Dating InsurTech Startups

By Prof. Dr Bjorn Cumps

Professor of Financial Services Innovation and FinTech, Vlerick Business School

ByeBye Traditional Insurance?

Allianz & Simplesurance, Munich Re & Slice, Axa & Trov, Zurich & Cocoon, Manulife & Indico …

Love is all around in the world of InsurTech today. Both large corporates and startups have observed and learned from what happened and is still happening in FinTech: disruptive innovation does not necessarily equal “bye bye traditional insurance companies”. Not all large corporate insurance companies will disappear and startups will not rule the insurance world. In fact, very few new players will manage to truly bring disruptive innovation as defined by Clayton Christensen:1 “a product or service that takes root initially in simple applications at the bottom of a market and then relentlessly moves up market, eventually displacing established competitors.” Most new players, in InsurTech too, will not be disruptive as such; however, they may change many different aspects of how the insurance sector operates today: new profit models and pricing structures, new products and features, new services, delivery channels, and client interactions. We see a clear trend towards creating better and more personalized client experiences, more client interactions, in-context services, real-time data-driven insurance solutions, microinsurances, claims prevention, and open collaboration (see Table 1). All of these can be valuable. All of these can fundamentally change the insurance sector. And all of them can be done in partnership between large corporates and new startups. InsurTech will not be the end of the large insurance corporates. But it will be the end of the traditional insurance operating model as we know it today.

Table 1: Traditional vs. new insurance model characteristics

| Traditional Insurance | Insurance 2.0 – InsurTech |

| Claims handling | Claims prevention |

| Avoid client interaction | Stimulate client interactions |

| Know your risks | Know your customer and their risks |

| 1-size-fits-all | Specific, personalized, sliced and diced |

| Insuring people | Insuring people and technology |

| Fat and gentle | Lean and mean |

| Manual and slow | Augmented, automated, and cognitive |

| Closed value chain | Open ecosystem |

| Product push | Client pull |

| Boring | Exciting |

Dating and Relationships inInsurTech

Collaborative innovation is gaining importance in the insurance sector. Why? Because it makes good business sense. Large insurance corporates have scale, customers, capital, business and market knowledge, regulatory expertise, licences, and the resources startups can only dream of. Startups are innovative, agile, creative, focused, customer-centric, opportunity-driven, tech-savvy, and change-oriented. Sounds like we have a match! However, dating and building relationships is often more complicated than it sounds.

So are large corporates swiping across their InsurTech startups Tinder apps? We do see a lot of startup CEOs dressing up with suit and tie to meet with possible new corporate partners. But what are their intentions? We see at least four different types of partnerships currently emerging.

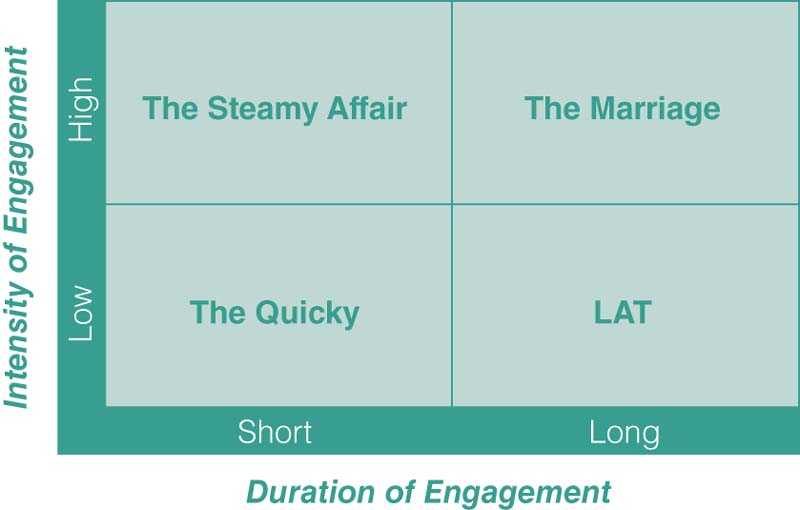

Figure 1 gives an overview.

Figure 1: Partnership models

- The horizontal axis indicates the duration of the engagement and makes the distinction between modular and flexible companies who team up for a short period and true partnerships for the long term.

- The vertical axis indicates the intensity of the engagement and indicates how much time, effort, and resources are being put in to make the relationship work.

If we zoom in on the four quadrants, each of which describes a different kind of relationship between startup and incumbent:

- TheQuicky. In our research scan of the InsurTech landscape we identified many incubators and accelerators. The Swiss Re accelerator, launched in 2016, is a 16-week program to mentor startups. Allianz X hosts promising entrepreneurs for 100-day sprints to build new businesses. AXA has launched a €100 million InsurTech dedicated incubator called Kamet. These are just a few of many similar corporate incubators we identified. We categorized these initiatives as “The Quicky”: startup and incumbent flirt with each other for a short period and with little true commitment to build a real relationship. Both in FinTech and InsurTech, large corporates want to get to know the startups better: how they work, how they think, what their culture is like, and how it can help their own employees to be more like the startups. Typically, the large corporate makes a selection of startups and provides them with facilities, mentoring, and access to their knowledge and network. The commitment of both sides is often limited and so is the real value creation potential. However, if they prove to be interesting, this first fling can be the start of a more serious partnership.

- The LAT (Living-Apart-Together). Partners engage for the long term yet effort invested in the relationship is low, e.g. taking minority stakes or product/service referral partnerships. In this type of relationship both partners do commit to each other yet leave each other the breathing space to grow and each go their own way. Corporate venture capital investments of corporates in InsurTech startups are a good example of how to build a more long-term commitment (if done for strategic reasons and not only financial investment) without committing to real operational integration of both organizations. The recent funding round of One Inc. led by AXA strategic ventures is a nice illustration of how a corporate like AXA can follow a startup like One building a new SaaS platform (Software-as-a-Service) changing the insurance infrastructure. It can be a strategic option for the future. A cautious approach, building a relationship without having to see each other every day. Similarly, when the corporate and startup make referral agreements for products and services and each serves different customer segments with their complementary products there is little true operational integration needed.

The first two relationship types described are characterized by a low engagement intensity – limited time, effort, and resources are invested in the relationship and there is no real focus on operational integration. The next two types we identify are quite different and do focus more on operational interaction and integration between the partners.

Figure 2 will be used to discuss these partnerships further.

Figure 2: Towards new operating models in insurance

- The Steamy Affair. Both partners engage in a more operational partnership, focused on short-term mutual interest and benefits. What we currently see in the insurance sector is how business functions (risk carrying, product development, pricing, claims handling, and distribution) are being split up across different business partners. A nice example from our study is the operating model of a company like Qover with the ambition to become full-stack insurance providers, partnering with insurance capacity providers like Lloyd’s (risk-carrying function) and selling both direct to clients or via an intermediary delivery partner. With such operating models, which are mostly flexible, API (Application Programming Interfaces), and cloud-based solutions, partners have a more “technical relationship”, producing and consuming each other’s APIs in an open and often platform-based setting. Partners do not necessarily need to know each other very well. A strong business architectural capability is at the basis of these kinds of “friends with benefits” models. Different dynamics will also coexist in these models ranging from customers and delivery partners who pull information from the insurance provider (on pricing, claims status, products, etc.) to platforms who push opportunities and leads to possible new or existing partners out there who can try to convert the lead.

- The Marriage. Long-term partnership built on a solid foundation of mutual platform or deep and meaningful integration of both organizations. This can be through equal partnership or acquisitions. The most common example is a traditional large corporate acquiring an InsurTech company and integrating it into its own offering and operations. The acquisition of the UK InsurTech startup Simple Business by the US corporate Travelers is one example. Basically, the corporate buys not only the products and services but also the InsurTech partner’s digital business capability to integrate it in its own business. However, as we all know, a marriage is not always easy. Especially in this case, where corporate and entrepreneurial cultures are quite different. We have already learned from FinTech that there needs to be a good balance between ring-fencing the entrepreneurial culture on the one hand and strongly blending and integrating the technological, infrastructural, and data components on the other.

Finally, much like in personal relationships, combinations of these four models are of course possible. Many corporates today combine the incubator/accelerator approach with corporate venture capital investments and/or acquisitions. Clearly, the insurance sector today has just hit puberty and partners are experimenting to see which approaches create most value. One major conclusion from our study is that partnerships will only work if win-win-(win) relationships can be created.

Based on what happened in FinTech and the first deals we analysed in the insurance sector, models with low-intensity engagement seem interesting yet not sufficient to deal with the changes we discussed in the table shown earlier in the chapter. Indeed, our first findings indicate that much more is needed than incubators or a financial stake. The high-intensity engagement models leading to successful new capability integration in existing corporates or new, flexible ecosystem operating models as discussed in the previous figure will be the leading partnership model for the InsurTech sector.