2

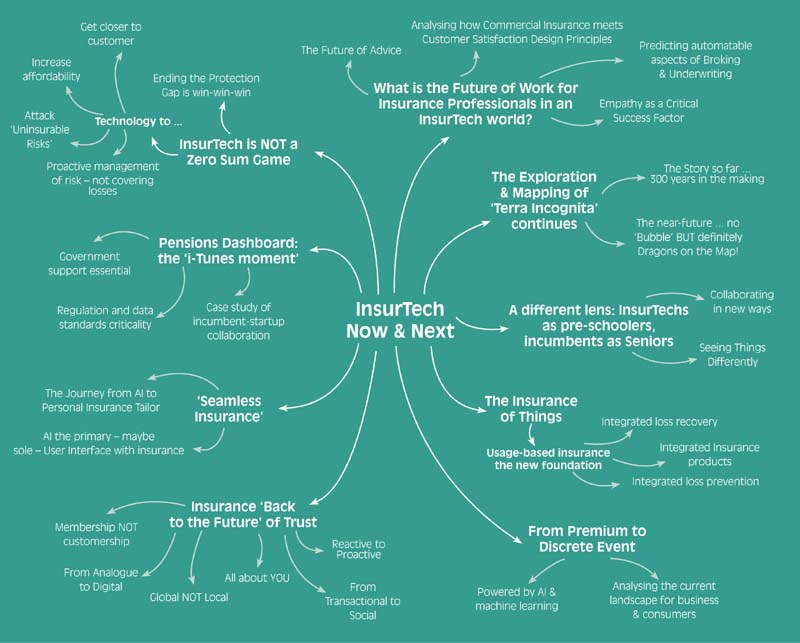

InsurTech Now and Next

This part presents nine distinctive voices answering the brief “InsurTech Now and Next”. Paolo Cuomo’s “Cartographer’s Dream” describes an analogy of InsurTech as Terra Incognita, a compelling but as yet unmapped world, being discovered, named, and classified beneath our feet. His view of this process of exploration, and what is held in store, does not include a bubble that bursts.

John Warburton envisions the impacts on people working in insurance, and specifically those working in Commercial Lines (CL) broking and underwriting. Looking at tech-driven change, Future of Work, Robotic Process Automation, and AI, his five-point action plan to enable CL brokers and underwriters to benefit proactively from technology exhorts them and us to build on their core professional strengths of tacit knowledge and empathy.

Neil Thomson offers up a personal and highly unusual lens to understand InsurTechs and their relationships with incumbents: look at them as preschool infants engaging with seniors, Thomson says, and learn from analogues in society. The next three contributions take the Internet of Things (IoT) – or Insurance of Things (InsoT), as Nick Bilodeau proposes – as the starting point for imagining the Next. Bilodeau posits next generation protection created by digital interconnectedness, integrated insurance products, loss prevention, and recovery support with usage-based insurance as the foundation.

Sylvia Michaelowski gives Personal Lines and Commercial Lines scenarios where insurance evolves, and is evolving, to support customers at specific moments and for specific risks, defined and chosen by them.

Henrique Volpi elaborates on a similar theme, albeit with a particular perspective, describing a “seamless insurance”, and an inexorable progress from AI to AI Personal Assistant to Personal Assistant as Personal Tailor. Volpi’s vision sees AI becoming the primary, if not sole, user interface (UI).

Yvonne Braun shares the story to date of the development of the UK’s Pensions Dashboard Project, the “Tunes moment” for Pensions. The case study illustrates how using methods any InsurTech would recognize (tech sprints, collaboration, transparency, consumer centricity) has created success, but also the importance of regulation and legislation, including on data standards as critical to ultimate implementation.

Susanne Møllegard’s chapter presents a positive vision for insurance where technology and coexistence in a sharing economy will bring back trust, and take the whole industry “Back to the Future”. Her six mega-trends transforming the insurance sector include membership, social media impact, and digital self-service and global impact.

In the final chapter of this part, Nick Martin urges us to move beyond insular InsurTech debates to seize the opportunity to close both the protection and communication gaps; increase insurance affordability and penetration globally; and make yesterday’s uninsurable risks insurable today. “New markets will emerge that expand the overall industry ‘pie’, not only to the benefit of all market participants, but more importantly, society at large.”

A prediction for InsurTech Now and Next that we can all join in striving and hoping for?