Chapter 1

Economic Growth and Growth Theory

1.1 Economic Growth

There is one central, simple, and everyday question in economic growth theory: why are some countries/races rich, and others poor? Economic growth theory is concerned with the rise and decline of economic systems. Its central task is to explain economic growth and interdependence between growth and other variables (such as education policy, R&D policy, economic structure, income distribution, saving, work efficiency, population, capital, resources, sexual division of labor and consumption, public goods, and tax structure). How can we account for the phenomenal disparities in living standards around the world? Why are countries, like the United States and Japan, so rich, and why are countries, like Mainland China and Vietnam, so poor? How can one explain the fact that while the average resident of a non-Asian country in 1990 was 72 percent richer than his or her parents were in 1960, the corresponding figure for the average South Korean is no less than 638 percent. Why could East Asian economies, like Japan, Korea, Singapore, Hong Kong and Taiwan, have experienced rapid economic growth after the Second World War? We may also ask why some countries have experienced economic declination. Figure 1.1 caricatures changes of incomes per capita in Taiwan and Singapore over 40 years from 1960 to 2000. Over the four decades, some rich countries like the U.S. have remained rich; while some poor economies like Singapore, Hong Kong, and Taiwan had experienced 'economic miracles'.1

The United States experienced an average annual growth rate of 1.75 percent of the real per capita gross domestic product (GDP) over the period from 1870 to 1990. The per capita GDP increased from U.S.S 2244 in 1870 to U.S.$ 18.258 in 1990 (when the U.S. citizens were enjoying the highest level of real per capita GDP in the world), measured in 1985 dollars.2 To maintain sustainable growth, even with a small growth rate on average, means much in the long term. For instance, if the real per capita growth rate was 0.75 percent instead of 1.75 percent, the real per capita GDP would have been changed from $2244 in 1870 to $5519 - rather than U.S.$ 18,258 at the rate of 1.75 percent - in 1990. But if the real per capita growth rate was 2.7 percent instead of 1.7 percent, the real per capita GDP would have been changed from U.S.$ 2244 in 1870 to U.S.$ 60,841 - rather than U.S.$ 18,258 at the rate of 1.7 percent-in 1990. If real income per person in India grows at annual rate of 1.3 percent, it will take about two hundred years for Indian real incomes to reach the current U.S. level. If the average growth rate is about 3 percent, it will take about hundred years for India to equal the current U.S. level of real income per capita. The time will be reduced to 50 years if the average growth rate is increased to 5.5 percent.

Figure 1.1 An Illustration of Cross-Country Economic Growth

Singapore is an interesting case for growth theory. When Singapore attained self-government on June 3, 1959 after nearly 140 years of British colonial rule, it had population of 1.58 million that was growing at the rate of 4 percent annually. The socio-economic environment was not much different from that in the premier cities of most underdeveloped countries. Majority of the Singaporeans merely managed to make a modest living by hard work. Half of the population was living in squatter huts and only 9 percent in public housing. Its per capita GNP in 1960 was 443 U.S. dollars.3 It has almost no natural resources. The independence had put Singapore in a situation that even survival seemed a miracle. But Singapore has achieved more than a survival miracle. The real GDP in 1996 was 16 times more than that in 1965, the year when Singapore attained political independence. On the average, the economy grew by more than 9 percent annually during this period. In 1997, the per capita indigenous Gross National Product was U.S.$36,422. In Table 1.1, we compare some development indicators between Singapore and some countries. The real income differences across countries imply large differences in nutrition, literacy, infant mortality, life expectancy, and other indicators of well-being. Singapore outperformed many highly industrialized economies such as Australia and United Kingdom in terms of real per capita GNP, even though it still lagged behind these countries in terms of some social indicators. Lucas asserted:4 'I do not think it is in any way an exaggeration to refer to this continuing transformation of Korean society as a miracle, or to apply this term to the very similar transformations that are occurring in Taiwan, Hong Kong, and Singapore. Never before have the lives of so many people (63 million in these four areas in 1980) undergone so rapid an improvement over so long a period, nor (with the tragic exception of Hong Kong) is there any sign that this progress is near its end.' The rapid progress was obviously at end soon after Lucas published his article, even though another miracle involved far more people in Mainland China was starting in East Asia.

Table 1.1 International Comparison of Development Indicators in 19955

| GNP per Capita In U.S.$ | Real GDP per Capita (in PPP) | Growth Rate (%) 1985-95 | Literature Rate (%) in 1994 | |

|---|---|---|---|---|

| Hong Kong | 22,990 | 22,950 | 4.8 | 92.3 |

| Japan | 39,640 | 22,110 | 2.9 | 99.0 |

| Singapore | 26,730 | 22,770 | 6.2 | 91.0 |

| U.K. | 18,700 | 19,260 | 1.4 | 99.0 |

| U.S.A. | 26,980 | 26,980 | 1.3 | 99.0 |

Kaldor observed a number of stylized facts of the progress of economic growth. These factors include:6

- (1) Per capita output grows over time, and its growth rate does not tend to diminish.

- (2) Capital-worker ratio grows over time.

- (3) The rate of return to capital exhibits almost the same over time.

- (4) The ratio of physical capital to output is nearly invariant over time.

- (5) The shares of labor and physical capital in national income change little over time.

- (6) The growth rate of output per worker differs substantially across countries.

Facts 1, 2, 4, and 5 appear to be held for the long-term data for currently developed economies. It seems that fact 3 should be replaced by the fact that real rate of return to capital tends to fall. In addition to the patterns of economic growth by Kaldor, Kuznets observed other characteristics of modern economic growth.7 According to Kuznets, there are rapid transformations from agriculture to industry to services in association of modern economic growth. In association with rapid economic structural transformations, an economy will also experience rapid urbanization, shifts from home work to employee status, an increasing role for formal education, increased international trade, and a reduced reliance on natural resources. In particular, he held that government plays a significant role in providing institutions and infrastructures in sustaining economic growth and development. We now review some traditional economic growth theories for explaining these phenomena.

1.2 Economic Growth Theory

Natural laws, once discovered, maintain structural stability in the sense that they can be repeated in a predictable way under certain circumstances. Natural laws are invisible and intangible but appear to exist everywhere and always. Newton's laws are valid in a predictable way; so is Einstein's relativity theory. Water boils in the same way in Japan, Sweden, and Australia. Under given conditions it boils at predictable temperatures at standard atmospheric presses. Snow forms much in the same way under similar conditions all over the world. Observations of natural law are reproducible. The regularity of natural laws is characterized by that under the same conditions the same experiments should always give the same results anywhere in the world at any time. Disciplines such as astronomy, chemistry, physics, geology, and biology have developed a robust combination of logical coherence, causal description, explanation, and testability. These disciplines are more or less mutually consistent. For instance, the laws of chemistry are compatible with the laws of physics, even though they are not reducible to them. Chemists do not propose theories that violate the elementary physics principles of the conservation of energy. Instead, they use the principle to make sound inferences about chemical processes. The traditional scientific strategy is to decompose the whole into simpler parts until we can deal with simple parts.

Similar to natural sciences, economics has tried to find simplicity in a complex reality by this strategy. But its success cannot be compared to those enjoyed by natural sciences. Various fields in economics live in isolation from each other. Students trained in one subfield often have not a shared understanding of the fundamentals of the others. When economists from each subfield are busy with pursuit of learning, they do not converge upon a common framework but find themselves in divergent directions. Economists have made various assumptions about the underlying laws of economic systems, which are supposed to determine the observed orders. Before we show that the reasons that economics has failed in explaining reality are partly due to its lack of structural integrity and omission of time and space dimensions, we introduce some of traditional growth theories.

Adam Smith (1723-1790)

He was the founder of the classical school of economics. In the Wealth of Nations Adam Smith was concerned with the forces that govern the relative levels of prosperity among countries and that cause differences between countries. He discussed the advantages of the division of labor and its dependence on the scale of activity and the extent of the market. Large-scale activity and extended market permit specification and thus improve skills and labor efficiency. Technological progress, division of labor and scale of market are interdependent. He emphasized the significance of free institutions under which people freely exploit the advantage of their skill and knowledge and resources. Adam Smith's economic theory with division of labor and competitive equilibrium, irrespective of positive dynamic elements, sets limits on economic growth.

Adam Smith was living in times of unusual economic change - the stage of initial industrialization. This partly explained his neglect of capital and for the conviction that agriculture and not manufacture was the principal source of Britain's wealth. He noted that industry generally affords greater scope for specialization than agriculture and insisted that division of labor is necessary to increase wealth and that exchanges and the system of prices are necessary as the division of labor develops. His theory of economic equilibrium has been supported by the modern competitive equilibrium approach; while his theory of division of labor is still not well formed, even though many efforts have been made in the literature on human capital accumulation.

Ricardo (1772-1823)

Smith assigned primary role to the division of labor in studying how and why nations could become wealthy. The division of labor was the primary factor for explaining a nation's relative productivity. He related the division of labor to the extent of market. According to Adam Smith, extension of markets would thus allow for an extended exploitation of the advantages of labor specialization. Nevertheless, Smith failed to give the precise relationship between extended specialization and economic productivity. Moreover, his economic theory was not so rich in addressing issues related to income distribution. In contrast, Ricardo was greatly concerned with the relations between prices and income distribution. He was concerned with income distribution in order to understand how a change in this distribution could hinder or favor accumulation. His On the Principles of Political Economy and Taxation of 1817 was considered the most valuable contribution to economic science since Adam Smith.

Although his interest in economics began with reading Adam Smith and was greatly influenced by the Wealth of Nations, Ricardo emphasized more manufacturing than Adam Smith. Ricardo drew analytical conclusions from the law of diminishing returns in agriculture concerning the theory of rent, which has no real counterpart in the Wealth of Nations. One of the hallmarks of Ricardo's system is that it links wages, interest rate and rent together in a compact theory. He tried to establish laws which regulate what proportion of the whole produce of the society will be allotted to each of three - landowner, capitalist and worker - under the names of rent, profit and wages, respectively. These laws show how the distribution will change at different stages of society. He was concerned with an economic system consisting of agriculture and industry. Economists formulated different aspects of Ricardo's system.8 Marx's economic system was profoundly influenced by Ricardo, though Marx interpreted the economic analysis in his distinctive way.

Malthus (1766-1834)

Malthus was not the first to examine demographic problems; but he was the first who succeeded in developing a theory of population growth. By emphasizing the interdependence of population growth and food supply, his theory lent support to the subsistence theory of wages, which had important influences upon Ricardo, Marx, and Keynes. By explaining poverty in terms of a simple interdependence between the population and the means of subsistence, the theory still provides important suggestions for poor countries' economic policies.

We now use a simple model to illustrate the essence of the theory. In the simplest form of the Malthusian growth model, the population grows at a constant rate times the population present, with no limitations on its resources. That is:

where N(t) is the population at time t and a is a positive parameter. Such a population growth may be valid for a short time, but it clearly cannot go on forever. There are limitations of natural resources that prevent population from limitlessly growing. The logistic growth model, which is defined by:

takes account of checking effects of natural resources upon population growth. Nevertheless, from a long-term perspective, resources are changeable. To analyze how income affects population growth, Haavelmo suggested the following extension of Malthus' system:9

in which Y is real output. Substituting Y(t) = AN(t)β into equation (1.2.1) yields:

(1.2.2)

where a1, ≡ ab/A. The growth law is a generalization of the familiar logistic form widely used in biological population and economic analysis. We specify the parameters as:

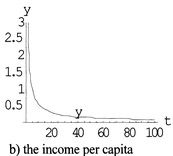

From the initial condition N(0) = 8, we run the model for 100 years. Figure 1.2 depicts the motion of N(t), Y(t), and the income per capita, y(t) (≡ Y(t)/ N(t)).

As demonstrated in Figure 1.2, the national product grows over time, but the income per capita (which is assumed to be the main factor for determining the level of consumption per capita) first suddenly but afterwards steadily declines. This book introduces some economic mechanisms to avoid decline of living standard. As observed in modern economic history, population growth may be associated with improvement in living standard. An obvious way to avoid the dismay implications of the Malthusian theory is to take account of technological change. For illustration, we specify a pattern of exogenous technological progress as follows:

Figure 1.2 The Dynamics of a Malthusian Economy

The technology parameter A(t) grows annually 2 percent. Figure 1.3 shows the motion of the system with the technological change. Comparing the two figures, we observe that with the technological change, the economy dramatically changes over 100 years. The economy is enlarged and the income per capita grows as the population grows after an initial decline.

Figure 1.3 The Malthusian Economy with Technological Change

It should be noted that Malthus was also aware of uncertainty in economic evolution with endogenous population. He believed in nonlinearity of structural relations, and their complicated multi-connected nature. In his approach, it is important to analyze the properties of a dynamic system out-of-equilibrium and to trace the paths by which equilibrium might be approached.

Joseph Alois Schumpeter (1883-1950)

The year 1883 is special for the history of the world economy and the history of economic analysis. The year saw the death of Karl Marx (1918-1883), the birth of John Maynard Keynes (1883-1946), the birth of Schumpeter. They got their names widely spread by working out political economic systems on the same premise that capitalism is an inherently unstable system. They were concerned with changes rather than routinely repeated equilibrium structures. They gave three different processes of capitalism.

For Schumpeter motion of capitalism is not simply growth. Growth is only an expanding replica of the steady state. He did not put much attention to such processes. He was not much concerned with the new equilibrium positions after changes take place. His vision about change is different from changes analyzed by the traditional analytical method. He is mainly concerned with changes, which are discontinuous and disruptive. These non-continuous changes are endogenous in the sense that the motion comprises the endogenous disruption of an equilibrium state of circular flow and the subsequent dynamic processes that result in a new equilibrium with different qualitative and quantitative features.

In the Theory of Economic Development published in 1911, Schumpeter argued that development should be understood as only such changes in economic life as are not forced upon it from without but arise by its own initiative, from within. He held that the production side is the determining side for generating economic change. Production means to combine materials and labor forces. To produce different things or to produce the same things by a different method means to combine these materials and forces differently. Schumpeter thus termed changes in production as 'new combinations'. For Schumpeter, development is defined as 'the carrying out of new combinations'. Development includes, for instance, changes such as improvement in quality of a commodity, opening of a new market or a new source of supply for inputs, introduction of a new commodity or a new method, and carrying out a new organization of any industry. He identified the key development process as the 'carrying out of new combinations'. In the competitive economy, new combinations mean the competitive elimination of the old. It is the entrepreneur who carries out new combinations. The entrepreneur leans the means of production into new channels and may thereby reap an entrepreneurial profit. The entrepreneur also plays a role of leadership in the sense that he draws other producers in his branch after him. But as they are his competitors, who first reduce and then annihilate his profit, the leadership is against one's own will.

According to Schumpeter, successful carrying out of new combinations of productive services is the essence of this process. It is spontaneous and discontinuous changes in the channels of the flow, disturbance of equilibrium, which alters and displaces the equilibrium state previously existing. The carrying out of new combinations is innovation, which consists of the following five cases:

- (i) introduction of a new good or a new quality of an old good;

- (ii) introduction of a new method of production;

- (iii) opening of a new market for a product;

- (iv) conquest of a new source of raw materials or half-manufactured articles; and

- (v) carrying out of a new organization of an industry like the creation of a monopoly position or the breaking up of a monopoly position.

Profits are temporary in the sense that they emerge at one point in the economy and accrue to the innovator, then start dwindling as they are shared by an increasing number of innovators on one hand and eaten up by rising costs and falling prices on the other, till they finally disappear. By this time, the development achieved in the form of the newly introduced method has been generalized, completely replacing the old inferior methods. Profits are thus both the child and the victim of economic development. Once again, the competitive process establishes cost-price equality all round. Factorial rewards equal marginal productivities. Wages and rents are now higher and prices of consumer goods lower. But the circular flow once again comes into its own. A dynamic flow is again disturbed by some new innovation. Creative destruction is continued by competition over profits. The competitive process will strike not at the margins of the profits of existing firms but at their very existence. The fear for survival encourages operating efficiency. The dynamic competition among the entrepreneurs creates innovations and destroys old equilibria by establishing new combinations. The process of such 'creative destruction' brings about progress in productivity.

There are a number of other studies designing and defining frameworks for explaining and forecasting economic growth and development. It has been recognized that growth and development theory has to choose an intrinsically dynamic approach. The first models of economic dynamics were constructed in the 1930s and 1940s by theorists such as Kalecki, Frisch, Kaldor, Hicks, Samuelson, and Goodwin.10 These models mainly focused on the dynamics of the product markets. Since then, various dynamic models of economic growth and development with endogenous money, capital, knowledge, population, environment and natural resources were constructed.

Harrod and Domar made efforts to introduce dynamic elements into static Keynesian analysis.11 They were concerned with the conditions under which an economy was capable of steady growth at a constant rate. The condition is proved that the national saving rate is equal to the product of the capital-output ratio and the rate of growth of the effective labor force. The Solow-Swan model is the starting point for almost all analyses of economic growth.12 It was the first neoclassical version of the Harrod-Domar growth model. It opened a new way to modeling economic growth. Nevertheless, the Solow model does not provide a solid behavior mechanism of consumers. Ramsey's 1928 paper on optimal growth theory has influenced modeling of consumers' behavior since the late 1960s. Cass and Koopmans combined Ramsey's analysis of consumer optimization and Solow's description of profit-maximizing producers within a compact framework.13 In the 1962 paper, Arrow introduced endogenous technological change through learning by doing into growth theory. In 1965 Uzawa made an important contribution to growth theory by taking account of interdependence between education and economic growth.14 These seminal papers were technically refined and generalized in different ways in the 1960s and early 1970s. Since then, growth theory had lost a mainstream position in economics until Romer published a paper 'increasing returns and long-run growth' in 1986 and Lucas published 'on the mechanics of economic development' in 1988.15 These works, together with historical events of the East Asian 'miracles', have rejuvenated growth theory. This has been particularly the case in theoretical development with imperfect competition, endogenous mechanism of growth, international trade.

Further issues on economic growth are referred to Growth Theory (composed of the classical articles collected by Becker and Burmeister in 1991) and Handbook of Macroeconomics (collected by Taylor and Woodford in 1999), which provide a survey of the state of knowledge in the broad area covering the theories and facts of economic growth and economic fluctuations, as well as the consequences of monetary and fiscal policies for general economic conditions.16 We will also further review the literature of growth theory in the coming chapters.

There are two well-mentioned limitations in growth models. The first is that each model emphasizes some aspects of economic reality and omits many others. Economic systems exhibit complicated interdependence between many variables. It is necessary to construct dynamic models, which include time-dependent motion of key economic variables and economic structure. It is argued that current growth theory has not succeeded in constructing an integrated framework to take into account the significant interdependence between economic variables. Each theory can be considered as a partial approximation of reality for a given time scale (and under certain historical circumstances). Theoretical economics is characterized by isolating the so-called elementary phenomena, from which everything else would follow. The current growth theory is a collection of economic theories, each of which has been enormously refined within its own domain. In fact, it has become clear that neither space nor time nor economic structure has been sufficiently analyzed in modern economics. This book attempts to make an advance in creating general economic framework(s). The second limitation is that from a genuine dynamic point of view the traditional studies are mainly concerned with linearized and static or equilibrium states of the dynamic systems. Indeed, many efforts have been made to analyze genuine nonlinear economic dynamic phenomena in the literature of nonlinear theory - also called, for instance, complexity theory, chaos theory, catastrophe theory, bifurcation theory, and synergetics.17 But nonlinear theory becomes meaningful only when it is applied to proper analytical frameworks.

1.3 The Structure of the Book

The student who wants to study growth theory is nowadays faced with a motley collection of growth models/theories - each with its unique non-invalid assumptions, refined structures, and complicated techniques. The student needs some years spent on advanced mathematics to read and digest these models. It is common for students to spend a few years on those disjoint models, being disappointed at the unorganized knowledge. The demand from the student for learning in an economic and effective way requires a growth theory that is built upon concepts and assumptions as few as possible, explains economic phenomena as rich as possible, reveals complexity of economic evolution as deep as possible, and uses mathematical techniques as simple as possible.

A number of excellent summaries on contemporary growth theory already exist. We mention a few of them, by Aghion and Howitt, Barro and Sala-i-Martin, Burmeister and Dobell, Grossman and Helpman, Romer, and Bretschger.18 It is useful to clarify how this book differs. First, our attempt is to economize growth theory itself for understanding the sources of varied patterns of growth: there are many concepts, assumptions, and techniques in growth theory. Growth is a complicated phenomenon; but modern growth theory as a whole is even more difficult to comprehend not because economic problems and insights but because of the complex of concepts and techniques. Our purpose is to employ concepts and assumption as few as possible and apply mathematical techniques as simple as possible to reveal growth phenomena as rich as possible. We try to develop a compact theoretical framework to systematize varied main ideas and conclusions of the growth theory in a simplified manner. The framework developed in this book allows one to deepen understanding of economic growth without losing the generality and robustness of traditional economic growth theories. This book provides an organizing framework for different approaches - the equilibrium economics, the Ricardian economics, the Solow growth model, the Ramsey growth model, Arrow's learning by doing model, Uzawa's education model, Romer's growth theory, Lucas' approach - in growth theory. We show how these important and economically sound findings can be consistently explained with a few concepts and simple techniques. We also try to identify the links between alternative growth models in the literature.

This book is concentrated in a single representative national economy. We are aware that national economies are connected through trade and other forms of exchanges. Contemporary economic systems cannot be properly studied without an international analytical framework. Nevertheless, as far as the determinants and mechanism of economic growth is concerned, it is essential to understand economic evolution of a single economy. The reader can extend the framework constructed in this book to spatial economies along the lines to international trade, urban economics, and interregional economies.19 This book is based on Capital and Knowledge by Zhang in 1999.20 It differs from the previous book in many important aspects. Different from Capital and Knowledge, this book introduces different approaches in growth theory, while the previous one is confined to the one-sector growth (OSG) model and its extensions. This book simulates models and provides over hundred simulation plots; while the previous book includes no simulation example. This book provides more general models than the previous book. It also updates the contemporary literature of economic growth. We also propose some new models. Some of the models proposed in the Capital and Knowledge are not included in this book.

The book is designed for first-year graduate courses in economic growth and development. It can also be used in advanced undergraduate courses. The student is presumed to have previously completed an introductory macroeconomic course and an introductory course in mathematical economics. It can also provide a source of economic growth theory for economists and others interested in economic growth and development. The book is organized as follows.

Chapter 2 constructs the OSG model and examines its behavior. The chapter is organized as follows. Section 2.1 models behavior of producers and explains the properties of neoclassical production functions. In Section 2.2, we introduce a novel approach to consumer behavior. Using the new utility function, we overcome the lacking of rational foundation for consumers in the Solow model and avoid the technical complexity of the Ramsey model. In Section 2.3, we explore relationships between the Keynesian consumption function and the consumption function derived from our new approach to consumers. The Keynesian consumption function has been widely applied in macroeconomics. We demonstrate that our approach predicts the consumer behavior in the Keynesian theory. Section 2.4 represents the OSG model in terms of dynamics of capital-labor ratio. The presentation makes it possible to analyze dynamic properties and behavior of the model. Section 2.5 proves that the dynamic system has a unique stable equilibrium. This guarantees the validity of comparative statics analysis. Section 2.6 examines effects of changes in productivity, population growth rate, and the propensity to own wealth on the equilibrium structure. In Section 2.7, we examine and simulate the model when the production function is specified with the Cobb-Douglas form. Section 2.8 demonstrates the behavior of the model when the production function is specified with the CES production function. In Section 2.9, we illustrate the motion of the OSG model with the Leontief production function. Section 2.10 shows dynamic properties of the OSG model when both production function and utility function are taken on general forms. Section 2.11 introduces a preference dynamics to show how to make the OSG model more realistic. We also mention that the OSG model becomes the Solow model when a special form of preference dynamics is taken. Section 2.12 represents the OSG model in discrete time. We show that the discrete-time version of the model has similar dynamic properties to the continuous-time version of the model. Finally, we make a few remarks on the OSG model to conclude the chapter. In Appendix A.2.1, we prove the main result in Section 2.4. In Appendix A.2.2, we provide a general OSG model in discrete time.

Chapter 3 is organized as follows. Section 3.1 represents the Harrod-Domar model and examines its dynamic behavior. In Section 3.2, first we define the Solow model and provide dynamic properties of the model. Then, we examine some relationships between the Solow model and the OSG model. We demonstrate that the OSG model exhibits identical dynamic behavior with these revealed by the Solow model when we specify preference change of the OSG model. Section 3.3 introduces the life cycle hypothesis and discusses relationships between the life cycle hypothesis and our approach to consumer behavior. We show that the two approaches have similar implications for consumers' decision on saving and consumption. Section 3.4 discusses the permanent income hypothesis and studies relationships between the hypothesis and our approach to consumer behavior. It is concluded that the two approaches have similar implications for consumers' decision on saving and consumption. This is expectable because the life cycle hypothesis and the permanent income hypothesis have similar economic implications. Section 3.5 defines the standard Ramsey model and examines its dynamic properties. We also discuss limitations and invalidity in modeling consumers' behavior in the Ramsey growth model. In Section 3.6, we show the connections between the Ramsey model and the OSG model by introducing some pattern of preference change. It is demonstrated that under the preference change, the two models reveal the same behavior pattern. Section 3.7 shows how poverty traps can be generated by the Solow model through making the saving rate an endogenous variable as well as by the OSG model through making the propensity to save an endogenous variable. In Section 3.8, we introduce money into the one-sector growth model. We discuss issues related to non-neutrality of money and possible instability in a monetary economy. Section 3.9 reasons our approach to consumer behaviors. In the appendix to this chapter, we deal with the golden rule of capital accumulation in the Solow model.

Chapter 4 is arranged as follows. Section 4.1 introduces endogenous technological change into the OSG model. First, we discuss the necessity of taking account of technological change and mention various possible patterns of technological change. Then, specifying the Harrod-neutral technological change, we show that the economic system may experience permanent economic growth in terms of per capita consumption. In Section 4.2, time distribution is no more fixed. We consider interdependence between time distribution (between leisure and work) and economic growth. We show how leisure changes as the economy grows. Section 4.3 simulates the growth model with leisure proposed in Section 4.3. In Section 4.4, we introduce infrastructures (or public goods in general) into the OSG model. Assuming that infrastructures affect both the production sector and consumers, we show that the dynamic system may exhibit increasing or decreasing returns, depending on how infrastructures enter the production function. Section 4.5 deals with the issues that are seldom mentioned in the traditional growth literature. The OSG model takes account of home production. Section 4.6 illustrates a dynamics between environment and economic growth. Our analysis provides some new insights into complexity of environmental issues. Section 4.7 portrays a dynamic economic evolution with endogenous population. Population growth rate is no more treated as a given parameter but considered as an endogenous variable. A large population may either benefit or harm economic growth, depending on various combinations of conditions in the system. Section 4.8 introduces money into the OSG model. In Appendix A.4.1, the results in Section 4.2 are proved. Appendix A.4.2 examines the OSG model with endogenous time when the utility function takes on general forms. In Appendix 4.3, the results in Section 4.4 are proved. Appendices 4.3 and 4.4 confirm the conclusions of Section 4.6.

Chapter 5 is organized as follows. Section 5.1 proposes a two-group growth model with income transfers. In Section 5.2, we examine how inequality in income and wealth may affect economic growth. Section 5.3 examines the dynamic model proposed in Section 5.1. In Section 5.4, we study how the distributional policy affects the national product, the total consumption and income, wealth distribution between the groups, and consumption per capita of the two groups. Section 5.5 deals with the case when the human capital of a group is related to incomes that the group receives from the other group. This case points out a possibility that income transfers may benefit everyone in the system. In Section 5.6, we show how our model explains the dynamics of the Lorenz curve. In Section 5.7, we introduce endogenous time in the two-group model. Section 5.8 generalizes the OSG model to include any number of groups. Section 5.9 simulates the three-group OSG model. In Section 5.10, we discuss dynamic interdependence between economic growth and sexual division of labor and consumption. Section 5.11 comments on modeling group differences and economic growth. In Appendix A.5.1, we prove the stability conditions in Section 5.3.

Chapter 6 examines economic structures and structural changes. We provide a compact framework to describe a dynamic interdependence between demand and production structures with given technology and preference under perfect competition. This chapter is organized as follows. Section 6.1 introduces the Uzawa model. In Section 6.2, we develop the Uzawa model within the framework proposed in this study, introducing the rational mechanism to determine behavior of consumers. Section 6.3 simulates the model proposed in Section 6.2. In Section 6.4, we propose a three-sector growth model, generalizing the traditional Ricardian economic system. Section 6.5 discusses growth rates of the variables in the general Ricardian model. Section 6.6 simulates the model in Section 6.4. In Section 6.7, we examine the impact of the propensity to own wealth on the equilibrium structure of the Ricardian economy. Section 6.8 addresses issues related to Engel's law and economic structural change. In Section 6.9, we show how to model economic structural changes when there are multiple capital goods. Section 6.10 concludes the chapter. Appendix A.6.1 proves the main analytical results in Section 6.4.

Chapter 7 shows that it is possible to introduce the economic mechanisms proposed by the theories of unemployment into the modeling framework of this book. This chapter is organized as follows. Section 7.1 proposes a model of dynamic interactions between unemployment and growth in a welfare economy. Section 7.2 represents dynamics in two-dimensional differential equations of capital-worker ratios. In Section 7.3, we examine the equilibrium structure of the welfare economy with unemployment. Section 7.4 examines how the unemployment policy affects the equilibrium unemployment rate and other economic variables. In Section 7.5, we introduce the efficiency wage theories. Section 7.6 introduces the efficiency wage theory into the OSG model to examine dynamics of unemployment and economic growth. Section 7.7 explains other economic theories of unemployment. In Appendix A.7.1, we generalize the growth model of unemployment proposed in Section 7.6.

Chapter 8 holds that the driving force of economic growth is not only the capital accumulation, but also the accumulation of human capital. We interpret the effectiveness of labor as a function of human capital and formally model the evolution of human capital over time. Section 8.1 refits the AK-model within the framework proposed in this book. We show how a linearized technological progress can sustain unlimited, steady economic growth. As demonstrated in Chapter 10, a 'linearized' technological change or knowledge accumulation is the key assumption in the new growth theories, which have claimed having succeeded in identifying conditions for an unlimited positive steady growth rate. Section 8.2 introduces the AK-Ramsey model to show how complicated it is to introduce a simple idea into the traditional growth theory with a rational basis for individual consumers behavior. In Section 8.3, the Lucas growth model, also called the Uzawa-Lucas growth model, is presented. Section 4 proposes a growth model with three ways of learning - Arrow's learning by doing, Uzawa's learning by education, and learning by leisure. The model may be considered as an extension and synthesis of the three key models - the Solow model, Arrow's learning by doing model, and Uzawa's growth model with education - in the growth theory. Section 8.5 shows how growth rates of some key economic variables are affected by the education policy. In Section 8.6, we demonstrate that even when we accept the assumption of full employment, we can still find situations under which reducing the propensity to own wealth leads to higher economic growth rates. Section 8.7 demonstrates economically that 'all work and no play make Jack an inefficient worker'. In Section 8.8, we show that the dynamic system may have either a unique equilibrium or multiple equilibriums - stability of each equilibrium point being determining whether the system is dominated by increasing or decreasing returns to scale. Section 8.9 finds relationships between leisure and the equilibrium. Section 8.11 comments on human capital and economic development. In Appendix A.8.1, we introduce endogenous education into the OSG model. Appendix A.8.2 represents the dynamics of Section 8.4 in terms of physical capital and human capital. Appendix A.8.3 proves the main results in Section 8.8.1. Appendix A.8.4 proposes a growth model to examine dynamic interactions between physical capital, human capital, and unemployment - the existence of unemployment being justified by the social welfare assumption made in Section 7.1.

Chapter 9 is organized as follows. Section 9.1 develops a growth model with learning by doing and research. Different from Young's learning by doing and research model, we include capital accumulation as an important factor of economic growth. Because of changeable returns to scales in the two sectors, the system has a mechanism to produce multiple equilibria. Section 9.2 examines how growth rates of some main economic variables are affected by the research policy. It demonstrates under what conditions the promotion of sciences by the government increases economic growth. Section 9.3 discusses some implications of the model in Sections 9.1 and 9.2 for poverty traps. In Section 9.4, we find conditions under which the system has either a unique equilibrium or two equilibria and then we determine stability of equilibrium. It is shown that returns to scale is the key factor of determining the stability of equilibriums. Section 9.5 examines whether an increase in scientists' wage improve the economic performance of the system. In Section 9.6, we study impact of the job amenities on the equilibrium structure. Section 9.7 introduces endogenous knowledge accumulation into the two-sector growth model proposed in Chapter 6. We show how the economic structure is affected by knowledge creation and utilization. In Section 9.8, we propose a growth model with physical accumulation and knowledge creation in a multi-group framework. Section 9.9 discusses economic growth with endogenous knowledge. Long-term economic evolution with knowledge is emphasized.

Chapter 10 is concerned with the new growth theories with monopolistic competition and endogenous knowledge. The chapter is organized as follows. Section 10.1 reviews Romer's economic development model with monopolistic competition. In Section 10.2, we examine the growth model with product variety proposed by Grossman and Helpman. In Section 10.3, we study the growth model with variety of consumer goods proposed by Barro and Sala-i-Martin. Section 10.4 represents Aghion and Howitt's economic development model with creative destruction. Section 10.5 studies a growth model with improvement in quality of products. In Section 10.6, we represent Young's growth model with learning by doing and research. Section 10.7 points out that the new growth theories can sustain positive steady growth rates perhaps because presumed linear or linearized knowledge growth. Without linearization in the key equations of knowledge growth, it is difficult to sustain unlimited economic growth.

Chapter 11 is organized as follows. Section 11.1 proposes a growth model with human capital and openness (as a variable of institutional change). This model is developed with special reference to Mainland China. Section 11.2 examines dynamic properties of the model. It provides conditions for existence of equilibrium and for stability. In Section 11.3, we examine what will happen to the economic evolution if the nation is isolated. We demonstrate that if the urban sector exhibits increasing returns to scale and the agricultural sector decreasing returns, then the economic system is faced with instabilities and multiple equilibria. Chairman Mao stabilized China's economy by sending intellectual to countryside - stopping industrialization and scientific research. In Section 11.4, we further examine issues related to multiple equilibria and poverty traps, proving some insights from our model. Section 11.5 demonstrates possible catastrophes in economic reforms when the political reform is characterized by slow openness. In Section 11.6, we show that when capital accumulation is a fast process in comparison to human capital accumulation and political change, then social cycles may appear. Section 11.7 comments on poverty traps versus affluence. Poverty is economically stable but undesirable and thus socially unstable; affluence is desirable but economically unstable.

Chapter 11 concludes the book. Section 11.1 shows the significance of preference change for comprehending contemporary economic reality. In Section 11.2, we demonstrate how a simple nonlinear interaction between the population and economic growth can generate chaotic behavior.

1 Zhang (2002a, 2003b, 2005) explains the industrialization and modernization of the three Chinese economies from cultural, political and economic perspectives.

2 See Barro and Sala-i-Martin (1995).

3 See Quah (1998).

4 Lucas (1993).

5 The table is referred to Zhang (2002).

6 Kaldor(1963).

7 See Kuznets (1973, 1981).

8 A formal approach is given by Morishima (1989).

9 Haavelmo (1954).

10 Introductory reviews are given by Burmeister and Dobell (1970), Takayama (1985), and Zhang (1990).

11 Harrod (1939) and Domar (1946).

12 The model was proposed independently by Solow (1956) and Swan (1956). In the remainder of this book, we call the model the Solow model, rather than the Solow-Swan model, following the custom of the economic literature.

13 See Ramsey (1928), Cass (1965) and Koopmans (1965).

14 Arrow (1962) and Uzawa (1965).

15 Romer (1986) and Lucas (1988).

16 Becker and Burmeister (1991) and Taylor and Woodford (1999).

17 The earlier literature is referred to, for instance, Day (1984), Hommes (1991), Rosser (1991), Zhang (1991), and Azaridis (1993). A recent literature is referred to Zhang (2005).

18 See Aghion and Howitt (1998), Barro and Sala-i-Martin (1995), Burmeister and Dobell (1970), Grossman and Helpman (1991), Romer (1996), Bretschger (1999).

19 Zhang (2000b, 2001, 2003a).

20 Zhang (1999a).