4

The Master Budget

When we talk about financial planning, it is the small battles that win the war. The biggest of these battles is the war within. So much can be learned about a person’s priorities simply by watching what they spend their money on. The debit card has never told a lie, and your statements tell the tale of true Master Wealth-Building—or of wasted opportunities.

Take a look at your most recent month’s bank statement. Better yet, the last two months—or three months if you are feeling really ambitious. If you skim your statements and think to yourself, “Man, I’m doing a good job,” you are probably a conservative saver with the need to reallocate your hard-earned dollars to vehicles where they can work better for you (I’ll get to that later). If your facial expression changes because you can smell the stench of your spending habits, well, that’s a good thing too. You obviously recognize that some changes need to be made and that you have development opportunities within your current spending habits.

Your prudent day-to-day habits are what will inch you forward in your journey to long-term wealth generation. Quite frankly, sometimes budgeting in this manner sucks. It feels like you’re making big sacrifices and is absolutely no fun—especially when your peers may be “making it rain” on unnecessary (but covetable) items and gadgets that they’ll soon replace. I know, they are entirely bogus and incredibly tempting. Yet if you are experiencing these emotions of envy and restraint you might just be doing something right. It means you’re sticking to your plan, reluctantly or otherwise.

Financial wellness consists of a long series of small victories won by executing your plan every day. Every day that you can stick to your plan is a day that you become closer to touching the wealth that you are working toward. Your ultimate victory lies in your ability to win the day. And so, before the stocks, mutual funds, and all the other sexy stuff that people like to talk about, you have to sit down with yourself and get to the nitty-gritty. The devil is in the details, and the details are in your Master Budget, a document that will act as your financial bible and serve as the set of procedures governing all of the inflows and outflows that you have on a monthly basis. I’ll walk you through this.

Today, there are many mobile and web-based applications that people use for budgeting purposes. While these applications are great supplementary tools to make it easier to track your expenses, many are too impersonal to be used as your only budget tool. They prevent you from internalizing your budget and its unique constraints. How many push notifications do you ignore on a daily basis? One more push notification will not change your life, but one solid budget that you write down, continually revisit, and work every day toward mastering could change your financial life.

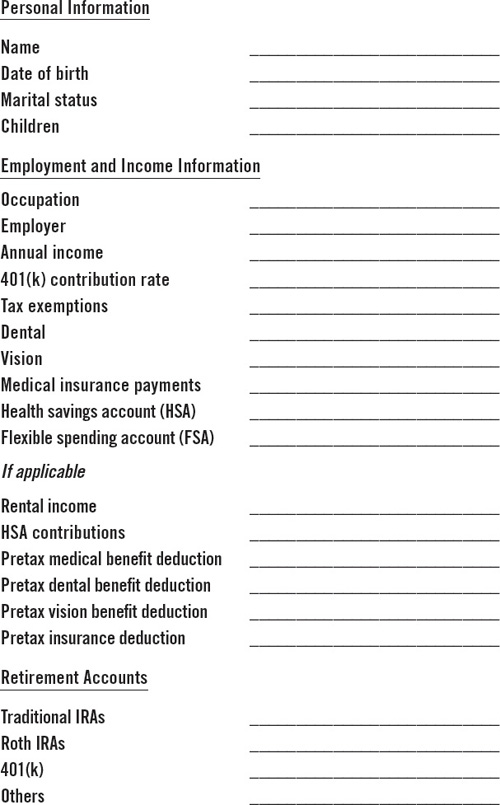

RIITE Planning Worksheet

Your Master Budget should be composed of everything that illustrates your financial life. Take a look at the RIITE (Retirement, Investments, Insurances, Taxes, and Estate Planning) worksheet we use for our clients at Berknell as an example (Figure 1). For simplicity, you can segment your Master Budget into five key parts: Income Information, Assets, Liabilities, Cash Flow, and Goals. Do you have your pen and paper ready? Good.

Income Information

On the first line, write Income Information. Here, as accurately as possible, list everything about all forms of income that you receive over the course of a given month. Start with your monthly gross income. Be sure to include any bonuses, rental income, and the dough you make from all of your side hustles. If the number is variable, list the worst-case scenario. Everything must be listed, because (dun, dun-dun!) soon come the taxes and deductions. Yes, it’s true. The only thing guaranteed in life is death and taxes. It’s not all bad, though. At least some of these deductions work in your favor.

Figure 1 RIITE Planning Worksheet

This taxes and deductions portion may require some research on your behalf. Your paystubs will definitely come in handy. List every single deduction that comes out of your check before or after your net earnings. Every. Single. One. This will include but not be limited to federal and state taxes (if applicable), your retirement plan contribution, healthcare, dental and vision plan deductions, health savings account contributions, and Roth IRA and 401(k) contributions, among others. Now, calculate your net income number for the month. Take a deep breath. Don’t panic. This is the number that you are working with to cover your monthly expenses.

If this number looks too small, you’re probably already realizing that you need to shift from the Consumer mindset to the Master Wealth-Builder mindset. For most people, it takes very conscious and meticulous planning to stride toward your goals. Most of us aren’t yet millionaires, and it often seems as if we need at least a couple of million dollars to get started. But don’t be discouraged. Attack these speed bumps by planning fiercely. It will give you more hope to reach your financial goals.

Assets and Liabilities

Assets and Liabilities should also be listed in your Master Budget. Some people will argue against including them, but I believe it’s important in giving you the full picture of your net worth and why you should save, pay down debt, and (most important) pay yourself first in the form of investments that grow your wealth over time. The very basic forms of your assets will be your checking and savings accounts, followed by your home value, retirement account balances (including traditional and Roth IRAs), employer-sponsored retirement accounts, certificates of deposit, and the value of any tangible assets like your car or a boat. Most of these assets are the cash and growth tools that will help you build your long-term wealth.

Now here come the Liabilities, the part that we never want to talk about. We all want to be owners and not loaners. Unfortunately, you cannot have one without giving up the lifestyle of the other. Let’s face them head on. In this section should be everything that you owe to an entity or another person. You should include your car loan, the total balance of all of your credit cards, your home mortgage, and, of course, those student loans.

It is very important that both Assets and Liabilities are listed on your Master Budget because they will guide all the financial decisions that you make. I would argue that there are three reasons why people do not design their wealth in the ways that they could: lack of knowledge of their financial situation, lack of preciseness in their goals (see chapter 5), and lack of discipline. My point here is that if you have a strong idea of your strength and development opportunities, you’ll be able to make sound day-to-day financial decisions.

The term “net worth” has been glamorized as something to flaunt among peers and admired by the general public. That’s complete and utter malarkey. I’ll use the word “malarkey.” Net worth is something that billionaires and homeless people both have. It is literally the value of all your assets minus the value of your liabilities. Knowledge of your financial situation means knowing all of the components of your net worth, which means knowledge of every asset and liability on your Master Budget. If you have this information, at minimum, you will be conscious about your money decisions and the results that they yield. If you can be honest and clear with yourself, the odds of being more disciplined with your decisions rises dramatically.

Cash Flow

Let’s talk a little bit more about discipline. Lack of discipline is a silent killer of the designs of Master Wealth-Builders. Our gross incomes listed in the Income Information segment are distractions that sway us into relaxation—which then shows up in our Cash Flow, the fourth component of the Master Budget. Traditionally, the cash flow statement is used to monitor a business’s transactions over the course of a quarter. I believe that you should run your personal finances like a business with defined goals. I say this because a budget only acts as an allocation of the money you make, not a diagnosis of the mistakes that you are making. We see this all the time: people set parameters for how their money will be spent and things come up. Life happens. Allocations for spending alone are not enough. Yet allocations based on your plan comprise the “how” that gets you closer to your design for building wealth.

The Cash Flow section should list all of the things that you are spending your money on after taxes and deductions are taken out of your gross income—that is, your expenses. Under this section of your Master Budget, you should list all of your expenses, including your mortgage or rent payments, investment account contributions, auto loan payments, credit card payments, life insurance premiums, emergency funding, auto insurance, auto fuel and maintenance expenses, education loan payments, monthly food expenses, transportation expenses, dry cleaning, entertainment such as eating out and movies, and any other miscellaneous expenses that you might have. Overwhelmed yet? Good. Fill out each line with the exact or near exact amounts. Now draw a line and list the total below.

This figure alone can tell you a lot about your habits. You will be either at a deficit or a surplus. If you are at a deficit, this could mean that you are living above your means or your spending habits are unwise. You should take the time to look at areas where you can cut back on expenses (more on this coming up). If you are at a surplus, perhaps you are a strong budgeter, but have too much in savings and could be missing out on market returns. Regardless, this figure will give you a clear picture of your strengths and weaknesses and direct you to reallocating funds for your day-to-day activities more judiciously.

Goals

Napoleon Hill, the author of the timeless book Think and Grow Rich, says that you are what you say you are. I agree. The practice of speaking things into existence triggers neurochemicals that promote actions and behaviors. Your wealth design lies not only in the way that you think, but also in what you do. Most people can rank their goals out of eight choices: retirement, home purchase, education savings, cash flow management, investment management, debt reduction, insurance, and estate planning. How would you rank these eight goals for your life?

By prioritizing these goals and revisiting them on a set schedule, you’ll be able to ingrain these priorities into your head. You will recommit over and over again to carrying out the actions that will bring you closer to achieving these goals. Listing your goals is the bow that ties the Master Budget together.

• • •

You have to be your own budget police. Do your spending patterns align with your income? Does what you’re spending your money on align with your listed goals and priorities? If not, how long has this mismatch been going on, and what opportunities have you missed as a result? Don’t let it get to that place.

Your Master Budget is just words and numbers on paper if you do not follow it. For this reason, you should evaluate how your actions are aligning with your goals on an ongoing basis. By setting a routine schedule to assess your habits, you will be able to identify shortfalls quickly and recommit to and readjust your Master Budget.

Whether monthly or quarterly, set a time to update your net worth statement (your list of assets and liabilities) and evaluate your spending. These self-assessments should be milestone trackers to determine whether you are just talking the talk or actually walking the walk. The numbers don’t lie, and I am confident that if you listen to what your Master Budget is telling you, your financial circumstance will change for the better—and fast.

The good part in all of this is that at this stage of your life, time is your friend. Go now and you’ll go far.