Applying the Major Adjustments

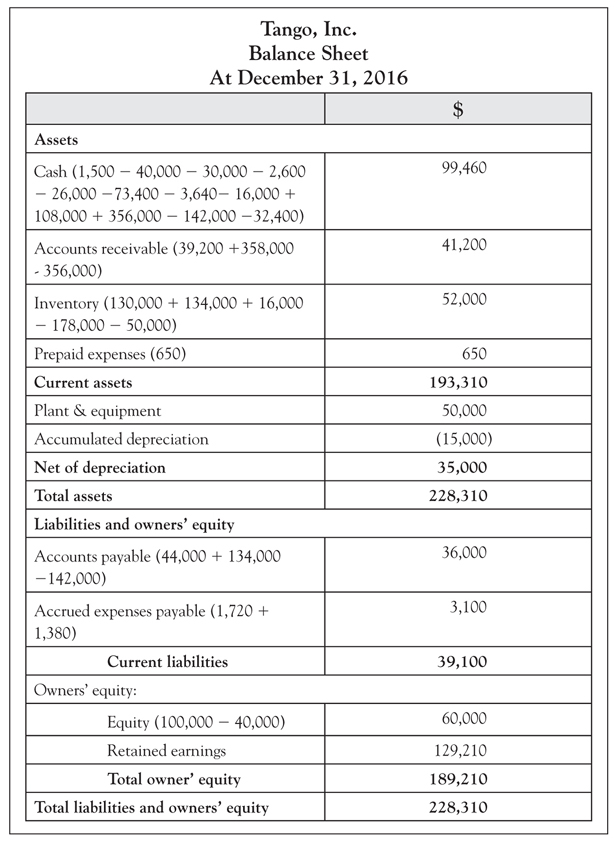

Solution (NB: I/S: Income statement; B/S: Balance sheet)

Workings

The 2016 workings will be discussed:

1.The owners withdrew equity in the form of cash of $40,000:

Minus bank |

$40,000 |

Minus equity |

$40,000 |

2.Premises continued to be rented at an annual rental of $40,000. During the year, rent of $30,000 was paid:

3.Insurance on the premises were paid during the year as follows: for the period April 1, 2016 to March 31, 2017 of $2,600:

4.A second piece of plant and equipment was bought on January 1, 2016 for $26,000. This is expected to be used in the business for four years and then be sold for $6,000:

5.Wages totaling $73,400 were paid during the year. At the end of the year, the business owed $1,720 of wages for the last week of the year.

6.Electricity bills for the first three quarters of the year and $1,240 (for the last quarter) of the previous year were paid, totaling $3,640. After December 31, 2016 but before the financial statements had been finalized for the year, the bill for the last quarter arrived showing a charge of $1,380.

7.The prepaid expenses of $10,600 consisted of insurance ($600) and rent ($10,000) are BFD balances.

8.The accrued expenses of $2,500 comprised of wages ($1,260) and electricity ($1,240) are BFD balances.

9.Inventories totaling $134,000 were bought on credit:

Credit purchases of $134,000 — Add to payables on B/S and add to inventory on B/S

10.Inventories totaling $16,000 were bought on cash:

Cash purchases of $16,000 — Deduct from cash B/S and add to inventory on B/S

11.Sales revenue on credit totaled $358,000 (cost $178,000):

12.Cash sales revenue totaled $108,000 (cost $50,000)

13.Receipts from receivables account totaled $356,000:

Receipt of $356,000 — Add to bank on B/S and minus receivables on B/S

14.Payments to payables account totaled $142,000:

Payment of $142,000 — Minus bank on B/S and minus payables on B/S

15.Machine running expenses paid totaled $32,400.

Payment of $32,400 — Minus bank on B/S and show on I/S

INCOME STATEMENT:

STATEMENT OF RETAINED EARNINGS:

CASHFLOW STATEMENT (DIRECT METHOD):

CASHFLOW STATEMENT (INDIRECT METHOD):

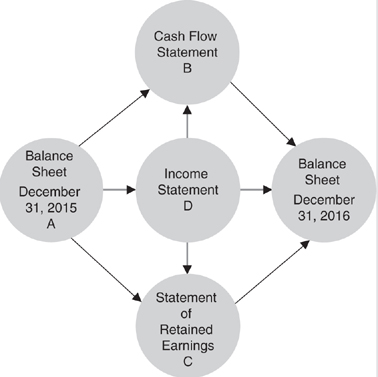

How the financial statements are inter-related:

We have just calculated the following balances based on the aforementioned financial statements:

A: Balance sheet December 31, 2015

Cash $1,500

Retained earnings $53,800

Prepaid expenses $10,600 consisted of insurance ($600) and Rent ($10,000)

Accrued expenses $2,500 comprised of wages ($1,260) and electricity ($1,240)

The beginning cash balance feeds into the cash flow statement including the opening retained earnings figure that appears on the statement of retained earnings. The brought forward prepaid and accrued expenses will flow into the income statement as they will affect the figures shown on the income statement.

B: Cash flow statement December 31, 2016

Closing cash of $99,460 flows into the balance sheet at December 31, 2016.

C: Statement of retained earnings December 31, 2016

Closing retained earnings of $129,210 flows into the balance sheet at December 31, 2016.

D: Income statement December 31, 2016

Prepaid expense insurance ($600)

Accrued expenses of $3,100 comprised of wages ($1,720) and electricity ($1,380)

The carry forward prepaid and accrued expenses used to adjust the income statement figures will be shown on the balance sheet.

Net income of $75,410 flows into the statement of retained earnings.

The aforesaid has been summarized in following diagram which will be replicated when the new accounting year begins, in this case January 1, 2017: