Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - Realtek

For Immediate Release - September 3, 2003

Contact: BIS Public Affairs - 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Freight Forwarder Settles Charge of Dealing with a Denied Person

The U.S. Department of Commerce announced today that Expeditors International of Washington, Inc. (Expeditors), a Seattle, Washington based freight forwarder, has agreed to pay a civil penalty of $5,000 to resolve charges that it facilitated an export to a company in Taiwan that was, at the time, denied U.S. export privileges.

The Commerce Department’s Bureau of Industry and Security (BIS) charged that, In December of 1996, Expeditors violated the terms of a Department of Commerce order denying the export privileges of Realtek Semiconductor Co., Ltd. (Realtek), in Taiwan, when it forwarded commercial air-conditioning units to Realtek. Firms that are subject to such denial orders may not participate in any transaction that is subject to the Export Administration Regulations (EAR). It is a violation of the EAR for anyone to participate in an export transaction in which a denied person also participates.

The Department settled related charges against Realtek in December of 2002. Realtek is no longer subject to a denial order.

“Those involved in international trade, especially freight forwarders, must ensure that they are not dealing with denied persons. To assist industry in fulfilling this responsibility, the Commerce Department maintains a list of persons currently subject to denial orders on its Web site,” said Acting Assistant Secretary for Export Enforcement Lisa Prager.

Acting Assistant Secretary Prager commended the Boston Field Office and Special Agent Edward Carrigan who investigated the case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News 2003 - W.R. Grace & Co.

For Immediate Release - August 3, 2003

Contact: BIS Public Affairs 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Fine Imposed on Massachusetts Company to Settle

Allegations of Chemical Exports Without Licenses

The U.S. Department of Commerce announced today that W.R. Grace & Co.-Conn. (W.R. Grace), of Cambridge, Massachusetts, has agreed to pay a civil penalty of $178,500 to settle allegations that W.R. Grace violated the Export Administration Regulations (EAR) by shipping chemicals without the required export licenses. The payment of the penalty will be subject to the outcome of bankruptcy proceedings involving W.R. Grace in the U.S. Bankruptcy Court for the District of Delaware.

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that W.R. Grace exported triethanolamine on 51 occasions to end-users in Brazil, the Dominican Republic, Hong Kong, Mexico, the Philippines, Singapore, Thailand, and Venezuela without the required licenses. Exports of triethanolamine require a license because the substance can be used to manufacture chemical weapons. W.R. Grace voluntarily disclosed the violations to BIS and cooperated fully in the investigation.

Acting Assistant Secretary for Export Enforcement Lisa A. Prager commended Special Agent James Brigham of BIS’s Boston Field Office for his efforts in this investigation.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - E&M Computing

For Immediate Release

August 18, 2003

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

E & M Computing Ltd. of Israel Fined for Unauthorized Computer Sales

The U.S. Department of Commerce announced today the imposition of a $165,000 fine and a three-year denial of export privileges on E & M Computing Ltd. (E&M), of Ramat-Gan, Israel, to settle multiple charges that the company violated the Export Administration Regulations (EAR) when it sold and serviced computers and computer components to three customers in Israel, including a nuclear research center. The denial period was suspended for three years, and will thereafter be waived if the company does not violate U.S. export control laws during the period of suspension.

The Commerce Department’s Bureau of Industry and Security (BIS) charged that E&M caused the export of central processing units (CPUs), a workstation, a server, and a high performance computer to Israel without the required export licenses. BIS also charged that E&M evaded the EAR by purchasing computers from another vendor after learning that BIS would deny the first vendor’s license application to export the items.

In addition, BIS charged that E&M “loaned” a computer to a customer until a BIS license could be obtained, and then provided false and misleading information in support of the license application. E&M later attempted to avoid detection of this loan by removing the computer from the end-user when they were notified that BIS officials were planning to conduct a post-shipment verification.

In other instances, E&M upgraded computers above the export control threshold with CPUs from its own warehouse. E&M also sold or loaned a server to a customer without authorization, after learning that a BIS license was required. Finally, E&M failed to disclose these upgrades to BIS when filing notifications required by the National Defense Authorization Act of 1998.

“This case demonstrates that companies may not evade the license requirements on exports of computer equipment by making illegal upgrades and transfers in-country. BIS will continue to pursue efforts by companies to circumvent U.S. export controls,” said Acting Assistant Secretary of Commerce for Export Enforcement Lisa Prager.

Acting Assistant Secretary Prager commended Special Agent Erin Kelly of BIS’s San Jose Field Office for her efforts in this investigation.

United States Department of Justice

United States Department of Justice

ROSCOE C. HOWARD, JR.

United States Attorney for the

District of Columbia

Judiciary Center

555 Fourth St. N.W.

Washington, D.C. 20530

For Information Contact

DOJ Public Affairs

Channing Phillips (202) 514-6933

or BIS Public Affairs

(202) 482-2721

FOR IMMEDIATE RELEASE - Tuesday, August 5, 2003

Bushneil Corporation fined $650,000

as part of sentence for

illegally exporting night vision equipment

Washington, D.C. - United States Attorney Roscoe C. Howard, Jr. and Acting Assistant Secretary of Commerce for Export Enforcement Lisa A. Prager today announced that Worldwide Sports & Recreation, Inc., which does business as Bushnell Corporation, was sentenced to a $650,000 criminal fine and five years of probation in the U.S. District Court for the District of Columbia for exporting, between September 1995 and December 1997, over 500 Night Ranger night vision devices to Japan and 14 other countries, without the required Department of Commerce export licenses. Under a separate agreement with the Department of Commerce, Bushnell agreed to pay a civil fine of $223,000 and receive a one year denial of export privileges (suspended). Bushnell’s sentence was imposed by the Honorable Richard W. Roberts.

United States Attorney Howard heralded the sentence as a warning to manufacturers, distributors, and exporters of night vision equipment that has potential military use. “Export licensing requirements and restrictions are not to be deliberately evaded or blindly ignored. Our national security is put at risk when export compliance is not taken seriously,” said Mr. Howard.

Acting Assistant Secretary Prager stated, “the Night Rangers that Bushnell exported are optical imaging binoculars and monoculars. These illegal exports can be diverted to countries and end-users that pose a direct threat to U.S. national security interests.”

Under the International Emergency Economic Powers Act, optical sensors, such as the Night Rangers, are controlled for national security and foreign policy reasons. While some optical sensors, whose value is less than $3,000, may be exported to some destinations without a license, that exception does not apply to Night Rangers, which must be licensed to all countries, except Canada, regardless of the value of the shipment.

Bushnell was informed by the manufacturer and its own lawyers of the comprehensive export licensing requirement when it entered into a distributorship agreement in 1994. In 1996, Bushnell received notification from the Department of Commerce, which stated that the Night Ranger models it was selling - that is, Model 150 (a monocular) and 250 (a binocular) - required licenses for each individual shipment to all countries (except Canada), and were not subject to the license exception for low-value shipments.

Bushnell began selling Night Ranger night vision equipment in 1995. Although it obtained export licenses for five shipments of 11 Night Rangers that it shipped directly overseas, it did not obtain export licenses for the bulk of its international shipments that required export licenses, in particular for shipments to Japan and for certain low-value shipments to other countries.

With regard to the Japanese sales, Bushnell arranged to deliver Night Rangers to a company in the United States that was conspiring with the Japanese purchase. The U.S. company exported the Night Rangers to Japan. Bushnell exported 11 shipments, totaling 471 Night Rangers, valued at over $300,000, to the Japanese company without obtaining an export license for those exports from the Department of Commerce in Washington, D.C. The dates and details of the transactions are stated in the Information to which defendant pleaded guilty on April 16, 2003.

With regard to shipments made to other countries, a Bushnell mid-level manager of the International Sales Department told her staff that low-value shipments of Night Rangers under $3,000 could be shipped internationally without an export license. Even after a Commodity Classification explicitly stating that an export license was required for all shipments and that no exception applied was received and distributed to the International Sales Department, Bushnell continued, from July 19, 1996, to February 13, 1997, to ship Night Rangers without an export license even if the value of the shipment was under $3,000. As set forth in the Information, 15 of these shipments were made, totaling 37 Night Rangers, valued at $33,290.

In announcing today’s sentence, U.S. Attorney Howard and Acting Assistant Secretary of Commerce for Export Enforcement Prager commended the work of Senior Special Agent David Poole and Senior Special Agent Christopher Tafe as well as the U.S. Customs Service Office of Investigations-Boston. They also praised Assistant United States Attorney Wendy Wysong.

BIS Home > BIS Press Page

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - SundStrand

Immediate Release

July 28, 2003

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Connecticut Company Settles Charges Concerning Unlicensed

Pump Exports to China, Taiwan, Israel, and Saudi Arabia

The U.S. Department of Commerce today announced that Hamilton Sundstrand Corporation (Sundstrand), of Windsor Locks, Conn., has agreed to pay a $171,500 civil penalty to settle allegations that the company violated the Export Administration Regulations (EAR).

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that Sundstrand exported or re-exported centrifugal pumps to various end-users in China, Taiwan, Israel, and Saudi Arabia, without obtaining the required Department of Commerce export licenses. Sundstrand is a manufacturer of centrifugal pumps used for general, industrial, and chemical process application. These pumps are controlled for chemical and biological weapons reasons, as well as for antiterrorism reasons.

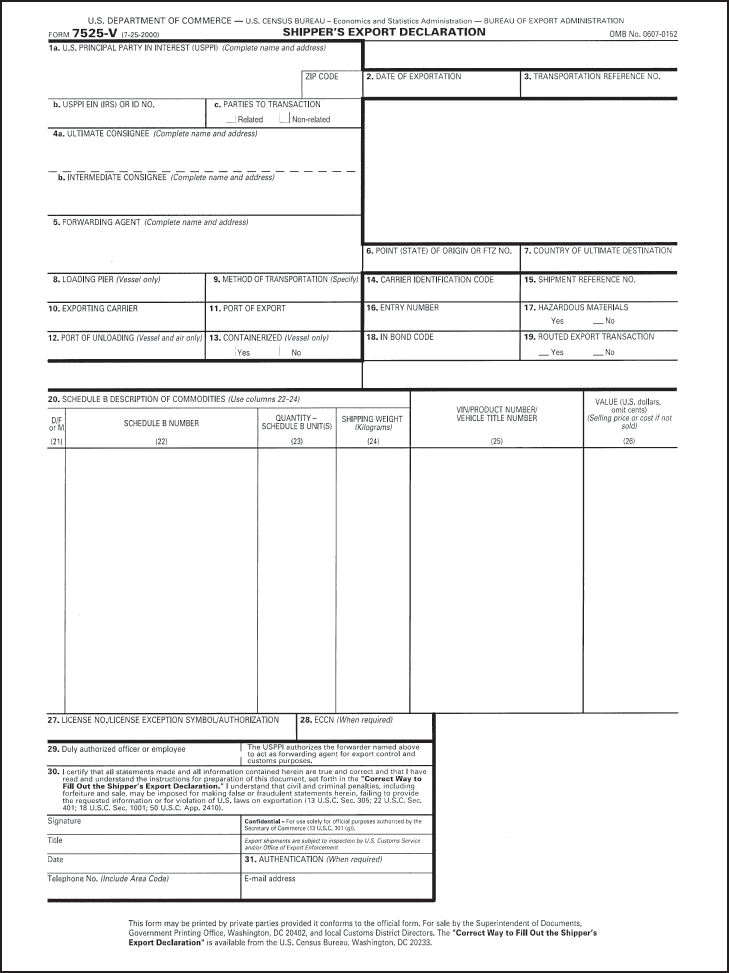

BIS also alleged that Sundstrand made false statements on Shipper’s Export Declarations (SEDs), stating that no export license was required, when in fact a license was required. Additionally, BIS alleged that Sundstrand failed to file SEDs as required, and failed to provide certain required information on those SEDs that Sundstrand did file. Sundstrand. voluntarily disclosed these violations to BIS and cooperated throughout the investigation.

Acting Assistant Secretary of Commerce for Export Enforcement Lisa A. Prager commended the efforts of Special Agent Renee Bohrer from BIS’s field office in Los Angeles, Calif., and Special Agent Randall Robinson from BIS’s field office in Chicago, Ill., who investigated the case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - McMaster-Carr

Immediate Release

July 28, 2003

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Illinois Company Fined for Alleged Antiboycott Violations

The U.S. Department of Commerce announced today that McMaster-Carr Supply Company (McMaster-Carr), an Elmhurst, Illinois supplier of industrial and commercial hardware, has agreed to pay an $8,000 civil penalty to settle allegations that McMaster-Carr committed eight violations of the antiboycott provisions of the Export Administration Regulations (EAR).

The Commerce Department’s Bureau of Industry and Security charged that McMaster-Carr failed to report its receipt of boycott-related requests within the time period required by the EAR. The alleged violations occurred in eight transactions involving sales of goods from the United States to Oman, the United Arab Emirates, Kuwait, Qatar, and Saudi Arabia. McMaster-Carr voluntarily disclosed the alleged violations to the Department.

Acting Assistant Secretary of Commerce for Export Enforcement Lisa Prager commended Senior Compliance Officer Ned Weant, who investigated the case.

United States Department of Justice

United States Department of Justice

ROSCOE C. HOWARD, JR.

United States Attorney for the

District of Columbia

Judiciary Center

555 Fourth St. N.W.

Washington, D.C. 20530

Contact DOJ Public Affairs

Channing Phillips (202) 514-6933

or BIS Public Affairs

(202) 482-2721

For Immediate Release - July 17, 2003

Freight Forwarder DSV Samson Transport Pleads Guilty and Sentenced for forwarding 30 Illegal Shipments to India

Washington, D.C. - United States Attorney Roscoe C. Howard, Jr. and Department of Commerce Acting Assistant Secretary for Export Enforcement Lisa A. Prager announced that DSV Samson Transport, a freight-forwarding company based in New Jersey, pleaded guilty today in U.S. District Court for the District of Columbia before the Honorable Royce C. Lamberth to a two-count Information, charging violations of the International Emergency Economic Powers Act and the Export Administration Act. In pleading guilty, DSV Samson admitted to forwarding over 30 shipments to India, between November 1999 and May 12, 2001, despite being warned by Special Agents from the Office of Export Enforcement on at least three occasions that such shipments would be in violation of Department of Commerce export controls designed to prevent nuclear proliferation. DSV Samson Transport was immediately sentenced by the Court to a $250,000 fine, an $800 special assessment and five years of probation.

Separately, the Department of Commerce’s Bureau of Industry and Security and DSV Samson have tentatively agreed that DSV Samson will pay a civil penalty of $399,000 to resolve related administrative charges.

In announcing today’s guilty plea and sentencing, United States Attorney Howard warned that “freight forwarders are the last link in the export chain and must not knowingly make shipments from the United States that do not comply with the export laws for the safety and protection of our national interests. Because of the position that freight forwarders hold in the chain of international commerce, they have a unique opportunity to ensure export compliance. Freight forwarders, and anyone else with responsibility for compliance with U.S. export laws, will be held responsible for such compliance, particularly when our national security is at issue.”

Acting Assistant Secretary of Commerce for Export Enforcement Prager stated, “this case demonstrates that the Department of Commerce will hold freight forwarders accountable for fulfilling their responsibilities under our export control laws. Forwarders play a key role in the global supply chain. As such, it is important that they be extremely attentive to their export control obligations.”

Freight forwarders are in the business of forwarding shipments for their exporting customers. A freight forwarder does not itself manufacture or sell goods, but provides the service of arranging and monitoring the intermediate stages of air, sea, or ground transport necessary for an exporting customer’s shipment to reach its intended destination. The law imposes upon all parties, including freight forwarders, an obligation to refrain from knowingly participating in illegal export transactions.

In May 1998, India detonated a nuclear test device. In response to this test, in November 1998, the Department of Commerce expanded the “Entity List,” a list of organizations published in the Export Administration Regulations (“EAR”), to include end-users of concern in India, thereby imposing a licensing requirement on virtually all exports to these organizations.

According to the government’s evidence, from December 1998 to June 1999, DSV Samson Transport, Inc. caused six illegal exports of items, valued in total over $13,500, such as radio frequency test equipment, a pulse generator, and an oscillator to the Government of India, Directorate of Purchase and Stores, Department of Atomic Energy, in India, which was an organization listed on the Entity List, without the required Department of Commerce licenses.

On June 29, 1999, a Special Agent from the Department of Commerce’s Office of Export Enforcement (“OEE”) warned the sales manager at DSV Samson Transport, Inc. in New Jersey that Bharat Heavy Electricals was listed on the Entity List, and gave the sales manager OEE outreach materials that included a description of the civil and criminal penalties that can be assessed for violations of the EAR. This information also included phone numbers for questions or self-disclosures of previous violations. Shortly thereafter, the sales manager sent an e-mail to his staff specifically addressing the Entity List and warning that shipments to India, among other countries, must be checked against the Entity List and if the consignee of the shipment appeared on the list, an export license would be required “regardless if the shipper is sending a paper clip or just documents.”

In August 1999, a different OEE agent, on a routine outreach visit, met with the sales coordinator and export supervisor of DSV’s California office, who denied knowledge of the Entity List and the EAR. The agent warned the DSV employee of the firm’s obligations and the potential penalties for violations. Thereafter, the sales coordinator and export supervisor sent a memorandum to DSV sales and export personnel referencing a shipment DSV had forwarded to a listed entity, that was later found to be illegal, warning of potential fines and jail terms for future violations, and referring them to the Department of Commerce web page for the EAR and further information about licensing and compliance.

In October 1999, an OEE Special Agent contacted a DSV export supervisor in New Jersey regarding a possible illegal export by DSV in May 1999. The export supervisor acknowledged that there may have been illegal shipments prior to the June 1999 visit, but told the agent that DSV was in compliance thereafter.

From November 13, 1999, to February 17, 2000, DSV forwarded nine illegal shipments of items, valued in total over $36,800, such as lenses, electronic equipment, and instruments to the Government of India, Directorate of Purchase and Stores, Department of Atomic Energy, to Bharat Heavy Electricals, and to the Nuclear Power Corporation of India, which were organizations listed on the Entity List, for which export licenses were required. DSV forwarded these shipments with the knowledge that its customers, who were exporting the items, had not obtained the required export licenses.

On March 17, 2000, the Department of Commerce changed its policy of presumption of denial for certain items being exported to organizations in India on the Entity List, but a license was still required for exports to such entities and was subject to case-by-case basis review.

From April 2000 to May 2001, DSV forwarded 21 illegal shipments of items, valued in total over $102,200, such as a power supply, software, a transducer, a radioisotope, and oscillators to the Government of India, Directorate of Purchase and Stores, Department of Atomic Energy, to Bharat Electronics, Ltd., and to Bharat Heavy Electricals in India, all organizations then on the Entity List. Again, DSV forwarded these shipments with the knowledge that its customers, who were exporting the items, had not obtained the required export licenses.

In addition, DSV representatives have made assurances to the U.S. Department of Commerce that an extensive export compliance program has been implemented that it intends to be a model for the international freight forwarding business.

In announcing today’s conviction, U.S. Attorney Howard and Acting Assistant Secretary of Commerce for Export Enforcement Prager commended the work of OEE Special Agents Michael Imbrogna and Scott Dunberg. They also praised Assistant United States Attorney Wendy Wysong.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - Bio Check, Inc

For Immediate Release - June 24, 2003

Contact - 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

California Firm Settles Allegations of Illegal Exports of Medical Equipment to Iran

The U.S. Department of Commerce announced today that Bio Check, Inc. (Bio Check), of Burlingame, California, has agreed to pay a civil penalty of $22,500 to settle allegations that the company violated the Export Administration Regulations (EAR) when it exported medical diagnostic kits to Iran without approval from the Treasury Department’s Office of Foreign Assets Control (OFAC), and without filing the required Shipper’s Export Declarations.

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that Bio Check shipped the items to Iran through freight forwarders in the United Arab Emirates and Italy. The settlement takes into account a $32,000 fine that OFAC imposed for violations of its regulations involving the same illegal exports. Bio Check voluntarily disclosed these violations to both BIS and OFAC and cooperated throughout the investigation.

BIS administers and enforces export controls for reasons of national security, foreign policy, nonproliferation and short supply. Criminal penalties and administrative sanctions can be imposed for violations of the EAR.

Acting Assistant Secretary for Export Enforcement Lisa A. Prager commended BIS’s field office in San Jose, California for their efforts in the investigation of this case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > 2003 - Zooma Enterprises

For Immediate Release - June 24, 2003

Contact - 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

California Company, President Penalized for Making False Statements in Connection with an Attempted Export to Iraq

The U.S. Department of Commerce announced today that Zooma Enterprises, Inc. (Zooma), of San Diego, California, and its president, Issa Salomi, have agreed to pay $32,000 in civil penalties to settle charges that they made false statements to the U.S. Government in connection with an attempted export of medical equipment to Iraq. Mr. Salomi will pay a $24,000 fine and Zooma will pay an $8,000 fine.

The Commerce Department’s Bureau of Industry and Security (BIS) charged that Zooma violated the Export Administration Regulations (EAR) by listing the country of ultimate destination on a Shipper’s Export Declaration as Jordan, when the destination was, in fact, Iraq. BIS also charged that Issa Salomi committed three violations of the EAR by filing a petition with the U.S. Customs Service that falsely represented facts about the sale of the medical equipment, an ampul filling and sealing machine, including its ultimate destination.

Acting Assistant Secretary for Export Enforcement Lisa A. Prager commended Special Agent Michael Imbrogna of the Office of Export Enforcement’s field office in Boston, Massachusetts, who investigated this case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home >News > 2003 - Thermal Imaging Camera to Syria

For Immediate Release - June 24, 2003

Contact - 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Bassem Alhalabi Settles Charges Concerning the Illegal Export of Thermal Imaging Camera to Syria

The U.S. Department of Commerce today imposed a one-year denial of export privileges on Bassem Alhalabi to resolve charges that Mr. Alhalabi caused the export of a thermal imaging camera to Syria without the license required under the Export Administration Regulations (EAR).

The Commerce Department’s Bureau of Industry and Security (BIS) charged that, on March 12, 1998, Alhalabi caused the export of a thermal imaging camera to Syria in violation of the EAR. Thermal imaging cameras are controlled for export to Syria for national security, regional stability, and anti-terrorism reasons.

Acting Assistant Secretary for Export Enforcement Lisa A. Prager commended the Office of Export Enforcement’s San Jose Field Office for its efforts in this investigation.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home >News > 2003 - Jagro Customs Brokers

For Immediate Release - June 24, 2003

Contact - 202-482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

New Jersey Freight Forwarder Settles Antiboycott Allegations

The U.S. Department of Commerce announced today that Jagro Customs Brokers and International Freight Forwarders, Inc. (Jagro), of Irvington, New Jersey, has agreed to pay a civil penalty of $5,700 to settle allegations that the company violated the antiboycott provisions of the Export Administration Regulations (EAR).

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that, in January 1998, in connection with a shipment of goods to Bahrain, Jagro furnished information about another company’s business relationships with Israel when it furnished a commercial invoice that contained the statement: “We confirmed that the goods are not of Israeli origin nor do they contain any Israeli material.” BIS also alleged that Jagro failed to report its receipt of the request for such an attestation.

The antiboycott provisions of the EAR prohibit U.S. persons from providing information about their, or any other person’s, business relationships with Israel. Additionally, the EAR requires that persons report their receipt of certain boycott requests. BIS investigates alleged violations of the antiboycott provisions, provides support in administrative or criminal litigation of cases involving the antiboycott provisions, and prepares cases for settlement.

While neither admitting nor denying the allegations, Jagro agreed to pay the civil penalty for the two alleged violations.

Acting Assistant Secretary for Export Enforcement Lisa A. Prager commended Senior Compliance Officer Shirley Rockenbaugh, who investigated this case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home >News > 2003 - Rockwell Automation Inc

Immediate Release

May 22, 2003

Contact: BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

U.S. Parent Company and Two Subsidiaries Fined for Alleged Antiboycott Violations

Acting Assistant Secretary for Export Enforcement Lisa A. Prager announced today that the U.S. Department of Commerce has imposed a $9,000 civil penalty on Rockwell Automation Inc, a Milwaukee, Wisconsin-based corporation and successor company to Reliance Electric Company, and two of Reliance’s foreign subsidiaries to settle allegations that the Reliance companies committed four violations of the antiboycott provisions of the Export Administration Regulations (EAR).

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that Dodge International, a division of Reliance Electric Company, violated the EAR’s antiboycott provisions by failing to report a request from a Kuwaiti purchaser for a declaration from Dodge that the goods at issue did not originate in Israel and that Dodge was not affiliated with any Israeli boycotted or blacklisted company. BIS further alleged that Dodge failed to maintain records containing information relating to a reportable boycott request as required by the EAR’s antiboycott provisions.

In addition, BIS alleged that two foreign subsidiaries of Reliance, prior to their acquisition by Rockwell, each committed one violation of the EAR’s antiboycott provisions by furnishing prohibited information about their or another company’s business relationships. Specifically, BIS alleged that Reliance Electric GmbH furnished information regarding its business relationship with Israel in a transaction involving a sale to the United Arab Emirates, and that Reliance Electric AG furnished information regarding the blacklist status of the aircraft carrying the goods in a transaction involving a sale to Pakistan.

The companies involved voluntarily disclosed the transactions and cooperated fully with the subsequent investigation.

Acting Assistant Secretary Prager commended Senior Compliance Officer Cathleen A. Ryan, who conducted the investigation of this case.

United States Department of Justice

United States Department of Justice

U.S. Attorney's Office

Northern District

of Illinois

Press Contacts:

AUSA George Jackson III

(312)886-7645

AUSA/PIO Randall Samborn

(312)353-5318

FOR IMMEDIATE RELEASE

Thursday April 10, 2003

U.S Charges Wheeling Firm with Violating Export Ban to Iran

CHICAGO - A Wheeling firm that manufactures pipe-cutting tools was charged today with two federal felony offenses for allegedly violating a foreign trade embargo against Iran, announced Patrick J. Fitzgerald, United States Attorney for the Northern District of Illinois. The defendant, E.H. Wachs Company, allegedly shipped pipe cutters and related equipment in 1995 and 1996 from its warehouse in Wheeling, through Canada, knowing that the products were destined for the National Iranian Gas Company (NIGC) in Iran, in violation of the Iranian embargo barring exports of such goods. Wachs manufactures pipe-cutting tools, including Trav-L-Cutters, and related parts and other items used in the construction and repair of gas and oil pipelines, which it sells worldwide.

The company was charged with one count each of violating the International Emergency Economic Powers Act and the Iranian Transactions Regulations in a two-count criminal information that was filed today in U.S. District Court. No individuals were charged. Through its lawyers, E.H. Wachs, has authorized the government to disclose that it has agreed to plead guilty to the charges at a later date, which has not yet been set.

An Executive Order issued in May 1995, pursuant to the International Emergency Economic Powers Act, prohibited the unauthorized exportation from the United States to Iran or the financing of such exportation, of any goods, technology or services except items intended to relieve human suffering. The prohibition, commonly known as the Iranian embargo, was also made part of the Code of Federal Regulations.

According to the charges, in 1993 and 1994, the NIGC invited bids to purchase approximately 50 pipe-cutting machines, related blades and other specified items. The bid invitations required that the successful bidder have an agent located in Iran in order to provide service for the pipe-cutting machines and to provide training for NIGC personnel on the use of the machines. In 1994, the NIGC initiated negotiations with Wachs and an unnamed Canadian company that had a subsidiary in Iran to purchase two Trav-L-Cutters from Wachs to use to train NIGC employees. The Canadian company was Wachs’ exclusive dealer for Iran, and their agreement provided that Wachs would pay the Canadian company a 10 percent commission on all sales of Wachs’ goods to companies located in Iran, even if the Canadian company did not participate in the transaction.

In late 1994, the Canadian company, on behalf of the NIGC, issued purchase and sales orders for two of Wach’s Trav-L-Cutters and related parts for $26,271. After the Iranian trade embargo took effect in May 1995, Wachs allegedly continued with plans to contract with the NIGC to sell pipe cutters and related items. In July 1995, the charges allege that Wachs wilfully violated the Iranian embargo by exporting pipe-cutting equipment from the United States to Canada, when Wachs employees were aware that the goods ultimately were destined for the NIGC in Iran without the required export authorization.

The charges further allege that in January 1995, Wachs issued to NIGC a quote of $4,669,643.90 for 50 Trav-L-Cutters and related items. Six months later, after the effective date of the trade embargo, a Wachs international sales coordinator issued a quote of $236,569.20 for 14 Trav-L-Cutters and other items, through a European company, which listed Pakistan as the ultimate destination for the items, when the Wachs employee knew that the ultimate destination was Iran. After further negotiations over the price and amount of the pipe cutters, in September 1996, Wachs allegedly violated the Iranian embargo and the Export Administration Regulations by shipping pipe cutters and related parts and items from the United States to Canada, knowing the goods were destines for the NIGC in Iran, without the required export authorization.

Mr. Fitzgerald announced the charges with Elissa A. Brown, Special Agent-in-Charge in Chicago of the Homeland Security Department’s Bureau of Immigration and Customs Enforcement, and Wendy B. Hauser, Special Agent-in-Charge in Chicago of the U.S. Commerce Department’s Bureau of Industry and Security, which togther conducted the investigation. The government is being represented by Assistant U.S. Attorney George Jackson III.

Upon conviction, E.H. Wachs faces a maximum penalty on each count of five years probation and a $500,000 fine. The Court, however, will determine the appropriate sentence to be imposed under the United States Sentencing Guidelines. The public is reminded that an information contains only charges and is not evidence of guilt. The defendant is presumed innocent and is entitled to a fair trial at which the government has the burden of proving guilt beyond a reasonable doubt.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > Industrial Scientific Corporation of Oakdale, PA Fined

For Immediate Release

Contact:

BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Pennsylvania Company Fined for Illegal Export to Iran

The Department of Commerce's Bureau of Industry and Security (BIS) today imposed a $30,000 civil penalty against Industrial Scientific Corporation (ISC) of Oakdale, Pennsylvania to resolve charges that ISC violated U.S. export control laws by exporting gas monitors to the United Arab Emirates (UAE) with knowledge that they would be reexported to Iran.

"This case, like a number of others recently prosecuted, demonstrates that this Bureau will not allow exporters to evade our export control laws by transshipping goods through third countries," Acting Assistant Secretary Lisa A. Prager said.

BIS alleged that ISC violated the Export Administration Regulations (EAR ) by shipping two gas monitors from the United States to the UAE in June 1998 without obtaining the proper authorization. In addition, BIS alleged that ISC violated the EAR by transferring the gas monitors to the UAE with knowledge that the monitors would be reexported from the UAE to Iran. ISC, primarily a maker of mine safety equipment for domestic use, was cooperative in the investigation and has taken efforts to ensure its compliance with U.S. export control laws.

The United States maintains a comprehensive embargo on trade with Iran because of Iran's support for international terrorism. Under the terms of the embargo, most exports and reexports to Iran are prohibited unless they are authorized in advance by the Treasury Department's Office of Foreign Assets Control (OFAC). The export to Iran of items subject to the EAR without OFAC approval is a violation of the EAR and can be subject to criminal penalties and administrative sanctions.

Acting Assistant Secretary Prager commended Special Agent Thalia Griffin of the Office of Export Enforcement's field office in Herndon, Virginia, who conducted the investigation of this case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Three-Year Denial of Export Privileges Imposed

For Attempted Export of Shotgun

The Department of Commerce's Bureau of Industry and Security (BIS) announced today that Frank Curie, of Bosnia and Herzegovina, has agreed to a three-year denial of export privileges to resolve charges that he attempted to export a shotgun to Bosnia and Herzegovina without the required Commerce Department license.

BIS charged that Curie tried to export a Mossberg shotgun in July 2000 by concealing it in a vehicle that he was shipping from the United States. In addition, BIS charged that Curie falsely claimed that the export of the vehicle was authorized under a license exception which required that the vehicle not contain any personal belongings.

The export of shotguns with barrel lengths of 18 inches or longer are subject to licensing requirements under the Export Administration Regulations to support the U.S. foreign policy of promoting the observance of human rights throughout the world.

BIS administers and enforces export and reexport controls for reasons of national security, foreign policy, nonproliferation, antiterrorism, and short supply. Criminal penalties and administrative sanctions can be imposed for violations of the Export Administration Regulations.

DEPARTMENT OF HEALTH AND HUMAN SERVICES

Food and Drug Administration

Florida District

555 Winderiey Place

Suite 200

Maitland Florida 32751

Telephone:407-475-4700

VIA FEDERAL EXPRESS

Reference: |

Customs Entry No.DM4-0085887-2 and DM4-0085886-4 |

Product: |

Snow Peas |

WARNING LETTER

FLA-02-58

September 10, 2002

Mr. Stanley F. Yu

Transamerica Food Enterprises

11077 NW 36th Avenue

Miami, Florida 33167

Dear Mr. Yu:

On June 1, 2002, your firm offered for import into the United States 246 cartons of snow peas under U. S. Customs Service (Customs) entries DM4-0085887-2 and DM4-0085886-4. On June 20, 2002, the U. S. Food and Drug Administration (FDA) issued a Notice of Refusal because the product contained chlorothalonil1

Section 801(a) [21 U.S.C. § 381(a)] of the Federal Food, Drug, and Cosmetic Act ("the Act") directs the Secretary of the Treasury to issue a Notice of Refusal when it appears from examination of samples, or otherwise, that an imported shipment is in violation. This Section also orders the destruction of any such shipment refused admission, unless it is exported within 90 days of the date of the notice, or within such additional time as may be permitted pursuant to such regulations. Under the Act, the product under entries DM4-0085887-2 and DM4-0085886-4 are subject to refusal of admission pursuant to Section 801(a)(3) in that it appears to contain pesticide chemicals, which is in violation of Section 402(a)(2)(B) [21 U.S.C. § 342(a)(2)(B)].

On July 12, 2002, FDA documented the substitution of the refused product upon examination of the refused merchandise at the South Dade County Landfill, located at 24000 SW 97th Avenue, Homestead, FL 30032. The product offered for destruction was labeled with an air waybill number that did not correspond with the original air waybill number (American Airlines AWB #00199470615) for the refused entries DM4-0085887-2 and DM4-0085886-4. FDA investigated the history of the air waybills and found that the product offered for destruction actually arrived nine days after the original FDA refused product (entries DM4-0085887-2 and DM4-0085886-4). On July 16, 2002, you provided FDA with a signed affidavit and supporting invoices demonstrating the sal? into interstate commerce, of at least cartons of the refused shipment.2

This is a violation of Title 21, Code of Federal Regulations, Section 1.90, which requires the importer to hold an entry intact pending receipt of a May Proceed or Release Notice from FDA. Since the articles were not held and there was an attempt to evade regulation, FDA has requested Customs to increase your bond, and require future entries from your firm to be held in a bonded warehouse until FDA makes a final decision as to admissibility. You will be responsible for all costs incurred at secured storage. In addition, FDA is requesting that Customs assess liquidated damages for failure to redeliver the entry noted above.

It is your responsibility, as the importer, to ensure that imported products meet all requirements of the Act, and the regulations promulgated thereunder. We wish to remind you that making fraudulent misrepresentations or false statements to federal officials are criminal offences under Title 18, United States Code (18 U.S.C.), sections 542 and 1001. When evidence demonstrates the article presented to FDA for examination is not from the original entry, but was substituted for the entry, the article may be seized under Title 19 section 1595a. Criminal charges of entry contrary to law (18 U.S.C. § 545) may result in addition to the charges mentioned above.

Failure to promptly correct this violation and prevent future violations may result in regulatory action without further notice such as seizure, injunction, or detention without examination of future shipments. Please notify this office in writing within 15 working days of receipt of this letter, of the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent the recurrence of the violation. In addition, you should inform Customs and FDA if and when redelivery is accomplished.

Your written reply should be addressed to the Food and Drug Administration, Attention: Christine M. Humphrey, Compliance Officer, 6601 NW 25th Street, P.O. Box 59-2256, Miami, Florida 33159-2256. If you have any questions related to this matter, you may contact Ms. Humphrey at (305) 526-2800, ext. 932.

Sincerly,

Emma R. Singleton

Director, Florida District

1 There is no tolerance for chlorothalonil pursuant to 40 CFR § 180.275.

2 Invoice # 14722 (copy attached)

DEPARTMENT OF HEALTH & HUMAN SERVICES |

Public Health Service |

Food and Drug Administration

555 Winderley Pl., Ste. 200

Maitland, Fl32751

VIA FEDERAL EXPRESS

Ref: |

Customs Entry No. 406-0318899-2 /001 |

|

Product: Frozen Langostinos (shrimp) |

WARNING LETTER

FLA-02-59

September 10, 2002

Mr. Mario Gatica, President

Nico’s Seafood & Products Corp.

13860 S.W. 100 Lane

Miami, Florida 33186

Dear Mr. Gatica:

On May 14, 2002, the Food and Drug Administration (”FDA”) issued a Notice of FDA Action to you, advising you that it would be examining the shipment of langostinos that was being offered by you for import into the United States under Customs Entry No. 4060318899-2/001. On May 28, 2002, FDA attempted to examine this entry.

Upon examination, FDA Investigators found that the product presented by you for examination was not the product received under entry number 406-0318899-2. When the FDA Investigators informed you of this fact, you told them that you had distributed the entry. This is a serious violation of Title 21, Code of Federal Regulations, Section 1.90, which requires you to hold an entry intact and to not distribute it when FDA has notified you that it will be examining the shipment, as it did in this instance. Since the entry was not held, FDA has requested U.S. Customs to issue a Demand for Redelivery of this entry.

It is your responsibility, as the importer, to ensure that imported products meet all requirements of the Federal Food, Drug and Cosmetic Act, and the regulations promulgated thereunder. We also remind you that knowingly filing a false import entry and knowingly making fraudulent misrepresentations or false statements to federal officials are criminal offenses under Title 18, United States Code, sections 542 and 1001, respectively, and under Title 18, Section 545. Further, when evidence demonstrates that an article presented to FDA for examination is not from the original entry, but was substituted for the entry, the article may be seized by U. S. Customs Service under Title 19, section 1595a (c) and civil monetary penalties may be assessed under Title 19 section 1595a(b). Liquidated damages may also be assessed for articles not redelivered.

Your failure to promptly correct this situation and prevent future premature distribution of imported product may result in regulatory action without further notice, such as seizure, injunction, or detention of future entries without examination. In addition, such failure may result in FDA recommending to the U. S. Customs Service that it is requiring that future entries by you be held in secured storage. Secured storage would be under the supervision and direction of the U. S. Customs Service, such as in a bonded warehouse and you would be responsible for all costs incurred for such storage.

Please notify this office in writing within 15 working days of receipt of this letter, of the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent the recurrence of the violation. In addition, if the U. S. Customs Service orders you to redeliver the entry, please inform this office in writing when redelivery is accomplished. Your written reply should be addressed to the Food and Drug Administration, Attention: Carlos W. Hernandez, Compliance Officer, P.O. Box 59-2256, Miami, Florida 33159-2256.

Sincerely,

Emma R. Singleton

Director, Florida District

cc: |

Thomas Winkowski Port Director U. S. Customs Service P. O. Box 02-580 Miami, Florida 33102-5280 |

DEPARTMENT OF HEALTH AND HUMAN SERVICES

Food and Drug Administration

Florida District

555 Winderley Place

Suite 200

Maitland Florida 32751

Telephone:407-475-4700

FAX:407-475-4768

VIA FEDERAL EXPRESS

Reference: |

Customs Entry No.DM4-0086124-9. |

Product: |

Fresh Produce |

WARNING LETTER

FLA-O2-57

September 6, 2002

Alan Michael Parr, President

Team Produce International, Inc.

8850 NW 20th Street

Miami, Florida 33172

Dear Mr. Parr:

On June 12, 2002, your firm offered for import into the United States 200 cartons of French Beans, 20 cartons of Green Zucchini and 20 cartons of Sunburst Squash under U. S. Customs Service entry DM4-0086124-9. On June 12, 2002, the U. S. Food and Drug Administration (FDA) detained the products without physical examination because the product appeared to be adulterated due to the presence of pesticides. On June 28, 2002, the products were refused entry into the United States.

Section 801(a) of the Federal Food, Drug, and Cosmetic Act (”Act”) directs the Secretary of the Treasury to issue a Notice of Refusal when it appears from examination of samples, or otherwise, that an imported shipment is in violation. This Section also orders the destruction of any such shipment refused admission, unless it is exported within 90 days of the date of the notice, or within such additional time as may be permitted pursuant to such regulations. Under the Act, the product under entry DM4-0086124-9 is subject to refusal of admission pursuant to Section 801(a)(3) in that it appears to contain pesticide chemicals, which is in violation of Section 402(a)(2)(B).

On June 28, 2002, FDA documented the substitution of the refused product (under entry #DM4-0086124-9). On July 10, 2002, you provided FDA with a signed affidavit and supporting invoices demonstrating the sale, into interstate commerce, of the refused shipment.

This is a violation of Title 21, Code of Federal Regulations, Section 1.90, which requires the importer to hold an entry intact pending receipt of a May Proceed or Release Notice from FDA. Since the articles were not held and there was an attempt to evade regulation, the FDA has requested U.S. Customs to increase your bond, and require future entries from your firm to be held in a bonded warehouse until FDA makes a final decision as to admissibility.

It is your responsibility, as the importer, to ensure that imported products meet all requirements of the Federal Food, Drug and Cosmetic Act, and the regulations promulgated thereunder. We wish to remind you that making fraudulent misrepresentations or false statements to federal officials are criminal offences under Title 18, United States Code (18 USC), 542 and 1001. When evidence demonstrates the article presented to FDA for examination is not from the original entry, but was substituted for the entry, the article may be seized under Title 19 section 1595a (c). Liquidated damages may also be assessed for articles not redelivered. Criminal charges of entry contrary to law (18 USC 545) may result in addition to the charges mentioned above. Criminal offenses can result in imprisonment or fines or both.

Failure to promptly correct this violation and prevent future violations may result in regulatory action without further notice such as seizure, injunction, or detention without examination of future shipments. Please notify this office in writing within 15 working days of receipt of this letter, of the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent the recurrence of the violation. In addition, you should inform Customs and FDA if and when redelivery is accomplished. Your written reply should be addressed to the Food and Drug Administration, Attention: Christine M. Humphrey, Compliance Officer, 6601 NW 25th Street, P.O. Box 59-2256, Miami, Florida 33159-2256.

Sincerely,

Emma R. Singleton

Director, Florida District

Public Health Service

Food and Drug Administratic

DEPARTMENT OF HEALTH & HUMAN SERVICES

San Francisco District

1431 Harbor Bay Parkway

Alameca. CA 94502-7070

Telephone: 510/337-6700

VIA FEDERAL EXPRESS

June 20, 2002

Our Reference: Entry Number MA7-0708834-4, lines 001/001 and 005/001

Yaswant Singh, CEO / President

Pioneer International

8017 36th Avenue

Sacramento, CA 95824-3310

WARNING LETTER

Dear Mr. Singh:

On May 21, 2002, we attempted to sample a shipment of mahi-mahi and duruka (entered as ”asparagus”), in accordance with Notice of FDA Action dated May 15, 2002 and found the shipment was not available, having already been sold. Tne shipment was offered for import into the United States by your firm on May 14, 2002 under entry number MA7-07078834-4.

The action taken by your firm is a violation of Title 21, Code of Federal Regulations, Section 1.90 (21 CFR 1.90), which requires the importer to hold an entry intact pending receipt of a May Proceed or Release Notice. We are hereby requesting U. S. Customs to order redelivery of the part of this shipment that was not held (copy enclosed).

Failure to promptly correct this violation and prevent future premature distribution of imponed products may result in requiring that future shipments be held in secured storage. Secured storage will be under the supervision and direction of the U.S. Customs Service, such as in a bonded warehouse. You would be responsible for all costs incurred in secured storage.

Within fifteen working days of receipt of this letter, notify this office in writing of the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent the recurrence of the violation. In addition, you should inform U.S. Customs and FDA if and when redelivery is accomplished.

Your written reply should be addressed to:

Charles D. Hoffman, Compliance Officer

U.S. Food and Drug Administration

1431 Harbor Bay Parkway

Alameda, CA 94502

You may fax your response to Mr. Hoffman at: 510-337-6707.

Sincerely,

Dennis K. Linsley

District Director

San Francisco District

Enclosure: Request to Customs to issue Redelivery Notice

Public Health Service |

Food and Drug Administration

555 Windertey Pl., Ste. 200

Martland, Fl32751

VIA FEDERAL EXPRESS

Ref: |

Customs Entry No. WKV-0036537-4 |

|

Product:Frozen Lobster Tails (23,320 lbs.) |

WARNING LETTER

FLA-02-46

June 3, 2002

Cauley Dennis, President

Patriot Foods, L.L.C.

800 Brickell Avenue

Suite 201

Miami, Florida 33131

Dear Mr. Dennis:

The Food and Drug Administration (FDA), on February 12, 2002, attempted to examine a shipment of frozen lobster tails in accordance with our Notice of FDA Action, dated February 12, 2002. The shipment was offered for entry into the United States by your firm on February 12, 2002, under the above referenced entry number. Although FDA requested documents for this entry on February 13, 2002, 50 cases of the adulterated product were shipped on March 8, 2002, into interstate commerce.

FDA collected physical samples of the lobster tails that revealed the presence of Salmonella. A Notice of FDA Action (refusal) was issued on April 3, 2002.

On April 18, 2002, U. S. Customs Service (Customs) notified FDA that 10 cases (lbs.) of frozen lobster tails were not redelivered into Customs’ custody pursuant to the Notice of FDA Action (refusal) dated April 3, 2002. The consignee, Penguin Frozen Foods, Inc., confirmed by letter dated April 19, 2002, that 10 cases of the original shipment could not be recovered and redelivered to Customs custody. In addition, FDA examination of the remaining portion of the lobster tails in this entry on April 23, 2002, revealed that 10 master cartons and 1 partial case (a total of lbs.) were unavailable. This is in violation of Title 21, Code of Federal Regulations, Section 1.90, which requires the importer to hold an entry intact pending receipt of a "May Proceed Notice" or "Notice of Release" from FDA.

Failure to promptly correct this situation and prevent future premature distribution of imported products may result in requiring that future shipments be held in secured storage. Secured storage will be under the supervision and direction of U.S. Customs Service, such as in a bonded warehouse. You will be responsible for all costs incurred in secured storage.

We request a response in writing within fifteen (15) working days of receipt of this letter outlining the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent recurrence. In the event that the product is still available for examination, you should inform Customs and FDA if and when redelivery is accomplished.

Your written reply should be addressed to the Food and Drug Administration, Attention: Christine M. Humphrey, Compliance Officer, P.O. Box 59-2256, Miami, Florida 331592256.

Sincerely,

Emma R. Singleton

Director, Florida District

cc: |

Thomas Winkowski Port Director U. S. Customs Service P. O. Box 02-580 Miami, Florida 33102-5280 |

DEPARTMENT OF HEALTH & HUMAN SERVICES |

Public Health Service |

Food and Drug Administration

555 Winderley Pl., Ste. 200

Maitland, Fl32751

VIA FEDERAL EXPRESS

Ref: |

Customs Entry No. EJ7-0027236-5/001 |

|

Product: Whole Pompano Fish (1000 lbs.) |

WARNING LETTER

FLA-02-48

June 6, 2002

Jose Gomez, Owner

Tip Top Trading

910 N.W. 128th Court

Miami, Florida 33182

Dear Mr. Gomez:

The Food and Drug Administration (FDA), on May 10, 2002, attempted to examine a shipment of whole pompano fish in accordance with our Notice of FDA Action, dated May 8, 2002. The shipment was offered for entry into the United States by your firm on May 8, 2002, under the above referenced entry number.

On May 10, 2002, the FDA inspector noted that the shipment was unavailable for FDA examination. The product had been distributed prior to the FDA examination. Since your firm voluntarily decided to redeliver the shipment, FDA conducted a second examination of the lot at Guanabo Seafood, Miami, Florida. As per your request, on May 17, 2002, the FDA investigator conducted another examination of the product redelivered. FDA examination revealed that you were not successful in redelivering 1000 lbs. of pompano fish from this entry. This is in violation of Title 21, Code of Federal Regulations, Section 1.90, which requires the importer to hold an entry intact pending receipt of a "May Proceed Notice" or "Notice of Release" from FDA. We have requested the U. S. Customs Service (Customs) to order redelivery of 1000 lbs. of the whole pompano fish referenced above.

Failure to promptly correct this situation and prevent future premature distribution of imported product may result in U. S. Customs requiring that future shipments be held in secured storage, such as in a bonded warehouse. You would also be responsible for all costs incurred in obtaining secured storage.

We request a response in writing within fifteen (15) working days of receipt of this letter outlining the specific steps you have taken to correct the violation, including an explanation of each step being taken to prevent recurrence. In the event that the product is still available for examination, you should inform Customs and FDA, if and when redelivery is accomplished.

Your written reply should be addressed to the Food and Drug Administration, Attention: Paul R. Bagdikian, Compliance Officer, P. O. Box 59-2256, Miami, Florida 33159-2256.

Sincerely,

Emma R. Singleton

Director, Florida District

cc: |

Thomas Winkowski Port Director U. S. Customs Service P. O. Box 02-580 Miami, Florida 33102-5280 |

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > Press Releases

For Immediate Release

July 3, 2003

Contact:

BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

COMMERCE DEPARTMENT FINES KANSAS FIRM FOR UNLICENSED PETROLEUM EXPORTS

Acting Assistant Secretary of Commerce for Export Enforcement Lisa A. Prager announced today that a $200,000 civil penalty has been imposed on Flint Hill Resources L.P. - formerly known as Koch Petroleum Group, L.P. - of Wichita, Kansas to settle allegations that the company exported crude petroleum from the United States to Canada without the required U.S. Government authorization. The Commerce Department controls the export of crude petroleum to any foreign destination to protect the domestic supply.

The Commerce Department’s Bureau of Industry and Security (BIS) alleged that between July 1997 and March 1999, Koch Petroleum committed 40 violations of the Export Administration Regulations by exporting crude petroleum to Canada on 20 occasions without the required export licenses and Shipper’s Export Declarations. Acting Assistant Secretary Prager noted that in determining the amount of the penalty, BIS gave consideration to the facts that Koch Petroleum voluntarily self-disclosed the violations, stopped exports of oil once the violations were discovered, and enhanced its export compliance program.

BIS administers and enforces export controls for reasons of national security, foreign policy, nonproliferation, anti-terrorism, and short supply. Criminal penalties and administrative sanctions can be imposed for violations of the Export Administration Regulations.

Acting Assistant Secretary Prager commended Special Agent John Ruiz of the Office of Export Enforcement’s field office in Dallas, Texas, who conducted the investigation of this case.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home > News > Press Releases

For Immediate Release

August 6, 2002

Contact:

BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases |

Speeches |

Testimony |

Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Johns Hopkins Health System Corporation Settles Antiboycott Case

Assistant Secretary of Commerce for Export Enforcement Michael J. Garcia announced today that Johns Hopkins Health System Corporation in Baltimore, Maryland has agreed to pay the maximum $10,000 civil penalty to settle charges that it violated U.S. antiboycott laws by discriminating against an individual in support of the Arab League boycott of Israel. Johns Hopkins Health System Corporation voluntarily disclosed the incident and cooperated fully with the subsequent investigation.

"As Under Secretary of Commerce for Industry and Security Kenneth I. Juster recently made clear, the Commerce Department will vigorously enforce our antiboycott laws," Assistant Secretary Garcia noted. "This case demonstrates that resolve."

The Commerce Department's Bureau of Industry and Security (BIS) had charged that in 1995, Johns Hopkins Health System Corporation discriminated against a U.S. person because she was Jewish. The person had been seeking a position in the company's International Services Department, which markets medical services around the world, including in the Middle East. BIS believes that the discriminatory conduct was motivated by the company's concern about having a Jewish person in that position because of the Arab League boycott of Israel.

The antiboycott provisions of the Export Administration Regulations prohibit U.S. persons from complying with certain aspects of unsanctioned foreign boycotts imposed or fostered by foreign governments, including taking discriminatory actions on the basis of religion or national origin. In addition, the antiboycott regulations require U.S. persons to report their receipt of certain boycott requests to the BIS's Office of Anti boycott Compliance (OAC), which investigates alleged violations, provides support in administrative or criminal litigation of cases, and prepares cases for settlement.

Assistant Secretary Garcia commended Senior Compliance Officer

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home >News >Press Releases

For Immediate Release

February 20, 2002

Contact:

BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases Speeches Testimony Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

KOCH Petroleum Group and Subsidiary Settle Antiboycott Allegations

The Commerce Department's Bureau of Export Administration (BXA) announced today that two affiliated crude oil trading companies - Koch Petroleum Group, L.P., a Wichita, Kansas limited partnership, and Koch Refining International Pte. Ltd., Koch Petroleum Group's wholly-owned subsidiary in Singapore – have agreed to pay a total of $37,000 to settle allegations that the companies committed 37 violations of the antiboycott provisions of the Export Administration Regulations. The companies voluntarily disclosed the transactions that led to the allegations and cooperated fully with the subsequent investigation. The antiboycott regulations prohibit U.S. persons, including foreign subsidiaries of U.S. companies, from complying with certain aspects of unsanctioned foreign boycotts. In addition, the antiboycott regulations require that U.S. persons report their receipt of certain boycott requests to BXA's Office of Antiboycott Compliance.

BXA alleged that, between 1996 and 1999, the companies failed to report within the time period prescribed by the regulations their receipt of boycott requests in 37 transactions. The boycott requests involved prohibitions on the sale of crude oil to Israel that Koch Petroleum Group and its affiliate purchased from Brunei, Gabon, Indonesia, Nigeria, Oman, and the United Arab Emirates. The antiboycott regulations permit compliance with such requests, but all U.S. persons must file a report upon their receipt of such requests.

Koch Petroleum Group, L.P. agreed to pay a $16,000 civil penalty to settle 16 alleged violations. Koch Refining International Pte. Ltd. agreed to pay a $21,000 civil penalty to settle 21 alleged violations.

Assistant Secretary of Commerce for Export Enforcement Michael J. Garcia commended the efforts of Senior Compliance Officer Shirley Rockenbaugh, who conducted the Investigation for the Office of Antiboycott Compliance.

Where Industry and Security Intersect |

What's New | Sitemap | Search |

Home >News >Archives >2001 >Press Releases

For Immediate Release

December 12, 2001

Contact:

BIS Public Affairs

(202) 482-2721

About BIS |

News |

Press Releases Speeches Testimony Archives |

Policies And Regulations |

Licensing |

Compliance And Enforcement |

Seminars And Training |

International Programs |

Defense Industrial Base Programs |

Two Foreign Subsidiaries of a Florida Company Settle Antiboycott Charges

U.S. Department of Commerce Assistant Secretary for Export Enforcement Michael J. Garcia announced today that two foreign subsidiaries of the Sunbeam Corporation, a Florida-based consumer products company, have agreed to pay $9,000 to settle allegations for violating antiboycott laws. The Sunbeam Corporation voluntarily disclosed the violations on behalf of its foreign subsidiaries, Coleman Benelux, B.V. and Sunbeam Europe, Limited. The antiboycott provisions of the Export Administration (EAR) prohibit U.S. persons - including foreign subsidiaries of U.S. companies - from complying with certain aspects of unsanctioned foreign boycotts.

The Bureau of Export Administration's Office of Antiboycott Compliance ("OAC") alleged that Coleman Benelux B.V., a Netherlands corporation, committed three violations of the antiboycott provisions of the EAR in connection with the shipment of goods to Lebanon in 1999. According to OAC, Coleman Benelux, B.V. agreed not to use ships "blacklisted" by the Israeli Boycott Office in Lebanon. In addition, Coleman Benelux B.V. gave prohibited information when it recorded this agreement on shipping documents. The company also failed to report its receipt of the boycott request in a timely fashion as required by the EAR. OAC also alleged that Sunbeam Europe Limited, a U.K. corporation, failed to make a timely report of its receipt of three boycott requests received in 1997 and 1998 from Lebanon and Qatar.

While neither admitting nor denying the allegations, Coleman Benelux B.V. agreed to pay a $6,000 civil penalty, and Sunbeam Europe Limited agreed to pay a $3,000 civil penalty.

Assistant Secretary Garcia commended the efforts of OAC Compliance Officer Gary Möhler who investigated this case.

Note

communications to trade

infrequent importer/traveler

antidumping and countervailing duties (add/cvd)

duty rates / hts

international agreements

informed compliance

commercial enforcement

regulatory audit program

textiles and quotas

carriers

cargo summary

cargo control

broker management

operations support

C-TPAT Fact Sheet and Frequently Asked Questions

What is C-TPAT?

• C-TPAT is a joint government-business initiative to build cooperative relationships that strengthen overall supply chain and border security.

• C-TPAT recognizes that Customs can provide the highest level of security only through close cooperation with the ultimate owners of the supply chain, importers, carriers, brokers, warehouse operators and manufacturers.

• Through this initiative, Customs is asking businesses to ensure the integrity of their security practices and communicate their security guidelines to their business partners within the supply chain.

What does participation in C-TPAT require?

Businesses must apply to participate in C-TPAT. Participants will sign an agreement that commits them to the following actions:

• Conduct a comprehensive self-assessment of supply chain security using the C-TPAT security guidelines jointly developed by Customs and the trade community. These guidelines, which are available for review on the Customs website, encompass the following areas: Procedural Security, Physical Security, Personnel Security, Education and Training, Access Controls, Manifest Procedures, and Conveyance Security.

• Submit a supply chain security profile questionnaire to Customs.

• Develop and implement a program to enhance security throughout the supply chain in accordance with C-TPAT guidelines.

• Communicate C-TPAT guidelines to other companies in the supply chain and work toward building the guidelines into relationships with these companies.

What are the benefits of participation in C-TPAT?

C-TPAT offers businesses an opportunity to play an active role in the war against terrorism. By participating in this first worldwide supply chain security initiative, companies will ensure a more secure supply chain for their employees, suppliers and customers. Beyond these essential security benefits, Customs will offer potential benefits to C-TPAT members, including:

• A reduced number of inspections (reduced border times)

• An assigned account manager (if one is not already assigned)

• Access to the C-TPAT membership list

• Eligibility for account-based processes (bimonthly/monthly payments, e. g.)

• An emphasis on self-policing, not Customs verifications

Who is eligible for C-TPAT?

C-TPAT is currently open to all importers and carriers (air, rail, sea). Customs plans to open enrollment to a broader spectrum of the trade community in the near future. C-TPAT membership will be made available to all sectors of the supply chain. Customs will be consulting with the trade community to develop the most effective approach for each sector to participate in C-TPAT. Please refer to this site for the latest information on eligibility and application procedures.

How do I apply?

• Applicants will submit signed agreements to Customs, which will represent their commitment to the C-TPAT security guidelines.

• Applicants will also submit a supply chain security profile questionnaire at the same time they submit their signed agreements or within a specified time thereafter.

• Complete application instructions will be maintained on this site.

When will benefits begin?

Benefits will begin once Customs has completed an evaluation of the importer’s C-TPAT application package and notified the importer of our findings. Customs aims to complete these evaluations within 30-60 days after the supply chain security questionnaire has been submitted.

How will the partnership work on an ongoing basis?

• Account managers will contact participants to begin joint work on establishing or updating account action plans to reflect C-TPAT commitments.

• Action plans will track participants’ progress in making security improvements, communicating C-TPAT guidelines to business partners, and establishing improved security relationships with other companies.

• Failure to meet C-TPAT commitments will result in suspension of C-TPAT benefits. Benefits will be reinstated upon correcting identified deficiencies in compliance and/or security.

Where can I get more information on C-TPAT?

C-TPAT information will be maintained on this site.

Frequently Asked Questions

Q: What exactly are Customs expectations for the trade on this program?

required to undergo a Focused Assessment in order to participate in C-TPAT. However, to take advantage of Customs Regulatory Audit Importer Self-Assessment (ISA) program, importers must be C-TPAT participants.

Q: As a carrier, I already participate in the Customs Carrier Initiative - is it a duplication of effort in joining C-TPAT?

A: Customs will be looking for carriers to join C-TPAT to enhance existing security practices and better address the terrorism threat to international air, sea, and land shipping. We will work to ensure that C-TPAT participation does not require duplicate work for current Customs Carrier Initiative Program (CIP) participants. CIP participants already subscribe to the importance of security from a narcotics-smuggling perspective and are well positioned to expand their security focus to encompass anti-terrorism.

Q: Is the C-TPAT program a viable consideration for medium or small size companies?

A: C-TPAT is designed for the entire trade community and Customs encourages all companies to take an active role in promoting supply chain and border security. While the benefits of C-TPAT are greatest for large companies that rely heavily on international supply chains, C-TPAT is not just a big-company program. Medium and small companies may want to evaluate the requirements and benefits of C-TPAT carefully in deciding whether to apply for the program. Moreover, even without official participation in C-TPAT, companies should still consider employing C-TPAT guidelines in their security practices.

For More Information:

Contact Industry Partnership Programs at (202) 927-0520 or email us, at [email protected]

C-TPAT Validation Process

Frequently Asked Questions

What is a C-TPAT validation?

A C-TPAT validation is a process through which the Customs Service meets with company representatives and potentially visits selected domestic and foreign sites to verify that the supply chain security measures contained in the C-TPAT participant’s security profile are accurate and are being followed.

What is the goal of a C-TPAT validation?