DISCOUNTED CASHFLOW (DCF)

Use when comparing future cash flows as to which option provides the greatest return at today’s prices.

Inflation erodes the value of money overtime. The value of £1000 today is greater than in three years, by which time inflation will have reduced its purchasing power. This is why, when calculating the return on an investment, it’s necessary to take this reduction in value into account to arrive at the Net Present Value (NPV) of the cashflows.

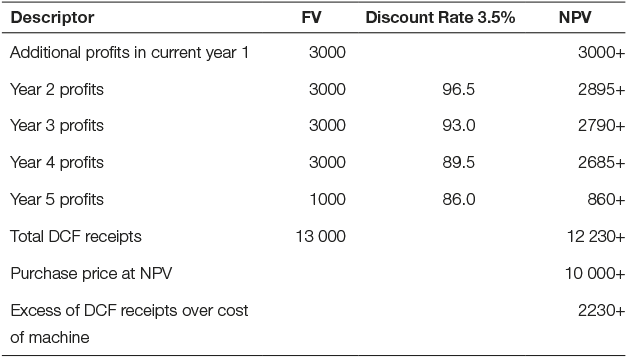

The table below shows the NPV of cashflows derived from the purchase of a new machine costing £10,000 which will be replaced in five years. The discount rate is set at the predicted inflation rate of 3.5% for each of the next 5 years.

On this basis, it’s worth purchasing the machine as it will increase profits, at today’s value, by £2230 over five years. However, if the chosen inflation rate proves to be understated the result can be rendered useless.

Most companies will also have a ‘hurdle rate of return’ which is the minimum annual return required from all investments. This percentage would be included in the discount rate.

DCF is a key financial tool when evaluating individual or competing investments.

HOW TO USE IT

- Normally DCF will be calculated by your accountant. Following discussions with you, they will use the following information in their calculations.

- The cost of the investment, e.g. will the full cost be paid in year 1 or spread over the life of the asset?

- Details of how you have estimated future cashflows.

- Details of the minimum ‘hurdle rate of return’ that all investments are expected to achieve and the rate of inflation to be used.

- It should be obvious from the above that any DCF calculation contains a number of difficult to quantify variables. This has implications for the level of accuracy that can be achieved. Therefore use DCF as indicative of future returns and not a precise calculation.

- Where one or more projects are competing for limited resources DCF provides a means of comparing disparate proposals. All other things being equal, you would normally select the project or investment which shows the greatest excess of NPV over cost. However, you may reject that option in favour of a proposal that carries less risk.

QUESTIONS TO ASK

- How often do I ask the accountant for financial information?

- Do I need to build a better working relationship with the accountant who is a key gate keeper in my organisation?