11

Cash Flow Statement

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Appreciate the need and objectives for cash flow statement.

- Differentiate between cash flow from operating activities, financing activities and investing activities.

- Prepare cash flow statement from the given information.

- Analyze the information conveyed by the cash flow statement of companies.

- Identify and apply key requirements of Ind AS 7 relating to cash flow statements.

11.1 INTRODUCTION

The balance sheet and the profit and loss statement provide useful information about the financial health of a business enterprise. The former provides us information about the sources (liabilities) and application (assets) of funds at the end of the accounting year, whereas the latter is a summary of income earned and expenses incurred during the accounting year. As the profit and loss statement is based upon the accrual principle and matching principle, it does not tell us about the cash generated by the enterprise during the year. Likewise, the balance sheet is a summary of assets and liabilities at the end of the year. It does not inform the user about the sources and uses of cash during the accounting year. Cash is generated and used by an enterprise through operating activities, investing activities as well as financing activities. The purpose of cash flow statement is to provide information about inflows and outflows of cash from operating activities, investing activities and financing activities during the year at one place.

Cash flow statement, when read with the other two financial statements, helps the users in better assessment of financial health of an organization by highlighting the ability of the enterprise to generate cash. ‘Historical cash flow information is often used as an indicator of the amount, timing and certainty of future cash flows.’1 As cash flows are not dependent upon the accounting methods and estimates used, the position depicted by cash flow statement is often seen as more objective. As a number of economic decisions like lending and investing are taken on the basis of cash flow estimates, cash flow statement provides a better basis to estimate the future cash flows of an enterprise.

Ind AS 7: Objective of Cash Flow Statement: Information about the cash flow of an enterprise is useful in providing users of financial statements with a basis to assess the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise to utilize those cash flows.

11.1.1 What is Cash?

For the purpose of preparing cash flow statement the expression, cash, is used in a wider sense. Cash flows are inflows and outflows of cash and equivalents. Cash includes cash in hand and demand deposits. Cash equivalents are short-term investments that can be quickly converted into cash without any significant risk of change in value. Cash equivalents are held as a substitute to cash and not as investments. For example, deposits held with banks for short duration, investment in money market instruments, like treasury bills, debt mutual funds, etc., will qualify as cash equivalents. However, investment in equity shares or equity mutual fund though highly liquid is not considered as cash equivalents since there is significant risk of change in value even in short-term. Investment in preference shares which are maturing shortly (generally within the next three months) for a known amount of cash would qualify as cash equivalents. Bank over drafts which are repayable on demand form integral part of an entity’s cash management, bank over drafts are included as a component of cash and cash equivalents.

Ind AS 7: Cash Equivalents are shortterm, highly liquid investments that are readily convertible into known amount of cash and which are subject to an insignificant risk of change in value.

It is important to note that short-term investments that are classified as cash equivalents are excluded from cash flows. Therefore, investment of surplus cash in long-term investments will be shown as a cash flow on account of investing activities, however investment in short-term instruments (considered as cash equivalents) will be treated as an integral part of cash management rather that as an investing activity.

■ Illustration 11.1

Which of the following will be treated as cash and cash equivalents?

- Balance in the current account with State Bank of India.

- Investment in the shares of a subsidiary company.

- Investment in 10 year government bonds maturing after two months.

- Investment in equity mutual funds.

- Fixed deposits with Canara Bank maturing after one year.

Out of the above only (a) and (c) will be classified as cash and cash equivalents as they are readily convertible into cash without any significant risk of change in value. Investment in shares of a subsidiary company (b) and fixed deposit (e) above are long-term investments and hence are not treated as cash equivalents. Whereas investment in equity mutual fund (d) above though can readily be converted into cash, but it carries significant risk of change in value and hence is not treated as cash equivalents.

11.2 CASH FLOW STATEMENT

The balance sheet contains a summary of the assets and liabilities held by a business enterprise at the end of the accounting period. Cash and cash equivalents are also shown as a part of the assets. By comparing the cash and cash equivalents as shown in the current year’s balance sheet with the immediately previous year’s balance sheet, we can ascertain the net increase or decrease in cash. The increase or decrease in cash between two balance sheets is the combined result of various activities carried on by the enterprise during the year. The cash flow statement aims at explaining the reasons for increase or decrease in the cash and cash equivalents between two Balance Sheet dates. For a better understanding of the sources and uses of cash, they are classified into three headings as follows:

- Cash flow from operating activities: Sources and uses of cash from the main revenue generating activities of the business. Conversely, any cash flow that is not occurring on account of investing activities or financing activities will be shown under this head.

- Cash flow from investing activities: Sources and uses of cash for acquiring or disposing off long-term assets and investments. This will also include the reward generated from financial investments like dividend or interest received.

- Cash flow from financing activities: Sources and uses of cash relating to means of financing. Cash flows arising from raising funds as well as repayments are included in this heading. Cash flow towards servicing of various sources of funds; for example, interest or dividend paid are also considered financing cash flows.

The net cash flows from (1) to (3) above is equal to the change in cash or cash equivalents between the two balance sheets. The relationship is depicted in Figure 11.1.

Thus, while preparing the cash flow statement, we start by comparing the cash and cash equivalents in the two successive balance sheets to obtain the net increase or decrease. The net increase or decrease is then explained under the three categories of activities as described earlier. To illustrate, the summary of cash flows in respect of Torrent Power Limited in given in Table 11.1.

The net increase or decrease in cash between the two balance sheet dates is fully explained with reference to the cash flows under the three categories. During the year 2015–16, Torrent Power Limited generated ₹ 2,501.60 crore from its operating activities but used ₹ 913.15 crore in the investing activities. It also used a net amount of ₹ 2,125.76 crore in financing activities resulting in a net decrease in cash balance by ₹ 537.31 crore. Similarly, during 2016–17, the company generated cash flow of ₹ 2,370.37 crore from its operating activities and utilized ₹ 1,941.11 crore in investing activities and ₹ 642.45 crore in financing activities resulting in a net decline in cash balance by ₹213.19crore.

Figure 11.1 Relationship Between Cash Flow and Cash Balance in the Balance Sheet

Table 11.1 Summarized Cash Flow Statement of Torrent Power Limited

■ Illustration 11.2

As on 31st March 2017, the cash and cash equivalents of Muscles Power Limited stood at ₹ 945 million as compared to ₹ 1,014 million in the previous year’s balance sheet. During the year, the company generated a net cash flow of ₹ 844 million from its operating activities and used a net amount of ₹ 1,235 million towards investing activities. What are the net cash flows from financing activities?

| Change in cash and cash equivalents | ( ₹ in Million) |

| Balance at the end of the year | 945 |

| Less: Balance in the beginning of the year | 1014 |

| Net decrease in cash and cash equivalents | (69) |

| The sum of cash flow under three heading should be equal to | ₹ 69 million. |

Cash flow from (Operating activities + Investing activities + Financing activities) = Net change in cash and cash equivalents

₹ 844 − ₹ 1235 + Financing activities = −₹ 69 million

−₹ 391 + Financing activities = −₹ 69 million; solving the equation

Cash flow from financing activities = ₹ 322 million.

The company raised a net cash flow of ₹ 322 million from financing activities during the year.

The three categories of cash flows are discussed in detail in the subsequent paragraphs.

11.3 CASH FLOW FROM OPERATING ACTIVITIES

Operating activities are the main revenue generating activities of a business. The cash generated by a business enterprise from operating activities is a key indicator of its ability to meet its cash requirements for various purposes. If the enterprise generates strong cash flows under this head, it will have sufficient resources to pay dividend, acquire assets and reduce dependence on external sources of finance.

This category includes receipts arising from cash sales, collection from customers and also payments to the suppliers of goods and services, payment of various expenses like salaries to employee, rent and other operating expenses. Cash receipts and payments towards premiums and claims, annuities and other policy benefits by an insurance company and cash receipts and payments from contracts held for dealing or trading purposes would also be treated as cash flow from operating activities.

Ind AS 7: Operating activities are the principal revenue-producing activities of the enterprise and other activities that are not investing or financing activities.

Primarily this information is derived from the profit and loss statement. However, as the profit and loss statement is based upon accrual basis, suitable adjustments are made to convert those numbers to cash flows. For example, if sales during the year amounted to ₹ 150 million out of which ₹ 30 million are yet to be collected from the customers, the profit and loss statement will show ₹ 150 million as income using accrual principle, whereas in cash flow statement, we will show only ₹ 120 million as cash flow.

As the profit and loss statement also relates to operation of the enterprise during an accounting period, the key information regarding cash flow from operating activities can be obtained from the profit and loss statement for the year. However, there are key differences between the two as detailed below:

- Profit and loss statement is prepared using accrual principle, both for revenue as well as expenses. Hence, revenue or expenses once accrued are recorded irrespective whether received or paid or not. In cash flow statement actual inflow or outflow is recorded.

- Due to matching concept followed in preparing profit and loss statement a number of non-cash expenses are recorded. For example, depreciation and amortization of assets, provisions for retirement benefits, etc. As there is no cash outflow involved, these non-cash expenses are not considered while arriving at cash flow from operating activities. Likewise, in the profit and loss statement we consider material consumed as a part of the expense, after adjusting for change in stock, whereas for cash flow from operating activities material purchased may be more relevant.

- Profit and loss statement also includes income and expenses which are not of operating nature but are either result of financing activities or investing activities. For example, interest or dividends received on investments are included in the profit and loss statement as other income but the same being in the nature of investing activities are not included in the cash flow from operating activities. Likewise, interest paid on loans though included in the profit and loss statement as an expense, is not considered in cash flow from operating activities being related to financing activities.

There are two alternative methods for ascertaining cash flow from operating activities—direct method and indirect method. In the direct method, major classes of gross cash receipts and gross cash payments are disclosed. In the indirect method, profit or loss is adjusted for the effects of transactions of a non-cash nature, any deferrals or accruals of past or future operating cash receipts or payments, and items of income or expense associated with investing or financing cash flows.

Ind AS 7 permits use of either of the methods. However, enterprises are encouraged to use direct method as it provides information which may be useful in estimating future cash flows and which is not available under the indirect method.

Table 11.2 Cash Flow from Operating Activities—Direct Method

11.3.1 Direct Method

In this approach, gross receipts and payments on account of operating activities are presented. The difference between receipts and payments is taken as the net cash from operating activities. Under this method, the cash flow from operating activities may be presented as given in Table 11.2.

The direct method excludes non-cash expenses, non-operating expenses (interest paid) and non-operating income (interest or dividends received, profit on sale of assets or investments). It also removes the effect of accrual basis of accounting by only considering actual receipts and payments rather that income accrued and expenses incurred.

The direct method is easier to understand for the reader but may require more efforts for the business enterprise to prepare it.

■ Illustration 11.3

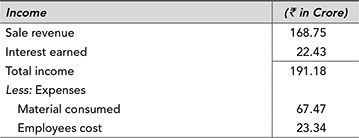

From the given profit and loss statement and additional information from the balance sheet, ascertain the cash flow from operating activities for Samurai Toys Limited for the year 2016–17 using the direct method.

Profit and Loss Statement for the Year Ended 31st March 2017

Additional Information

The company paid ₹ 8 crore towards taxes during the year.

The following details were extracted from the balance sheet of the company.

Solution

Notes

- Interest earned and interest & finance charges are ignored as they are non-operating income and non-operating expense, respectively.

- Depreciation and amrortization has been ignored being non-cash expense.

- Sale revenue has been adjusted for trade receivables (₹ 168.75 – ₹ 30.43 + ₹ 39.77).

- Material consumed has been adjusted for inventory and trade payables (₹ 67.47 + ₹ 55.15 + ₹ 43.24 – ₹ 20.45 + ₹ 26.89).

- Administrative and marketing expenses has been adjusted for outstanding expenses (₹ 37.89 – ₹ 11.34 + ₹ 7.75) assuming that other current liabilities are towards outstanding expenses.

- Tax paid during the year has been taken as the outflow.

11.3.2 Indirect Method

In this method, we start with the profit or loss figure from the profit and loss statement and make suitable adjustments to arrive at the cash flow from operating activities. The adjustments are made to remove the effect of:

- Non-cash expenses: Depreciation, amortization and provisions.

- Non-operating income and expenses: Interest expenses, profit or loss on sale of assets or investments, interest or dividend earned.

- Accrual basis of accounting: Increase or decrease in trade receivables, prepaid expenses, inventories, trade payables, outstanding expenses, etc.

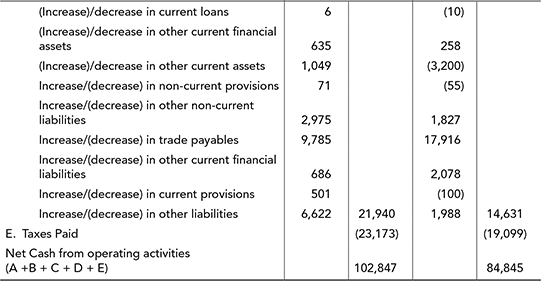

To illustrate the cash flow from operating activities for Maruti Suzuki Limited2 for the year 2016–17 and 2015–16 is presented in Table 11.3.

Table 11.3 Cash Flow from Operating Activities for Maruti Suzuki Limited

The above adjustments have been discussed in detail as follows:

Non-cash Expenses and Incomes

Non-cash expenses like depreciation and amortization, provisions for doubtful debts, provisions for retirement benefits, unrealized foreign exchange losses are added back to the profits. As they do not involve cash outflow. Likewise, incomes and gains included in the profit and loss statement which are not earned in cash, for example, provisions no longer required, unrealized gains on foreign exchange are deducted from the profit to arrive at the cash flow from operating activities. Since they have been considered while arriving at the profits, their effect is removed by deducting them from the profit figures.

Non-cash expenses and losses are added back to profit whereas non-cash incomes and gains are subtracted to arrive at cash flow from operating activities.

Non-operating Income or Expenses

Any income and gain or expense and loss considered in profit or loss statement arising from activities which are either financing or investing in nature need to be eliminated. Accordingly, non-operating incomes, for example, interest earned, dividend income, profit on sale of assets or investments are deducted from profits to arrive at cash flow from operating activities. Likewise, non-operating expenses or losses, for example, interest expense, loss on sale of assets or investments are added back to profit to ascertain cash flow from operating activities.

Non-operating expenses and losses are added back to profit whereas non-operating incomes and gains are subtracted to arrive at cash flow from operating activities.

Increase or Decrease in Trade Receivables

In the profit and loss statement revenue is recorded on accrual basis irrespective whether received or not, whereas in cash flow statement the focus is on actual cash received from customers. The cash received from customers during a year may also include collection in respect of credit sales of the previous year. Similarly collection in respect of current year’s sale may actually take place in the next period. Accordingly, cash collected from customers during an accounting period may be given by Equation 11.1:

By rearranging Equation 11.1, we can arrive at Equation 11.2:

Any increase in trade receivables represents blockage of funds and the same in deducted from profits to arrive at cash flows, whereas decease in trade receivables results in release of funds and hence in added to profits to arrive at cash flow from operating activities.

To illustrate, the sales of a business enterprise for the year is ₹ 230 million. The trade receivables in the beginning of the year (last year’s balance sheet) were ₹ 83 million, whereas trade receivables outstanding at the end of the year (current year’s balance sheet) are ₹ 97 million. There is an increase in Trade receivables by ₹ 14 million. Though in the profit and loss statement, sales has been taken at ₹ 230 million the actual collection from customers is only ₹ 216 million ( ₹ 83 million + ₹ 230 million − ₹ 97 million). While arriving at cash flow from operating activities, an amount of ₹ 14 million will be deducted as increase in trade receivables. However, if the trade receivables at the end of the year amounted to ₹ 60 million only, that is, a decrease in trade receivables by ₹ 23 million, the actual collection from customers is ₹ 253 million ( ₹ 83 million + ₹ 230 million – ₹ 60 million). While arriving at cash flow from operating activities an amount of ₹ 23 million will be added as decrease in trade receivables.

Increase or Decrease in Inventories

As discussed in the Chapter 8, the cost of goods sold is arrived at by using Equation 11.3:

This may also be represented in Equation 11.4.

In the profit and loss statement, we consider the cost of goods sold by making adjustments for change in inventories. However for cash flow purposes, the effect of inventory adjustment needs to be eliminated. Accordingly, any increase in inventories between two balance sheets (representing additional blockage of cash) is deducted, whereas any decrease in inventories is added to profits to arrive at cash flow from operating activities.

Increase in inventories is deducted whereas decrease in inventories is added to profit to arrive at cash flow from operating activities.

To illustrate, the goods purchased during the year amounted to ₹ 430 million, out of which goods costing ₹ 138 million are unsold at the end of the year (current year balance sheet) compared to ₹ 89 million of opening stock (last year’s balance sheet). Though the company has spent ₹ 430 towards purchases, the profit and loss statement will show only ₹ 381 million ( ₹ 89 million + ₹ 430 million – ₹ 138 million) as cost of goods sold. To negate the effect of increase in inventory, an amount of ₹ 49 million will be deducted from profit to arrive at cash flow from operating activities. However, if the ending inventory amounted to ₹ 53 million (i.e., a decrease of ₹ 36 million compared to the beginning inventory) the decrease will be added to profits to arrive at cash flow from operating activities.

Increase or Decrease in Current Liabilities

While accounting for expenses in the profit and loss statement, we follow accrual principle, that is, expenses are recorded when incurred irrespective when paid. Whereas for cash flow statement we are concerned about actual cash flow. Accordingly, the effect of accrual on expense accounting needs to be eliminated.

To illustrate, the profit and loss statement shows employee cost of ₹ 879 million. In the beginning of the year (last year’s balance sheet) ₹ 34 million was outstanding towards salaries and at the end of the current year (current year’s balance sheet) salaries of ₹ 45 million are yet to be paid. The actual payment during the year towards employee cost amounts to ₹ 868 million ( ₹ 34 + ₹ 879 − ₹ 45). Accordingly, while arriving at cash flow from operating activities, a sum of ₹ 11 million ( ₹ 45 million − ₹ 34 million) will be added towards increase in current liabilities. Assuming if the current outstanding is only ₹ 15 million, the actual outflow towards employee cost is ₹ 898 million ( ₹ 34 + ₹ 879 − ₹ 15). In such a case, ₹ 19 million will be deducted from profits towards decrease in current liabilities.

Increase in current liabilities is added whereas decrease in current liabilities isdeducted from profit to arrive at cash flow from operating activities.

Taxes on Income

Any cash flow towards taxes on income is usually considered as operating cash flow and is required to be disclosed separately as operating activities. However, if the cash flow can be specifically identified with investing or financing activities, it needs to be classified under suitable head. By default, tax on income is considered as a part of operating activities.

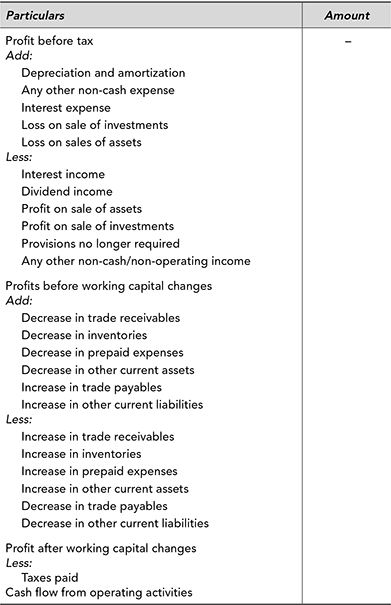

Based upon the above discussion cash flow from operating activities using indirect method may be presented as given in Table 11.4.

Table 11.4 Cash Flow from Operating Activities—Indirect Method

■ Illustration 11.4

From the information given in Illustration 11.3, ascertain the cash flow from operating activities for Samurai Toys Limited for the year 2016–17 using indirect method.

Cash Flow from Operating Activities of Samurai Limited for 2016–17

11.4 CASH FLOW FROM INVESTING ACTIVITIES

This category includes cash inflows and outflows relating to acquisition and disposal of fixed assets and investments. As discussed earlier, short-term investments which are included in cash equivalents are not considered as a part of investing activities. While reporting cash flow under this head focus is on cash inflows and outflows. Thus, assets acquired for non-cash considerations are not included in the cash flows. In respect of assets or investments disposed off, it is the gross consideration received that is included in the cash inflow rather that gain or loss on disposal of the asset. By comparing the gross fixed assets, capital work in progress and investments (other than cash equivalents) in the current year’s balance sheet with the previous year, basic information about investing activities can be obtained.

Ind AS 7: Investing activities are the acquisition and disposal of longterm assets and other investments not included in cash equivalents.

The following cash flows are usually reported under this category:

- Outflows: Payments for acquiring fixed assets—tangible and intangible, payments for acquiring shares, debentures and other financial instruments (excluding those classified as cash equivalents), loans and advances given to third parties, capitalized development costs and self-constructed property, plant and equipment.

- Inflows: Receipts from disposal of fixed assets and sale of share, bonds, debentures and other financial instruments and receipts on account of repayment of loans and advances. Interest and dividends received are also reported as cash inflows from investing activities.

It may, however, be noted that an entity which is primarily engaged in purchase and sale or otherwise dealing in securities, these cash flows constitute its operating activities. In such a case, cash flows from such transactions will be reported as cash flow from operating activities. Likewise, a finance company engaged in the business of giving loans and advances and other form of lending will classify such cash outflows as operating activities and not as investing activities.

Cash flow from Investing Activities for Maruti Suzuki Limited for the year 2016–17 and 2015–16 is given in Table 11.5.

Table 11.5 Cash flow from Investing Activities for Maruti Suzuki Limited

■ Illustration 11.5

How will the following transactions be recorded while presenting cash flow from investing activities?

- Asset with an original cost of ₹ 12 million and accumulated depreciation of ₹ 9.5 million is sold for ₹ 1 million in cash.

- Amount spent on construction of a factory building during the year is ₹ 30 million.

- Machinery bought for ₹ 10 million. Consideration paid by issuing one million equity shares of ₹ 10 each.

- Investment made in short-term investments (considered as cash equivalents) amounting to ₹ 2 million.

- Loans given by ABC Finance Limited engaged in the business of lending amounting to ₹ 120 million. Interest received on these loans amounted to ₹ 13.5 million.

Solution:

- Sale consideration of ₹ 1 million will be included as a cash inflow from investing activities.

- Amount spent on construction of a factory building during the year amounting to ₹ 30 million will be shown as an outflow towards investing activities.

- As no cash flow in involved, it will not appear in the cash flow from investing activities. It will appear elsewhere as a footnote.

- As the investment made has been included in cash equivalents, it will not be shown in the cash flow from investing activities.

- As giving loans is the principal revenue generating activity of ABC Finance Limited, cash flows towards giving loans and interest received on such loans will be shown under operating activities and not under investing activities.

11.5 CASH FLOWS FROM FINANCING ACTIVITIES

Financing activities relate to the sources of financing used by a business enterprise, both share capital as well as borrowings. The sources of funds raised also need to be serviced by payment of interest, dividends and also by repayment of principal. By comparing the shareholders’ funds and borrowed funds in the current year’s balance sheet with the previous year, basic idea about the movement in sources of funds can be obtained. However, if the change has happened without involving cash, the same will not be a subject matter of cash flow statement. For example, if some assets have been acquired by issue of shares, increase in capital will not be reported as a financing activity. Likewise, conversion of convertible debentures into equity will change the composition of sources of funds in the balance sheet but will have no cash flow effect.

Ind AS 7: Financing activities are the activities that result in the change in size and composition of owners’ capital (Including preference share capital in case of a company) and borrowings of the enterprise.

The following cash flows are usually reported under this category:

- Inflows: Proceeds from issue of shares (equity as well as preference), bonds, debentures and other similar instruments and long- and short-term borrowings. If these instruments have been issued at a premium, the premium received is also a part of the cash inflows.

- Outflows: Repayment of loans, payment towards redemption of bonds, debentures, preference shares and other similar instruments. Payments made towards interest on loans and debentures, dividends paid (both equity and preference shares) as well as dividend distribution tax paid during the year will also be reported as cash outflow from financing activities. However, in case of a financial enterprise (e.g., bank) interest paid will be classified as an operating activity. Cash payments by a lessee for the reduction of the outstanding liability relating to a finance lease will also be classified under this head.

The financing activities are often supplementary to the operating and investing activities. If the enterprise on a net basis has used cash for operating activities and investing activities, i.e., net cash flow from operating and investing activities is negative, it may have to raise funds either through equity or borrowings. In such a case, net cash flow from financing activities will be positive (net inflow). If, however, cash flow from operating activities is positive and is large enough to meet the funds requirements for investing activities, there is no need to resort to financing and in such a cash flow from financing activities will be negative representing servicing of sources of funds.

Cash flow from financing activities for Maruti Suzuki Limited for the year 2016–17 and 2015–16 is given in Table 11.6.

Table 11.6 Cash Flow from Financing Activities for Maruti Suzuki Limited

■ Illustration 11.6

How will the following transactions be recorded while presenting cash flow from financing activities?

- Issue of 10 million equity shares of the face value ₹ 10 each at a premium of ₹ 40 each. Issue expenses amounted to ₹ 10 million.

- Debentures issued five years back with a face value of ₹ 100 crore are converted into one crore equity shares of the face value ₹ 10 each at a conversion price of ₹ 100 each during the year.

- Fresh loan taken during the year from SBI amounting to ₹ 430 million. Earlier loan of ₹ 280 million repaid during the year. The net increase in loan from SBI amounts to ₹ 150 million.

- Debentures of face value ₹ 50 crore redeemed during the year at a premium of 10%.

- Company bought back two million shares from the market at ₹ 120 per share.

- 10 million equity shares of ₹ 10 each issued as bonus shares to existing shareholders.

Solution:

- The issue proceeds of ₹ 500 million (including premium) will be shown as cash inflows, whereas issue expenses of ₹ 10 million will be cash outflow under financing activities.

- Conversion of debentures into equity has no cash flow implications. It will not appear in the cash flow statement rather will be mentioned as notes to accounts.

- Fresh loan taken during the year from SBI amounting to ₹ 430 million will be shown as a cash inflow and repayment of earlier loan of ₹ 280 million as an outflow under cash flow from financing activities. The inflows and outflows are shown on gross basis rather than on net basis.

- Redemption amount paid ( ₹ 50 crore plus premium ₹ 5 crore) will appear as cash outflow from financing activities.

- Amount paid towards buy-back of shares aggregating to ₹ 240 million is cash outflow from financing activities.

- As bonus shares are issued without consideration, it will not appear in the cash flow statement.

11.6 SPECIAL POINTS

In this section, we will discuss certain special situations with reference to cash flow statement.

11.6.1 Non-cash Transactions

A number of investing and financing activities may not involve any cash inflow or outflow. Such transactions do have an impact on the composition and values of assets and liabilities in the balance sheet but do not have any cash effect. As no cash flow in involved they are not included in cash flow statement. However, such non-cash transactions are reported separately in the annual report. Some of the non-cash transactions are stated as follows:

- Conversion of debentures or preference shares into equity

- Issue of bonus shares

- Splitting shares of higher face value to lower face value

- Acquisition of assets by issuing debentures

- Acquisition of another enterprise by issue of shares

11.6.2 Foreign Currency Cash Flows

Cash flows in foreign currency are reported by converting the same in the reporting currency by applying the appropriate exchange rate prevailing on the date of the transaction. Cash and cash equivalents held in foreign currency are also converted in the reporting currency. Any unrealized gain or loss due to changes in the foreign exchange rates do not involve any cash flow and hence not reported in the cash flow statement. However, the effect of changes in exchange rates on cash and cash equivalents held in a foreign currency is reported separately in order to reconcile cash and cash equivalents at the beginning and end of the period.

11.6.3 Change In Ownership Interest

Cash flows arising from obtaining or losing control of subsidiaries or other businesses shall be presented separately and classified a sinvesting activities.

11.6.4 Reporting Cash Flows On Net Basis

Major classes of cash receipts and cash payments arising from investing and financing activities are generally reported on gross basis. For example, an entity might have taken a fresh long-term loan of ₹ 100 million and repaid another long-term loan of ₹ 60 million during the year with a net addition of ₹ 40 million to long-term loan. This will be presented as inflow of ₹ 100 million and outflow of ₹ 60 million under cash flow from financing activities rather than a net cash inflow of ₹ 40 million.

However, certain cash flows arising from operating, investing or financing activities may be reported on a net basis. For example, cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the entity and cash receipts and payments for items in which the turnover is quick, the amounts are large and the maturities are short.

In case of a financial institution, the following cash flows may be reported on a net basis:

- Cash receipts and payments for the acceptance and repayment of deposits with a fixed maturity date.

- The placement of deposits with and withdrawal of deposits from other financial in stitutions.

- Cash advances and loans made to customers and the repayment of those advances and loans.

11.7 CASH FLOWS AT DIFFERENT STAGES OF LIFE CYCLE

The composition of cash flow for enterprises at different stages of life cycle may differ significantly.

- Start-up and initial stage: A start-up will have negative or low cash flow from operating activities as the operations have just commenced. As the enterprise is in the process of creating or acquiring non-current assets and facilities, cash flow from investing activities is likely to be significantly negative. To meet the cash needs of operating and investing activities, the enterprise has to resort to raising funds and resultant positive cash flows from financing activities. After some time once operations stabilize, cash flow from operating activities may turn positive, requirement of funds for investing activities also slows down and therefore financing activities will also come down significantly.

- Maturity stage: Once operating activities of the enterprise start generating significant cash flows, it will use these positive cash flows to meet its limited requirements for investing activities. The enterprise will use the surplus cash flow to pay interest on borrowed funds, dividend on equity and also for repayment of principal. At this stage, cash flow from financing activities will be negative.

- Expansion stage: If the enterprise decides to undertake a major expansion (by expanding capacities, modernization of facilities or by acquisition), cash flow from investing activities will turn negative. Cash flow from operating activities though positive may not be sufficient to meet the cash needed for investing activities. The enterprise has to go for another round of funding either by borrowings or issuance of shares, bonds, debentures or similar instrument resulting is a positive cash flow from financing activities.

- Cash rich: In case cash flows from operating activities far exceed the cash needed for investing activities, the enterprise may decide to use the excess cash for rewarding the shareholders by paying special dividends, repaying its loans to acquire zero debt status and also for buy-back of shares. The cash flow from financing activities in such a case will be significantly negative.

■ Illustration 11.7

On the basis of information given fill the missing entries:

The completed table is shown as follows.

Summary

- Cash flow statement depicts the inflows and outflows of cash during an accounting period. It reconciles the opening balance of cash and cash equivalents with closing balance of cash and cash equivalents.

- Cash and cash equivalents include cash in hand, cash in banks and short-term investments that are readily convertible into cash without any significant risk of change in value. Ind AS 7 requires bank overdraft to be shown as a part of cash and cash equivalents.

- Cash flows are required to be broken into three categories: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities.

- Operating activities are the primary revenue generating activities of the business enterprise. Cash flow from operating activities may be ascertained either by following direct method or indirect method.

- In direct method, gross inflow and outflows are ascertained by eliminating the affect of accrual and matching principles. In indirect method, the profit figure is adjusted for non-cash expenses, non-operating expenses and incomes and also by changes in current assets and current liabilities.

- Taxes on income are usually considered as outflow from operating activities. However, if it could be identified with either financing or investing activities, it will be so classified.

- Non-cash transactions—not involving any inflow or outflow—are excluded from the cash flow statement.

- Cash flow statement is a useful tool is explaining the reasons for change in cash position as well as predicting the ability of a business enterprise to generate cash in future.

Assignment Questions

- What is the purpose of preparing cash flow statement?

- ‘The expression ‘‘cash’’ is used in a wider sense to include ‘‘cash equivalents’’ as well while preparing the cash flow statement’. What kinds of items are included in ‘cash equivalents’?

- Explain the three broad headings under which cash inflows and cash outflows are reported while preparing cash flow statement?

- Identify the main reasons for difference between cash flow from operating activities and reported profit for the year.

- Differentiate between direct and indirect method of calculating cash flow from operating activities.

- How do we treat the income tax paid in the cash flow statement?

- What are non-cash transactions? Give three examples.

Problems

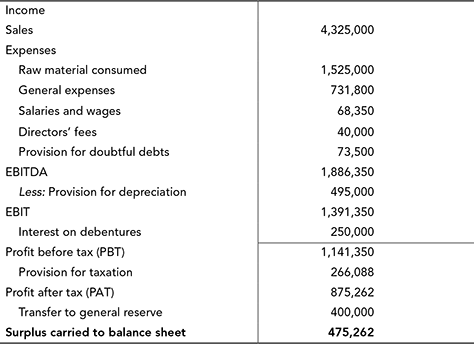

- Cash flow from operating activities: Calculate the cash flow from operating activities on the basis of the following information using direct method and indirect method:

Profit and Loss Statement for the Year Ended 31st December 2017

- Finding out the figure of loan taken and repaid: The balance sheet of Axon Limited for the year 2017 and 2016 showed the following amounts under the heading borrowed funds:

The company took fresh long-term loans during the year amounting to ₹ 250 million. Working capital loans repaid during the year amounted to ₹ 300 million.

- Based upon the above information, ascertain the amount repaid towards long-term loans and fresh working capital loans taken during the year.

- How will you show the above cash flows under cash flow from financing activities?

- Finding the figure of property, plant and equipment purchased: The balance sheet of Axon Limited for the year 2017 and 2016 showed the following amounts under the heading property, plant and equipment:

During the year, the company sold an item of PPE with original cost of ₹ 87 million and accumulated depreciation of ₹ 69.45 million for ₹ 21.50 million.

- Based upon the above information, ascertain the depreciation charged for the current year and also profit or loss on sale of PPE.

- Ascertain the cost of PPE purchased during the year.

- How will the depreciation and profit/loss on sale of PPE be treated while calculating cash flow from operating activities (using indirect method)?

- How will you show the above transactions under cash flow from investing activities?

- Inferring balance sheet changes from cash flow statement: The cash flow from operating activities (indirect method) in respect of A-One Batteries for the year 2017 is give as follows:

On the basis of the information in the cash flow statement as above, please ascertain the changes that have taken place in inventories, trade receivables, trade payables and other liabilities between the last year’s balance sheet and current year’s balance sheet.

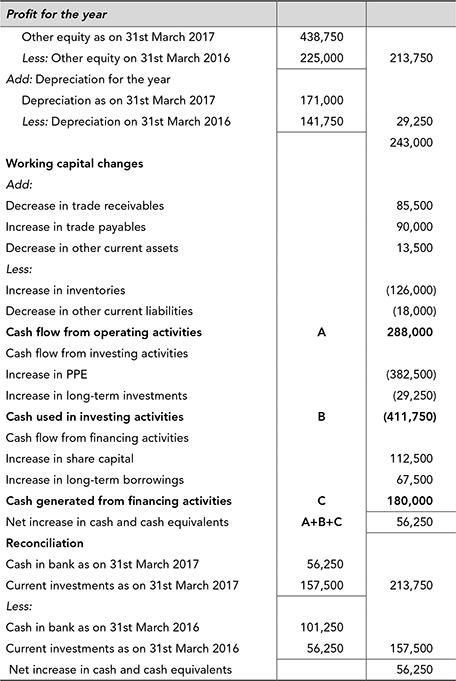

- Based upon the following balance sheets, prepare the cash flow statement for the year 2016–17:

- Preparing cash flow statement: On the basis of the profit and loss statement for the year ended 31st March 2017, balance sheets as on 31st March 2017 and 2016 respectively, and the additional information, prepare the cash flow statement for the year 2016–17.

Additional Information:

- Dividend paid during the year amounted to ₹ 60,000.

- Fresh loans taken during the year: ₹ 12,500.

- During the year a machine with an original cost of ₹ 4,000 and accumulated depreciation of ₹ 1,500 was sold for ₹ 500.

Solutions to Problems

-

Cash Flow from Operating Activities—Direct Method

Cash Flow from Operating Activities—Indirect Method

-

- By using the relation; opening balance of loans + fresh loan taken – loan repaid = closing balance of loan; we can ascertain the fresh loan taken or repaid during the year.

- Cash Flow from financing activities

- By using the relation; opening balance of loans + fresh loan taken – loan repaid = closing balance of loan; we can ascertain the fresh loan taken or repaid during the year.

-

- Depreciation charged during the year can be calculated by using the following relationship:

Opening balance of provision + Provision for depreciation for the year—provision on the PPE sold during the year = Closing balance of provision for depreciation

₹ 189.34 + Current year depreciation – ₹ 69.45 = ₹ 261.32 million

Current year depreciation = ₹ 261.32 – ₹ 119.89 = ₹ 141.43 million

Book value of the PPE sold = Original cost – Accumulated depreciation

₹ 87.00 – ₹ 69.45 = ₹ 17.55 millionProfit on sale of PPE = Sale price – Book value

₹ 21.50 – ₹ 17.55 = ₹ 3.95 million - PPE acquired during the year can be ascertained by using the following relationship; Gross Block in the beginning + PPE acquired during the year – Cost price of PPE sold = Gross Block at the end of the year.

Accordingly, ₹ 734.15 + PPE acquired – ₹ 87 = ₹ 872.24

PPE acquired during the year = ₹ 872.24 – ₹ 674.15 = ₹ 225.09

- While calculating cash flow from operating activities (using indirect method) current year’s depreciation will be added back to profits being a non-cash expenses and profit on sales of PPE will be subtracted being a non-operating activity as follows:

Cash flow from operating activities

-

Cash flow from investing activities

- Depreciation charged during the year can be calculated by using the following relationship:

- Trade receivables have decreased by ₹ 48.23 million whereas inventories have increased by ₹ 14.67 million between the two balance sheet dates. Trade payables have shown a decline of ₹ 23.44 million whereas outstanding expenses have gone up by ₹ 7.09 million in the same period.

- Cash Flow Statement for the year 2016–17

It is assumed that the current investments are short-term in nature and are part of cash equivalents.

- Cash Flow Statement for the Year Ended 31st March 2017

Working notes

Try It Yourself

- On the basis of information given fill the missing entries:

Comment upon the cash flows of the respective companies.

- Finding the amount of tax paid: Avon Limited made a provision of ₹ 103 million towards income tax for the year 2016–17. The provision for income tax in the current year balance sheet is ₹ 108 million compared to ₹ 97 million in the last year balance sheet. Ascertain the income tax paid during the year.

- Cash flow from operating activities: Calculate the cash flow from operating activities on the basis of the following information using indirect method:

Profit and loss account for the year ended 31st December 2017

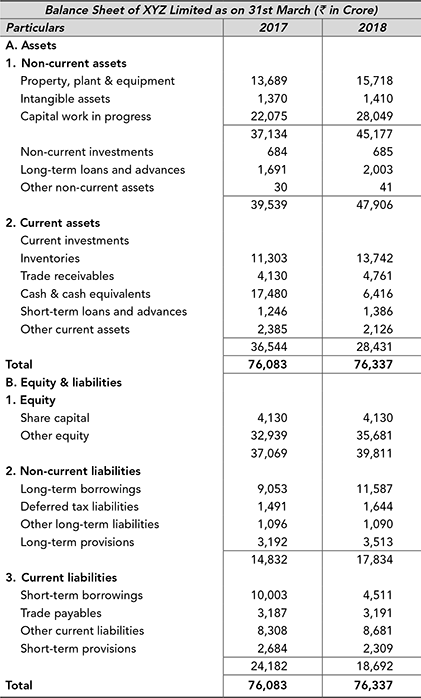

- From the following balance sheets of XYZ Limited, prepare the cash flow statement for the year ended 31st March 2018 and explain the reasons for the decline in the cash and cash equivalents:

- From the following Balance Sheets and Profit and Loss Statement prepare the Cash Flow Statement for the year 2016–17

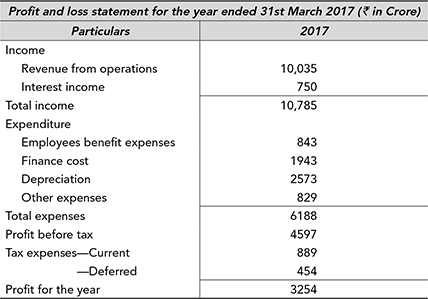

- The profit and loss statement for the year ended 31st March 2017 and the balance sheets as on 31st March 2016 and 2017 are given below. You are required to prepare the cash flow statement for the year ended 31st March 2017 and explain the main reasons for the decline in cash and cash equivalents.

Other Information:

- The board of directors of the company has proposed dividend @ 20% amounting to ₹ 926 crore on which dividend distribution tax of ₹ 207 crore is payable.

- During the year similar dividend and distribution tax pertaining to the previous year was actually paid.

- Income tax actually paid during the year amounted to ₹ 889 crore.

- Preparation of cash flow statement: On the basis of the following information, prepare the cash flow statement for Seven Wonders Limited for the year 2016–17.

Additional Information:

- Short-term investments represent investment of short-term cash surplus in highly liquid and risk free instruments.

- The company issued bonus shares during the year with face value of ₹435 million to the existing shareholders.

- During the year the company acquired PPE for ₹4250 million.

- Long-term loan repaid during the year amounted to ₹1750 million.

- Fresh long-term investment made during the year amounted to ₹765 million.

- A dividend of ₹ 435 million was proposed during the year on which dividend distribution tax of ₹ 65 million is payable.

Cases

Case 11.1: ‘Where has the Cash Gone’?: Cash Flow Statement of New Age Limited

Mr. Know-It-All is the chairman and managing director (CMD) for New Age Limited that completed its first year of operations on 31st March 2018. Mr. Kuber is the chief financial officer (CFO) of the company. They are reviewing the financial results of the company (balance sheet and profit and loss statement attached). The following conversation took place between them:

CMD: I am happy to note that the company has made a profit of over ₹ 8 lakh in its first year of operations. Let us consider declaring a maiden dividend at 10% on equity shares.

CFO: Yes sir. It had been a good first year but I am afraid that it may not be possible to declare any dividend.

CMD: Why not? A 10% dividend on the equity capital of ₹ 4,400,000 would require only ₹ 440,000. We can easily afford to pay this amount out of the PAT of ₹ 875,262.

CFO: Sir, I agree that we have adequate profits to pay the dividend but there is not enough cash to pay this dividend. Our cash balance is just ₹ 37,850.

CMD: I do not understand your accounting jargons. If the profits earned is ₹ 875,262 then Where has the cash gone?

Mr. Kuber wants your help in explaining the cash position to the CMD with the help of a cash flow statement clearly indicating cash flow from operating activities, investing activities and financing activities.

Profit and loss statement of New Age Limited for the year ended 31st March 2018

Case 11.2: Analysis of Cash Flow Statement—Container Corporation of India Limited

Container Corporation of India Ltd. (CONCOR) commenced operation from November 1989. It is now an undisputed market leader having the largest network of 68 inland containers depots (ICDs). In addition to providing inland transport by rail for containers, it has also expanded to cover management of ports, air cargo complexes and establishing cold-chain. Out of total 68 terminals, 13 are exportimport container depots and 17 exclusive domestic container depots and as many as 37 terminals perform the combined role of domestic as well as international terminals.

The company reported profit before tax (PBT) of ₹ 1,180.61 crore and ₹ 1,307.95 crore for the year 2016–17 and 2015–16, respectively. However, the cash and cash equivalents have declined from ₹ 2,587.93 crore as on 1st April 2015 to ₹ 4,14.45 crore as on 31st March 2017.

The statement of cash flow of the company for the year 2016–17 with comparative figures for the previous year is presented below:

Statement of Cash Flow for the Year Ended 31st March 31 2017

Questions for Discussion

- Identify the main reasons for the decline in cash and cash equivalents in the last two years despite strong profit before tax.

- For the year 2015–16, the company reported profit before tax (PBT) of ₹ 1,307.95 crore. However, cash flow from operating activities was (₹ 1,045.32) crore. Identify the main reasons for the negative cash flow from operating activities during the year.

- In 2016–17, the company deducted interest income while calculating cash flow from operating activities and added interest received in cash flow from investing activities. Explain the reason for this treatment.

- For 2016–17, the company had positive adjustment in respect of trade receivables and trade payables and negative adjustment in respect of inventories in the cash flow from operating activities. Explain reasons for the same.

- The company has negative net cash flow from investing activities in both the years. What does it indicate?

- There is no cash flows (inflows or outflows) relating to borrowings or equity in the cash flow from financing activities. What does it indicate?

Case 11.3: Analysis of Cash Flow Statement: Suzlon Energy Limited

Suzlon Energy Limited, founded in the year 1995, is a leading wind power company. It has presence in 21 countries in the continents of America, Asia, Australia and Europe. It has emerged as the third largest wind power supplier. The year 2009–10 proved to be a disappointing year for Suzlon as it suffered its first full year loss. The economic downturn had a significant impact on lowering demand—and therefore the relative price—of energy. During these difficult times, the company’s management of cash is depicted in the cash flow statements for the year 2008–09 and 2009–10 as follows.

Cash Flow Statement for the Year Ended 31st March

Questions for Discussion

- For the year 2009, the company earned a profit before tax of ₹ 432.96 crore but its cash flow from operating activities was negative (−₹ 391.17 crore). In the next year, the company suffered a loss (−₹ 799.67 crore) but the cash flow from operating activities was positive ( ₹ 2,423.62 crore). Identify the main reasons for the same.

- What has happened to debtors’ position in the year 2009 and 2010?

- Indentify and analyse major uses of cash towards investing activities.

- Analyse the major financing activities of Suzlon during 2009 and 2010.

Endnotes

- ICAI : Ind AS 7, statement of cash flows.

- Annual report of Maruti Suzuki Limited for the year 2016-17