9

Accounting for Fixed Assets and Depreciation

CHAPTER OBJECTIVES

This chapter will help the readers to:

- Differentiate between operating expenses and capital expenditure.

- Indentify tangible assets and intangible assets.

- Understand the principles involved in ascertaining the cost of acquired assets and selfgenerated assets.

- Appreciate the treatment of expenditure on improvement, repair and maintenance.

- Understand the concept of depreciation, depletion and amortization.

- Apply different methods for calculating depreciation.

- Understand the accounting of sale, exchange and discarding of fixed assets.

- Understand the impact of change in method of depreciation and impairment of assets on the financial statements of a company.

- Identify the issues involved in accounting of intangible assets particularly brands, goodwill, research and development cost.

- Apply the key requirements of Ind AS 16, Ind AS 17, Ind AS 20, Ind AS 23, Ind AS 36, Ind AS 38 and Ind AS 40 on accounting for non-current assets.

9.1 INTRODUCTION

As discussed in Chapter 6, assets of an entity are required to be classified as current assets and noncurrent assets. Non-current assets are intended to be used by the entity over a long period of time, whereas current assets are intended to be used or converted into cash within the next 12 months or normal operating cycle of the entity. In this chapter, the initial recognition and subsequent measurement of tangible non-current assets (property, plant and equipment and investment property) and intangible non-current assets (goodwill and other intangible assets) have been discussed.

9.1.1 Operating Expenses versus Capital Expenses

Expenses incurred for day-to-day running of the business are often called operating expenses (or OPEX in short) or revenue expenses. As these expenses benefit a particular accounting period, they are charged to the profit and loss statement of that period using accrual basis of accounting. On the other hand, expenses that are expected to provide benefit over a long period of time are called capital expenditure (or simply CAPEX). Capital expenditure results in creation or acquisition of non-current assets or fixed assets as they are popularly called. As these assets are expected to generate benefits over more than one accounting period, it is fair to match the cost of these assets against the benefits. Accordingly, capital expenditure is appropriated over the useful lives of these assets.

It may be noted that it is not the nature of asset but its intended use that determine whether to treat the same as operating expenses or capitalize the same. If the intention is to use it over a long period of time, it is capitalized.

■ Illustration 9.1

Fast-track Limited is a dealer of commercial vehicles and spare parts. It bought 10 trucks at a cost of ₹ 1.5 million each. Seven of these trucks are intended to be sold in the ordinary course of business, whereas other three are meant to be used within the business for carrying goods from one godown to another. How should the consideration amount of ₹ 15 million be accounted for?

As seven trucks are intended to be resold, their cost will be treated as operating expense. Accordingly, ₹ 10.50 million will be charged to profit and loss statement of the year. The other three trucks are intended to be used over a period of time; hence their cost will be capitalized. Accordingly, ₹ 4.50 million will be capitalized and will be amortized over the useful life of these trucks.

9.1.2 Type of Fixed Assets

Fixed assets may be classified as tangible and intangible. Tangible assets have physical existence and one can see, touch and feel the same. Examples will include plant and machinery, furniture and fixtures, land and building, and vehicles. Intangible assets, on the other hand, have no physical existence but they do represent some valuable rights. For example, patents right acquired by a pharmaceutical company to manufacture a drug is a valuable right and hence an intangible asset. Intangible assets may not have physical substance but they are not worthless. In fact, in a knowledge economy they often are more valuable than tangible assets. Examples include patent rights, copyrights, software license, etc. In this chapter, firstly the accounting of tangible assets is covered and in the later part intangible assets are covered.

Tangible assets have physical substance. Intangible assets are without physical substance.

Assets may further be classified as acquired assets and self-constructed assets. In case of acquired assets, identifying the cost of acquisition of the asset may be relatively straight forward, whereas for self-constructed assets identifying relevant costs attributable to the asset may require extra efforts.

Further, an entity may be holding land or building or both, not for use in the production or supply of goods or services or for administrative purposes or sale in the ordinary course of business but to earn rentals or for capital appreciation or both. Such assets are called investment property.

9.2 PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are tangible items because they are used in the production or supply of goods or services, for rental to others, or for administrative purposes. These assets are expected to be used during more than one accounting period. Property, plant and equipment (PPE) includes a wide variety of tangible assets, viz., land, building, plant and machinery, furniture and fixtures, vehicles, computers, etc. These assets are tangible in nature and have been acquired by the entity with the intention to use during more than one period. An item of property, plant and equipment shall be recognized as an asset only if it is probable that future economic benefits associated with the item will flow to the entity and the cost of the item can be measured reliably. Recognition criteria are depicted in Figure 9.1.

Ind AS 16 defines property, plant and equipment as tangible items held for use in the production or supply of goods or services, for rental to others or for administrative purpose and to be used during more than one period.

Figure 9.1 Recognition Criteria for PPE

9.2.1 Initial Cost

An item of property, plant and equipment is initially recognized at its cost. When an asset is acquired, besides the purchase price, a number of other expenses may be incurred before the asset is ready for its intended use. As a guiding principle, all costs that are necessary to be incurred to bring the assets to its intended use are capitalized. Besides the purchase price, other costs include import duties, freight to bring the asset to the site, installation cost, professional cost of architects etc,. Classification of expenses incurred as capital expenditure or operating expense will have significant impact on the value of the asset in the balance sheet as well as profit or loss as shown in the statement of profit and loss.

The initial cost of an asset will include the purchase price paid after adjusting for trade discounts and rebates. Taxes and import duties are also included in the initial cost, however, if any of the taxes paid is refundable the same is excluded. In addition, costs directly attributable for bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management are also included. Costs incurred on site preparation, initial delivery, installation and assembly, costs of testing, professional fees and employee benefits are also capitalized. If any item produced during the testing or trial run is sold, the net proceeds from sale are deducted from the cost.

An entity may have obligations to dismantle, remove and restore the site on which the asset is located. Such obligation may arise when the item is acquired or as a consequence of having used the item during a particular period for purposes other than to produce inventories during that period. Estimated cost of dismantling and removing the items and restoring of site are also included in the initial cost of PPE.

■ Illustration 9.2

During 2016–17, New Age Fashion Limited bought a machine at a cost of ₹ 6.5 million. Additionally it paid ₹ 80,000 towards freight charges and ₹ 25,000 towards insurance during transportation. Cost of installation and test run came to ₹ 120,000. Inventories costing ₹ 30,000 were consumed during the trial run. Items produced during the test run were sold for ₹ 45,000. At what value the machine will be capitalized?

All expenses (purchase price, freight, insurance and installation, test run and inventories used) are necessary to bring the machine to its intended use and will be capitalized. Proceeds from sale of products will be deducted. As such, the initial cost will be recorded at ₹6,710,000 million.

Assets Acquired in Exchange

A new fixed asset may be acquired in exchange of an existing asset. In such a case, the cost of acquisition will be the fair market value of either the asset given up or the fair market value of the asset acquired, whichever is more evident. As an alternative, the asset may be recorded at the book value of the asset given up, especially when the assets being exchanged are similar. If a part consideration is met in cash, the same also is adjusted to arrive at the cost of acquisition.

Similarly, the consideration of an asset may be paid by issue of securities. In such a case, again the asset will be recorded either at the fair market value of the asset being acquired or at the fair market value of the securities being issued whichever is more evident.

■ Illustration 9.3

Peerless Chemical Limited is acquiring a new machine in exchange of an old one. The book value of the old machine is ₹ 200,000. The consideration for the new machine will be met by a cash payment of ₹ 2.7 million and the old machine. At what value the new machine should be recorded in each of the following situations:

- The fair market price of old machine is difficult to determine but the fair price of the new machine is ₹ 3 million.

- The fair market price of the old machine is ₹ 400,000.

- As the machines are highly specialized ascertaining the fair market value of either of them is difficult.

- As the fair value of the new machine is evident at ₹ 3 million, it will be recorded at the same. It will be assumed that the old machine is being taken over at ₹ 300,000, i.e., ₹ 3 million less ₹ 2.7 million.

- The new machine will be recorded at ₹ 3.1 million, i.e., cash payment of ₹ 2.7 million plus fair value of old machine at ₹ 400,000.

- As the fair market value of either machine is difficult to determine, the new machine will be recorded at the cash consideration plus the book value of old machine. Accordingly, the cost of acquisition will be taken at ₹ 2.9 million.

Self-constructed Asset

The principles applicable for acquired assets also apply to self-constructed assets. In addition to cost of construction directly incurred for the specific asset, a fair share of cost incurred on construction activity in general will also form part of the cost of the asset. If similar assets are made by the entity for sale in the normal course of business, internal profits, if any, shall be eliminated to arrive at the cost.Accordingly, the cost of the self-constructed assets would be same as cost of constructing an asset for sale. Cost of abnormal wastages—material, labour or other resources—is also excluded from cost.

■ Illustration 9.4

Bharat Construction Material Limited is engaged in trading of construction material. It constructed a new warehouse building during 2016–17. The cost incurred specifically on this building came to ₹ 6.8 million. This include construction material consumed from own stock valued at ₹ 2.8 million at selling price. The cost of this material to the company was ₹ 2.2 million only. The company also has a project division which supervised the construction of building besides other projects. The annual cost of the project division during 2016–17 was ₹ 20 million. It is estimated that the project division spent about 10% of its time on supervising the building in question. What is the cost of construction of this building?

The capitalized vale of the building will be calculated as follows:

| (₹ in Million) | |

| Specific cost of construction: | 6.8 |

| Less: Internal profit eliminated: | 0.6 |

| Add: 10% allocated cost of project division | 2.0 |

| Total cost of construction | 8.2 |

Asset Acquired on Deferred Payment

An asset may be acquired by an entity on deferred credit terms, i.e., the purchase price is paid beyond the normal credit terms of the vendor. In such a case, the asset will be capitalized at the cash price equivalent on the recognition date. The difference between the cash price equivalent and the total payment will be recognized as interest over the period of credit.

Capitalization of Interest

The principle that expenses incurred to bring the asset to its intended use are capitalized is extended to interest on borrowed funds as well. Borrowing costs are normally treated as expenses in the period in which they are incurred, however, if the funds have been borrowed for the acquisition, construction or production of an asset, the same will be capitalized as part of that asset. If the borrowed funds have been temporarily invested pending their deployment, the income earned should be deducted from the borrowing costs. Once the asset is ready for its intended use, interest in the subsequent period will be charged to the statement of profit and loss as an expense.

Ind AS 23: To the extent that funds are borrowed specifically for the purposeof obtaining a qualifying asset, the amount of borrowing costs eligible for capitalization on that asset should be determined as the actualborrowing costs incurred on that borrowing during the period less any-income on the temporary investment of those borrowings.

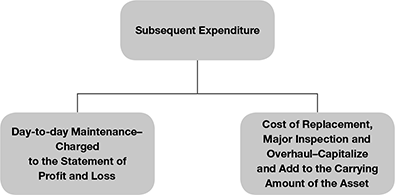

Subsequent Expenditure

Once the asset has been capitalized and put to use, any subsequent expenditure incurred for day-to-day servicing of an asset are in the nature of repair and maintenance. Such costs are treated as operating expenses and are transferred to the statement of profit and loss for the period and not included in the carrying amount of the asset.

However, cost of replacements is capitalized if it meets the recognition criteria, i.e., future economic benefits associated with the item will flow to the entity and the cost of the item can be measured reliably. Once the new parts are recognized, the old parts are derecognized and removed from the balance sheet. If an item of PPE is subject to major periodical inspection and overhaul, the cost of inspection and overhauling expenses are also capitalized and added to the carrying amount of the asset.

The treatment of subsequent expenditure is depicted in Figure 9.2.

Figure 9.2 Treatment of Subsequent Expenditure

9.2.2 Subsequent Measurement

After initial recognition at cost, an entity has a choice between cost model and revaluation model for subsequent measurement. The accounting policy in this regard shall apply to the entire class of plant, property and equipment. In the cost model, the asset is carried in the books at its costs less accumulated depreciation and impairment losses, if any. Whereas in revaluation model, the asset is revalued at sufficient frequency at its fair value and it is carried at the revalued amount less accumulated depreciation and impairment losses, post revaluation.

A class of property, plant and equipment is a grouping of assets of a similar nature and use in an entity’s operations. For example, the following may be treated as separate classes:

- Land

- Land and buildings

- Machinery

- Ships

- Aircraft

- Motor vehicles

- Furniture and fixtures

- Office equipment

- Bearer plants

Revaluation Model

Revaluation model can be used only where the fair value of an asset is reliably measurable. In such a case, revaluations shall be made with sufficient regularity to ensure that the carrying amount of the assets is close to the fair value at the end of the reporting period.

The frequency of revaluation is determined keeping in the mind the fluctuation in the fair value of the item of property, plant and equipment. An annual revaluation may be needed in case of items which experience volatile changes in the fair value. For other items, revaluation once every three to five years may be sufficient. However, if an item of property, plant and equipment is revalued, the entire class of property, plant and equipment to which that asset belongs shall be revalued

An increase in an asset’s carrying amount, as a result of a revaluation, is recognized in other comprehensive income and accumulated in equity under the heading of revaluation surplus.There may be a situation where the carrying amount of an asset decreases in one accounting period and increases subsequently. In such a situation, the increase is recognized in the profit or loss to the extent is reverses a revaluation decrease of the same asset which was previously recognized in profit or loss.

Any decrease in the carrying amount, as a result of revaluation, is recognized in profit and loss. However, the decrease is recognized in other comprehensive income to the extent of any credit balance existing in the revaluation surplus in respect of that asset. The decrease reduces the amount accumulated in equity under the heading of revaluation surplus.Upon de-recognition of an item of property, plant and equipment, the revaluation surplus may be transferred directly to retained earnings.

■ Illustration 9.5

As per the accounting policy of XXX Limited, items of property, plant and equipment (PPE) are carried at their revalued amount. Each item of PPE is annually revalued. What would be the impact of the following revaluation on the financial statements of the company?

Item A

In 1st year, the increase in carrying amount will be recognized in the other comprehensive income at ₹ 2,00,000 and the same would appear as revaluation surplus under other equity in the balance sheet. In 2nd year, further increase in the carrying amount will be recognized in the other comprehensive income at ₹ 1,00,000 and the same would be added to the revaluation surplus. In 3rd year, the decrease in the carrying amount will be recognized in the other comprehensive income and adjusted against the balance in the revaluation surplus. As a result, the revaluation surplus will be reduced by ₹ 150,000.

Item B

In 1st year, the decrease in carrying amount will be recognized in the profit and loss at ₹ 3,00,000. In 2nd year, increase in the carrying amount (₹ 2,00,000) will be recognized in the profit and loss as it represents a reversal of revaluation decrease. In 3rd year, the decrease in the carrying amount will be recognized in the profit and loss.

Figure 9.3 Measurement of Property, Plant and Equipment

Cost Model

In the cost model, assets are carried in the books at its costs less accumulated depreciation and impairment losses, if any. If an entity choses cost model for a class of property, plant and equipment, the assets of that particular class will be carried in the books at their initial cost less depreciation and impairment loss. It would obviate the need for periodic revaluation of assets.

The measurement principle for items of property, plant and equipment as per Ind AS 16 are depicted in Figure 9.3.

9.2.3 Depreciation

The concept of depreciation is based upon matching concept. An asset that is expected to benefit more than one accounting period, the cost of such asset should be apportioned over its useful life in a systematic manner to match cost against the benefits derived. Apportioning the cost of an asset over its useful life in a systematic manner is called depreciation. By charging depreciation, a part of the capitalized cost of an asset is converted in operating expense and charged to the statement of profit and loss of each of the period in which the asset has been used. As the asset is likely to have some residual value after its useful life, the depreciable value of an asset is determined after deducting its estimated value. Please note that the depreciation amount merely represents apportionment of the cost of the asset over its useful life, it has no relation with the change in market value of the asset.

Ind AS-16: The depreciable amount of an asset should be allocated on a systematic basis over its useful life.

In fact there are various terms being used in this regard. Depreciation is generally associated with tangible assets, like plant and machinery, furniture and vehicles, etc. These assets have a limited useful life, are expected to be used during more than one accounting period and are not intended for resale. As land does not have a limited useful life, no depreciation is charged on land. However, if the land has been taken on leasehold basis for a defined period of time, it will also be subject to depreciation. Apportionment of the cost of intangible assets, like software licenses, goodwill, etc., is called amortization. Whereas when a non-current asset consists of natural resources, the apportionment of cost is referred to as depletion.

Tangible assets are depreciated, intangible assets are amortized and natural resources are depleted. Land is a non-depreciable asset.

Ind AS 16 requires that each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately. For example, the airframe and engines of an aircraft may be depreciated separately as they may have different useful lives. However, various parts having same useful life and depreciation method may be grouped together for calculating depreciation.

The depreciation amount is recognized in profit or loss in each year over the useful life of the asset. Depreciation of an asset begins when it is available for use. It ceases when the asset is derecognized or is classified as held for sale, whichever is earlier. Depreciation does not cease even if the asset is idle or is retired from active use till it is derecognized, classified as held for sale or is fully depreciated.

To assess the amount of depreciation, the following estimates need to be made:

- Cost of the asset

- Expected useful life of the asset

- Estimated residual value of the asset at the end of the useful life

- Method of depreciation

The depreciation amount to be charged can be determined by the following formula:

Cost of the asset has been covered in the earlier part. The other three variables have been discussed below:

Useful Life of the Asset

Estimation of expected useful life is a matter of managerial judgment. It is often shorter than the physical life of the asset as the enterprise may like to dispose of the asset before it becomes obsolete. The past experience with similar type of assets is often useful. The expected usage of the asset and related wear and tear would have an impact on the useful life. Likewise, technological changes resulting in the asset becoming obsolete need to be factored in. If there are significant contractual restrictions, for example, assets taken on lease basis for a fixed period, the useful life of the asset will get adjusted accordingly. If the asset in question is based upon a new technology about which the management has no past experience, the estimation becomes that much more difficult to make.

In case of natural resources, the assessment of the embedded quantity of resources and the rate of extraction will guide the estimate about the useful life of the asset.

Residual Value

Residual value of a depreciable asset means its realizable value after the useful life. As the useful life is often shorter than the physical life, the asset is expected to have some disposal value. As a guide, the past experience with similar type of assets may be used. Generally, the residual value is expected to be insignificant, and is therefore immaterial in calculation of depreciation. However, if the residual value is expected to be significant, it needs to be estimated. The residual value should be taken net of cost of disposal of the asset.

Methods of Depreciation

Given the above estimates, the depreciation charge may be computed in a variety of ways called methods of depreciation. The most popular methods being straight line method, diminishing balance method and unit-of-production method, though other methods like sum-of-digits method can also be used. The depreciation method used shall reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity. Method of depreciation, once chosen, is applied consistently period after period. If there is a change in the expected pattern of consumption of future economic benefits, depreciation method may be changed.

Straight Line Method (SLM)

As the name suggests, this method assumes that the asset provides similar economic benefits period after period over its useful life, and hence, the same amount of depreciation is charged to each period. For example, depreciation for a machine costing ₹ 10 million,with an estimated residual value of ₹ 1 million and a useful life of 10 years will be calculated as follows:

Thus, depreciation for the first year will be ₹ 900,000. The depreciation amount will remain same period after year. The reciprocal of useful life (1/10th or 10% in this case) provides the depreciation rate on a SLM basis. Thus, the 10% of the depreciable amount (Cost − residual value) will be charged as depreciation every year.

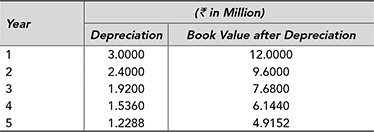

Diminishing Balance Method

Depreciation rate in reducing balance method is always higher that the straight line method

The underlying assumption under diminishing balance method (also called reducing balance method) is that the asset provides higher economic benefits in the initial years and therefore should be subjected to higher depreciation. In the later years, asset’s operational efficiency goes down and so should the depreciation charged. Lower depreciation in later years also compensate for higher repair and maintenance costs that are incurred. This method is also called Written Down Value Method (WDV method). Assuming that a machine costing ₹ 10 million is depreciated at 20% on reducing balance method over its useful life of seven years. The depreciation for the first year will be 20% of cost or ₹ 2 million. The carrying amount of the asset after the first year comes down to ₹ 8 million. The depreciation for the second year will be calculated at the given rate (20%) on the carrying amount (₹ 8 million). Accordingly, the depreciation expense for the second year comes to ₹ 1.6 million. This process will continue over the useful life of the asset. The depreciation schedule over the useful life of the asset is given below:

Similar effect can also be achieved by following sum-of-year digits method. Let us assume an asset costing ₹ 10 million with useful life of seven years. First, we find the sum of number 1, 2, 3, 4, 5, 6 and 7. The sum comes to 28. The sum can also be found by the following formula for an asset with useful life on n years:

The depreciation for the first year will be 7/28 of cost where the numerator is n. For the second year numerator will be n–1; for the third year n–2 and so on. The denominator in each case will be SOYD. Depreciation for the first year comes to 7/28 of ₹ 10 million, reducing to 6/28 of ₹ 10 million for the second year and so on. The depreciation schedule as per SOYD method is given below:

Reducing balance method and sum-of-year digits method are called accelerated methods as higher depreciation is charged in the initial years. The accelerated methods are more conservative as higher depreciation is written-off in the initial years.

Unit-of-Production Method

In this method, the life of an asset is defined not in terms of number of years but in terms of number of units it is expected to produce over its useful life. Depreciation per unit is then calculated by dividing the cost of the asset by number of units. The total depreciation for a period is calculated by number of units produced during the period multiplied by the depreciation expense per unit. For example, a machine costing ₹ 10 million is expected to produce 200,000 units before it will become obsolete. In the first year, 30,000 units were produced. The depreciation expense per unit comes to ₹ 50 (₹ 10 million divided by 200,000 units). Depreciation charges for the year comes to ₹ 1.5 million (30,000 units multiplied by ₹ 50). Similarly, depreciation charges for other years will be calculated based upon the number of units produced using this machine in each of the years.

■ Illustration 9.6

Curewell Hospitals Limited bought a MRI machine at a cost of ₹ 60 million. Though the physical life of the machine is 10 years, the company feels that due to technological changes it will have to replace the machine after five years. At the end of fifth year, the machine is expected to be taken back by the manufacturer at a value of ₹ 20 million. Calculate the depreciation expenses for the first two years in each of the following cases

- Company follows SLM for charging depreciation.

- Company decides to charge depreciation at the rate of 30% on reducing balance method.

- Company follows sum-of-years-digits method for calculating depreciation.

- Company estimates that the machine is good for 20,000 scans. In the first two years, 4,500 and 3,700 scans were performed, respectively.

- Depreciation = ( ₹ 60 million − ₹ 20 million)/5 = ₹ 8 million. Depreciation will be charged at ₹ 8 million every year.

- Depreciation for the first year will be 30% of ₹ 60 million = ₹ 18 million.

The book value after the first year will be ₹ 60 million less ₹ 18 million or ₹ 42 million.

Depreciation for the second year will be 30% of ₹ 42 million = ₹ 12.6 million.

- SOYD = 5 (5 + 1)/2 = 15

Depreciation for the first year = 5/15 of ₹ 40 million = ₹ 13.33 million

Depreciation for the second year = 4/15 × ₹ 40 million = ₹ 10.67 million

- Depreciation expense per scan = ₹ 40 million/20,000 = ₹ 2,000

Depreciation for the first year = 4,500 × 2,000 = ₹ 9 million

Depreciation for the first year = 3,700 × 2,000 = ₹ 7.4 million

Depreciation as per Companies Act, 2013

Schedule II of the Companies Act, 2013 prescribes the useful lives for various categories of assets and residual value for calculating depreciation. The useful life of an asset shall not be longer than the useful life as prescribed in the schedule. The residual value shall not be more than 5% of the original cost of the asset. If a company uses a useful life or residual value of an asset different from what is prescribed, justification for the difference needs to be provided in the financial statements.

The useful lives prescribed by Schedule II of Companies Act, 2013 for certain categories of assets are given in Table 9.1.

Table 9.1 Useful lives of Assets as per Schedule II of Companies Act, 2013

In respect of assets added or discarded during the year, depreciation is to be calculated on a proportionate basis for the period for which the asset was used. The useful life as mentioned above is based upon single shift working. If the asset is used for double shift, the depreciation would increase by 50% and in case of triple shift working depreciation would increase by 100% for the period for which the asset was so used.

Depreciation as per Income Tax Act, 1961

For computation of tax liability under Income Tax Act, 1961, depreciation is allowed to be charged at the prescribed rates on the written-down value of the asset. For this purpose, assets are classified in various blocks based upon the depreciation rate that they are subjected to. Assets used for less than 180 days in a year are entitled to half the normal depreciation allowance. As the Income Tax Act, 1961, permits use of WDV method for computing depreciation, enterprises are able to postpone their tax liability by charging higher depreciation in the earlier years. Rates of depreciation on certain categories of assets as per Income Tax Act, 1961, are given in Table 9.2.

For financial accounting, companies usually charge depreciation on SLM basis at the rates prescribed in the Companies Act. For tax accounting, depreciation is charged on WDV basis at the rates prescribed under Income Tax Act.

Table 9.2 Depreciation Rates as per Income Tax Act, 1961

As depreciation method and rates used for financial reporting and tax accounting are different, it is a major source of difference between reported profit as per profit and loss statement and taxable income.

9.2.4 Special Situations

Small Value Items

By definition, any expenditure that is likely to benefit an enterprise over a long period of time and results in creation of a fixed asset is capitalized and is depreciated over its useful life. However, an enterprise may be incurring expenditure on small value items which by definition are capital assets but have insignificant value. In such cases, an enterprise may decide to treat such capital expenditure as revenue expense by charging 100% depreciation. This treatment is based upon the concept of materiality. For example, a calculator purchased for ₹ 1,000 with a useful life of three years; if capitalized will be depreciated at the rate of ₹ 333 per annum. As the amount involved is insignificant, the enterprise may decide to treat the cost of the calculator as a revenue expense, and thus saving on efforts in maintaining detailed records of asset and depreciation over the next three years. The accounting policy of some Indian companies in this regard is given in Box 9.1.

Assets Taken on Lease

An enterprise may acquire an asset on a lease basis rather than on outright purchase basis. In a lease agreement, the acquirer (lessee) agrees to make a periodic payment (lease rent) to the vendor (lessor) to obtain a right to use the asset. A lease agreement may be in the nature of operating lease or finance lease. In a finance lease, the lease period covers substantially the entire useful life of the asset, and risk and rewards relating to the asset are transferred to the lessee. Operating leases are generally for a shorter period compared to the useful life of the asset.

Ind AS 17–A finance lease is a lease that transfers substantially all the risks and rewards incident to the ownership of an asset. A lease other than finance lease is operating lease.

If the agreement is in the nature of operating lease the asset is capitalized in the books of the lessor. However in case of a finance lease, the asset is recorded in the books of the lessee. The asset should normally be recorded at the fair value of the asset at the inception of the lease. However, if the fair value of the asset exceeds the present value of the minimum lease rentals, then the asset will be recorded at the present value of the lease rentals. The discount rate to be used for calculating the present value is the interest rate implicit in the lease or the incremental borrowing rate of the lessee if the former is difficult to determine.

Once the asset has been capitalized in the books of the lessee, it will be depreciated over its useful life. Therefore, the asset given out on a finance lease can’t be capitalized and depreciated in the books of the lessor.

Box 9.1 Accounting for Small Value Items

- Assets individually costing less than or equal to 10,000 are fully depreciated in the year of purchase. Ultra Tech Cements Limited.

- Assets costing ₹ 5,000 or less are fully depreciated in the year of purchase—Hindustan Unilever Limited.

Government Grants

An asset may be entirely or partially funded out of government grants. Grants related to assets are government grants whose primary condition is that an entity qualifying for them should purchase, construct or otherwise acquire long-term assets. Subsidiary conditions may also be attached restricting the type or location of the assets or the periods during which they are to be acquired or held.

In such a situation, what value the asset will be capitalized? Ind AS 20 requires that government grants related to assets, including non-monetary grants at fair value, shall be presented in the balance sheet by setting up the grant as deferred income.

Accordingly, the asset is initially recognized at its normal cost of acquisition and the grant is treated as deferred income. The asset will be depreciated over its useful life and at the same time the grant would be apportioned from the deferred income account to the statement of profit and loss. The asset will appear on the asset side of the balance sheet at the depreciated value and at the same time, the balance left in the deferred income account will appear on the liabilities side of the balance sheet as a separate heading. The net impact on the statement of profit and loss will be equal to the deprecation charge less the amount transferred from the deferred income account.

Asset Acquired in Foreign Exchange

An enterprise may acquire an asset where the payment is settled in foreign currency. In such a case, the acquisition cost is recorded in the functional currency by applying to the foreign currency amount the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

Revising Estimated Useful Life and Residual Value

Ind AS 16 requires that the residual value and the useful life of an asset shall be reviewed at least at the end of each financial year. For example, due to a major overhaul the useful life of an asset may get extended. Likewise, due to new technological developments or due to wear and tear the estimated useful life may have to be shortened. In either case, the change in carried out prospectively. The carrying amount of the related asset is adjusted in the period of the change. The effect of change is applied prospectively by including it in the profit or loss in the period of change and future periods.1

■ Illustration 9.7

A machine was purchased at a cost of ₹ 10,00,000 with an estimated useful life of 8 years and residual value of ₹ 2,00,000. The company uses straight line method of depreciation. After using the machine for 3 years, the company revised the remaining useful life to be three years and the residual value at ₹ 1,00,000. How would the change in estimate be reflected in the financial statements?

Initially, the annual depreciation works out to be ₹ 1,00,000. After three years, the carrying amount of the asset is ₹ 7,00,000. With the revised estimated residual value of ₹ 1,00,000, the depreciable value comes to ₹ 6,00,000, which would be depreciated over the remaining useful life of three years. The annual depreciation from fourth to sixth year accordingly comes to ₹ 2,00,000.

Change in the Method of Depreciation

Normally depreciation method once chosen is applied over the useful life of the asset. This is based on the fundamental accounting assumption of consistency. Ind AS 16 requires that the depreciation method applied to an asset shall be reviewed at least at the end of each financial year. In case there has been a significant change in the expected pattern of consumption of the future economic benefits, the method shall be changed to reflect the changed pattern. Any change in the depreciation method is treated as a change in an accounting estimate and is recognized prospectively.

AS 16–Change in the method of depreciation is treated as a change in an accounting estimate.

The nature and amount of a change in accounting estimates (useful life, residual value, method of depreciation etc.), its impact on the current period and future periods need to be disclosed in the financial statements.

9.2.5 De-recognition of Assets

An asset is derecognized either on disposal or when no further economic benefits are expected from its use or disposal. Once an asset is derecognized, its carrying amount is eliminated from the financial statements. Any gain or loss arising on de-recognition of an item of property, plant and equipment is recognized in the profit or loss when the item is derecognized. The gain or loss is computed as a difference between the net disposal proceeds and the carrying amount of the item.

Accounting policy of Colgate Palmolive (India) Limited related to depreciation is given in Box 9.2.

Box 9.2: Depreciation Accounting Policy of Colgate Palmolive (India) Limited

- The useful lives of the assets are based on technical estimates approved by the management, and are lower than or same as the useful lives prescribed under schedule II to the companies Act, 2013 in order to reflect the period over which depreciable assets are expected to be used by the company.

- Depreciation is calculated on a pro-rata basis as per the straight line method so as to writedown the cost of property, plant and equipment to its residual value systematically over its estimated useful life based on useful life of the assets as prescribed under Part C of Schedule II to the Companies Act, 2013 except in case of following assets, wherein based on internal assessment and independent technical evaluation, a different useful life has been determined.

Assets class Useful Lives Residential and office building 40 Years Factory building 20 Years Plant and machinery 7 Years to 15 Years Dies and moulds 3 Years Furniture and fixtures 5 Years Office equipment 5 Years - Estimated useful lives, residual values and depreciation methods are reviewed annually, taking into account commercial and technological obsolescence as well as normal wear and tear and adjusted prospectively, if appropriate.

9.2.6 Accounting for Depreciation

Items of property, plant and equipment are initially recognized at their cost of acquisition. In subsequent periods, they are presented in the balance sheet at their carrying cost (initial cost less accumulated depreciation). Depreciation expense for the year is charged to the statement of profit and loss of the respective year. The following entries will be passed:

At the time of buying the asset

| Asset Account | Dr. |

| To Bank Account |

If the asset is bought on credit, instead of crediting bank account, the vendor account will be credited. At the end of the year, depreciation amount is ascertained and the following entries are passed:

For charging depreciation:

| Depreciation Account | Dr. |

| To Accumulated Depreciation/Provision for Depreciation Account | |

The asset account is maintained at its gross value. Instead of reducing the balance in the asset account, the amount of depreciation is credited to a contra-asset account, namely, accumulated depreciation account or provision for depreciation account.

For transferring depreciation to statement of profit and loss

| Statement of Profit and Loss | Dr. |

| To Depreciation Account |

As a result of this entry, the depreciation expense for the year is transferred to the profit and loss statement. This entry is repeated each year end over the life of the asset. The balance sheet of each year will show the asset account at its gross value less accumulated depreciation account to arrive at the net book value.

At the time of de-recognition of the asset:

Once the useful life of the asset is over and the asset is derecognized, the asset account and accumulated depreciation account are closed. The gain or loss on disposal of the asset is ascertained and transferred to the statement of profit and loss of the year. The following entries are passed:

| Bank Account | Dr. (by the amount of consideration) |

| Accumulated Depreciation Account | Dr. (by the balance amount in the account) |

| Loss on Disposal of Asset | Dr. (by the loss amount) |

| To Asset Account (by the cost of the asset) |

If the asset is sold for a consideration higher than the net book value, the resultant gain will be credited to gain on disposal of asset account. The loss or gain on disposal will be transferred to the profit and loss statement.

■ Illustration 9.8

On 1st April 2014, Super Technologies Limited bought three computers at a total cost of ₹ 300,000. The estimated useful life of computers is three years with a residual value of ₹ 60,000. The company follows SLM for charging depreciation. On 31st March 2017, these were sold for ₹ 70,000. Pass the necessary journal entries in the books of Super Technologies Limited. How will the asset and depreciation appear in the financial statements of the company?

1st April 2014: For buying the computers

| Computer Account | Dr. | ₹ 300,000 |

| To Bank Account | ₹ 300,000 |

31st March 2015/2016 and 2017: As the company is following SLM, same depreciation will be charged every year and the following entries will be passed at the end of each year:

| Depreciation Account | Dr. | ₹ 80,000 |

| To Accumulated Depreciation Account | ₹ 80,000 | |

| Profit and Loss Statement | Dr. | ₹ 80,000 |

31st March 2017: For disposal of asset

| Bank Account | Dr. | ₹ 70,000 |

| Accumulated Depreciation Account | Dr. | ₹ 240,000 |

| To Computers Account | ₹ 300,000 | |

| To Gain on Sale of Assets | ₹ 10,000 | |

| Gain on Sale of Assets Account | Dr. | ₹ 10,000 |

| To Profit and Loss Statement | ₹ 10,000 |

The statement of profit and loss will show the following information

The balance sheet will appear as follows:

9.2.7 Disclosures

For each class of property, plant and equipment, the following disclosures are required to be made in the financial statements:

- The measurement bases used for determining the gross carrying amount.

- The depreciation methods used.

- The useful lives or the depreciation rates used.

- The gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period.

- A reconciliation of the carrying amount at the beginning and end of the period showing:

- Additions.

- Assets classified as held for sale or included in a disposal group classified as held for sale and other disposals.

- Acquisitions through business combinations.

- Increase or decrease resulting from revaluations and from impairment losses recognized or reversed in other comprehensive income.

- Impairment losses recognized in profit or loss.

- Impairment losses reversed in profit or loss.

- Depreciation.

- The net exchange differences arising on the translation of the financial statements from the functional currency into a different presentation currency, including the translation of a foreign operation into the presentation currency of the reporting entity.

- Other changes.

The financial statements shall also disclose:

- The existence and amounts of restrictions on title, and property, plant and equipment pledged as security for liabilities.

- The amount of expenditures recognized in the carrying amount of an item of property, plant and equipment in the course of its construction.

- The amount of contractual commitments for the acquisition of property, plant and equipment.

- If it is not disclosed separately in the statement of profit and loss, the amount of compensation from third parties for items of property, plant and equipment that were impaired, lost or given up that is included in profit or loss.

9.3 INVESTMENT PROPERTY

As discussed, Ind AS 40 defines investment property as property (land or a building—or part of a building—or both) held to earn rentals or for capital appreciation or both, rather than for use in the production or supply of goods or services or for administrative purposes or sale in the ordinary course of business. Investment property is initially measured at cost. Transactions costs, if any, are also included in the cost. Subsequently, investment property is measured using the cost model as discussed in para 9.2.2 above.

Box 9.3: Accounting Policy of Colgate Palmolive (India) Limited Relating to Investment Property

- Property that is held for long-term rental yields or for capital appreciation or both, and that is not occupied by the company, is classified as investment property.

- Investment property is measured initially at its cost, including related transaction costs and where applicable borrowing costs.

- Subsequent expenditure is capitalized to the asset’s carrying amount only when it is probable that future economic benefits associated with the expenditure will flow to the company and the cost of the item can be measured reliably.

- All other repairs and maintenance costs are expensed when incurred.

- Investment properties are depreciated using the straight line method over their estimated useful lives, which is 40 years.

Upon de-recognition, an investment property is eliminated from the balance sheet. De-recognition of an investment property happens on disposal or when the investment property is permanently withdrawn from use and no future economic benefits are expected from its disposal. Gain or loss from the retirement or disposal of investment property is determined as the difference between the net disposal proceeds and the carrying amount of the asset. Gain or loss upon de-recognition is taken to the profit or loss.

Accounting policy of Colgate Palmolive (India) Limited relating to investment property has been mentioned in Box 9.3.

9.4 INTANGIBLE ASSETS

Ind AS 38 defines an intangible asset as ‘an identifiable non-monetary asset, without physical substance’. An entity may spend considerable amount of resources to acquire or internally develop intangible assets, like computer software, patents, copyrights, mortgage servicing rights, licences, etc. An intangible asset should be recognized only if it is identifiable, the entity has control over it, the entity would derive future economic benefits and cost of the asset can be measured reliably.

An asset is considered to be identifiable if it can be separated or is capable of being separated or divided from the identity and can be sold or licenced or rented or exchanged. It may also arise from contractual or legal rights, whether transferable or separable or not. The entity also needs to have power to obtain future benefits from the asset to the exclusion of others. The control over the future economic benefits is normally derived from legal rights that are enforceable in a court of law, e.g., patent rights, copyrights, etc. The future economic benefits may flow to the entity by way of revenue from the sale of products or services or cost savings or other benefits.

9.4.1 Initial Measurement

Intangible assets are measured initially at cost. Cost for this purpose includes purchase price, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates and all expenses necessary to make the asset ready for its intended use. For example, professional fees for legal services are also capitalized. In respect of the asset acquired in business combination (e.g., merger and amalgamation), initial measurement shall be at the fair value on the acquisition date.

9.4.2 Subsequent Measurement

For subsequent measurement, an entity may choose either cost model or revaluation model. In the cost model, an intangible asset is carried at its cost less accumulated amortization and accumulated impairment loss, if any. In revaluation model, an intangible asset is carried at a revalued amount (fair value) less amortization and impairment loss subsequent to revaluation.

If an intangible asset is accounted for using revaluation model, all other assets in the same class are also required to be accounted for using the same model. If the carrying amount of an intangible asset increases as a result of revaluation, the same is recognized in other comprehensive income and accumulated under other equity as revaluation surplus. If, however, the increase is reversing an earlier revaluation decrease, it would be recognized in the profit or loss.

If the carrying amount of an intangible asset decreases as a result of revaluation, the same is recognized in profit or loss. If however, the decrease is reversing an earlier revaluation increase, it would be recognized in the other comprehensive income and adjusted against the revaluation surplus in other equity.

9.4.3 Amortization of Intangible Assets

The depreciable amount of an intangible asset should be systematically amortized over its estimated useful life. The depreciable amount is the cost of an asset less its estimated residual value.

Estimated Useful Life

An intangible asset may have a finite life or an infinite life. If it is assessed that there is no foreseeable limit to the period over which the asset is expected to generate net cash inflow for the entity, the useful life of the asset will be taken as infinite. An intangible asset with infinite life will not be amortized. However, it would be tested for impairment annually and whenever there is an indication that the asset has been impaired.

While arriving at the estimated useful life, various factors like expected usage of the asset, product cycle, technological and commercial obsolescence, expected actions by competitors, level of maintenance expenditure, stability of the industry, period of control over the asset, legal restriction, etc., must be considered.

Residual Value

The residual value of an intangible asset is normally assumed to be zero. However, if the enterprise already has a commitment from a third party to buy the asset at the end of the useful life or if there is an active market for the asset and the residual value can be reasonably estimated, in such cases the estimated residual value can be taken.

Amortization Method

Amortization method should reflect the pattern in which the economic benefits from the assets are expected to be derived by the entity. If, however, such pattern cannot be determined reliably, the assets will be amortized using straight line method.

The amortization period and method shall be reviewed at least at the end of each financial year. The principles for measurement of intangible assets as per Ind AS 38 are depicted in Figure 9.4.

Figure 9.4 Measurement of Intangible Assets

9.4.4 Brand

Brands, if acquired, by an enterprise can be recognized as an intangible asset at the acquisition price and all related expenses. However, internally generated brands can’t be recognized. As the cost of developing a brand is not distinguishable from the cost of doing business in general, it should not be recognized as an intangible asset. As per Ind AS 38, ‘Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance should not be recognized as intangible assets’. Expenditure on internally generated brands, mastheads, publishing titles, customer lists and items similar in substance cannot be distinguished from the cost of developing the business as a whole. Therefore, such items are not recognized as intangible assets.

For example, advertising expenses incurred may lead to improved brand image of the company, however, it may not be possible to distinguish the same from the normal cost of doing business. As such these expenses are not to be capitalized.

9.4.5 Goodwill

Internally generated goodwill is not allowed to be recognized. It is not considered to be an identifiable resource controlled by the enterprise that can be measured reliably at cost. However, acquired value of the goodwill is recognized at cost. As it is not possible to separately acquire goodwill, it gets recognized only at the time of acquisition of a business. Goodwill is measured as the excess of the consideration paid over net assets acquired. Consideration paid and net assets acquired are measured at their fair value. Net assets for this purpose are taken as the assets less liabilities taken over. Goodwill is not amortized rather tested for impairment annually even if there is no indication for impairment.

■ Illustration 9.9

Wolf Limited acquired Lamb Limited for a purchase consideration of ₹ 1,200,000. The fair value of assets and liabilities of Lamb Limited were ₹ 1,800,000 and ₹ 700,000, respectively. What is the value of goodwill to be recorded in the books of Wolf Limited?

Acquisition cost of goodwill will be calculated as follows:

| Fair value of assets taken over | ₹ 1,800,000 |

| Less: Fair value of liabilities taken over | ₹ 700,000 |

| Net Assets taken over | ₹ 1,100,000 |

Excess of purchase consideration ( ₹ 1,200,000) over the net assets ( ₹ 1,100,000) will be taken as the acquisition cost of goodwill ( ₹ 100,000). Goodwill so recognized will be tested for impairment annually, even if there is no indication of impairment.

9.4.6 Research and Development Expenses

In the knowledge economy of today, business enterprises spend significant sum of money on research and development. Such activities are expected to result in development of new products, designs, processes or newer application of exiting products, etc., and are expected to bring substantial economic benefits to the enterprise. The strategic advantage of a pharmaceutical business may be dependent on the new drugs it is able to develop and commercially launch. These efforts, if successful, will be a source of significant economic benefits to the enterprise in future, however at the time when these expenses are incurred it is difficult to assess whether they will generate probable future benefits. The key question that arises is whether these expenses can be capitalized as assets or should they be expensed away by charging to the statement of profit and loss. To answer this question, R&D activities are divided into two parts:

- Research Phase: Activities are directed towards acquiring new knowledge but it is still not possible to demonstrate that an intangible asset exists capable of providing probable future benefits.

- Development Phase: Activities are directed towards commercial development of findings of research phase; it is now possible to identity an economic asset with probable future economic benefits.

Expenditure incurred on research phase should not be capitalized but expensed as period costs, as and when incurred. The development costs can be capitalized as Intangible assets if the following conditions are met2:

- It is technically feasible to complete the asset.

- There is intention to complete the asset for the purpose of sale or use.

- The enterprise has the ability to use or sell the asset.

- The asset will generate probable economic benefits.

- The enterprise has adequate technical, financial and other resources to compete the development and to use or sell the asset.

- Expenditure during development phase attributable to the asset can be measured reliably.

Box 9.4 Research and Developments Costs

- Management monitors progress of internal research and development projects by using a project management system. Significant judgement is required in distinguishing research from the development phase. Development costs are recognised as an asset when all the criteria are met, whereas research costs are expensed as incurred.

- Management also monitors whether the recognition requirements for development costs continue to be met. This is necessary due to inherent uncertainty in the economic success of any product development.

The asset so recognized will be capitalized by the expenditure incurred from the time when the asset first met the recognition criteria. Costs that have already been expenses in the past should not be added to the cost of the asset. Accounting policies being followed by CIPLA Limited relating to research and development costs are given in Box 9.4.

9.4.7 Web Site Costs

Similar consideration also applies to costs incurred for developing own web site. Expenses incurred at panning stage—undertaking feasibility studies, defining objectives and specifications, evaluating alternatives and selecting preferences—are treated as research expenses and are charged to the statement of profit and loss. At this stage, it is not possible for an enterprise to identify an asset with probable economic benefits. Expenses incurred at the development stage can be capitalized as internally generated asset provided it meets the recognition criteria.

9.5 IMPAIRMENT OF ASSET

Non-current assets are normally carried in the financial statements at cost less depreciation and amortization following the cost principle. If the carrying amount of the asset exceeds its recoverable amount, it is said to be impaired. Ind AS 36 requires an entity to assess whether there is any indication that an asset may be impaired. Such an assessment must be made at the end of each reporting period. If any such indication exists, the entity shall estimate the recoverable amount of the asset and provide for the impairment loss.

The recoverable amount of an asset is determined with reference to its net selling price or its value in use. The carrying amount of the asset is such a case should be reduced to its recoverable amount.The impairment loss is charged as an expense in the profit and loss statement. However, if the asset has been revalued earlier, the impairment loss will be adjusted against the revaluation reserve so created.

The following procedure should be followed to account for impairment of assets:

- On every balance sheet date, look for indication that an asset may be impaired.

- Indications of impairment may be external (e.g., fall in the market value of the asset, adverse technical, economic or legal developments, change in interest rate) or internal (obsolescence or physical damage to the asset, decline in physical performance of asset, plans to discontinue or restructure the operation).

- If there are indications that an asset may be impaired, measure the recoverable amount. The recoverable amount is measured with reference to its fair value less cost to sell or its value in use.

- Fair value, less costs of disposal, is the amount obtainable from the sale of an asset or cashgenerating unit in an arm’s length transaction between knowledgeable and willing parties, less the costs of disposal.

- The value in use is the present (discounted) value of the future cash flow that the asset is expected to generate both during its useful active life and on disposal.

- If the recoverable amount is lower than the carrying amount of the asset, the difference is recognized as impairment loss in the statement of profit and loss.

- After the recognition of an impairment loss, the depreciation (amortization) charge for the asset shall be adjusted in future periods to allocate the asset’s revised carrying amount, less its residual value (if any), on a systematic basis over its remaining useful life.

- The impairment loss is reviewed on every subsequent balance sheet date. An impairment loss is reversed if there is an increase in the recoverable amount of the asset. In such a case, the carrying amount of the asset shall be increased to its recoverable amount. The increase is also the reversal of earlier impairment loss. However, the increased carrying amount cannot exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset in prior years.

The key features for impairment accounting are depicted in Figure 9.5.

Figure 9.5 Impairment of Asset

Summary

- Expenses incurred for day-to-day operations are called operating expenses and are charged to the profit and loss statement, whereas expenses which are expected to benefit the enterprise over more than one accounting period are capitalized. Fixed assets are expected to provide benefit over long period of time.

- Assets having physical substance are called tangible assets; assets without physical substance are called intangible assets. Fixed assets may either be acquired or self-constructed.

- Acquired assets are capitalized at the sum of all costs that are necessary to be incurred to bring the asset to its intended use. Even the interest on borrowed funds upto the date of putting the asset to its intended use is capitalized.

- Self-constructed assets are capitalized at the cost directly attributable to the specific asset plus a fair share of construction activities in general. Internal profits are eliminated.

- Cost of a fixed asset is systematically apportioned over its useful life. Such an apportionment is called depreciation for tangible assets, amortization for intangible assets and depletion for natural resources.

- Depreciation charges depend upon cost of a fixed asset, estimated useful life, estimated residual value and method of depreciation.

- In the straight line method, depreciation charges remain same period after period, whereas in accelerated methods higher depreciation is charged in the initial years. Written down value method and sum-of-years-digits method are accelerated methods.

- Companies Act, 2013, prescribes the maximum useful life and residual value for different categories os assets. For tax computation only WDV method is permitted at prescribed rates for different blocks of assets.

- Small value items are charged off to profit and loss statement in the year of purchase.

- Any change in method of depreciation is treated as change in accounting policy. The impact of the change needs to be quantified and disclosed separately. The change is affected prospectively

- Impairment in the value of the asset, that is, recoverable amount falling below the carrying amount is charged as an impairment loss in the profit and loss statement, and the carrying amount of the asset is reduced.

- Depreciation charges are transferred to the profit and loss statement. In the balance sheet the gross book value, accumulated depreciation and net book value are disclosed.

- Assets without physical substance are recorded as intangible assets if the cost can be measured reliably and the enterprise will enjoy the future economic benefits.

- Self-generated goodwill and brands are not recognized. However, acquired goodwill and brands are recorded at their cost of acquisition.

- Intangible assets are amortized over their useful life. Intangible assets with infinite life are not amortized but are tested for impairment annually.

- Goodwill is recorded only in amalgamation as the excess of purchase consideration over the net assets taken over.

- Expenses incurred during research phase are charged to the statement of profit and loss, whereas expense during development phase can be capitalized. If it is not possible to distinguish research phase from the development phase, expenses incurred will be treated as having incurred on research and charged to the statement of profit and loss. Similar treatment is given to website cost as well.

Assignment Questions

- ‘All expenses necessary to be incurred to bring the asset to its intended use are capitalized’. Explain with suitable examples.

- Differentiate between:

- Operating expenses and capital expenses

- Tangible and intangible assets

- Depreciation, depletion and amortization

- Repair and improvement

- Finance lease and operating lease

- Do you agree with the following statements? Give reasons.

- A company may follow different methods and rates of depreciation for financial accounting and tax accounting.

- Fixed assets are normally shown at their historical cost less accumulated depreciation.

- Depreciation is a source of cash for replacement of assets.

- How is straight line method different from written down value method?

- How is the cost model different from revaluation model for the subsequent measurement of PPE?

- Briefly explain the accounting for revaluation of an item of PPE.

- How is impairment different from depreciation?

- ‘Depreciation is a non-cash expense’. Explain.

- How are self-generated intangible assets—brand and goodwill—accounted for?

- What is the treatment of expenditure incurred on property, plant and equipment subsequent to its initial capitalization?

Problems

- Ascertaining the cost of an asset and capital work-in-progress: High Fashions Limited is a recognized export house. In the month of January 2017, it imported a highly sophisticated embroidery machine from US at a cost of $ 200,000. At the time of import, the prevailing exchange rate was $ = ₹ 65. The company incurred an amount of ₹ 100,000 towards freight and insurance during transit. The import attracted import duty at the rate of 20%. The machine was transported to the factory building at an additional cost of ₹ 20,000 towards local transportation. Expenses towards installation came to ₹ 30,000. The installation was completed on 31st March 2017. The test runs were conducted during April 2017. During the test run company spent a further sum of ₹ 25,000. After successful test run the machine was put to commercial use.

- How would the amounts spent upto 31st March 2017 impact the balance sheet as on that date and the statement of profit and loss for the year ended on that date?

- When and at what value the machine should be capitalized?

- Straight line method of depreciation: Satluj Cements Limited purchased a machine costing ₹ 15 million. As per suppliers warranty, the physical life of the machine is estimated to be eight years. However, the management would like to replace the machine after five years. At that time, the machine is expected to fetch a residual value of ₹ 5 million.

- What will be the annual depreciation if the company follows the straight line method of charging depreciation?

- How will the asset and depreciation appear in the second year’s balance sheet and profit and loss statement of Satluj Cements Limited after acquisition of the machine?

- Written down value method: Assume that Satluj Cements Limited charges depreciation on the written down value method basis and the rate of depreciation being 20% per annum.

- Prepare the depreciation schedule for the above machine over its useful life.

- Pass the necessary journal entries in the books of Satluj Cements Limited.

- How will the machine appear in the balance sheet after three years of acquisition?

- SOYD method: Prepare the depreciation schedule for Satluj Limited using SOYD method.

- Compare the depreciation schedule of SOYD with WDV and SLM.

- Why are WDV and SOYD methods called accelerated methods of depreciation?

- Exchange of assets: Fast Track Limited is a provider of cab services in New Delhi. The company purchased a new car with a list price of ₹ 800,000 in exchange of an old car and cash consideration of ₹ 680,000. The old car was purchased four years back at a cost of ₹ 500,000 and the accumulated depreciation of the same is ₹ 400,000. The company recently received a bid for the old car at ₹ 90,000. At what value should the new car be capitalized?

- Financial accounting versus tax accounting: Aar Dee Limited bought a machine for ₹ 600,000. The management estimates a useful life of 10 years for the machine after which it can be sold for ₹ 30,000. For accounting purposes, the company charges depreciation on SLM basis. Whereas for tax purposes the machine is eligible for depreciation at 25% on WDV basis.

- Prepare the depreciation schedule for financial accounting as well as tax accounting?

- How would the depreciation charge cause difference between taxable income and reported profit in each of these years?

- Disposal of assets: A-One Industries follows financial year as its accounting period. On 1st December 2013, the company bought five computers for a total consideration of ₹ 500,000. The company estimates the useful life of the computers to be four years with negligible residual value. The company charges depreciation on a SLM basis. In the year of acquisition and disposal proportionate depreciation is charged.

On 15th January 2015, the hard disk of one of the computer became corrupted beyond repairs and accordingly the computer was disposed of for ₹ 30,000. The company sold two of the computers on 31st July 2016 for ₹ 80,000. The other two computers are still in working condition.

- Prepare the depreciation schedule for the years 2013–14 to 2016–17

- Pass the necessary journal entries in the books of A-One Industries.

- How would the remaining two computers appear in the balance sheet of the company on 31st March 2017?

- Asset partially funded by government grant: Pure Copper Limited bought pollution control equipments costing ₹ 30 million. As per the scheme of the government, to promote use of pollution control devices, 40% of the cost of the equipment is given as a grant. The equipment is estimated to have a useful life of three years will nil residual value. The company follows straight line method of charging depreciation.

- How will the acquisition be initially recorded?

- How will the equipment and grant appear in the first balance sheet after acquiring the equipment?

- What will be the impact of government grant in the profit and loss account?

- Revision of estimated useful life: Clarity Printers Limited bought a printing press on 1st April 2008 at a cost of ₹ 3 million. The management estimated the useful life of the press to be 10 years with a residual value of ₹ 200,000. The machine was depreciated using SLM till 2016–17. On 1st April 2017, based upon a technical review of the press, the management incurred a cost of ₹ 500,000 for overhauling the press. It is estimated that after overhauling, the press, will be useful for another five years and will have a residual value of ₹ 100,000.

- How will the cost of overhauling be treated?

- What will be the revised annual depreciation?

- Change in method of depreciation: Please refer to the Problem 2 above. After depreciating the machine for three years using SLM, in the fourth year Satluj Cements decided to change the method of depreciation to WDV at 20% per annum. How will the change affect the profit and loss statement and balance sheet of the company?

- Recognition of goodwill on amalgamation: Italian Ceramics Limited acquired Sonia Tiles Limited for a purchase consideration of ₹ 20 million. The fair value of assets and liabilities taken over are as follows:

- Ascertain the value of goodwill to be recorded in the above transaction.

- How will the goodwill amount be treated in the books of Italian Ceramics Limited?

Solutions to Problems

-

- As the machine is not ready for use by 31st March 2017, the amount spent will be shown as capital work-in-progress in the balance sheet under the heading fixed assets. There will be no impact in the profit and loss statement for the year ended 31st March 2017, as depreciation will commence only after the machine is ready for its intended use.

- As all the expenses incurred were necessary to be incurred to bring the machine to its intended use, all of them will be added to find the capitalized value of the machine.

Accordingly, the machine will be capitalized at ₹ 14,975,000 as follows:

-

Cost of the machine (Cost) ₹ 15 million Estimated useful life (Life) 5 years Estimated residual value (RV) ₹ 5 million Annual depreciation

₹ 2 million In the second year profit and loss account, depreciation of ₹ 5 million will appear as an expense. In the balance sheet the machine will appear on the asset side as follows:

-

-

Cost ₹ 15 million Rate of depreciation 20% Depreciation Schedule

- c. In the third year profit and loss statement, depreciation of ₹ 1.92 million will appear as an expense. In the balance sheet, the machine will appear on the asset side as follows:

-

-

SOYD N × (N + 1)/2 15 Depreciable Amount Cost − RV ₹ 10 million Depreciation Schedule Using SOYD

- The capitalized value of the new car will be as follows:

Cash consideration ₹ 680,000 Fair market value of old car given up ₹ 90,000 Total ₹ 770,000 - The new car will be capitalized at

₹ 770,000

Cost of the machine ₹ 600,000 Residual value ₹ 30,000 Useful life 10 years Depreciation for income tax 25% WDV

In the first four years, depreciation for income tax purposes on WDV is higher as compared to depreciation for financial accounting purposes on SLM. Accordingly, the taxable income in the first four years will be lower than the reported profit. In subsequent years, the taxable income will be higher than the reported profit.

-

-

Cost ₹ 500,000 Useful life 4 years Annual depreciation per machine ₹ 25,000

Sale price 30,000 80,000 Book value at the time of disposal 71,875 66,667 Gain/(Loss) on disposal (41,875) 13,333 In the balance sheet as on 31st March 2017, only the remaining two computers will appear on the asset side with a gross value of ₹ 200,000 and accumulated depreciation of ₹ 166,667 as follows:

Tangible Assets (Amount in ₹) Property, plant and equipment 200,000 Less: Accumulated depreciation 166,667 Net block 33,333 -

-

- The equipment will be capitalized at ₹ 30 million and at the same time the grant of ₹ 12 million will be recorded as a deferred income to be apportioned over the life of the asset.

- Property, plant and equipment

Pollution control equipment ₹ 30 million Less: Accumulated depreciation ₹ 10 million Net Block ₹ 20 million Liabilities side

Government grant ₹ 12 million Less: Transferred to profit and loss statement ₹ 4 million ₹ 8 million - Statement of Profit and loss

Depreciation (1/3rd of ₹ 30 million) ₹ 10 million Less: Transferred from deferred income ₹ 4 million ₹ 6 million

-

- The cost of overhauling is resulting in extending the useful life of the asset and hence will be capitalized by adding to the net book value.

- Annual depreciation from 2008–09 till 2016–17 = (₹ 3,000,000 - ₹ 200,000)/10 = ₹ 280,000 Accumulated depreciation as on 31st March 2017 = ₹ 280,000 × 9 = ₹ 2,520,000

Net book value of the press on 31st March 2017 = ₹ 3,000,000 - ₹ 2,520,000 = ₹ 480,000

Add: Overhauling cost capitalized = ₹ 500,000 Revised book value = ₹ 980,000