CHAPTER

10

Consolidation

One of the key activities performed by the finance department is to prepare consolidated financial statements when a company controls one or more other legal entities. Consolidated financial statements are prepared as per accounting requirements (US GAAP, Local GAAP, or IFRS), and the process to prepare the statement for legal reporting of the parent company is called consolidation. Determining when to consolidate one entity to another is a complex area of accounting, but generally, if an entity is exposed or has rights to variable return on the investment made on another entity and has the power to control those returns, then the consolidation process should take effect. It is also important to investors because when one entity consolidates another, it reports the other entity’s assets, liabilities, revenues, and expenses together with its own, as if they are a single economic unit.

In this chapter, we will explain how to perform consolidation in Oracle Fusion GL. This chapter has been divided into three major sections. The first section will introduce readers to the concept of consolidation. The second section will provide details of different methods of consolidation offered in Fusion General Ledger that can be considered based on the business requirements. The third section provides details about how to apply this knowledge gained to meet the consolidation requirements of ACME Bank. Readers should understand that consolidation is an advanced concept in Fusion Financials and requires many features of Fusion Financials to be configured in the system. So this chapter will have reference to other chapters where those concepts and features are explained in detail.

The Consolidation Process

The consolidation process can be complex based on the percentage ownership of how one entity controls the other, like joint ventures, minority interests, or partially or fully owned subsidiary. When a purchasing company owns (in terms of equity or shareholding) more than 50 percent of the acquired company, then the acquired company is classed as a subsidiary of the purchasing company (also known as the parent company). As part of the consolidation process, the following steps are performed to prepare the consolidated financial statements for legal reporting:

![]() Combine like items of assets, liabilities, equity, income, expenses, and cash flows of the parent with those of its subsidiaries.

Combine like items of assets, liabilities, equity, income, expenses, and cash flows of the parent with those of its subsidiaries.

![]() Offset or eliminate the parent portion of equity or investment amount in each of the subsidiaries; for example, joint ventures where only a portion of the business (usually denoted on a percentage basis) is owned by the parent company as part of the joint venture agreement.

Offset or eliminate the parent portion of equity or investment amount in each of the subsidiaries; for example, joint ventures where only a portion of the business (usually denoted on a percentage basis) is owned by the parent company as part of the joint venture agreement.

![]() Eliminate any inter- or intra group balances on revenue, expenses, liabilities, assets and cash flows originating from transactions performed between two legal entities within the parent company (known as intercompany transactions) and between two departments under the same legal entity (known as intracompany transactions).

Eliminate any inter- or intra group balances on revenue, expenses, liabilities, assets and cash flows originating from transactions performed between two legal entities within the parent company (known as intercompany transactions) and between two departments under the same legal entity (known as intracompany transactions).

Consolidation in a broader sense also refers to the consolidation of results for management information purposes that will help internally to measure Key Performance Indicators, also known as KPI or Key Success Indicators (KSI), and also to aid in making strategic decisions for organic and inorganic growth. Management information will help an organization define and measure progress toward organizational goals. This type of management consolidation is usually based on the organization’s internal alignment, that is, based on their service lines or product lines or lines of business, and also largely based on the type of industry that the company operates. Management consolidation also cuts across different legal entities. For example, the company may want to measure the profitability of a product line consolidated at a group level, but this may not be a legal requirement for consolidation.

Consolidation is usually performed at the end of an accounting period on a monthly, quarterly, and yearly basis, and after the subledger accounting entries and feeder system accounting entries have been successfully transferred and accounted for in General Ledger. In large organizations, usually a dedicated consolidation team within the finance department will handle all consolidation/intercompany reconciliations and corresponding adjustments.

Elimination Entries

A parent company and its subsidiaries often engage in a variety of transactions among themselves. For example, manufacturing companies often have subsidiaries that develop raw materials or produce components to be included in the products of affiliated companies. These transactions between related companies or legal entities are referred to as intercorporate transfers. All aspects of intercorporate transfers must be eliminated in preparing consolidated financial statements so that the statements appear as if they were those of a single company. Normally, transactions between legal entities within the group company are booked using Intercompany Clearing accounts defined in the Chart of Accounts, like Intercompany Payables and Intercompany Receivables accounts. When Group accounts are reported, these accounts should normally net to zero. The following are a few general scenarios where elimination entries are booked during consolidation for removing the effects of intercompany transactions:

1. Intercompany transfers of services

2. Intercompany sales of inventory

3. Intercompany transfers of land

4. Intercompany transfers of depreciable assets

5. Elimination of intercompany debts (such as loans) and ownership interests

In the following section, we will discuss the concept of intercompany transfer of services and intercompany sales of inventory with regard to eliminations between entities, using an example. This will provide readers with a good understanding of the kind of Elimination Journals that are passed during consolidation.

Scenario: Intercompany Transfer of Services

For example, if a parent company called “P Ltd” receives a consulting service from a subsidiary company called “S Ltd” for $50,000, the parent company will recognize $50,000 expenses on its books, and the subsidiary company would recognize $50,000 of consulting revenue. As part of consolidation, an elimination entry would be needed to reduce both consulting revenue (debit) and consulting expense (credit) by $50,000. Even though the income is not affected, elimination is important; otherwise, both revenue and expenses are overstated.

Intercompany Sales of Inventory

The Parent Company called “P Ltd” owns all shares of a subsidiary company called “S Ltd,” and consolidations need to be performed as of the period March 2014. Assume that on January 1, 2014, P Ltd purchased $10,000 worth of inventory for cash from S Ltd. The inventory had cost S Ltd about $8,000. Let us assume that there is no tax implication on these transactions and the inventory purchased from S Ltd is still in the inventory of P Ltd.

The following points should be considered while creating elimination entries for intercompany transactions:

![]() For profit and loss accounts like Intercompany Sales and Cost of Goods Sold, elimination entries should be performed using Period To Date Balances (PTD) as the period activity.

For profit and loss accounts like Intercompany Sales and Cost of Goods Sold, elimination entries should be performed using Period To Date Balances (PTD) as the period activity.

![]() For balance sheet accounts like Intercompany Payables and Intercompany Receivables, elimination entries should be performed using Year To Date Balances (YTD) as the period activity. Because we are using YTD balances, make sure that elimination entries of the previous period are reserved in the current period to avoid incorrect accounting.

For balance sheet accounts like Intercompany Payables and Intercompany Receivables, elimination entries should be performed using Year To Date Balances (YTD) as the period activity. Because we are using YTD balances, make sure that elimination entries of the previous period are reserved in the current period to avoid incorrect accounting.

![]() It is common industry practice to define separate elimination company codes for posting Elimination Journal entries. In the scenarios discussed in the preceding tables, the 095 Elimination Company code is used to post Elimination Journal entries, which provides better transparency and auditability. It also helps keep the original legal entity accounting entries untouched.

It is common industry practice to define separate elimination company codes for posting Elimination Journal entries. In the scenarios discussed in the preceding tables, the 095 Elimination Company code is used to post Elimination Journal entries, which provides better transparency and auditability. It also helps keep the original legal entity accounting entries untouched.

If both the parent and subsidiary reside in the same ledger, the consolidated statement can be prepared by combining the balances of all three company codes (01, 02, and 95) as shown in Figure 10-1. This method of consolidation is called Report-Only Consolidation, and we will discuss this in detail in the next section.

FIGURE 10-1. Consolidation of single ledger with elimination company

If the parent and subsidiary reside in different ledgers, the consolidated statement can be prepared by creating an Elimination Ledger or Consolidation Ledger as shown in Figure 10-2. Prerequisites are that all the ledgers should share the same Chart of Accounts and Calendar so that they can be grouped into a Ledger Set. Using Report Only Consolidation, a consolidated statement can be prepared for the group accordingly.

FIGURE 10-2. Consolidation of multiple ledgers using an Elimination Ledger

Different Consolidation Methods

Oracle Fusion Applications supports three types of consolidation methods for handling different scenarios that may arise during the consolidation process, as shown in Figure 10-3. The three consolidation methods are as follows:

FIGURE 10-3. Different consolidation methods

![]() Report-Only Consolidation

Report-Only Consolidation

![]() Balance Transfer Consolidation

Balance Transfer Consolidation

![]() Oracle Fusion Hyperion Finance Management (HFM) Consolidation

Oracle Fusion Hyperion Finance Management (HFM) Consolidation

Choosing a consolidation method depends on how the input consolidation data are currently represented and how the balances need to be aggregated. More often, it may be the case that we need to choose more than one consolidation method to meet the legal reporting needs.

Some of the key questions that functional consultants may ask to evaluate the consolidation requirement for all the subsidiaries and the parent company are as follows:

![]() How many finance systems are involved, and where are the balances of subsidiaries recorded? Do all subsidiaries use Oracle Fusion? Are there any other external non-Oracle ERP systems where balances are recorded?

How many finance systems are involved, and where are the balances of subsidiaries recorded? Do all subsidiaries use Oracle Fusion? Are there any other external non-Oracle ERP systems where balances are recorded?

![]() How many ledgers are involved, and what is the finance reporting structure (Calendar, Chart of Accounts Structure, and Currency) of each of the ledgers? Do all ledgers share the same Chart of Accounts Structure and Calendar?

How many ledgers are involved, and what is the finance reporting structure (Calendar, Chart of Accounts Structure, and Currency) of each of the ledgers? Do all ledgers share the same Chart of Accounts Structure and Calendar?

![]() Do all subsidiaries and corporate ledgers have a Globalized Chart of Accounts so that all of their company balances can be easily consolidated?

Do all subsidiaries and corporate ledgers have a Globalized Chart of Accounts so that all of their company balances can be easily consolidated?

![]() If there are multiple ledgers, how are the corporate currency balances recorded? Are there any secondary ledgers or reporting currencies?

If there are multiple ledgers, how are the corporate currency balances recorded? Are there any secondary ledgers or reporting currencies?

![]() What are the complexities in the company structure, like joint ventures or fully owned subsidiary, and how are consolidation and elimination performed for these companies?

What are the complexities in the company structure, like joint ventures or fully owned subsidiary, and how are consolidation and elimination performed for these companies?

Report-Only Consolidations

Report-Only Consolidation is the simplest method of preparing consolidation statements using Fusion Reports. This method assumes that all subsidiaries and corporate company balance data required for consolidation reside in a single instance of Oracle Fusion General Ledger, either as a single ledger or multiple ledgers. More importantly, if there are multiple ledgers, all the ledgers should share the same Chart of Accounts and Calendar. We can then create the consolidated statement as a report using Fusion Financial Reporting and Analysis capabilities, such as Smart View, Reporting Center Studio, Oracle Transaction Business Intelligence, and Oracle Business Intelligence Applications, as explained in Chapter 13.

Scenarios Where This Method Is Applicable

The following sections describe common scenarios that you can relate to while making your implementation choice for this type of consolidation.

Scenario 1: Single Ledger This may be the case where all subsidiaries and corporate group companies (represented as individual balancing segments in COA) operate in a single country or area where they share the same Chart of Accounts, Calendar, and currency as the corporate currency. An example would be a U.S.-based company with diversified business interests and operating within the United States only; however, this company has different legal entities for each of their business interests. All these companies can reside in a single ledger and use Report-Only Consolidation.

Another case may be that a corporation operates across different countries, and each country has its own ledger for its local reporting purposes. For local reporting purposes, you can potentially use Report-Only Consolidation to satisfy the local legal reporting requirements.

Scenario 2: Ledger with Different Currency Other Than Corporate Currency In this scenario, we have more than one ledger involved in the consolidation process and all use a Global Chart of Accounts; however, each has its own local currency for its Primary Ledger. In this case, we use the Reporting Currency feature to record balances in the corporate currency in addition to the local currency and use the Report-Only Consolidation method to generate the consolidated statement.

Let us consider an example where a company operating in the United States and the United Kingdom only has a need to consolidate corporate earnings at the U.S. level. Let us assume that there are two ledgers—one for the United States and one for the United Kingdom with Global Chart of Accounts. However, the primary currency for the U.S. ledger is U.S. dollars, and the primary currency for the U.K. ledger is GBP. In this case, the U.K. ledger can use the Reporting Currency feature to record balances in U.S. corporate currency and then subsequently, use the Report-Only Consolidation method to generate the consolidated statement at the U.S. level.

Implementation Steps

In the previous section, we have seen different scenarios where Report-Only Consolidation can be used. We will now look at the high-level steps to perform for this type of consolidation.

Step 1: Create Ledger Set The first step in this process is to create a ledger set if the balances of the companies are stored in multiple ledgers. A ledger set allows group ledgers to share the same Chart of Accounts and Calendar so that Business Users can manage ledgers centrally for the period-close process, as well as analysis and reporting purposes. Using a ledger set, summarized balances can be generated from multiple ledgers using Fusion reporting capabilities.

Step 2: Translate Balances to the Corporate Currency As explained in Scenario 2 in the preceding section, translate the local currency balances to the corporate currency so that reporting can be performed using the corporate currency balances. This is accomplished through the Translation process as explained in Chapter 12. Business Users always need to make sure that translation to the consolidation currency is current to reflect all balances.

Step 3: Create Elimination Entries The next step is to create elimination entries for intercompany and intracompany transactions so as to avoid double counting of income and expenses. Creation of elimination entries can be automated using Allocation Rules Manager as explained in Chapter 11.

Step 4: Create Adjustment Entries Adjustment entries are performed basically to reclassify certain types of account balances to another for legal reporting needs and to alter the ending balances in various General Ledger accounts. When adjustment entries are created, they are usually booked as Manual Journals via ADFI spreadsheet upload or by using the Create Journal Entry form. You would have seen how to enter manual journal entries in Chapter 8.

Step 5: Report Using Ledger Set and Corporate Currency as Parameter for Consolidated Balances Use Financials Reporting Center to generate a consolidation report with parameters as Ledger Set and Corporate Currency. Chapter 13 provides detailed steps of how you could build a report using Financials Reporting Center.

Balance Transfer Consolidations

The Balance Transfer Consolidation method will be applicable if Chart of Accounts or Calendar or both Calendar and Chart of Accounts are different between the parent company and the subsidiaries. In this case, the parent and subsidiaries are configured as different ledgers, and either can be associated as a Primary and Secondary Ledger (usually the Primary Ledger will hold subsidiary balances and the Secondary Ledger will represent corporate balances) or a stand-alone ledger with no association between them. Oracle provides a Balance Transfer feature to bring across balances from one ledger to another for consolidation purposes.

Scenarios Where This Method Is Applicable

Balance Transfer Consolidation can be used in the following two scenarios:

![]() Primary to Secondary Ledger Balance Transfer

Primary to Secondary Ledger Balance Transfer

![]() Cross-Ledger Balance Transfer

Cross-Ledger Balance Transfer

Primary to Secondary Ledger Balance Transfer

This scenario is applicable where the Primary Subsidiary ledger is maintained in Local COA or Local Calendar and where the Secondary Ledger is maintained in Corporate COA or Corporate Calendar. Balances are transferred from Primary to Secondary Ledger using the Balance Transfer feature. This Secondary Ledger is included in the Consolidation Ledger Set for reporting.

Cross-Ledger Balance Transfer

In this scenario, the Primary Subsidiary ledger is maintained in Local COA or Local Calendar and there is a separate Corporate Ledger, which is maintained in Corporate COA or Corporate Calendar. To consolidate corporate balances, Primary Subsidiary balances are translated to corporate currency using the Report Currency feature (as discussed in Chapter 6), and corporate currency balances are transferred from Primary to Corporate Ledger using the Balance Transfer feature.

Implementation Steps

Let us look at the high-level steps to be performed for this type of consolidation.

Step 1: Translate Balances to the Corporate Currency The first step is to translate non corporate currency Subsidiary Ledger balances to the corporate currency. This allows subsidiary corporate balances to be transferred into the target ledger.

Step 2: Create Chart of Accounts Mapping from Subsidiary Account Values to Corporate Chart of Account Values Create a Chart of Accounts mapping from subsidiary Chart of Accounts values to corporate Chart of Accounts values. This Chart of Accounts mapping information is used within Oracle to transfer amounts and balances from the source (subsidiary) ledger to the target (corporate) ledger. You would have seen an introduction to the Chart of Accounts mapping feature in Chapter 6.

Step 3: Run Balance Transfer Program Oracle provides two programs to transfer balances from one ledger to another to handle both Scenarios 1 and 2 discussed earlier in the Balance Transfer Consolidation section.

![]() Transfer Balances to Secondary Ledger Program: This program allows balances to be transferred from the Primary Ledger to Secondary Ledger. This program is applicable for the Primary to Secondary Ledger Balance Transfer Consolidation scenario.

Transfer Balances to Secondary Ledger Program: This program allows balances to be transferred from the Primary Ledger to Secondary Ledger. This program is applicable for the Primary to Secondary Ledger Balance Transfer Consolidation scenario.

![]() Transfer Ledger Balances Program: This program allows balance transfers from one ledger to another ledger, as long as the Chart of Accounts mapping exists between those ledgers. This is applicable for the Cross-Ledger Consolidation scenario.

Transfer Ledger Balances Program: This program allows balance transfers from one ledger to another ledger, as long as the Chart of Accounts mapping exists between those ledgers. This is applicable for the Cross-Ledger Consolidation scenario.

Step 4: Create Elimination Entries and Create Adjustment Entries The next step is to generate Elimination entries and Adjustment entries as per the reporting needs in the Consolidation ledger.

Step 5: Generate Report Generate a consolidated statement, including Eliminations and Adjustment balances.

Oracle Fusion Hyperion Financial Management Consolidations

Oracle Hyperion Financial Management (HFM), Fusion Edition is a separate software application from Oracle used primarily for the purpose of complex consolidation and reporting. You may choose to use HFM if you would like to take advantage of HFM’s powerful feature to consolidate balances from different data sources of General Ledgers, including Fusion General Ledger and previous versions of Oracle E-Business Suite, as well as non-Oracle applications like SAP. HFM also allows drill-down of balances from HFM to source systems. As with Balance Transfer Consolidation, implementation users would need to map the source Chart of Accounts and Hierarchies to HFM to perform advanced consolidation. Standard Oracle Financial Data Quality Management ERP Integrator Adapter can be leveraged to bring balances from Fusion General Ledger to HFM. The setup and configuration of HFM with respect to Oracle Fusion Financials is beyond the scope of this book; however, this section is included in this chapter for completeness of different consolidation options that implementation users can consider.

Comparison of Report-Only Consolidation and Balance Transfer Consolidation

In this section we will explain the advantages and disadvantages of Report-Only Consolidation versus Balance Transfer Consolidation.

Advantages and Disadvantages of Report-Only Consolidation

These are the advantages of Report-Only Consolidation:

![]() Provides near-real-time consolidation of balances, as this consolidation doesn’t require running of Balance Transfer program steps like the Balance Transfer Consolidation method.

Provides near-real-time consolidation of balances, as this consolidation doesn’t require running of Balance Transfer program steps like the Balance Transfer Consolidation method.

![]() Eliminates the need to run additional processes unless the ledgers have a different currency than the consolidation currency.

Eliminates the need to run additional processes unless the ledgers have a different currency than the consolidation currency.

![]() Facilitates a faster period-close process, as the consolidation process is relatively simple.

Facilitates a faster period-close process, as the consolidation process is relatively simple.

This is the disadvantage of Report-Only Consolidation:

![]() Requires a standardized Chart of Accounts or Global Chart of Accounts and Calendar for the subsidiaries and corporate ledgers in order to group ledgers into a set of ledgers.

Requires a standardized Chart of Accounts or Global Chart of Accounts and Calendar for the subsidiaries and corporate ledgers in order to group ledgers into a set of ledgers.

Advantages and Disadvantages of Balance Transfer Consolidation

This is the advantage of Balance Transfer Consolidation:

![]() Ability to consolidate even when the Chart of Accounts and Calendars of the subsidiaries and corporate ledgers are different.

Ability to consolidate even when the Chart of Accounts and Calendars of the subsidiaries and corporate ledgers are different.

These are the disadvantages of Balance Transfer Consolidation:

![]() May be necessary to define a separate consolidation ledger; or the existing parent ledger can act as a consolidation ledger. Need to transfer subsidiary balances to that consolidation ledger for reporting.

May be necessary to define a separate consolidation ledger; or the existing parent ledger can act as a consolidation ledger. Need to transfer subsidiary balances to that consolidation ledger for reporting.

![]() If the subsidiary ledger currency is different from the consolidation currency, then we need to run the Translation process first to convert balances to the consolidation currency and then run the Balance Transfer process to transfer subsidiary balances to the consolidation ledger.

If the subsidiary ledger currency is different from the consolidation currency, then we need to run the Translation process first to convert balances to the consolidation currency and then run the Balance Transfer process to transfer subsidiary balances to the consolidation ledger.

![]() Additional effort to maintain Chart of Accounts mapping.

Additional effort to maintain Chart of Accounts mapping.

![]() The Balance Transfer program doesn’t send an incremental update of balances from source ledger to target ledger. As a result, every time subsidiary ledger balances are changed, business users need to reserve all the earlier journals in the consolidation ledger and rerun the Balance Transfer process. If the subsidiary currency is different from the consolidation currency, additionally we need to run the Translation process before running the Balance Transfer program.

The Balance Transfer program doesn’t send an incremental update of balances from source ledger to target ledger. As a result, every time subsidiary ledger balances are changed, business users need to reserve all the earlier journals in the consolidation ledger and rerun the Balance Transfer process. If the subsidiary currency is different from the consolidation currency, additionally we need to run the Translation process before running the Balance Transfer program.

Consolidation for ACME Bank

In this section, readers will understand how different consolidation methods can be applied to meet ACME Bank’s consolidation requirements.

Requirements

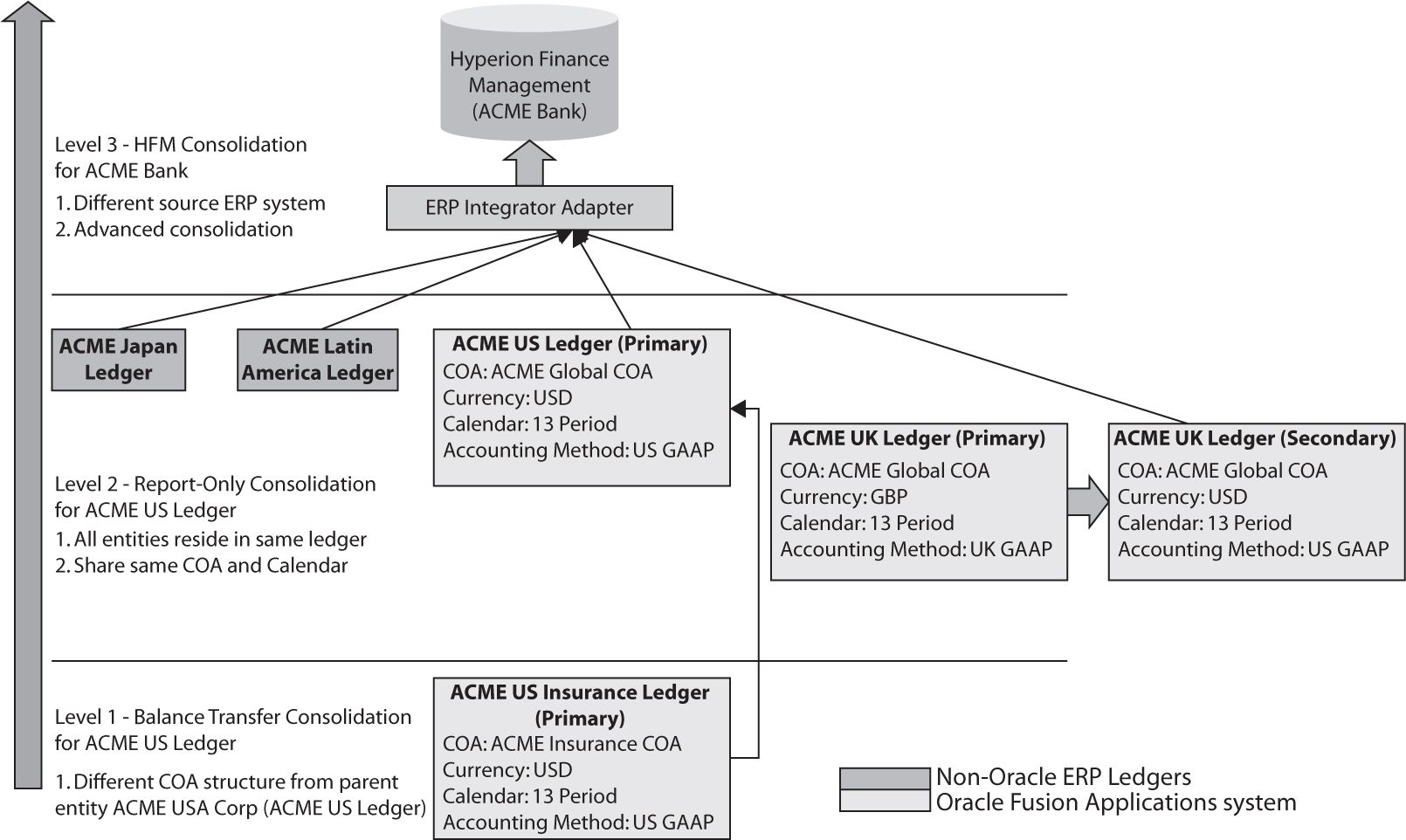

Requirement 10.1: ACME Bank has many subsidiary legal entities as part of its reporting structure, as shown in Figure 10-4. ACME Bank Group Company needs to consolidate balances from its subsidiaries from Japan, Latin America, United States of America (USA), and United Kingdom (UK). ACME Bank needs to prepare financial statements in US GAAP and eliminate all intercompany journal entries. In addition, it should include financial figures of partly owned companies or non controlling interests (an ownership stake in a company where the held position gives the investor no influence on how the company is run) held under the group company.

FIGURE 10-4. ACME Bank Group reporting structure

Requirement 10.2: Both ACME Japan Holding Corp and ACME Latin American Holdings Inc are using non-Oracle ERP General Ledgers with their own localized Chart of Accounts and Calendar. Balances from these companies need to be consolidated to ACME Bank Group Company on a quarterly basis.

Requirement 10.3: ACMECorp USA (part of Fusion Implementation) needs to consolidate balances of its subsidiaries for both management reporting and legal reporting purposes. This consolidation should include ACME Insurance Holding Company, which has its own ledger with a different Chart of Accounts than the Globalized ACME Chart of Accounts. It has been agreed that this consolidation will happen on a monthly basis inline with a monthly management review cycle. Additionally, consolidated figures of ACMECorp USA in US GAAP (Generally Accepted Accounting Principles) need to be reported to ACME Bank Group company on a quarterly basis.

Requirement 10.4: ACME UK Limited (part of Fusion Implementation) needs to report its balances in US GAAP (Generally Accepted Accounting Principles) to the ACME Bank Group Company on a quarterly basis.

Proposed Consolidation Method

The proposed ACME Bank consolidation should take into consideration the following aspects of the legal entity structure:

![]() There are multiple source General Ledgers (both Oracle Fusion and non-Oracle ERP ledgers) involved in the consolidation of ACME Bank.

There are multiple source General Ledgers (both Oracle Fusion and non-Oracle ERP ledgers) involved in the consolidation of ACME Bank.

![]() Within Fusion Applications, legal entities are spread across multiple ledgers with a different Chart of Accounts structure.

Within Fusion Applications, legal entities are spread across multiple ledgers with a different Chart of Accounts structure.

![]() There are local consolidation requirements within certain intermediate legal entities like ACME Corp USA.

There are local consolidation requirements within certain intermediate legal entities like ACME Corp USA.

The proposed structure for ACME Bank consists of three levels of consolidation as shown in Figure 10-5. The details of the consolidation process are explained in the following sections in a bottom-up approach from Level 1 to Level 3, leading to the consolidation of ACME Bank Group Company.

FIGURE 10-5. Proposed ACME Bank consolidation structure

Level 1 Consolidation Using the Balance Transfer Method

The legal entity ACME Insurance Holdings residing in ACME US Ledger needs to bring balances across from ACME Insurance companies. Because both source and target ledgers are using a different Chart of Accounts structure and the requirement is to consolidate on the balance level, the Balance Transfer Method of consolidation will be used. Later in the chapter, we will look at how to set up this type of consolidation in detail.

Level 2 Consolidation Using Report Only

ACMECorp USA represents a consolidated entity of all the companies operating in the United States. Because we have balances from all the U.S. companies in a single ledger, ACME US Ledger, we can easily generate consolidated statements using the Report-Only Consolidation method.

Level 3 Consolidation Using HFM Consolidation

ACME Bank Group Company needs to consolidate balances from different general ledgers (Oracle and non-Oracle ERP) across different countries like the United States, the United Kingdom, Japan, and Latin America. Because not all companies use a Global COA structure, and many entities have complex ownership and accounting requirements, the Hyperion Financial Management Consolidation method is used.

Consolidation Using the Balance Transfer Method from ACME Insurance Ledger to ACME US Ledger

In this section, we will look at how to set up and perform consolidation for cross-ledgers.

Requirements

ACME US Ledger needs to consolidate ACME Insurance Ledger balances at the same level of detail as the Global COA. However, for consolidation purposes, they would not require Location Segment details from ACME Insurance Ledger. So the resulting mapping should be as shown in Figure 10-6.

FIGURE 10-6. Source to target Chart of Accounts mapping

Consolidation Steps

Based on Chapter 6, readers will have already created ACME Insurance Ledger and ACME US Ledger in Fusion. Let us now try to perform the necessary setup steps to consolidate balances between cross-ledgers using the Balance Transfer method.

Step 1: Transfer Balances to the Corporate Currency This step is not applicable in our case because ACME Insurance Ledger is already in the corporate USD currency.

Step 2: Create Chart of Accounts Mapping from Subsidiary Account Values to Corporate Chart of Account Values Note: Readers would have already been introduced to the concept of Chart of Accounts mapping in Chapter 6.

Steps to create Chart of Accounts mapping are as follows:

1. Navigate to the Manage Chart Of Accounts Mappings task under Define Chart Of Accounts.

2. Click the Create icon on the Manage Chart Of Accounts Mapping page.

3. Create a mapping from ACME Insurance COA instance (Source Chart of Accounts) to ACME Global COA Instance (Target Instance) as shown in Figure 10-7. We have created Segment Rules for each of the Target Segments and used the Copy Value From Source mapping method, as the segment values used are common across both the source and target COA.

FIGURE 10-7. Segment rules mapping

Step 3: Run Balance Transfer Program

1. Create a few journals in ACME Insurance Ledger as described in Chapter 8.

2. Run the Transfer Ledger Balances program from the Scheduled Process page providing parameters for Source Ledger, Target Ledger, and Chart Of Accounts Mapping as shown in Figure 10-8.

FIGURE 10-8. Submitting the Transfer Ledger Balances program

3. After successfully running the transfer program, review consolidated journals created in ACME US Ledger. Optionally, create Elimination entries and Adjustment entries to complete the intermediate consolidation.

Summary

In this chapter, we have introduced readers to the concepts of consolidation and elimination. Readers would have also understood different methods available for consolidation and a rationale for choosing one option over the other. Based on the knowledge gained, we have applied our learning to the ACME Bank enterprise to see how different options can be applied to meet consolidation requirements. We have also provided step-by-step details to show how the Balance Transfer method of consolidation can be performed for ACME ledgers. In the next chapter, we will look at different reporting solutions available within Fusion Applications.