

| 14 | Legg Mason Wood Walker | 170,500 |

5 |

| 15 | FleetBoston Corp. | 125,000 |

1 |

| 16 | Ferris, Baker Watts, Inc. | 119,500 |

2 |

| 17 | Advest, Inc. | 103,500 |

1 |

| 18 | A. G. Edwards & Sons, Inc. | 100,521 |

5 |

| 19 | First Tennessee Bank | 100,000 |

1 |

| 20 | Sandler OșNeil & Partners | 100,000 |

1 |

| 21 | Wells Fargo Bank | 100,000 |

1 |

| 22 | Janney Montgomery Scott | 100,000 |

1 |

| 23 | Howe Barnes Investments, Inc. | 91,475 |

6 |

| 24 | Banco Bilbao Vizcaya Argentaria | 80,000 |

1 |

| 25 | Ryan Beck & Co. | 60,000 |

1 |

Source: Bloomberg Financial Markets

EXHIBIT 12.3 Bloomberg’s Preferred Security Display for Fannie Mae Preferred Stock

Source: Bloomberg Financial Markets

EXHIBIT 12.4 Bloomberg’s Call Schedule for Fannie Mae Preferred Stock

Source: Bloomberg Financial Markets

Adjustable-Rate Preferred Stock

For adjustable-rate preferred stock (ARPS), the dividend rate is reset quarterly based on a predetermined spread from the highest of three points on the Treasury yield curve. The predetermined spread is called the dividend reset spread. The three points on the yield curve (called the benchmark rate) to which the dividend reset spread is either added to or subtracted from is the highest of (1) the 3-month Treasury bill rate, (2) the 10-year constant maturity rate, or (3) a 10-year or 30-year constant maturity rate. Correspondingly, the dividend reset spread may be expressed as a certain percentage of the benchmark rate. As an example, Citigroup has preferred stock outstanding issued in August 1994 where the dividend rate is 84% of the highest of the 3-month U.S. Treasury bill rate, the 10-year CMT, and the 30-year CMT. This issue is callable at the issue price of $25. The motivation for linking the dividend rate to the highest of the three points on the Treasury yield curve is to provide the investor with protection against unfavorable shifts in the yield curve. However, since the U.S. Treasury yield curve is upward-sloping most of the time, the dividend rate is effectively tied to the long-term Treasury rate.

Auction Rate and Remarketed Preferred Stock

Most ARPS are perpetual, with a floor and ceiling imposed on the dividend rate of most issues. Because most ARPS are not putable, however, ARPS can trade below par if after issuance the spread demanded by the market to reflect the issuer’s credit risk is greater than the dividend reset spread. The popularity of ARPS declined when instruments began to trade below their par value because the dividend reset rate is determined at the time of issuance, not by market forces. In particular, if an issuer’s credit risk deteriorates, the dividend rate formula remains unchanged and the value of the preferred stock will decline. In 1984, a new type of preferred stock, auction rate preferred stock, was designed to overcome this problem, particularly for corporate treasurers who sought tax-advantaged short-term instruments to invest excess funds. The dividend rate on auction rate preferred is reset periodically, as with ARPS, but the dividend rate is established through a Dutch auction process.1 Participants in the auction consist of current holders and potential buyers. The dividend rate that participants are willing to accept reflects current market conditions as well as commercial paper rates that typically serve as benchmarks. Auction rate preferred stock’s dividend rate is reset every 28 or 49 days.

EXHIBIT 12.5 Bloomberg’s Call Schedule for Fannie Mae Preferred Stock

Source: Bloomberg Financial Markets

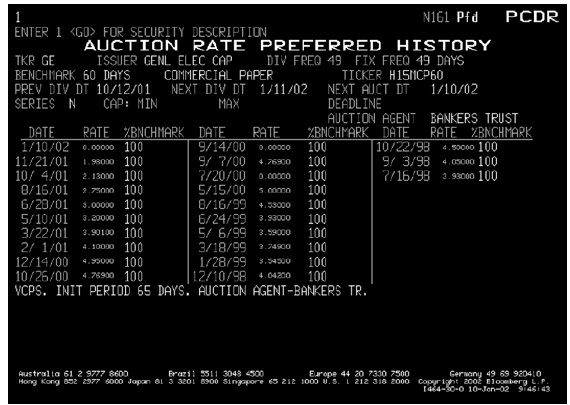

As an illustration, GE Capital issued some auction rate preferred stock in December 1990. Exhibit 12.5 presents the Bloomberg “Preferred Security Display” screen for this issue. Exhibit 12.6 presents the Bloomberg “Auction Rate Preferred History” screen. We see at the top of the screen that the benchmark rate is the 60-day commercial paper rate and the reset frequency is 49 days. The bottom portion of the screen presents the dividend history.

In the case of remarketed preferred stock, the dividend rate is determined periodically by a remarketing agent who resets the dividend rate so that any preferred stock can be tendered at par and can be resold (remarketed) at the original offering price. An investor has the choice of dividend resets every 7 days or every 49 days. As an example, Exhibit 12.7 presents a Preferred Security Display screen for some remarketed preferred stock issued by a closed-end fund of Duff and Phelps in November 1988. Note three things about the issue. First, the dividend reset is every 49 days. Second, there is a mandatory redemption date of November 28, 2012. Third, the issue is callable on any payment date at par (i.e., $100,000) plus accrued dividends.

EXHIBIT 12.6 Bloomberg’s Auction Rate Preferred History for GE Capital Auction Rate Preferred Stock

Source: Bloomberg Financial Markets

EXHIBIT 12.7 Bloomberg’s Preferred Security Display for Duff & Phelps Remarketed Preferred Stock

Source: Bloomberg Financial Markets

PREFERRED STOCK RATINGS

As with corporate debt instruments, preferred stock is rated. A preferred stock rating is an assessment of the issuer’s ability to make timely dividend payments and fulfill any other contractually specified obligations (e.g., sinking fund payments). The three nationally recognized statistical rating organizations (NRSROs) that rate corporate bonds also rate preferred stock-Fitch, Moody’s Investors Service, Inc., and Standard & Poor’s Ratings Group.

Symbols used by the NRSROs for rating preferred stock are the same as those used for rating long-term debt. However, it is important to note the rating applies to the security issue in question and not to the issuer per se. As such, two different securities issued by the same firm could have different ratings. Panels A and B of Exhibit 12.8 show a Bloomberg screen with the S&P’s preferred stock rating definitions. At the bottom of Panel B, it indicates that S&P attaches “ + ”s and “–”s which are called “notches” to denote an issue’s relative standing within the major ratings categories. Moody’s attaches “1”s, “2”s, and “3”s to indicate the same information.

EXHIBIT 12.8 Panel A: Standard & Poor’s Preferred Stock Ratings Definitions

Source: Bloomberg Financial Markets

Tax Treatment of Dividends

Unlike debt, payments made to preferred stockholders are treated as a distribution of earnings. This means that they are not tax deductible to the corporation under the current tax code.2 Interest payments are tax deductible, not dividend payments. While this raises the after-tax cost of funds if a corporation issues preferred stock rather than borrowing, there is a factor that reduces the cost differential: a provision in the tax code exempts 70% of qualified dividends from federal income taxation if the recipient is a qualified corporation. For example, if Corporation A owns the preferred stock of Corporation B, for each $100 of dividends received by A, only $30 will be taxed at A’s marginal tax rate. The purpose of this provision is to mitigate the effect of double taxation of corporate earnings.

There are two implications of this tax treatment of preferred stock dividends. First, the major buyers of preferred stock are corporations seeking tax-advantaged investments. Second, the cost of preferred stock issuance is lower than it would be in the absence of the tax provision because the tax benefits are passed through to the issuer by the willingness of corporate investors to accept a lower dividend rate.

CONVERTIBLE PREFERRED STOCK

Some preferred stock is convertible into the common stock of the issuer. The conversion feature grants the preferred shareholder the right to convert a share of preferred stock into a predetermined amount of common stock of the issuer. A convertible preferred stock is preferred stock with an embedded call option on the common stock. However, most convertible preferred stock issues are also callable which, in essence, allows the issuer to force the preferred shareholders to either convert their preferred stock into common stock or redeem their shares for cash.

To understand the preferred stockholder’s decision when their shares are called, we must define some terms. First, the preferred stock’s conversion value is the number of common shares into which one share of a preferred stock can be converted multiplied by the current share of the common stock. Second, the effective call price is the sum of the nominal call price applicable at the time of the call plus any accrued dividends.3 Given this backdrop, if a convertible issue is called, the preferred shareholder’s decision is generally straightforward. If the effective call price is greater than the conversion value, the preferred shareholder will surrender the security in exchange for its redemption value. If the conversion value is greater than the effective call price, the preferred shareholder will convert the shares into common stock. Firms usually call preferred stock issues when they are “in-the-money” (i.e., the conversion value exceeds the call price). Thus, a call of an “in-the-money” preferred stock is known as a “conversion-forcing-call.”

As an illustration of callable and convertible preferred stock, consider a preferred stock issued by Western Gas Resources which has an annual cash dividend of $2.6250 per share, payable quarterly. Exhibit 12.9 presents the Bloomberg Preferred Security Display screen for this issue. Each of these preferred shares is convertible until December 31, 2049 into 1.2579 common shares at any time. The preferred shares were callable at a price of $50.79. The parity price is the conversion value that is the market price of the common stock ($30.61) multiplied by the number of common shares into which a preferred share can be converted (1.2579). Correspondingly, the premium is the ratio of the preferred stock’s market value divided by the conversion value expressed as a percentage. Investors pay a premium to buy the common shares via the convertible preferred stock because the conversion feature represents an embedded call option on the common stock that need only be converted when it is in the best interest of the convertible preferred investor. The investor’s downside risk is limited to the straight value of the preferred stock (i.e., the value of the convertible preferred stock without the conversion feature).

Convertible Preferred Stock with Special Features

The mid-1990s witnessed an explosion of innovations in convertible preferred shares with special features. In this last section of the chapter, we sketch some of the major types.

EXHIBIT 12.9 Bloomberg’s Preferred Security Display for Western Gas Resources Convertible Preferred Stock

Source: Bloomberg Financial Markets

Trust Originated Preferred Securities

Trust Originated Preferred Securities (TOPrS) are convertible preferred securities that differ from the convertible preferred shares just described in that the issuer may deduct the cash dividends for tax purposes yet still receive partial equity credit from the rating agencies. The primary issuer sets up a Delaware statutory business trust to issue the securities to the investing public but the securities are guaranteed by the primary issuer. TOPrS’ dividend payments are not subject to the 70% dividend exclusion and the issuer may defer dividends up to 20 quarters (5 years). However, if the dividends are deferred, the primary issuer may not pay dividends to common or preferred shareholders and TOPrS dividends accrue and compound quarterly. TOPrS are usually callable beginning 3 to 5 years from the date of issuance and usually mature in 20-30 years. Due to their tax treatment and the possibility of dividend deferrals, TOPrS carry a relatively higher dividend yield than other preferred stock.

A Miscellany of Acronyms

There are a host of convertible preferred products that provide investors with higher dividend yields and limited participation in the upside potential of common stock underlying the convertible. Dividend Enhanced Convertible Stocks (DECS) created by Salomon Smith Barney and Preferred Redeemable Increased Dividends Equity Securities (PRIDES) created by Merrill Lynch are two prominent examples. These convertible preferred securities offer high dividend yields, mandatory conversion at maturity (usually 3 to 4 years), and conversion ratios that adjust downward as the underlying common stock appreciates, thereby limiting the upside potential.

Another similar type of convertible preferred security is Preferred Equity Redemption Cumulative Stock (PERCS) which was created by Merrill Lynch. PERCS also offer a high dividend yield and require mandatory conversion at maturity, but cap the investor’s upside potential by adjusting the conversion ratio at maturity so that the investor receives a fixed dollar amount of common stock.4