Chapter 38

Other credits including the earned income credit

What’s New

Adoption credit. The maximum adoption credit is $13,570 for 2017. See Adoption Credit.

Excess withholding of social security and railroad retirement tax. Social security tax and tier 1 railroad retirement (RRTA) tax were both withheld during 2017 at a rate of 6.2% of wages up to $127,200. If you worked for more than one employer and had too much social security or RRTA tax withheld during 2017, you may be entitled to a credit for the excess withholding. See Credit for Excess Social Security Tax or Railroad Retirement Tax Withheld.

Alternative fuel vehicle refueling property credit. The credit for alternative fuel vehicle refueling property has expired.

Alternative motor vehicle credit. The alternative motor vehicle credit has expired.

Residential energy credit. The nonbusiness energy property credit has expired.

Plug in electric drive motor vehicle credit. The credit for qualified two-wheeled plug-in electric drive motor vehicles has expired.

Text intentionally omitted.

This chapter discusses the following nonrefundable credits.

- Adoption credit.

- Credit to holders of tax credit bonds.

- Foreign tax credit.

- Mortgage interest credit.

- Nonrefundable credit for prior year minimum tax.

- Plug-in electric drive motor vehicle credit.

- Residential energy credit.

- Retirement savings contributions credit.

Text intentionally omitted.

Although the following nonrefundable credits have expired for 2017, discussion of these is included in case Congress extends them as it had previously done when these credits expired in prior tax years.

- Alternative motor vehicle credit.

- Alternative fuel vehicle refueling property credit.

- Plug-in electric drive motor vehicle credit for qualifying two-wheeled vehicles.

- Nonbusiness energy property credit.

This chapter also discusses the following refundable credits.

- Credit for tax on undistributed capital gain.

- Health coverage tax credit.

- Earned income credit.

- Credit for excess social security tax or railroad retirement tax withheld.

Several other credits are discussed in other chapters in this publication.

- Child and dependent care credit (chapter 33).

- Credit for the elderly or the disabled (chapter 34).

- Child tax credit (chapter 35).

- Education credits (chapter 36).

- Premium tax credit (chapter 37).

Nonrefundable credits. The first part of this chapter, Nonrefundable Credits, covers credits that you subtract from your tax. These credits may reduce your tax to zero. If these credits are more than your tax, the excess is not refunded to you.

Refundable credits. The second part of this chapter, Refundable Credits, covers four credits that are treated as payments and are refundable to you. These credits are added to the federal income tax withheld and any estimated tax payments you made. If this total is more than your total tax, the excess may be refunded to you.

Useful Items

You may want to see:

Publication

- 502 Medical and Dental Expenses

- 514 Foreign Tax Credit for Individuals

- 530 Tax Information for Homeowners

- 590-A Contributions To Individual Retirement Arrangements (IRAs)

- 590-B Distributions From Individual Retirement Arrangements (IRAs)

Form (and Instructions)

- 1116 Foreign Tax Credit

- 2439 Notice To Shareholder of Undistributed Long-Term Capital Gains

- 5695 Residential Energy Credit

- 8396 Mortgage Interest Credit

- 8801 Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts

- 8828 Recapture of Federal Mortgage Subsidy

- 8839 Qualified Adoption Expenses

- 8880 Credit for Qualified Retirement Savings Contributions

- 8885 Health Coverage Tax Credit

Text intentionally omitted.

- 8912 Credit To Holders of Tax Credit Bonds

- 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit

Nonrefundable Credits

The credits discussed in this part of the chapter can reduce your tax. However, if the total of these credits is more than your tax, the excess is not refunded to you.

Adoption Credit

You may be able to take a tax credit of up to $13,570 for qualified expenses paid to adopt an eligible child. The credit may be allowed for the adoption of a child with special needs even if you do not have any qualified expenses.

If your modified adjusted gross income (AGI) is more than $203,540, your credit is reduced. If your modified AGI is $243,540 or more, you cannot take the credit.

Qualified adoption expenses. Qualified adoption expenses are reasonable and necessary expenses directly related to, and whose principal purpose is for, the legal adoption of an eligible child. These expenses include:

- Adoption fees,

- Court costs,

- Attorney fees,

- Travel expenses (including amounts spent for meals and lodging) while away from home, and

- Re-adoption expenses to adopt a foreign child.

Nonqualified expenses. Qualified adoption expenses do not include expenses:

- That violate state or federal law,

- For carrying out any surrogate parenting arrangement,

- For the adoption of your spouse’s child,

- For which you received funds under any federal, state, or local program,

- Allowed as a credit or deduction under any other federal income tax rule, or

- Paid or reimbursed by your employer or any other person or organization.

Eligible child. The term “eligible child” means any individual:

- Under 18 years old, or

- Physically or mentally incapable of caring for himself or herself.

Child with special needs. An eligible child is a child with special needs if all three of the following apply.

- The child was a citizen or resident of the United States (including U.S. possessions) at the time the adoption process began.

- A state (including the District of Columbia) has determined that the child cannot or should not be returned to his or her parents’ home.

- The state has determined that the child will not be adopted unless assistance is provided to the adoptive parents. Factors used by states to make this determination include:

- The child’s ethnic background,

- The child’s age,

- Whether the child is a member of a minority or sibling group, and

- Whether the child has a medical condition or a physical, mental, or emotional handicap.

When to take the credit. Generally, until the adoption becomes final, you take the credit in the year after your qualified expenses were paid or incurred. If the adoption becomes final, you take the credit in the year your expenses were paid or incurred. See the Instructions for Form 8839 for more specific information on when to take the credit.

Foreign child. If the child is not a U.S. citizen or resident at the time the adoption process began, you cannot take the credit unless the adoption becomes final. You treat all adoption expenses paid or incurred in years before the adoption becomes final as paid or incurred in the year it becomes final.

How to take the credit. Figure your 2017 nonrefundable credit and any carryforward to 2018 on Form 8839 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8839” on the line next to that box.

More information. For more information, see the Instructions for Form 8839.

Alternative Motor Vehicle Credit

Text intentionally omitted.

Qualified fuel-cell vehicle. A qualified fuel-cell vehicle is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel, and that meets certain additional requirements.

Amount of credit. Generally, you can rely on the manufacturer’s certification to the IRS that a specific make, model, and model-year vehicle qualifies for the credit and the amount of the credit for which it qualifies. In the case of a foreign manufacturer, you generally can rely on its domestic distributor’s certification to the IRS.

Ordinarily, the amount of the credit is 100% of the manufacturer’s (or domestic distributor’s) certification to the IRS of the maximum credit allowable.

How to take the credit.If the credit is retroactively extended to the beginning of 2017, you would take the credit by completing Form 8910 and attaching it to your Form 1040. You would then include the credit in your total for Form 1040, line 54. Check box c and enter “8910” on the line next to that box.

More information. For more information on the credit, see the Instructions for Form 8910.

Alternative Fuel Vehicle Refueling Property Credit

Text intentionally omitted.

Qualified alternative fuel vehicle refueling property. Qualified alternative fuel vehicle refueling property is any property (other than a building or its structural components) used to store or dispense alternative fuel into the fuel tank of a motor vehicle propelled by the fuel, but only if the storage or dispensing is at the point where the fuel is delivered into that tank.

An alternative fuel is a fuel at least 85% of the volume of which consists of hydrogen.

Amount of the credit. For business use property, the credit is generally the smaller of 30% of the property’s cost or $30,000. For all other property, the credit is generally the smaller of 30% of the property’s cost or $1,000.

How to take the credit. If the credit is retroactively extended to the beginning of 2017, you would take the credit by completing Form 8911 and attaching it to your Form 1040. You would then include the credit in your total for Form 1040, line 54. Check box c and enter “8911” on the line next to that box.

Recipients of these credits that are partnerships or S corporations must report these amounts on line 8 of Form 8911.

More information. For more information on the credit, see the Instructions for Form 8911.

Credit To Holders of Tax Credit Bonds

Tax credit bonds are bonds in which the holder receives a tax credit in lieu of some or all of the interest on the bond.

You may be able to take a credit if you are a holder of one of the following bonds.

- Clean renewable energy bonds (issued before 2010).

- New clean renewable energy bonds.

- Qualified energy conservation bonds.

- Qualified school construction bonds.

- Qualified zone academy bonds.

- Build America bonds.

In some instances, an issuer may elect to receive a credit for interest paid on the bond. If the issuer makes this election, you cannot also claim a credit.

Interest income. The amount of any tax credit allowed (figured before applying tax liability limits) must be included as interest income on your tax return.

How to take the credit. Complete Form 8912 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8912” on the line next to that box.

More information. For more information, see the Instructions for Form 8912.

Foreign Tax Credit

You generally can choose to take income taxes you paid or accrued during the year to a foreign country or U.S. possession as a credit against your U.S. income tax. Or, you can deduct them as an itemized deduction (see chapter 23).

You cannot take a credit (or deduction) for foreign income taxes paid on income that you exclude from U.S. tax under any of the following.

- Foreign earned income exclusion.

- Foreign housing exclusion.

- Income from Puerto Rico exempt from U.S. tax.

- Possession exclusion.

Limit on the credit. Unless you can elect not to file Form 1116 (see Exception), your foreign tax credit cannot be more than your U.S. tax liability (the total of lines 44 and 46), multiplied by a fraction. The numerator of the fraction is your taxable income from sources outside the United States. The denominator is your total taxable income from U.S. and foreign sources. See Pub. 514 for more information.

How to take the credit. Complete Form 1116 and attach it to your Form 1040. Enter the credit on Form 1040, line 48.

Exception. You do not have to complete Form 1116 to take the credit if all of the following apply.

- All of your gross foreign source income was from interest and dividends and all of that income and the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or Schedule K-1 (or substitute statement).

- You held the stock or bonds on which the dividends and interest were paid for at least 16 days and were not obligated to pay these amounts to someone else.

- You are not filing Form 4563 or excluding income from sources within Puerto Rico.

- The total of your foreign taxes was not more than $300 (not more than $600 if married filing jointly).

- All of your foreign taxes were:

- Legally owed and not eligible for a refund or reduced tax rate under a tax treaty, and

- Paid to countries that are recognized by the United States and do not support terrorism.

More information. For more information on the credit and these requirements, see the Instructions for Form 1116.

Mortgage Interest Credit

The mortgage interest credit is intended to help lower-income individuals own a home. If you qualify, you can take the credit each year for part of the home mortgage interest you pay.

Who qualifies. You may be eligible for the credit if you were issued a qualified Mortgage Credit Certificate (MCC) from your state or local government. Generally, an MCC is issued only in connection with a new mortgage for the purchase of your main home.

Amount of credit. Figure your credit on Form 8396. If your mortgage loan amount is equal to (or smaller than) the certified indebtedness (loan) amount shown on your MCC, enter on Form 8396, line 1, all the interest you paid on your mortgage during the year.

If your mortgage loan amount is larger than the certified indebtedness amount shown on your MCC, you can figure the credit on only part of the interest you paid. To find the amount to enter on line 1, multiply the total interest you paid during the year on your mortgage by the following fraction.

Limit based on credit rate. If the certificate credit rate is more than 20%, the credit you are allowed cannot be more than $2,000. If two or more persons (other than a married couple filing a joint return) hold an interest in the home to which the MCC relates, this $2,000 limit must be divided based on the interest held by year person. See Pub. 530 for more information.

Carryforward. Your credit (after applying the limit based on the credit rate) is also subject to a limit based on your tax that is figured using Form 8396. If your allowable credit is reduced because of this tax liability limit, you can carry forward the unused portion of the credit to the next 3 years or until used, whichever comes first.

If you are subject to the $2,000 limit because your certificate credit rate is more than 20%, you cannot carry forward any amount more than $2,000 (or your share of the $2,000 if you must divide the credit).

How to take the credit. Figure your 2017 credit and any carryforward to 2018 on Form 8396, and attach it to your Form 1040. Be sure to include any credit carryforward from 2014, 2015, and 2016.

Include the credit in your total for Form 1040, line 54. Check box c and enter “8396” on the line next to that box.

Reduced home mortgage interest deduction. If you itemize your deductions on Schedule A (Form 1040), you must reduce your home mortgage interest deduction by the amount of the mortgage interest credit shown on Form 8396, line 3. You must do this even if part of that amount is to be carried forward to 2018. For more information about the home mortgage interest deduction, see chapter 24.

Recapture of federal mortgage subsidy. If you received an MCC with your mortgage loan, you may have to recapture (pay back) all or part of the benefit you received from that program. The recapture may be required if you sell or dispose of your home at a gain during the first 9 years after the date you closed your mortgage loan. See the Instructions for Form 8828 and chapter 15 for more information.

More information. For more information on the credit, see the Instructions for Form 8396.

Nonrefundable Credit for Prior Year Minimum Tax

The tax laws give special treatment to some kinds of income and allow special deductions and credits for some kinds of expenses. If you benefit from these laws, you may have to pay at least a minimum amount of tax in addition to any other tax on these items. This is called the alternative minimum tax.

The special treatment of some items of income and expenses only allows you to postpone paying tax until a later year. If in prior years you paid alternative minimum tax because of these tax postponement items, you may be able to take a credit for prior year minimum tax against your current year’s regular tax.

You may be able to take a credit against your regular tax if for 2016 you had:

- An alternative minimum tax liability and adjustments or preferences other than exclusion items,

- A minimum tax credit that you are carrying forward to 2017, or

- An unallowed qualified electric vehicle credit.

How to take the credit. Figure your 2017 nonrefundable credit (if any), and any carryforward to 2018 on Form 8801, and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54, and check box b. You can carry forward any unused credit for prior year minimum tax to later years until it is completely used.

More information. For more information on the credit, see the Instructions for Form 8801.

Plug-In Electric Drive Motor Vehicle Credit

You may be able to take this credit if you placed in service for business or personal use a qualified plug-in electric drive motor vehicle in 2017 and you meet some other requirements.

Qualified plug-in electric drive motor vehicle. This is a new vehicle with at least four wheels that:

- Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 4 kilowatt hours and is capable of being recharged from an external source of electricity, and

- Has a gross vehicle weight of less than 14,000 pounds.

Certification and other requirements. Generally, you can rely on the manufacturer’s (or, in the case of a foreign manufacturer, its domestic distributor’s) certification to the IRS that a specific make, model, and model-year vehicle qualifies for the credit and, if applicable, the amount of the credit for which it qualifies. However, if the IRS publishes an announcement that the certification for any specific make, model, and model year vehicle has been withdrawn, you cannot rely on the certification for such a vehicle purchased after the date of publication of the withdrawal announcement.

The following requirements must also be met to qualify for the credit.

- You are the owner of the vehicle. If the vehicle is leased, only the lessor, and not the lessee, is entitled to the credit.

- You placed the vehicle in service during 2016.

- The vehicle is manufactured primarily for use on public streets, roads, and highways.

- The original use of the vehicle began with you.

- You acquired the vehicle for your use or to lease to others, and not for resale.

- You use the vehicle primarily in the United States.

How to take the credit. To take the credit, you must complete Form 8936 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8936” on the line next to that box.

More information. For more information on the credit, see the Instructions for Form 8936.

Residential Energy Credits

You may be able to take the residential energy efficient property credit if you made energy saving improvements to your home located in the United States in 2017.

Text intentionally omitted.

If you are a member of a condominium management association for a condominium you own or a tenant-stockholder in a cooperative housing corporation, you are treated as having paid your proportionate share of any costs of the association or corporation.

Residential energy efficient property credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, fuel cell property, small wind energy property, and geothermal heat pump property. The credit amount for costs paid for qualified fuel cell property is limited to $500 for each one-half kilowatt of capacity of the property.

Text intentionally omitted.

Basis reduction. You must reduce the basis of your home by the amount of any credit allowed.

How to take the credit. Complete Form 5695 and attach it to your Form 1040. Enter the credit on Form 1040, line 53.

More information. For more information on the credit, see the Instructions for Form 5695.

Retirement Savings Contributions Credit (Saver’s Credit)

You may be able to take this credit if you, or your spouse if filing jointly, made:

- Contributions (other than rollover contributions) to a traditional or Roth IRA (including a myRA),

- Elective deferrals to a 401(k) or 403(b) plan (including designated Roth contributions) or to a governmental 457, SEP, or SIMPLE plan,

- Voluntary employee contributions to a qualified retirement plan (including the federal Thrift Savings Plan), or

- Contributions to a 501(c)(18)(D) plan.

However, you cannot take the credit if either of the following applies.

- The amount on Form 1040, line 38, or Form 1040A, line 22, is more than $31,000 ($46,500 if head of household; $62,000 if married filing jointly).

- The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 2000, (b) is claimed as a dependent on someone else’s 2017 tax return, or (c) was a student (defined next).

Student. You were a student if during any part of 5 calendar months of 2017 you:

- Were enrolled as a full-time student at a school, or

- Took a full-time, on-farm training course given by a school or a state, county, or local government agency.

School. A school includes a technical, trade, or mechanical school. It does not include an on-the-job training course, correspondence school, or school offering courses only through the Internet.

How to take the credit. Figure the credit on Form 8880. Enter the credit on your Form 1040, line 51, or your Form 1040A, line 34, and attach Form 8880 to your return.

More information. For more information on the credit, see the Instructions for Form 8880.

Refundable Credits

The credits discussed in this part of the chapter are treated as payments of tax. If the total of these credits, withheld federal income tax, and estimated tax payments is more than your total tax, the excess can be refunded to you.

Credit for Tax on Undistributed Capital Gain

You must include in your income any amounts that regulated investment companies (commonly called mutual funds) or real estate investment trusts (REITs) allocated to you as capital gain distributions, even if you did not actually receive them. If the mutual fund or REIT paid a tax on the capital gain, you are allowed a credit for the tax since it is considered paid by you. The mutual fund or REIT will send you Form 2439 showing your share of the undistributed capital gains and the tax paid, if any.

How to take the credit. To take the credit, attach Copy B of Form 2439 to your Form 1040. Include the amount from box 2 of your Form 2439 in the total for Form 1040, line 73, and check box a.

More information. See Capital Gain Distributions in chapter 8 for more information on undistributed capital gains.

Recapturing (Paying Back) the First-Time Homebuyer Credit

If you took this credit prior to 2012, you may be responsible for repayment.

Credit for Excess Social Security Tax or Railroad Retirement Tax Withheld

Most employers must withhold social security tax from your wages. If you work for a railroad employer, that employer must withhold tier 1 railroad retirement (RRTA) tax and tier 2 RRTA tax.

If you worked for two or more employers in 2017, you may have had too much social security tax withheld from your pay. If one or more of those employers was a railroad employer, too much tier 1 RRTA tax may also have been withheld at the 6.2% rate. You can claim the excess social security or tier 1 RRTA tax as a credit against your income tax when you file your return. For the tier 1 RRTA tax, only use the portion of the tier 1 RRTA tax that was taxed at the 6.2% rate when figuring if excess tier 1 RRTA tax was withheld; do not include any portion of the tier 1 RRTA tax that was withheld at the Medicare tax rate (1.45%) or the Additional Medicare Tax rate (0.9%). The following table shows the maximum amount of wages subject to tax and the maximum amount of tax that should have been withheld for 2017.

| Type of Tax | Maximum Wages Subject to Tax | Maximum Tax That Should Have Been Withheld |

| Social security or RRTA tier 1 | $127,200 | $7,886.40 |

| RRTA tier 2 | $88,200 | $4,321.80 |

Employer’s error. If any one employer withheld too much social security or tier 1 RRTA tax, you cannot take the excess as a credit against your income tax. The employer should adjust the tax for you. If the employer does not adjust the overcollection, you can file a claim for refund using Form 843.

Joint return. If you are filing a joint return, you cannot add the social security or tier 1 RRTA tax withheld from your spouse’s wages to the amount withheld from your wages. Figure the withholding separately for you and your spouse to determine if either of you has excess withholding.

How to figure the credit if you did not work for a railroad. If you did not work for a railroad during 2017, figure the credit as follows:

| 1. Add all social security tax withheld (but not more than $7,886.40 for each employer). Enter the total here | |

| 2. Enter any uncollected social security tax on tips or group-term life insurance included in the total on Form 1040, line 62, identified by “UT” | |

| 3. Add lines 1 and 2. If $7,886.40 or less, stop here. You cannot take the credit | |

| 4. Social security tax limit | 7,886.40 |

| 5. Credit. Subtract line 4 from line 3. Enter the result here and on Form 1040, line 71 (or Form 1040A, line 46) | $ |

Example. You are married and file a joint return with your spouse who had no gross income in 2017. During 2017, you worked for the Brown Technology Company and earned $66,500 in wages. Social security tax of $4,123 was withheld. You also worked for another employer in 2017 and earned $63,700 in wages. $3,949.40 of social security tax was withheld from these wages. Because you worked for more than one employer and your total wages were more than $127,200, you can take a credit of $186 for the excess social security tax withheld.

| 1. Add all social security tax withheld (but not more than $7,886.40 for each employer). Enter the total here | $8,072.40 |

| 2. Enter any uncollected social security tax on tips or group-term life insurance included in the total on Form 1040, line 62, identified by “UT” | -0- |

| 3. Add lines 1 and 2. If $7,886.40 or less, stop here. You cannot take the credit | 8,072.40 |

| 4. Social security tax limit | 7,866.40 |

| 5. Credit. Subtract line 4 from line 3. Enter the result here and on Form 1040, line 71 (or Form 1040A, line 46) | $186 |

How to figure the credit if you worked for a railroad. If you were a railroad employee at any time during 2017, figure the credit as follows:

| 1. Add all social security and tier 1 RRTA tax withheld at the 6.2% rate (but not more than $7,886.40 for each employer). Enter the total here | |

| 2. Enter any uncollected social security and tier 1 RRTA tax on tips or group-term life insurance included in the total on Form 1040, line 62, identified by “UT” | |

| 3. Add lines 1 and 2. If $7,886.40 or less, stop here. You cannot take the credit | |

| 4. Social security and tier 1 RRTA tax limit | 7,886.40 |

| 5. Credit. Subtract line 4 from line 3. Enter the result here and on Form 1040, line 71 (or Form 1040A, line 46) | $ |

How to take the credit. Enter the credit on Form 1040, line 71, or include it in the total for Form 1040A, line 46.

More information. For more information on the credit, see Pub. 505.

| 1. Total social security and tier 1 RRTA tax withheld (do not include more than $7,886.40 for each employer) | $8,317.40 |

| 2. Total social security and tier 1 RRTA tax on tips or group-term life insurance included on line 61, Form 1040 | -0- |

| 3. Total: Add lines 1 and 2 | $8,317.40 |

| 4. Limit | $7,886.40 |

| 5. Credit: Subtract line 4 from line 3 | $431.00 |

Health Coverage Tax Credit (HCTC)

You can elect to take the health coverage tax credit only if (a) you were an eligible trade adjustment assistance (TAA) recipient, alternative TAA (ATAA) recipient, reemployment TAA (RTAA) recipient, or Pension Benefit Guaranty Corporation (PBGC) payee (defined later); or you were a qualified family member of one of these individuals who passed away or finalized a divorce with you, (b) you cannot be claimed as a dependent on someone else’s 2017 tax return, and (c) you have met all of the conditions listed on line 1 of Form 8885. If you cannot be claimed as a dependent on someone else’s 2017 tax return, complete Form 8885, Part I, to see if you are eligible to take this credit.

TAA recipient. You were an eligible TAA recipient on the first day of the month if, for any day in that month or the prior month, you:

- Received a trade readjustment allowance, or

- Would have been entitled to receive such an allowance except that you had not exhausted all rights to any unemployment insurance (except additional compensation that is funded by a state and is not reimbursed from any federal funds) to which you were entitled (or would be entitled if you applied).

Example. You received a trade adjustment allowance for January 2017. You were an eligible TAA recipient on the first day of January and February.

ATAA recipient. You were an eligible ATAA recipient on the first day of the month if, for that month or the prior month, you received benefits under an ATAA program for older workers established by the Department of Labor.

Example. You received benefits under an ATAA program for older workers for October 2017. The program was established by the Department of Labor. You were an eligible ATAA recipient on the first day of October and November.

RTAA recipient. You were an eligible RTAA recipient on the first day of the month if, for that month or the prior month, you received benefits under a RTAA program for older workers established by the Department of Labor.

PBGC payee. You were an eligible PBGC payee as of the first day of the month, if both of the following apply.

- You were age 55 to 65 and not enrolled in Medicare as of the first day of the month.

- You received a benefit for that month paid by the PBGC under title IV of the Employee Retirement Income Security Act of 1974 (ERISA).

If you received a lump-sum payment from the PBGC after August 5, 2002, you meet item (2) above for any month that you would have received a PBGC benefit if you had not received the lump-sum payment.

How to take the credit. The HCTC is an election. If you are eligible for the credit, you must elect the HCTC to receive the benefit of the HCTC. You make your election by checking the box on line 1 of Form 8885 for the first eligible coverage month you are electing to take the HCTC and all boxes on line 1 for each eligible coverage month after the election month. Once you elect to take the HCTC for a month in 2017, the election to take the HCTC applies to all subsequent eligible coverage months in 2017. The election does not apply to any month for which you are not eligible to take the HCTC.

Once you have completed Form 8885, attach it to your Form 1040. Include your credit in the total for Form 1040, line 73, and check box c.

In addition to other required documentation, you must, for each month you are claiming the credit, attach health insurance bills (or COBRA payment coupons) and proof of payment for any amounts you include on Form 8885, line 2. For details, see Pub. 502 or the Instructions for Form 8885.

More information. For definitions and special rules, including those relating to qualified health insurance plans, qualifying family members, the effect of certain life events, and employer-sponsored health insurance plans, see Pub. 502 and the Instructions for Form 8885.

Earned Income Credit (EIC)

The earned income credit (EIC) is a tax credit for certain people who work and have less than $53,930 of earned income. A tax credit usually means more money in your pocket. It reduces the amount of tax you owe. The EIC may also give you a refund.

What’s New

Earned income amount is more. The maximum amount of income you can earn and still get the credit has increased. You may be able to take the credit if:

- You have three or more qualifying children and you earned less than $48,340 ($53,930 if married filing jointly),

- You have two qualifying children and you earned less than $45,007 ($50,597 if married filing jointly),

- You have one qualifying child and you earned less than $39,617 ($45,207 if married filing jointly), or

- You do not have a qualifying child and you earned less than $15,010 ($20,600 if married filing jointly).

Your adjusted gross income also must be less than the amount in the above list that applies to you. For details, see Rules 1 and 15.

Delayed refund if claiming EIC. Due to changes in the law, the IRS cannot issue refunds before February 15, 2018, for returns that claim the EIC. This applies to the entire refund, not just the portion associated with the EIC.

Investment income amount is more. The maximum amount of investment income you can have and still get the credit has increased to $3,450. See Rule 6.

Reminders

Valid SSN required by due date of return. If you did not have a social security number (SSN) by the due date of your 2017 return (including extensions), you cannot claim the EIC on either your original or an amended 2017 return, even if you later get an SSN. Also, if a child did not have an SSN by the due date of your return (including extensions), you cannot count that child as a qualifying child in figuring the EIC on either your original or an amended 2017 return, even if that child later gets an SSN.

Increased EIC on certain joint returns. A married person filing a joint return may get more EIC than someone with the same income but a different filing status. As a result, the EIC table has different columns for married persons filing jointly than for everyone else. When you look up your EIC in the EIC table, be sure to use the correct column for your filing status and the number of children you have.

Online help. You can use the EITC Assistant at www.irs.gov/eitc to find out if you are eligible for the credit. The EITC Assistant is available in English and Spanish.

EIC questioned by IRS. The IRS may ask you to provide documents to prove you are entitled to claim the EIC. The IRS will tell you what documents to send. These may include: birth certificates, school records, medical records, etc. The process of establishing your eligibility will delay your refund.

How do you get the earned income credit? To claim the EIC, you must:

- Qualify by meeting certain rules, and

- File a tax return, even if you:

- Do not owe any tax,

- Did not earn enough money to file a return, or

- Did not have income taxes withheld from your pay.

Figure your EIC by using a worksheet in the Instructions for Form 1040, Form 1040A, or Form 1040EZ. Or, if you prefer, you can let the IRS figure the credit for you.

How will this chapter help you? This chapter will explain the following.

- The rules you must meet to qualify for the EIC.

- How to figure the EIC.

Useful Items

You may want to see:

Publication

- 596 Earned Income Credit (EIC)

Form (and Instructions)

- Schedule EIC Earned Income Credit (Qualifying Child Information)

- 8862 Information To Claim Earned Income Credit After Disallowance

Do You Qualify for the Credit?

To qualify to claim the EIC, you must first meet all of the rules explained in Part A, Rules for Everyone. Then you must meet the rules in Part B, Rules If You Have a Qualifying Child, or Part C, Rules If You Do Not Have a Qualifying Child. There is one final rule you must meet in Part D, Figuring and Claiming the EIC. You qualify for the credit if you meet all the rules in each part that applies to you.

- If you have a qualifying child, the rules in Parts A, B, and D apply to you.

- If you do not have a qualifying child, the rules in Parts A, C, and D apply to you.

Table 38.1, Earned Income Credit in a Nutshell. Use Table 38.1 as a guide to Parts A, B, C, and D. The table is a summary of all the rules in each part.

Table 38.1 Tests for Qualifying Child

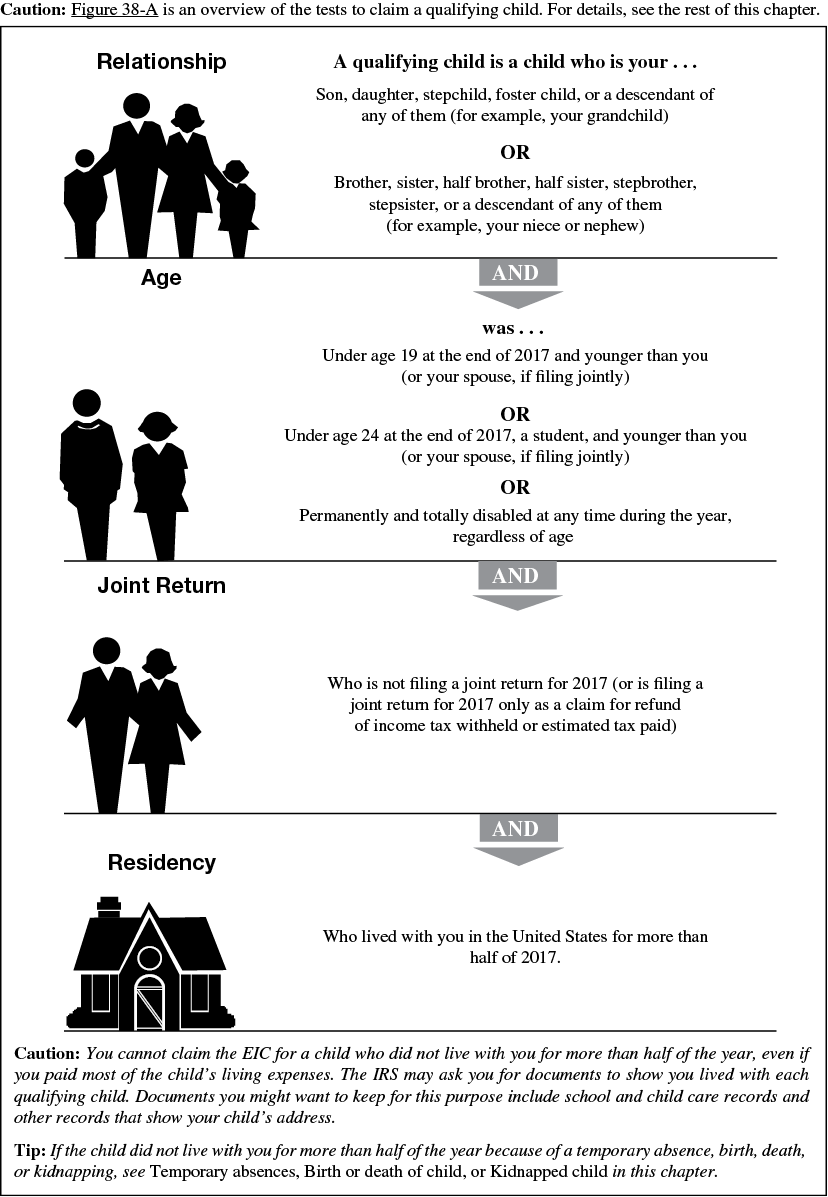

Do you have a qualifying child? You have a qualifying child only if you have a child who meets the four tests described in Rule 8 and illustrated in Figure 38.1.

Figure 38.1 Tests for Qualifying Child

If Improper Claim Made in Prior Year

If your EIC for any year after 1996 was denied or reduced for any reason other than a math or clerical error, you must attach a completed Form 8862 to your next tax return to claim the EIC. You must also qualify to claim the EIC by meeting all the rules described in this chapter.

However, if your EIC was denied or reduced as a result of a math or clerical error, do not attach Form 8862 to your next tax return. For example, if your arithmetic is incorrect, the IRS can correct it. If you do not provide a correct social security number, the IRS can deny the EIC. These kinds of errors are called math or clerical errors.

If your EIC for any year after 1996 was denied and it was determined that your error was due to reckless or intentional disregard of the EIC rules, then you cannot claim the EIC for the next 2 years. If your error was due to fraud, then you cannot claim the EIC for the next 10 years.

More information. See chapter 5 in Pub. 596 for more detailed information about the disallowance period and Form 8862.

Part A. Rules for Everyone

This part of the chapter discusses Rules 1 through 7. You must meet all seven rules to qualify for the earned income credit. If you do not meet all seven rules, you cannot get the credit and you do not need to read the rest of the chapter.

If you meet all seven rules in this part, then read either Part B or Part C (whichever applies) for more rules you must meet.

Rule 1. Your AGI Must Be Less Than

- $48,340 ($53,930 for married filing jointly) if you have three or more qualifying children,

- $45,007 ($50,597 for married filing jointly) if you have two qualifying children,

- $39,617 ($45,207 for married filing jointly) if you have one qualifying child, or

- $15,010 ($20,600 for married filing jointly) if you do not have a qualifying child.

Adjusted gross income (AGI). AGI is the amount on line 38 (Form 1040), line 22 (Form 1040A), or line 4 (Form 1040EZ). If your AGI is equal to or more than the applicable limit listed above, you cannot claim the EIC.

Example. Your AGI is $40,000, you are single, and you have one qualifying child. You cannot claim the EIC because your AGI is not less than $39,617. However, if your filing status was married filing jointly, you might be able to claim the EIC because your AGI is less than $45,207.

Community property. If you are married, but qualify to file as head of household under special rules for married taxpayers living apart (see Rule 3), and live in a state that has community property laws, your AGI includes that portion of both your and your spouse’s wages that you are required to include in gross income. This is different from the community property rules that apply under Rule 7.

Rule 2. You Must Have a Valid Social Security Number (SSN)

To claim the EIC, you (and your spouse, if filing a joint return) must have a valid SSN issued by the Social Security Administration (SSA) by the due date of your 2017 return (including extensions). Any qualifying child listed on Schedule EIC also must have a valid SSN by the due date of your 2017 return (including extensions). (See Rule 8 if you have a qualifying child.)

If your social security card (or your spouse’s, if filing a joint return) says “Not valid for employment’’ and your SSN was issued so that you (or your spouse) could get a federally funded benefit, you cannot get the EIC. An example of a federally funded benefit is Medicaid.

If you have a card with the legend “Not valid for employment’’ and your immigration status has changed so that you are now a U.S. citizen or permanent resident, ask the SSA for a new social security card without the legend.

U.S. citizen. If you were a U.S. citizen when you received your SSN, you have a valid SSN.

Valid for work only with INS or DHS authorization. If your social security card reads “Valid for work only with INS authorization’’ or “Valid for work only with DHS authorization,’’ you have a valid SSN, but only if that authorization is still valid.

SSN missing or incorrect. If an SSN for you or your spouse is missing from your tax return or is incorrect, you may not get the EIC. If an SSN for you or your spouse is missing from your return because either you or your spouse did not have a valid SSN by the due date of your 2017 return (including extensions), and you later get a valid SSN, you cannot file an amended return to claim the EIC.

Other taxpayer identification number. You cannot get the EIC if, instead of an SSN, you (or your spouse, if filing a joint return) have an individual taxpayer identification number (ITIN). ITINs are issued by the Internal Revenue Service to noncitizens who cannot get an SSN.

No SSN. If you do not have a valid SSN by the due date of your 2017 return (including extensions), put “No” next to line 66a (Form 1040), line 42a (Form 1040A), or line 8a (Form 1040EZ). You cannot claim the EIC on either your original or an amended 2017 return.

Getting an SSN. If you (or your spouse, if filing a joint return) do not have an SSN, you can apply for one by filing Form SS-5, Application for a Social Security Card, with the SSA. You can get Form SS-5 online at www.socialsecurity.gov, from your local SSA office, or by calling the SSA at 1-800-772-1213.

Filing deadline approaching and still no SSN. If the filing deadline is approaching and you still do not have an SSN, you can request an automatic 6-month extension of time to file your return. You can get this extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. For more information, see chapter 1.

Rule 3. Your Filing Status Cannot Be Married Filing Separately

If you are married, you usually must file a joint return to claim the EIC. Your filing status cannot be “Married filing separately.’’

Spouse did not live with you. If you are married and your spouse did not live in your home at any time during the last 6 months of the year, you may be able to file as head of household, instead of married filing separately. In that case, you may be able to claim the EIC. For detailed information about filing as head of household, see chapter 2.

Rule 4. You Must Be a U.S. Citizen or Resident Alien All Year

If you (or your spouse, if married) were a nonresident alien for any part of the year, you cannot claim the earned income credit unless your filing status is married filing jointly. You can use that filing status only if one spouse is a U.S. citizen or resident alien and you choose to treat the nonresident spouse as a U.S. resident. If you make this choice, you and your spouse are taxed on your worldwide income. If you (or your spouse, if married) were a nonresident alien for any part of the year and your filing status is not married filing jointly, enter “No” on the dotted line next to line 66a (Form 1040) or in the space to the left of line 42a (Form 1040A). If you need more information on making this choice, get Pub. 519, U.S. Tax Guide for Aliens.

Rule 5. You Cannot File Form 2555 or Form 2555-EZ

You cannot claim the earned income credit if you file Form 2555, Foreign Earned Income, or Form 2555-EZ, Foreign Earned Income Exclusion. You file these forms to exclude income earned in foreign countries from your gross income, or to deduct or exclude a foreign housing amount. U.S. possessions are not foreign countries. See Pub. 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, for more detailed information.

Rule 6. Your Investment Income Must Be $3,450 or Less

You cannot claim the earned income credit unless your investment income is $3,450 or less. If your investment income is more than $3,450, you cannot claim the credit. For most people, investment income is the total of the following amounts.

- Taxable interest (line 8a of Form 1040 or 1040A).

- Tax-exempt interest (line 8b of Form 1040 or 1040A).

- Dividend income (line 9a of Form 1040 or 1040A).

- Capital gain net income (line 13 of Form 1040, if more than zero, or line 10 of Form 1040A).

If you file Form 1040EZ, your investment income is the total of the amount of line 2 and the amount of any tax-exempt interest you wrote to the right of the words “Form 1040EZ” on line 2.

However, see Rule 6 in chapter 1 of Pub. 596 if:

- You are filing Schedule E (Form 1040), Form 4797, or Form 8814,

- You are reporting income from the rental of personal property on Form 1040, line 21,

- You have income or loss from a passive activity.

Rule 7. You Must Have Earned Income

This credit is called the “earned income’’ credit because, to qualify, you must work and have earned income. If you are married and file a joint return, you meet this rule if at least one spouse works and has earned income. If you are an employee, earned income includes all the taxable income you get from your employer. If you are self-employed or a statutory employee, you will figure your earned income on EIC Worksheet B in the Instructions for Form 1040.

Earned Income

Earned income includes all of the following types of income.

- Wages, salaries, tips, and other taxable employee pay. Employee pay is earned income only if it is taxable. Nontaxable employee pay, such as certain dependent care benefits and adoption benefits, is not earned income. But there is an exception for nontaxable combat pay, which you can choose to include in earned income, as explained below.

- Net earnings from self-employment.

- Gross income received as a statutory employee.

Wages, salaries, and tips. Wages, salaries, and tips you receive for working are reported to you on Form W-2, in box 1. You should report these on line 1 (Form 1040EZ) or line 7 (Forms 1040A and 1040).

Nontaxable combat pay election. You can elect to include your nontaxable combat pay in earned income for the earned income credit. Electing to include nontaxable combat pay in earned income may increase or decrease your EIC. Figure the credit with and without your nontaxable combat pay before making the election.

If you make the election, you must include in earned income all nontaxable combat pay you received. If you are filing a joint return and both you and your spouse received nontaxable combat pay, you can each make your own election. In other words, if one of you makes the election, the other one can also make it but does not have to.

The amount of your nontaxable combat pay should be shown in box 12 of your Form W-2 with code “Q.’’

Self-employed persons and statutory employees. If you are self-employed or received income as a statutory employee, you must use the Form 1040 Instructions to see if you qualify to get the EIC.

Approved Form 4361 or Form 4029

This section is for persons who have an approved:

- Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners, or

- Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Each approved form exempts certain income from social security taxes. Each form is discussed here in terms of what is or is not earned income for the EIC.

Form 4361. Whether or not you have an approved Form 4361, amounts you received for performing ministerial duties as an employee count as earned income. This includes wages, salaries, tips, and other taxable employee compensation.

If you have an approved Form 4361, a nontaxable housing allowance or the nontaxable rental value of a home is not earned income. Also, amounts you received for performing ministerial duties, but not as an employee, do not count as earned income. Examples include fees for performing marriages and honoraria for delivering speeches.

Form 4029. Whether or not you have an approved Form 4029, all wages, salaries, tips, and other taxable employee compensation count as earned income. However, amounts you received as a self-employed individual do not count as earned income. Also, in figuring earned income, do not subtract losses on Schedule C, C-EZ, or F from wages on line 7 of Form 1040.

Disability Benefits

If you retired on disability, taxable benefits you receive under your employer’s disability retirement plan are considered earned income until you reach minimum retirement age. Minimum retirement age generally is the earliest age at which you could have received a pension or annuity if you were not disabled. You must report your taxable disability payments on line 7 of either Form 1040 or Form 1040A until you reach minimum retirement age.

Beginning on the day after you reach minimum retirement age, payments you receive are taxable as a pension and are not considered earned income. Report taxable pension payments on Form 1040, lines 16a and 16b (or Form 1040A, lines 12a and 12b).

Disability insurance payments. Payments you received from a disability insurance policy that you paid the premiums for are not earned income. It does not matter whether you have reached minimum retirement age. If this policy is through your employer, the amount may be shown in box 12 of your Form W-2 with code “J.”

Income That Is Not Earned Income

Examples of items that are not earned income include interest and dividends, pensions and annuities, social security and railroad retirement benefits (including disability benefits), alimony and child support, welfare benefits, workers’ compensation benefits, unemployment compensation (insurance), nontaxable foster care payments, and veterans’ benefits, including VA rehabilitation payments. Do not include any of these items in your earned income.

Earnings while an inmate. Amounts received for work performed while an inmate in a penal institution are not earned income when figuring the earned income credit. This includes amounts for work performed while in a work release program or while in a halfway house.

Workfare payments. Nontaxable workfare payments are not earned income for the EIC. These are cash payments certain people receive from a state or local agency that administers public assistance programs funded under the federal Temporary Assistance for Needy Families (TANF) program in return for certain work activities such as (1) work experience activities (including remodeling or repairing public housing) if private sector employment is not available, or (2) community service program activities.

Community property. If you are married, but qualify to file as head of household under special rules for married taxpayers living apart (see Rule 3), and live in a state that has community property laws, your earned income for the EIC does not include any amount earned by your spouse that is treated as belonging to you under those laws. That amount is not earned income for the EIC, even though you must include it in your gross income on your income tax return. Your earned income includes the entire amount you earned, even if part of it is treated as belonging to your spouse under your state’s community property laws.

Nevada, Washington, and California domestic partners. If you are a registered domestic partner in Nevada, Washington, or California, the same rules apply. Your earned income for the EIC does not include any amount earned by your partner. Your earned income includes the entire amount you earned. For details, see Pub. 555, Community Property.

Conservation Reserve Program (CRP) payments. If you were receiving social security retirement benefits or social security disability benefits at the time you received any CRP payments, your CRP payments are not earned income for the EIC.

Tip Combat pay. You can elect to include your nontaxable combat pay in earned income for the EIC. See Nontaxable combat pay election, earlier.

Nontaxable military pay. Nontaxable pay for members of the Armed Forces is not considered earned income for the EIC. Examples of nontaxable military pay are combat pay, the Basic Allowance for Housing (BAH), and the Basic Allowance for Subsistence (BAS). See Pub. 3, Armed Forces’ Tax Guide, for more information.

Part B. Rules If You Have a Qualifying Child

If you have met all of the rules in Part A, read Part B to see if you have a qualifying child.

Part B discusses Rules 8 through 10. You must meet all three of these rules, in addition to the rules in Parts A and D, to qualify for the earned income credit with a qualifying child.

You must file Form 1040 or Form 1040A to claim the EIC with a qualifying child. (You cannot file Form 1040EZ.) You also must complete Schedule EIC and attach it to your return. If you meet all the rules in Part A and this part, read Part D to find out what to do next.

Rule 8. Your Child Must Meet the Relationship, Age, Residency, and Joint Return Tests

Your child is a qualifying child if your child meets four tests. The four tests are:

- Relationship,

- Age,

- Residency, and

- Joint return.

The four tests are illustrated in Figure 38.1. The paragraphs that follow contain more information about each test.

Relationship Test

To be your qualifying child, a child must be your:

- Son, daughter, stepchild, foster child, or a descendant of any of them (for example, your grandchild), or

- Brother, sister, half brother, half sister, stepbrother, stepsister, or a descendant of any of them (for example, your niece or nephew).

The following definitions clarify the relationship test.

Adopted child. An adopted child is always treated as your own child. The term “adopted child” includes a child who was lawfully placed with you for legal adoption.

Foster child. For the EIC, a person is your foster child if the child is placed with you by an authorized placement agency or by judgment, decree, or other order of any court of competent jurisdiction. An authorized placement agency includes:

- A state or local government agency,

- A tax-exempt organization licensed by a state, and

- An Indian tribal government or an organization authorized by an Indian tribal government to place Indian children.

Example. Debbie, who is 12 years old, was placed in your care 2 years ago by an authorized agency responsible for placing children in foster homes. Debbie is your foster child.

Age Test

Your child must be:

- Under age 19 at the end of 2017 and younger than you (or your spouse, if filing jointly),

- Under age 24 at the end of 2017, a student, and younger than you (or your spouse, if filing jointly), or

- Permanently and totally disabled at any time during 2017, regardless of age.

The following examples and definitions clarify the age test.

Example 1—child not under age 19. Your son turned 19 on December 10. Unless he was permanently and totally disabled or a student, he is not a qualifying child because, at the end of the year, he was not under age 19.

Example 2—child not younger than you or your spouse. Your 23-year-old brother, who is a full-time student and unmarried, lives with you and your spouse. He is not disabled. Both you and your spouse are 21 years old and you file a joint return. Your brother is not your qualifying child because he is not younger than you or your spouse.

Example 3—child younger than your spouse but not younger than you. The facts are the same as in Example 2 except that your spouse is 25 years old. Because your brother is younger than your spouse, he is your qualifying child even though he is not younger than you.

Student defined. To qualify as a student, your child must be, during some part of each of any 5 calendar months during the calendar year:

- A full-time student at a school that has a regular teaching staff, course of study, and regular student body at the school, or

- A student taking a full-time, on-farm training course given by a school described in (1), or a state, county, or local government.

The 5 calendar months need not be consecutive.

A full-time student is a student who is enrolled for the number of hours or courses the school considers to be full-time attendance.

School defined. A school can be an elementary school, junior or senior high school, college, university, or technical, trade, or mechanical school. However, on-the-job training courses, correspondence schools, and schools offering courses only through the Internet do not count as schools for the EIC.

Vocational high school students. Students who work in co-op jobs in private industry as a part of a school’s regular course of classroom and practical training are considered full-time students.

Permanently and totally disabled. Your child is permanently and totally disabled if both of the following apply.

- He or she cannot engage in any substantial gainful activity because of a physical or mental condition.

- A doctor determines the condition has lasted or can be expected to last continuously for at least a year or can lead to death.

Residency Test

Your child must have lived with you in the United States for more than half of 2017.

The following paragraphs clarify the residency test.

United States. This means the 50 states and the District of Columbia. It does not include Puerto Rico or U.S. possessions such as Guam.

Homeless shelter. Your home can be any location where you regularly live. You do not need a traditional home. For example, if your child lived with you for more than half the year in one or more homeless shelters, your child meets the residency test.

Military personnel stationed outside the United States. U.S. military personnel stationed outside the United States on extended active duty are considered to live in the United States during that duty period for purposes of the EIC.

Extended active duty. Extended active duty means you are called or ordered to duty for an indefinite period or for a period of more than 90 days. Once you begin serving your extended active duty, you are still considered to have been on extended active duty even if you do not serve more than 90 days.

Birth or death of a child. A child who was born or died in 2017 is treated as having lived with you for more than half of 2017 if your home was the child’s home for more than half the time he or she was alive in 2017.

Temporary absences. Count time that you or your child is away from home on a temporary absence due to a special circumstance as time the child lived with you. Examples of a special circumstance include illness, school attendance, business, vacation, military service, and detention in a juvenile facility.

Kidnapped child. A kidnapped child is treated as living with you for more than half of the year if the child lived with you for more than half the part of the year before the date of the kidnapping. The child must be presumed by law enforcement authorities to have been kidnapped by someone who is not a member of your family or your child’s family. This treatment applies for all years until the child is returned. However, the last year this treatment can apply is the earlier of:

- The year there is a determination that the child is dead, or

- The year the child would have reached age 18.

If your qualifying child has been kidnapped and meets these requirements, enter “KC,” instead of a number, on line 6 of Schedule EIC.

Joint Return Test

To meet this test, the child cannot file a joint return for the year.

Exception. An exception to the joint return test applies if your child and his or her spouse file a joint return only to claim a refund of income tax withheld or estimated tax paid.

Example 1—child files joint return. You supported your 18-year-old daughter, and she lived with you all year while her husband was in the Armed Forces. He earned $25,000 for the year. The couple files a joint return. Because your daughter and her husband filed a joint return, she is not your qualifying child.

Example 2—child files joint return only to claim a refund of withheld tax. Your 18-year-old son and his 17-year-old wife had $800 of wages from part-time jobs and no other income. They do not have a child. Neither is required to file a tax return. Taxes were taken out of their pay, so they filed a joint return only to get a refund of the withheld taxes. The exception to the joint return test applies, so your son may be your qualifying child if all the other tests are met.

Example 3—child files joint return to claim American opportunity credit. The facts are the same as in Example 2 except no taxes were taken out of your son’s pay. He and his wife are not required to file a tax return, but they file a joint return to claim an American opportunity credit of $124 and get a refund of that amount. Because claiming the American opportunity credit is their reason for filing the return, they are not filing it only to get a refund of income tax withheld or estimated tax paid. The exception to the joint return test does not apply, so your son is not your qualifying child.

Married child. Even if your child does not file a joint return, if your child was married at the end of the year, he or she cannot be your qualifying child unless:

- You can claim an exemption for the child, or

- The reason you cannot claim an exemption for the child is that you let the child’s other parent claim the exemption under the Special rule for divorced or separated parents (or parents who live apart), described later.

Social security number. The qualifying child must have a valid social security number (SSN) by the due date of your 2017 return (including extensions) unless the child was born and died in 2017 and you attach to your return a copy of the child’s birth certificate, death certificate, or hospital records showing a live birth. You cannot claim the EIC on the basis of a qualifying child if:

- The qualifying child’s SSN is missing from your tax return or is incorrect,

- The qualifying child’s social security card says “Not valid for employment” and was issued for use in getting a federally funded benefit, or

- Instead of an SSN, the qualifying child has:

- An individual taxpayer identification number (ITIN), which is issued to a noncitizen who cannot get an SSN, or

- An adoption taxpayer identification number (ATIN), which is issued to adopting parents who cannot get an SSN for the child being adopted until the adoption is final.

If you have more than one qualifying child and only one has a valid SSN, you can use only that child to claim the EIC. For more information about SSNs, see Rule 2.

Rule 9. Your Qualifying Child Cannot Be Used By More Than One Person To Claim the EIC

Sometimes a child meets the tests to be a qualifying child of more than one person. However, only one of these persons can actually treat the child as a qualifying child. Only that person can use the child as a qualifying child to take all of the following tax benefits (provided the person is eligible for each benefit).

- The exemption for the child.

- The child tax credit.

- Head of household filing status.

- The credit for child and dependent care expenses.

- The exclusion for dependent care benefits.

- The EIC.

The other person cannot take any of these benefits based on this qualifying child. In other words, you and the other person cannot agree to divide these tax benefits between you. The other person cannot take any of these tax benefits unless he or she has a different qualifying child.

The tiebreaker rules explained next explain who, if anyone, can claim the EIC when more than one person has the same qualifying child. However, the tiebreaker rules do not apply if the other person is your spouse and you file a joint return.

Tiebreaker rules. To determine which person can treat the child as a qualifying child to claim the six tax benefits just listed, the following tiebreaker rules apply.

- If only one of the persons is the child’s parent, the child is treated as the qualifying child of the parent.

- If the parents file a joint return together and can claim the child as a qualifying child, the child is treated as the qualifying child of the parents.

- If the parents do not file a joint return together but both parents claim the child as a qualifying child, the IRS will treat the child as the qualifying child of the parent with whom the child lived for the longer period of time during the year. If the child lived with each parent for the same amount of time, the IRS will treat the child as the qualifying child of the parent who had the higher adjusted gross income (AGI) for the year.

- If no parent can claim the child as a qualifying child, the child is treated as the qualifying child of the person who had the highest AGI for the year.

- If a parent can claim the child as a qualifying child but no parent does so claim the child, the child is treated as the qualifying child of the person who had the highest AGI for the year, but only if that person’s AGI is higher than the highest AGI of any of the child’s parents who can claim the child. If the child’s parents file a joint return with each other, this rule can be applied by treating the parents’ total AGI as divided evenly between them. See Example 8.

Subject to these tiebreaker rules, you and the other person may be able to choose which of you claims the child as a qualifying child. See Examples 1 through 13.

If you cannot claim the EIC because your qualifying child is treated under the tiebreaker rules as the qualifying child of another person for 2017, you may be able to take the EIC using a different qualifying child, but you cannot take the EIC using the rules in Part C for people who do not have a qualifying child.

If the other person cannot claim the EIC. If you and someone else have the same qualifying child but the other person cannot claim the EIC because he or she is not eligible or his or her earned income or AGI is too high, you may be able to treat the child as a qualifying child. See Examples 6 and 7. But you cannot treat the child as a qualifying child to claim the EIC if the other person uses the child to claim any of the other six tax benefits listed earlier.

Examples. The following examples may help you in determining whether you can claim the EIC when you and someone else have the same qualifying child.

Example 1—child lived with parent and grandparent. You and your 2-year-old son Jimmy lived with your mother all year. You are 25 years old, unmarried, and your AGI is $9,000. Your only income was $9,000 from a part-time job. Your mother’s only income was $20,000 from her job, and her AGI is $20,000. Jimmy’s father did not live with you or Jimmy. The special rule explained later for divorced or separated parents (or parents who live apart) does not apply. Jimmy is a qualifying child of both you and your mother because he meets the relationship, age, residency, and joint return tests for both you and your mother. However, only one of you can treat him as a qualifying child to claim the EIC (and the other tax benefits listed earlier for which that person qualifies). He is not a qualifying child of anyone else, including his father. If you do not claim Jimmy as a qualifying child for the EIC or any of the other tax benefits listed earlier, your mother can treat him as a qualifying child to claim the EIC (and any of the other tax benefits listed earlier for which she qualifies).

Example 2—parent has higher AGI than grandparent. The facts are the same as in Example 1 except your AGI is $25,000. Because your mother’s AGI is not higher than yours, she cannot claim Jimmy as a qualifying child. Only you can claim him.

Example 3—two persons claim same child. The facts are the same as in Example 1 except that you and your mother both claim Jimmy as a qualifying child. In this case, you as the child’s parent will be the only one allowed to claim Jimmy as a qualifying child for the EIC and the other tax benefits listed earlier for which you qualify. The IRS will disallow your mother’s claim to the EIC and any of the other tax benefits listed earlier unless she has another qualifying child.

Example 4—qualifying children split between two persons. The facts are the same as in Example 1 except that you also have two other young children who are qualifying children of both you and your mother. Only one of you can claim each child. However, if your mother’s AGI is higher than yours, you can allow your mother to claim one or more of the children. For example, if you claim one child, your mother can claim the other two.

Example 5—taxpayer who is a qualifying child. The facts are the same as in Example 1 except that you are only 18 years old. This means you are a qualifying child of your mother. Because of Rule 10, discussed next, you cannot claim the EIC and cannot claim Jimmy as a qualifying child. Only your mother may be able to treat Jimmy as a qualifying child to claim the EIC. If your mother meets all the other requirements for claiming the EIC and you do not claim Jimmy as a qualifying child for any of the other tax benefits listed earlier, your mother can claim both you and Jimmy as qualifying children for the EIC.

Example 6—grandparent with too much earned income to claim EIC. The facts are the same as in Example 1 except that your mother earned $50,000 from her job. Because your mother’s earned income is too high for her to claim the EIC, only you can claim the EIC using your son.

Example 7—parent with too much earned income to claim EIC. The facts are the same as in Example 1 except that you earned $50,000 from your job and your AGI is $50,500. Your earned income is too high for you to claim the EIC. But your mother cannot claim the EIC either, because her AGI is not higher than yours.

Example 8—child lived with both parents and grandparent. The facts are the same as in Example 1 except that you and Jimmy’s father are married to each other, live with Jimmy and your mother, and have an AGI of $30,000 on a joint return. If you and your husband do not claim Jimmy as a qualifying child for the EIC or any of the other tax benefits listed earlier, your mother can claim him instead. Even though the AGI on your joint return, $30,000, is more than your mother’s AGI of $20,000, for this purpose half of the joint AGI can be treated as yours and half as your husband’s. In other words, each parent’s AGI can be treated as $15,000.

Example 9—separated parents. You, your husband, and your 10-year-old son Joey lived together until August 1, 2017, when your husband moved out of the household. In August and September, Joey lived with you. For the rest of the year, Joey lived with your husband, who is Joey’s father. Joey is a qualifying child of both you and your husband because he lived with each of you for more than half the year and because he met the relationship, age, and joint return tests for both of you. At the end of the year, you and your husband still were not divorced, legally separated, or separated under a written separation agreement, so the special rule for divorced or separated parents (or parents who live apart) does not apply.

You and your husband will file separate returns. Your husband agrees to let you treat Joey as a qualifying child. This means, if your husband does not claim Joey as a qualifying child for any of the tax benefits listed earlier, you can claim him as a qualifying child for any tax benefit listed earlier for which you qualify. However, your filing status is married filing separately, so you cannot claim the EIC or the credit for child and dependent care expenses. See Rule 3.

Example 10—separated parents claim same child. The facts are the same as in Example 9 except that you and your husband both claim Joey as a qualifying child. In this case, only your husband will be allowed to treat Joey as a qualifying child. This is because, during 2017, the boy lived with him longer than with you. You cannot claim the EIC (either with or without a qualifying child). However, your husband’s filing status is married filing separately, so he cannot claim the EIC or the credit for child and dependent care expenses. See Rule 3.

Example 11—unmarried parents. You, your 5-year-old son, and your son’s father lived together all year. You and your son’s father are not married. Your son is a qualifying child of both you and his father because he meets the relationship, age, residency, and joint return tests for both you and his father. Your earned income and AGI are $12,000, and your son’s father’s earned income and AGI are $14,000. Neither of you had any other income. Your son’s father agrees to let you treat the child as a qualifying child. This means, if your son’s father does not claim your son as a qualifying child for the EIC or any of the other tax benefits listed earlier, you can claim him as a qualifying child for the EIC and any of the other tax benefits listed earlier for which you qualify.

Example 12—unmarried parents claim same child. The facts are the same as in Example 11 except that you and your son’s father both claim your son as a qualifying child. In this case, only your son’s father will be allowed to treat your son as a qualifying child. This is because his AGI, $14,000, is more than your AGI, $12,000. You cannot claim the EIC (either with or without a qualifying child).

Example 13—child did not live with a parent. You and your 7-year-old niece, your sister’s child, lived with your mother all year. You are 25 years old, and your AGI is $9,300. Your only income was from a part-time job. Your mother’s AGI is $15,000. Her only income was from her job. Your niece’s parents file jointly, have an AGI of less than $9,000, and do not live with you or their child. Your niece is a qualifying child of both you and your mother because she meets the relationship, age, residency, and joint return tests for both you and your mother. However, only your mother can treat her as a qualifying child. This is because your mother’s AGI, $15,000, is more than your AGI, $9,300.

Special rule for divorced or separated parents (or parents who live apart). A child will be treated as the qualifying child of his or her noncustodial parent (for purposes of claiming an exemption and the child tax credit, but not for the EIC) if all of the following statements are true.

- The parents:

- Are divorced or legally separated under a decree of divorce or separate maintenance,

- Are separated under a written separation agreement, or

- Lived apart at all times during the last 6 months of 2017, whether or not they are or were married.

- The child received over half of his or her support for the year from the parents.

- The child is in the custody of one or both parents for more than half of 2017.

- Either of the following statements is true.

- The custodial parent signs Form 8332 or a substantially similar statement that he or she will not claim the child as a dependent for the year, and the noncustodial parent attaches the form or statement to his or her return. If the divorce decree or separation agreement went into effect after 1984 and before 2009, the noncustodial parent may be able to attach certain pages from the decree or agreement instead of Form 8332.

- A pre-1985 decree of divorce or separate maintenance or written separation agreement that applies to 2017 provides that the noncustodial parent can claim the child as a dependent, and the noncustodial parent provides at least $600 for support of the child during 2017.

For details, see chapter 3. If a child is treated as the qualifying child of the noncustodial parent under this special rule for children of divorced or separated parents (or parents who live apart), only the noncustodial parent can claim an exemption and the child tax credit for the child. However, only the custodial parent, if eligible, or another eligible taxpayer can claim the child as a qualifying child for the EIC. For details and examples, see Applying the tiebreaker rules to divorced or separated parents (or parents who live apart) in chapter 3.

Rule 10. You Cannot Be a Qualifying Child of Another Taxpayer

You are a qualifying child of another taxpayer (such as your parent, guardian, foster parent, etc.) if all of the following statements are true.

- You are that person’s son, daughter, stepchild, foster child, or a descendant of any of them. Or, you are that person’s brother, sister, half brother, half sister, stepbrother, or stepsister (or a descendant of any of them).

- You were:

- Under age 19 at the end of the year and younger than that person (or that person’s spouse, if the person files jointly),

- Under age 24 at the end of the year, a student, and younger than that person (or that person’s spouse, if the person files jointly), or

- Permanently and totally disabled, regardless of age.