6

Balance Sheet

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Understand the contents of balance sheet in depth.

- Differentiate between equity and liabilities, current liabilities and non-current liabilities, current assets and non-current assets.

- Appreciate the issues involved in valuation of assets and liabilities in the balance sheet.

- Appreciate the impact of relevant accounting standards on the balance sheet—Ind AS 40 (Investment Property), Ind AS 2 (Inventories), Ind AS 109 (Financial Instruments) Ind AS 7 (Statement of Cash Flow) and Ind AS 113 (Fair Value Measurement).

6.1 INTRODUCTION

To ensure uniformity in the presentation of the balance sheet, the format for the same has been prescribed in the Schedule III of the Companies Act, 2013. The information is presented in a vertical format—assets followed by equities and liabilities. The balance sheet, in simple terms, is a statement of assets and liabilities of a business enterprise on the last day of the accounting period. The balance sheet may also be viewed as a statement of sources and uses of funds. A business enterprise raises funds either from the owners (called capital) or from creditors or lenders (called liabilities). These funds are then used to acquire various types of assets to be used in the business. The total funds raised by the business (capital + liabilities) therefore are always equal to the assets. To that extent the balance sheet represents the financial position of the business enterprise at the end of the accounting period.

Balance sheet depicts the financial position of the enterprise on a particular day.

6.1.1 GAAP Revisited

The relevant accounting principles, discussed earlier in Chapter 2, having a direct bearing on the balance sheets are summarized as follows:

- Separate entity principle: For the purpose of the balance sheet, owner and business are treated separately. Owners’ contribution to the business is called capital, and is shown on the liabilities side or sources side of the balance sheet.

- Money measurement principle: All the assets and liabilities are shown in the reporting currency as a common unit of measurement. Assets held or obligations in a currency other than the reporting currency are converted in the reporting currency for incorporating in the balance sheet.

- Going concern principle: It is assumed than the business will continue to operate indefinitely. There is neither the need nor the intent to liquidate the assets in the near future.

- Cost concepts: The non-current assets are usually shown at their cost of acquisition less accumulated depreciation. However, if there is a fall in the value of the assets which is non-temporary, the assets value is impaired.

- Conservatism: It is preferable to understate the assets rather that overstating them. Likewise in case of doubt, it is better to overstate the obligations rather than understate them.

- Dual aspect: Every accounting transaction affects atleast two accounts in such a way that the fundamental accounting equation, i.e., Assets = Owners’ Capital + Liabilities, is always true. The equation suggests that the funds for acquiring assets have either been raised from the owners (called capital) or from creditors (called liabilities). Thus, at any point of time the total of what an enterprise owns will be equal to the claims of various suppliers of funds, i.e., owners and creditors. Due to the dual aspect concept, both sides of the balance sheet will always be equal.

6.1.2 Fair Value Measurement

An asset or liability may be recognized either at its historical cost or at its fair value. Ind AS 113 states that ‘fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement value.’ The fair value may be determined by using:

- Market approach—using prices and other relevant information from market transactions involving comparable assets or liabilities.

- Cost approach—amount that would be needed to replace an asset.

- Income approach—finding the present value of future cash flows of income and expenses.

When an asset or liability is measured at its fair value, the difference between the carrying amount and its fair value is recorded in profit or loss, or other comprehensive income. Ind AS 113 does not stipulate when fair value should be used. It addresses how to measure the fair value and requires the following disclosures to be made:

- The extent of usage of fair value in valuation of assets and liabilities.

- Valuation techniques, inputs and assumptions used in measuring fair value.

- The impact of fair value measurements on profit and loss or other comprehensive income.

6.2 FORMAT OF BALANCE SHEET

The format for the balance sheet has been prescribed in the schedule III of the Companies Act, 2013. The format of the balance sheet is reproduced in Table 6.1 and related disclosures have been given in Appendix-I to the chapter.

Format of the Balance Sheet has been prescribed in Schedule III of the Companies Act, 2013 to ensure comparability.

Table 6.1 Format of Balance Sheet

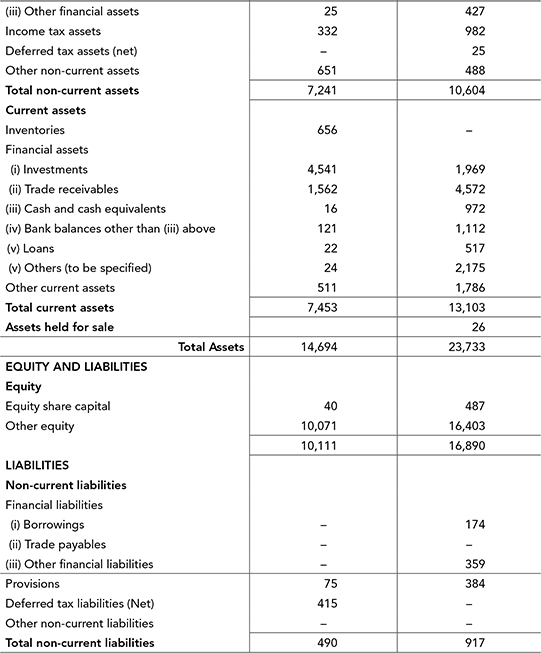

A brief snapshot of the information given in the balance sheet of Biocon Limited as on 31st March 2017 is given below in Table 6.2:

Table 6.2 Balance Sheet of Biocon Limited as on 31st March 2017

Before the contents of the balance sheet are discussed in detail, some quick observations can be made. The above balance sheet represents the financial position of Biocon Limited, the reporting entity at the end of the accounting period, i.e., 31st March 2017 compared with the previous year. This represents the cumulative assets and liabilities on that particular date since inception of the company. The reporting currency is Indian Rupee and the figures have been presented in rupees million.

The balance sheet has two sides—on one side, all the assets (uses of funds) are presented and, on the other side, the equity and liabilities (sources of funds) are shown. Because of the dual aspect concept, the totals of both the sides are equal. The assets side represents the resources owned by the enterprise, whereas the equities and liabilities represent the funds supplied by owners and creditors, respectively and their respective claims on the assets of the business.

The asset side represents resources owned by the enterprise at the end of the accounting period. The assets owned are classified into current and non-current based upon their intended use. Cash and assets which are intended to be converted into cash shortly, i.e., usually within 12 months are classified as current assets. The current assets include cash in hand, bank balance, inventories, debtors, short–term loans and advances and current investments. On the other hand, assets intended to be used over a long period of time are called non-current assets (or fixed assets). This category includes assets like plant and machinery, land and building, furniture, computer system, etc. Non-current assets without any physical substance are also included in this category. Such assets are called intangible assets and include copyrights, patents, software licenses and similar rights controlled by the enterprise. Investments which are meant to be held over a long period of time are also classified as non-current.

The liabilities side has three major headings—shareholders’ funds, non-current liabilities and current liabilities. The shareholders’ funds (also called equity) represent the funds supplied by the owners of the business. Liabilities, on the other hand, represent the obligation of the enterprise to external parties, i.e., amount it owes to supplier of goods and services, banks and financial institutions, debenture holders, employees, etc. Liabilities which are expected to be met shortly (usually within 12 months) are called current liabilities whereas other obligations (maturing after 12 months) are classified as non-current liabilities.

A quick look at the balance sheet of Biocon Limited reveals that as on 31st March 2017, the company owns total assets amounting to ₹ 74,689 million out of which ₹ 23,785 million are current assets and the balance ₹ 50,904 million are non-current assets. On the liabilities sides, the equity (shareholders’ funds) amount to ₹ 65,411 million whereas claims of external parties amounted to ₹ 9,278 million out of which ₹ 7,052 million is expected to mature shortly (current liabilities) and liabilities amounting to ₹ 2,226 million are of long–term nature (non-current liabilities). Both sides of the balance sheet, of course are, equal as per double entry book keeping system.

Various components of the balance sheet are depicted in Figure 6.1.

Figure 6.1. Components of the Balance Sheet

6.3 ASSETS

The expression ‘asset’ generally denotes something which the enterprise own. The funds raised by an enterprise through shareholders’ funds and borrowed funds are used to acquire various assets needed for the operations of the business. Though ownership is often viewed as a criterion for recognizing an asset, it may not always be a necessary condition. The expression asset may be defined as ‘a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.’1 Accordingly, for an asset to be recognized the following conditions must be satisfied:

Assets—resources controlled by an enterprise as a result of past events from which future economic benefits are expected to the entity

- It must represent a resource from which future economic benefits are expected—The future benefit from an asset may be derived in a number of possible ways. For example, it may be used in production of goods and services by the enterprise or for settling a liability or for simply acquiring any other asset. The asset may be in the form of cash or cash equivalent or has the potential to contribute to the cash flow of the enterprise in future.

- It must be controlled by the enterprise—The control normally is associated with the ownership but it may not always be true. For example, a machine obtained on a finance lease basis where the lease period covers almost the entire useful life of the machine will be recognized as an asset in the books of the lessee. Though the legal ownership of the asset is with the lessor, the lessee has the control over it.

- The control is because of past event—The assets are acquired as a result of transaction that has already taken place. Assets which are expected to be controlled in future are not recognized.

An asset may or may not have a physical form or existence. Assets in physical form, e.g., machinery, furniture, vehicle, etc., are called tangible assets. Assets representing certain rights from which future economic benefits can be derived but not having a physical form, e.g., patent rights, copyrights, software licenses, etc., are called intangible assets.

Assets controlled by an entity are classified as current assets and non-current assets based upon their liquidity. Assets which are intended to be converted into cash in short period of time, usually 12 months or in the normal operating cycle of the business are classified as current assets. Cash and cash equivalents, inventories held by the enterprise, trade receivables, etc., are examples of current assets.

Current assets are short-term assets, i.e., assets which are in the form of cash or are intended to be converted into cash in the normal operating cycle of the business. The Schedule III of the Companies Act, 2013, provides that ‘an asset shall be classified as current when it satisfies any of the following criteria:

- It is expected to be realized in, or is intended for sale or consumption in, the company’s normal operating cycle.

- It is held primarily for the purpose of being traded.

- It is expected to be realized within twelve months after the reporting date; or

- It is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

Usually a cut-off of 12 months is used to distinguish current assets from non-current assets, however, in businesses where operating cycle is longer than 12 months a current asset may have conversion period exceeding 12 months. For example, for an enterprise engaged in construction business, the operating cycle may well exceed 12 months due to long time period needed to complete the project. The operating cycle of an entity is the time between the acquisition of assets for processing and their realization in cash or cash equivalents. The operating cycle of a business is presented in Figure 6.2.

Figure 6.2 Operating Cycle of a Business

A business enterprise needs to maintain sufficient cash and bank balance to fund its day-to-day operations. These funds are used to procure raw material, components and other consumable stores to be used for producing goods and services. It must keep sufficient quantities of these items to ensure continuous and uninterrupted supply for the production purposes. Raw material and other supplies are injected in the production cycle where other expenses are incurred at the work-in-progress stage. Once the production cycle is over, the enterprise obtains finished goods. To meet the requirements of its customers, sufficient quantities of finished goods are kept in the store to be sold in the ordinary course of business. These finished goods when sold on credit get converted into debtors or receivables. Upon collection the operating cycle is complete and the enterprise again has access to cash.

When the entity’s normal operating cycle is not clearly identifiable, it is assumed to be twelve months. When an entity is engaged in multiple businesses with different operating cycles, the classification of assets into current and non-current would be done depending upon the operating cycles of respective businesses.

Non-current assets are intended to be held for long period in the business and not for the purpose of consumption or sale tion of assets into current and non-current would be done depending upon the operating cycles of respective businesses.

All other assets (other than current assets) will be classified as non-current. Assets intended to be used within the business over a long period of time, exceeding 12 months, are classified as non-current assets. Plant and machinery, furniture, vehicles, patent rights are some of the examples of non-current assets.

6.4 NON-CURRENT ASSETS

Any asset that is intended to be used in the business over a long period of time (exceeding 12 months or the normal operating cycle of the business) is classified as a non-current asset. Such assets have been acquired by the enterprise to be used for production of goods and services and not for the purpose of resale in the ordinary course of its business. It is not the nature of asset but its intended use that determine whether it is a current asset or a non-current asset. For example, furniture purchased for the purpose of resale and lying in inventory is a current asset, but the same furniture if purchased for the purpose of use in the office will be shown as a non-current asset. The non-current asset are required to be classified into the following sub-headings

- Property, plant and equipment

- Capital work-in-progress

- Investment property

- Goodwill

- Other intangible assets

- Intangible assets under development

- Biological assets other than bearer plants

- Financial assets

- Investments

- Trade receivables

- Loans

- Other

- Deferred tax assets (net)

- Other non-current assets

6.4.1 Property, Plant and Equipment

These are the assets acquired or controlled by an enterprise to be used for the production of goods and services over a long period of time. As these assets are expected to benefit the entity over a long period of time, the cost of acquisition of these assets is appropriated over their useful life by charging depreciation. The depreciated value of property, plant and equipment (PPE) is depicted in the balance sheet.

Schedule III of the companies act requires these assets to be classified as:

- Land

- Buildings

- Plant and equipment

- Furniture and fixtures

- Vehicles

- Office equipment

- Bearer plants

- Others (specify nature)

Assets under lease are required to be disclosed separately under each category. Assets given on an operating lease (short-term lease) are shown in the balance sheet of the lessor, whereas assets taken on a finance lease (long-term lease) are shown in the balance sheet of the lessee. In either case, these assets are required to be shown separately.

A reconciliation of the gross and net carrying amounts of each class of assets—at the beginning and end of the reporting period—showing additions, disposals, acquisitions through business combinations and other adjustments and the related depreciation and impairment losses/reversals are required to be disclosed separately. PPE are disclosed in the balance sheet at their depreciated value. The reconciliation as aforesaid is given in the notes to accounts.

PPE are initially recognized at cost. Subsequently, an entity may present the PPE as cost less accumulated depreciation and impairment losses or alternatively at revalued amount less the accumulated depreciation and accumulated impairment loss. Accounting, depreciation and valuation of PPE have been discussed in detail in Chapter 9.

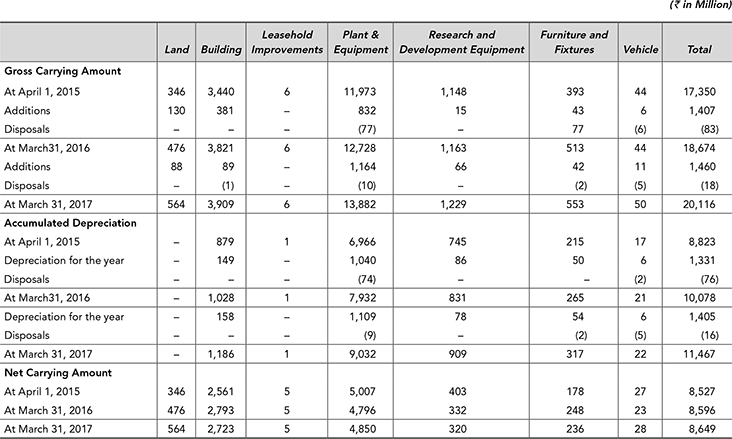

The details of property, plant and equipment as appearing in the balance sheet of Biocon Limited are given in Table 6.3. The balance sheet shows the PPE at ₹ 8,649 million. The reconciliation for the same is provided in the notes to account.

The break-up amount property, plant and equipment of ₹ 8,649 million as on 31 March 2017 is presented below:

| (₹ in Million) | |

| Gross carrying amount | 20,116 |

| Accumulated depreciation | 11,467 |

| Net carrying amount | 8,649 |

From Table 6.3, it can be observed that the gross carrying amount of PPE has gone up from ₹ 18,674 million to ₹ 20,116 million. Major portion of the PPE is blocked in plant and equipment followed by building. The accumulated depreciation accounts for about 55% of the gross carrying amount implying that 55% of the cost of the assets being used has already been depreciated.

Table 6.3 Property, Plant and Equipment (PPE) of Biocon Limited as on 31st March 2017

6.4.2 Capital Work-in-Progress

The capital work-in-progress represents the expenditure incurred on acquiring or constructing tangible assets which are not yet ready for intended use. It may be noted that advances given to the supplier for acquisition of fixed assets are not included under this heading. Once the asset is ready for its intended use, the amount accumulated under this head is transferred to the carrying amount of the PPE.

6.4.3 Investment Property

Ind AS 40 defines investment property as land or building or both which is held to earn rentals or capital appreciation or both. If the property is being held for use in production or supply of goods or services or for administrative purposes or for sale in the ordinary course of business, it will not be classified as investment property. Initial recognition of investment property is at cost, i.e., purchase price plus transaction cost and any other directly attributable expenditure. Investment property is carried in the balance sheet at cost less accumulated depreciation and any impairment losses.

A reconciliation of the gross and net carrying amounts of each class of property needs to be presented at the beginning and end of the reporting period showing additions, disposals, acquisitions through business combinations and other adjustments and the related depreciation and impairment losses or reversals.

6.4.4 Goodwill

Goodwill is required to be presented as a separate line item on the face of the balance sheet apart from ‘Other Intangible Assets’. Like PPE, a reconciliation of the gross and net carrying amount of goodwill at the beginning and end of the reporting period showing additions, impairments, disposals and other adjustments is also required to be given in the notes to accounts.

6.4.5 Other Intangible Assets

Intangible assets are generally in the nature of rights. The following break up of intangible assets is required to be disclosed:

- Brands /trademarks

- Computer software

- Mastheads and publishing titles

- Mining rights

- Copyrights, patents and other intellectual property rights, services and operating rights

- Recipes, formulae, models, designs and prototypes

- Licenses and franchise

- Others (specify nature)

As these intangible assets are expected to generate economic benefits over a period of time, the cost of acquiring or developing these assets is apportioned over their useful lives. Apportioning the cost of an intangible asset over its useful life is called amrotization. Intangible assets are initially recognized at cost. They are carried in the balance sheet at cost less accumulated amortization and any impairment losses. Alternatively, they may be carried in the balance sheet at the revalued amount less accumulated amortization and subsequent accumulated impairment losses.

A reconciliation of the gross and net carrying amounts of each class of asset needs to be presented at the beginning and end of the reporting period showing additions, disposals, acquisitions through business combinations and other adjustments and the related amortization and impairment losses or reversals.

6.4.6 Intangible Assets Under Development

Expenditure incurred on development of intangible assets which are yet to be finished are accumulated and reported separately under this heading. Once the development of an intangible asset is completed, the amount accumulated under this head is transferred to gross carrying amount of the relevant intangible asset.

The details of intangible assets as appearing in the balance sheet of Biocon Limited are given in Table 6.4.

Table 6.4: Intangible Assets of Biocon Limited as on 31st March 2017

The recognition and valuation of tangible assets (plant, property and equipment) and intangible assets can have a significant impact on the financial position of the enterprise depicted in the balance sheet. The principles governing initial recognition of these assets, their depreciation and amortization and subsequent revaluation has been covered in detail in Chapter 9.

6.4.7 Biological Assets Other than Bearer Plants

A biological asset is defined in Ind AS 41 as a living animal or plant. Examples of biological assets, as given in Ind AS 41, include sheep, trees in a timber plantation, dairy cattle, cotton plants, sugar cane, tea bushes, oil palms, fruit trees, rubber trees, etc. Some plants, for example, cotton plants, tea bushes, oil palms, fruit trees, grape vines, usually meet the definition of a bearer plant, and therefore, are excluded from this heading. However, the produce growing on bearer plants, viz., cotton, tea leaves, oil palm fruit, fruits, grapes, etc., are biological assets.

A reconciliation of changes in the carrying amount of biological assets between the beginning and the end of the current period is required to be presented in the notes to accounts.

6.4.8 Financial Assets

Financial assets generally mean cash, financial instruments of another entity (equity instruments, debt instruments) and a contractual right to receive cash or other financial assets. Accordingly, this heading includes:

- Non-current investments

- Non-current trade receivables

- Non-current loans

- Other non-current financial assets

Non-current Investments

A business enterprise may invest its resources in acquiring the securities issued by another enterprise. Such an investment may be made either for controlling the other enterprise or simply for making a return either as periodical returns or by capital gains. Where the intention is to hold such investments for a long period of time (usually exceeding 12 months), they are classified as non-current investments.

Investments are required to be classified as:

- Investments in equity instruments

- Investment in preference shares

- Investments in government or trust securities

- Investments in debentures or bonds

- Investments in mutual funds

- Investments in partnership firms

- Other investments (specify nature)

Under each classification, names of the bodies corporate that are subsidiaries, associates, joint ventures, or structured entities, in which investments have been made are required to be disclosed. The nature and extent of the investment so made in each such body corporate showing separately investments which are partly-paid is also required to be disclosed in the notes to accounts.

Investments in partnership firms showing names of the firms, their partners, total capital and the shares of each partner is required to be disclosed separately.

In addition, aggregate amount of quoted investments and market value thereof, aggregate amount of unquoted investments and aggregate amount of impairment in value of investments is required to be disclosed.

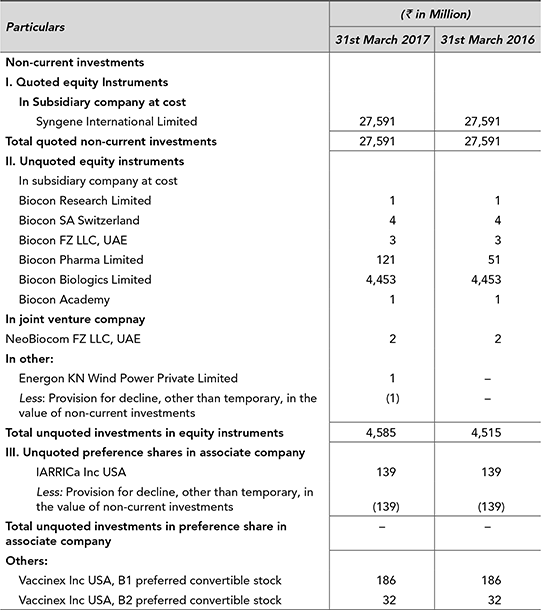

The details of non-current investments of Biocon Limited as on 31st March 2017 are given in Table 6.5.

Table 6.5: Long-term Investments of Biocon Limited as on 31st March 2017

The non-current investments of the company have increased from ₹ 32,106 million to ₹ 33,635 million as on 31st March 2017. Majority of these investments are strategic in nature—in joint ventures, associate and subsidiary companies. The company has recognized impairment loss to the extent of ₹ 359 towards decline in the value of these investments which is non-temporary in nature. The quoted investments have been recognized in the books at ₹ 27,591 million as against the market value of these investments is ₹ 75,622 million.

Investments are initially recognized at cost. The cost includes acquisition charges, like brokerage and fees & taxes duties. The subsequent measurement may be either at historical cost (amortized cost) or at fair value. The impact of fair value measurement may be recognized either through profit or loss (fair value through profit or loss) or through other comprehensive income (fair value through other comprehensive income). The requirements of Ind AS 109 in this regards have been discussed in detail in Chapter 10.

Non-current Trade Receivables

Amount outstanding to be received from the customers on the balance sheet date towards goods sold or services rendered is classified as trade receivables. Trade receivables which are expected to be realized after 12 months from the balance sheet date are classifies as non-current. It needs to be classified as:

- Secured—considered good

- Unsecured—considered good

- Doubtful

Provision made towards bad and doubtful debts shall be disclosed under the relevant heads separately. Amounts due by directors or other officers of the company or any of them either severally or jointly with any other person or debts due by firms or private companies respectively in which any director is a partner or a director or a member is separately stated.

Non-current Loans

Loans represent the money extended by an enterprise to another as loan which is repayable in future. Loans expected to be realized after 12 months are classified as non-current loans. This also includes security deposits given by the enterprise for various purposes during the ordinary course of business. Loans to related parties are required to be disclosed separately. Loans are accordingly classified as:

- Security deposits

- Loans to related parties (giving details thereof)

- Other loans (specify nature)

Likewise a loan or an advance may be secured against some collateral given by the borrower or unsecured. Accordingly the aggregate value of loans and advances is broken down in three sub-headings:

- Secured—considered good

- Unsecured—considered good

- Doubtful

The loans and advances are shown at their gross value less provision for bad and doubtful loans made. The above breakup is provided in the relevant notes to the balance sheet.

Other Non-current Financial Assets

Non-current financial assets other than investments, trade receivables and loans are classified under this heading. Any financial asset which is non-current is nature and has not been classified in the earlier sub-headings will get disclosed under this heading. For example, amounts due under contractual rights, dues in respect of insurance claims, receivables on account of sale of property, plant and equipment, contractually reimbursable expenses, etc. are classified as other non-current financial assets if they are realizable after 12 months. Likewise, bank deposits with more than 12 months maturity and non-current portion of finance lease receivables are also classified under this heading.

6.4.9 Deferred Tax Assets

Deferred tax assets are recognized due to timing differences between the taxable income and the reported income. If due to such timing difference an enterprise has paid higher taxes in the current accounting period which will get reversed and result in lowering of tax liability in the future accounting period, the same is recognized as deferred tax asset. If the aggregate of deferred tax asset on the balance sheet date exceeds the aggregate of deferred tax liabilities, the net amount is shown under non-current assets as deferred tax asset (net). The deferred tax asset usually arises when certain expenses or provisions are recognized for the purpose of reported profit on accrual basis but for tax computation, the same are permitted as deduction on payment basis. For example, provision for doubtful debts reduces the reported profit for the period when the provision is made but the same is allowable for tax computation only when the bad debts are actually written off.

6.4.10 Other Non-current Assets

This is the residual category for non-current asset. Any asset which is non-current and non-finance is nature and has not been classified in the above sub-headings will get disclosed under this heading. Capital advances and other advances which are not in the nature of loans are classified here. Other non-current assets are classified as:

- Capital advances

- Advances other than capital advances

- Others (specify nature)

Advances other than capital advances are further classified as

- Security deposits

- Advances to related parties (giving details thereof)

- Other advances (specify nature).

Advances to directors or other officers of the company or any of them either severally or jointly with any other persons or advances to firms or private companies respectively in which any director is a partner or a director or a member are separately stated.

6.5 CURRENT ASSETS

As discussed earlier, current assets include cash, cash equivalents, assets intended for sale or consumption or expected to be realized in cash within 12 months or in the company’s normal operating cycle and held primarily for the purpose of being traded. Current assets are more liquid than the non-current assets. Current asset are required to be classified into the following sub-headings:

- Inventories

- Financial assets

- Investments

- Trade receivables

- Cash and cash equivalents

- Bank balances other than (iii) above

- Loans

- Others (to be specified)

- Current tax assets (net)

- Other current assets

Current assets are intended to be converted into cash within 12 months or normal operating cycle of the company.

6.5.1 Inventories

The expression ‘inventories’ include goods held by an enterprise for the purpose of consumption in the production process or which are currently in the production cycle or are being held for sale in the ordinary course of business. Inventories are classified as:

- Raw materials

- Work-in-progress

- Finished goods

- Stock-in-trade

- Stores and spares

- Loose tools

- Others (specify nature)

Goods in transit are disclosed under the relevant heading of inventories. Inventories are initially recognized at cost. The cost for this purpose includes the cost of acquiring the inventory and appropriate conversion cost.

After initial recognition at cost, inventories are carried in the balance sheet at ‘the lower of cost or net realizable value’ following conservatism principle. The valuation of inventories can have a significant impact on the balance sheet as well as the statement of profit and loss. The inventory valuation is the subject matter of Ind AS 2 and has been covered in detail in Chapter 8. Appropriate disclosure regarding the mode of valuation used should be made. The details of inventories held by Biocon Limited are depicted in Table 6.6.

Table 6.6: Inventories held by Biocon Limited as on 31st March 2017

As on 31st March 2017, total inventories held by Biocon Limited were ₹ 5,396 million (previous year ₹ 5,046 million). Major portion of inventories is represented by work-in-progress followed by finished goods. The inventories have been valued at ‘lower of cost and net realizable value’ and the resultant loss has been charged to the statement of profit and loss.

6.5.2 Current Financial Assets

As discussed earlier, financial assets generally mean cash, financial instruments of another entity (equity instruments, debt instruments) and a contractual right to receive cash or other financial assets. Financial assets of current nature are included under this heading. Accordingly, this heading includes:

- Current investments

- Current trade receivables

- Current loans

- Other current financial assets

Current Investments

An enterprise instead of keeping its short-term cash surpluses in bank accounts may invest the same in financial instruments to generate higher returns. Such investments are usually made in instruments which are highly liquid and convertible into cash quickly. Current investments are intended by the company to be sold within twelve months or within the company’s operating cycle. They also include investments which have a remaining maturity of less than twelve months or within the company’s operating cycle. Current Investments are required to be classified as:

- Investments in equity instruments

- Investment in preference shares

- Investments in government or trust securities

- Investments in debentures or bonds

- Investments in mutual Funds

- Investments in partnership firms; or

- Other investments (specify nature)

Under each classification, names of the bodies corporate that are subsidiaries, associates, joint ventures, or structured entities, in which investments have been made are required to be disclosed. The nature and extent of the investment so made in each such body corporate, showing separately investments which are partly-paid, is also required to be disclosed in the notes to accounts.

Investments in partnership firms, showing names of the firms, their partners, total capital and the shares of each partner, are required to be disclosed separately.

In addition, aggregate amount of quoted investments and market value thereof, aggregate amount of unquoted investments and aggregate amount of impairment in value of investments is required to be disclosed.

Investments are initially recognized at cost. The cost includes acquisition charges, like brokerage and fees taxes and duties. The subsequent measurement may be either at historical cost (amortized cost) or at fair value. The impact of fair value measurement may be recognized either through profit or loss (fair value through profit or loss) or through other comprehensive income (fair value through other comprehensive income). The requirements of Ind AS 109 in this regards have been discussed in detail in Chapter 10.

The details of current investments of Biocon Limited as on 31st March 2017 are given in Table 6.7.

Table 6.7: Current Investments of Biocon Limited as on 31st March 2017

The current investments of Biocon Limited have declined from ₹ 5,983 million in the previous year to ₹ 5,247 million as on 31st March 2017. The company is keeping its short-term surplus cash in mutual funds and inter-corporate deposits, which are highly liquid and have low risk.

Current Trade Receivables

Trade receivables which are expected to be realized within 12 months from the balance sheet date or within the normal operating cycle are classifies as current trade receivables. The amount of receivables needs to be classified as:

- Secured—considered good

- Unsecured—considered good

- Doubtful

Provision made towards bad and doubtful debts shall be disclosed under the relevant heads separately. Amounts due by directors or other officers of the company or any of them either severally or jointly with any other person or debts due by firms or private companies respectively in which any director is a partner or a director or a member is separately stated. The accounting for receivables and doubtful debts has been discussed at length in Chapter 7.

The details of trade receivables of Biocon Limited as on 31st March 2017 are given in Table 6.8.

Table 6.8: Current Trade Receivables of Biocon Limited as on 31st March 2017

The trade receivables for Biocon Limited has gone up to ₹ 7,982 million as on 31st March 2017 compared to ₹ 5,038 million in the previous year. The company has a provision of ₹ 58 million (previous year ₹ 42 million) towards credit loss expected on account of non-recovery of receivables.

Cash and Bank Balances

Cash and bank balances are classified into two sub-heading:

- Cash and cash equivalents

- Bank balances other than cash and cash equivalents

As per Ind AS-7, cash and cash equivalents include cash in hand and demand deposits with banks. Cash equivalents are defined as short-term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value. An investment would normally qualify as a cash equivalent only when it has a short maturity of three months or less from the date of acquisition. This would include term deposits with banks that have an original maturity of three months or less. Cash and equivalents are further classified as:

- Balances with banks (of the nature of cash and cash equivalents)

- Cheques and drafts on hand

- Cash on hand

- Others (specify nature)

Bank balances, other than cash and cash equivalents as above, are required to be disclosed below cash and cash equivalents on the face of the balance sheet. The following additional disclosures are required to be made with regard to cash and bank balances:

- Earmarked balances with banks (for example, for unpaid dividend).

- Balances with banks to the extent held as margin money or security against the borrowings, guarantees, other commitments, etc.

- Repatriation restrictions, if any, in respect of cash and bank balances.

It may be noted that deposits with maturity period exceeding twelve months should not be shown under this heading rather is should be shown under other non-current financial assets.

The cash and bank balances of Biocon Limited as on 31st March 2017 is shown in Table 6.9:

Table 6.9: Cash and Bank Balances of Biocon Limited as on 31st March 2017

As on 31st March 2017, total cash and bank balance of the company stood at ₹ 3,829 million (previous year ₹ 6,430 million). The major portion (₹ 3,416 million) is represented by cash and cash equivalents. It may be noted that bank deposits exceeding 12 months maturity are not included under this heading.

Current Loans

Loans expected to be realized within 12 months of the date of the balance sheet are classified as current loans. This also includes security deposits given by the enterprise for various purposes during the ordinary course of business. Loans to related parties are required to be disclosed separately. Accordingly, loans are classified as:

- Security deposits

- Loans to related parties (giving details thereof)

- Other loans (specify nature)

Likewise, a loan or an advance may be secured against some collateral given by the borrower or unsecured. Accordingly, the aggregate value of loans and advances is broken down in three sub-headings:

- Secured; considered good

- Unsecured; considered good

- Doubtful

The loans and advances are shown at their gross value less provision for bad and doubtful loans made. The above breakup is provided in the relevant notes to the balance sheet.

6.6 CURRENT TAX ASSETS (NET)

Companies are required to pay advance tax on the estimated taxable income for the year. It may happen that the amount of tax already paid in respect of current and prior periods exceeds the amount of tax due for those periods. The excess tax so paid is recognized as an asset. The excess tax paid is computed for each assessment period separately.

6.7 OTHER CURRENT ASSETS

This is the residual category for the current asset. Any asset which is current is nature and has not been classified in the above sub-headings will get disclosed under this heading. Other current assets are further classified as advances other than capital advances and others.

Advances other than capital advances are further broken into security deposits, advances to related parties (giving details thereof) and other advances.

Advances to directors or other officers of the company or any of them either severally or jointly with any other persons or advances to firms or private companies respectively in which any director is a partner or a director or a member should be separately stated. Other current assets will also include prepaid expenses and income received in advance.

6.7.1 Pre-paid Expenses

An enterprise may incur certain expenses in one accounting period a portion of which pertains to the next accounting period. The unexpired portion of expenses incurred in an accounting period is referred to as prepaid expense and is shown as a current asset. To illustrate annual maintenance charges paid amounting to ₹ 600,000 for a period covering 12 months out of which say 3 months fall in the next accounting period. Three-fourth of the expenses incurred (for 9 months) will be expensed in the current accounting period whereas the unexpired portion (for three months) amounting to ₹ 150,000 will be shown in the balance sheet as prepaid expenses. Similarly, other expenses incurred are analysed to ensure proper matching of expenses.

6.7.2 Income Earned but not Received

An enterprise might earn certain income in one accounting period which is actually received in the subsequent accounting period. The income is recognized following accrual principle in the period when earned and at the same time it is recorded as a current asset. To illustrate, an enterprise placed a fixed deposit of ₹ 10 million for one year on 1st December 2016. The deposit earns interest @ 12% per annum and will mature on 30th November 2017. Interest for the period of 4 months (from 1st December 2016 to 31st March 2017) amounting to ₹ 400,000 will be recognized as an income in the statement of profit and loss for the period ended 31st March 2017. At the same time, interest earned but not received for the same amount will be recorded in the Balance Sheet as on 31st March 2017 as other current asset.

6.8 EQUITY AND LIABILITIES

The second part of the balance sheet—Equity and Liabilities—reflects what the company owes to the providers of capital. Liabilities are the present obligations of the entity arising from the past events which is expected to result in outflow on settlement. Equity represents the claim of the owners i.e. the residual interest in the assets of the entity after settlement of all liabilities.

6.9 EQUITY

Equity represents the claim of the shareholders over the assets owned by the company. As the shareholders are the owner of the business their ‘claim’ is not of the same nature as that of external suppliers of funds. They are perpetual in nature and are not expected to be repaid except in case of liquidation of the company and that too after paying all other obligations. Equity, therefore, ‘is the residual interest in the assets of the entity after deducting all its liabilities’. To that extent, the accounting equation may be represented as Equity = Assets – Liabilities. The equity is further broken down in two sub-headings—share capital and other equity. Schedule III requires a separate ‘statement of change in equity’ to be presented comprising equity share capital and other equity. Other equity includes all items other than equity shares that are attributable to the holders of equity instruments of an entity. The statement of change in equity provides a reconciliation of equity, showing balances in the beginning of the year, changes during the year and balances at the end of the year.

6.9.1 Share Capital

The total capital of a company is divided into small units called shares. Each share has a ‘face value’ or ‘par value’. The share capital represents the amount raised by the company by issuance of shares at the stated face value. A company being an artificial person is managed in accordance with its constitution called memorandum of association. The memorandum of association amongst other things also define the maximum amount that the company is authorized to raise by way of issue of shares. The upper limit so defined is called the authorized share capital. Each share represents a part ownership of the company. The shares issued by the company may be either preference shares or equity shares. As the rights associated with the preference shares capital and equity shares capital are different, they are shown separately in the balance sheet.

Preference Shares

Preference shares carry a fixed rate of dividend and have a preference over equity in the payment of dividend as well as repayment of principle in case of liquidation of the company. Preference shares have a face value and a stated rate of dividend. For example, 10% preference share of ₹ 100 each means that the face value per share is ₹ 100 on which dividend at a fixed rate of 10% will be paid. Though they are entitled to a fixed rate of dividend, it is payable only if the company has adequate profits. In case the company is unable to pay dividend on the preference shares due to inadequacy of profit, the same gets accumulated and has to be paid once the company starts making profits provided that the preference shares were cumulative in nature. In case of non-cumulative preference shares, the dividend once skipped does not accumulate. They normally do not have any voting rights. However, in case of non-payment of dividend they do get limited voting rights.

Preference shares are entitled to a fixed rate of dividend and have preference over equity in payment of dividend and repayment of capital in case of winding up of the company.

Preference shares further may be redeemable or irredeemable. Redeemable preference shares are issued for a fixed maturity. On maturity the shares are redeemed, that is, the principal amount is repaid to the holders. Irredeemable preference shares, on the other hand, are perpetual in nature. The Companies Act, 2013, permits issuance of only redeemable preference shares with maturity not exceeding 20 years.2 The preference shares may also be convertible into equity shares. Preference shares with convertibility clause are called convertible preference shares.

Equity Shares

Equity shares also called common shares or ordinary shares represent the ownership of the company. They have the last preference in getting dividend and repayment of principle. The dividend in not fixed—it is declared at the discretion of the board of directors of the company. Dividend, if any, on equity shares is paid only after paying the dividend on preference shares. Similarly, in case of liquidation of the company they have the last claim over the assets of the company. Equity shares are issued with a par value also called the face value per share.

Equity shares represent the ownership of a company as they enjoy voting rights.

When a company raises funds by issue of equity shares its bank balance increases and at the same time the share capital representing claim of the owners also goes up. The following entry is passed:

| Bank Account | Dr. |

| To Equity Share Capital Account |

Share Premium

An existing and profit-making company may issue its equity shares to new shareholders at a price higher than the face value of the shares. The excess of the issue price over and above the face value of share is called premium. The amount of securities premium is not included in the share capital but is shown separately as securities premium account. It may be noted that securities premium is in the nature of a capital profit and therefore not taken to the profit and loss statement. It is credited to the securities premium account which is an example of capital reserve and is included in other equity. Securities premium account cannot be used to pay dividends to the shareholders but is permitted to be used for issuing fully paid up bonus shares.4

■ Illustration 6.1

Blue Bell Limited issued 20 million equity shares of the face value of ₹ 10 each at an issue price of ₹ 50 each for cash. How will this transaction be recorded?

The issue price of ₹ 50 per share is made up of two components—₹ 10 towards face value and ₹ 40 towards premium. Accordingly, the transaction will be recorded as follows:

| Bank Account | Dr. | ₹ 1,000 million | (20 million × ₹ 50 per share) |

| To Equity Share Capital Account | ₹ 200 million (20 million × ₹ 10 per share) | ||

| To Securities Premium Account | ₹ 800 million (20 million × ₹ 40 per share) | ||

Only the amount of ₹ 200 million will be shown as share capital. The securities premium account at ₹ 800 million will appear as a separate heading under other equity.

Issued, Subscribed and Paid-up Capital

The authorized share capital is the maximum amount that the company may raise by the issue of shares. This is also called the nominal capital because this amount has not actually been raised by the company. A part of the authorized capital that is actually offered by the company for subscription to investors is called the issued capital. The issued capital cannot exceed the authorized capital. The part of issued capital that is actually taken up and allotted to the investors is called the subscribed capital. The subscribed capital cannot exceed the issued capital. The issuing company may not call the entire face value per share in one go rather decide to call the amount in instalments. The part of subscribed capital in respect of which calls have been made on the shareholders by the company for payment is known as the called-up capital. If the shareholders fail to pay a part of the amount called up, the same is termed as calls in arrear. The calls in arrear amount is deducted from the called up capital to arrive at the paid up capital. The paid up capital is the real capital of the company which is taken in the amount column in the balance sheet.

Share Application Money is shown separately as a part of shareholders’ funds till allotment is made

■ Illustration 6.2

Kay Kay Limited has an authorized capital of 60 million equity shares of the face value ₹ 10 each and one million preference shares of the face value ₹ 100 each carrying dividend at 10%. The company offered 20 million equity shares at par for subscription and on which ₹ 8 has been called up. All shareholders paid the amount called except holder of 500,000 shares who failed to pay call amount of ₹ 4 each. How will this information appear in the balance sheet of the company?

The information will be shown as follows:

Balance Sheet of Kay Kay Limited as on………….

The paid up capital of ₹ 158 million will be shown in the balance sheet as the share capital. All other details are provided in the schedule to the balance sheet. Usually the issued, subscribed, called up and paid up capital is the same for most of the companies.

Share Application Money

The issue of share capital may be a three step process—the company invites the prospective investors to apply for the shares of the company, the investors apply for the shares paying application money with the application and the company accepts the application by way of making an allotment. It may be noted that the share capital comes into existence only when the company accepts the application by way of making the allotment. Accordingly, money received on application is shown separately till the allotment is made. Upon allotment, the application money is transferred to share capital.

■ Illustration 6.3

Readwell Book Store Limited, with an authorized share capital of ₹ 40 million (four million equity shares of ₹ 10 each), has a paid up capital of ₹ 10 million (one million shares of ₹ 10 each). It further offered two million equity shares of ₹ 10 each at par for subscription on 28th February 2017. The company received applications for three million equity shares with application money amounted to ₹ 30 million. The company made allotment of two million shares and refunded the excess application money on 25th April 2017. How will the necessary entries be passed? How will it appear in the balance sheet as on 31st March 2017?

The necessary journal entries will be as follows:

On receiving the application money:

| Bank Account | Dr. | ₹ 30 million |

| To Share Application Money Account | ₹ 30 million |

At the time of allotment:

| Share Application Money Account | Dr. | ₹ 20 million |

| To Equity Share Capital Account | ₹ 20 million |

For making the refund:

| Share Application Money Account | Dr. | ₹ 10 million |

| To Bank Account | ₹ 10 million |

As on 31st March 2017, the allotment is yet to be made, the application money received will not be included in the equity share capital. The application money in respect of the two million shares will be shown funds separately. The excess application money to be refunded shortly will be shown in the current liabilities. The share capital in the balance sheet as on 31st March 2017 will appear as follows:

Balance Sheet of Readwell Book Stores Limited as on 31st March 2017

Share Forfeiture Account

If the shareholder to whom the shares have been allotted fails to pay the amount due on call, the company by giving due notice to the defaulting shareholder has a right to forfeit the shares issued. The forfeiture involves forfeiting the amount already paid, writing-off the calls in arrear and reducing the paid up capital to that extent. The amount forfeited is shown separately in the balance sheet. The shares forfeited for non-payment can be subsequently reissued by the company. At that stage, the balance available in the share forfeiture account is transferred to capital reserves and shown in the reserves and surplus.

■ Illustration 6.4

Assume that Kay Kay Limited (Illustration 6.2) decides to forfeit the 500,000 equity shares on which the call money has not been paid after giving due notice to the defaulting shareholders. What will be the accounting entry for the forfeiture? How will it be shown in the balance sheet?

In respect of 500,000 equity shares, ₹ 8 per share has been called up. Out of which, ₹ 4 per share has been paid up and the balance ₹ 4 is call in arrears. The following entry will be passed to record the forfeiture:

| Equity Share Capital Account | ₹ 4,000,000 | (500,000 shares at ₹ 8 each called up) |

| To Share Forfeited Account | ₹ 2,000,000 (500,000 shares at ₹ 4 each paid) | |

| To Calls in Arrear Account | ₹ 2,000,000 (500,000 shares at ₹ 4 each in arrear) | |

After forfeiture the paid up capital will be shown in the balance sheet as follows:

| ( ₹ in Million) | |

| 19.5 million equity shares of ₹ 10 each, ₹ 8 called up | 156 |

| Add: Share Forfeited Account | 2 |

| 158 |

Issue of Warrants

A warrant is an instrument that gives the holder a right to buy the specified number of shares at a predetermined price. It may be noted that issue of warrants by a company does not lead to an increase in the share capital. The warrant holder has a right to apply for and purchase equity shares of the company at a predetermined price some time in future. At the time when the warrant is exercised, the holder will pay the agreed price and the company will issue the new shares. The necessary entries for issue of share capital will be passed when the warrant is exercised. If the company has received some amount from the warrant holders as a precondition for issue of warrant, the same will be shown separately in the balance sheet and will be adjusted when shares are issued in lieu of the warrants.

Warrant gives the holders a right to apply for a fixed number of shares of the company at a predetermined price in future

Stock Splits

A company may decide to split its shares into share of lower face value. Stock split essentially involves substituting equity shares with larger face value by equity shares of smaller face value in such a way that the total paid up capital of the company and the proportionate ownership of the company remain unaltered. As a result of stock split, the number of shares goes up but with proportionately lowers face value. Consequently, the share capital of the company remains unaffected.

■ Illustration 6.5

The paid up capital of the company consists of 25 million equity shares of ₹ 10 each and the management decides to split each share into five shares of face value ₹ 2 each. How will the share capital appear before and after the split?

Before the split the share capital of the company will appear as follows:

Equity share capital (25 million shares of ₹ 10 each) ₹ 250 million

After split of five for one the share capital will be shown as follows:

Equity share capital (125 million shares of ₹ 2 each) ₹ 250 million

It may be observed that the paid up capital of the company has remained unaltered though the number of equity shares outstanding have gone up five times due to five for one split.

Bonus Share

Bonus refers to the issue of new shares to the existing shareholders in proportion of their existing shareholding without consideration. A company may decide to issue new shares to its existing shareholders without any consideration. Such an issue of shares is called bonus shares or stock dividend. As the shares are issued without consideration there is no change in the cash position of the company. The paid up share capital of the company though go up by the face value of the new shares, there is no change in the shareholders’ funds. The bonus shares are issued by capitalization of reserves. The reserves and surplus of the company is reduced to the extent of the face value of the new shares issued. Consequent upon the issue of bonus shares, the paid up capital of the company increases proportionately though the shareholders’ funds remain unaltered.

■ Illustration 6.6

The shareholders’ funds of Dee Jay Limited as on 31st March 2017 are given as follows:

| (₹ in Million) | |

| Equity Share Capital (30 million shares of ₹ 10 each) | 300 |

| General Reserves Account | 900 |

| Securities Premium Account | 450 |

| Total | 1,650 |

The company decided to issue bonus shares to its shareholders in the ratio of 2:1 (i.e., two new equity shares for each share held). For this purpose, it decided to capitalize securities premium account and general reserves account. Pass the necessary accounting entries and show how the equity will be shown in the balance sheet after the bonus issue.

Journal Entry

| Securities Premium Account | Dr. | ₹ 450 million |

| General Reserves Account | Dr. | ₹ 150 million |

| To Equity Share Capital Account | ₹ 600 million |

Equity after the Bonus Issue:

| ( ₹ in Million) | |

| Equity Share Capital (90 million shares of ₹ 10 each) | 900 |

| General Reserves Account | 750 |

| Total | 1,650 |

Share Buy-back

Share buy-back in Indian context essentially means buying the shares from the market and cancelling them. If the management feels that the company is overcapitalized and has surplus cash, it may decide to buy-back the shares for the purpose of cancellation. This is also called share repurchase. The Companies Act, 2013, lays down the necessary conditions for the buy-back of shares.3

Share buy-back is exactly opposite of issue of shares. In case of buy-back, the paid up share capital of the company goes down due to cancellation of shares repurchased. At the same time, the surplus cash of the company gets utilized towards payment to the shareholders. If the shares are bought back at a price higher than the face value of the share, the excess is adjusted from the accumulated reserves of the company.

■ Illustration 6.7

The current share capital of the company is 50 million equity shares of ₹ 5 each and the company has reserves and surplus of ₹ 800 million. The company decides to repurchase five million shares from the existing shareholders for cancellation at ₹ 60 each. The excess will be adjusted from the general reserve of the company. Pass the necessary journal entry. How will the transaction affect the balance sheet of the company?

The following journal entry will be passed:

| Equity Share Capital Account | Dr. | ₹ 25 million | (5 million × ₹ 5 face value) |

| General Reserves Account | Dr. | ₹ 275 million | (5 million × ( ₹ 60 – ₹ 5)) |

| To Bank Account | ₹ 300 million | (5 million × ₹ 60) |

As a consequence of the buy-back, the number of shares outstanding will go down by five million. The paid up capital post buy-back will stand at ₹ 225 million with reserves and surplus at ₹ 525 million. At the same time, the cash balance will also be reduced by ₹ 300 million.

Employee Stock Option Plan (ESOP)

As discussed in Chapter 5, a number of companies are offering stock options to their employees. An option is like a warrant that gives the holder a right to buy a certain number of shares at a predetermined price (called the strike price) after a defined period of time (vesting period). The shares are issued only when the option is exercised and therefore share capital does not increase at the time when the options are issued. The value attached to such options is treated as another form of employee compensation in the financial statements of the company. The option value is taken as the fair value using option pricing method. The option value is amortized over the vesting period.

■ Illustration 6.8

On 1st April 2015, Nav Bharat Hitech Limited granted 100,000 stock options to its employees. The employees have a right to exercise the options after three years at an exercise price of ₹ 100 each. The fair value per option at the time of granting the option is ₹ 60. On 31st March 2018, all the options are exercised by the employees. Pass the necessary journal entries and show the impact on the balance sheet.

The total fair value of the options granted is ₹ 6,000,000. The fair value will be treated as a deferred expense with simultaneous credit to employee stock option account. The deferred expenses will be amortized over the vesting period of three years on a straight line basis. Accordingly, each year ₹ 2,000,000 will be included in employees cost in the statement of profit and loss. The amount standing to the credit of employee stock option account will be adjusted at the time of exercise of the option. The following entries will be passed:

1st April 2015

| ESOP Deferred Expenses Account | Dr. | ₹ 6,000,000 |

| To Employee Stock Option Outstanding Account | ₹ 6,000,000 |

31st March 2016

| Employee Cost Account | Dr. | ₹ 2,000,000 (1/3rd of ₹ 6,000,000) |

| To ESOP Deferred Expenses Account | ₹ 2,000,000 |

The same entry will be repeated on 31st March 2017 and 31st March 2018 as well. The option value of ₹ 6,000,000 will get amortized over the vesting period.

31st March 2018

At the time of exercise the employee have to make payment for the shares @ ₹ 100 per share, i.e., the exercise price, and they will be allotted shares. The allotment price will be taken at ₹ 160 per share. The following entry will be passed

| Bank Account | Dr. | ₹ 10,000,000 |

| Employee Stock Option Outstanding Account | Dr. | ₹ 6,000,000 |

| To Equity Share Capital Account | ₹ 1,000,000 | |

| To Equity Share Premium Account | ₹ 15,000,000 |

In the balance sheet of the company, the employee stock option account − ESOP deferred expenses account will be shown separately under reserves and surplus.

Disclosure as per Schedule III

The following disclosures are required to be made relating to the share capital of the company. As noted earlier, in the main body of the balance sheet only the paid up capital is shown, the related disclosures are made in the relevant schedule to the balance sheet which constitutes an integral part of the same. A company shall disclose the following in the notes to accounts for each class of share capital (different classes of preference shares to be treated separately):

- The number and amount of shares authorized.

- The number of shares issued, subscribed and fully paid, and subscribed but not fully paid.

- Per value per share.

- A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

- The rights, preferences and restrictions attached to each class of shares including restrictions on the distribution of dividends and the repayment of capital.

- Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate.

- Shares in the company held by each shareholder holding more than 5% shares specifying the number of shares held.

- Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts.

- For the period of five years immediately preceding the date as at which the balance sheet is prepared:

- Aggregate number and class of shares allotted as fully paid up pursuant to contract(s) without payment being received in cash.

- Aggregate number and class of shares allotted as fully paid up by way of bonus shares.

- Aggregate number and class of shares bought back.

- Terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest such date.

- Calls unpaid (showing aggregate value of calls unpaid by directors and officers)

The information as required by the Schedule III is given in the notes to the balance sheet and is useful in understanding the composition and changes in the share capital of the company during the year. The details of share capital of Biocon Limited are given in Table 6.10.

The paid up capital of the Biocon Limited has remained unchanged at ₹ 1,000 million against authorized capital of ₹ 1,100 million signifying the fact that no new shares have been issued during the year. The face value per share is ₹ 5 each.

Table 6.10 Share Capital of Biocon Limited as on 31st March 2017

The paid up capital of the Biocon Limited has remained unchanged at ₹ 1,000 million against authorized capital of ₹ 1,100 million signifying the fact that no new shares have been issued during the year. The face value per share is ₹ 5 each. The company further stated that it has only one class of equity shares having a par value of ₹ 5 per share. Each holder of equity shares is entitled to one vote per share. The company declares and pays dividends in Indian rupees. The dividend proposed by the board of directors is subject to the approval of the shareholders in the ensuing annual general meeting. In the event of liquidation of the company, the holders of equity shares will be entitled to receive remaining assets of the company, after distribution of all preferential amounts, if any. The distribution will be in proportion to the number of equity shares held by the shareholders. There were two shareholders with holding in excess of 5% each. Kiran Mazumdar-Shaw held 79,287,564 equity shares (39.64%) and Glentec International Limited held 39,535,194 equity shares (19.77%)

6.9.2 Other Equity

Other equity includes all items other than equity shares that are attributable to the holders of equity instruments of an entity. The followings are disclosed as other equity:

- Share application money pending allotment

- Equity component of compound financial instrument

- Reserves and surplus

- Debt instruments through other comprehensive income

- Equity instruments through other comprehensive income

- Effective portion of cash flow hedges

- Revaluation surplus

- Exchange difference on translating the financial statements of a foreign corporation

- Other items of other comprehensive income

- Money received against share warrants

Share Application Money Pending Allotment

Application money received from the applicants is a part of other equity as a separate line item. It may be noted that only share application money, to the extent of not refundable, shall be shown in this line item. Share application money, to the extent of refundable, is separately shown under ‘other financial liabilities’.

Equity Component of Compound Financial Instruments

An entity might have issued instruments that have both, equity as well as liability component. Such compound instruments are required to be split into two components—debt and equity. The ‘equity component of compound financial instrument’ is required to be presented as a part of ‘other equity’. The ‘liability component of compound financial instrument’ is required to be presented as a part of ‘borrowings’. For example, convertible debentures issued by the company would be split as ‘other equity’ and borrowings.

Reserves and Surplus

Reserves and surplus is an important component of shareholders’ funds. In respect of profit making companies with long existence, this heading may be much larger than the share capital. These shall be further bifurcated as:

- Capital reserves

- Securities premium reserve

- Other reserves (specify nature)

- Retained earnings

Capital Reserves: A capital reserve is defined as a reserve of an enterprise which is not available for distribution as dividend. These reserves are not created out of the profits earned in the usual course of business. For example, profit on reissue of forfeited shares is in the nature of capital reserve and therefore is required to be disclosed separately.

Securities Premium Reserve: As discussed in the earlier paragraphs, the Securities premium reserve representing excess of issues price over the face value of the securities issues is shown separately as a part of reserves and surplus.

Other Reserves: Any other reserve not covered above is shown under this heading. Nature, purpose and amount of each of such reserve are required to be stated separately.

Retained Earnings

As discussed earlier, dividend on equity shares is a discretionary payment—based upon the profits made and future funds requirements of the enterprise, the board of directors recommends the dividend to be paid. Conversely, part of profit is retained within the business and ploughed back in the business. The retained earnings of the business since inception, i.e., profits made since beginning less the dividends paid both of preference shares and equity shares are accumulated in the reserves and surplus. After providing for dividend and transferring profits to specific reserves, any balance left in the profit and loss statement is called ‘surplus’ and is a part of retained earnings. As retained earnings keep on accumulating year after year, companies with long track record of profitability will have large amounts in reserves and surplus. The retained earnings are also dependent upon the dividend policy being pursued by the company. A company distributing large part of its profits as dividends will be adding lower amounts to retained earnings, whereas a company with lower dividend payments will be retaining more and therefore will have larger reserves and surplus.

The credit balance of retained earnings is shown separately under the heading reserves and surplus. If the net balance in the statement of profit and loss is a loss (or a debit balance), the same is shown as a negative balance. A company with huge accumulated losses may have a negative figure in retained earnings.

Debt Instruments through Other Comprehensive Income

Any fair value gain or loss on debt instruments which are measured at fair value through other comprehensive income (FVOCI) is presented as a part of other equity. Ind AS 109 requires subsequent measurement of investments at FVOCI based on the company’s business model for managing the portfolio of debt instruments and contractual cash flow characteristics.

Equity Instruments through Other Comprehensive Income

As per Ind AS 109, companies have an option to designate investments in equity instruments to be measured at FVOCI. For such instruments, the cumulative fair value gain or loss is presented as a part of other equity under this heading.

Effective Portion of Cash Flow Hedges

For all qualifying cash flow hedges, this component of other equity associated with the hedged item (i.e., cash flow hedge reserve) is adjusted to the lower of the cumulative change in the fair value of the hedging instrument and the cumulative change in the fair value of the hedged item attributable to the hedged risk. The portion of the gain or loss on the hedging instrument that is determined to be an effective hedge (i.e., the portion that is offset by the change in the cash flow hedge reserve) is recognized in other comprehensive income. Also, Ind AS 109 requires that exchange differences on monetary items that qualify as hedging instruments in a cash flow hedge are recognized initially in other comprehensive income to the extent that the hedge is effective.

Revaluation Surplus

An enterprise may decide to revalue its assets to show them at their current realizable value. Reserves created out of the gain on revaluation of assets are called revaluation reserves. When the carrying amount of an asset is increased, the increase is recognized in the other comprehensive income and is accumulated as revaluation surplus under ‘Other Equity’.

Exchange Differences on Translating the Financial Statements of a Foreign Operation

An entity with foreign operations is required to translate the financial statements of foreign operations to the presentation currency. As per Ind AS 21 ‘The effects of changes in foreign exchange rates requires that the exchange differences arising on translation of the financial statements of foreign operation from functional currency to presentation currency should be recognized in the OCI. The accumulated amount of the exchange difference is presented in other equity.

Other Items of Other Comprehensive Income (specify nature)

Any other items that need to be presented in OCI as per the relevant Ind AS shall be included under other equity.

Money Received Against Share Warrants

An entity may issue warrants which give the holders a right to acquire equity shares of the entity sometime in future. The holder of the warrant is required to pay money as a consideration. The money paid against warrants would be finally adjusted when the shares are issued against warrants in future. Since shares are yet to be allotted against the same, these are not reflected as part of share capital but as a separate line item—money received against share warrants.

It may be noted that a balance in the reserves and surplus does not mean that the amount is lying with the company in cash. However, if the amount standing to the credit of a reserve is represented by specific earmarked investments, it should be separately disclosed. For example, an entity may decide to create a reserve for the repayment of a loan by transferring a certain amount from the statement of profit and loss annually. The amount transferred to the reserve account is simultaneously invested in identified investments to generate sufficient cash for the repayment of loan on maturity. The fact that the reserve is backed by earmarked investments shall be disclosed.

The addition and deduction since last balance sheet is also required to be disclosed under each of the specified heads.

The details of other equity of Biocon Limited are given in Table 6.11.

Table 6.11 Other Equity of Biocon Limited as on 31st March 2017

On 31st March 2017, the other equity of the company stood at ₹ 64,411 million which is largely made up of balance in the retained earnings at ₹ 58,244 million, securities premium of ₹ 2,908 million and general reserves of ₹ 3,458 million.

6.10 STATEMENT OF CHANGE IN EQUITY

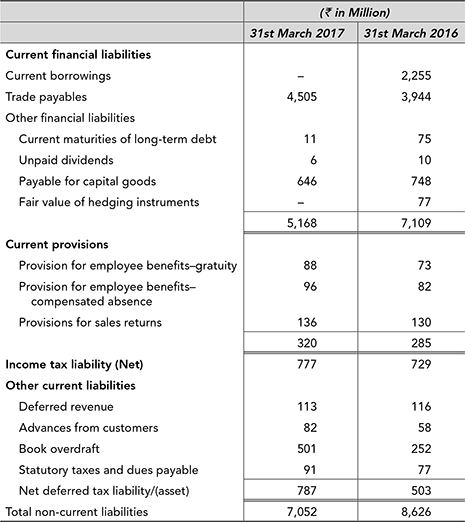

In addition to the presentation of balance sheet at the end of the accounting period, an entity is also required to separately present a statement of change in equity. The statement of change in equity essentially provides a reconciliation of equity share capital and all items of other equity. The statement is broken into two parts. The part of equity share capital provides details regarding balance at the beginning of the period, changes in equity shares capital during the year and balance at the end of the reporting period. Likewise, the part for Other Equity provides a reconciliation during a particular reporting period, as a part of one single statement, of all items other than equity share capital, that are attributable to the holders of equity instruments of an entity. The statement is prepared in columnar form with the following details: