CHAPTER 8

Option Hedging

As we noted in Chapter 1, the Chicago Board of Trade was established to provide farmers, dealers, and food processors a way of hedging against price risk by entering forward contracts to buy or sell a commodity at a future date at a price specified today. While futures contracts enable businesses, farmers, and other economic entities to hedge the costs or revenues from unfavorable price movements, they also eliminate the benefits realized from favorable price movements. One of the differences of using options instead of futures contracts as a hedging tool is that the hedger, for the price of the option, can obtain protection against adverse price movements while still realizing benefits if the underlying asset moves in a favorable direction. Some of the important uses of options in hedging are from purchasing stock, index, futures options, and OTC put options as a way of attaining downside protection on the future sale of a portfolio, currency, bond, or commodity and by purchasing call options as a strategy for capping the costs of future purchases. In this chapter, we examine hedging equity, commodity, currency, and fixed‐income positions with spot and futures options.

Hedging Stock Portfolio Positions

Creating a Floor for a Stock Portfolio Using Index Options

An equity portfolio insurance strategy is a hedging position in which an equity portfolio manager protects the future value of her fund by buying spot or futures index put options. The index put options, in turn, provide downside protection against a stock market decline, while allowing the fund to grow if the market increases. As an example, consider an equity fund manager who on May 27, 2016, planned to sell a portion of a stock portfolio in mid‐August to meet an anticipated liquidity need. Suppose the portfolio the manager planned to sell was well‐diversified and highly correlated with the S&P 500, had a beta (β) of 1.25, and currently was worth V0 = $100 million. On May 27, the spot S&P 500 was at 2,100. Suppose the manager on that date expected a bullish market to prevail in the future with the S&P 500 rising. As a result, the manager would have been hoping to benefit from selling her portfolio in August at a higher value. At the same time, though, suppose the manager was also concerned that the market could be lower in mid‐August and did not want to risk selling the portfolio in a market with the index lower than 2,100. On May 27, an August S&P 500 put option with an exercise price of 2,100 and multiplier of 100 was trading at 54.40. As a strategy to lock in a minimum value from the portfolio sale if the market decreased, while obtaining a higher portfolio value if the market increased, suppose the manager set up a portfolio insurance strategy by buying August S&P 500 2,100 puts. To form the portfolio insurance position, the manager would have needed to buy 595.2381 August S&P 500 puts (assume perfect divisibility) at a cost of $3,238,095:

Exhibit 8.1 shows for spot index values ranging from 1,860 to 2,460, the manager’s revenue that would have resulted from selling the portfolio at the option’s August expiration date and closing her puts by selling them at their intrinsic values. Note, for each index value shown in Column 1, there is a corresponding portfolio value (shown in Column 4) that reflects the proportional change in the market given the portfolio beta of 1.25. For example, if the spot index were at 1,860 at expiration, then the market as measured by the proportional change in the index would have decreased by 11.43% from its May 27 level of 2,100 (−0.1143 = (1,860 − 2,100)/2,100). Since the well‐diversified portfolio has a beta of 1.25, it would have decreased by 14.29% (β (%Δ S&P 500) = 1.25(−0.1143) = −0.1429), and the portfolio would, in turn, have been worth only $85,714,280—85.714% of its May 26 value of $100 million. Thus, if the market were at 1,860, the corresponding portfolio value would be $85,714,286 (= (1 + β (%Δ S&P 500)V0 = (1 + 1.25(−0.1143)($100,000,000))). On the other hand, if the spot S&P 500 index were at 2,460 at the August expiration, then the market would have increased by 17.14% (= (2,460 − 2,100)/2,100) and the portfolio would have increased by 21.43% (=1.25(0.1714)) to equal $121,428,571 (=1.2143 ($100,000,000)). Thus, when the market is at 2,460, the portfolio’s corresponding value is $121,428,571. Given the corresponding portfolio values, Column 5 in Exhibit 8.1 shows the intrinsic values of the S&P 500 put corresponding to the spot index values, and Column 6 shows the corresponding cash flows that would be received by the portfolio manager from selling the 595.2381 expiring August index puts at their intrinsic values. As shown in the exhibit, if the spot S&P 500 is less than 2,100 at expiration, the manager would have realized a positive cash flow from selling her index puts, with the put revenue increasing proportional to the proportional decreases in the portfolio values, providing, in turn, the requisite protection in value. On the other hand, if the S&P 500 spot index is equal to or greater than 2,100, the manager’s put options would be worthless, but her revenue from selling the portfolio would be greater, the greater the index. Thus, if the market were 2,100 or less at expiration, the value of the hedged portfolio (stock portfolio value plus put values) would be $100 million; if the market were above 2,100, the value of the hedged portfolio would increase as the market rises. Thus, for the $3,238,095 cost of the put options, the fund manager would have attained on May 27 a $100 million floor for the value of the portfolio in mid‐August, while benefiting with greater portfolio values if the market increased.

| Portfolio Hedged with S&P 500 Index Puts; Portfolio: Initial Value = $100,000,000, β = 1.25; S&P 500 Put: X = 2100, Multiplier = 100, Premium = 54.40; Hedge: 595.2381 Puts; Cost = (595.2381)(54.40)($100) = $3,238,095 Short S&P 500 Call: X = 2100, Multiplier = 100, Premium = 24.10; Hedge: 595.2381; Revenue = (595.2381)(24.10)($100) = $1,434,524 Range Forward: Long 595.2381 Put Contracts and Short 595.2381 Call Contracts; Net cost = $3,328,095 − $1,434,524 = $1,893,571 |

|||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| S&P 500 at T, ST | Proportional Change in S&P 500: g = (ST − 2100)/2100 | Proportional Change in Portfolio: βg = 1.25g | Portfolio Value: VT = (1+βg)$100m | Put Value PT = IV = Max[2100 − ST,0] | Value of Puts: CF = (595.2381)($100) (IV) | Hedged Portfolio Value | Short Call Value: IV = Max[ST − 2310,0] | Value of Short Call: 595.2381(100)IV | Ranged Forward: Hedged Portfolio Value = (4) + (6) − (9) |

| 1860 | −0.1143 | −0.1429 | $85,714,286 | 240 | $14,285,714 | $100,000,000 | $0 | $0 | $100,000,000 |

| 1890 | −0.1000 | −0.1250 | $87,500,000 | 210 | $12,500,000 | $100,000,000 | $0 | $0 | $100,000,000 |

| 1920 | −0.0857 | −0.1071 | $89,285,714 | 180 | $10,714,286 | $100,000,000 | $0 | $0 | $100,000,000 |

| 1950 | −0.0714 | −0.0893 | $91,071,429 | 150 | $8,928,571 | $100,000,000 | $0 | $0 | $100,000,000 |

| 1980 | −0.0571 | −0.0714 | $92,857,143 | 120 | $7,142,857 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2010 | −0.0429 | −0.0536 | $94,642,857 | 90 | $5,357,143 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2040 | −0.0286 | −0.0357 | $96,428,571 | 60 | $3,571,429 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2070 | −0.0143 | −0.0179 | $98,214,286 | 30 | $1,785,714 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2100 | 0.0000 | 0.0000 | $100,000,000 | 0 | $0 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2130 | 0.0143 | 0.0179 | $101,785,714 | 0 | $0 | $101,785,714 | $0 | $0 | $101,785,714 |

| 2160 | 0.0286 | 0.0357 | $103,571,429 | 0 | $0 | $103,571,429 | $0 | $0 | $103,571,429 |

| 2190 | 0.0429 | 0.0536 | $105,357,143 | 0 | $0 | $105,357,143 | $0 | $0 | $105,357,143 |

| 2220 | 0.0571 | 0.0714 | $107,142,857 | 0 | $0 | $107,142,857 | $0 | $0 | $107,142,857 |

| 2250 | 0.0714 | 0.0893 | $108,928,571 | 0 | $0 | $108,928,571 | $0 | $0 | $108,928,571 |

| 2280 | 0.0857 | 0.1071 | $110,714,286 | 0 | $0 | $110,714,286 | $0 | $0 | $110,714,286 |

| 2310 | 0.1000 | 0.1250 | $112,500,000 | 0 | $0 | $112,500,000 | $0 | $0 | $112,500,000 |

| 2340 | 0.1143 | 0.1429 | $114,285,714 | 0 | $0 | $114,285,714 | $30 | $1,785,714 | $112,500,000 |

| 2370 | 0.1286 | 0.1607 | $116,071,429 | 0 | $0 | $116,071,429 | $60 | $3,571,429 | $112,500,000 |

| 2400 | 0.1429 | 0.1786 | $117,857,143 | 0 | $0 | $117,857,143 | $90 | $5,357,143 | $112,500,000 |

| 2430 | 0.1571 | 0.1964 | $119,642,857 | 0 | $0 | $119,642,857 | $120 | $7,142,857 | $112,500,000 |

| 2460 | 0.1714 | 0.2143 | $121,428,571 | 0 | $0 | $121,428,571 | $150 | $8,928,572 | $112,500,000 |

|

|||||||||

EXHIBIT 8.1 Stock Portfolio Value Hedged with S&P 500 Puts

Creating a Cap for a Stock Portfolio Purchase Using Index Options

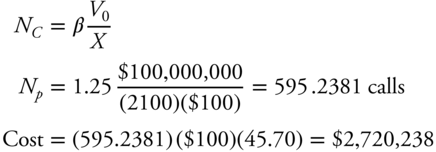

In addition to protecting the value of a portfolio, spot and futures index options also can be used to hedge the costs of future stock portfolio purchases. For example, suppose on May 27 the above portfolio manager was anticipating a cash inflow of $100 million in August, which she planned to invest in a well‐diversified portfolio with a β of 1.25 that was currently worth $100 million when the current spot S&P 500 index was at 2,100. On May 27, an August S&P 500 call option with an exercise price of 2,100 and multiplier of 100 was trading at 45.70. As a strategy to cap the portfolio purchase in case the market increases, the manager could have purchased 595.2381 August S&P 500 2100 calls (assume perfect divisibility) at a cost of $2,720,238:

As shown in Exhibit 8.2, if the spot index were 2,100 or higher at the August expiration, the corresponding cost of the portfolio would be higher; the higher portfolio costs, though, would have been offset by profits from the index calls. For example, if the market were at 2,370 in September, then the well‐diversified portfolio with a β of 1.25 would cost $121,428,571; the additional $16,071,429 cost of the portfolio would be offset, though, by the $16,071,429 cash flow obtained from the selling 595.2381 August 2,100 index calls at their intrinsic value of 270. Thus, as shown in the exhibit, for index values of 2,100 or greater, the hedged costs of the portfolio would be $100 million. On the other hand, if the index is less than 2,100, the manager would have been able to buy the well‐diversified portfolio at a lower cost, with the losses on the index calls limited to just the premium. Thus, for the $2,720,238 costs of the index call option, the manager on May 27 could have capped the maximum cost of the portfolio in mid‐August at $100 million, while still benefiting with lower costs if the market declined.

| Portfolio Purchase with Cost Hedged with S&P 500 Index Calls; Portfolio: Initial Value at Time of Hedge = $100,000,000, β = 1.25 S&P 500 Call: X = 2,100, Multiplier = 100, Premium = 45.70; Hedge: 595.2381 Calls; Cost = (595.2381)(45.70)($100) = $2,720,238 Short S&P 500 Put: X = 1,910, Multiplier = 100, Premium = 24.10; Hedge: 595.2381; Revenue = (595.2381)(24.10)($100) = $1,434,524 Range Forward: Long 595.2381 Call Contracts and Short 595.2381 Put Contracts; Net Cost = $2,720,238 − $1,434,524 = $1,285,714 |

|||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| S&P 500 at T, ST | Proportional Change in S&P 500: g = (ST − 2100)/2100 | Proportional Change in Portfolio: βg = 1.25g | Portfolio Cost: VT = (1+βg)$100m | Call Value CT = IV = Max[ST − 2100,0] | Value of Calls: CF = (595.2381)($100) (IV) | Hedged Portfolio Cost: Col (4) − Col (6) | Short Put Value: = IV = Max[1910 − ST, 0] | Value of Short Put: 595.2381(100) IV | Range Forward: Hedged Portfolio Cost: (4) − (6) − (9) |

| 1770 | −0.1571 | −0.1964 | $80,357,143 | 0 | $0 | $80,357,143 | −$140 | −$8,333,333 | $88,690,476 |

| 1800 | −0.1429 | −0.1786 | $82,142,857 | 0 | $0 | $82,142,857 | −$110 | −$6,547,619 | $88,690,476 |

| 1830 | −0.1286 | −0.1607 | $83,928,571 | 0 | $0 | $83,928,571 | −$80 | −$4,761,905 | $88,690,476 |

| 1860 | −0.1143 | −0.1429 | $85,714,286 | 0 | $0 | $85,714,286 | −$50 | −$2,976,191 | $88,690,476 |

| 1890 | −0.1000 | −0.1250 | $87,500,000 | 0 | $0 | $87,500,000 | −$20 | −$1,190,476 | $88,690,476 |

| 1910 | −0.0905 | −0.1131 | $88,690,476 | 0 | $0 | $88,690,476 | $0 | $0 | $88,690,476 |

| 1920 | −0.0857 | −0.1071 | $89,285,714 | 0 | $0 | $89,285,714 | $0 | $0 | $89,285,714 |

| 1950 | −0.0714 | −0.0893 | $91,071,429 | 0 | $0 | $91,071,429 | $0 | $0 | $91,071,429 |

| 1980 | −0.0571 | −0.0714 | $92,857,143 | 0 | $0 | $92,857,143 | $0 | $0 | $92,857,143 |

| 2010 | −0.0429 | −0.0536 | $94,642,857 | 0 | $0 | $94,642,857 | $0 | $0 | $94,642,857 |

| 2040 | −0.0286 | −0.0357 | $96,428,571 | 0 | $0 | $96,428,571 | $0 | $0 | $96,428,571 |

| 2070 | −0.0143 | −0.0179 | $98,214,286 | 0 | $0 | $98,214,286 | $0 | $0 | $98,214,286 |

| 2100 | 0.0000 | 0.0000 | $100,000,000 | 0 | $0 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2130 | 0.0143 | 0.0179 | $101,785,714 | 30 | $1,785,714 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2160 | 0.0286 | 0.0357 | $103,571,429 | 60 | $3,571,429 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2190 | 0.0429 | 0.0536 | $105,357,143 | 90 | $5,357,143 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2220 | 0.0571 | 0.0714 | $107,142,857 | 120 | $7,142,857 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2250 | 0.0714 | 0.0893 | $108,928,571 | 150 | $8,928,571 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2280 | 0.0857 | 0.1071 | $110,714,286 | 180 | $10,714,286 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2310 | 0.1000 | 0.1250 | $112,500,000 | 210 | $12,500,000 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2340 | 0.1143 | 0.1429 | $114,285,714 | 240 | $14,285,714 | $100,000,000 | $0 | $0 | $100,000,000 |

| 2370 | 0.1286 | 0.1607 | $116,071,429 | 270 | $16,071,429 | $100,000,000 | $0 | $0 | $100,000,000 |

|

|||||||||

EXHIBIT 8.2 Stock Portfolio Purchase Hedged with S&P 500 Calls

Range Forward Contracts

Using put options to provide a floor and call options to provide a cap involves the cost of buying the underlying options. By limiting some of the upside potential for floors or downside benefits for caps, the cost of buying the options can be defrayed by selling options with a different exercise price. In Chapter 7, we define a splitting the strikes strategy consisting of long (short) call and short (long) put positions with different exercise prices. The premium on the short position, in turn, defrays part of the cost of the long position. Sometimes options to sell can be selected such that there is little cost, or even a profit. This position is sometimes referred to as a range forward contract or zero‐cost collar.

A short‐range forward contract consists of a long position in a put with a low exercise price, X1, and a short position in a call with a higher exercise price, X2. An investor holding the underlying security or portfolio and planning to sell it at time T could take a short‐range forward contract to guarantee that the price of the stock or portfolio would be sold at a price between the exercise prices at the options’ maturity. Exhibit 8.3 shows the structure of a range forward contract for the sale of Tesla stock at the options’ August expiration. The contract is formed with a long position in the August 215 put (cost of $24.10 on May 27) and a short position in an August 225 call (sold for $22.25). As shown in the exhibit, the position ensures that the sale of Tesla in mid‐August will be between $215 and $225.

| Cash Flows at Expiration | ||||

| Position | ST < X1 | X1 ≤ ST ≤ X2 | ST > X2 | |

| Stock Sale | ST | ST | ST | |

| Short X2 Call | 0 | 0 | −(ST − X2) | |

| Long X1 Put | X1 − ST | 0 | 0 | |

| X1 | ST | X2 | ||

| TSLA Call: X = $225, C0 = 22.25; TSLA Put: X = $215, P0 = $24.10 | ||||

| Tesla Motors Stock Prices at T, ST | Cash Flow of Short $225 TSLA Call: −(Max(ST − 225),0) | Cash Flow of Long 215 TSLA Put: (Max(215 − ST,0)) | ST − PT + CT | |

| $185 | $0 | $30 | $215 | |

| $190 | $0 | $25 | $215 | |

| $195 | $0 | $20 | $215 | |

| $200 | $0 | $15 | $215 | |

| $205 | $0 | $10 | $215 | |

| $210 | $0 | $5 | $215 | |

| $215 | $0 | $0 | $215 | |

| $217 | $0 | $0 | $217 | |

| $219 | $0 | $0 | $219 | |

| $221 | $0 | $0 | $221 | |

| $223 | $0 | $0 | $223 | |

| $225 | $0 | $0 | $225 | |

| $230 | −$5 | $0 | $225 | |

| $235 | −$10 | $0 | $225 | |

| $240 | −$15 | $0 | $225 | |

| $245 | −$20 | $0 | $225 | |

| $250 | −$25 | $0 | $225 | |

| $255 | −$30 | $0 | $225 | |

EXHIBIT 8.3 Selling Stock at T with a Short‐Range Forward Contract Long in Put with X1 and Short in Call with X2

In Exhibit 8.1, Columns (8), (9), and (10) show:

- The intrinsic values of a short call position on a 2,310 August S&P 500.

- The expiration cash flow from selling 595.2381 call contracts at 24.10; the calls raised $1,434,524 (= (595.2381)($100)(24.10)) to defray the cost of purchasing 595.2381 put contracts to hedge the $100 million portfolio.

- The values of the portfolio with the long put and short call positions.

As shown in Column 10, this range forward contract provides a minimum portfolio value of $100 million if the S&P 500 is 2,100 or less and a maximum value of $112.5 million if the S&P 500 is 2,310 or greater. Thus, the portfolio ranges in value between $100 million and $112.5 million. In contrast to the portfolio insurance position in which there is upside potential and downside protection, the range forward provides a range of portfolio values between $100 million and $112.5 million, with a limit on the upside potential. However, the cost of the range forward positon is $1,893,571 (= $3,328,095 − $1,434,524), while the cost of the portfolio insurance position is $3,238,095.

In contrast to a short‐range forward contract, a long‐range forward contract consists of a short position in a put with a lower exercise price, X1, and a long position in a call with a higher exercise price, X2. An investor planning to purchase the options’ underlying security at time T could take a long‐range forward contract to guarantee that the purchase price of the stock would be between the exercise prices at the options’ maturity. Exhibit 8.4 shows the structure of a long‐range forward contract for the purchase of the Tesla stock at the options’ August expiration. The contract is formed with a long position in the August 225 call (cost of $22.25 on May 27) and a short position in an August 215 put (sold for $24.10). As shown in the exhibit, the position ensures that the purchase of Tesla in mid‐August will be between $215 and $225.

| Cash Flows at Expiration | ||||

| Position | ST < X1 | X1 ≤ ST ≤ X2 | ST > X2 | |

| Stock Purchase | −ST | −ST | −ST | |

| Long X2 Call | 0 | 0 | ST − X2 | |

| Short X1 Put | −(X1 − ST) | 0 | 0 | |

| −X1 | −ST | −X2 | ||

| TSLA Call: X = $225, C0 = 22.25; TSLA Put: X = $215, P0 = $24.10 | ||||

| Purchase of Tesla Motors Stock Prices at T, ST | Cash Flow of Long 225 TSLA Call: Max (ST − 225),0) | Cash Flow of Short 215 TSLA Put: −(Max(215 − ST,0) | Cost of Tesla with Long Range Forward Contract: −ST + PT − CT | |

| $185 | $0 | −$30 | −$215 | |

| $190 | $0 | −$25 | −$215 | |

| $195 | $0 | −$20 | −$215 | |

| $200 | $0 | −$15 | −$215 | |

| $205 | $0 | −$10 | −$215 | |

| $210 | $0 | −$5 | −$215 | |

| $215 | $0 | $0 | −$215 | |

| $217 | $0 | $0 | −$217 | |

| $219 | $0 | $0 | −$219 | |

| $221 | $0 | $0 | −$221 | |

| $223 | $0 | $0 | −$223 | |

| $225 | $0 | $0 | −$225 | |

| $230 | $5 | $0 | −$225 | |

| $235 | $10 | $0 | −$225 | |

| $240 | $15 | $0 | −$225 | |

| $245 | $20 | $0 | −$225 | |

| $250 | $25 | $0 | −$225 | |

| $255 | $30 | $0 | −$225 | |

EXHIBIT 8.4 Purchasing Stock at T with a Long‐Range Forward Contract: Short in Put with X1 and Long in Call with X2

In Exhibit 8.2, Columns (8), (9), and (10) show:

- The intrinsic values of a long call position in a 2,100 August S&P 500.

- The expiration cash flow from selling 595.2381 put contracts with an exercise price of 1,910 at 24.10; the puts sold raised $1,434,524 (= (595.2381)($100)(24.10)) to defray part of the cost of purchasing the 595.2381 call contracts to hedge the $100 million portfolio purchase.

- The cost of the portfolio with the long call and short put positions.

As shown, this long‐range forward contract provides a minimum portfolio cost of $88,690,476 if the S&P 500 is 1,910 or less and a maximum cost of $100 million if the S&P 500 is 2,100 or greater. Thus, the cost of the portfolio ranges between $88,690,476 and $100 million. In contrast to the portfolio cap position in which there is downside lower cost potential, the long‐range forward provides a range of portfolio costs between $88,690,476 and $100 million, with a limit on the downside cost potential. However, the cost of the range forward position is $1,285,714 (= $2,720,238 − $1,434,524), while the cost of the capped portfolio position is $2,720,238.

Note that when the exercise prices are the same, then the range forward positions becomes a simulated long or short stock position that can be used to lock in the purchase or sales price at a specific price. This makes the range forward contract a regular forward contract.

Portfolio Exposure—Market Timing and Beta Convexity

Instead of hedging a portfolio’s value against market risk, suppose a manager wanted to change her portfolio’s exposure to the market. As we discussed in Chapter 3, an equity portfolio manager who is very confident of a bull (bear) market can increase (decrease) her portfolio’s exposure to the market by increasing (decreasing) the portfolio’s beta, β0, to a new target beta, βTR, by going long (short) in equity index futures contracts. The manager also could increase (decrease) her portfolio’s exposure by buying index calls (puts). The number of option contracts needed to move the portfolio beta from β0 to βTR can be determined using the price‐sensitivity model in which:

where

- if βTR > β0, Long equity index call options

- if βTR < β0, Long equity index put options

Changing a portfolio’s market exposure with options instead of futures provides an asymmetrical gain and loss relation, referred to as a convex beta. For example, when calls (puts) are purchased to increase (decrease) the target beta, the option‐adjusted portfolio has a βTR for market increases (decreases) and β0 for market decreases (increases). The cost of obtaining this asymmetrical or convex beta relation is the cost of the options.

For example, suppose on May 27, 2016, the equity fund manager in our earlier example was very bullish and wanted to increase her beta from 1.25 to 2.00. On May 27, the portfolio had a value of V0 = $100 million, and there was an August S&P 500 call with an exercise price of 2,100 trading at 45.70. To increase the portfolio’s beta to 2.00, the manager would have needed to buy 357.142857 August S&P 500 calls for $1,632,143:

As shown in Exhibit 8.5, if the market increases from 2,100, the manager earns higher proportional gains from the call‐enhanced portfolio than from the unadjusted portfolio. As shown in the exhibit, the proportional increases in the call‐enhanced portfolio for proportional increases in the market reflect a beta of 2.00. On the other hand, if the market decreases from 2,100, then proportional declines in the portfolio for declines in the market reflect a beta of 1.25.

| Portfolio Enhanced with S&P 500 Index Calls; Portfolio: Initial Value = $100,000,000, β = 1.25; Target: βTR = 2.00 S&P 500 Call: X = 2,100, Multiplier = 100, Premium = 45.70; Hedge: 357.142857 Calls; Cost = (357.142857)(45.70)($100) = $1,632,143 |

||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| S&P 500 at T, ST | Proportional Change in S&P 500: g = (ST − 2100)/2100 | Proportional Change in Portfolio: βg = 1.25g | Portfolio Value: VT = (1+βg)$100m | Call Value CT = IV = Max[ST − 2,100,0] | Value of Calls: CF = (357.142857)($100) (IV) | Enhance Hedged Value: Col (4) + Col (6) | Proportional Change: [Col (7)/$100m)] − 1 | Beta: Col (8)/Col (2) |

| 1,910 | −0.0905 | −0.1131 | $88,690,476 | 0 | $0 | $88,690,476 | −0.1131 | 1.2500 |

| 1,940 | −0.0762 | −0.0952 | $90,476,190 | 0 | $0 | $90,476,190 | −0.0952 | 1.2500 |

| 1,970 | −0.0619 | −0.0774 | $92,261,905 | 0 | $0 | $92,261,905 | −0.0774 | 1.2500 |

| 2,000 | −0.0476 | −0.0595 | $94,047,619 | 0 | $0 | $94,047,619 | −0.0595 | 1.2500 |

| 2,030 | −0.0333 | −0.0417 | $95,833,333 | 0 | $0 | $95,833,333 | −0.0417 | 1.2500 |

| 2,060 | −0.0190 | −0.0238 | $97,619,048 | 0 | $0 | $97,619,048 | −0.0238 | 1.2500 |

| 2,090 | −0.0048 | −0.0060 | $99,404,762 | 0 | $0 | $99,404,762 | −0.0060 | 1.2500 |

| 2,100 | 0.0000 | 0.0000 | $100,000,000 | 0 | $0 | $100,000,000 | 0.0000 | 1.2500 |

| 2,120 | 0.0095 | 0.0119 | $101,190,476 | 20 | $714,286 | $101,904,762 | 0.0190 | 2.0000 |

| 2,150 | 0.0238 | 0.0298 | $102,976,190 | 50 | $1,785,714 | $104,761,905 | 0.0476 | 2.0000 |

| 2,180 | 0.0381 | 0.0476 | $104,761,905 | 80 | $2,857,143 | $107,619,048 | 0.0762 | 2.0000 |

| 2,210 | 0.0524 | 0.0655 | $106,547,619 | 110 | $3,928,571 | $110,476,190 | 0.1048 | 2.0000 |

| 2,240 | 0.0667 | 0.0833 | $108,333,333 | 140 | $5,000,000 | $113,333,333 | 0.1333 | 2.0000 |

| 2,270 | 0.0810 | 0.1012 | $110,119,048 | 170 | $6,071,429 | $116,190,476 | 0.1619 | 2.0000 |

| 2,300 | 0.0952 | 0.1190 | $111,904,762 | 200 | $7,142,857 | $119,047,619 | 0.1905 | 2.0000 |

| 2,330 | 0.1095 | 0.1369 | $113,690,476 | 230 | $8,214,286 | $121,904,762 | 0.2190 | 2.0000 |

| 2,360 | 0.1238 | 0.1548 | $115,476,190 | 260 | $9,285,714 | $124,761,905 | 0.2476 | 2.0000 |

| 2,390 | 0.1381 | 0.1726 | $117,261,905 | 290 | $10,357,143 | $127,619,048 | 0.2762 | 2.0000 |

| 2,420 | 0.1524 | 0.1905 | $119,047,619 | 320 | $11,428,571 | $130,476,190 | 0.3048 | 2.0000 |

| 2,450 | 0.1667 | 0.2083 | $120,833,333 | 350 | $12,500,000 | $133,333,333 | 0.3333 | 2.0000 |

EXHIBIT 8.5 Call‐Enhanced Portfolio—Asymmetrical Betas

In contrast, suppose on May 27, the equity fund manager was very bearish and wanted to decrease her beta from 1.25 to 0.75. On May 27, the August S&P 500 put with an exercise price of 2,100 was trading at 54.40. To decrease the portfolio’s beta to 0.75, the manager would have needed to buy 238.095238 August S&P 500 puts for $1,295,238:

As shown in Exhibit 8.6, if the market decreases from 2,100, the manager earns smaller proportional losses from the put‐hedged portfolio than from the unadjusted portfolio. As shown in the exhibit, the proportional decreases in the put‐hedged portfolio for proportional decreases in the market reflect a beta of 0.75. On the other hand, if the market increases from 2,100, then proportional increases in the portfolio for increases in the market reflect a beta of 1.25.

| Portfolio Hedged with S&P 500 Index Puts; Portfolio: Initial Value = $100,000,000, β = 1.25; Target: βTR = 0.75 S&P 500 Put: X = 2,100, Multiplier = 100, Premium = 54.40; Hedge: 238.095238 Puts; Cost = (238.095238)(54.40)($100) = $1,295,238 |

||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| S&P 500 at T, ST | Proportional Change in S&P 500: g = (ST − 2100)/2100 | Proportional Change in Portfolio: βg = 1.25g | Portfolio Value: VT = (1+βg)$100m | Put Value PT = IV = Max[2,100 − ST,0] | Value of put: CF = (238.095238)($100) (IV) | Put Hedged Value: Col (4) + Col (6) | Proportional Change: [Col (7)/$100m)] − 1 | Beta: Col (8)/Col (2) |

| 1,910 | −0.0905 | −0.1131 | $88,690,476 | 190 | $4,523,810 | $93,214,286 | −0.0679 | 0.7500 |

| 1,940 | −0.0762 | −0.0952 | $90,476,190 | 160 | $3,809,524 | $94,285,714 | −0.0571 | 0.7500 |

| 1,970 | −0.0619 | −0.0774 | $92,261,905 | 130 | $3,095,238 | $95,357,143 | −0.0464 | 0.7500 |

| 2,000 | −0.0476 | −0.0595 | $94,047,619 | 100 | $2,380,952 | $96,428,571 | −0.0357 | 0.7500 |

| 2,030 | −0.0333 | −0.0417 | $95,833,333 | 70 | $1,666,667 | $97,500,000 | −0.0250 | 0.7500 |

| 2,060 | −0.0190 | −0.0238 | $97,619,048 | 40 | $952,381 | $98,571,429 | −0.0143 | 0.7500 |

| 2,090 | −0.0048 | −0.0060 | $99,404,762 | 10 | $238,095 | $99,642,857 | −0.0036 | 0.7500 |

| 2,100 | 0.0000 | 0.0000 | $100,000,000 | 0 | $0 | $100,000,000 | 0.0000 | 0.7500 |

| 2,120 | 0.0095 | 0.0119 | $101,190,476 | 0 | $0 | $101,190,476 | 0.0119 | 1.2500 |

| 2,150 | 0.0238 | 0.0298 | $102,976,190 | 0 | $0 | $102,976,190 | 0.0298 | 1.2500 |

| 2,180 | 0.0381 | 0.0476 | $104,761,905 | 0 | $0 | $104,761,905 | 0.0476 | 1.2500 |

| 2,210 | 0.0524 | 0.0655 | $106,547,619 | 0 | $0 | $106,547,619 | 0.0655 | 1.2500 |

| 2,240 | 0.0667 | 0.0833 | $108,333,333 | 0 | $0 | $108,333,333 | 0.0833 | 1.2500 |

| 2,270 | 0.0810 | 0.1012 | $110,119,048 | 0 | $0 | $110,119,048 | 0.1012 | 1.2500 |

| 2,300 | 0.0952 | 0.1190 | $111,904,762 | 0 | $0 | $111,904,762 | 0.1190 | 1.2500 |

| 2,330 | 0.1095 | 0.1369 | $113,690,476 | 0 | $0 | $113,690,476 | 0.1369 | 1.2500 |

| 2,360 | 0.1238 | 0.1548 | $115,476,190 | 0 | $0 | $115,476,190 | 0.1548 | 1.2500 |

| 2,390 | 0.1381 | 0.1726 | $117,261,905 | 0 | $0 | $117,261,905 | 0.1726 | 1.2500 |

| 2,420 | 0.1524 | 0.1905 | $119,047,619 | 0 | $0 | $119,047,619 | 0.1905 | 1.2500 |

| 2,450 | 0.1667 | 0.2083 | $120,833,333 | 0 | $0 | $120,833,333 | 0.2083 | 1.2500 |

EXHIBIT 8.6 Put‐Hedged Portfolio—Asymmetrical Betas

Hedging Currency and Commodity Positions

Hedging Currency Positions with Futures Options

Until the introduction of currency options, exchange‐rate risk usually was hedged with foreign currency forward or futures contracts. Hedging with these instruments made it possible for foreign exchange participants to lock in the local currency values of their international revenues or expenses. However, with exchange‐traded currency futures options and dealer’s options, hedgers, for the cost of the options, can obtain not only protection against adverse exchange rate movements, but (unlike forward and futures positions) benefits if the exchange rates move in favorable directions.

To illustrate currency hedging with options, consider the case presented in Chapter 3 of a US investment fund expecting a payment of £10 million in principal on its Eurobonds next September. The fund hedged its future BP receipt by going short in 160 CME September BP futures trading at f0 = $1.50/BP (Nf = £10,000,000/£62,500 = 160 BP). With this futures hedge, the fund at expiration would sell its £10 million on the spot market at the spot exchange rate, and then close its futures position by going long in an expiring September BP futures contract at an expiring future price equal (or approximately equal) to the spot exchange rate (fT = ET). This futures hedge, in turn, locked in a US dollar receipt of $15 million.

For the costs of BP futures put options, the US fund could also protect its dollar revenues from possible exchange rate decreases when it converts, while still benefiting if the exchange rate increases by purchasing BP put futures options—a currency‐insured position. For example, suppose a September BP futures put with an exercise price of X = $1.50/£ were available at P0 = $0.02/£. Given the contract size of 62,500 British pounds, the US fund would need to buy 160 put contracts (Np = £10,000,000/£62,500 = 160) at a cost of $200,000 (Cost = (160)(£62,500)(0.02/£)) to set up a floor for the dollar value of its £10,000,000 receipt in September. Exhibit 8.7 shows the dollar cash flows the US fund would receive in September from converting its receipts of £10,000,000 to dollars at the spot exchange rate (ET) and closing its 160 futures put contracts at a price equal to the put’s intrinsic value.

| September 10 Million British Pound Receipt Hedged with BP Futures Put September BP Put: X = $1.50, Size = 62,500 BP, Premium = $0.02/BP Purchase 160 BP Futures Puts at $0.02/BP; Np = 160 = 10,000,000 BP/62,500 BP; Cost = (160)(62,500 BP)($0.02/BP) = $200,000 Sale of 160 BP Call Contracts: X = $1.70/BP; Premium = $0.015; Revenue = (160)(62,500BP)($0.015) = $150,000 Range Forward: Long 160 Puts and Short 160 Calls: Cost = $200,000 − $150,000 = $50,000 Expiration: Futures and Futures Options Expire at the Same Time: fT = ET |

|||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| fT = ET | Dollar Receipt from Converting 10 Milion BP on Spot: ET (10,000,000 BP) | Put Value PT = IV = Max[$1.50 − fT,0] | Value of Puts: CF = (160)(62,500 BP) (IV) | Currency‐Insured Position: (2) + (4) | Short Call Value: CT = −IV = −Max[fT − $1.70, 0] | Value of Short Calls: CF = (160)(62,500 BP) (IV) | Dollar Revenue with Short Range Forward: (2) + (4) + (7) |

| $1.00 | $10,000,000 | $0.50 | $5,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.10 | $11,000,000 | $0.40 | $4,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.20 | $12,000,000 | $0.30 | $3,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.30 | $13,000,000 | $0.20 | $2,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.40 | $14,000,000 | $0.10 | $1,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.50 | $15,000,000 | $0.00 | $0 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.55 | $15,500,000 | $0.00 | $0 | $15,500,000 | $0.00 | $0 | $15,500,000 |

| $1.60 | $16,000,000 | $0.00 | $0 | $16,000,000 | $0.00 | $0 | $16,000,000 |

| $1.65 | $16,500,000 | $0.00 | $0 | $16,500,000 | $0.00 | $0 | $16,500,000 |

| $1.70 | $17,000,000 | $0.00 | $0 | $17,000,000 | $0.00 | $0 | $17,000,000 |

| $1.80 | $18,000,000 | $0.00 | $0 | $18,000,000 | −$0.10 | −$1,000,000 | $17,000,000 |

| $1.90 | $19,000,000 | $0.00 | $0 | $19,000,000 | −$0.20 | −$2,000,000 | $17,000,000 |

| $2.00 | $20,000,000 | $0.00 | $0 | $20,000,000 | −$0.30 | −$3,000,000 | $17,000,000 |

| $2.10 | $21,000,000 | $0.00 | $0 | $21,000,000 | −$0.40 | −$4,000,000 | $17,000,000 |

EXHIBIT 8.7 Hedging £10 Million Cash Inflow with a British Pound Futures Put Option and Short‐Range Forward Contract

As shown in the exhibit, if the exchange rate is less than X = $1.50/£, the company would receive less than $15,000,000 when it converts its £10,000,000 to dollars; these lower revenues, however, would be exactly offset by the cash flows from the put position. For example, at a spot exchange rate of $1.30/£ the company would receive only $13 million from converting its £10 million, but would receive a cash flow of $2 million from the puts ($2,000,000 = 160 Max[($1.50/£) − ($1.30/£), 0](£62,500)); this would result in a combined receipt of $15 million. Thus, if the exchange rate is $1.50/£ or less, the company would receive $15 million. On the other hand, if the exchange rate at expiration exceeds $1.50/£, the US fund would realize a dollar gain when it converts the £10 million at the higher spot exchange rate, while its losses on the put would be limited to the amount of the premium. Thus, by hedging with currency futures put options, the US investment fund is able to obtain exchange‐rate risk protection in the event the exchange rate decreases while still retaining the potential for increased dollar revenues if the exchange rate rises.

It should be noted that if the investment fund wanted to defray part of the cost of its put‐insured currency position, it could sell British pound calls with a higher exercise price to form a short‐range forward contract. Column (8) in Exhibit 8.7 shows the range forward position formed by combining the put‐insured currency position with a short position of 160 BP futures call contracts with an exercise price of $1.70 and premium $0.015/BP. With the short call position providing the investment fund $150,000, the cost of range forward contract is only $50,000 compared to the put‐insured cost of $200,000. The short‐range forward position, however, limits the dollar revenue to a range between $15 million and $17 million, limiting the upside potential gains once the exchange rate increases past $1.70/BP.

Suppose that instead of receiving foreign currency, a US company had a foreign liability requiring a foreign currency payment at some future date. To protect itself against possible increases in the exchange rate while still benefiting if the exchange rate decreases, the company could hedge the position by taking a long position in a currency futures call option. For example, suppose a US company owed £10 million, with the payment to be made in September. To benefit from the lower exchange rates and still limit the dollar costs of purchasing £10,000,000 in the event the $/£ exchange rate rises, suppose the company bought 160 British pound futures call options with X = $1.50/£ (Nc = £10,000,000/£62,500 = 160) at a cost of 0.02/£ (total cost = $200,000 = (160)(£62,500)(0.02/£)). Exhibit 8.8 shows the costs of purchasing £10 million at different exchange rates and the cash flows from selling 160 September British pound futures call contracts at expiration at a price equal to the call’s intrinsic value.

| September 10 Million British Pound Expense Hedged with BP Futures Call September BP Call: X = $1.50, Size = 62,500 BP, Premium = $0.02/BP Purchase 160 BP Futures Call Contracts at $0.02/BP; NC = 160 = 10,000,000 BP/62,500 BP; Cost = (160)(62,500 BP)($0.02/BP) = $200,000 Sale of 160 BP Put Contracts: X = $1.30/BP; Premium = $0.015; Revenue = (160)(62,500BP)($0.015) = $150,000 Range Forward: Long 160 calls and short 130 puts: Cost = $200,000 − $150,000 = $50,000 Expiration: Futures and Futures Options Expire at the Same Time: fT = ET |

|||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| fT = ET | Dollar Cost of purchasing 10 milion BP on Spot: ET (10,000,000 BP) | Call Value CT = IV = Max[fT − $1.50, 0] | Value of Calls: CF = (160)(62,500 BP) (IV) | Cap‐Insured Position: (2) − (4) | Short Put Value: PT = −IV = −Max[$1.30 − fT, 0] | Value of Short Calls: CF = (160)(62,500 BP) (IV) | Dollar BP Cost with Long Range Forward: (2) − (4) − (7) |

| $1.00 | $10,000,000 | $0.00 | $0 | $10,000,000 | −$0.30 | −$3,000,000 | $13,000,000 |

| $1.10 | $11,000,000 | $0.00 | $0 | $11,000,000 | −$0.20 | −$2,000,000 | $13,000,000 |

| $1.20 | $12,000,000 | $0.00 | $0 | $12,000,000 | −$0.10 | −$1,000,000 | $13,000,000 |

| $1.30 | $13,000,000 | $0.00 | $0 | $13,000,000 | $0.00 | $0 | $13,000,000 |

| $1.35 | $13,500,000 | $0.00 | $0 | $13,500,000 | $0.00 | $0 | $13,500,000 |

| $1.40 | $14,000,000 | $0.00 | $0 | $14,000,000 | $0.00 | $0 | $14,000,000 |

| $1.45 | $14,500,000 | $0.00 | $0 | $14,500,000 | $0.00 | $0 | $14,500,000 |

| $1.50 | $15,000,000 | $0.00 | $0 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.60 | $16,000,000 | $0.10 | $1,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.70 | $17,000,000 | $0.20 | $2,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.80 | $18,000,000 | $0.30 | $3,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $1.90 | $19,000,000 | $0.40 | $4,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $2.00 | $20,000,000 | $0.50 | $5,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

| $2.10 | $21,000,000 | $0.60 | $6,000,000 | $15,000,000 | $0.00 | $0 | $15,000,000 |

EXHIBIT 8.8 Hedging £10 Million Cost with a British Pound Futures Call Option and Long‐Range Forward Contract

As shown in the exhibit, for cases in which the exchange rate is greater than $1.50/£, the company has dollar expenditures exceeding $15 million; the expenditures, though, are exactly offset by the cash flows from the calls. On the other hand, when the exchange rate is less than $1.50/£, the dollar costs of purchasing £10 million decreases as the exchange rate decreases, while the losses on the call options are limited to the option premium.

If the US company wanted to defray part of the cost of the currency cap position, it could sell British pound puts with a lower exercise price to form a long‐range forward contract. Column (8) in Exhibit 8.8 shows the range forward position formed by combining the cap‐insured currency position with a short position of 160 BP futures put contracts with an exercise price of $1.30 and premium $0.015/BP. With the short put position providing $150,000, the cost of the long‐range forward contract is $50,000 compared to the cap‐insured cost of $200,000. The long‐range forward position, in turn, limits the dollar cost to a range between $13 million to $15 million, limiting the lower dollar cost potential when the exchange rate falls below $1.30.

Hedging Commodity Positions with Futures Options

In Chapter 1, we presented the case of an oil refinery that locked in the cost of purchasing 100,000 barrels of crude oil in July by taking long position in 100 New York Mercantile Exchange (NYMEX)–listed July crude oil contracts (size = 1,000 barrels) at $35.24/barrel. Suppose, the company’s treasury department was confident that crude oil prices would be declining in the future but still wanted some protection in case prices increase. For the costs of 100 NYMEX futures crude oil call options expiring in July, the company could obtain this objective of capping the costs of purchasing the crude oil in July, while still benefiting if crude oil costs decrease. For example, suppose the oil refinery purchases 100 crude oil futures calls with an exercise price of $35 and expiring in February at the same time as crude oil futures for $3.00 per barrel. The refining company’s futures call option hedge position is shown in Exhibit 8.9. As shown, for the $300,000 cost of the options (contract size on the underlying crude oil futures is 1,000 barrels), the futures call option position serves to cap the refinery’s cost of crude at $3,500,000 while allowing them to realized lower costs if crude prices are less than $35. For example, at $30 the company would pay $3 million for the 100,000 barrels of crude with its loss on the option limited to the $300,000 costs of the futures calls. On the other hand, if crude oil costs are greater than $35, the greater crude oil costs are offset by greater cash flows from the futures call options. For example, if crude prices were at $50, the $5 million cost of 100,000 barrels would be offset by $1.5 million cash flow from the closing of the call options. For this insurance, the refiner pays $300,000 for the futures calls. If the company wanted to defray part of the cost, it could form a long‐range forward contract by selling crude oil futures call contracts with a lower exercise price.

| July Purchase of 100,000 Barrels of Crude Oil on the Spot Purchase 100 July Crude Oil Contracts: X = $35/brl, Premium = $3.00/brl; Contract Size = 1,000 Barrels Nc = 100,000 brl/1,000 brl = 100; Cost = (100)($3.00/brl)(1,000 Barrels) = $300,000 Expiration: At Futures Option’s Expiration, Assume: fT = ST |

||||

| 1 | 2 | 3 | 4 | 5 |

| fT = ST | Cost: Purchase of 100,000 Barrels of Crude Oil on the Spot Market: ST (100,000 barrels) | Call Value: CT = IV = Max[fT − $35, 0] | Value of Calls: CF = 100 (1,000 barrels) (IV) | Hedged Cost: (2) − (4) |

| $20.00 | $2,000,000 | $0.00 | $0 | $2,000,000 |

| $25.00 | $2,500,000 | $0.00 | $0 | $2,500,000 |

| $30.00 | $3,000,000 | $0.00 | $0 | $3,000,000 |

| $35.00 | $3,500,000 | $0.00 | $0 | $3,500,000 |

| $40.00 | $4,000,000 | $5.00 | $500,000 | $3,500,000 |

| $45.00 | $4,500,000 | $10.00 | $1,000,000 | $3,500,000 |

| $50.00 | $5,000,000 | $15.00 | $1,500,000 | $3,500,000 |

| $55.00 | $5,500,000 | $20.00 | $2,000,000 | $3,500,000 |

| $60.00 | $6,000,000 | $25.00 | $2,500,000 | $3,500,000 |

| $65.00 | $6,500,000 | $30.00 | $3,000,000 | $3,500,000 |

EXHIBIT 8.9 Hedging a Crude Oil Purchase with a Call Option on Crude Oil Futures

In Chapter 1, we also presented the case of a corn farmer who went short in September corn contracts (contract size is 5,000 bushels) to lock in his revenue from his corn sale in September. Suppose another farmer planned to sell 100,000 bushels of corn in September but expected corn prices to increase but wanted protections against an unexpected price decrease. Accordingly, the farmer could obtain downside protection by purchasing a put option on a corn futures contract. Exhibit 8.9 shows this put insurance strategy in which the farmer purchases 20 September put options on a corn futures contract with X = $2.40, size = 5,000 bushels, and P = $0.20/bu. As shown in Exhibit 8.10, if corn prices decrease, the farmer’s lower revenue is offset by greater cash flows from the puts. In contrast, if corn prices increase, the farmer realizes greater revenues. For this insurance, the farmer pays $20,000. If the farmer wanted to defray part of the cost, he could form a short‐range forward contract by selling corn futures put contracts with a lower exercise price.

| September Sale of 100,000 Bushels of Corn on the Spot Purchase 20 September Corn Futures Put Contracts: X = $3.30/bu, Premium = $0.20/bu; Contract Size = 5,000 bu Np = 100,000 bu/5,000 bu = 20; Cost = (20)($0.20/bu)$5,000 bu) = $20,000 Expiration: At Futures Option’s Expiration, assume: fT = ST |

||||

| 1 | 2 | 3 | 4 | 5 |

| fT = ST | Revenue: Sale of 100,000 Bushels of Corn on the Spot Market: ST (100,000 bu) | Put Value PT = IV = Max[$3.30 − fT,0] | Value of Puts: CF = 20 (5,000 bu) (IV) | Hedged Revenue: (2) + (4) |

| $2.40 | $240,000 | $0.90 | $90,000 | $330,000 |

| $2.50 | $250,000 | $0.80 | $80,000 | $330,000 |

| $2.70 | $270,000 | $0.60 | $60,000 | $330,000 |

| $2.90 | $290,000 | $0.40 | $40,000 | $330,000 |

| $3.10 | $310,000 | $0.20 | $20,000 | $330,000 |

| $3.30 | $330,000 | $0.00 | $0 | $330,000 |

| $3.50 | $350,000 | $0.00 | $0 | $350,000 |

| $3.70 | $370,000 | $0.00 | $0 | $370,000 |

| $3.90 | $390,000 | $0.00 | $0 | $390,000 |

| $4.10 | $410,000 | $0.00 | $0 | $410,000 |

EXHIBIT 8.10 Hedging a Corn Sale with a Corn Futures Put Option

Note that there is no hedging risk in both of the hedging cases. With many commodity futures options having expirations different from the expiration on the underlying futures contract or having an expiration period, hedging with futures options often involves timing risk as well as quantity risk.

Hedging Fixed‐Income Positions with Options

As examined in Chapter 4, a fixed‐income manager planning to invest a future inflow of cash in high‐quality, intermediate‐term bonds could hedge the investment against possible higher bond prices and lower rates by going long in T‐note futures contracts. If intermediate‐term rates were to decrease, the higher costs of purchasing the bonds would then be offset by profits from his futures positions. On the other hand, if rates increased, the manager would benefit from lower bond prices, but he would also have to cover losses on his futures position. Thus, hedging future fixed‐income investments with futures locks in a future price and return and therefore eliminates not only the costs of unfavorable price movements but also the benefits from favorable movements. However, by hedging with either exchange‐traded futures call options on a T‐note, T‐bond, Eurodollar deposit, or with an OTC spot call option on a debt security, a hedger can obtain protection against adverse price increases while still realizing lower costs if security prices decrease.

For cases in which bond or money market managers are planning to sell some of their securities in the future or who want to hedge their security values, hedging can be done by going short in a T‐note, T‐bond, or Eurodollar futures contracts. If rates were higher at the time of the sale, the resulting lower bond prices and therefore revenue from the bond sale would be offset by profits from the futures positions (just the opposite would occur if rates were lower). The hedge also can be set up by purchasing an exchange‐traded futures put options on Treasuries and Eurodollar contracts or an OTC spot put option on a debt security. This hedge would provide downside protection if bond prices decrease while earning values if security prices increase.

Short hedging positions with futures and put options can be used not only by holders of fixed‐income securities planning to sell their instruments before maturity, but also by bond issuers, borrowers, and debt security underwriters. A company planning to issue bonds or borrow funds from a financial institution at some future date, for example, could hedge the debt position against possible interest rate increases by going short in debt futures contracts or cap the loan rate by buying an OTC put or exchange‐traded futures put. Similarly, as we examined in Chapter 4, a bank that finances its short‐term loan portfolio of one‐year loans by selling 90‐day CDs could manage the resulting maturity gap by also taking short positions in Eurodollar futures or futures options. Finally, an underwriter or a dealer who is holding a debt security for a short‐period of time could hedge the position against interest rate increases by going short in an appropriate futures contract or by purchasing a futures put option.

Note that many debt and fixed‐income positions involve securities and interest rate positions in which a futures contract on the underlying security does not exist. In such cases, an effective cross hedge needs to be determined to minimize the price risk in the underlying spot position. As noted in Chapter 4, one commonly used model for bond and debt positions is the price‐sensitivity model developed by Kolb and Chiang and Toevs and Jacobs. For option hedging, the number of options (call for long hedging positions and puts for short hedging positions) using the price‐sensitivity model is:

where

| Duroption | = | duration of the bond underlying the option contract |

| DurS | = | duration of the bond being hedged |

| V0 | = | current value of bond to be hedged |

| YTMS | = | yield to maturity on the bond being hedged |

| YTMf | = | yield to maturity implied on the underlying futures contract |

In Chapter 4, we presented the case of a fixed‐income manager who on 12/30/15 planned to buy 10 five‐year T‐notes in June from an anticipated $1 million cash inflow resulting from maturing bonds in her portfolio. Concerned about rates decreasing and bond price rising over the next six months, the manager hedged the purchase by going long in 10 CME June five‐year T‐note futures contracts at a futures price of 117.6875. The most likely‐to‐deliver bond on the contract was a T‐note with a 13/8% coupon, maturity of 8/31/20, conversion factor (CFA) of 0.8371, and accrued interest on the delivery date of $0.457 (see Exhibit 4.16). With this long futures position, the manager was able to lock in a T‐note cost of $983,557 by purchasing the delivered bonds on the contract and paying the accrued interest: T‐Note Price per $100 Face Value: Cost of 10 T‐notes with $100,000 face value plus accrued interest: Alternatively, the manager could have a realized the $983,557 cost by buying her T‐notes on the spot at the futures expiration and closing her expiring futures position. Suppose on 12/30/15, the manager wanted to still hedge against the possibility of rates decreasing, but believed that rates would increase, causing five‐year T‐note prices to fall. In this case, the manager, for the cost of 10 June five‐year T‐notes call futures contracts, could cap the June cost of purchasing 10 T‐notes in June while benefiting with lower bond cost if bond prices decreased as she expected. On 12/30/15, there was a CME call on the June five‐year T‐note with an exercise price of 118 selling for $750 per contract. Suppose that the manager purchased the call options in order to set a cap on the cost of buying the five‐year notes in June. Exhibit 8.11 shows: EXHIBIT 8.11 Hedging the Purchase of 10 Five‐Year T‐Notes with 10 Five‐Year T‐Note Futures Call Options As shown in the exhibit, the hedge caps the upper cost between $966,912 and $981,077 if bond prices are above 98.1406 (futures price of 118) and yields are less than 1.84476%, while allowing the manager to purchase bonds at lower prices if the bond price is at 98.1406 or less and the yield is at 1.84476% or greater. To illustrate how a short hedge works, suppose the fixed‐income manager on 12/30/15 in the preceding example anticipated needing cash in June and planned to obtain it by selling her holdings of 10 T‐notes with coupon rates of 13/8% and maturity of 8/31/20 (same as the futures cheapest‐to‐deliver bond). Suppose the manager this time believed that five‐year rates would decrease and bond prices would rise, but still wanted to hedge against the possibility that rates could increase and bond prices fall when she sold her 10 T‐notes in June. Suppose on 12/30/15 the manager purchased CME puts on the June five‐year T‐note futures with an exercise price of 118 for $750 per contract in order to set a floor on the revenue from here June bond sale. Exhibit 8.12 shows: EXHIBIT 8.12 Hedging the Sale of 10 Five‐Year T‐Notes with 10 Five‐Year T‐Note Futures Put Options As shown in the exhibit, the hedge creates a floor on the revenue between $983,030 and $993,219 if bond prices are less than 98.1406 (futures price of 118) and yields are greater than 1.84476%, while allowing the manager to sell her bonds at higher prices if bond prices are greater than 98.1406 and yields are less than 1.84476%. In Chapter 4, we examined the case of the managers of the Xavier Bond Fund hedging the June value of their portfolio on 12/30/15 by going short in the June 2016 five‐year T‐note futures contract. The fund’s portfolio consisted of 39 investment‐grade corporates, treasuries, and federal agency bonds. On 3/15/16, the value of the bond portfolio was $11,637,935 with a duration of 5.31 and yield to maturity of 2.78% (see Exhibit 4.21 for portfolio description on 12/30/15). Suppose on 3/15/15, the managers believed that rates would decrease and bond prices would rise, but still wanted to hedge against the possibility that rates could increase and bond prices fall, and accordingly decided to set a floor on their portfolio by buying the CME put on the June five‐year T‐note with an exercise price of 120 and trading at 0‐59 or $921.875 per contract. The most likely‐to‐deliver bond on the underlying futures was the 13/8% T‐note maturing on 8/31/20; this bond had a duration of 4.02. Using the price‐sensitivity model, the managers would have needed to purchase 127 June T‐note futures puts with an exercise price of 120 for a cost of $117,078: where Exhibit 8.13 shows: EXHIBIT 8.13 Hedging the Value of a Portfolio with T‐Note Futures Put Options As shown in the Exhibit 8.13, the hedge creates a floor for the portfolio value of around $11.9 million if rates increase by 10 basis point or more, while the portfolio gains in value if interest rates increase. It should be noted that for a 50 basis points increase in rates, the puts provide a portfolio savings of $194,388 (= Hedge value − Unhedged value = $11,983,853 − $11,789,467), while for a 20 bp increase, the savings is only $7,177 (= Hedge value − Unhedged value = $11,991,595 − $11,984,418). With the cost of the insurance at $117,078, the managers may have concluded that this protection was not large enough, given the costs of the puts. Alternatively, they may have found a better hedging strategy would be to set up a range forward contract by selling a call with a higher exercise price to defray part of the cost of the puts. In Chapter 4, we showed how the Xavier Bond Fund increased the fund’s duration from 5.43 to 6.08 in anticipation of a decrease in interest rates by going long in 16 June T‐note contract. Instead of using futures to change its portfolio’s exposure to interest rate, the managers could have alternatively used futures options. A bond portfolio manager who is very confident of an interest rate decrease (increase) could increase (decrease) her bond portfolio’s exposure by increasing (decreasing) the portfolio’s duration, Dur0, to a new target duration, DurTR, by going long (short) in a bond futures contracts. The manager also could increase (decrease) her portfolio’s exposure by buying futures calls (puts). The number of option contracts needed to move the portfolio duration from Dur0 to DurTR can be determined using the price‐sensitivity model in which: where Changing interest rate exposure with options instead of futures provides an asymmetrical gain and loss exposure—a convex duration. For example, when calls (puts) are purchased to increase (decrease) the target duration, the option‐adjusted portfolio has a βTR for interest rate decreases (decreases) and Dur0 for interest rate increases (decreases). The cost of obtaining this asymmetrical relation is the cost of the options. For example, suppose on 3/15/15, the Xavier Bond Fund manager strongly believed that rates would decrease and bond prices would rise, and as a result decided to use call options to increase the bond portfolio’s duration from 5.31 to 7.00. On 3/15/16, the CME call on the June five‐year T‐note with an exercise price of 120 was trading at 0‐59 or $921.875 per contract. (The most likely‐to‐deliver bond on the futures was the 13/8% T‐note maturing on 8/31/20; this bond had a duration of 4.02.) Using the price‐sensitivity model, the managers would have needed to purchase 40 June T‐note futures calls with an exercise price of 120 for a cost of $36,875: As shown in Columns 14 to 18 in Exhibit 8.13, for downward yield curve shifts the call‐enhanced portfolio has a significant greater proportional returns than the unadjusted portfolio, reflecting a greater duration, while for upward shift the returns are the same with the calls out of the money. In Chapter 4 we presented the case of a small bank with a maturity gap problem in which it made short‐term loans with maturities of 180 days financed by a series of 90‐day CDs sold now and 90 days later. In the absence of a hedge, the bank was subject to interest‐rate risk. To minimize its exposure to interest rate risk the bank hedged its CD sale 90 days later by going short in a Eurodollar futures contract (see Exhibit 4.20). Instead of hedging its future CD sale with Eurodollar futures, the bank could alternatively buy put options on Eurodollar futures. By hedging with puts, the bank would be able to lock in or cap the maximum rate it pays on it future CD. If the LIBOR exceeds the implied yield on the underlying futures, the bank would have to pay a higher rate on its CD used to finance the maturing debt, but it would profit from its Eurodollar futures put position, with its put profits being greater, the higher the rates. The put profit would serve to reduce the funds the bank would need to pay the maturing CD, in turn, offsetting the higher rate it would have to pay on its new CD. Thus, the bank would be able to lock in a maximum rate that it would pay on its debt obligation. On the other hand, if the rate is less than or equal to the implied yield on the futures, then the bank would be able to finance its maturing debt at lower rates, while its losses on its futures puts would be limited to the premium it paid for the options. As a result, for lower rates the bank would realize a lower interest rate paid on its debt obligation 90 days later and therefore a lower rate paid over the 180‐day period. Thus, for the cost of the puts, hedging the maturity gap with puts allows the bank to lock in a maximum rate on its debt obligation, with the possibility of paying lower rates if interest rates decrease. In Chapter 4, we examined how a series or strip of Eurodollar futures contracts could be used to create a fixed or floating rate on the cash flow of an asset or liability. When there is a series of cash flows, such as a floating‐rate loan or an investment in a floating‐rate note, a strip of interest rate options can similarly be used to place a cap or a floor on the cash flow. For example, a company with a one‐year floating‐rate loan starting in September at a specified rate and then reset in December, March, and June to equal the spot LIBOR plus BP, could obtain a cap on the loan by buying a series of Eurodollar futures puts expiring in December, March, and June. At each reset date, if the LIBOR exceeds the discount yield on the put, the higher LIBOR applied to the loan will be offset by a profit on the nearest expiring put, with the profit increasing the greater the LIBOR; if the LIBOR is equal to or less than the discount yield on the put, the lower LIBOR applied to the loan will only be offset by the limited cost of the put. Thus, a strip of Eurodollar futures puts used to hedge a floating‐rate loan places a ceiling on the effective rate paid on the loan. In the case of a floating‐rate investment, such as a floating‐rate note tied to the LIBOR or a bank’s floating rate loan portfolio, a minimum rate or floor can be obtained by buying a series of Eurodollar futures calls, with each call having an expiration near the reset date on the investment. If rates decrease, the lower investment return will be offset by profits on the calls; if rates increase, the only offset will be the limited cost of the calls. As an example of a cap, suppose Northwestern Bank offers Ryan’s Department Store a $20 million floating‐rate loan to finance its inventory over the next two years. The loan has a maturity of two years, starts on December 20, and is reset the next seven quarters. The initial quarterly rate on the loan is equal to 2%/4 (the current LIBOR of 1% plus 100 bp), the other rates are set on the quarterly reset dates equal to one fourth of the annual LIBOR on those dates plus 100 basis points: (LIBOR % + 1%)/4. Suppose Ryan’s wants to cap the loan by purchasing a strip of CME Eurodollar futures puts consisting of the seven put futures options. The top panel in Exhibit 8.14 shows seven Eurodollar futures puts each with an exercise price of $995,000 (IMM X = 98; RD = 2) and with expirations coinciding with the reset dates on the loan. Expiring futures (or settlement price): EXHIBIT 8.14 Capping a Floating‐Rate Loan with Eurodollar Futures Puts: Loan Starts on 12/12 at 2% (1% + 100 Bp); Reset Next Seven Quarters at LIBOR + 100 BP; Strip of Seven Eurodollar Futures Puts Each with X = $995,000; Expirations Coinciding with Loan Reset Dates Given these Eurodollar futures puts, Ryan’s could cap the floating‐rate loan by buying a strip of 20 Eurodollar futures puts for a total cost of $80,500. The lower panel in Exhibit 8.14 shows the put‐hedged rates on the loan and the unhedged rates for an increasing interest rate scenario in which the LIBOR increases from 1% on March 20 to 4% seven quarters later. The numbers in the exhibit show for each period, Ryan’s quarterly interest payments, option cash flow, option values at the interest payment date, hedged interest payments (interest minus option cash flow), and hedged rate as a proportion of a $20 million loan. The scenarios shown assume that the options’ expiration dates coincide with the reset dates. As shown, the put options allow Ryan’s to cap its loan at 3.00%, when the LIBOR is greater than 2%, while benefiting with lower rates on its loan when the LIBOR is less than 2%. As a an example of a floor, suppose Kendall Trust is planning to invest $20 million in a Northwestern Bank two‐year floating‐rate note paying LIBOR plus 100 basis points. The investment starts on 12/20 at 2% (when the LIBOR = 1%) and is then reset the next seven quarters. Suppose Kendall Trust would like to establish a floor on the rates it obtains on the floating‐rate note with a strip of the seven CME Eurodollar futures call options shown in the top panel in Exhibit 8.15. Each of the Eurodollar futures calls has an exercise price of $995,000 (IMM X = 98; RD = 2) and expirations coinciding with the reset dates on the floating‐rate note. Expiring futures (or settlement price): EXHIBIT 8.15 Setting A Floor on a Floating‐Rate Investment with Eurodollar Futures Call: Floating‐Rate Note Starts on 12/12 At 2% (1% + 100 Bp); Reset Next Seven Quarters At LIBOR + 100 BP; Strip of Seven Eurodollar Futures Calls Each with X = $995,000; Expirations Coinciding with Reset Dates on the Floating‐Rate Note To set the floor on the floating note, Kendall would need to buy 20 Eurodollar call strips for a total cost of $80,500. The lower panel of Exhibit 8.15 shows Kendall Trust’s quarterly interest receipts, option cash flow, option values at the interest payment dates, hedged interest revenue (interest plus option cash flow), and hedged rate as a proportion of a $20 million investment for each period with the assumption that the reset dates and option expiration dates coincide. The assumed LIBOR rate shown in the exhibit reflect an increasing interest rate scenario in which the LIBOR increases from 1% on March 20 to 4% seven quarters later. As shown, the call options allow Kendall to attain a floor on investment rate of 3% when the LIBOR is 2% or less with the benefit of higher yields when the LIBOR is greater than 3%. As noted in Chapter 6, a popular option offered by financial institutions is the cap: a series of European interest rate call options—a portfolio of caplets. For example, a 2.5%, two‐year cap on a three‐month LIBOR, with a NP of $100 million, provides, for the next two years, a payoff every three months of (LIBOR − 0.025)(0.25)($100,000,000) if the LIBOR on the reset date exceeds 2.5% and nothing if the LIBOR equals or is less than 2%. Caps are often written by financial institutions in conjunction with a floating‐rate loan and are used by buyers as a hedge against interest rate risk. As an example, suppose the Jones Development Company borrows $100 million from Southern Bank to finance a two‐year construction project. Suppose the loan is for two years, starting on March 1 at a known rate of 2.5% (1% LIBOR plus 150 bp) then resets every three months—6/1, 9/1, 12/1, and 3/1—at the prevailing LIBOR plus 150 BP. In entering this loan agreement, suppose the Jones Company is uncertain of future interest rates and therefore would like to lock in a maximum rate, while still benefiting from lower rates if the LIBOR decreases. To achieve this, suppose the Jones Company buys a cap corresponding to its loan from Southern Bank for $150,000, with the following terms: On each reset date, the payoff on the corresponding caplet would be With the 2.5% exercise rate or cap rate, the Jones Company would be able to lock in a maximum rate each quarter equal to the cap rate plus the basis points on the loan (4%), while still benefiting with lower interest costs if rates decrease. This can be seen in Exhibit 8.16, where the quarterly interests on the loan, the cap payoffs, and the hedged and unhedged rates are shown for different assumed LIBORs at each reset date on the loan. For the four reset dates from 6/1/Y2 to the end of the loan, the LIBOR exceeds 2.5%. In each of these cases, the higher interest on the loan is offset by the payoff on the cap yielding a hedged rate on the loan of 4.0% (the 4% rate excludes the $150,000 cost of the cap). For the first two reset dates on the loan, 6/1/Y1, 9/1/Y1, and 12/1/Y1, the LIBOR is less than the cap rate. At these rates, there is no payoff on the cap, but the rates on the loan are lower with the lower LIBORs.

n There is no cap on this date EXHIBIT 8.16 Hedging a Floating‐Rate Loan with a Cap n There is no floor on this date EXHIBIT 8.17 Hedging a Floating‐Rate Investment with a Floor As explained in Chapter 6, a plain‐vanilla floor is a series of European interest rate put options—a portfolio of floorlets. For example, a 2.5%, two‐year floor on a three‐month LIBOR, with a NP of $100 million, provides, for the next two years, a payoff every three months of (0.025 − LIBOR)(0.25)($100,000,000) if the LIBOR on the reset date is less than 2.5% and nothing if the LIBOR equals or exceeds 2.5%. Floors are often purchased by investors as a tool to hedge their floating‐rate investments against interest rate declines. Thus, with a floor, an investor with a floating‐rate security is able to lock in a minimum rate each period, while still benefiting from higher yields if rates increase. As an example, suppose Southern Bank in the above example wanted to establish a minimum rate or floor on the rates it was to receive on the two‐year floating‐rate loan it made to the Jones Development Company. To this end, suppose the bank purchased from another financial institution a floor for $100,000 with the following terms corresponding to its floating‐rate asset: On each reset date, the payoff on the corresponding floorlet would be With the 2.5% exercise rate, Southern Bank would be able to lock in a minimum rate each quarter equal to the floor rate plus the basis points on the floating‐rate asset (4%), while still benefiting with higher returns if rates increase. In Exhibit 8.17, Southern Bank’s quarterly interests received on its loan to Jones, its floor payoffs, and its hedged and unhedged yields on its loan asset are shown for different assumed LIBORs at each reset date. For the first three reset dates on Southern Bank’s loan to Jones, 6/1/Y1, 9/1/Y1, and 12/1/Y1, the LIBOR is less than the floor rate of 2.5%. At these rates, there is a payoff on the floor that compensates Southern Bank for the lower interest it receives on the loan; this results in a hedged rate of return on the bank’s loan asset of 4% (the cost of the floor excluded). For the five reset dates from 6/1/Y1 to the end of the loan, the LIBOR equals or exceeds the floor rate. At these rates, there is no payoff on the floor, but the rates the bank earns on its loan to Jones are greater, given the greater LIBORs. A collar is a combination of a long position in a cap and a short position in a floor with different exercise rates. The sale of the floor is used to defray the cost of the cap. For example, the Jones Development Company in our previous case could reduce the cost of the cap it purchased to hedge its floating‐rate rate loan by selling a floor. By forming a collar to hedge its floating‐rate debt, the Jones Company, for a lower net hedging cost, would still have protection against a rate movement against the cap rate, but it would have to give up potential interest savings from rate decreases below the floor rate. For example, suppose the Jones Company decided to defray the $150,000 cost of its 2.5% cap by selling a 1% floor for $75,000, with the floor having similar terms to the cap (effective dates on floorlet = reset dates, reference rate = LIBOR, NP on floorlets = $100 million, and time period for rates = 0.25). By using the collar instead of the cap, Jones reduces its hedging cost from $150,000 to $75,000, and the company can still lock in a maximum rate on its loan of 4%. However, when the LIBOR is less than 1%, the company has to pay on the 1% floor, offsetting the lower interest costs it would pay on its loan. See Exhibit 8.18. n Loan interest, cap payoff, and floor payment made on payment date EXHIBIT 8.18 Hedging a Floating‐Rate Loan with a Collar An alternative financial structure to a collar is a corridor. A corridor is a long position in a cap and a short position in a similar cap with a higher exercise rate. The sale of the higher exercise‐rate cap is used to partially offset the cost of purchasing the cap with the lower strike rate. For example, the Jones Company, instead of selling a 1% floor for $75,000 to partially finance the $150,000 cost of its 2.5% cap, could sell a 3.5% cap for, say, $75,000. If cap purchasers, however, believe there was a greater chance of rates increasing than decreasing, they would prefer the collar to the corridor as a tool for financing the cap. In practice, collars are more frequently used than corridors. A reverse collar is a combination of a long position in a floor and a short position in a cap with different exercise rates. The sale of the cap is used to defray the cost of the floor. For example, suppose that Southern Bank in our above floor example decided to reduce the $100,000 cost of the 2.5% floor it purchased to hedge the floating‐rate loan it made to the Jones Company by selling a 4% cap for $50,000, with the cap having similar terms to the floor. By using the reverse collar instead of the floor, Southern Bank reduces its hedging cost from $100,000 to $50,000, and the bank can still lock in a minimum rate on its investment of 2.5%. However, when the LIBOR is greater than 4%, the bank rates on the investment are fixed at 5.5%, offsetting the higher interest it would have received. See Exhibit 8.19. Finally, note that instead of financing a floor with a cap, an investor could form a reverse corridor by selling another floor with a lower exercise rate. n Loan interest, floor payoff, and cap payment made on payment date EXHIBIT 8.19 Hedging a Floating‐Rate Investment with Reverse CollarHedging a T‐Note Purchase with T‐Note Futures Calls

Cheapest‐to‐Deliver T‐Note: 1 3/8 8/31/20: On 5/20/16 (Futures Expiration), Accrued Interest (AI) = $0.303 per $100 face; Conversion Factor = CFA = 0.8317

Futures Price at T: (Cheapest‐to‐Deliver T‐Note Price + AI)/Conversion Factor = (ST + AI)/CFA

Call Options on June 5‐Year T‐Note Futures with X = 118, Expiration = 5/20/15, Premium on 12/30/15 = 0 − 48; [(48/64)/100]($100,000) = $750

1

2

3

4

5

6

7

8

YTM

Price of T‐Note: 1 3/8 8/31/20, ST

Cost of 10 T‐Notes with $100,000 Face plus Accrued Interest: 10 [(ST + $0.303)/100] $100,000

Futures Prices at T, fT: (ST + AI)/(CFA) = (ST + AI)/(0.8317)

Call Value CT = IV = Max[fT − 118,0]

Cash Flow from Selling 10 June Futures Calls at IV: (10) (IV/100) ($100,000)

Futures Call Hedge: Cost of Buying T‐Notes minus Cash Flow from Futures Call: (3) − (6)

Hedged Cost Savings: (3) − (9)

3.39891%

92

$923,030

110.98

$0.00

$0

$923,030

$0

3.13518%

93

$933,030

112.18

$0.00

$0

$933,030

$0

2.87466%

94

$943,030

113.39

$0.00

$0

$943,030

$0

2.89617%

95

$953,030

114.59

$0.00

$0

$953,030

$0

2.63588%

96

$963,030

115.79

$0.00

$0

$963,030

$0

2.37866%

97

$973,030

116.99

$0.00

$0

$973,030

$0

2.12446%

98

$983,030

118.20

$0.20

$1,953

$981,077

$1,953

1.84476%

98.1406

$984,436

118.36

$0.36

$3,643

$980,793

$3,643

1.87319%

99

$993,030

119.40

$1.40

$13,976

$979,054

$13,976

1.62480%

100

$1,003,030

120.60

$2.60

$26,000

$977,030

$26,000

1.37924%

101

$1,013,030

121.80

$3.80

$38,023

$975,007

$38,023

1.36426%

102

$1,023,030

123.00

$5.00

$50,047

$972,983

$50,047

0.89632%

103

$1,033,030

124.21

$6.21

$62,070

$970,960

$62,070

0.65885%

104

$1,043,030

125.41

$7.41

$74,094

$968,936

$74,094

0.42348%

105

$1,053,030

126.61

$8.61

$86,118

$966,912

$86,118

Hedging a T‐Note Sale with T‐Note Futures Puts

Cheapest‐to‐Deliver T‐Note: 1 3/8 8/31/20: On 5/20/16 (Futures Expiration), Accrued Interest (AI) = $0.303 per $100 Face; Conversion Factor = CFA = 0.8317

Futures Price at T: (Cheapest‐to‐Deliver T‐Note Price + AI)/Conversion Factor = (ST + AI)/CFA

Put Options on June 5‐Year T‐Note Futures with X = 118, Expiration = 5/20/15, Premium on 12/30/15 = 0 − 48; [(48/64)/100]($100,000) = $750

1

2

3

4

5

6

7

9

YTM

Price of T‐Note: 1 3/8 8/31/20, ST

Revenue from Selling 10 T‐Notes with $100,000 Face plus Accrued Interest: 10 [(ST + $0.303)/100] $100,000

Futures Prices at T, fT: (ST + AI)/(CFA) = (ST + AI)/(0.8317)

Put Value PT = IV = Max[118 − fT,0]

Cash Flow from Selling 10 June Futures Puts at IV: (10) (IV/100) ($100,000)

Futures Put Hedge: Revenue from Selling T‐Notes plus Cash Flow from Futures Puts: (3) + (6)

Hedged Value Savings: (7) − (4)

3.39891%

92

$923,030

110.98

$7.02

$70,189

$993,219

$70,189

3.13518%

93

$933,030

112.18

$5.82

$58,165

$991,195

$58,165

2.87466%

94

$943,030

113.39

$4.61

$46,142

$989,172

$46,142

2.89617%

95

$953,030

114.59

$3.41

$34,118

$987,148

$34,118

2.63588%

96

$963,030

115.79

$2.21

$22,095

$985,125

$22,095

2.37866%

97

$973,030

116.99

$1.01

$10,071

$983,101

$10,071

2.12446%

98

$983,030

118.20

$0.00

$0

$983,030

$0

1.84476%

98.1406

$984,436

118.36

$0.00

$0

$984,436

$0

1.87319%

99

$993,030

119.40

$0.00

$0

$993,030

$0

1.62480%

100

$1,003,030

120.60

$0.00

$0

$1,003,030

$0

1.37924%

101

$1,013,030

121.80

$0.00

$0

$1,013,030

$0

1.36426%

102

$1,023,030

123.00

$0.00

$0

$1,023,030

$0

0.89632%

103

$1,033,030

124.21

$0.00

$0

$1,033,030

$0

0.65885%

104

$1,043,030

125.41

$0.00

$0

$1,043,030

$0

0.42348%

105

$1,053,030

126.61

$0.00

$0

$1,053,030

$0

Hedging a Bond Portfolio with T‐Bond Futures Puts

DurS = duration of the bond fund = 5.31

Durf = duration of the cheapest‐to‐deliver bond = 4.02

V0 = value of bond portfolio = $11,637,934

X = 120

Put premium per contract = $921.875

Future conversion factor on cheapest‐to‐deliver bond = CFA = 0.8371

T = time to expiration on the option as proportion of year = 141/365

YTMS = yield to maturity on the bond fund = 2.78%

YTMf = yield to maturity implied on the futures contract = 1.76%

Portfolio: Value on 3/15/16 = $11,637,934, Duration = 5.31, YTM = 2.78%

Cheapest‐to‐Deliver T‐Note: 1 3/8 8/31/20: On 5/20/16 (Options Expiration), Accrued Interest (AI) = $0.303 per $100 Face

Futures Price at T: (Cheapest‐to‐Deliver T‐Note Price + AI)/Conversion Factor = (ST + AI)/CFA