15

Financial Shenanigans

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Understand the regulatory framework in place to ensure that the financial statements are reliable.

- Appreciate the accounting areas where managerial discretion is available.

- Develop familiarity with the common areas of creative accounting.

- Dissect some of the infamous accounting scams of recent times.

- Apply techniques to detect financial shenanigans.

- Appreciate the need for ethics in accounting.

15.1 INTRODUCTION

As discussed in Chapter 1, the accounting information is prepared by the management and used by a large number of stakeholders for taking economic decisions. The end result of the accounting cycle, i.e., the three key financial statements—balance sheet, the statement of profit and loss and cash flow statement—convey useful information about the financial health and performance of the enterprise and in turn can be used to make estimates about the future. By using common size & trend analysis and ratios, one can infer about the profitability, liquidity, solvency and efficiency of the enterprise as well as its cash generating ability. However, the quality of such analysis is dependent upon the quality of the information contained in financial statements. To be really useful, the information provided in financial statements must be reliable. Reliability is one of the key qualitative attribute desirable in financial statements to enhance their usefulness. ‘Information has the quality of reliability when it is free from material errors and bias, and can be depended upon by users to represent faithfully that which it either purports to represent or could reasonably be expected to represent.’1

Reliability–financial statements to be reliable must be free from material errors and bias and can be depended upon by stakeholders for taking economic decisions.

To be considered reliable, financial statements must be free from bias and must faithfully represent the transactions and events that they are purporting to represent. All the material information that may have an influence over the decisions by the stakeholder must be disclosed (relevance principle). The information given must be guided by the substance of the transaction rather than the legal form (substance over form). Additionally, wherever in doubt, it is better to under-report the assets and incomes in the financial statements rather than overstate them. Likewise, while reporting expenses and liabilities, in case of doubt, overstatement is preferable than understatement (conservatism).

To ensure that the financial statements of a company have the attributes of reliability and they do give a ‘true and fair view’ of the state of affair of the enterprise, the following regulatory framework has been prescribed:

- Standardized formats and disclosure requirement: The formats of the balance sheet and the profit and loss statement have been prescribed under Schedule III of the Companies Act, 2013 with the relevant details to be provided in the notes to accounts. This ensures that at least a certain minimum level of disclosure is provided to the users.

- Accounting standards: The financial statements must comply with the applicable accounting standards issued by the ICAI2. In case of non-compliance the reasons for non-compliance and the financial effect arising due to such deviation need to be disclosed3. The board of directors in their report to the shareholders needs to confirm that the applicable accounting standards had been followed in the preparation of the financial statements giving proper explanation in case of material departures4. The accounting standards to some extent reduce the management’s choice of accounting alternatives and also enforce a certain degree of disclosure.

- Independent audit: Financial statements are required to be audited by a Chartered Accountant who is not an officer or employee of the company or in any other way associated with the company. Such an audit is called ‘external audit’ or ‘independent audit’ or ‘statutory audit’. The audit report is addressed to the shareholders of the company5. In case of any observations or audit qualifications, comments of the board of directors on each observation or qualification is also required to be given in the directors’ report to the shareholders.

To ensure independence of the auditors, the Companies Act, 2013 provides for compulsory rotation of the auditor. Further, the auditor is also prohibited from providing specified services to the same firm.

- Listing agreement: Section 177 of the Companies Act, 2013 requires every listed company to constitute an audit committee of the board of directors. As per the listing agreement, such a committee shall have a minimum three directors out of which at least two-thirds must be independent. The audit committee is chaired by an independent director and all members of the committee need to be financially literate. The audit committee is responsible for oversight of the company’s financial reporting process and the disclosure of its financial information to ensure that the financial statements are correct, sufficient and credible. Financial statements need to be reviewed and certified by the CEO and CFO of the company as to their reliability. The format of the CEO/CFO certificate is provided in the listing agreement.The purpose of CEO/CFO certification is to ensure accountability of the top management for financial disclosures.

The CEO/CFO certificate in case of Grasim Industries Limited is given in Box 15.1

The above framework consisting of accounting standards, standardized format and disclosure requirements, independent audit, approval of accounts by audit committee with independent directors and CEO/CFO certification has been put in place to enhance the reliability of the financial statements.

Box 15.1 CEO/CFO Certification of Grasim Industries Limited

The Board of Directors

Grasim Industries Limited

We certify that:

- We have reviewed the financial statements and the cash flow statement of Grasim Industries Limited for the year 31st March 2017, and that to the best of our knowledge and belief:

- These statements do not contain any materially untrue statement or omit any material fact or contain statements that might be misleading.

- These statements together present a true and fair view of the company’s affairs and are in compliance with the existing accounting standards, applicable laws and regulations.

- There are, to the best of our knowledge and belief, no transactions entered into by the company during the year which are fraudulent, illegal or violative of the company’s code of conduct.

- We accept responsibility for establishing and maintaining internal controls for financial reporting and that we have evaluated the effectiveness of the internal control systems of the company pertaining to financial reporting. We have disclosed to the auditors and the audit committee, deficiencies in the design or operation of internal controls, if any, of which we are aware and the steps taken or proposed to be taken to rectify the deficiencies.

- We have indicated to the auditors and the audit committee:

- Significant changes in the internal control over financial reporting during the year.

- Significant changes in the accounting policies during the year and that the same have been disclosed in the notes to the financial statements.

- Instances of significant fraud, of which we have become aware and the involvement therein, if any, of the management or an employee having a significant role in the company’s internal control system over financial reporting.

For Grasim Industries Limited

| Dilip Gaur | Sushil Agarwal |

| Managing Director | Whole-time Director & CFO |

| [DIN : 02071393 ] | [DIN: 00060017]. |

15.2 FINANCIAL SHENANIGANS

Notwithstanding all the regulatory safeguards discussed above, there have been an increasing number of cases of creative accounting and accounting frauds leading to massive losses to the investors and other stakeholders. Financial shenanigan refers to all actions of the management which attempt to depict financial performance of an enterprise different from what it really is. It may be in the form of creative accounting or aggressive accounting, or active manipulation of accounting records to falsify the information disclosed in financial statements. Various actions that constitutes financial shenanigan include creative accounting, window dressing, earnings management and accounting frauds. Whatever the name and form, there is an intent and action on the part of the preparer of financial statements (management) to manipulate the financial information to depict financial performance and financial position different from what the real performance and position are.

Figure 15.1 Financial Shenanigans—Motivations and Opportunities

Some of the financial shenanigan may well be within the boundaries of law and hence not illegal, whereas some other may involve active concealment of relevant information, falsification of accounts and furnishing incorrect information with an intent to cheat. For example, change in method of accounting or using estimates which are aggressive with full disclosure in the annual report is not fraudulent. On the other extreme, falsifying accounts by recording fictitious revenue or omitting expenses are clearly fraudulent misrepresentations of the financial information to the stakeholders.

Financial shenanigan is a combined result of motivation and opportunity to manipulate. As discussed earlier, the reported financial numbers are used by external stakeholders for taking various economic decisions. The management may be motivated to manipulate financial statements to further its own objectives. At the same time there are opportunities also for financial statement manipulation. The reasons behind financial shenanigans (motivations) and the contributory factors (opportunities) are depicted in Figure 15.1.

15.3 MOTIVATIONS FOR FINANCIAL SHENANIGANS

15.3.1 Performance-based Compensation

Performance measurement system used by companies often starts with setting up of performance targets and concludes by comparing the actual performance against these targets. In order to motivate managers, monetary and non-monetary rewards are offered for meeting and exceeding these targets. Missing the target may meet with unfavorable consequences which may include loss of job. Such performance-based compensation does motivate the managers to work towards the organizational goals, but also has an undesirable side effect of earnings manipulation. For example, a CEO holding a large number of ESOP may be tempted to manipulate financial statements to increase the market price of the company’s shares so that the value of his own holding is maintained or improved upon.

15.3.2 Earnings Expectations

In case of listed companies, there is a requirement of disclosing quarterly results. These results are closely watched by a number of stakeholder including investors, prospective investors and market analysts. The management, on its part, gives earning guidance for the quarter ahead. Failure to meet earnings expectations so created often leads to sell off and plummeting of the share price of the company. As a result, the management may resort to financial shenanigans to meet the market expectations.

15.3.3 Conceal Deteriorating Financial Condition

Financial shenanigans may be put into practice by management when the enterprise is facing deterioration in its financial conditions. A sudden decline in the profitability due to internal or external reasons may prompt the management to resort to accounting actions to falsify the earnings.

15.3.4 Tax Evasion

One of the reasons often cited for financial shenanigans is a desire to lower the tax liability. The accounting policies and actions may be so arranged so as to either reduce tax liability of postpone tax liability.

15.3.5 Raising Funds

An enterprise may be planning to come up with a public offering of shares to finance its expansion plans. At this stage, it is critical to present financial numbers that will enable the enterprise to obtain a good pricing for its securities. Likewise, an enterprise planning to take a large loan or coming to the market for a debenture issue may also resort to window dressing to get a favourable credit rating or simply, to meet the lender’s covenants to be able to get the loan.

15.3.6 Diversion of Funds

Financial shenanigans may also be used to cover up diversion of funds by unscrupulous management. If funds or other assets of the enterprise have been diverted or otherwise misappropriated by the management, there may be attempts to cover up the hole so created by accounting manipulations.

An e-survey of over 1,000 Indian organizationsby a leading audit firm revealed that 81% of the respondents perceive financial statement frauds as a major issue in India. The survey also indicate pursuit of meeting market expectations (63%) and performance-based remuneration (61%) as the main reasons for financial statement frauds besides tax evasion (37%), raising finance or meeting debt covenants (35%), diversion of funds (25%) and continuation of employment (22%).6

15.4 OPPORTUNITIES FOR FINANCIAL SHENANIGANS

15.4.1 Accounting Flexibilities

Accounting statements are based upon the applicable GAAP and accounting standards. The accounting standards do limit the managerial choices of accounting policies but do not completely eliminate them. Furthermore, accounting information is based upon a number of estimates. For example, depreciation of fixed assets is based upon the estimate about their useful lives and also the residual value. The management may use these accounting choices and estimates to further their own purpose rather than choosing the most appropriate accounting policy. Some of the areas where significant managerial latitude existsand in which different accounting policies may be adopted by different enterprises are:

- Methods of depreciation, depletion and amortization

- Treatment of expenditure during construction

- Conversion or translation of foreign currency items

- Valuation of inventories

- Treatment of goodwill

- Valuation of investments

- Treatment of retirement benefits

- Recognition of profit on long-term contracts

- Valuation of fixed assets

- Treatment of contingent liabilities

15.4.2 Weak Internal Controls

Presence of internal controls including internal checks and internal audit acts a deterrent to financial shenanigans. However where internal controls are not strong or the senior management has the flexibility to by-pass the inter controls, the chances of accounting manipulations are severe. Not having a well drafted whistle-blower policy as an integral part of internal controls may also contribute to financial shenanigans.

15.4.3 Lack of Auditors’ Independence

Financial statements of a company are required to be audited by external auditors. These auditors are expected to be ‘independent’ as they are not on the pay roll of the company which is the subject of the audit. However the auditors’ independence may be compromised in real practice. For example, the auditor of a company may also be providing other consulting services to the same company. In such a case, it is difficult to maintain their objectivity in audit as any disagreement with the management may lead to loss of the consulting income as well. Such a conflict of interest may lead to compromising auditors’ independence, Likewise, the same audit firm continue to audit the financial statement of an enterprise year after year. In such a situation, there is always a possibility of a personal relationship getting developed between the auditors and the management of the company.

15.4.4 Poor Governance Structure

The financial statementsand the audit report are reviewed by the board of directors and the audit committee thereof. The board and the audit committee also have independent directors. It is expected that the presence of independent directors will serve as a deterrent to financial shenanigans. However, the board may be either dominated by the family members or friends of the promoters, or the board members may lack the necessary expertise to perform the duties assigned to them. Likewise, the independent directors receiving significant fees or commission or other benefits from the company may not perform their role objectively. The board of directors that either lacks competence or independence may not be effective in monitoring financial shenanigans.

The Fraud Survey 2010 by KPMG identifies management override of controls (66%), inadequate whistle blower mechanism and inadequate internal controls (56%), inadequate monitoring by the Board/audit committee (48%) and Lack of independent audit functions (40%) as the major factors facilitating financial statement frauds. It may be noted that financial shenanigans are often perpetrated by the senior management and usually more than one person is involved. It may also have either active involvement or tacit understanding with the auditors as well. As a result, detection of such shenanigans is quite difficult.

15.5 FINANCIAL SHENANIGANS TECHNIQUES

After having discussed the reasons for financial shenanigans and the factors that facilitate such practices, in the following section we discuss some of the commonly used financial shenanigan techniques. Normally these techniques are used to show a rosy picture of the earnings and financial position of the company but they may also be used to depict lower earnings than actual.

15.5.1 Revenue Recognition

Revenue recognition—both timing and quantum—is one of the most vulnerable areas for financial shenanigans. As per a study of 347 alleged cases of fraudulent financial reporting by US companies between1998 and 2007, over 60% of the companies covered were found to have overstated revenues.7 Financial shenanigan relating to revenue may involve advancing or postponing revenue recognition as well as recording sham revenue. Some of the techniques affecting revenue recognition are discussed below:

Consignment Sales

Revenue in respect of goods sent on consignment basis to a consignee (agent) for onwards sale to the customer is recognized only when the goods are actually sold by the consignee. The risk and rewards related to the goods gets transferred only when the goods are sold by the consignee. The financial shenanigan involves recording revenue in respect of goods sent on consignments as final sale even before the risk and rewards associated with the goods have been transferred to the buyer. The accounting practice deployed by Lucent Technologies in this regards has been described in Box 15.2.

Consignment sales—recognizing revenue before actual sale by the consignee while ownership is still with the consignor.

Box 15.2 Lucent Technologies—Accounting for Consignment Sales

Lucent Technologies, a fortune 500 company, was investigated and fined by the Securities Exchange Commission (SEC) for improperly recognizing approximately $1.148 billion of revenue and $470 million in pre-tax income during fiscal year 2000. Besides other violations Lucent recorded more than $350 million in equipment sales to two distributors with a promise that the equipment could be returned if no buyers could be found. Ultimately, the equipment was returned to Lucent, but only after the fourth quarter closed. This way Lucent was able to report higher revenue in violation of GAAP.

Round Tripping

A ‘round-trip’ trade aims at artificially boosting the revenue by selling some goods, assets or securities to another entity with an understanding to buy it back at the same or almost the same price. The transaction lacks any economic justification other that increasing the revenue. As both the legs of the transaction are done at almost the same price, it may not have any impact on the bottom line of the company. A company which is likely to miss its revenue guidance may resort to this financial shenanigan to artificially recognize revenue. Round tripping practiced by Dynegy Inc. has been described in Box 15.3

Round tripping—selling goods or other assets with a tacit agreement to buy it back later at almost the same price resulting in artificial boost to revenue.

Channel Stuffing

Channel Stuffing is the name given to the deceptive business practice used by a company to inflate its sales and earnings figures by deliberately sending retailers along its distribution channel more products than they are able to sell.The channel partners are given the flexibility to return the goods later, incentives in the form of discounts and extended credit period. The channel partners may also be assured an agreed return on their investments in inventory by way of a side agreement.Channel stuffing as practiced by Bristol-Myers Squibb Company is described in Table 15.4.

Channel stuffing—shipping goods to the dealers in excess of the genuine demand from the end users by extending lucrative incentives.

Box 15.3 Dynegy Inc.: ‘Round Tripping’ to Enhance Revenue

Dynegy Inc. a fortune 500 company was investigated and fined by SEC for ‘overstatement of its energy-trading activity resulting from ‘‘round-trip’’ or ‘‘wash’’ trades—simultaneous, pre-arranged buy-sell trades of energy with the same counter-party, at the same price and volume, and over the same term, resulting in neither profit nor loss to either transacting party.’ Through these ‘round trip’ or ‘sham trades’ the company misled its investors about the volume of its energy trading activity.

Round tripping may also take the form of a barter trade of similar goods or services. For example, an agreement whereby two TV channels or websites agree to advertise on each other with the sole purpose of increasing revenue without any economic justification may help both the parties to the transaction to boost the reported revenue figure.

Box 15.4 Bristol-Myers Squibb Company—Channel Stuffing

Bristol-Myers Squibb Company (a fortune 500 company) was investigated and fined by SEC. The complaint alleged among other things that:

- From the first quarter of 2000 through the fourth quarter of 2001, Bristol-Myers engaged in a fraudulent scheme to inflate its sales and earnings in order to create the false appearance that the company had met or exceeded its internal sales and earnings targets and Wall Street analysts’ earnings estimates.

- Bristol-Myers inflated its results primarily by (1) stuffing its distribution channels with excess inventory near the end of every quarter in amounts sufficient to meet its targets by making pharmaceutical sales to its wholesalers ahead of demand; and (2) improperly recognizing $1.5 billion in revenue from such pharmaceutical sales to its two biggest wholesalers. In connection with the $1.5 billion in revenue, Bristol-Myers covered these wholesalers’ carrying costs and guaranteed them a return on investment until they sold the products.

Booking Future Income as Current Income

As the GAAP the revenue is recognized when earned using accrual principle of accounting. Revenue is deemed to have been earned when the goods have been sold or the services have been performed. The financial shenanigan involved here is booking the future income (which is not yet earned) as current income. By advancement of income by improper accounting the current period’s revenue as well as earnings gets inflated. It however will have a negative impact on the reported earnings in the future periods. Xerox Corporation deployed this accounting shenanigan as described in Box 15.5.

Box 15.5 Xerox Corporation—Advancement of Revenue Recognition

Xerox Corporation (a fortune 500 company) was imposed a penalty of $10 million by the SEC. The company also agreed to restate its financial results and set up a committee to review its accounting controls. The SEC alleged that ‘from at least 1997 through 2000, Xerox used a variety of what it called ‘‘accounting actions’’ and ‘‘accounting opportunities’’ to meet or exceed Wall Street expectations and disguise its true operating performance from investors. These actions, most of which violated generally accepted accounting principles (GAAP), accelerated the company’s recognition of equipment revenue by over $3 billion and increased its pre-tax earnings by approximately $1.5 billion.’

The accounting practice in question revolved around company’s leasing arrangements. The revenue of Xerox under leasing arrangement was made up of three components—the value of the equipment, revenue from servicing of the equipment over the lease period and interest earned on lease. Revenue from the sale of the equipment is recognized upfront at the time of commencement of lease whereas revenue from the servicing and financing is earned and recognized over the life of the lease. Between the year 1997 to 2000 Xerox used accounting policies (called return on equity and margin normalization) to shift revenue from financing and servicing to the equipment and booked it upfront rather than over the lease period. By not disclosing this change in accounting policy and estimate, the company created an impression that it was earning more from the sale of equipment than in reality it was.

Reporting Cost Over Runs as Revenue

One of the conditions for booking revenue is the certainty that it will be realized. In case any uncertainty exists regarding realization, revenue recognition is postponed till the uncertainty is resolved. In case of construction projects cost over runs are not recorded as revenue unless the same has been accepted by the customer. The financial shenanigan involved here is booking of the revenue in case of cost over runs even before the same has been accepted by the customer. The financial shenanigan as used by Halliburton is described in Box 15.6.

Percentage Completion Method

As discussed in Chapter 7, revenue from services and construction contracts is often recognized using percentage completion method. In this method of revenue recognition, revenue gets recognized well before the completion of the project based upon the degree of completion and even before raising invoice to the customer. The difference between the revenue recognized and invoice raised is recorded as ‘unbilled revenue’ which is disclosed in the Balance Sheet as a current asset. Revenue recognition in this method is based upon the estimate about the percentage of completion. By manipulating the estimated percentage of completion, revenue may be over or under recognized.

Unbilled Revenue—excess of revenue recognized on the basis of % completion over revenue invoiced to the customer.

Box 15.6 Halliburton—Booking Cost Over Runs as Revenue

SEC investigated the change in accounting policy by Halliburton (a fortune 500 company). Halliburton’s construction projects, which made up the bulk of the company’s business, often, went over budget. The company used to account for the revenue it received from these projects after agreeing with its clients. But after 1998, it adopted a more aggressive accounting policy and started booking revenues in respect of cost overruns assuming that the customers would eventually pay.

Halliburton added $89 million in revenues to its books in 1998, helping the company beat its earnings target by 2 cents a share for the year and increasing its stock value. If the accounting change hadn’t been employed, the company would have missed its earnings target by 11 cents a share8.

Sales versus Commission

An enterprise may be engaged in the business of trading in goods or financial securities for other entities. In such transactions, the enterprise may pay a certain price to the seller, adds its service charges or commission on it and receives the purchase price plus service charges from the buyer. In such backto-back transaction, the enterprise should recognize only the service charge or commission as revenue. However to inflate its revenue, management may decide to book revenue at the amount charged from the buyer (purchase price plus service charge) at the same time including the purchase price in the cost. This financial shenanigan is bottom-line neutral but has the effect of enhancing the top-line. For example, a stock broker bought shares worth ₹10 million for its client charging 1% as commission. It paid ₹10 million to the seller and collected ₹10.1 million from the buyer inclusive of commission. The broker should record only ₹0.1 million, i.e., the commission earned as revenue. To inflate revenue it may show ₹10.1 million as revenue and at the same time ₹10 million as expenses.

The audit report of MMTC Limited, a public sector company, was qualified by its auditors for improper revenue recognition as described in Box 15.7.

Backdating of Transactions

In order to increase revenue to meet the targets—internal or external—an enterprise may keep its accounts open for extended period of time. Sales of subsequent period may than can be backdated and included in the previous accounting period. For example, the accounts for the quarter ended 31st March 2017 may be kept open till say 15th of April 2017. Any sales order received till theextended date may be backdated and recognized as revenue for the quarter ended 31st March 2017 at the same time recording accounts receivable for the equivalent amount.

Fictitious Revenue

Revenue from sales of goods or services may be recognized by falsifying accounting records, raising false invoices, manipulating inventory records and booking non-existent receivables. This is the extreme form of financial shenanigans which involves active fraud by the management of the company. The modus operandi used by Satyam Computer Services Ltd (Satyam) for booking fictitious revenue is described in Box 15.8.

Box 15.7 MMTC Limited—Overstatement of Revenue

The auditors of MMTC Limited, a public sector company, qualified the audit report on the accounts for the year 2004–05 stating that ‘In terms of Accounting Policy No. 1(b) regarding accounting of certain transactions as sales/purchasesw here Letters of Credit in the name of the Company are assigned in favour of Business Associates and Accounting Policy No. 1(f) where purchases of some commodities are booked based on sales value less service charges, the Company has treated sales of 27,246,587 thousand (to the extent details made available and including canalized items) during the year as its own, as per past practice. On examination of the facts, circumstances and the manner of effecting these transactions, we are of the opinion that the sales and purchases booked by the Company are not its own and as such, the above, accounting policy is not in conformity with Accounting Standard 9 ‘‘revenue recognition’’ issued by the Institute of Chartered Accountants of India and the guidelines issued by the Department of Public Enterprises. As a result of this policy, sales and purchases have been overstated by ₹27,896,466 thousand and ₹27,246,587 thousand respectively. However, this policy has no effect on the profit of the Company for the year.’

Box 15.8 Satyam Computer Services Limited—Recording Fictitious Revenue

Satyam had a regular application flow for generation of invoices. It consisted of five interrelated applications:

- Operational real-time management (OPTIMA) for creating and maintaining the projects.

- Satyam project repository (SRP) for generating the project ID.

- On time application, to key-in the man hours put in by the employees.

- Project bill management system (PBMS) for generating the billing advises from the data received from the on time and from the rates agreed upon with the customer.

- Invoice management system (IMS) to generate invoices based on the billing advice generated by the PBMS.

Apart from the regular application flow, Satyam had another method of generating invoices through Excel Porting, wherein the invoices can be generated directly in IMS by-passing the regular application flow by porting the data into the IMS. This application was expected to be used sparingly for emergency requirements only.

In order to perpetrate this fraud, Satyam created a new user ID called Super User which had the power to hide/unhide the invoices generated in IMS. By logging in as a Super User, it was possible to hide invoices that were generated through Excel Porting. The hidden invoices are not visible to the other divisions within the company but only to the Sales Team in Finance Division of Satyam. These invoices were not despatched to the customers. All the invoices that were hidden using the Super User ID in the IMS server were false and fabricated.

These false and fabricated invoices were generated for the purpose of inflating the sales and the amounts pertaining to these false and fabricated invoices were shown as receivables in the books of accounts of Satyam thereby dishonestly inflating the revenues and receivables of the company. There were 7,561 invoices hidden in the IMS amounting to ₹5,117 crore. The accused entered 6,603 out of these false and fabricated invoices amounting to ₹4,746 crore into their books of accounts thereby inflating the revenues of the company to that extent.

15.5.2 Treating Operating Expenses as Capital Expenditure

As discussed in Chapter 9, expenses incurred for day to day normal operations of the enterprise are charged off to the profit and loss statement of the period when incurred whereas expenditure likely to benefit the enterprise over a long period of time are capitalized. The capital expenditure so capitalized are depreciated or amortized over the useful life of the asset so created. The management may use its discretion to treat normal operating expenses as capital expenditure. This shenanigan impacts both the reported profit as well as assets in the balance sheet. By treating operating expenses as capital expenditure, the incidence in the profit and loss statement is deferred resulting is higher reported profits. At the same time by capitalizing the same, the assets as shown in the balance sheet are inflated. As these assets will be depreciated over their useful lives, the future profits will be adversely affected. The financial shenanigan as used by WorldCom is described in Box 15.9.

Box 15.9 WorldCom—Treating Operating Expenses as Capital Expenditure

WorldCom, the second largest long distance telecommunications company of the USA admitted that it had overstated its earnings in 2001 and first quarter of 2002 by a whopping $3.8 billion. The financial shenanigan deployed here was classification of $3.8 billion payments towards line cost as capital expenditure. Routine payments made by WorldCom to other companies for using their communication network were called line cost. Instead of treating these payments as operating expenses the same were capitalized in the books of the company. As a result, both the profits as well as the assets of the company were overstated. Such an accounting practice results in higher current income (by understatement of operating expenses) but lower future profits (due to higher depreciation of expenditure capitalized).

Similar effect can be achieved by postponing the date of completion of the project. As discussed in Chapter 9, expenses incurred, including interest during construction, till the asset is ready for its intended use can be capitalized. By postponing the cut-off date, it may be possible to book more expenses as capital expenditure thereby inflating both current profits and assets. However, future profits will be lower due to higher incidence of depreciation.

15.5.3 Under-provisioning of Expenses, Losses or Liabilities

Besides day-to-day expenses which are recognized on accrual basis, there are a number of expenses and losses which are required to be estimated and provided for. The management inflates earnings by under providing for these expenses, losses and liabilities. At the same time, in the balance sheet the assets get overstated and/or liabilities get understated. Some of the possible shenanigans in this category are:

Depreciation and Amortization

The amount of depreciation to be charged in the profit and loss statement is dependent upon the method of depreciation (WDV vs. SLM) and estimates about the useful life and residual value of the asset. It is expected that managerial estimates about these variables are guided by the pattern of benefits that the asset is likely to generate over its useful life. However the choice of depreciation methods, etc., may be used to manipulate earnings and assets. By stretching the estimate regarding the useful life of the asset, the company can boost its earnings (because of lower depreciation charge) as well overstate its assets.

Provisions for Doubtful Debts

Trade receivables in respect of goods sold or services provided are disclosed in the balance sheet at their realizable value. Suitable provision is made towards doubtful debts based upon the past experience. The amount of provision is charged as an expense in the profit and loss statement and trade receivables are shown in the balance sheet net of the provisions for doubtful debts. Such an accounting is warranted by conservatism principle and matching principle. Management may skip making appropriate provisions resulting in overstatement both of profits and assets. This may be of special significance in case of banks and other lending institutions, if they fail to provide for non-performing assets.

Box 15.10 ITI Limited—Under Provisioning Towards Doubtful Debts

‘Sundry debtors includes a sum of ₹260.02 crore outstanding for three years and more. As against this, provision has been made only to the extent of ₹9.63 crore. In view of the uncertainty regarding the collectability and realisability of some of these debts, the adequacy of the provision is not ascertainable. Other recoverable such as claims (Inland and Foreign), loans and advances, and other outstanding for more than three years amount to ₹64.04 crore. As against this, provision has been made only to the extent of ₹13.28 crore. In view of the uncertainty regarding the collectability and realisability of some of these recoverable, the adequacy of the provision is not ascertainable.’

The auditors of ITI Limited issued a qualified report on the accounts for the year 2008-09 for under provision of doubtful debts as stated in Box 15.10.

Provisions for Warranties

Manufacturers and suppliers of machinery and equipment provide performance warranties to their customers. As the revenue in respect of such sales is booked in the current period, it is appropriate that costs expected towards those warranties are also recognized in the current period. For that purpose, suitable provisions towards cost of warranties are made in the books of accounts to ensure proper matching of revenue and costs. To inflate profits, the management may decide to not to make appropriate provision towards warranty, thereby resulting in higher reported profits and understatement of liabilities.

Provisions for Employees’ Costs

Companies in terms of the condition of employment provide certain retirement benefits to its employees. These defined benefit plans include pension, leave encashment, post-retirement medical benefits, etc. Suitable provisions are required to be made towards these obligations as they are being provided in lieu of the services rendered by the employees in the current period. Non-provision of employees’ cost results in overstatement of profits and understatement of liabilities. Further, as these provisions are based upon actuarial assumptions relating to return on investment, annual increments, employee iteration, etc., the management may under-provide towards these costs by making unrealistic assumptions.

15.5.4 Cookie Jar Accounting

This financial shenanigan essentially aims at income smoothening. This is based upon the assumption that companies reporting smooth profits are viewed to be less risky by the investors than the companies with fluctuating profits. For example, a company with quarterly profits of ₹400 million, ₹120 million, ₹360 million and ₹180 million will be considered volatile compared to another company with quarterly profits of ₹280 million, ₹240 million, ₹300 million and ₹240. In both the cases, the aggregate annual profit though is the same. As the second income stream is perceived to be more stable, the company will enjoy better valuations in the market. This perception leads the management to resort to ‘cookie-jar’ accounting. The management may shift profits from relatively ‘good periods’ to relatively ‘bad periods’. This can be achieved by creating secret reserves or over-provisioning of expenses in one accounting period and reversing the same in another accounting period when needed to support lower profits. The ‘cookie-jar’ accounting practiced by Dell Inc. is described in Box 15.11.

Cookie Jar accounting—practice of income smoothening by creating reserves during good periods and utilizing the same during not so good periods.

Box 15.11 Dell Inc.—Cookie Jar Accounting

The SEC investigated and fined Dell Inc. and its senior executive for ‘failing to disclose material information to investors and using fraudulent accounting to make it falsely appear that the company was consistently meeting Wall Street earnings targets and reducing its operating expenses’.* In a complaint in the U. S. District Court, the SEC alleged that between 2002 and 2005, Dell maintained a number of ‘cookie-jar’ reserves to manage its financial results. Dell maintained excess accruals in multiple reserve accounts and used the same to offset the financial statement effect of future expenses. The ‘cookie-jars’ were maintained in the name of strategic funds, corporate contingencies, restructuring reserve, and reserve for bonus and profit sharing. During good periods excess amounts were credited to these reserves and the same were used in future periods to misstate its operating expenses as a percentage of revenue (OpEx Ratio). Dell attributed the reduction in OpEX ratio ‘to “cost reduction initiatives” or a “focus on cost controls.” In fact, Dell’s reported OpEx ratio during this period was impacted by accounting manipulations’.**

15.5.5 Big Bath Accounting

‘Big bath’ refers to massive one time writing off of assets or expenses. It actually involves advanced recognition of expenses and losses and is justified by unscrupulous management as a ‘cleaning up’ exercise or as a ‘conservative approach’. The company takes a big hit in the current period by accruing higher expenses, writing off assets and recording liabilities, but it will surely have a positive effect on the future earnings. ‘Big bath’ is often practiced in the face of expected poor results. As the company in any case is likely to disappoint the market by missing the earnings expectations, the management decides to take a ‘big bath’ by writing off higher expenses and assets. By advance accruals of future expenses and losses the company is ensuring that the future profits will show an increasing trend.

‘Big bath’ is also associated with a change in management or CEO. The new management may decide to write-off assets and investments or make large provisions towards anticipated losses or expenses. This way the blame for the poor reported earnings is shifted to the previous management and the new management is assured of better performance in the future. A ‘big-bath’ may also help the company is evading taxes by declaring lower taxable income due to excessive write-offs.

15.5.6 Direct Write-off from Reserves

In order to show higher earnings an enterprise may decide to write off certain expenses and losses directly from reserves rather than routing them through the profit and loss statement. Such an accounting policy overstates the reported profits having no other effect on the financial statements.The auditors of Dish TV India Limited qualified the audit report on the consolidated financial statements for the year 2010–11 as stated in Box 15.12.

Box 15.12 Dish TV—Writing-off Impairment Loss from General Reserves

During the year 2010, the company transferred its non-DTH business along with assets and liabilities as on 31st March 2010 to one of its subsidiary companies. The excess of book value of net assets over the consideration received was directly adjusted in the general reserves instead of accounting for impairment of fixed assets as required by AS 28. The auditors opined that ‘had the company followed the above standard in the previous year, the loss on impairment of the above fixed assets would have been adjusted in the consolidated profit and loss account and loss for the previous year and debit balance in the consolidated profit and loss account as on 31st March 2010 would have been higher by ₹ 1,743,523,943’.

Box 15.13 Reliance Communications Limited—Accounting Policy

Issue Expenses and Premium on Foreign Currency Convertible Bonds (FCCBs):

‘The premium payable on redemption of foreign currency convertible bonds (FCCBs) is charged to securities premium account over the period of the issue. Issue expenses are debited to securities premium account at the time of the issue’. In the same year, the company bought back and cancelled some of the FCCB at a discount to the face value. The saving of ₹ 24.49 crore was included in other income for the year.

Similarly, a number of companies which have issued debenture redeemable at a premium directly adjust the premium on redemption from the Securities Premium Account instead of treating the same as a financial cost. This shenanigan again has the effect of understating financial expenses and overstating reported profits. Companies can inflate their profits by offering higher redemption premium and thereby keeping the interest rate on debentures low.The accounting policy of Reliance Communications Limited in this regards is stated in Box 15.13.

15.5.7 Deferred Tax Assets

As discussed in Chapter 5, deferred tax assets are recognized in case the company has paid higher taxes in the current period which will be reversed in the future periods due to timing difference between the reported income and taxable income. The accounting for deferred tax asset involves taking a deferred tax credit in the profit and loss statement and at the same time recording it as an asset which will benefit the future periods. The deferred tax credit in the profit and loss statement has the effect of increasing reported profit after tax (or reducing the loss after tax). The carrying amount of deferred tax assets need to be reviewed at each balance sheet date. If it is no longer reasonably certain or virtually certain that sufficient future taxable income will be available against which direct tax assets can be realized, the carrying amount of deferred tax assets should be written down.

Box 15.14 Kingfisher Airlines Limited—Accounting for Deferred Tax Assets

Kingfisher Airlines Limited reported a loss before tax of ₹ 152,078.29 lacs for the year 2010–11. On this loss, the company recognized a deferred tax credit of ₹ 49,341.80 lacs and accordingly loss after tax came down to ₹ 102,739.80 lacs. The cumulative losses as on 31st March 2011 amounted to ₹ 534,847.43 lacs. The company has deferred tax assets of ₹ 328,690.40 lacs on that date. The company is in losses since its inception. The auditors in their report stated ‘Attention of the members is invited to note 16 of schedule 19 regarding recognition of deferred tax credit during the year aggregating to ₹ 49,341.80 lacs (year ended 31st March 2010 ₹ 76,463.31 lacs) (Total amount recognized up to 31st March 2011 ₹ 292,778.31 lacs) by virtue of which its loss for the year and debit balance in profit and loss account stand reduced by ₹ 493,41.80 lacs (year ended 31st March 2010 ₹ 76,463.31 lacs) and ₹ 292,778.31 lacs (as at 31st March 2010 ₹ 243,436.51 lacs), respectively. In view of explanation 1 to clause 17 of Accounting Standard 22, we cannot express any independent opinion in the matter’.

Such an assessment is usually left to the discretion of the management. By not writing down the deferred tax assets both profits and assets get overstated. The accounts of Kingfisher Airlines Limited were given a qualified audit report for similar accounting practice as stated in Box 15.14.

15.5.8 Change in Accounting Policies

The consistency principle requires that the accounting policies once adopted must be used consistently year after year. Consistency is an essential attribute for inter-period comparison and is prescribed as one of the fundamental attributes of accounting. Any change in accounting policy is justified either by a change in the requirements of law or accounting standards or for better disclosure. Accounting policies may be changed by management in some cases to inflate profits as well. The impact of change in accounting policy in respect of exchange rate fluctuation by Asahi India Glass Limited is described in Box 15.15.

15.5.9 Improper Classification

An enterprise may ‘window dress’ its financial statements by improper classification of incomes, expenses, assets, liabilities or cash flows in its financial statements. For example, extra-ordinary incomes may be clubbed with the operating income to create a wrong impression about the revenue growth of the company. Likewise,cash flows may be misclassified from say financing to operating or vice versa. The financial shenanigan here is not about wrong accounting but improper disclosure.

Box 15.15 Asahi India Glass Limited—Change in Accounting Policy

Asahi India Glass Limited reported a profit after tax of ₹ 1,367 lacs for the year 2007–08. In the notes to accounts the company stated that ‘Pursuant to Accounting Standard (AS)11 notified as part of Companies (Accounting Standard) Rules, 2006, exchange rate fluctuations arising on loans/liabilities incurred for acquisition of fixed assets (other than capital projects under progress) are recognized in the profit and loss account which were hitherto capitalized. Due to the above change, the profit of the year is higher by ₹ 3,908 lacs’. It is obvious that but for the above change in the accounting treatment, the company would have reported a loss rather than a profit for the year.

Box 15.16 International Business Machine Corporation—Linked Transactions

In 1999, IBM entered into an agreement with one of its customers (Dollar General) to supply electronic cash registers to replace the old ones. Dollar General in such case would be required to write-off the book value of old registers. This would have lead to a negative impact on its reporting earnings. IBM and Dollar General devised a scheme to overcome this ‘book-loss’ problem. IBM agreed to buy the old cash registers from Dollar General for approximately $11 million resulting in Dollar General avoiding booking the loss. This purchase was a sham as the old equipments were worthless and IBM never took possession thereof. The amount paid by IBM was repaid by Dollar General by way of increase in price of the new equipment. Through these linked transactions, IBM was able to increase its sales and Dollar General was able to avoid recognizing the book loss due to write off.

15.5.10 Linked Transactions

An enterprise may enter into a set of linked transactions with its customer or vendor to create a false impression in the books of account of both. These transactions when seen in isolation may appear to be genuine business transactions but the underlying intent may be to falsify the accounts. The financial shenanigan used by International Business Machine Corporation (IBM) with its customer is described in Box 15.16.

15.5.11 Related Party Transactions

One of the basic assumptions in commercials transactions that lends objectively is that parties to the transaction are at arm’s length relationship. Therefore, the price and other terms negotiated between such parties to the agreement are assumed to be genuine and form the basis of recording the transaction. However, if this essential condition is violated, the management gets an opportunity for financial shenanigan. Related party transaction may be used for recording fictitious revenues and also for hiding liabilities and unproductive assets. For example, an enterprise holding an asset at a book value of ₹10 million can sell the same to another enterprise (a related party) for say ₹15 million, thereby recording a fictitious gain of ₹5 million. This shenanigan may be adopted, especially in those cases where accounts of related entities are not required to be consolidated. Enron Corporation used the related party transactions to boost its profits as described below in Box 15.17.

The above list of financial shenanigans is only illustrative and not comprehensive. The Fraud Survey 2010 by KPMG identified

- Advance revenue recognition from a future financial period (42%).

- Unrecorded/concealed expenses (42%).

- Deferring expenses to a future financial period (32%).

- Creating fictitious revenue (29%).

- Capitalizing operating expenses (26%) as the most common forms of financial statement frauds.

Box 15.17 Enron Corporation-related Party Transactions

Enron Corporation was falling short of its earnings estimates in 1999. To artificially generate earnings it entered into related party transactions with a partnership firm (LJM1) controlled by its CFO. Enron held about 65% interest in a power project in Cuiaba, Brazil, to generate and sell electricity. Enron sold its interest in the Cuiaba project to LJM1 and improperly recognized earnings of approximately $84 million between the third quarters of 1999–2001. Enron was able to take the Cuiaba project off its balance sheet and recognize related earnings. However, it was not a genuine sale as Enron by an oral side agreement assured that LJM1 will not lose money on the deal. As such there was no transfer of risks and rewards of ownership. In 2001, Enron bought back the interest in the Cuiaba project from LJM1. As per the terms of the buy-back, LJM1 made a profit of $3.202 million on its investments. The earnings booked by Enron and later by LJM1 were fictitious as there was no transfer of risk and rewards associated with the ownership of Cuiaba assets. This transaction helped Enron in inflating its earnings during the period under question.

15.6 REGULATORY REACTIONS

A large number of accounting frauds were reported in the Unites States in late nineties (Enron, WorldCom, Xerox, etc.) which lead to enactment of a new statute namely Sarbanes-Oxley Act, 2002 with an aim to ₹protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws and for other purposes’9. Some of the key focus areas of the act are described below:

Auditors’ Independence

To ensure independence of external auditors, the Act prohibits the auditors to provide any other service (like book keeping, internal audit, corporate advisory, etc.) to the enterprise being audited. This is necessary to avoid any conflict of interest. The Act also provides for rotation of the audit partners (with primary responsibility for the audit) as well as partner responsible for reviewing the audit every five year.

Corporate Responsibility for Financial Reports

The Act puts the responsibility of review of financial statements on the principal executive officer and the principal financial officer to ensure that they are free from any material error or fraud and for instituting necessary internal controls to that affect. Accordingly, all the filings with SEC need to accompany with a certificate signed by the CEO and CFO of the company to that affect. Such a provision is needed to ensure greater involvement of the top management in ensuring reliability of financial disclosures. The Act also provides for strengthening of Audit Committee of the Board of Directors for appointment, remuneration and oversight of external auditors.

Enhanced Financial Disclosures

The Act provides for enhanced disclosures in accordance with the generally accepted accounting principles. All material off balance sheet transactions, arrangements and obligations are required to be disclosed in the annual and quarterly reports.

Increased Criminal Penalties

Any willful certification of the statements as prescribed knowing they do not conform to all the requirements will attract a penalty up to $5,000,000 and/or imprisonment not exceeding 20 years.

The Companies Act, 2013 incorporates significant provisions in the regard. It provides for compulsory auditors’ rotation, prohibition of specified non-audit services by the auditors, establishment of a vigil mechanism with protection to the whistleblower, and enhanced criminal penalties. As per Section 448 of the Act any person making a statement which is false, knowing it to be false in any return, report, certificate, financial statement, prospectus, statement or other document required by, or for, the purposes of any of the provisions of this Act will be punishable with imprisonment for a term which shall not be less than six months but which may extend to ten years and shall also be liable to fine which shall not be less than the amount involved in the fraud, but which may extend to three times the amount involved in the fraud.

The Act also imposes similar punishment to other persons involved in covering up the frauds as well. Section 447 of the Act defines ‘fraud in relation to affairs of a company includes any act, omission, concealment of any fact or abuse of position committed by any person or any other person with the connivance in any manner, with intent to deceive, to gain undue advantage from, or to injure the interests of, the company or its shareholders or its creditors or any other person, whether or not there is any wrongful gain or wrongful loss.’ Accordingly, even the auditors of the company and audit firms also may be implicated and penalized under the provisions of the proposed Act.

The listing agreement also prescribe a requirement to have a whistle-blower policy to establish a mechanism for employees to report to the management concerns about unethical behaviour, actual or suspected fraud or violation of the company’s code of conduct or ethics policy. Adequate safeguards against victimization of whistle blowers also need to be provided.

15.7 HOW TO DETECT FINANCIAL SHENANIGANS?

Notwithstanding all the regulatory provisions, financial shenanigans are here to stay. Unscrupulous management will continue to use accounting gimmicks to portray a picture different than the real financial health of the organization. The users of the financial statements will need to guard against such practices by being vigilant. As discussed earlier, such practices are perpetrated often by the top management working as a group and may be in connivance with the auditors making it difficult to detect the same. Some of the warning signs a user may look for are discussed below:

Governance Structure

Look at the board of director and audit committee composition. The presence of independent directors-persons of eminence with accounting/finance background—may act a deterrent to financial shenanigans. On the other hand, a board dominated by family members or friends of the promoters may not be conducive to check financial frauds.

Accounting Policies

Go through the accounting policies of the company closely. Aggressive and unusual accounting policies may indicate the management’s willingness for reporting better numbers than reality. Compare, for example, the depreciation rate used by a company with accounting policy being followed by other companies in the same industry. This may give an indication about the adequacy or otherwise of depreciation charged.

Change in Accounting Policies

Frequent changes in accounting policies without any reasonable justification with an object to overstate/understate earnings is again an indicator of financial shenanigans.

Auditors’ Report

The frequency and nature of audit qualification is another area to look for. An audit qualification signifies the auditors’ opinion is subject to the observations stated in the audit report. Not only audit qualifications, even the reference drawn by the auditors to specific comments in ‘notes to accounts’ also warrants a close scrutiny.

Notes to Accounts

Don’t ignore the details given in schedules and notes to accounts. A company may fulfill the disclosure requirements by giving the requisite details in small prints in the notes to accounts. For example, the break-up of other income as given in schedule/notes to accounts may reveal the presence of nonrecurring income. That will be useful while estimating the future revenues.

Ratio Analysis

Compare the key financial ratios of the enterprise in the current period with the earlier periods to identify any major deviation. The deviation may be genuine or may indicate the presence of financial shenanigans. For example, if the cost of goods sold as a percentage of sales has declined substantially compared to the previous trend, it may indicate under-booking of expenses or shenanigan involving inventory valuation. Similarly, comparing the ratios of an enterprise with other companies in the same industry may also be helpful. Companies in the same industry are expected to follow the same trend. For example, a sudden increase in the average collection period compared to the previous periods or compared to other companies in the industry may indicate the presence of sham transaction without intentto collect.

A company with super normal growth or continually beating expectations or outperforming industry aggregates or which is in significant deviation from the industry trends may be taken as leading indicators of financial shenanigans.

Related Party Disclosures

Related partytransactions are often used for financial shenanigans. The presence of a large number of subsidiary companies, a large percentage of total sales coming from related parties, transfer of assets or securities between related parties need to be looked closely for economic justifications.

Cash Flow Statement

The profit and loss statement and the balance sheet are based upon accrual principle, whereas the cash flow statement is not. A large deviation between cash flow from operation and EBITDA may be an indication of the presence of large non-cash transactions. For example, improper recognition of revenue (sale or return, consignment sale, etc.) will lead to larger blockage of funds in trade receivables which is reported separately in the cash flow statement.

Contingent Liabilities

An enterprise may try to hide real liabilities by stating the same as contingent liabilities. As discussed earlier, liabilities are on balance sheet items whereas contingent liabilities are disclosed in notes to account, and are off-balance sheet items. Contingent obligations like disputed tax demands are often classified as contingent liabilities. Likewise, a financial strong parent company may stand as a guarantor to a weak subsidiary. In the books of the parent company such a guarantee will appear only in notes to accounts.

15.8 PREVENTION OF FINANCIAL SHENANIGANS

The accounting gimmicks and frauds as discussed in the earlier paragraphs do have a positive impact on the reported financial results at least in the short run. A desire to meet internal and external expectations acts as a strong motivation for the managers to adopt deceptive and fraudulent accounting and disclosure practices. However, such gains are only short term. As the financial statements are continually under scrutiny by auditors, bankers, investors, analysts, rating agencies and other stakeholders, sooner or later such shenanigans will get detected. In such a situation, not only the company in question is liable to civil and criminal actions but also loss of credibility. Often it leads to even more serious consequences including liquidation of the company.

The conflict between short term gains from financial shenanigans and long term consequences there of creates an ethical dilemma for the management and they need to make the choice. ‘The primary responsibility for the prevention and detection of fraud is on the board of directors and managers of the company.’10 Though the auditors are also expected to be more vigilant but they are not responsible for prevention of fraud and errors. To effectively discharge this responsibility, the followings steps need to be taken by the management:

- Create and maintain high standards of moral values, honesty and ethics throughout the organization. In long run ethical behavior lends credibility to the organization. Strong emphasis on compliances with the applicable laws in the letter and spirit need to be reinforced by the management.

- Set realistic targets—both for external reporting as well for internal performance measurement. The pressure to meet unrealistically high targets often leads to financial shenanigans. Performance management system to focus not only on achievement of results but also achieving them in the right way.

- Establish and maintain a strong internal control environment reducing the opportunity to manipulate. The internal controls to have adequate internal checks and balances including internal audit commensurate with the size and complexities of the business. No single person, howsoever high in hierarchy, can have complete control over a transaction. Deviations from established controls and procedures, e.g., ability to supersede the laid down procedure to be kept minimum and also be well documented.

- Emphasis on regular reconciliations and confirmation of outstanding balances—large and long-standing entries in suspense account, un-reconciled inter-branch balances, gap between inventory records and physical inventory, non-confirmation of balances outstanding with the debtors, etc., provide opportunities for financial shenanigans.

- Encourage an environment of openness and transparency where in employees and managers are encouraged to bring any dishonest practices being used in the organization to the attention of the top management without any fear of reprisal. Lay down a detailed ‘whistle-blower’ policy with adequate protection to the whistle blower.

- Lay down a strong governance structure with presence of independent directors of high integrity and expertise on the Board of Directors and Audit Committee. Oversight by the audit committee on the accounts and audit functions—both internal and external will also be helpful in prevention and detection of financial shenanigans.

- Proper corporate communication with the stakeholders so that the potential damage caused by below par financial results can be minimized.

In short the management needs to reduce the motivations as well as opportunities for financial shenanigans.

Summary

- Reliability is an important attribute to make the information conveyed by the financial statements useful to the stakeholders. Financial statements are said to be reliable when they are free from any material errors or frauds and correctly depict the performance and financial position of the enterprise.

- Standardized format of financial statements, compliance with accounting standards, audit by external auditors, oversight by audit committee and certification of financial statements by the CEO/CFO are meant to ensure that the financial statements are reliable.

- Reliability of financial statements gets eroded by the presence of financial shenanigans. Financial shenanigans include all actions by the management to create a wrong impression about the financial performance and position of the enterprise. It includes aggressive accounting policies, non-compliance with GAAP as well as improper disclosure, non-disclosure and accounts manipulation with an intent to cheat.

- Financial shenanigans are the combined result of motivation and opportunity. Managers are motivated for financial shenanigans to earn higher performance-based compensation, to protect their jobs, to meet external expectations, to conceal deterioration in the performance of the company and to facilitate fund raising by the company.

- Flexibility in accounting standards, poor internal controls, lack of auditors’ independence and poor governance structures provide the necessary opportunities for financial shenanigans.

- The major forms of financial shenanigans include advance recognition of revenue, recording fictitious revenue, omission to record expenses, under-provisioning of depreciation, doubtful debts, warranty costs and employees cost, treating operating expenses as capital expenditure, related part transactions, change in accounting policies and improper disclosures in financial statements.

- The users of financial statements need to be vigilant to be able to suspect financial shenanigans. Close watch on auditors’ report, notes to accounts, related party disclosures, and contingent liabilities is helpful in identifying financial shenanigans. Comparing the key ratios of the enterprise with the industry aggregates also can be useful for detection.

- Financial shenanigans may give some short-term advantage but the credibility of the enterprise gets compromised besides attracting civil and criminal actions.

- The primary responsibility for prevention and detection of financial shenanigans is on the Board of Directors and management of the company. Financial shenanigans can be prevented by creating an environment of honesty and ethics. Opportunity for financial shenanigans may be reduced by putting in place strong system of internal controls with minimum exceptions. Encouraging the employees to report any unethical behavior to the senior management also helps. The motivations for financial shenanigans can be reduced by setting realistic expectations—both internal and external—and emphasizing not only on achieving the targets but also on the achieving them in the right way. The management must also be forthcoming in communicating below par financial results to the market.

Assignment Questions

- Reliability is one of the key attributes of financial statements. Do you agree with the statement?

- Briefly describe the regulatory environment to ensure that the financial statements are reliable.

- Define the term ‘financial shenanigans’. Is it necessarily illegal?

- Revenue recognition is one of the most vulnerable accounting areas. Describe some of the methods of manipulating revenue recognition.

- Explain the following financial shenanigan techniques:

- ‘Big bath’ accounting

- ‘Cookie-jar’ accounting

- Channel-stuffing

- Round-tripping

- What steps would you suggest for the management to take to prevent financial shenanigans?

- How will you detect presence of financial shenanigans in the financial statements?

- ‘Financial shenanigans are short-term measures’. Comment.

Cases

Case 15.1: Reliance Industries Limited:11 Impact of Abnormal Item in the Profit and Loss Account

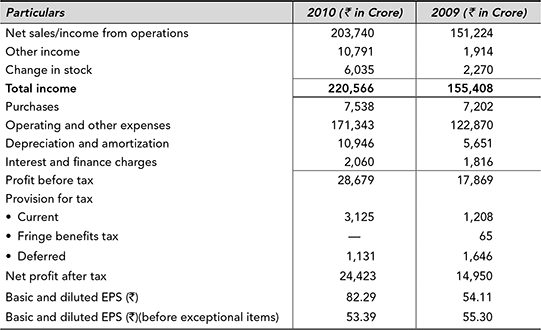

Reliance Industries Limited (RIL) is a fortune 500 company, and is the largest private sector company in India. It is the flagship company of Reliance Group founded by Mr. Dhirubhai Ambani. The company reported consolidated net profit after tax of ₹ 24,423 crore for the year 2009–10 compared to ₹ 14,950 crore during 2008–09. The excerpts from the consolidated profit and loss account of the company for the year ended 31st March 2010 and the previous year are given as follows:

Consolidated Profit and Loss Account for the Year Ended

Questions for Discussion

- The PAT of the company has grown from ₹ 14,950 crore in 2008–09 to ₹ 24,423 crore in 2009–10. How do you rate the performance of the company?

- What are the main contributors for increase in the profit of the company?

- The schedule of ‘Other Income’ of RIL discloses an exceptional item amounting to ₹ 8,605.57 crore as ‘income from sale of Reliance Industries Limited shares by Petroleum Trust’. No other details regarding this gain have been provided in the annual report. Is it correct to include exceptional item in the Other Income category?

- How should RIL have disclosed the exceptional items?

- How do you rate the performance of the company excluding exceptional item?

Case 15.2: State Bank of India—Impact of Provisioning12

State Bank of India (SBI) is the oldest bank in India holding premier position in terms of balance sheet size, number of branches and market capitalization. It was adjudged as the best bank by the Business India in August 2009. The Government of India holds over 59% of the share capital of the bank with the balance 41% held by institutional investors (29%) and retail investors (12%).

‘State Bank of India surprised the market by posting a 99% decline in net profit to ₹ 21 crore for the fourth quarter ended 31st March 2011 against ₹ 1,867 Crore during the corresponding period last year. Profits were dragged down by higher provisioning towards pension and gratuity and loan loss and standard assets provision on special home loan schemes.’13 Though the income grew by 18% to ₹ 26,536 crore from ₹ 22,474 crore in the corresponding quarter in the past year, the net profit fell by 99%. The audited financial results as declared by the bank are reproduced below.

Audited Financial Results for the Year Ended 31st March 2011

While announcing the result, Mr. Pratip Chaudhuri—newly appointed chairman of the bank—said that ‘whether it is pension, provision coverage ratio or standard assets provisioning we have done a considerable clean-up act. In the interest of transparency, we have taken the hit this year itself so that, going forward, we have no legacy issues. For gratuity too, we could have amortized this expense over five years, we decided to load it upfront, so that the impact over the next 16 quarters will only be ₹ 25 crore’.

The ‘clean up act’ of SBI did not go too well with all concerned. ‘We have decided to send a letter to SBI to enquire about the reasons, which led to an increase in provisions, to explain a rise in provisions in the March quarter over that in December (2010) quarter. We would like to know the factual position about such high provisioning’. said the Institute of Chartered Accountants president to the Indian Express.

RBI Deputy Governor, K C Chakrabarty, also commented ‘Reporting has to be credible. You see our banks, when the chairman retires profits decline. If we don’t make the system credible and create a standard, people will report anything. Reporting should not be according to chairman but according to books. So we need to improve the standard of reporting and examination’.

However, the outgoing RBI Deputy Governor, Shyamala Gopinath, who is also on the board of SBI argued that ‘If a bank chooses to make a one-time provision, it is their choice and there is nothing wrong with it. The provisions toward gratuity, pensions and other annuities that SBI made in Q4 could have been staggered’.

The stock market reacted on the expected line after the result announcement. The SBI stock fell by almost 8%, from ₹ 2,617 on 16th May to ₹ 2,413 on the next day. The stock continued to fall and closed at ₹ 2,175 on 25th May 2011, a fall of over 17% in seven trading sessions. In the same period, the sensitive index (SENSEX) of the Bombay Stock Exchange fell by about 3% and the stock index of banking companies (BANKEX) fell by about 5%.

Questions for Discussion

- Why do companies make provisions? Which accounting principle supports this?

- What is the impact of over-provisioning on the reported profits of the company?

- The principle of conservatism or prudence is against over-reporting of profits. Does it justify under-reporting of profits?

- What is the impact if in the subsequent year some of the provisions made in the current period are found to be excessive?

- Can these provisions be used by companies for earnings management?

Case 15.3: Revenue Recognition by Real Estate Companies—DLF Limited

As per a report published in the Economic Times dated 23rd June 2011 titled ‘No standards, so real estate numbers remain a riddle’ in absence of any regulations in this regards, revenue recognition by real estate companies places question marks over the accuracy of reported revenue numbers and makes any comparison across peer group redundant. The report doubts the way ‘percentage completion’ method of revenue calculation is used by builders. As per the report, DLF has reported a total revenue of ₹ 9,560 crore for the year 2010–11. As against this, the company has ‘unbilled receivables’ of ₹ 7,200 crore, that is, over 75% of the total revenue. Similarly for the year 2009–10, the company reported consolidated revenue of ₹ 7,423 crore and unbilled receivables under ‘other current assets’ at ₹ 4,367 crore.

Revenue from constructed properties is generally recognized on the percentage of completion method. Total sale consideration as per the duly executed agreement to sell/application (containing salient terms of agreement to sell), is recognized as revenue based on the percentage of actual project costs incurred thereon to total estimated project cost, subject to such actual cost incurred being 30% or more of the total estimated project cost. Project cost includes cost of land, cost of development rights, estimated construction and development cost, and borrowing cost of such properties. The estimates of the saleable area and costs are reviewed periodically and effect of any changes in such estimates is recognized in the period such changes are determined. However, when the total project cost is estimated to exceed total revenues from the project, the loss is recognized immediately.

The difference between the revenue recognized on the basis of percentage of completion method and payment plan agreed with the customers is recorded as ‘unbilled receivables’ and the same are shown under ‘other current assets’. The use of percentage completion method avoids spiking of revenue when the project gets completed as the revenue recognition is spread over the construction period. There is no merit in deferring income to the end of the project. It is better to show income and profit periodically as they come. It also facilitates quarterly reporting says the group chief financial officer of DLF.