| Chapter 13 | Statement of Cash Flows |

Learning Objectives

After studying this chapter, you should be able to:

1 Indicate the usefulness of the statement of cash flows.

2 Distinguish among operating, investing, and financing activities.

3 Prepare a statement of cash flows using the indirect method.

4 Analyze the statement of cash flows.

![]()

Feature Story

What Should We Do with This Cash?

In today's environment, companies must be ready to respond to changes quickly in order to survive and thrive. This requires that they manage their cash very carefully. A company's cash needs, and how it addresses them, depend on a lot of factors. For example, many high-tech companies need significant cash in order to grow, especially in their early years. To conserve cash, some young companies pay their employees with company shares, or share options. Not only does this conserve cash, but it creates an incentive for employees to work hard. If the company succeeds, then the value of their company shares will increase.

Successful mature companies frequently generate lots of cash—often exceeding their immediate needs. This excess cash is often referred to as “free cash flow.” A company with lots of free cash flow must decide what to do with this cash. If it doesn't want to expand its capacity in its existing product lines, it might decide to acquire businesses in other industries. Or, it might increase its dividend payments, buy back shares, or pay down its debt.

In some instances, management will simply accumulate mass amounts of cash, which can result in shareholder criticism. For example, Keyence (JPN), a manufacturer of sensors and measuring instruments, generated significant amounts of cash for many years. The company is debt-free and not inclined toward acquisitions. But, it also has been reluctant to pay out dividends. Some have suggested that its aversion to dividend payments is due to the fact that the company's chairman and largest shareholder does not want to incur the personal income tax that would result if he received dividends on his 25% share ownership. At a recent shareholder meeting, many of the company's other shareholders complained loudly that the company's returns were being dragged down because it was accumulating so much cash and investing it in low-paying government securities. They demanded that the company increase its dividend.

It appears that there is a general movement in Japan and other maturing Asian economies to begin to pay higher dividends. Many suffer from excess productive capacity, so it makes sense for them to use their excess cash to either pay higher dividends or buy back shares. As this occurs, the percentage of cash flow paid out in dividends may well begin to approach about 50%, which is common in mature markets such as Europe.

After the financial crisis, emerging-market companies and developed-market companies had quite different philosophies regarding cash flows. Companies in developed countries accumulated cash and paid down debt. In contrast, companies in developing countries continued to spend cash to expand operations as well as borrow it to finance their expansion.

![]()

Preview of Chapter 13

The statement of financial position, income statement, and retained earnings statement do not always show the whole picture of the financial condition of a company or institution. In fact, looking at the financial statements of some well-known companies, a thoughtful investor might ask questions like these: How did Anheuser-Busch InBev (BEL) finance cash dividends of €2.1 billion in a year? How could Cathay Pacific Airways (HKG) purchase new assets that cost HK$9.2 billion in a year in which it reported a net loss of over HK$8.6 billion? How did the companies that spent a combined fantastic $3.4 trillion on mergers and acquisitions in a recent year finance those deals? Answers to these and similar questions can be found in this chapter, which presents the statement of cash flows.

The content and organization of this chapter are as follows.

![]()

Statement of Cash Flows: Usefulness and Format

The statement of financial position, income statement, and retained earnings statement provide only limited information about a company's cash flows (cash receipts and cash payments). For example, comparative statements of financial position show the increase in property, plant, and equipment during the year. But, they do not show how the additions were financed or paid for. The income statement shows net income. But, it does not indicate the amount of cash generated by operating activities. The retained earnings statement shows cash dividends declared but not the cash dividends paid during the year. None of these statements presents a detailed summary of where cash came from and how it was used.

Usefulness of the Statement of Cash Flows

LEARNING OBJECTIVE 1

Indicate the usefulness of the statement of cash flows.

The statement of cash flows reports the cash receipts, cash payments, and net change in cash resulting from operating, investing, and financing activities during a period. The information in a statement of cash flows should help investors, creditors, and others assess:

- The entity's ability to generate future cash flows. By examining relationships between items in the statement of cash flows, investors can make predictions of the amounts, timing, and uncertainty of future cash flows better than they can from accrual-basis data.

- The entity's ability to pay dividends and meet obligations. If a company does not have adequate cash, it cannot pay employees, settle debts, or pay dividends. Employees, creditors, and shareholders should be particularly interested in this statement because it alone shows the flows of cash in a business.

Ethics Note

Ethics NoteThough we would discourage reliance on cash flows to the exclusion of accrual accounting, comparing cash from operations to net income can reveal important information about the “quality” of reported net income. Such a comparison can reveal the extent to which net income provides a good measure of actual performance.

- The reasons for the difference between net income and net cash provided (used) by operating activities. Net income provides information on the success or failure of a business. However, some financial statement users are critical of accrual-basis net income because it requires many estimates. As a result, users often challenge the reliability of the number. Such is not the case with cash. Many readers of the statement of cash flows want to know the reasons for the difference between net income and net cash provided by operating activities. Then, they can assess for themselves the reliability of the income number.

- The cash investing and financing transactions during the period. By examining a company's investing and financing transactions, a financial statement reader can better understand why assets and liabilities changed during the period.

Classification of Cash Flows

LEARNING OBJECTIVE 2

Distinguish among operating, investing, and financing activities.

The statement of cash flows classifies cash receipts and cash payments as operating, investing, and financing activities. Transactions and other events characteristic of each kind of activity are as follows.

- Operating activities include the cash effects of transactions that create revenues and expenses. They thus enter into the determination of net income.

- Investing activities include (a) acquiring and disposing of investments and property, plant, and equipment, and (b) lending money and collecting the loans.

- Financing activities include (a) obtaining cash from issuing debt and repaying the amounts borrowed, and (b) obtaining cash from shareholders, repurchasing shares, and paying dividends.

The operating activities category is the most important. It shows the cash provided by company operations. This source of cash is generally considered to be the best measure of a company's ability to generate sufficient cash to continue as a going concern.

Illustration 13-1 lists typical cash receipts and cash payments within each of the three classifications. Study the list carefully. It will prove very useful in solving homework exercises and problems.1

Illustration 13-1 Typical receipt and payment classifications

Note the following general guidelines:

- Operating activities involve income statement items.

- Investing activities involve cash flows resulting from changes in investments and non-current asset items.

- Financing activities involve cash flows resulting from changes in non-current liability and equity items.

IFRS requires that the amount of cash paid for taxes, as well as cash flows from interest and dividends received and paid, be disclosed. The category (operating, investing, or financing) that each item was included in must be disclosed as well. An example of such a disclosure from the notes to Daimler's (DEU) financial statements is provided in Illustration 13-2.

Illustration 13-2 Daimler's statement of cash flows note

Significant Non-Cash Activities

Not all of a company's significant activities involve cash. Examples of significant non-cash activities are:

- Direct issuance of ordinary shares to purchase assets.

- Conversion of bonds into ordinary shares.

- Direct issuance of debt to purchase assets.

- Exchanges of plant assets.

Helpful Hint

Do not include non-cash investing and financing activities in the body of the statement of cash flows. Report this information in a separate schedule.

Companies do not report in the body of the statement of cash flows significant financing and investing activities that do not affect cash. Instead, they report these activities in either a separate note or supplementary schedule to the financial statements.

In solving homework assignments, you should present significant non-cash investing and financing activities in a separate note to the financial statements. (See the last entry in Illustration 13-3, on page 627, for an example.)

ACCOUNTING ACROSS THE ORGANIZATION ![]()

Net What?

Net income is not the same as net cash provided by operating activities. Below are some results from recent annual reports (currencies in millions). Note the wide disparity among these companies, all of which engaged in retail merchandising.

![]() In general, why do differences exist between net income and net cash provided by operating activities? (See page 682.)

In general, why do differences exist between net income and net cash provided by operating activities? (See page 682.)

Format of the Statement of Cash Flows

The general format of the statement of cash flows presents the results of the three activities discussed previously—operating, investing, and financing—plus the significant non-cash investing and financing activities. Illustration 13-3 shows a widely used form of the statement of cash flows.

Illustration 13-3 Format of statement of cash flows

The cash flows from operating activities section always appears first, followed by the investing activities section, and then the financing activities section. The sum of the operating, investing, and financing sections equals the net increase or decrease in cash for the period. This amount is combined with the beginning cash balance to arrive at the ending cash balance—the same amount reported on the statement of financial position.

![]() DO IT!

DO IT!

Classification of Cash Flows

During its first week, Hu Na Company had these transactions.

- Issued 100,000 HK$50 par value ordinary shares for HK$8,000,000 cash.

- Borrowed HK$2,000,000 from Castle Bank, signing a 5-year note bearing 8% interest.

- Purchased two semi-trailer trucks for HK$1,700,000 cash.

- Paid employees HK$120,000 for salaries and wages.

- Collected HK$200,000 cash for services provided.

Classify each of these transactions by type of cash flow activity.

Action Plan

- Identify the three types of activities used to report all cash inflows and outflows.

- Report as operating activities the cash effects of transactions that create revenues and expenses and enter into the determination of net income.

- Report as investing activities transactions that (a) acquire and dispose of investments and non-current assets and (b) lend money and collect loans.

- Report as financing activities transactions that (a) obtain cash from issuing debt and repay the amounts borrowed and (b) obtain cash from shareholders and pay them dividends.

Solution

- Financing activity

- Financing activity

- Investing activity

- Operating activity

- Operating activity

Related exercise material: BE13-1, BE13-2, BE13-3, E13-1, E13-2, E13-3, and ![]() 13-1.

13-1.

![]()

Preparing the Statement of Cash Flows

Companies prepare the statement of cash flows differently from the three other basic financial statements. First, it is not prepared from an adjusted trial balance. It requires detailed information concerning the changes in account balances that occurred between two points in time. An adjusted trial balance will not provide the necessary data. Second, the statement of cash flows deals with cash receipts and payments. As a result, the company must adjust the effects of the use of accrual accounting to determine cash flows.

The information to prepare this statement usually comes from three sources:

- Comparative statements of financial position. Information in the comparative statements of financial position indicates the amount of the changes in assets, liabilities, and equities from the beginning to the end of the period.

- Current income statement. Information in this statement helps determine the amount of cash provided or used by operations during the period.

- Additional information. Such information includes transaction data that are needed to determine how cash was provided or used during the period.

Preparing the statement of cash flows from these data sources involves three major steps, explained in Illustration 13-4 on the next page.

Indirect and Direct Methods

In order to perform Step 1, a company must convert net income from an accrual basis to a cash basis. This conversion may be done by either of two methods: (1) the indirect method or (2) the direct method. Both methods arrive at the same total amount for “Net cash provided by operating activities.” They differ in how they arrive at the amount.

The indirect method adjusts net income for items that do not affect cash. A great majority of companies use this method. Companies favor the indirect method for two reasons: (1) It is easier and less costly to prepare, and (2) it focuses on the differences between net income and net cash flow from operating activities.

The direct method shows operating cash receipts and payments, making it more consistent with the objective of a statement of cash flows. The IASB has expressed a preference for the direct method but allows the use of either method.

The next section illustrates the more popular indirect method. Appendix 13B illustrates the direct method.

Illustration 13-4 Three major steps in preparing the statement of cash flows

Preparing the Statement of Cash Flows—Indirect Method

LEARNING OBJECTIVE 3

Prepare a statement of cash flows using the indirect method.

To explain how to prepare a statement of cash flows using the indirect method, we use financial information from Computer Services Company. Illustration 13-5 presents Computer Services' current- and previous-year statements of financial position, its current-year income statement, and related financial information for the current year.

Illustration 13-5 Comparative statements of financial position, income statement, and additional information for Computer Services Company

We will now apply the three steps to the information provided for Computer Services Company. (Appendix 13C demonstrates an approach that employs T-accounts to prepare the statement of cash flows. Many students find this approach helpful. We encourage you to give it a try as you walk through the Computer Services example.)

Step 1: Operating Activities

DETERMINE NET CASH PROVIDED/USED BY OPERATING ACTIVITIES BY CONVERTING NET INCOME FROM AN ACCRUAL BASIS TO A CASH BASIS

To determine net cash provided by operating activities under the indirect method, companies adjust net income in numerous ways. A useful starting point is to understand why net income must be converted to net cash provided by operating activities.

Under IFRS, companies use the accrual basis of accounting. This basis requires that companies record revenue when their performance obligation is satisfied and record expenses when incurred. Revenues may include credit sales for which the company has not yet collected cash. Expenses incurred may include some items that the company has not yet paid in cash. Thus, net income under the accrual basis is not the same as net cash provided by operating activities.

Therefore, under the indirect method, companies must adjust net income to convert certain items to the cash basis. The indirect method (or reconciliation method) starts with net income and converts it to net cash provided by operating activities. Illustration 13-6 lists the three types of adjustments.

Illustration 13-6 Three types of adjustments to convert net income to net cash provided by operating activities

Helpful Hint

Depreciation is similar to any other expense in that it reduces net income. It differs in that it does not involve a current cash outflow. That is why it must be added back to net income to arrive at cash provided by operating activities.

We explain the three types of adjustments in the next three sections.

DEPRECIATION EXPENSE

Computer Services' income statement reports depreciation expense of €9,000. Although depreciation expense reduces net income, it does not reduce cash. In other words, depreciation expense is a non-cash charge. The company must add it back to net income to arrive at net cash provided by operating activities. Computer Services reports depreciation expense in the statement of cash flows as shown below.

Illustration 13-7 Adjustment for depreciation

As the first adjustment to net income in the statement of cash flows, companies frequently list depreciation and similar non-cash charges such as amortization of intangible assets, depletion expense, and bad debt expense.

LOSS ON DISPOSAL OF PLANT ASSETS

Illustration 13-1 (page 625) states that cash received from the sale (disposal) of plant assets should be reported in the investing activities section. Because of this, companies must eliminate from net income all gains and losses related to the disposal of plant assets, to arrive at cash provided by operating activities.

In our example, Computer Services' income statement reports a €3,000 loss on disposal of plant assets (book value €7,000, less €4,000 cash received from disposal of plant assets). The company's loss of €3,000 should not be included in the operating activities section of the statement of cash flows. Illustration 13-8 shows that the €3,000 loss is eliminated by adding €3,000 back to net income to arrive at net cash provided by operating activities.

Illustration 13-8 Adjustment for loss on disposal of plant assets

If a gain on disposal occurs, the company deducts the gain from its net income in order to determine net cash provided by operating activities. In the case of either a gain or a loss, companies report the actual amount of cash received from the sale as a source of cash in the investing activities section of the statement of cash flows.

CHANGES TO NON-CASH CURRENT ASSET AND CURRENT LIABILITY ACCOUNTS

A final adjustment in reconciling net income to net cash provided by operating activities involves examining all changes in current asset and current liability accounts. The accrual accounting process records revenues in the period in which a company's performance obligation is satisfied and expenses in the period incurred. For example, companies use Accounts Receivable to record amounts owed to the company for sales that have been made but for which cash collections have not yet been received. They use the Prepaid Insurance account to reflect insurance that has been paid for but which has not yet expired and therefore has not been expensed. Similarly, the Salaries and Wages Payable account reflects salaries and wages expense that has been incurred by the company but has not been paid.

As a result, we need to adjust net income for these accruals and prepayments to determine net cash provided by operating activities. Thus, we must analyze the change in each current asset and current liability account to determine its impact on net income and cash.

CHANGES IN NON-CASH CURRENT ASSETS. The adjustments required for changes in non-cash current asset accounts are as follows. Deduct from net income increases in current asset accounts, and add to net income decreases in current asset accounts, to arrive at net cash provided by operating activities. We can observe these relationships by analyzing the accounts of Computer Services Company.

DECREASE IN ACCOUNTS RECEIVABLE Computer Services Company's accounts receivable decreased by €10,000 (from €30,000 to €20,000) during the period. For Computer Services, this means that cash receipts were €10,000 higher than sales revenue. The Accounts Receivable account in Illustration 13-9 shows that Computer Services Company had €507,000 in sales revenue (as reported on the income statement), but it collected €517,000 in cash.

Illustration 13-9 Analysis of accounts receivable

To adjust net income to net cash provided by operating activities, the company adds to net income the decrease of €10,000 in accounts receivable (see Illustration 13-10). When the Accounts Receivable balance increases, cash receipts are lower than sales revenue under the accrual basis. Therefore, the company deducts from net income the amount of the increase in accounts receivable, to arrive at net cash provided by operating activities.

INCREASE IN INVENTORY Computer Services Company's inventory balance increased €5,000 (from €10,000 to €15,000) during the period. The change in the Inventory account reflects the difference between the amount of inventory purchased and the amount sold. For Computer Services, this means that the cost of merchandise purchased exceeded the cost of goods sold by €5,000. As a result, cost of goods sold does not reflect €5,000 of cash payments made for merchandise. The company deducts from net income this inventory increase of €5,000 during the period, to arrive at net cash provided by operating activities (see Illustration 13-10). If inventory decreases, the company adds to net income the amount of the change, to arrive at net cash provided by operating activities.

INCREASE IN PREPAID EXPENSES Computer Services' prepaid expenses increased during the period by €4,000. This means that cash paid for expenses is higher than expenses reported on an accrual basis. In other words, the company has made cash payments in the current period but will not charge expenses to income until future periods (as charges to the income statement). To adjust net income to net cash provided by operating activities, the company deducts from net income the €4,000 increase in prepaid expenses (see Illustration 13-10).

Illustration 13-10 Adjustments for changes in current asset accounts

If prepaid expenses decrease, reported expenses are higher than the expenses paid. Therefore, the company adds to net income the decrease in prepaid expenses, to arrive at net cash provided by operating activities.

CHANGES IN CURRENT LIABILITIES. The adjustments required for changes in current liability accounts are as follows. Add to net income increases in current liability accounts, and deduct from net income decreases in current liability accounts, to arrive at net cash provided by operating activities.

INCREASE IN ACCOUNTS PAYABLE For Computer Services Company, Accounts Payable increased by €16,000 (from €12,000 to €28,000) during the period. That means the company received €16,000 more in goods than it actually paid for. As shown in Illustration 13-11 (page 634), to adjust net income to determine net cash provided by operating activities, the company adds to net income the €16,000 increase in Accounts Payable.

DECREASE IN INCOME TAXES PAYABLE When a company incurs income tax expense but has not yet paid its taxes, it records income taxes payable. A change in the Income Taxes Payable account reflects the difference between income tax expense incurred and income tax actually paid. Computer Services' Income Taxes Payable account decreased by €2,000. That means the €47,000 of income tax expense reported on the income statement was €2,000 less than the amount of taxes paid during the period of €49,000. As shown in Illustration 13-11, to adjust net income to a cash basis, the company must reduce net income by €2,000.

Illustration 13-11 Adjustments for changes in current liability accounts

Illustration 13-11 shows that, after starting with net income of €145,000, the sum of all of the adjustments to net income was €27,000. This resulted in net cash provided by operating activities of €172,000.

Summary of Conversion to Net Cash Provided by Operating Activities—Indirect Method

As shown in the previous illustrations, the statement of cash flows prepared by the indirect method starts with net income. It then adds or deducts items to arrive at net cash provided by operating activities. The required adjustments are of three types:

- Non-cash charges such as depreciation, amortization, and depletion.

- Gains and losses on the disposal of plant assets.

- Changes in non-cash current asset and current liability accounts.

Illustration 13-12 provides a summary of these changes.

Illustration 13-12 Adjustments required to convert net income to net cash provided by operating activities

ETHICS INSIGHT ![]()

Cash Flow Isn't Always What It Seems

Some managers have taken actions that artificially increase cash flow from operating activities. They do this by moving negative amounts out of the operating section and into the investing or financing section.

For example, WorldCom, Inc. (USA) disclosed that it had improperly capitalized expenses: It had moved $3.8 billion of cash outflows from the “Cash from operating activities” section of the statement of cash flows to the “Investing activities” section, thereby greatly enhancing cash provided by operating activities. Similarly, Dynegy, Inc. (USA) restated its statement of cash flows because it had improperly included in operating activities, instead of in financing activities, $300 million from natural gas trading. The restatement resulted in a drop of 37% in cash flow from operating activities.

Source: Henny Sender, “Sadly, These Days Even Cash Flow Isn't Always What It Seems to Be,” Wall Street Journal (May 8, 2002).

![]() For what reasons might managers at WorldCom and at Dynegy take the actions noted above? (See page 683.)

For what reasons might managers at WorldCom and at Dynegy take the actions noted above? (See page 683.)

![]() DO IT!

DO IT!

Cash from Operating Activities

Josh's PhotoPlus reported net income of £73,000 for 2014. Included in the income statement were depreciation expense of £7,000 and a gain on disposal of plant assets of £2,500. Josh's comparative statements of financial position show the following balances.

![]()

Calculate net cash provided by operating activities for Josh's PhotoPlus.

Action Plan

- Add non-cash charges such as depreciation back to net income to compute net cash provided by operating activities.

- Deduct from net income gains on the disposal of plant assets, or add losses back to net income, to compute net cash provided by operating activities.

- Use changes in non-cash current asset and current liability accounts to compute net cash provided by operating activities.

Solution

Related exercise material: BE13-4, BE13-5, BE13-6, E13-4, E13-5, E13-6, E13-7, E13-8, and ![]() 13-2.

13-2.

![]()

Step 2: Investing and Financing Activities

ANALYZE CHANGES IN NON-CURRENT ASSET AND LIABILITY ACCOUNTS AND RECORD AS INVESTING AND FINANCING ACTIVITIES, OR DISCLOSE AS NON-CASH TRANSACTIONS

INCREASE IN LAND As indicated from the change in the Land account and the additional information, the company purchased land of €110,000 through the issuance of long-term bonds. The issuance of bonds payable for land has no effect on cash. But, it is a significant non-cash investing and financing activity that merits disclosure in a separate schedule. (See Illustration 13-14 on pages 637–638.)

INCREASE IN BUILDINGS As the additional data indicate, Computer Services Company acquired an office building for €120,000 cash. This is a cash outflow reported in the investing section. (See Illustration 13-14 on pages 637–638.)

INCREASE IN EQUIPMENT The Equipment account increased €17,000. The additional information explains that this net increase resulted from two transactions: (1) a purchase of equipment of €25,000, and (2) the sale for €4,000 of equipment costing €8,000. These transactions are investing activities. The company should report each transaction separately. Thus, it reports the purchase of equipment as an outflow of cash for €25,000. It reports the sale as an inflow of cash for €4,000. The T-account below shows the reasons for the change in this account during the year.

Illustration 13-13 Analysis of equipment

The following entry shows the details of the equipment sale transaction.

INCREASE IN BONDS PAYABLE The Bonds Payable account increased €110,000. As indicated in the additional information, the company acquired land from the issuance of these bonds. It reports this non-cash transaction in a separate schedule at the bottom of the statement.

Helpful Hint

When companies issue shares or bonds for cash, the actual proceeds will appear in the statement of cash flows as a financing inflow (rather than the par value of the shares or face value of bonds).

INCREASE IN SHARE CAPITAL—ORDINARY The statement of financial position reports an increase in Share Capital—Ordinary of €20,000. The additional information section notes that this increase resulted from the issuance of new shares. This is a cash inflow reported in the financing section.

INCREASE IN RETAINED EARNINGS Retained earnings increased €116,000 during the year. This increase can be explained by two factors: (1) Net income of €145,000 increased retained earnings. (2) Dividends of €29,000 decreased retained earnings. The company adjusts net income to net cash provided by operating activities in the operating activities section. Payment of the dividends (not the declaration) is a cash outflow that the company reports as a financing activity.

For more than a decade, the top executives at the Italian dairy products company Parmalat (ITA) engaged in multiple frauds which overstated cash and other assets by more than €1 billion while understating liabilities by between €8 and €12 billion. Much of the fraud involved creating fictitious sources and uses of cash. Some of these activities incorporated sophisticated financial transactions with subsidiaries created with the help of large international financial institutions. However, much of the fraud employed very basic, even sloppy, forgery of documents. For example, when outside auditors requested confirmation of bank accounts (such as a fake €4.8 billion account in the Cayman Islands), documents were created on scanners, with signatures that were cut and pasted from other documents. These were then passed through a fax machine numerous times to make them look real (if difficult to read). Similarly, fictitious bills were created in order to divert funds to other businesses owned by the Tanzi family (who controlled Parmalat).

Total take: Billions of euros

THE MISSING CONTROL

Independent internal verification. Internal auditors at the company should have independently verified bank accounts and major transfers of cash to outside companies that were controlled by the Tanzi family.

STATEMENT OF CASH FLOWS—2014

Using the previous information, we can now prepare a statement of cash flows for 2014 for Computer Services Company as shown in Illustration 13-14.

Step 3: Net Change in Cash

COMPARE THE NET CHANGE IN CASH ON THE STATEMENT OF CASH FLOWS WITH THE CHANGE IN THE CASH ACCOUNT REPORTED ON THE STATEMENT OF FINANCIAL POSITION TO MAKE SURE THE AMOUNTS AGREE

Illustration 13-14 indicates that the net change in cash during the period was an increase of €22,000. This agrees with the change in the Cash account reported on the statement of financial position in Illustration 13-5 (page 629).

Illustration 13-14 Statement of cash flows, 2014—indirect method

![]() DO IT!

DO IT!

Use the information below and on the next page to prepare a statement of cash flows using the indirect method.

Action Plan

- Determine net cash provided/used by operating activities by adjusting net income for items that did not affect cash.

- Determine net cash provided/used by investing activities and financing activities.

- Determine the net increase/decrease in cash.

Solution

Related exercise material: BE13-4, BE13-5, BE13-6, BE13-7, E13-4, E13-5, E13-6, E13-7, E13-8, and E13-9.

![]()

Using Cash Flows to Evaluate a Company

Traditionally, investors and creditors have most commonly used ratios based on numbers derived from accrual accounting. These days, cash-based ratios are gaining increased acceptance among analysts.

Free Cash Flow

In the statement of cash flows, cash provided by operating activities is intended to indicate the cash-generating capability of the company. Analysts have noted, however, that cash provided by operating activities fails to take into account that a company must invest in new fixed assets just to maintain its current level of operations. Companies also must at least maintain dividends at current levels to satisfy investors. The measurement of free cash flow provides additional insight regarding a company's cash-generating ability. Free cash flow describes the cash remaining from operations after adjustment for capital expenditures and dividends.

Consider the following example: Suppose that MPC produced and sold 10,000 personal computers this year. It reported HK$1,000,000 cash provided by operating activities. In order to maintain production at 10,000 computers, MPC invested HK$150,000 in equipment. It chose to pay HK$50,000 in dividends. Its free cash flow was HK$800,000 (HK$1,000,000 − HK$150,000 − HK$50,000). The company could use this HK$800,000 either to purchase new assets to expand the business or to pay an HK$800,000 dividend and continue to produce 10,000 computers. In practice, free cash flow is often calculated with the formula in Illustration 13-15. (Alternative definitions also exist.)

![]()

Illustration 13-15 Free cash flow

Illustration 13-16 provides basic information (in millions) excerpted from a recent statement of cash flows of Anheuser-Busch InBev (BEL).

Illustration 13-16 Anheuser-Busch InBev cash flow information (€ in millions)

Anheuser-Busch InBev's free cash flow is calculated as shown in Illustration 13-17.

Illustration 13-17 Calculation of Anheuser-Busch InBev's free cash flow (€ in millions)

The company generates a significant amount of cash from its operations, but it spent most of it to buy property, plant, and equipment, and to pay dividends.

![]() DO IT!

DO IT!

Free Cash Flow

Luó Corporation issued the following statement of cash flows for 2014.

(a) Compute free cash flow for Luó Corporation. (b) Explain why free cash flow often provides better information than “Net cash provided by operating activities.”

Action Plan

- Compute free cash flow as: Cash provided by operating activities − Capital expenditures − Cash dividends.

Solution

(a) Free cash flow (¥ in thousands) = ¥29,300 − ¥19,000 − ¥9,000 = ¥1,300

(b) Cash provided by operating activities fails to take into account that a company must invest in new plant assets just to maintain the current level of operations. Companies must also maintain dividends at current levels to satisfy investors. The measurement of free cash flow provides additional insight regarding a company's cash-generating ability.

Related exercise material: BE13-8, BE13-9, BE13-10, BE13-11, E13-7, E13-9, and ![]() 13-3.

13-3.

![]()

![]() Comprehensive DO IT! 1

Comprehensive DO IT! 1

The income statement for the year ended December 31, 2014, for Kosinski Company contains the following condensed information.

Included in operating expenses is a €24,000 loss resulting from the sale of machinery for €270,000 cash. Machinery was purchased at a cost of €750,000.

The following balances are reported on Kosinski's comparative statements of financial position at December 31.

Income tax expense of €353,000 represents the amount paid in 2014. Dividends declared and paid in 2014 totaled €200,000.

Instructions

Prepare the statement of cash flows using the indirect method.

Action Plan

- Determine net cash from operating activities. Operating activities generally relate to changes in current assets and current liabilities.

- Determine net cash from investing activities. Investing activities generally relate to changes in non-current assets.

- Determine net cash from financing activities. Financing activities generally relate to changes in non-current liabilities and equity accounts.

Solution to Comprehensive ![]() 1

1

![]()

SUMMARY OF LEARNING OBJECTIVES

![]()

1 Indicate the usefulness of the statement of cash flows. The statement of cash flows provides information about the cash receipts, cash payments, and net change in cash resulting from the operating, investing, and financing activities of a company during the period.

2 Distinguish among operating, investing, and financing activities. Operating activities include the cash effects of transactions that enter into the determination of net income. Investing activities involve cash flows resulting from changes in investments and non-current asset items. Financing activities involve cash flows resulting from changes in non-current liability and equity items.

3 Prepare a statement of cash flows using the indirect method. The preparation of a statement of cash flows involves three major steps: (1) Determine net cash provided/used by operating activities by converting net income from an accrual basis to a cash basis. (2) Analyze changes in non-current asset and liability accounts and record as investing and financing activities, or disclose as non-cash transactions. (3) Compare the net change in cash on the statement of cash flows with the change in the Cash account reported on the statement of financial position to make sure the amounts agree.

4 Analyze the statement of cash flows. Free cash flow indicates the amount of cash a company generated during the current year that is available for the payment of additional dividends or for expansion.

GLOSSARY

Direct method A method that shows operating cash receipts and payments, making it more consistent with the objective of the statement of cash flows. (p. 628).

Financing activities Cash flow activities that include (a) obtaining cash from issuing debt and repaying the amounts borrowed and (b) obtaining cash from shareholders, repurchasing shares, and paying dividends. (p. 625).

Free cash flow Cash provided by operating activities adjusted for capital expenditures and dividends paid. (p. 640).

Indirect method A method of preparing a statement of cash flows in which net income is adjusted for items that do not affect cash, to determine net cash provided by operating activities. (p. 628).

Investing activities Cash flow activities that include (a) acquiring and disposing of investments and property, plant, and equipment and (b) lending money and collecting the loans. (p. 624).

Operating activities Cash flow activities that include the cash effects of transactions that create revenues and expenses and thus enter into the determination of net income. (p. 624).

Statement of cash flows A basic financial statement that provides information about the cash receipts, cash payments, and net change in cash during a period, resulting from operating, investing, and financing activities. (p. 624).

APPENDIX 13A USING A WORKSHEET TO PREPARE THE STATEMENT OF CASH FLOWS—INDIRECT METHOD

LEARNING OBJECTIVE 5

Explain how to use a worksheet to prepare the statement of cash flows using the indirect method.

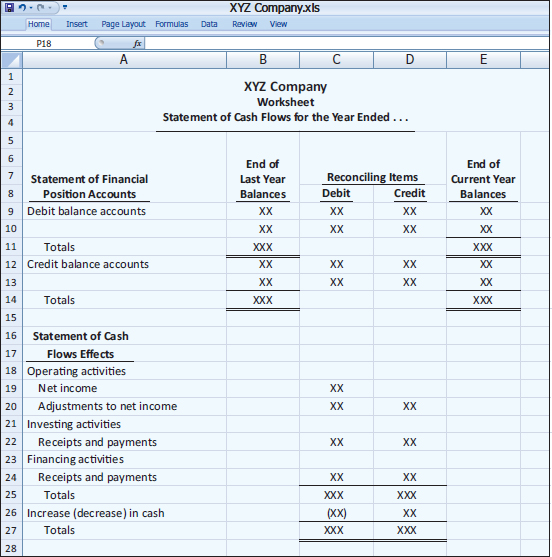

When preparing a statement of cash flows, companies may need to make numerous adjustments of net income. In such cases, they often use a worksheet to assemble and classify the data that will appear on the statement. The worksheet is merely an aid in preparing the statement. Its use is optional. Illustration 13A-1 shows the skeleton format of the worksheet for preparation of the statement of cash flows.

Illustration 13A-1 Format of worksheet

The following guidelines are important in preparing a worksheet.

- In the statement of financial position accounts section, list accounts with debit balances separately from those with credit balances. This means, for example, that Accumulated Depreciation appears under credit balances and not as a contra account under debit balances. Enter the beginning and ending balances of each account in the appropriate columns. Enter as reconciling items in the two middle columns the transactions that caused the change in the account balance during the year.

After all reconciling items have been entered, each line pertaining to a statement of financial position account should “foot across.” That is, the beginning balance plus or minus the reconciling item(s) must equal the ending balance. When this agreement exists for all statement of financial position accounts, all changes in account balances have been reconciled.

- The bottom portion of the worksheet consists of the operating, investing, and financing activities sections. It provides the information necessary to prepare the formal statement of cash flows. Enter inflows of cash as debits in the reconciling columns. Enter outflows of cash as credits in the reconciling columns. Thus, in this section, the sale of equipment for cash at book value appears as a debit under investing activities. Similarly, the purchase of land for cash appears as a credit under investing activities.

- The reconciling items shown in the worksheet are not entered in any journal or posted to any account. They do not represent either adjustments or corrections of the statement of financial position accounts. They are used only to facilitate the preparation of the statement of cash flows.

Preparing the Worksheet

As in the case of worksheets illustrated in earlier chapters, preparing a worksheet involves a series of prescribed steps. The steps in this case are:

- Enter in the statement of financial position accounts section the statement of financial position accounts and their beginning and ending balances.

- Enter in the reconciling columns of the worksheet the data that explain the changes in the statement of financial position accounts other than cash and their effects on the statement of cash flows.

- Enter on the cash line and at the bottom of the worksheet the increase or decrease in cash. This entry should enable the totals of the reconciling columns to be in agreement.

To illustrate the preparation of a worksheet, we will use the 2014 data for Computer Services Company. Your familiarity with these data (from the chapter) should help you understand the use of a worksheet. For ease of reference, the comparative statements of financial position, income statement, and selected data for 2014 are presented in Illustration 13A-2 (page 646).

DETERMINING THE RECONCILING ITEMS

Companies can use one of several approaches to determine the reconciling items. For example, they can first complete the changes affecting net cash provided by operating activities, and then can determine the effects of financing and investing transactions. Or, they can analyze the statement of financial position accounts in the order in which they are listed on the worksheet. We will follow this latter approach for Computer Services, except for cash. As indicated in Step 3, cash is handled last.

ACCOUNTS RECEIVABLE The decrease of €10,000 in accounts receivable means that cash collections from sales revenue are higher than the sales revenue reported in the income statement. To convert net income to net cash provided by operating activities, we add the decrease of €10,000 to net income. The entry in the reconciling columns of the worksheet is:

Illustration 13A-2 Comparative statements of financial position, income statement, and additional information for Computer Services Company

![]()

INVENTORY Computer Services Company's inventory balance increases €5,000 during the period. The Inventory account reflects the difference between the amount of inventory that the company purchased and the amount that it sold. For Computer Services, this means that the cost of merchandise purchased exceeds the cost of goods sold by €5,000. As a result, cost of goods sold does not reflect €5,000 of cash payments made for merchandise. We deduct this inventory increase of €5,000 during the period from net income to arrive at net cash provided by operating activities. The worksheet entry is:

![]()

PREPAID EXPENSES An increase of €4,000 in prepaid expenses means that expenses deducted in determining net income are less than expenses that were paid in cash. We deduct the increase of €4,000 from net income in determining net cash provided by operating activities. The worksheet entry is:

![]()

Helpful Hint

These amounts are asterisked in the worksheet to indicate that they result from a significant non-cash transaction.

LAND The increase in land of €110,000 resulted from a purchase through the issuance of long-term bonds. The company should report this transaction as a significant non-cash investing and financing activity. The worksheet entry is:

![]()

BUILDINGS The cash purchase of a building for €120,000 is an investing activity cash outflow. The entry in the reconciling columns of the worksheet is:

![]()

EQUIPMENT The increase in equipment of €17,000 resulted from a cash purchase of €25,000 and the sale of equipment costing €8,000. The book value of the equipment was €7,000, the cash proceeds were €4,000, and a loss of €3,000 was recorded. The worksheet entries are:

ACCOUNTS PAYABLE We must add the increase of €16,000 in accounts payable to net income to determine net cash provided by operating activities. The worksheet entry is:

![]()

INCOME TAXES PAYABLE When a company incurs income tax expense but has not yet paid its taxes, it records income taxes payable. A change in the Income Taxes Payable account reflects the difference between income tax expense incurred and income tax actually paid. Computer Services' Income Taxes Payable account decreases by €2,000. That means the €47,000 of income tax expense reported on the income statement was €2,000 less than the amount of taxes paid during the period of €49,000. To adjust net income to a cash basis, we must reduce net income by €2,000. The worksheet entry is:

![]()

BONDS PAYABLE The increase of €110,000 in this account resulted from the issuance of bonds for land. This is a significant non-cash investing and financing activity. Worksheet entry (d) above is the only entry necessary.

SHARE CAPITAL—ORDINARY The statement of financial position reports an increase in Share Capital—Ordinary of €20,000. The additional information section notes that this increase resulted from the issuance of new shares. This is a cash inflow reported in the financing section. The worksheet entry is:

![]()

ACCUMULATED DEPRECIATION—BUILDINGS, AND ACCUMULATED DEPRECIATION—EQUIPMENT Increases in these accounts of €6,000 and €3,000, respectively, resulted from depreciation expense. Depreciation expense is a non-cash charge that we must add to net income to determine net cash provided by operating activities. The worksheet entries are:

RETAINED EARNINGS The €116,000 increase in retained earnings resulted from net income of €145,000 and the declaration and payment of a €29,000 cash dividend. Net income is included in net cash provided by operating activities, and the dividends are a financing activity cash outflow. The entries in the reconciling columns of the worksheet are:

DISPOSITION OF CHANGE IN CASH The firm's cash increased €22,000 in 2014. The final entry on the worksheet, therefore, is:

![]()

As shown in the worksheet, we enter the increase in cash in the reconciling credit column as a balancing amount. This entry should complete the reconciliation of the changes in the statement of financial position accounts. Also, it should permit the totals of the reconciling columns to be in agreement. When all changes have been explained and the reconciling columns are in agreement, the reconciling columns are ruled to complete the worksheet. The completed worksheet for Computer Services Company is shown in Illustration 13A-3.

Illustration 13A-3 Completed worksheet—indirect method

SUMMARY OF LEARNING OBJECTIVE FOR APPENDIX 13A

![]()

5 Explain how to use a worksheet to prepare the statement of cash flows using the indirect method. When there are numerous adjustments, a worksheet can be a helpful tool in preparing the statement of cash flows. Key guidelines for using a worksheet are: (1) List accounts with debit balances separately from those with credit balances. (2) In the reconciling columns in the bottom portion of the worksheet, show cash inflows as debits and cash outflows as credits. (3) Do not enter reconciling items in any journal or account, but use them only to help prepare the statement of cash flows.

The steps in preparing the worksheet are: (1) Enter beginning and ending balances of statement of financial position accounts. (2) Enter debits and credits in reconciling columns. (3) Enter the increase or decrease in cash in two places as a balancing amount.

APPENDIX 13B STATEMENT OF CASH FLOWS—DIRECT METHOD

LEARNING OBJECTIVE 6

Prepare a statement of cash flows using the direct method.

To explain and illustrate the direct method, we will use the transactions of Computer Services Company for 2014, to prepare a statement of cash flows. Illustration 13B-1 presents information related to 2014 for Computer Services Company.

Illustration 13B-1 Comparative statements of financial position, income statement, and additional information for Computer Services Company

To prepare a statement of cash flows under the direct approach, we will apply the three steps outlined in Illustration 13-4 (page 629).

Step 1: Operating Activities

DETERMINE NET CASH PROVIDED/USED BY OPERATING ACTIVITIES BY CONVERTING NET INCOME FROM AN ACCRUAL BASIS TO A CASH BASIS

Under the direct method, companies compute net cash provided by operating activities by adjusting each item in the income statement from the accrual basis to the cash basis. To simplify and condense the operating activities section, companies report only major classes of operating cash receipts and cash payments. For these major classes, the difference between cash receipts and cash payments is the net cash provided by operating activities. These relationships are as shown in Illustration 13B-2 (page 652).

An efficient way to apply the direct method is to analyze the items reported in the income statement in the order in which they are listed. We then determine cash receipts and cash payments related to these revenues and expenses. The following pages present the adjustments required to prepare a statement of cash flows for Computer Services Company using the direct approach.

CASH RECEIPTS FROM CUSTOMERS The income statement for Computer Services Company reported revenues from customers of €507,000. How much of that was cash receipts? To answer that, companies need to consider the change in accounts receivable during the year. When accounts receivable increase during the year, revenues on an accrual basis are higher than cash receipts from customers. Operations led to revenues, but not all of these revenues resulted in cash receipts.

Illustration 13B-2 Major classes of cash receipts and payments

To determine the amount of cash receipts, the company deducts from sales revenue the increase in accounts receivable. On the other hand, there may be a decrease in accounts receivable. That would occur if cash receipts from customers exceeded sales revenue. In that case, the company adds to sales revenue the decrease in accounts receivable. For Computer Services Company, accounts receivable decreased €10,000. Thus, cash receipts from customers were €517,000, computed as shown in Illustration 13B-3.

Illustration 13B-3 Computation of cash receipts from customers

Computer Services can also determine cash receipts from customers from an analysis of the Accounts Receivable account, as shown in Illustration 13B-4.

Illustration 13B-4 Analysis of accounts receivable

Illustration 13B-5 shows the relationships among cash receipts from customers, sales revenue, and changes in accounts receivable.

Illustration 13B-5 Formula to compute cash receipts from customers—direct method

CASH PAYMENTS TO SUPPLIERS Computer Services Company reported cost of goods sold of €150,000 on its income statement. How much of that was cash payments to suppliers? To answer that, it is first necessary to find purchases for the year. To find purchases, companies adjust cost of goods sold for the change in inventory. When inventory increases during the year, purchases for the year have exceeded cost of goods sold. As a result, to determine the amount of purchases, the company adds to cost of goods sold the increase in inventory.

In 2014, Computer Services Company's inventory increased €5,000. It computes purchases as follows.

Illustration 13B-6 Computation of purchases

After computing purchases, a company can determine cash payments to suppliers. This is done by adjusting purchases for the change in accounts payable. When accounts payable increase during the year, purchases on an accrual basis are higher than they are on a cash basis. As a result, to determine cash payments to suppliers, a company deducts from purchases the increase in accounts payable. On the other hand, if cash payments to suppliers exceed purchases, there is a decrease in accounts payable. In that case, a company adds to purchases the decrease in accounts payable. For Computer Services Company, cash payments to suppliers were €139,000, computed as follows.

Illustration 13B-7 Computation of cash payments to suppliers

Computer Services also can determine cash payments to suppliers from an analysis of the Accounts Payable account, as shown in Illustration 13B-8.

Helpful Hint

The T-account shows that purchases less increase in accounts payable equal payments to suppliers.

Illustration 13B-8 Analysis of accounts payable

Illustration 13B-9 shows the relationships among cash payments to suppliers, cost of goods sold, changes in inventory, and changes in accounts payable.

Illustration 13B-9 Formula to compute cash payments to suppliers—direct method

CASH PAYMENTS FOR OPERATING EXPENSES Computer Services reported on its income statement operating expenses of €111,000. How much of that amount was cash paid for operating expenses? To answer that, we need to adjust this amount for any changes in prepaid expenses and accrued expenses payable. For example, if prepaid expenses increased during the year, cash paid for operating expenses is higher than operating expenses reported on the income statement. To convert operating expenses to cash payments for operating expenses, a company adds the increase in prepaid expenses to operating expenses. On the other hand, if prepaid expenses decrease during the year, it deducts the decrease from operating expenses.

Companies must also adjust operating expenses for changes in accrued expenses payable. When accrued expenses payable increase during the year, operating expenses on an accrual basis are higher than they are in a cash basis. As a result, to determine cash payments for operating expenses, a company deducts from operating expenses an increase in accrued expenses payable. On the other hand, a company adds to operating expenses a decrease in accrued expenses payable because cash payments exceed operating expenses.

Computer Services Company's cash payments for operating expenses were €115,000, computed as follows.

Illustration 13B-10 Computation of cash payments for operating expenses

Illustration 13B-11 shows the relationships among cash payments for operating expenses, changes in prepaid expenses, and changes in accrued expenses payable.

Illustration 13B-11 Formula to compute cash payments for operating expenses—direct method

DEPRECIATION EXPENSE AND LOSS ON DISPOSAL OF PLANT ASSETS Computer Services' depreciation expense in 2014 was €9,000. Depreciation expense is not shown on a statement of cash flows under the direct method because it is a non-cash charge. If the amount for operating expenses includes depreciation expense, operating expenses must be reduced by the amount of depreciation to determine cash payments for operating expenses.

The loss on disposal of plant assets of €3,000 is also a non-cash charge. The loss on disposal of plant assets reduces net income, but it does not reduce cash. Thus, the loss on disposal of plant assets is not shown on the statement of cash flows under the direct method.

Other charges to expense that do not require the use of cash, such as the amortization of intangible assets, depletion expense, and bad debt expense, are treated in the same manner as depreciation.

CASH PAYMENTS FOR INTEREST Computer Services reported on the income statement interest expense of €42,000. Since the statement of financial position did not include an accrual for interest payable for 2013 or 2014, the amount reported as expense is the same as the amount of interest paid.

CASH PAYMENTS FOR INCOME TAXES Computer Services reported income tax expense of €47,000 on the income statement. Income taxes payable, however, decreased €2,000. This decrease means that income taxes paid were more than income taxes reported in the income statement. Cash payments for income taxes were therefore €49,000, as shown on the next page.

Illustration 13B-12 Computation of cash payments for income taxes

Illustration 13B-13 shows the relationships among cash payments for income taxes, income tax expense, and changes in income taxes payable.

Illustration 13B-13 Formula to compute cash payments for income taxes—direct method

The operating activities section of the statement of cash flows of Computer Services Company is shown in Illustration 13B-14.

Illustration 13B-14 Operating activities section of the statement of cash flows

When a company uses the direct method, it must also provide in a separate schedule (not shown here) the net cash flows from operating activities as computed under the indirect method.

Step 2: Investing and Financing Activities

ANALYZE CHANGES IN NON-CURRENT ASSET AND LIABILITY ACCOUNTS AND RECORD AS INVESTING AND FINANCING ACTIVITIES, OR DISCLOSE AS NON-CASH TRANSACTIONS

Helpful Hint

The investing and financing activities are measured and reported the same under both the direct and indirect methods.

INCREASE IN LAND As indicated from the change in the Land account and the additional information, the company purchased land of €110,000 by directly exchanging bonds for land. The exchange of bonds payable for land has no effect on cash. But, it is a significant non-cash investing and financing activity that merits disclosure in a note to the financial statements. (See Illustration 13B-16 on page 657.)

INCREASE IN BUILDINGS As the additional data indicate, Computer Services Company acquired an office building for €120,000 cash. This is a cash outflow reported in the investing section. (See Illustration 13B-16.)

INCREASE IN EQUIPMENT The Equipment account increased €17,000. The additional information explains that this was a net increase that resulted from two transactions: (1) a purchase of equipment of €25,000, and (2) the sale for €4,000 of equipment costing €8,000. These transactions are investing activities. The company should report each transaction separately. The statement in Illustration 13B-16 reports the purchase of equipment as an outflow of cash for €25,000. It reports the sale as an inflow of cash for €4,000. The T-account on the next page shows the reasons for the change in this account during the year.

Illustration 13B-15 Analysis of equipment

The following entry shows the details of the equipment sale transaction.

INCREASE IN BONDS PAYABLE The Bonds Payable account increased €110,000. As indicated in the additional information, the company acquired land by directly exchanging bonds for land. Illustration 13B-16 reports this non-cash transaction in a separate note at the bottom of the statement.

INCREASE IN SHARE CAPITAL—ORDINARY The statement of financial position reports an increase in Share Capital—Ordinary of €20,000. The additional information section notes that this increase resulted from the issuance of new shares. This is a cash inflow reported in the financing section in Illustration 13B-16.

Helpful Hint

When companies issue shares or bonds for cash, the actual proceeds will appear in the statement of cash flows as a financing inflow (rather than the par value of the shares or face value of bonds).

INCREASE IN RETAINED EARNINGS Retained earnings increased €116,000 during the year. This increase can be explained by two factors: (1) Net income of €145,000 increased retained earnings and (2) dividends of €29,000 decreased retained earnings. The company adjusts net income to net cash provided by operating activities in the operating activities section. Payment of the dividends (not the declaration) is a cash outflow that the company reports as a financing activity in Illustration 13B-16.

STATEMENT OF CASH FLOWS—2014

Illustration 13B-16 shows the statement of cash flows for Computer Services Company.

Step 3: Net Change in Cash

COMPARE THE NET CHANGE IN CASH ON THE STATEMENT OF CASH FLOWS WITH THE CHANGE IN THE CASH ACCOUNT REPORTED ON THE STATEMENT OF FINANCIAL POSITION TO MAKE SURE THE AMOUNTS AGREE

Illustration 13B-16 indicates that the net change in cash during the period was an increase of €22,000. This agrees with the change in balances in the Cash account reported on the statements of financial position in Illustration 13B-1 (page 650).

Illustration 13B-16 Statement of cash flows, 2014—direct method

SUMMARY OF LEARNING OBJECTIVE FOR APPENDIX 13B

![]()

6 Prepare a statement of cash flows using the direct method. The preparation of the statement of cash flows involves three major steps: (1) Determine net cash provided/used by operating activities by converting net income from an accrual basis to a cash basis. (2) Analyze changes in non-current asset and liability accounts and record as investing and financing activities, or disclose as non-cash transactions. (3) Compare the net change in cash on the statement of cash flows with the change in the Cash account reported on the statement of financial position to make sure the amounts agree. The direct method reports cash receipts less cash payments to arrive at net cash provided by operating activities.

GLOSSARY FOR APPENDIX 13B

Direct method A method of determining net cash provided by operating activities by adjusting each item in the income statement from the accrual basis to the cash basis. (p. 651).

![]() Comprehensive DO IT! 2

Comprehensive DO IT! 2

The income statement for Taipei Company contains the following condensed information.

Included in operating expenses is a NT$24,000 loss resulting from the sale of machinery for NT$270,000 cash. Machinery was purchased at a cost of NT$750,000. The following balances are reported on Taipei's comparative statements of financial position at December 31.

Income tax expense of NT$353,000 represents the amount paid in 2014. Dividends declared and paid in 2014 totaled NT$200,000.

Instructions

Prepare the statement of cash flows using the direct method.

Action Plan

- Determine net cash from operating activities. Each item in the income statement must be adjusted to the cash basis.

- Determine net cash from investing activities. Investing activities generally relate to changes in non-current assets.

- Determine net cash from financing activities. Financing activities generally relate to changes in non-current liabilities and equity accounts.

Solution to Comprehensive ![]() 2

2

![]()

APPENDIX 13C STATEMENT OF CASH FLOWS—T-ACCOUNT APPROACH

Many people like to use T-accounts to provide structure to the preparation of a statement of cash flows. The use of T-accounts is based on the accounting equation. The basic equation is:

![]()

Now, let's rewrite the left-hand side as:

![]()

Next, rewrite the equation by subtracting Non-Cash Assets from each side to isolate Cash on the left-hand side:

![]()

Finally, if we insert the Δ symbol (which means “change in”), we have:

![]()

What this means is that the change in cash is equal to the change in all of the other statement of financial position accounts. Another way to think about this is that if we analyze the changes in all of the non-cash statement of financial position accounts, we will explain the change in the Cash account. This, of course, is exactly what we are trying to do with the statement of cash flows.

To implement this approach, first prepare a large Cash T-account, with sections for operating, investing, and financing activities. Then, prepare smaller T-accounts for all of the other non-cash statement of financial position accounts. Insert the beginning and ending balances for each of these accounts. Once you have done this, then walk through the steps outlined below and on the next page. As you walk through the steps, enter debit and credit amounts into the affected accounts. When all of the changes in the T-accounts have been explained, you are done. To demonstrate, we will apply this approach to the example of Computer Services Company that is presented in the chapter. Each of the adjustments in Illustration 13C-1 (page 660) is numbered so you can follow them through the T-accounts.

1. Post net income as a debit to the operating section of the Cash T-account and a credit to Retained Earnings. Make sure to label all adjustments to the Cash T-account. It also helps to number each adjustment so you can trace all of them if you make an error.

2. Post depreciation expense as a debit to the operating section of Cash and a credit to each of the appropriate accumulated depreciation accounts.

3. Post any gains or losses on the sale of property, plant, and equipment. To do this, it is best to first prepare the journal entry that was recorded at the time of the sale and then post each element of the journal entry. For example, for Computer Services the entry was:

The €4,000 cash entry is a source of cash in the investing section of the Cash account. Accumulated Depreciation—Equipment is debited for €1,000. The Loss on Disposal of Plant Assets is a debit to the operating section of the Cash T-account. Finally, Equipment is credited for €8,000.

Illustration 13C-1 T-account approach

4–8. Next, post each of the changes to the non-cash current asset and current liability accounts. For example, to explain the €10,000 decline in Computer Services' Accounts Receivable, credit Accounts Receivable for €10,000 and debit the operating section of the Cash T-account for €10,000.

9. Analyze the changes in the non-current accounts. Land was purchased by issuing Bonds Payable. This requires a debit to Land for €110,000 and a credit to Bonds Payable for €110,000. Note that this is a significant non-cash event that requires disclosure in a note at the bottom of the statement of cash flows.

10. Buildings is debited for €120,000, and the investing section of the Cash T-account is credited for €120,000 as a use of cash from investing.

11. Equipment is debited for €25,000 and the investing section of the Cash T-account is credited for €25,000 as a use of cash from investing.

12. Share Capital—Ordinary is credited for €20,000 for the issuance of ordinary shares, and the financing section of the Cash T-account is debited for €20,000.

13. Retained Earnings is debited to reflect the payment of the €29,000 dividend, and the financing section of the Cash T-account is credited to reflect the use of Cash.

At this point, all of the changes in the non-cash accounts have been explained. All that remains is to subtotal each section of the Cash T-account and agree the total change in cash with the change shown on the statement of financial position. Once this is done, the information in the Cash T-account can be used to prepare a statement of cash flows.

Self-Test, Brief Exercises, Exercises, Problem Set A, and many more resources are available for practice in WileyPLUS.

Self-Test, Brief Exercises, Exercises, Problem Set A, and many more resources are available for practice in WileyPLUS.

Note: All Questions, Exercises, and Problems marked with an asterisk relate to material in the appendices to the chapter.

SELF-TEST QUESTIONS

Answers are on page 683.

- Which of the following is incorrect about the statement of cash flows? (LO 1)

(a) It is a fourth basic financial statement.

(b) It provides information about cash receipts and cash payments of an entity during a period.

(c) It reconciles the ending cash account balance to the balance per the bank statement.

(d) It provides information about the operating, investing, and financing activities of the business.

- Which of the following will not be reported in the statement of cash flows? (LO 1)

(a) The net change in plant assets during the year.

(b) Cash payments for plant assets purchased during the year.

(c) Cash receipts from sales of plant assets during the year.

(d) Cash payments for dividends.

- The statement of cash flows classifies cash receipts and cash payments by these activities: (LO 2)

(a) operating and non-operating.

(b) investing, financing, and operating.

(c) financing, operating, and non-operating.

(d) investing, financing, and non-operating.

- Which is an example of a cash flow from an operating activity? (LO 2)

(a) Payment of cash to lenders for interest.

(b) Receipt of cash from the sale of ordinary shares.

(c) Payment of cash to reacquire shares.

(d) None of the above.

- Which is an example of a cash flow from an investing activity? (LO 2)

(a) Receipt of cash from the issuance of bonds payable.

(b) Payment of cash to repurchase outstanding shares.

(c) Receipt of cash from the sale of equipment.

(d) Payment of cash to suppliers for inventory.

- The purchase of treasury shares is classified on the statement of cash flows as: (LO 2)

(a) operating activities.

(b) investing activities.

(c) a combination of (a) and (b).

(d) financing activities.

- Which is an example of a cash flow from a financing activity? (LO 2)

(a) Receipt of cash from sale of land.

(b) Issuance of debt for cash.

(c) Purchase of equipment for cash.

(d) Receipt of interest.

- Which of the following is incorrect about the statement of cash flows? (LO 2)

(a) The direct method may be used to report cash provided by operations.

(b) The statement shows the cash provided (used) for three categories of activity.

(c) The operating section is the last section of the statement.

(d) The indirect method may be used to report cash provided by operations.

Questions 9 through 11 apply only to the indirect method.

- Net income is £132,000, accounts payable increased £10,000 during the year, inventory decreased £6,000 during the year, and accounts receivable increased £12,000 during the year. Under the indirect method, what is net cash provided by operating activities? (LO 3)

(a) £102,000.

(b) £112,000.

(c) £124,000.

(d) £136,000.

- Items that are added back to net income in determining cash provided by operating activities under the indirect method do not include: (LO 3)

(a) depreciation expense.

(b) an increase in inventory.

(c) amortization expense.

(d) loss on sale of equipment.

- The following data are available for Allen Clapp Corporation. (LO 3)

Net income HK$2,000,000 Depreciation expense 400,000 Dividends paid 600,000 Gain on disposal of land 100,000 Decrease in accounts receivable 200,000 Decrease in accounts payable 300,000 Net cash provided by operating activities is:

(a) HK$1,600,000.

(b) HK$2,200,000.

(c) HK$2,400,000.

(d) HK$2,800,000.

- The following data are available for Orange Peels Corporation. (LO 3)

Sale of land $100,000 Sale of equipment 50,000 Issuance of ordinary shares 70,000 Purchase of equipment 30,000 Payment of cash dividends 60,000 Net cash provided by investing activities is:

(a) $120,000.

(b) $130,000.

(c) $150,000.

(d) $190,000.

- The following data are available for Something Strange! (LO 3)

Increase in accounts payable € 40,000 Increase in bonds payable 100,000 Sale of investment 50,000 Issuance of ordinary shares 60,000 Payment of cash dividends 30,000 Net cash provided by financing activities is:

(a) €90,000.

(b) €130,000.

(c) €160,000.

(d) €170,000.

- The statement of cash flows should not be used to evaluate an entity's ability to: (LO 4)

(a) earn net income.

(b) generate future cash flows.

(c) pay dividends.

(d) meet obligations.

- Free cash flow provides an indication of a company's ability to: (LO 4)

(a) generate net income.

(b) sell its equipment.

(c) generate cash to invest in new capital expenditures.

(d) purchase treasury shares.

- *In a worksheet for the statement of cash flows, a decrease in accounts receivable is entered in the reconciling columns as a credit to Accounts Receivable and a debit in the: (LO 5)

(a) investing activities section.

(b) operating activities section.

(c) financing activities section.

(d) None of the choices is correct.

- *In a worksheet for the statement of cash flows, a worksheet entry that includes a credit to accumulated depreciation will also include a: (LO 5)

(a) credit in the operating section and a debit in another section.

(b) debit in the operating section.

(c) debit in the investing section.

(d) debit in the financing section.

Questions 18 and 19 apply only to the direct method.

- *The beginning balance in accounts receivable is $44,000, the ending balance is $42,000, and sales during the period are $129,000. What are cash receipts from customers? (LO 6)

(a) $127,000.

(b) $129,000.

(c) $131,000.

(d) $141,000.

- *Which of the following items is reported on a statement of cash flows prepared by the direct method? (LO 6)

(a) Loss on sale of building.

(b) Increase in accounts receivable.

(c) Depreciation expense.

(d) Cash payments to suppliers.

Go to the book's companion website, www.wiley.com/college/weygandt, for additional Self-Test Questions.

![]()

QUESTIONS

-

(a) What is a statement of cash flows?

(b) Nick Johns maintains that the statement of cash flows is an optional financial statement. Do you agree? Explain.

- What questions about cash are answered by the statement of cash flows?

- Distinguish among the three types of activities reported in the statement of cash flows.

-

(a) What are the major sources (inflows) of cash in a statement of cash flows?

(b) What are the major uses (outflows) of cash?

- Why is it important to disclose certain non-cash transactions? How should they be disclosed?

- Wilma Flintstone and Barny Rublestone were discussing the format of the statement of cash flows of Saltwater Candy Co. At the bottom of Saltwater Candy's statement of cash flows was a note entitled “Non-cash investing and financing activities.” Give three examples of significant non-cash transactions that would be reported in this manner.

- Why is it necessary to use comparative statements of financial position, a current income statement, and certain transaction data in preparing a statement of cash flows?

- Contrast the advantages and disadvantages of the direct and indirect methods of preparing the statement of cash flows. Are both methods acceptable? Which method is preferred by the IASB? Which method is more popular?

- When the total cash inflows exceed the total cash outflows in the statement of cash flows, how and where is this excess identified?

- Describe the indirect method for determining net cash provided (used) by operating activities.

- Why is it necessary to convert accrual-based net income to cash-basis income when preparing a statement of cash flows?

- The president of Ferneti Company is puzzled. During the last year, the company experienced a net loss of £800,000, yet its cash increased £300,000 during the same period of time. Explain to the president how this could occur.

- Identify five items that are adjustments to convert net income to net cash provided by operating activities under the indirect method.