Automotive Innovation Model and the Supply Chain: PACE Awards

Introduction

What lies behind technical change in the auto industry during the past 25 years? One approach is to look to new materials, computer-based engineering, and the availability of sensors and processing chips as key. Certainly these are enablers, but does innovation in the industry merely drive down a path opened up by such advances? Alternatively necessity is the mother of invention. After all it is costly, apropos of Thomas Edison’s comment that 99 percent of his work represented perspiration, and only a small portion inspiration. From that perspective, technology responds to perceived market opportunities. This can include “technology-forcing” regulation, and not just innovations that lower cost or meet latent consumer demand. Finally, there is the inspiration component: some innovation may come from an engineer or manager looking at a long-standing way of doing things, and spotting an alternative.

This chapter analyzes the Automotive News PACE Awards, which recognize innovation by suppliers, to get at this issue. The results indicate that technology-pull is dominant, not technology-push. We do observe some innovation that seems to represent using new materials to implement a well-understood approach that was not previously cost-effective or otherwise was not used. We also find the occasional bright idea that in some cases could have been implemented decades ago, had anyone thought to try. However, overall we find that new vehicle technologies are responses to regulatory pressure to improve safety, limit emissions, and improve fuel efficiency.

The next chapter extends this analysis with case studies of specific innovations. These highlight the shifting boundaries of the firm, as new suppliers undertake design responsibilities that previously resided “in-house” in automotive assemblers. The case studies also highlight the role of technology roadmaps as a coordinating mechanism for innovation by multiple players across the value chain.

The Automotive News PACE Awards

The award originated in discussions in 1993 to 1994 between the publisher of Automotive News, Peter Brown, and Lee Sage, a partner running consulting projects for the auto industry at Ernst & Young. Both retired years ago. They were aware of a new dynamism at automotive suppliers, from spinoffs, mergers and acquisitions to a growing role in bringing new technology to the industry. To reach this target market they explored sponsoring a management competition. The PACE award that they developed recognizes an innovation developed by one or more suppliers. The first awards were given out in April 1995. Now entering its 23rd year, the award is today well recognized in the supplier world, in the United States, Europe, and more recently in Asia.

Winners of the award are chosen by a panel of unpaid, independent judges. Firms must apply to be considered for an award, providing details on a specific innovation. In early Fall, a subset of the judges chooses a group of about 30 finalists on the basis of applicants’ paper submissions. Each finalist is then visited by two of the judges who typically sit through presentations of the development process, the technology of the innovation, a benchmarking analysis against competitive technologies, the business case for developing the technology, and the benefits their innovation provides to their customers. This typically occurs at the relevant factory or R&D center. All of this takes place under a nondisclosure agreement. The judges also contact at least two outside references on a confidential basis, typically customers of the supplier who are buying or considering adapting an innovation to verify the claims and competitive analysis provided by the finalist in the site visit. They then prepare a written report, which is distributed to the full panel of judges, who then meet as a group to collectively choose award recipients. The awards themselves are presented at the start of the Society of Automotive Engineers (SAE) convention, replete with video presentations on each innovation.

The Award Criteria

Awards are given for an innovation, not to a firm per se. Firms can apply jointly with other suppliers, and different divisions of the same firm may apply with separate innovations in the same year. Innovations need not be physical products, but can be software or machine tools. Process innovations can be ones used by themselves or other suppliers. PACE considers innovations relevant to the trucking industry and not just for passenger cars, but in general does not consider innovations relevant only to dealers or repair shops. However, the innovation must have been developed primarily by a supplier or group of suppliers, and not by an automotive or truck assembler. Similarly, it needs to be recent. Suppliers cannot apply retroactively for innovations that are now standard across the industry. There are three key criteria:

Innovative

Has it been seen before? Suppliers can document this through patents, the benchmarking of competitors and through customer references. Every significant supplier will compete for the business of a BMW or a Ford. Part of the job of OEM development engineers is to know the state of the art, and what alternatives suppliers around the world have to offer. Because of the multiple criteria, innovations that depend upon trade secrets rather than patents can and do win PACE awards.

Uptake

Has it been sold? Many innovations never make it to market, but the purpose of the award is to recognize contributions to the state of the art. Judges thus require that an innovation be “on the road” or, when it is for a process or machine tool, in use at a customer. A contract with a near-term start of production (SOP) is generally not sufficient, and in practice many winners have “booked” business from multiple customers by the time of the award.

Does it “change the name of the game?” Are competitors being forced to respond, has the supplier won substantial new business, does it result in large cost savings? Is it a one-off invention, or does it open up a new approach amenable to subsequent extensions and refinements?

All of these criteria involve judgment. Few ideas have no commercial antecedents; novelty is a matter of degree. Sometimes the innovation has been adopted by only one customer, but the judges believe it represents a fundamental advance that the entire industry will follow. More frequently, the judges are looking at “Gen I” of an innovation that has just been launched on a new car model, but “Gen II” has already sold for use on a later model and the supplier is showing third-generation concepts to potential customers. An innovation may be novel and have an array of customers, but still not win because other finalists are stronger across one or more dimensions.

Examples

Here are select examples of PACE finalists designed to illustrate the range of new technologies

A) 2006: StARS Micro-Hybrid system. StARS, developed by the French supplier Valeo Electrical Systems, is a belt-driven motor/generator that replaces a conventional alternator. The system allows the engine to be turned off automatically when the car stops and to be restarted when the brake pedal is released. It brings a fuel saving of 6 to 20 percent in city driving. Initial commercial uptake was on smaller platforms in Europe. After much further development, it is now being widely implemented on cars of all sizes, including SUVs.

B) 1999: Radiant Floor Construction Paint Oven. Dürr Industries, a capital equipment supplier with operations in 28 countries, developed an oven design that uses the floor as the main source to provide controlled radiant heat. This results in a 10 percent savings in the cost of a new oven and operating savings in the most energy intensive part of an assembly plant.

C) 2008: Piezo Direct Injection System. The system developed by Continental, a Germany supplier that is also a major tire manufacturer, improves the response time and precision with which gasoline can be injected into a cylinder. This improves combustion control, allowing both better efficiency and lower emissions. This can result in fuel savings of up to 20 percent, with a consequent reduction in CO2 emissions, and a 40 percent reduction in hydrocarbon emissions from poorly burned fuel. The fast response time doubles the rpm range that these injectors engine can handle.

D) 2016: Inverter Power Device for Electrified Vehicles. Delphi, an American supplier that began as a division of General Motors and is today a global supplier. Engineers in Kokomo Indiana worked with Delphi’s semiconductor suppliers to modify a power chip to allow two-sided water cooling. This allowed reducing the cost, size, and weight of the unit that does the conversion between alternating and direct current for running the drive motors and charging the batteries for electric vehicles. This is an enabler for lower-cost, higher-range battery electric vehicles.

E) 2016: Full Display Mirror: In 1995 Gentex was a young Michigan company with $100 million in sales; in 2016 it was a $1.5 billion multinational corporation. The CEO invented an automatic dimming rearview mirror in 1982 and gradually expanded functionality while lowering costs. All increased market uptake. The 2016 PACE winner innovation uses a camera to provide the rearview, allowing a full field of vision and improved contrast over a mirror.

F) 2012: Cut-to-fit wheel weights and robotic balancing system. This automated wheel balancing system uses robots to attach a magnetized, weighted adhesive tape to a wheel. In final assembly, this innovation replaces manual steps and individual lead weights while improving the quality of the balancing. It was developed by an individual inventor, and was commercialized by 3M Automotive Division and Esys Automation.

G) 2006: Monosteel Piston. Federal-Mogul developed a piston for high-compression diesel engines that is welded from two separate pieces. It responds to a trend toward higher pressures used to meet emissions and higher fuel efficiency targets. The piston case is also a good example of the long rollout process for certain types of technologies. Engines may remain in production for 8 to 10 years, and also require a longer time to develop than a car. So even if a customer decides to use this piston design, it can be several years before the first engine is produced. In this case, while the first launch of the “Monosteel” was in 2003, it was only in 2009 that a third customer entered production, and only in 2010 did output first surpass 1 million units. Many more customers will launch during 2016 to 2018, some 15 years after low-volume production commenced.

Analysis Approach and Data Issues

There are many approaches to analyzing innovation. One is to use patent data. This suffers from several defects. Some innovations are never patented, sometimes because they would be outdated by the time a patent would be issued, sometimes because firms wish to keep production technologies or other key features secret. Patents thus miss many innovations. Most patents are never commercialized, or many are purely defensive in nature. Patent data thus include many observations that do not in fact represent innovations.

The PACE data likewise have strengths and weaknesses. Firms must apply, and pay an application fee, so the sample is small and non-random. The competition began in the United States and as a practical matter was expanded in stages to include Europe, and then extended to the global industry. It is likely that Japanese suppliers in particular are under-represented. As the Award has gained wider recognition, the judges believe the applicant pool became stronger. One strength is that the competition includes a wide array of technologies, includes products that involve multiple technologies but are not themselves patented, and innovations that build upon trade secrets that firms have therefore chosen not to patent. Furthermore, because the award criteria include the impact of an innovation, suppliers have already self-selected to bring forward innovations that they believe are important. Unlike with patent data, the data thus exclude innovations that are trivial or were never commercialized.

Findings

In the end, we focused on three drivers of innovation: safety, emissions, and fuel efficiency. Innovations could potentially contribute to more than one: a new steel could allow for both better safety and lower weight and hence also enhance fuel efficiency. We also noted innovations that were made at the request of a customer, as well as ones that appeared to reflect a one-off invention rather than a systematic R&D process, and innovations that were reflected in, and directed toward, a roadmap of current and anticipated regulation of safety, emissions and fuel efficiency. We discuss the latter at greater length in Chapter 7.

The dataset is modest in size, with 567 finalists to date through April 2016. However, in any given year there are no more than 36 finalists, and for the earlier years only 20 or so. That limits the analysis to trends over time. For our analysis, we have categorized each innovation across a set of criteria. Was the primary benefit to customers a cost savings, or a weight savings, or new functionality? Did it involve new materials, or new chemistry? Did it contribute to safety, or solve an environmental issue through the elimination of heavy metals or a reduced waste stream in the production process? While we have tried to make that judgment on the basis of public information, one of the authors is a PACE judge and so this categorization inevitably reflects knowledge gained through confidential discussions and reports. Our analysis is thus structured to keep the categorization of any particular innovation confidential. We also exclude the first 3 years, when there were very few finalists.

General Trends: Enablers

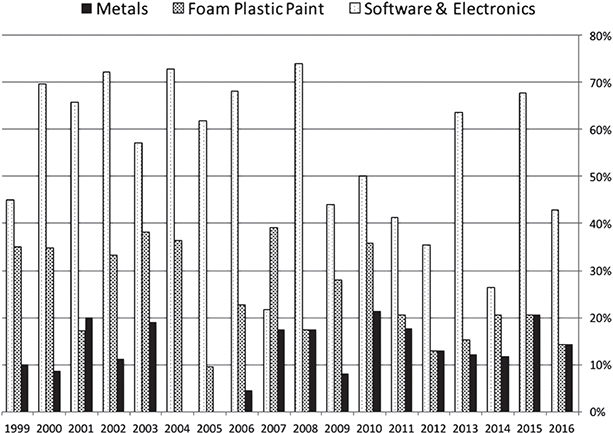

First, we find no clear patterns for enabling technologies. For example, by the time the competition commenced in 1995, computerized engineering tools were already widespread. Although the sophistication of the software is now much greater, as discussed in Chapters 8 and 9, it thus proved impossible to categorize innovations as fundamentally enabled by the new digital engineering tools. Similarly, new paints and adhesives, new plastics, and new metals were by 1999 already affecting the innovations being adopted in the auto industry. No trends are apparent (Figure 6.1).

General Trends: Policy Drivers

There are three main policy drivers of automotive innovation. One is improved safety. This has many components, from better visibility and measures designed to keep drivers alert, to innovations that improve braking and handling, accident avoidance systems, crush zones to absorb energy and lower the g-forces in a crash, and stronger passenger compartments that lessen intrusions. A second is lower tailpipe emissions of particulates and other elements of incomplete combustion, as well as NOx compounds. A third is increased fuel efficiency, which with a diesel or gasoline engine is synonymous with lower CO₂ emissions.

Figure 6.1 PACE Finalist Analysis: Enabling Technologies

These mandates are in tension with one another. The easiest way to make a car more fuel efficient is to make it lighter. That however runs counter to safety, as the easiest way to improve performance in a crash is to make a car larger and heavier. Emissions involve other tradeoffs: an engine that burns fuel more efficiently will produce different sorts of pollutants, such as higher levels of NOx.

These regulations evolve slowly, and targets are announced many years before they are effective to give manufacturers time to develop vehicles that can meet new requirements. Current-generation vehicle technologies already result in very low levels of NOx emissions, but that then constrains what can be done with combustion improvements. There are many other tradeoffs, as illustrated in Figure 6.2 from a supplier of engine components.

Figure 6.2 Regulatory Drivers: Macro Trends in Engines

The analysis of PACE innovations shows that regulatory drivers have become more important over time. Through 2005 about one-third of PACE finalists were nominated for innovations that contributed to savings in weight or direct gains in fuel efficiency, for innovations that reduced emissions, and for safety innovations. From 2011, however, that rose to three-fourths of all finalists (Figure 6.3).

PACE innovations bring a wide array of other benefits. These include features that appeal directly to consumers, such as LED lighting and digital displays, and of course more recently navigation systems and infotainment features. Other innovations improve handling, reduce noise or give a smoother ride, addressing the issues of NVH (noise–vibration–handling). Finally, PACE has seen many process innovations that lessen toxic materials that require special handling and disposal, such as unused paint or heavy metals such as chrome and lead (Figure 6.4).

The Innovation Process

Two further findings relate to the innovation process.

Figure 6.3 PACE Finalist Analysis: Benefits from Innovation

Figure 6.4 PACE Finalist Analysis: Miscellaneous Benefits

One is the rise of interfirm collaboration, both with other suppliers and with OEMs and other customers. Some innovations represent the commercialization of a request from a car company. Of course if the judges believe that most of the ideas came from the OEM customer, then it may be viewed as good engineering but the supplier may not receive an award. But sometimes it is an idea that an OEM has but which they are not convinced is feasible, or do not know how to actually implement—car company engineers have long wish-lists. Good suppliers listen to their own suppliers as well, and may work with them to implement one of their ideas. More generally, however, as suppliers undertake a wider range of innovation and the role of car companies moves more toward a coordinator or integrator, they need to be able to address the interdependencies of a vehicle as a system. In addition, innovations themselves frequently involve an array of mechanical and electronic features, and are contingent on developing new methods of manufacturing. Suppliers routinely form teams crossing firm boundaries to meet these challenges.

The second is the rise of systematic innovation, and the decline of individual invention, whether internal to an existing supplier or in the form of an engineer working in their garage to develop an idea and then finding a parts supplier who will help commercialize it. An example is the tire balancing system noted above. While such examples continue to show up in the PACE process, for the past decade they have been infrequent. In contrast, what we see are companies that are the repeated PACE finalists, such as Delphi, which through 2016 has had a representative on the award ceremony stage 62 times. Figure 6.5 represents an attempt to categorize innovations that came from a systematic innovation process, and those that furthermore were following a roadmap of where technology was going. Some are a reflection of the external regulatory mandates discussed above. Others, such as paints or adhesives, reflect product and process improvements that the industry has long sought, and where modern polymer chemistry and process controls are allowing improvements to finally be attained (Figure 6.3).

Figure 6.5 Cross-Firm Collaboration

Conclusion

The PACE process provides examples, from software to microlevel process control, of the flood of innovations that the auto industry has commercialized over the past quarter century. In actual practice, vehicles are today a high-tech industry. Suppliers are central to that process. From a world in which into the 1980s some suppliers merely “produced to [blue]print,” it is now one dominated by teams of engineers. We trace that in further detail in subsequent chapters.