CHAPTER 6

The Fifth Principle of Digital Business Strategy—Current Position

Where Are We Now?

Foreword

If you have been paying attention up until now, you might very reasonably be expecting this chapter to be about the fourth principle of digital business strategy: resources. Fear not, we haven’t lost the ability to count or dropped a Principle. We find that like many of the best combinations in the world, these next three principles make most sense in relation to one another, but in this instance, that comes at the expense of numerical sequencing. Much like sweet only becomes meaningful when compared to salty and sour, and like Grumpy, Happy, and Dopey’s distinguishing characteristics really only become apparent in the context of the foibles of the remaining seven dwarves so do Principles 4, 5, and 6 rely on each other for explanation.

Resources are the fourth principle because they form part of the microanalysis, but resources really come into play when it comes to selecting one of the engines of growth. Furthermore, engines of growth only make sense when we understand the quadrant and where we are on that quadrant.

Having said all that, now we can return/skip forward to Principle 5: Where are we now?

One of the biggest challenges any leader faces is to simply articulate to their teams the current status of their business within a marketplace in comparison with competitors and deciding what to do about it. Being able to bring technologists, marketers, and business leaders together to discuss the current business proposition in a strategic fashion without defaulting to tactical, marketing, or technology discussions is difficult.

This is the Ionology quadrant. It solves that challenge. It is designed to help plot a business’ current market position using evidence. We can examine where our business is within a defined marketplace, and as the next chapter will show, we will be able to define where we’d like to take our business in the future and the tactical implications that brings.

Before we can determine how we’d like to grow or transform our business, we must first plot our current standing within our defined marketplace. This chapter deals with how to use evidence to plot a business position within a marketplace.

All strategies need a starting point and a destination. Principle 5 is about defining your starting position. We look at evidence and business characteristics to plot your current position within your chosen market. As you’ll see, that will then enable you to clearly articulate a starting position with other team members.

As Alice in Wonderland once discussed with the Cheshire Cat,

Would you tell me, please, which way I ought to go from here?

“That depends a good deal on where you want to get to,” Said the cat.

I don’t much care where —

Then it doesn’t matter which way you go.

Principle 6 is entitled engine of growth; it allows you to plot a new desired destination, a strategic end game. The move we wish to make between our current position and our future desired position determines the actions we must undertake. We cover the available engines of growth in the next chapter.

Naturally with any quadrant there are four key segments: advocacy, attention, authority, and prime. These labels are used to describe how we currently gain new customers. We’ll cover this in more detail later.

Each of these positions has very different marketing and growth profile, and the deliberate decision to move from one position in the quadrant to the next will determine the tactical response, resource requirements, communications, innovation requirements, value proposition, and how we obtain new clients. A move in macroanalysis (the quadrant) affects the variables in microanalysis (Principles 1 to 4).

Before we plot our current position on the quadrant we must first add context to the situation. As the quadrant is used to plot not only our current position but also our desired future position, we must constrain our conversations by focusing on a few parameters. We call this setting the “lens lock.” A lens lock usually contains two or three of the following variables:

1. A geography— We service the New York state area.

2. A vertical—We operate in the financial services market.

3. A niche within a vertical—We’re in the foreign exchange business.

When creating a strategy, the lens lock may change as we hit dead ends or change direction during planning. For instance, James, the CEO of a company named JcoFX, has invented a new predictive modeling software tool he’d like to sell to other foreign exchange traders. He may want to explore what happens if he expands his company into the British market. He may find that there is already a similar product in the UK market that has large momentum and so changes the lens lock to see how a strategy would work if his company became an authority in a new subniche in his hometown.

All strategies are future focused and we set the lens lock to look something like this: New York and London in Financial Services with a special focus on foreign exchange predictive modeling.

The lens lock expresses a desire to expand the business into the London market.

An alternative lens lock could be as follows: New York, financial services, predictive modeling within foreign exchange.

The lens lock can work for simple business propositions also. Maddison sells pies in Alabama via her two retail outlets and she wants consumers around the United States to buy them online.

The lens lock for this business is to grow the territory using digital means. Note she’s not trying to sell to the entire world and she is not looking to sell to other retailers. She still wants to target consumers.

For Maddison, this ambitious plan may be a struggle as she’ll soon find out when she completes the entire strategy board. The lens lock is very broad for a small business, and while her pies are good, there’s no way potential customers in Chicago will be as enthusiastic for her pies without having had the retail experience.

The wider the geography we target, the likelihood of meeting tougher competition increases. The greater the competition, the more resources we usually require to win market share and the more important it becomes to have not just a clear value proposition, but a unique value proposition, something that really differentiates you in your chosen market.

It’s easier to differentiate in a smaller market (especially the one you’re familiar with) than in a wider market. Innovation powers the creation of unique product and service propositions, enabling businesses to have greater cut-through in a wider market.

The X-axis looks to define the size of the customer base being pursued within a strategy.

Exclusive—indicates that you’ve got the names and addresses of the people and organizations you want to pursue.

Niche or limited audience—this means we don’t know the identities of our target audience, but they can be clearly defined as a subsection of a larger group.

Mainstream—indicates that we want to persuade a large proportion of the defined market of the value of our goods or services.

Mass market—We’d like anyone that’s interested in our product or service to know about it.

Here are examples:

Exclusive: We sell outsourced radiology services to 200 potential hospitals in our target geography. We know the names of the hospital CEO and head radiologist.

Niche: We sell health care products to the medical profession, be it hospitals, schools, prisons, and so on in the Boston area. Our target customers are qualified medical practitioners, purchasing managers, and health and safety managers.

Mainstream: We sell health care products to the medical profession, be it hospitals, schools, prisons, and so on all over the United States.

Mass market: We manufacture and sell pain killers to pharmacies and the wholesale channel across the United States.

Notice that the difference between the niche example and mainstream example was simply the size of the market we addressed within our chosen lens lock. In this circumstance, a mainstream market does not always necessarily mean a consumer market. It means that we’re choosing to address a broad range of people or a wide geography. Mass market indicates the largest addressable size of a market, while exclusive means a very small addressable size of an overall market.

A familiar tale is for large businesses to choose broad mainstream lens-locked market positions. This can be because growing a $400 million turnover by 5 percent in a year doesn’t happen when we focus on small niche markets. However, Wilbur and Orville Wright conquered flight on December 17, 1903. That niche industry grew significantly albeit slowly.

It can take many years for an innovation to become an industry overnight success! The challenge big business has is nurturing innovations that can provide perpetual growth in a period acceptable to their shareholders. Quite often they choose broad “mainstream” markets when they should really focus on building a “niche” market first.

The Y-axis describes how your potential customers perceive your business.

Cold and rational—This indicates that the customer is price-sensitive. Most utility companies have a cold relationship; brand loyalty is often bought with low prices; customers will migrate if a better deal comes along.

Mild and Informed—While the cost of a product or service still matters, there are other conditions a customer considers including a personal relationship, a service differentiator, or location of supply. For example, I may choose a four-star hotel because of its closeness to a conference center. There may be lower cost three-star hotels as well as more expensive five-star hotels but they’re too expensive. However, should a better value four-star hotel option appear, I’d take it assuming it’s close to the conference center.

Warm and Comforted—The customer and potential customer recognize your brand as a leading authority in your space. Brand warmth is usually created by innovation or repeated consistent advertising. Customers are less price-sensitive and in fact many will pay a premium to be associated with a warm brand.

Hot and Passionate—Customers will pay a high premium for this must-have product or service. An Apple iPhone costs $600 retail, yet it costs around $100 to make. It’s in a highly competitive market but still maintains healthy margin and very high demand. It was innovation that drove this appeal. Customers will pay very large premiums for the privilege.

It’s possible for a brand to move from cold to hot and back again. Nokia was once a hot brand until it was unseated by the iPhone. It eventually became a mild-informed brand before being acquired by Microsoft.

In 1994 Global Positioning System (GPS) went live. Companies supplying GPS-guided bombs became exclusive/hot suppliers to the military. This technology is now mild/mainstream and no longer demands a premium.

Let’s now plot James and his predictive modeling software for foreign exchange and Maddison’s pies.

JcoFX predictive modeling software is in use with some customers in New York but has no presence in London. If he settles on a lens lock on the geographic niche of New York and London, it would be fair to say that his product is cold/rational. While innovative, at this moment in time very few customers in this market know anything about the product, particularly in London.

If James was to focus on his home market of New York first and set that as his niche, we could say that the customer would have a mild/informed response to James as they’ll be able to reference other users in this limited marketplace.

This nuanced initial position really matters. If James is to make it in both London and New York, his resources (Principle 4) requirement rockets. A move from cold/rational to mild/informed in both the UK and United States may be his desired destination but he may struggle to make either work if the outlook is too broad.

Maddison’s pies are considered hot/passionate within a lens lock of a 1-mile radius of her retail shops. When she sets her lens lock to the entire United States, the vast majority of the potential pie market doesn’t care who Maddison is. They’ll struggle to find her and she’ll struggle to build a brand online without customers having the retail experience first. Her newly defined position in her chosen lens lock is cold/rational and mainstream. This is not where she wants to be, it’s too price-sensitive. She wants to be warm/comforted and mainstream. Unfortunately, it’s not her choice but that of the customer.

To service this lens lock may require serious investment if Maddison is to sell her luxury pies at a premium price on the web. Alternatively, she may wish to consider a smaller identified market and grow her business by combining her retail expertise and opening more shops, combined with online ordering.

Advocacy/Authority/Attention and Prime

There are eight points marked on the Ionology quadrant. Each quad contains two possible plot points that could match your business profile. Before we find our exact plot point we must first find which of the four main quadrants best match our current business characteristics.

Advocacy, authority, attention, and prime describe how businesses gain new customers.

Advocacy

The default position for most businesses:

Sales tend to happen because a sales representative proactively seeks customers for their product. Personal relationship building over a long period is an essential driver of business growth and many sales opportunities come from recommendations of happy customers. They market to existing customers using e-mail marketing and social media channels mostly.

Attention

Paying for attention:

While maintaining many of the same features of advocacy, some businesses advertise a product or service. Attention techniques include search engine advertising and optimization as well as attending trade shows, sponsorship, and display advertising. They spend cash on customer acquisition.

Authority

Earned media, inbound links, and social media shares due to repeated innovation:

Many niche businesses invent new industry categories or subcategories. They invent a thing worth sharing which creates a story worth telling and they contribute something that others want to talk about. They lead a group of like-minded individuals passionate about their subcategory by creating insights and value.

If the invention is indeed newsworthy, it will spread without advertising. The business can become an industry authority. It is authority leaders that create and lead the best communities, get shared the most on social media, get referenced in academic journals, and get paid to speak at international conferences. Customers come to them because of who they are, what they stand for, and they seek to align with the authority innovation and use it to their own advantage.

Prime

Mature industries tend to have a dominant player(s). Around 65 percent of the global tire market is dominated by four manufacturers. Fifty two percent of all ice cream sold in the United States is either chocolate, cookie flavor, or vanilla. The next 1,000 flavors don’t add up to the top three.

Prime players are the dominant market player. They get attention because they are so dominant, so well known. Their strategic imperative is to defend against attention seekers and to acquire or assimilate emerging new threats created by authority businesses.

Each of the quads has a typical growth profile.

Advocacy has the slowest growth profile. It is predicated on the fact that building personal relationships takes time.

Attention businesses buy the attention of customers. In the digital world that is most often by way of purchased advertising, large retail presence, or search engine advertising.

In the digital world, attention is often purchased at the time a customer has the need and types their task into a search engine. When the advertising spend is reduced, we see an immediate effect on customer acquisition.

Typically, attention-based businesses don’t gain a sustaining reputation beyond those who they have serviced well and conducted advocacy practices on to maintain the relationship.

Authority positions are attained by businesses practicing continued cycles of innovation, choosing their niche, and seeking to dominate and lead that niche by way of earned references from independent third parties.

Earned references include bloggers blogging about you and tweeters tweeting about your product, service, or cause. It can include magazines and industry commentators talking about your business. We cannot self-proclaim to be an industry authority. The true measure of an authority is underpinned by evidence of sustained, high volumes of peer-review attention for reasons of innovation or great storytelling.

It is through these references we build a brand reputation. Incredibly, once a reputation is gained, it carries with it a momentum that can last for a long time, unlike attention modeling.

Prime businesses are the industry giants. Depending on the lens lock used, the term “giant” can be a relative term. Remember Maddison and her pies? Her shop was the prime place for pies in a 1-mile radius around her shop. This is enough to sustain her retail business, but not enough to feed her ambition; therefore, she opens her lens lock wider.

She moves to become an authority player when we consider her marketability within her county. She’s often asked to speak at business events and share her business-building baking experiences.

When she moves outside her county she falls to an overall position of advocacy. When we go further afield again, and we take in the entirety of the United States, her relationship with the entirety of the United States can only be described as “cold” (unlike her pies). Of 300 million plus people, only several thousand have any brand recognition.

For the sake of simple explanation, we’ll take a large well-known global prime player, in this case Nike. Their marketing role, unlike rising authority businesses or attention businesses, is to be in a position of both defense and growth. They must defend from new innovators coming at them from the authority quadrant, and they must defend from brands in the attention quadrant wishing to out-advertise them.

It’s easier for a prime brand to defend than for an authority or attention brand to attack. As shown with the tire and ice cream example, the major financial spoils go to the prime player. This leaves the prime player fully resourced to acquire or assimilate new innovative competitors and to out-spend rising attention brands.

An active prime brand like Nike will not be taken down by others out-spending them just as Coke wasn’t displaced by Pepsi’s spending. Once established, it is usually innovation that dislodges prime brands or their own internal inability to react to threats.

Here are the top five characteristics of each quad. The most effective way to establish the quadrant a business is in is to look at the supporting data. As we’ll see in the next chapter, as the business moves from one quadrant to another so too does the website and social data profile.

Top Five Characteristics

Advocacy (or Word of Mouth)

1. Advocacy is the default starting position for businesses that have not taken deliberate action to invest in advertising, thus moving to attention or have not innovated to gain sustainable repeated references from industry publications and social influencers.

2. Data: Typically, advocacy businesses have a high percentage of website visits to their “people” page, “about us” page, or “contact us” page. This is because website readers are as interested in the people they’re dealing with as the product/service they are purchasing.

3. Value proposition: Advocacy businesses often compete head-to-head with competitors’ nondifferentiated value propositions. The value they proclaim to offer customers is usually based on “soft” points of difference anyone can claim. For example, “we have the best people.”

4. Customers are typically obtained by offline efforts supported by digital marketing.

5. The marketing tactics that tend to be most successful are e-mail marketing and the managing of existing clients through social media interactions. An advocacy website focuses on the people within the company as much as the product or service it sells.

Authority (or Thought Leader)

Being good is not the same as being a thought leader. Most business leaders will claim “we’re an industry authority.” Unless they can produce evidence that they are publishing high-quality insights that are being shared by independent third parties, then it’s likely they are simply “good at what they do,” but not an industry authority. There is typically only room for a couple of industry authorities for any niche, no matter what the size the niche is.

Below are the top five characteristics of an authority business:

1. Authority businesses are those that have deliberately set out to lead a defined niche market and in doing so gain momentum, build brand equity, and gather customers by independent industry pundits referencing them. They typically publish their innovations and gain a reputation as a good source of industry insight.

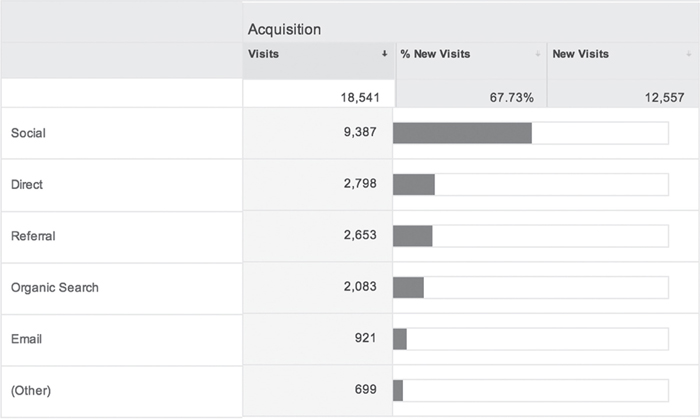

2. Data: A typical profile of website traffic for an emerging authority business shows that most traffic comes from referral traffic and third party social shares. Over time “organic search” will increase as the brand starts to dominate the position of authority.

3. Value proposition: Most authority businesses are first to create a new or define an emerging market with a unique and clearly differentiated proposition to that of the current status quo.

4. Customers follow thought leaders. They share interest in the innovation, cause, or community that the authority business has created.

5. The marketing tactics that tend to be most successful are online Public Relations (PR), blogging, and YouTube channels that gain lots of subscriptions. Simply having these features on a website does not make an authority business. Content must be successfully syndicated and spread thereafter.

Attention (or Advertising Driven Business)

The advantage of running an attention-driven business is that demand can be created almost instantly. Once a website has been created, it takes little in the way of effort to set up online ads that target the desired audience.

The disadvantage of running an attention-driven business is that the cost of advertising is driven by auctioning search terms. It’s not uncommon that the cost of advertising escalates over time until it equals or exceeds the value of the transaction. Retailers can spend $100 to get $75 in profit in the hope to retain a client for further transactions. Other kinds of businesses such as complex solution providers can spend thousands of dollars in the hope of gaining a new client. The running costs of this model can quickly get out of control. Once hooked on gaining clients using this method, it becomes a challenge to wean a business off this form of sales lead generation.

Below are the top five characteristics of an attention business:

1. Attention-driven businesses are the obvious choice for businesses that want to seek new customers via digital channels. It suits businesses that don’t wish to change their offline business model to compete better online. Unlike authority businesses this kind of activity typically doesn’t build brand equity as it simply responds to customer need rather than defining a market. As soon as the advertising stops, so too does the flow of new clients.

2. Data: Typically, attention-driven businesses see the clear majority of their website traffic coming from paid search.

3. Value proposition: Attention businesses often win business based on small points of differentiation or price. Rarely do attention-driven businesses have a “unique” value proposition.

4. New customers typically find the business from searching the web at their time of need.

5. The marketing tactics are search engine marketing, search engine optimization, and display advertising. The website of an attention-driven business focuses upon product features and price. It’s common that a searcher bypasses the home page of attention-driven businesses as search engines and ad campaigns land them directly on the page that best answers the searchers query. Websites should be designed bearing this in mind.

Prime (The Dominant Industry Player)

This is the ultimate destination for any business, to become a dominant market player with a large percentage of market share.

The prime player has the great advantage over smaller businesses in that when it announces a new product or service, the industry often just assimilates and accepts the wishes of the prime. There is usually room for two or three prime players, and as such they typically obsess over retaining market share and defending against other prime players attacking their position. More often prime players can be blindsided not by other prime businesses but by rising authorities. For this reason, the three most important functions of a prime business are to innovate, defend against innovators, and spend cash on advertising to protect against attackers coming up from a position of attention.

Below are the top five characteristics of a prime business:

1. Prime position is not achieved or defined by a set of actions. It’s the ultimate destination, the winner’s podium for the largest businesses in any lens locked market. A business may be the prime player in one state, but if we widen the geography to include the entire country, the prime business can be dethroned by larger national businesses in this wider context.

2. Data: Typically, prime businesses gain the vast majority of their website traffic from people searching for them by their brand name. As the industry leader, most get large volumes of search engine or direct traffic.

3. Value proposition: The prime player often defines the entire market. They have a unique value proposition often achieved by way of having disproportionate resources to the competition.

4. New customers are typically drawn to the prime player based on reputation.

5. The prime player must acquire authority businesses that threaten its status or give it leverage into extending its market position. It defends against attention-driven businesses. Therefore, almost all digital marketing tactics are required depending on the scenario confronting a prime player in any situation. A prime website should be designed to reduce customer inertia and allow them to complete their task as swiftly as possible. Unlike authority websites, the prime player doesn’t have to convince readers of its credentials, and therefore, blogging and other authority tactics are not necessary to maintain position.