As was discussed in Chapter 7, valuation of a company requires knowledge of the cost of capital. Cost of capital is the opportunity cost a company incurs to secure funds for investment. From an investor’s point of view, cost of capital is that rate of return on investment, which makes the discounted stream of future earnings equal to the supply price of the asset. This chapter is concerned with the meaning and method of estimating the cost of capital.

Estimating cost of capital requires calculation of the components of the cost of capital: equity, debt, and preferred stocks. We discuss the components and methods of calculating them next.

Cost of Equity

To calculate the cost of equity or required rate of return on the stock, we use the capital asset pricing model (CAPM). CAPM states that the required rate of return on equity of a firm is determined by the risk-free return and a risk factor. Specifically, we write

where r, is the required return on stock j,

rRF is the risk-free rate (yield on a Treasury security),

rM is the required rate of return on all stocks in the market, and

βj is the beta coefficient of the stock. It measures the risk contribution of the jth stock to the market risk. β is the slope of the line showing the relationship between return on the ith stock, rj, and market return, rM.

Also, the higher the value of beta, the higher the risk of investment. Note that (rM − rRF) measures the deviation of the risk associated with the market from the risk-free rate of return.

It is important to note that CAPM as previously formulated is a linear function of two variables of the form y = a + mx. As such, having the time series for rj, rRF, and rM, one could estimate CAPM for any stock and determine β and the vertical intercept. Using the estimated regression model for any given rM and rRF, one may estimate the cost of equity or rj. For consistency with use of notation in the subsequent analysis, let us use ke instead of rj for cost of equity.

To illustrate the concept and application of CAPM, we use several examples.

Example 8.1

What is the cost of equity (required rate of return on stock) for Company A, if the risk-free rate is 6 percent, the required return on the market is 13 percent, and Company A’s β = 0.7?

rA = 0.06 + (0.13 − 0.06)(0.7),

meaning that the cost of equity for this company is 10.9 percent.

Of course, as we will discuss in the following, in estimating CAPM we will use the index for the stock exchange where the individual stock to calculate the rate of returns on all stocks in the market, yields on U.S. Treasury bills as the risk-free rate, and the closing prices of the stock under consideration.

Example 8.2

Using Dow Jones Industrial Average, Citigroup’s weekly closing prices, and Treasury bill yields for April 23, 2012, to April 23, 2013, estimate CAPM for the company.

Using the ordinary least square, the estimated model is

rc = − 0.001815 + 2.106 ERP,

where rc is investors’ required return to invest in Citigroup’s stocks (cost of equity), and ERP is the equity risk premium. Note that β = 2.106 is the risk Citigroup contributes to the risk of the entire stock market where it is listed (Figure 8.1).

We use the following values for rc = − 0.005583 and rM = 0.0213655 to illustrate the calculation of the cost of equity for Citigroup on the date with the individual and market returns we are using. According to the estimated CAPM, the cost of equity on that date is rc = − 0.001815 + 2.106 [0.0213655 − (−0.005583)] = 0.05493.

We note that the aforementioned estimated model is for illustrative purposes only. Based on the estimated regression when rRF > rM, rc < 0. This is, economically speaking, meaningless. In practice, the cost of equity determination is based on long-term historical time series of average returns on equity and yields on long-term government securities. Based on time series observations of returns on equities in the United States between 1928 and 2012, the geometric mean of returns on the S&P 500 stock market index is 9.31 percent, and the geometric average of 10-year government bond yields is 5.11 percent (Damodaran 2013). These numbers imply that the risk factor in the U.S. equity market is 4.2 percent.

Figure 8.1 Regression line for CAPM for Citigroup

Another component of cost of capital is the cost of debt, which is discussed next. Due to the deductibility of interest expenses, we consider the cost of debt on an after-tax basis, and define the cost of debt as follows:

where kd denotes after-tax cost of debt, kβ is the before-tax cost of debt, and T is the tax rate.

In practice, before-tax cost of debt for a corporation may be calculated by calculating the weighted average of the yields to maturity of all outstanding bonds of the company.

Example 8.3

Calculate the after-tax cost of debt for Company A, given the tax rate of 0.4, and a before-tax cost of debt of 0.1.

kd = 0.1(1 − 0.4) = 0.06.

The Cost of Raising Funds via Issuing Preferred Stocks

Approximately, the cost of preferred stocks is equal to the yields on long-term debt. This is due to the common practice of payment of dividend to the preferred stock owners before payment of dividend to the common stockholders. The constant dividend payments for the preferred stocks are another reason for the similarity of the cost of preferred stocks and the yield on long-term debt. Moreover, the risk associated with preferred stocks is higher than the risk associated with debt, due to the creditors’ standing concerning their residual claims against the debtor. Accordingly, the cost of raising funds through preferred stocks is higher than the cost of debt financing.

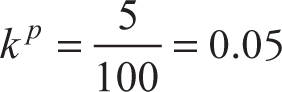

Assuming the dividend payments on preferred stocks in perpetuity, the cost of preferred stock (kp) is calculated by

where dp is the dividend per share of preferred stock, and PR the price of the preferred stock.

Example 8.4

Calculate the cost of preferred stock if the price of the preferred stock is $100 and the stock pays $5 dividend at the end of the period.

Cost of Capital as the Weighted Average of Costs of Equity, Debt, and Preferred Stocks

As previously stated, the cost of capital is the expected value (weighted average) of the cost of equity, cost of debt, and cost of preferred stocks.

where wi are percentages of equity, debt, and preferred stock financing of the company and ke, kd, and kp are the cost of equity, cost of debt after taxes, and cost of preferred stocks, respectively.

The Weighted Average

In computing the simple average, all observations are considered to contribute equally to the average. For the weighted mean, on the other hand, the observations contribute differently to the average.

The formula for weighted average is

where  is the weighted average, wi is the weight attached to the ith observation, Xi is the ith observation, and n is the number of observations.

is the weighted average, wi is the weight attached to the ith observation, Xi is the ith observation, and n is the number of observations.

A company raises capital by selling common stocks, preferred stocks, short-term bonds, and long-term bonds. The size of each category of capital, the cost of each type of equity, and the interest rates on the short-term and long-term bonds are given in Table 8.1.

Calculate the cost of capital for this firm.

Example 8.6

Company A decides to buy Company B. Both companies have a cost of debt of 10 percent and 40 percent debt, respectively. The companies have no preferred stocks. Company A’s beta equals 1.2, and Company B’s beta is 1.5. It is expected that the beta for the combined company is 1.1.

If the risk-free rate is 6 percent, the equity premium is 5 percent, and the tax rate is 30 percent, calculate the cost of capital for the two firms and the combined firm.

Solution

Table 8.1 Data for calculation of cost of capital

|

Capital |

Size of capital |

Cost of capital |

Interest rate |

|

Common stocks |

$1,000,000 |

0.10 |

– |

|

Preferred stocks |

$5,000,000 |

0.08 |

– |

|

Short-term bonds |

$500,000 |

– |

0.06 |

|

Long-term bonds |

$3,500,000 |

– |

0.09 |

As a result of synergies generated by the merger, the cost of capital of the combined company has been reduced to 9.7 percent.

Summary

This chapter dealt with the cost of capital. Cost of capital is the weighted average of costs of equity, debt, and preferred stocks. We used CAPM as a method for calculating cost of equity. Additionally, we defined weighted average and discussed cost of debt and a formula to calculate the cost of preferred stock.