The starting point for calculating or understanding any adjustments is the trial balance, which is a summary of “T” accounts that are underpinned by double entry bookkeeping. You will have studied double entry, but for most accounting students it is difficult to remember as they are not practicing accountants. Instead, in the following examples and in the case studies, we begin from the trial balance and examine the impact of the adjustments on the financial statements.

Before the financial statements for the year end can be prepared, some year-end adjustments will need to be made. These year-end adjustments are required in order to satisfy the accruals concept in the preparation of financial statements. The accruals concept requires that:

•All income and expenditure must be MATCHED to the relevant accounting period.

•Going concern—that is the business will operate into the foreseeable future.

There are two broad categories of adjustments:

•When we pay or receive cash BEFORE the expense or revenue is recorded: this category includes prepaid or deferred expenses (including depreciation), and unearned revenues or deferred revenues.

•When cash is paid or received AFTER the expense or revenue is recorded: this category includes accrued expenses and accrued revenues.

Accrued expenses occur when a business had the benefit of something such as heat and light in one accounting period but will not account for it until the next period.

Accruals have the following impact:

A)Increase the expense or purchases which are shown on the income statement.

B)The change/increase in expenses or purchases is shown as a current liability in the liabilities and owners’ equity section of the balance sheet.

Calculation of Accruals

1. “Full Accrual”

This usually occurs when the business has not received an invoice for the service such as legal by the time the financial statements are drawn up, and that expense has not been included in the trial balance.

For Example:

Cool Cupcakes has called on the services of its business lawyers several times during the year just ended. The trial balance includes a balance of $27,000 in the Legal Fees account.

At the year end, the management of the store tells their accountant that they have not yet received a bill of costs for some work done by the lawyers a month ago. They estimate the bill to be $5,000.

Therefore, The Accrual Is $5,000.

A figure of $32,000 ($27,000 + $5,000) will appear on the income statement, and the accrual of $5,000 will appear in the liabilities and owners’ equity section of the balance sheet.

Again this occurs due to late invoices usually after the year end; however, they stagger the year end and will have to be calculated.

For Example:

The year end for Cool Cupcakes is the 31 March 2017 and they receive an electricity bill for $600 for the quarter-ended/3 month period—30 April 2017:

Electricity was used in February and March 2017 of the 3-month quarter but was not paid because the invoice was received after the yearend probably in May 2017 so is an accrued expense. We do not need to worry about April 2017 because the electricity that was used in April 2017 will be paid during the year.

Two months accrued and one month (ignore – into new accounting period)

Thus, we will apportion the 3-month period and the accrual will be:

2/3 x $600 = $400

This $400 will be treated just the same as before—see full accrual.

3.2 Prepaid (Deferred) Expenses

Prepaid expenses occur when a business has accounted for a good or service in advance during one accounting period but does not get the benefit of all or some of what it has accounted for until the next period.

Prepayments have the following impact:

A)The relevant expense accounted, for example, rent is reduced, so that it records the correct amount of “benefit” used in the accounting period. This is shown in the income statement.

B)An asset account is created on the balance sheet in current assets because the business has accounted for certain sums in advance and can look forward to receiving the benefit in the next accounting period.

For Example:

SHU Clubbing has paid $30,000 rent for its business premises. The rent was accounted for on the 1 October, 2017 for 12 months in advance.

SHU Clubbing has an accounting year end of 31 December 2017.

The trial balance shows that SHU Clubbing has paid $30,000 of rent in the accounting year. However, SHU Clubbing should only be paying rent in the present accounting period for the 3 months of October, November, and December 2017. The remaining nine months should be accounted for in the next accounting period.

Thus:

9/12 × $30,000 = $22,500 is the prepayment.

A figure of $7,500 ($30,000 – $22,500) will appear on the income statement and the prepayment of $22,500 will be recorded as a current asset on the balance sheet.

3.3 Accounts Receivable and Bad Debt Expense

Accounts receivable are customers who owe money to the business as they purchase goods or services on credit, and the total of these amounts is shown in the “receivables” account. This is an asset account.

Some receivables will never pay monies owed to the business. When this is known with certainty, this is known as a bad debt expense which may be written off during the accounting year. If this is the case, there will already be a bad debts expense accounted for in the trial balance, and no adjustment is required. However, the business may also need to carry out further year-end adjustments as a review is made of the debts owed to the business. The two methods for calculating the amount of bad debts expense:

•Direct write-off method

•Allowance method

Direct Write-Off Method:

A)Additional bad debts will be shown as an expense on the income statement.

B)The total in part a will be deducted from the receivables figure in current assets on the balance sheet.

For example:

Loreto Inc. has a balance on its receivables account of $7,000. At the year end, it is discovered that one of its trade customers has been declared bankrupt, owing $360.

The trial balance will show that $7,000 is owing to Lotto Inc. but the company knows $360 of that will never be paid.

The receivables asset account on the balance sheet must be reduced to $6,640 (i.e., $7,000 – $360)

The bad debt expense itself will be shown as an expense account on the income statement.

Allowance Method:

A doubtful debt occurs when a business is cautiously providing for the possibility that a debt or debts may not be paid. A doubtful debt differs from a bad debt in that the business is not writing off the debt completely.

There are two ways of “being doubtful” about debts:

A)Specific doubtful debts: A business may know that a particular receivable is in trouble financially and make the necessary provision

B)General doubtful debts: Experience tells them that a business may not have any information on a specific receivable but knows that the market generally is not doing well and wants to make a general provision for a certain percentage of its receivables who are not expected to pay. For example, it is estimated that 5% of its receivables may not pay.

A business may choose to make specific or general or both provisions.

The impact on the financial statements is:

1.The provision for doubtful debts will appear as an expense and is adjusted accordingly.

2.The provision for doubtful debts is a liability and will be deducted from the receivables figure in the current assets section of the balance sheet.

For example:

Chill Fashion Inc. is a new business. Chill’s first accounting period is “Year 1.”

Year 1: At the end of Year 1, Chill Fashion’s receivables amount to $101,000. It believes that Rude Boy Inc., one of its customers, is on the brink of insolvency. It is unlikely that Rude Boy will pay its outstanding invoice of $1,000. Thus, Chill will make a SPECIFIC provision for doubtful debts for this $1,000.

In addition, Chill Fashion decides that it is likely that 1.5% of the remaining debts may never be paid (i.e., ($101,000 – $1,000 = $100,000 x 1.5% = $1,500). Chill therefore wishes to create a GENERAL provision of $1,500 for doubtful debts.

The total provision for doubtful debts at the end of Year 1 is $2,500 ($1,500 + $1,000).

As Chill Fashion is a new business, there has been an increase of $2,500 from $0 which must be shown as an expense on the income statement and $2,500 will be deducted from receivables on the balance sheet.

Year 2: It is decided that the provision should now be $3,000. There has been an increase of $500 and will be shown as an expense on the income statement and added to the bad and doubtful debts expense and $500 will be taken away from receivables.

Year 3: It is felt that business conditions are improving and the provision should be reduced by $2000. Thus the bad and doubtful debts expense will be reduced by $2,000 and it shows as $1,000, and $2,000 will added back to receivables on the balance sheet.

3.4 Depreciation

A fixed asset may have a useful life for several years, after which it may be of little or no value. Depreciation is the mechanism used in the accounts to deal with this decline in value and this cost is spread over the useful life of the asset.

There are other methods for calculating depreciation but two most common are straight-line or declining balance. Either method is acceptable but must be used consistently over the life of the asset unless a change improves the quality of the financial statements.

The annual depreciation expense will be shown in the income statement and the accumulated depreciation on the balance sheet.

PLEASE NOTE! LAND IS NEVER DEPRECIATED

Straight-Line Method

A)Spreads the depreciation charge evenly over the life of the asset and gives rise to the same charge for depreciation each year.

Formula for annual depreciation charge:

A)Cost—Residual value/No. of years of useful economic life

(Residual Value is the value at the end of the useful economic life of the asset which can be 0/zero)

B)Or a percentage will be given, say 25%; therefore, take 25% of the cost of the asset and apply accordingly.

Cost $6,000

Net realizable value $0

Useful economic life 5 Years

Annual depreciation charge:

($6,000 – $0) = $1,200 or 20% annually – (6,000 x 0.20 = 1,200) see the table that follows:

Notes:

1.This figure will be picked up from the trial balance—it is the original cost of the asset.

2.During the first year, the bfd/brought forward accumulated depreciation is always zero/0. It can also be found on the trial balance.

3.This is the depreciation expense and will appear on the income statement.

4.The cfd/carry forwards are calculated by adding the bfd and charge for the year and will become the bfd in the subsequent year. This cfd will appear on the balance sheet.

5.The net book value/NBV is calculated by deducting the total cost of the asset from the cfd accumulated depreciation and will also appear on the balance sheet.

The depreciation charge each year is expressed as a percentage of the declining balance i.e., The NBV of the asset.

Example:

Cost $ 6,000

20% declining balance per annum—see the table that follows.

Notes:

1.As this is the first year, the charge will be 6,000 x 0.20 = $1,200

2.4,800 x 0.20 or (6,000–1,200) x 0.20

3.3,840 x 0.20 or (6,000–2,160) x 0.20

4.3,072 x 0.20 or (6,000–2,928) x 0.20

5.2,458 x 0.20 or (6,000–3,542) x 0.20

Just as before, the cost/cfd/nbv appears on the balance sheet and the expense is disclosed on the income statement.

Since the declining balance method results in bigger depreciation expenses near the beginning of an fixed asset’s life and smaller depreciation expenses later on, it makes sense to use this method with assets that lose value quickly.

Addition and Disposal of Fixed Assets

Regardless of which ever method we use for calculating depreciation, additions and disposals are calculated in the same manner. When an addition to fixed assets is made, it will lead to an increase in cost and accumulated depreciation. Similarly a disposal of a fixed asset will cause a reduction in the cost and accumulated depreciation and will result in a gain or loss on disposal.

Example:

Cost $6,000

Net realizable value $500

Useful economic life 4 years

There was an addition in Year 2 of an asset costing $1,000, $0 residual value, and was depreciated at 25% per annum.

The original asset was disposed of in Year 3 for $3,000 and depreciation was not charged in the year of disposal. Straight-line depreciation is used.

See the table that follows

1.Original asset depreciated at 6,000 – 500 = 5,500/4 = 1,375 per annum

2.Addition 6,000 + 1,000 = 7,000

3.New asset depreciation 1,000 x 0.25 = 250

Original asset depreciation = 1,375

Total = 1,625

4.Original asset disposed 7,000 – 6,000 = 1,000

5.Original accumulated depreciation to date must be removed 1,375 x 2 = 2,750

6.3,000 + 250 – 2,750 = 500

NB gain or loss on disposal – proceeds – NBV of original asset

Proceeds 3,000

NBV 6,000 – 2,750 (accumulated depreciation to date) = 3,250

Loss on disposal 3,000 – 3,250 = 250 and will be treated as an expense on the income statement, and if it had been a gain, it would be shown as an addition on the balance sheet under owners’ equity.

3.5 Closing Inventory

This is the business’s remaining inventory as at the year end. It includes raw materials, work-in-progress, or finished goods and is deducted from the cost of sales on the income statement and shown as a current asset on the balance sheet.

At the end of each period (month or year), a company should do a physical inventory count to determine the amount of inventory on hand. Then the company needs to place a value on the goods. There are three methods for inventory valuation: weighted-average cost method; First-In-First-Out, or FIFO; and Last-In-First-Out, or LIFO. U.S. GAAP allows all three methods to be used, and the following example will demonstrate all three methods.

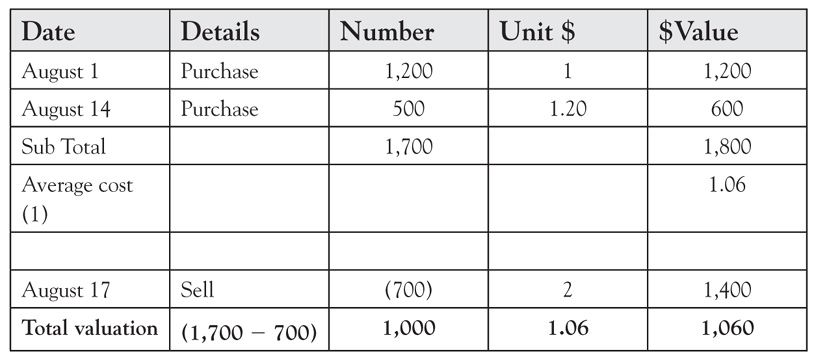

Jody runs a candy shop. She enters into the following transactions during August:

August 1: Purchases 1,200 candy bars at $1 each.

August 14: Purchases 500 candy bars at $1.20 each.

August 17: Sells 700 candy bars at $2 each.

How many candy bars does she have at the end of the month?

1,200 + 500 – 700 = 1,000 candy bars.

Jody must value her closing inventory of candy bars.

First-In-First-Out or FIFO

This method assumes that the first inventories bought are the first ones to be sold, and that inventories bought later are sold later.

Using the First-In-First-Out method, our closing inventory comes to $1,100. This equates to a cost of $1.10 per candy bar ($1,100/1,000 candy bars).

Food companies or those that trade in other goods that have a limited shelf life use FIFO because the earlier goods need to be sold before they pass their sell-by date.

This method assumes that last inventories bought are the first to be sold and that inventories bought first are sold last.

Using the Last-In-First-Out method, our closing inventory comes to $1,000. This equates to a cost of $1.00 per candy bar ($1,000/1,000 candy bars).

Weighted-Average Cost Method

This method assumes the company will sell all their inventories simultaneously. The weighted-average cost method is mostly used in manufacturing businesses, where inventories are piled or mixed together and cannot be differentiated, such as chemicals and oils. For example, chemicals bought three months ago cannot be differentiated from those bought yesterday, as they are all mixed together. Thus we work out an average cost for all chemicals that the company possesses. The method specifically involves working out an average cost per unit at each point in time after a purchase.

Notes (1) 1,800/1,700 = 1.06 (2dp)

3.6 Unearned (Deferred) Revenue

Deferred revenue, or unearned revenue, is advance invoicing for products or services that are to be delivered in the future. The beneficiary of such prepayment recognizes unearned revenue as a liability on a balance sheet, because it refers to revenue that has not yet been earned, but represents products or services that are owed to a customer. As the product or service is delivered over time, it is recorded as revenue on the income statement.

Unearned revenue is recorded as an obligation on the balance sheet of a company that receives advance payment, because it owes its customers services or products. Examples of unearned revenue are rent payments made in advance, prepayment for newspapers subscriptions, annual prepayment for the use of software, and prepaid insurance.

Example:

Consider an IT company that receives $3,000 in advance payment at the beginning of its fiscal year from a customer for annual IT Support. Upon receipt of the payment, the company’s bank will increase by $3,000, and $3,000 recorded as deferred revenue. As the fiscal year progresses, the company invoices the customer $250 per month. By the end of the fiscal year, the entire deferred revenue balance of $3,000 is reversed and is booked as revenue on the income statement.