10

Rank‐Based Shrinkage Estimation

This chapter introduces the R‐estimates and provides a comparative study of ridge regression estimator (RRE), least absolute shrinkage and selection operator (LASSO), preliminary test estimator (PTE) and the Stein‐type estimator based on the theory of rank‐based statistics and the nonorthogonality design matrix of a given linear model.

10.1 Introduction

It is well known that the usual rank estimators (REs) are robust in the linear regression models, asymptotically unbiased with minimum variance. But, the data analyst may point out some deficiency with the R‐estimators when one considers the “prediction accuracy” and “interpretation.” To overcome these concerns, we propose the rank‐based least absolute shrinkage and selection operator (RLASSO) estimator. It defines a continuous shrinking operation that can produce coefficients that are exactly “zero” and competitive with the rank‐based “subset selection” and RRE, retaining the good properties of both the R‐estimators. RLASSO simultaneously estimates and selects the coefficients of a given linear regression model.

However, there are rank‐based PTEs and Stein‐type estimators (see Saleh 2006; Jureckova and Sen 1996, and Puri and Sen 1986). These R‐estimators provide estimators which shrink toward the target value and do not select coefficients for appropriate prediction and interpretations. Hoerl and Kennard (1970) introduced ridge regression based on the Tikhonov (1963) regularization, and Tibshirani (1996) introduced the LASSO estimators in a parametric formulation. The methodology is minimization of least squares objective function subject to ![]() ‐ and

‐ and ![]() ‐penalty restrictions. However, the

‐penalty restrictions. However, the ![]() penalty does not produce a sparse solution, but the

penalty does not produce a sparse solution, but the ![]() ‐penalty does.

‐penalty does.

This chapter points to the useful aspects of RLASSO and the rank‐based ridge regression R‐estimators as well as the limitations. Conclusions are based on asymptotic ![]() ‐risk lower bound of RLASSO with the actual asymptotic

‐risk lower bound of RLASSO with the actual asymptotic ![]() risk of other R‐estimators.

risk of other R‐estimators.

10.2 Linear Model and Rank Estimation

Consider the multiple linear model,

where ![]() ,

, ![]() is the

is the ![]() matrix of real numbers,

matrix of real numbers, ![]() is the intercept parameter, and

is the intercept parameter, and ![]() is the

is the ![]() ‐vector of regression parameters. We assume that:

‐vector of regression parameters. We assume that:

- Errors

are independently and identically distributed (i.i.d.) random variables with (unknown) cumulative distributional function (c.d.f.)

are independently and identically distributed (i.i.d.) random variables with (unknown) cumulative distributional function (c.d.f.)  having absolutely continuous probability density function (p.d.f.)

having absolutely continuous probability density function (p.d.f.)  with finite and nonzero Fisher information

(10.2)

with finite and nonzero Fisher information

(10.2)

- For the definition of the linear rank statistics, we consider the score generating function

which is assumed to be nonconstant, non‐decreasing, and square integrable on

which is assumed to be nonconstant, non‐decreasing, and square integrable on  so that

(10.3)

so that

(10.3)

The scores are defined in either of the following ways:

for

, where

, where  are order statistics from a sample of size

are order statistics from a sample of size  from

from  .

. - Let

(10.4)where

is the

is the  th row of

th row of  and

and  ,

,  . We assume that

. We assume that

For the R‐estimation of the parameter ![]() , define for

, define for ![]() the rank of

the rank of ![]() among

among ![]() by

by ![]() . Then for each

. Then for each ![]() , consider the set of scores

, consider the set of scores ![]() and define the vector of linear rank statistics

and define the vector of linear rank statistics

Since ![]() are translation invariant, there is no need of adjustment for the intercept parameter

are translation invariant, there is no need of adjustment for the intercept parameter ![]() .

.

If we set ![]() for

for ![]() , then the unrestricted RE is defined by any central point of the set

, then the unrestricted RE is defined by any central point of the set

Let the RE be as ![]() . Then, using the uniform asymptotic linearity of Jureckova (1971),

. Then, using the uniform asymptotic linearity of Jureckova (1971),

for any ![]() and

and ![]() . Then, it is well‐known that

. Then, it is well‐known that

where

and

Similarly, when ![]() , the model reduces to

, the model reduces to

Accordingly, for the R‐estimation of ![]() , in this case, we define rank of

, in this case, we define rank of ![]() among

among

as ![]() . Then, for each

. Then, for each ![]() , consider the set of scores

, consider the set of scores ![]() and define the vector of linear rank statistics

and define the vector of linear rank statistics

where

Then, define the restricted RE of ![]() as

as

which satisfy the following equality

where ![]() , for any

, for any ![]() and

and ![]() . Then, it follows that

. Then, it follows that

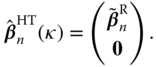

We are basically interested in the R‐estimation of ![]() when it is suspected the sparsity condition

when it is suspected the sparsity condition ![]() may hold. Under the given setup, the RE is written as

may hold. Under the given setup, the RE is written as

where ![]() and

and ![]() are

are ![]() and

and ![]() vectors, respectively; and if

vectors, respectively; and if ![]() is satisfied, then the restricted RE of

is satisfied, then the restricted RE of ![]() is

is

where ![]() is defined by (10.13).

is defined by (10.13).

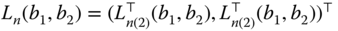

In this section, we are interested in the study of some shrinkage estimators stemming from ![]() and

and ![]() . In order to look at the performance characteristics of several R‐estimators, we use the two components asymptotic weighted

. In order to look at the performance characteristics of several R‐estimators, we use the two components asymptotic weighted ![]() ‐risk function

‐risk function

where ![]() is any estimator of the form

is any estimator of the form ![]() of

of ![]() .

.

Note that ![]() so that the marginal distribution of

so that the marginal distribution of ![]() and

and ![]() are given by

are given by

Hence, asymptotic distributional weighted ![]() risk of

risk of ![]() is given by

is given by

For the test of sparsity ![]() , we define the aligned rank statistic

, we define the aligned rank statistic

and ![]() . Further, it is shown (see, Puri and Sen 1986) that

. Further, it is shown (see, Puri and Sen 1986) that

It is easy to see that under ![]() ,

, ![]() has asymptotically the chi‐square distribution with

has asymptotically the chi‐square distribution with ![]() degrees of freedom (DF) and under the sequence of local alternatives

degrees of freedom (DF) and under the sequence of local alternatives ![]() defined by

defined by

For a suitable estimator ![]() of

of ![]() , we denote by

, we denote by

where we assume that ![]() is non‐degenerate.

is non‐degenerate.

One may find the asymptotic distributional weighted ![]() risks are

risks are

where

Our focus in this chapter is the comparative study of performance properties of these rank‐based penalty R‐estimators and PTEs and Stein‐type R‐estimators. We refer to Saleh (2006) for the comparative study of the PTEs and Stein‐type estimators. We extend the study to include penalty estimators which have not been done yet.

Now, we recall several results that form the asymptotic distribution of

For the RE given by ![]() , we see under regularity condition and Eq. (10.22),

, we see under regularity condition and Eq. (10.22),

where ![]() .

.

As a consequence, the asymptotic marginal distribution of ![]() (

(![]() ) under local alternatives

) under local alternatives

is given by

where ![]() is

is ![]() th diagonal of

th diagonal of ![]() .

.

10.2.1 Penalty R‐Estimators

In this section, we consider three basic penalty estimators, namely:

- The hard threshold estimator (HTE) (Donoho and Johnstone 1994),

- The LASSO by Tibshirani (1996),

- The RRE by Hoerl and Kennard (1970).

Motivated by the idea that only few regression coefficients contribute signal, we consider threshold rules that retain only observed data that exceed a multiple of the noise level. Accordingly, we consider the “subset selection” rule given by Donoho and Johnstone (1994) known as the “hard threshold” rule as given by

where ![]() is the

is the ![]() th element of

th element of ![]() and

and ![]() is an indicator function of the set

is an indicator function of the set ![]() . The quantity

. The quantity ![]() is called the threshold parameter. The components of

is called the threshold parameter. The components of ![]() are kept as

are kept as ![]() if they are significant and zero, otherwise. It is apparent that each component of

if they are significant and zero, otherwise. It is apparent that each component of ![]() is a PTE of the predictor concerned. The components of

is a PTE of the predictor concerned. The components of ![]() are PTEs and discrete variables and lose some optimality properties. Hence, one may define a continuous version of (10.29) based on marginal distribution of

are PTEs and discrete variables and lose some optimality properties. Hence, one may define a continuous version of (10.29) based on marginal distribution of ![]() (

(![]() ).

).

In accordance with the principle of the PTE approach (see Saleh 2006), we define the Stein‐type estimator as the continuous version of PTE based on the marginal distribution of

given by

See Saleh (2006, p. 83) for more details.

Another continuous version proposed by Tibshirani (1996) and Donoho and Johnstone (1994) is called the LASSO. In order to develop LASSO for our case, we propose the following modified R LASSO (MRL) given by

where for ![]() ,

,

The estimator ![]() defines a continuous shrinkage operation that produces a sparse solution which may be derived as follows:

defines a continuous shrinkage operation that produces a sparse solution which may be derived as follows:

One may show that ![]() is the solution of the equation

is the solution of the equation

Thus, the ![]() th component of (10.32) equals

th component of (10.32) equals

Now, consider three cases, ![]() and 0. We can show that the asymptotic distributional expressions for

and 0. We can show that the asymptotic distributional expressions for ![]() is given by

is given by

Finally, we consider the R ridge regression estimator (RRRE) of ![]() . They are obtained using marginal distributions of

. They are obtained using marginal distributions of ![]() ,

, ![]() , as

, as

to accommodate sparsity condition; see Tibshirani (1996) on the summary of properties discussed earlier.

Our problem is to compare the performance characteristics of these penalty estimators with that of the Stein‐type and preliminary test R‐estimators (PTREs) with respect to asymptotic distributional mean squared error criterion. We present the PTREs and Stein‐type R‐estimators in the next section.

10.2.2 PTREs and Stein‐type R‐Estimators

For the model (10.1), if we suspect sparsity condition, i.e. ![]() , then the restricted R‐estimator of

, then the restricted R‐estimator of ![]() is

is ![]() . For the test of the null‐hypothesis

. For the test of the null‐hypothesis ![]() vs.

vs. ![]() , the rank statistic for the test of

, the rank statistic for the test of ![]() is given by

is given by

where ![]() ,

, ![]() , and

, and

It is well known that under the model (10.1) and assumptions (10.2)–(10.4) as ![]() ,

, ![]() follows the chi‐squared distribution with

follows the chi‐squared distribution with ![]() DF Then, we define the PTE of

DF Then, we define the PTE of ![]() as

as

where ![]() is the indicator function of the set

is the indicator function of the set ![]() .

.

Similarly, we define the Stein‐type R‐estimator as

Finally, the positive rule Stein‐type estimator is given by

10.3 Asymptotic Distributional Bias and  Risk of the R‐Estimators

Risk of the R‐Estimators

First, we consider the asymptotic distribution bias (ADB) and ADR of the penalty estimators.

10.3.1 Hard Threshold Estimators (Subset Selection)

It is easy to see that

where ![]() is the c.d.f. of a noncentral chi‐square distribution with

is the c.d.f. of a noncentral chi‐square distribution with ![]() DF and noncentrality parameter,

DF and noncentrality parameter, ![]() .

.

The ADR of ![]() is given by

is given by

Since

for ![]() . Hence,

. Hence,

Note that (10.43) is free of the threshold parameter, ![]() .

.

Thus, we have Lemma 10.1, which gives the asymptotic distributional upper bound (ADUB) of ![]() as

as

If we have a sparse solution with ![]() coefficients

coefficients ![]() (

(![]() ) and

) and ![]() zero coefficients, then

zero coefficients, then

Then, the ADUB of the weighted ![]() ‐risk is given by

‐risk is given by

is independent of the threshold parameter, ![]() .

.

10.3.2 Rank‐based LASSO

The ADB and ADR of ![]() are given by

are given by

and

where

Hence, the following Lemma 10.2 gives the ADUB of ![]() ‐risk of

‐risk of ![]() .

.

As for the sparse solution, the weighted ![]() ‐risk upper bound are given by

‐risk upper bound are given by

independent of ![]() .

.

Next, we consider “asymptotic oracle for orthogonal linear projection” (AOOLP) in the following section.

10.3.3 Multivariate Normal Decision Theory and Oracles for Diagonal Linear Projection

Consider the following problem in multivariate normal decision theory. We are given the least‐squares estimator (LSE) of ![]() , namely,

, namely, ![]() according to

according to

where ![]() is the marginal variance of

is the marginal variance of ![]() ,

, ![]() , and noise level and

, and noise level and ![]() are the object of interest. We measure the quality of the estimator based on

are the object of interest. We measure the quality of the estimator based on ![]() ‐loss and define the risk as

‐loss and define the risk as

If there is a sparse solution, then use the (10.18) formulation. We consider a family of diagonal linear projections,

Such estimators “keep” or “kill” the coordinate. The ideal diagonal coefficients, ![]() are in this case

are in this case ![]() . These coefficients estimate those

. These coefficients estimate those ![]() 's which are larger than the noise level

's which are larger than the noise level ![]() , yielding the asymptotic lower bound on the risk as

, yielding the asymptotic lower bound on the risk as

As a special case of (10.57), we obtain

In general, the risk ![]() cannot be attained for all

cannot be attained for all ![]() by any estimator, linear or nonlinear. However, for the sparse case, if

by any estimator, linear or nonlinear. However, for the sparse case, if ![]() is the number of nonzero coefficients,

is the number of nonzero coefficients, ![]() and

and ![]() is the number of zero coefficients, then (10.58) reduces to the lower bound given by

is the number of zero coefficients, then (10.58) reduces to the lower bound given by

Consequently, the weighted ![]() ‐risk lower bound is given by

‐risk lower bound is given by

10.4 Comparison of Estimators

In this section, we compare various estimators with respect to the unrestricted R‐estimator (URE), in terms of relative weighted ![]() ‐risk efficiency (RWRE).

‐risk efficiency (RWRE).

10.4.1 Comparison of RE with Restricted RE

In this case, the RWRE of restricted R‐estimator versus RE is given by

where ![]() . The

. The ![]() is a decreasing function of

is a decreasing function of ![]() . So,

. So,

In order to compute ![]() , we need to find

, we need to find ![]() ,

, ![]() , and

, and ![]() . These are obtained by generating explanatory variables using the following equation following McDonald and Galarneau (1975),

. These are obtained by generating explanatory variables using the following equation following McDonald and Galarneau (1975),

where ![]() are independent

are independent ![]() pseudorandom numbers and

pseudorandom numbers and ![]() is the correlation between any two explanatory variables. In this study, we take

is the correlation between any two explanatory variables. In this study, we take ![]() , and 0.9, which shows the variables are lightly collinear and severely collinear. In our case, we chose

, and 0.9, which shows the variables are lightly collinear and severely collinear. In our case, we chose ![]() and various

and various ![]() . The resulting output is then used to compute

. The resulting output is then used to compute ![]() .

.

10.4.2 Comparison of RE with PTRE

Here, the RWRE expression for PTRE vs. RE is given by

where

Then, the PTRE outperforms the RE for

Otherwise, RE outperforms the PTRE in the interval ![]() . We may mention that

. We may mention that ![]() is a decreasing function of

is a decreasing function of ![]() with a maximum at

with a maximum at ![]() , then it decreases crossing the 1‐line to a minimum at

, then it decreases crossing the 1‐line to a minimum at ![]() with a value

with a value ![]() , and then increases toward 1‐line.

, and then increases toward 1‐line.

The RWRE expression for PTRE vs. RE belongs to the interval

where ![]() depends on the size

depends on the size ![]() and given by

and given by

The quantity ![]() is the value

is the value ![]() at which the RWRE value is minimum.

at which the RWRE value is minimum.

10.4.3 Comparison of RE with SRE and PRSRE

To express the RWRE of SRE and PRSRE, we assume always that ![]() . We have then

. We have then

It is a decreasing function of ![]() . At

. At ![]() , its value is

, its value is ![]() and when

and when ![]() , its value goes to 1. Hence, for

, its value goes to 1. Hence, for ![]() ,

,

Also,

So that,

We also provide a graphical representation (Figure 10.1) of RWRE of the estimators for ![]() and

and ![]() .

.

Figure 10.1 RWRE for the restricted, preliminary test, Stein‐type, and its positive‐rule R‐estimators.

10.4.4 Comparison of RE and Restricted RE with RRRE

First, we consider the weighted ![]() ‐risk difference of RE and RRRE given by

‐risk difference of RE and RRRE given by

Hence, RRRE outperforms the RE uniformly. Similarly, for the restricted RE and RRRE, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

If ![]() , then (10.68) is negative. The restricted RE outperforms RRRE at this point. Solving the equation

, then (10.68) is negative. The restricted RE outperforms RRRE at this point. Solving the equation

we get

If ![]() , then the restricted RE outperforms the RRRE, and if

, then the restricted RE outperforms the RRRE, and if ![]() , RRRE performs better than the restricted RE. Thus, neither restricted RE nor RRRE outperforms the other uniformly.

, RRRE performs better than the restricted RE. Thus, neither restricted RE nor RRRE outperforms the other uniformly.

In addition, the RWRE of RRRE versus RE equals

which is a decreasing function of ![]() with maximum

with maximum ![]() at

at ![]() and minimum 1 as

and minimum 1 as ![]() . So,

. So,

10.4.5 Comparison of RRRE with PTRE, SRE, and PRSRE

Here, the weighted ![]() ‐risk difference of PTRE and RRRE is given by

‐risk difference of PTRE and RRRE is given by

Since the first term is a decreasing function of ![]() with a maximum value

with a maximum value ![]() at

at ![]() and tends to 0 as

and tends to 0 as ![]() . The second function in brackets is also decreasing in

. The second function in brackets is also decreasing in ![]() with maximum

with maximum ![]() at

at ![]() which is less than

which is less than ![]() , and the function tends to 0 as

, and the function tends to 0 as ![]() . Hence, (10.72) is nonnegative for

. Hence, (10.72) is nonnegative for ![]() . Hence, the RRRE uniformly performs better than the PTRE.

. Hence, the RRRE uniformly performs better than the PTRE.

Similarly, we show the RRE uniformly performs better than the SRE, i.e. the weighted ![]() risk of

risk of ![]() and

and ![]() is given by

is given by

The weighted ![]() ‐risk difference of SRE and RRRE is given by

‐risk difference of SRE and RRRE is given by

Since the first function decreases with a maximum value ![]() at

at ![]() , the second function decreases with a maximum value

, the second function decreases with a maximum value ![]() and tends to 0 as

and tends to 0 as ![]() . Hence, the two functions are one below the other and the difference is nonnegative for

. Hence, the two functions are one below the other and the difference is nonnegative for ![]() .

.

Next, we show that the weighted ![]() risk (W

risk (W![]() R) of the two estimators may be ordered as

R) of the two estimators may be ordered as

Note that

where ![]() is defined by Eq. (9.70).

is defined by Eq. (9.70).

Thus, we find that the W![]() R difference is given by

R difference is given by

Hence, the RRE uniformly performs better than the PRSRE.

10.4.6 Comparison of RLASSO with RE and Restricted RE

First, note that if ![]() coefficients

coefficients ![]() and

and ![]() coefficients are zero in a sparse solution, the lower bound of the weighted

coefficients are zero in a sparse solution, the lower bound of the weighted ![]() risk is given by

risk is given by ![]() . Thereby, we compare all estimators relative to this quantity. Hence, the W

. Thereby, we compare all estimators relative to this quantity. Hence, the W![]() R difference between RE and RLASSO is given by

R difference between RE and RLASSO is given by

Hence, if ![]() , the RLASSO performs better than the RE; while if

, the RLASSO performs better than the RE; while if ![]() , the RE performs better than the RLASSO. Consequently, neither the RE nor the RLASSO performs better than the other uniformly.

, the RE performs better than the RLASSO. Consequently, neither the RE nor the RLASSO performs better than the other uniformly.

Next, we compare the restricted RE and RLASSO. In this case, the W![]() R difference is given by

R difference is given by

Hence, the RRE uniformly performs better than the RLASSO. If ![]() , RLASSO and RRE are

, RLASSO and RRE are ![]() ‐risk equivalent. If the RE estimators are independent, then

‐risk equivalent. If the RE estimators are independent, then ![]() . Hence, RLASSO satisfies the oracle properties.

. Hence, RLASSO satisfies the oracle properties.

10.4.7 Comparison of RLASSO with PTRE, SRE, and PRSRE

We first consider the PTRE versus RLASSO. In this case, the W![]() R difference is given by

R difference is given by

Hence, the RLASSO outperforms the PTRE when ![]() . But, when

. But, when ![]() , then the RLASSO outperforms the PTRE for

, then the RLASSO outperforms the PTRE for

Otherwise, PTRE outperforms the modified RLASSO estimator. Hence, neither PTRE nor the modified RLASSO estimator outperforms the other uniformly.

Next, we consider SRE and PRSRE versus the RLASSO. In these two cases, we have the W![]() R differences given by

R differences given by

and from (10.74),

where ![]() is given by (9.70). Hence, the modified RLASSO estimator outperforms the SRE as well as the PRSRE in the interval

is given by (9.70). Hence, the modified RLASSO estimator outperforms the SRE as well as the PRSRE in the interval

Thus, neither SRE nor the PRSRE outperforms the modified RLASSO estimator uniformly.

10.4.8 Comparison of Modified RLASSO with RRRE

Here, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

Hence, the RRRE outperforms the modified RLASSO estimator, uniformly.

10.5 Summary and Concluding Remarks

In this section, we discuss the contents of Tables 10.1–10.10 presented as confirmatory evidence of the theoretical findings of the estimators.

Table 10.1 RWRE for the estimators for ![]() and

and ![]() .

.

| RRE | PTRE | ||||||||||||

| RE | 0.1 | 0.2 | 0.8 | 0.9 | MRLASSO | 0.2 | SRE | PRSRE | RRRE | ||||

| 0 | 1.0000 | 3.7179 | 3.9415 | 5.0593 | 5.1990 | 3.3333 | 1.9787 | 1.7965 | 1.6565 | 2.0000 | 2.3149 | 3.3333 | |

| 0.1 | 1.0000 | 3.5845 | 3.7919 | 4.8155 | 4.9419 | 3.2258 | 1.9229 | 1.7512 | 1.6194 | 1.9721 | 2.2553 | 3.2273 | |

| 0.5 | 1.0000 | 3.1347 | 3.2920 | 4.0374 | 4.1259 | 2.8571 | 1.7335 | 1.5970 | 1.4923 | 1.8733 | 2.0602 | 2.8846 | |

| 1 | 1.0000 | 2.7097 | 2.8265 | 3.3591 | 3.4201 | 2.5000 | 1.5541 | 1.4499 | 1.3703 | 1.7725 | 1.8843 | 2.5806 | |

| 1.62 | 1.0000 | 2.3218 | 2.4070 | 2.7829 | 2.8246 | 2.1662 | 1.3920 | 1.3164 | 1.2590 | 1.6739 | 1.7315 | 2.3185 | |

| 2 | 1.0000 | 2.1318 | 2.2034 | 2.5143 | 2.5483 | 2.0000 | 1.3141 | 1.2520 | 1.2052 | 1.6231 | 1.6597 | 2.1951 | |

| 2.03 | 1.0000 | 2.1181 | 2.1887 | 2.4952 | 2.5287 | 1.9879 | 1.3085 | 1.2474 | 1.2014 | 1.6194 | 1.6545 | 2.1863 | |

| 3 | 1.0000 | 1.7571 | 1.8054 | 2.0091 | 2.0308 | 1.6667 | 1.1664 | 1.1302 | 1.1035 | 1.5184 | 1.5245 | 1.9608 | |

| 3.23 | 1.0000 | 1.6879 | 1.7324 | 1.9191 | 1.9388 | 1.6042 | 1.1404 | 1.1088 | 1.0857 | 1.4983 | 1.5006 | 1.9187 | |

| 3.33 | 1.0000 | 1.6601 | 1.7031 | 1.8832 | 1.9023 | 1.5791 | 1.1302 | 1.1004 | 1.0787 | 1.4903 | 1.4911 | 1.9020 | |

| 5 | 1.0000 | 1.3002 | 1.3264 | 1.4332 | 1.4442 | 1.2500 | 1.0088 | 1.0018 | 0.9978 | 1.3829 | 1.3729 | 1.6901 | |

| 7 | 1.0000 | 1.0318 | 1.0483 | 1.1139 | 1.1205 | 1.0000 | 0.9419 | 0.9500 | 0.9571 | 1.3005 | 1.2910 | 1.5385 | |

| 7.31 | 1.0000 | 1.0001 | 1.0155 | 1.0770 | 1.0832 | 0.9701 | 0.9362 | 0.9458 | 0.9541 | 1.2907 | 1.2816 | 1.5208 | |

| 7.46 | 1.0000 | 0.9851 | 1.0001 | 1.0596 | 1.0656 | 0.9560 | 0.9337 | 0.9440 | 0.9528 | 1.2860 | 1.2771 | 1.5126 | |

| 8.02 | 1.0000 | 0.9334 | 0.9468 | 1.0000 | 1.0054 | 0.9073 | 0.9262 | 0.9389 | 0.9493 | 1.2700 | 1.2620 | 1.4841 | |

| 8.07 | 1.0000 | 0.9288 | 0.9421 | 0.9947 | 1.0000 | 0.9029 | 0.9256 | 0.9385 | 0.9490 | 1.2686 | 1.2606 | 1.4816 | |

| 10 | 1.0000 | 0.7879 | 0.7975 | 0.8349 | 0.8386 | 0.7692 | 0.9160 | 0.9338 | 0.9473 | 1.2250 | 1.2199 | 1.4050 | |

| 13 | 1.0000 | 0.6373 | 0.6435 | 0.6677 | 0.6700 | 0.6250 | 0.9269 | 0.9458 | 0.9591 | 1.1788 | 1.1766 | 1.3245 | |

| 15 | 1.0000 | 0.5652 | 0.5701 | 0.5890 | 0.5909 | 0.5556 | 0.9407 | 0.9576 | 0.9690 | 1.1571 | 1.1558 | 1.2865 | |

| 20 | 1.0000 | 0.4407 | 0.4437 | 0.4550 | 0.4561 | 0.4348 | 0.9722 | 0.9818 | 0.9877 | 1.1201 | 1.1199 | 1.2217 | |

| 30 | 1.0000 | 0.3059 | 0.3073 | 0.3127 | 0.3132 | 0.3030 | 0.9967 | 0.9981 | 0.9989 | 1.0814 | 1.0814 | 1.1526 | |

| 50 | 1.0000 | 0.1898 | 0.1903 | 0.1924 | 0.1926 | 0.1887 | 1.0000 | 1.0000 | 1.0000 | 1.0494 | 1.0494 | 1.0940 | |

| 100 | 1.0000 | 0.0974 | 0.0975 | 0.0981 | 0.0981 | 0.0971 | 1.0000 | 1.0000 | 1.0000 | 1.0145 | 1.0145 | 1.0480 | |

First, we note that we have two classes of estimators, namely, the traditional rank‐based PTEs and Stein‐type estimators and the penalty estimators. The restricted R‐estimators play an important role due to the fact that LASSO belongs to the class of restricted estimators. We have the following conclusion from our study.

- Since the inception of the RRE by Hoerl and Kennard (1970), there have been articles comparing RRE with PTE and Stein‐type estimators. We have now definitive conclusion that the RRE dominates the RE, PTRE, and Stein‐type estimators uniformly. See Tables 10.1 and 10.2 and graphs thereof in Figure 10.1. The RRRE ridge estimator dominates the modified RLASSO estimator uniformly for

, while they are

, while they are  ‐risk equivalent at

‐risk equivalent at  . The RRRE ridge estimator does not select variables, but the modified RLASSO estimator does.

. The RRRE ridge estimator does not select variables, but the modified RLASSO estimator does. - The restricted R‐ and modified RLASSO estimators are competitive, although the modified RLASSO estimator lags behind the restricted R‐estimator, uniformly. Both estimators outperform the URE, PTRE, SRE, and PRSRE in a subinterval of

(see Tables 10.1 and 10.2).

(see Tables 10.1 and 10.2).

- The lower bound of

risk of HTE and the modified RLASSO estimator is the same and independent of the threshold parameter. But the upper bound of

risk of HTE and the modified RLASSO estimator is the same and independent of the threshold parameter. But the upper bound of  risk is dependent on the threshold parameter.

risk is dependent on the threshold parameter. - Maximum of RWRE occurs at

, which indicates that the RE underperforms all estimators for any value of

, which indicates that the RE underperforms all estimators for any value of  . Clearly, RRE outperforms all estimators for any

. Clearly, RRE outperforms all estimators for any  at

at  . However, as

. However, as  deviates from 0, the rank‐based PTE and the Stein‐type estimator outperform URE, RRE, and the modified RLASSO estimator (see Tables 10.1 and 10.2).

deviates from 0, the rank‐based PTE and the Stein‐type estimator outperform URE, RRE, and the modified RLASSO estimator (see Tables 10.1 and 10.2). - If

is fixed and

is fixed and  increases, the RWRE of all estimators increases (see Tables 10.7 and 10.8).

increases, the RWRE of all estimators increases (see Tables 10.7 and 10.8). - If

is fixed and

is fixed and  increases, the RWRE of all estimators decreases. Then, for

increases, the RWRE of all estimators decreases. Then, for  small and

small and  large, the modified RLASSO, PTRE, SRE, and PRSRE are competitive (see Table 10.9 and 10.10).

large, the modified RLASSO, PTRE, SRE, and PRSRE are competitive (see Table 10.9 and 10.10). - The PRSRE always outperforms the SRE (see Tables 10.1–10.10).

Table 10.2 RWRE for the estimators for ![]() and

and ![]() .

.

| RRE | PTRE | ||||||||||||

| RE | 0.1 | 0.2 | 0.8 | 0.9 | MRLASSO | 0.2 | SRE | PRSRE | RRRE | ||||

| 0 | 1.0000 | 2.9890 | 3.0586 | 3.3459 | 3.3759 | 2.8571 | 1.9458 | 1.7926 | 1.6694 | 2.2222 | 2.4326 | 2.8571 | |

| 0.1 | 1.0000 | 2.9450 | 3.0125 | 3.2909 | 3.3199 | 2.8169 | 1.9146 | 1.7658 | 1.6464 | 2.2017 | 2.3958 | 2.8172 | |

| 0.5 | 1.0000 | 2.7811 | 2.8413 | 3.0876 | 3.1132 | 2.6667 | 1.8009 | 1.6683 | 1.5627 | 2.1255 | 2.2661 | 2.6733 | |

| 1 | 1.0000 | 2.6003 | 2.6528 | 2.8664 | 2.8883 | 2.5000 | 1.6797 | 1.5648 | 1.4739 | 2.0423 | 2.1352 | 2.5225 | |

| 2 | 1.0000 | 2.3011 | 2.3421 | 2.5070 | 2.5238 | 2.2222 | 1.4910 | 1.4041 | 1.3365 | 1.9065 | 1.9434 | 2.2901 | |

| 2.14 | 1.0000 | 2.2642 | 2.3039 | 2.4633 | 2.4795 | 2.1878 | 1.4688 | 1.3854 | 1.3205 | 1.8899 | 1.9217 | 2.2628 | |

| 2.67 | 1.0000 | 2.1354 | 2.1707 | 2.3116 | 2.3259 | 2.0673 | 1.3937 | 1.3218 | 1.2663 | 1.8323 | 1.8488 | 2.1697 | |

| 3 | 1.0000 | 2.0637 | 2.0966 | 2.2278 | 2.2410 | 2.0000 | 1.3535 | 1.2878 | 1.2375 | 1.8005 | 1.8100 | 2.1192 | |

| 4.19 | 1.0000 | 1.8378 | 1.8639 | 1.9669 | 1.9772 | 1.7872 | 1.2352 | 1.1885 | 1.1534 | 1.7014 | 1.6962 | 1.9667 | |

| 4.31 | 1.0000 | 1.8173 | 1.8427 | 1.9433 | 1.9534 | 1.7677 | 1.2251 | 1.1801 | 1.1463 | 1.6925 | 1.6864 | 1.9533 | |

| 5 | 1.0000 | 1.7106 | 1.7332 | 1.8219 | 1.8307 | 1.6667 | 1.1750 | 1.1385 | 1.1114 | 1.6464 | 1.6370 | 1.8848 | |

| 7 | 1.0000 | 1.4607 | 1.4771 | 1.5411 | 1.5474 | 1.4286 | 1.0735 | 1.0554 | 1.0425 | 1.5403 | 1.5289 | 1.7316 | |

| 10 | 1.0000 | 1.1982 | 1.2092 | 1.2517 | 1.2559 | 1.1765 | 0.9982 | 0.9961 | 0.9952 | 1.4319 | 1.4243 | 1.5808 | |

| 15 | 1.0000 | 2.0533 | 2.0685 | 2.0958 | 2.0966 | 1.8182 | 1.0934 | 1.0694 | 1.0529 | 2.1262 | 2.1157 | 2.3105 | |

| 13 | 1.0000 | 1.0156 | 1.0236 | 1.0539 | 1.0568 | 1.0000 | 0.9711 | 0.9767 | 0.9811 | 1.3588 | 1.3547 | 1.4815 | |

| 13.31 | 1.0000 | 1.0000 | 1.0077 | 1.0370 | 1.0399 | 0.9848 | 0.9699 | 0.9760 | 0.9807 | 1.3526 | 1.3488 | 1.4732 | |

| 13.46 | 1.0000 | 0.9925 | 1.0000 | 1.0289 | 1.0318 | 0.9775 | 0.9694 | 0.9757 | 0.9805 | 1.3496 | 1.3459 | 1.4692 | |

| 14.02 | 1.0000 | 0.9655 | 0.9727 | 1.0000 | 1.0027 | 0.9514 | 0.9679 | 0.9749 | 0.9801 | 1.3391 | 1.3358 | 1.4550 | |

| 14.07 | 1.0000 | 0.9631 | 0.9702 | 0.9974 | 1.0000 | 0.9490 | 0.9678 | 0.9748 | 0.9801 | 1.3381 | 1.3349 | 1.4537 | |

| 15 | 1.0000 | 0.9220 | 0.9285 | 0.9534 | 0.9558 | 0.9091 | 0.9667 | 0.9745 | 0.9802 | 1.3221 | 1.3195 | 1.4322 | |

| 20 | 1.0000 | 0.7493 | 0.7536 | 0.7699 | 0.7715 | 0.7407 | 0.9743 | 0.9820 | 0.9870 | 1.2560 | 1.2553 | 1.3442 | |

| 30 | 1.0000 | 0.5451 | 0.5473 | 0.5559 | 0.5567 | 0.5405 | 0.9940 | 0.9964 | 0.9977 | 1.1809 | 1.1808 | 1.2446 | |

| 50 | 1.0000 | 0.3528 | 0.3537 | 0.3573 | 0.3576 | 0.3509 | 0.9999 | 1.0000 | 1.0000 | 1.1136 | 1.1136 | 1.1549 | |

| 100 | 1.0000 | 0.1875 | 0.1877 | 0.1887 | 0.1888 | 0.1869 | 1.0000 | 1.0000 | 1.0000 | 1.0337 | 1.0337 | 1.0808 | |

Finally, we present the RWRE formula from which we prepared our tables and figures, for a quick summary.

Now, we describe Table 10.1. This table presents RWRE of the seven estimators for ![]() ,

, ![]() , and

, and ![]() ,

, ![]() against

against ![]() ‐values using a sample of size

‐values using a sample of size ![]() , the

, the ![]() matrix is produced. Using the model given by Eq. (10.62) for chosen values,

matrix is produced. Using the model given by Eq. (10.62) for chosen values, ![]() and

and ![]() . Therefore, the RWRE value of RLSE has four entries – two for low correlation and two for high correlation. Some

. Therefore, the RWRE value of RLSE has four entries – two for low correlation and two for high correlation. Some ![]() ‐values are given as

‐values are given as ![]() and

and ![]() for chosen

for chosen ![]() ‐values. Now, one may use the table for the performance characteristics of each estimator compared to any other.

‐values. Now, one may use the table for the performance characteristics of each estimator compared to any other.

Tables 10.2–10.3 give the RWRE values of estimators for ![]() , and 7 for

, and 7 for ![]() , and 30.

, and 30.

Table 10.3 RWRE of the R‐estimators for ![]() and different

and different ![]() ‐values for varying

‐values for varying ![]() .

.

| Estimators | ||||||||

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

5.6807 | 3.7105 | 2.1589 | 1.4946 | 3.6213 | 2.7059 | 1.7755 | 1.3003 |

| RRE ( |

6.1242 | 3.9296 | 2.2357 | 1.5291 | 3.7959 | 2.8204 | 1.8271 | 1.3262 |

| RRE ( |

9.4863 | 5.0497 | 2.5478 | 1.6721 | 4.8660 | 3.3549 | 2.0304 | 1.4325 |

| RRE ( |

10.1255 | 5.1921 | 2.5793 | 1.6884 | 5.0292 | 3.4171 | 2.0504 | 1.4445 |

| RLASSO | 5.0000 | 3.3333 | 2.0000 | 1.4286 | 3.3333 | 2.5000 | 1.6667 | 1.2500 |

| PTRE ( |

2.3441 | 1.9787 | 1.5122 | 1.2292 | 1.7548 | 1.5541 | 1.2714 | 1.0873 |

| PTRE ( |

2.0655 | 1.7965 | 1.4292 | 1.1928 | 1.6044 | 1.4499 | 1.2228 | 1.0698 |

| PTRE ( |

1.8615 | 1.6565 | 1.3616 | 1.1626 | 1.4925 | 1.3703 | 1.1846 | 1.0564 |

| SRE | 2.5000 | 2.0000 | 1.4286 | 1.1111 | 2.1364 | 1.7725 | 1.3293 | 1.0781 |

| PRSRE | 3.0354 | 2.3149 | 1.5625 | 1.1625 | 2.3107 | 1.8843 | 1.3825 | 1.1026 |

| RRRE | 5.0000 | 3.3333 | 2.0000 | 1.4286 | 3.4615 | 2.5806 | 1.7143 | 1.2903 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

1.4787 | 1.2993 | 1.0381 | 0.8554 | 0.8501 | 0.7876 | 0.6834 | 0.5991 |

| RRE ( |

1.5069 | 1.3251 | 1.0555 | 0.8665 | 0.8594 | 0.7970 | 0.6909 | 0.6046 |

| RRE ( |

1.6513 | 1.4324 | 1.1204 | 0.9107 | 0.9045 | 0.8346 | 0.7181 | 0.6257 |

| RRE ( |

1.6698 | 1.4437 | 1.1264 | 0.9155 | 0.9100 | 0.8384 | 0.7206 | 0.6280 |

| RLASSO | 1.4286 | 1.2500 | 1.0000 | 0.8333 | 0.8333 | 0.7692 | 0.6667 | 0.5882 |

| PTRE ( |

1.0515 | 1.0088 | 0.9465 | 0.9169 | 0.9208 | 0.9160 | 0.9176 | 0.9369 |

| PTRE ( |

1.0357 | 1.0018 | 0.9530 | 0.9323 | 0.9366 | 0.9338 | 0.9374 | 0.9545 |

| PTRE ( |

1.0250 | 0.9978 | 0.9591 | 0.9447 | 0.9488 | 0.9473 | 0.9517 | 0.9665 |

| SRE | 1.5516 | 1.3829 | 1.1546 | 1.0263 | 1.3238 | 1.2250 | 1.0865 | 1.0117 |

| PRSRE | 1.5374 | 1.3729 | 1.1505 | 1.0268 | 1.3165 | 1.2199 | 1.0843 | 1.0114 |

| RRRE | 1.9697 | 1.6901 | 1.3333 | 1.1268 | 1.5517 | 1.4050 | 1.2000 | 1.0744 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

0.4595 | 0.4406 | 0.4060 | 0.3747 | 0.1619 | 0.1595 | 0.1547 | 0.1499 |

| RRE ( |

0.4622 | 0.4435 | 0.4086 | 0.3768 | 0.1622 | 0.1599 | 0.1551 | 0.1503 |

| RRE ( |

0.4749 | 0.4549 | 0.4180 | 0.3849 | 0.1638 | 0.1613 | 0.1564 | 0.1516 |

| RRE ( |

0.4764 | 0.4561 | 0.4188 | 0.3858 | 0.1640 | 0.1615 | 0.1566 | 0.1517 |

| RLASSO | 0.4545 | 0.4348 | 0.4000 | 0.3704 | 0.1613 | 0.1587 | 0.1538 | 0.1493 |

| PTRE ( |

0.9673 | 0.9722 | 0.9826 | 0.9922 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9783 | 0.9818 | 0.9890 | 0.9954 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9850 | 0.9877 | 0.9928 | 0.9971 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| SRE | 1.1732 | 1.1201 | 1.0445 | 1.0053 | 1.0595 | 1.0412 | 1.0150 | 1.0017 |

| PRSRE | 1.1728 | 1.1199 | 1.0444 | 1.0053 | 1.0595 | 1.0412 | 1.0150 | 1.0017 |

| RRRE | 1.2963 | 1.2217 | 1.1111 | 1.0407 | 1.1039 | 1.0789 | 1.0400 | 1.0145 |

Table 10.4 gives the RWRE values of estimators for ![]() and

and ![]() , and 55, and also for

, and 55, and also for ![]() and

and ![]() , and 53. Also, Table 10.5 presents the RWRE values of estimators for

, and 53. Also, Table 10.5 presents the RWRE values of estimators for ![]() and

and ![]() , and 57 as well as

, and 57 as well as ![]() and

and ![]() , and 53 to see the effect of

, and 53 to see the effect of ![]() variation on RWRE (Figures 10.2 and 10.3).

variation on RWRE (Figures 10.2 and 10.3).

Table 10.4 RWRE of the R‐estimators for ![]() and different

and different ![]() ‐values for varying

‐values for varying ![]() .

.

| Estimators | ||||||||

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

9.1045 | 5.9788 | 3.4558 | 2.3953 | 5.6626 | 4.2736 | 2.8084 | 2.0654 |

| RRE ( |

9.8493 | 6.3606 | 3.6039 | 2.4653 | 5.9410 | 4.4650 | 2.9055 | 2.1172 |

| RRE ( |

15.1589 | 8.0862 | 4.0566 | 2.6637 | 7.5344 | 5.2523 | 3.1928 | 2.2620 |

| RRE ( |

16.1151 | 8.2786 | 4.0949 | 2.6780 | 7.7633 | 5.3329 | 3.2165 | 2.2723 |

| RLASSO | 7.5000 | 5.0000 | 3.0000 | 2.1429 | 5.0000 | 3.7500 | 2.5000 | 1.8750 |

| PTRE ( |

2.8417 | 2.4667 | 1.9533 | 1.6188 | 2.1718 | 1.9542 | 1.6304 | 1.4021 |

| PTRE ( |

2.4362 | 2.1739 | 1.7905 | 1.5242 | 1.9277 | 1.7680 | 1.5192 | 1.3354 |

| PTRE ( |

2.1488 | 1.9568 | 1.6617 | 1.4462 | 1.7505 | 1.6288 | 1.4325 | 1.2820 |

| SRE | 3.7500 | 3.0000 | 2.1429 | 1.6667 | 3.1296 | 2.5964 | 1.9385 | 1.5495 |

| PRSRE | 4.6560 | 3.5445 | 2.3971 | 1.8084 | 3.4352 | 2.7966 | 2.0402 | 1.6081 |

| RRRE | 7.5000 | 5.0000 | 3.0000 | 2.1429 | 5.1220 | 3.8235 | 2.5385 | 1.9014 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

2.2555 | 1.9970 | 1.6056 | 1.3318 | 1.2875 | 1.1989 | 1.0458 | 0.9223 |

| RRE ( |

2.2983 | 2.0378 | 1.6369 | 1.3531 | 1.3013 | 1.2134 | 1.0590 | 0.9325 |

| RRE ( |

2.5034 | 2.1876 | 1.7244 | 1.4109 | 1.3646 | 1.2651 | 1.0950 | 0.9596 |

| RRE ( |

2.5282 | 2.2015 | 1.7313 | 1.4149 | 1.3720 | 1.2697 | 1.0977 | 0.9614 |

| RLASSO | 2.1429 | 1.8750 | 1.5000 | 1.2500 | 1.2500 | 1.1538 | 1.0000 | 0.8824 |

| PTRE ( |

1.2477 | 1.1936 | 1.1034 | 1.0338 | 0.9976 | 0.9828 | 0.9598 | 0.9458 |

| PTRE ( |

1.1936 | 1.1510 | 1.0793 | 1.0235 | 0.9948 | 0.9836 | 0.9665 | 0.9568 |

| PTRE ( |

1.1542 | 1.1200 | 1.0619 | 1.0166 | 0.9936 | 0.9850 | 0.9721 | 0.9653 |

| SRE | 2.0987 | 1.8655 | 1.5332 | 1.3106 | 1.6727 | 1.5403 | 1.3382 | 1.1948 |

| PRSRE | 2.0783 | 1.8494 | 1.5227 | 1.3038 | 1.6589 | 1.5294 | 1.3315 | 1.1909 |

| RRRE | 2.6733 | 2.2973 | 1.8000 | 1.4885 | 1.9602 | 1.7742 | 1.5000 | 1.3107 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

0.6928 | 0.6663 | 0.6162 | 0.5711 | 0.2433 | 0.2400 | 0.2331 | 0.2264 |

| RRE ( |

0.6968 | 0.6708 | 0.6208 | 0.5750 | 0.2438 | 0.2405 | 0.2338 | 0.2270 |

| RRE ( |

0.7146 | 0.6863 | 0.6329 | 0.5852 | 0.2459 | 0.2425 | 0.2355 | 0.2285 |

| RRE ( |

0.7166 | 0.6876 | 0.6339 | 0.5859 | 0.2462 | 0.2427 | 0.2356 | 0.2287 |

| RLASSO | 0.6818 | 0.6522 | 0.6000 | 0.5556 | 0.2419 | 0.2381 | 0.2308 | 0.2239 |

| PTRE ( |

0.9660 | 0.9675 | 0.9720 | 0.9779 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9761 | 0.9774 | 0.9810 | 0.9854 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9828 | 0.9839 | 0.9866 | 0.9900 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| SRE | 1.3731 | 1.3034 | 1.1917 | 1.1091 | 1.1318 | 1.1082 | 1.0689 | 1.0389 |

| PRSRE | 1.3720 | 1.3026 | 1.1912 | 1.1089 | 1.1318 | 1.1082 | 1.0689 | 1.0389 |

| RRRE | 1.5184 | 1.4286 | 1.2857 | 1.1798 | 1.1825 | 1.1538 | 1.1053 | 1.0669 |

Table 10.5 RWRE of the R‐estimators for ![]() and different

and different ![]() ‐values for varying

‐values for varying ![]() .

.

| Estimators | ||||||||

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

12.9872 | 8.5010 | 4.9167 | 3.4047 | 7.8677 | 5.9631 | 3.9460 | 2.9092 |

| RRE ( |

14.0913 | 9.0423 | 5.1335 | 3.5107 | 8.2590 | 6.2241 | 4.0844 | 2.9863 |

| RRE ( |

21.5624 | 11.4369 | 5.7360 | 3.7651 | 10.3661 | 7.2732 | 4.4569 | 3.1684 |

| RRE ( |

22.8744 | 11.6969 | 5.7922 | 3.7803 | 10.6590 | 7.3774 | 4.4908 | 3.1791 |

| RLASSO | 10.0000 | 6.6667 | 4.0000 | 2.8571 | 6.6667 | 5.0000 | 3.3333 | 2.5000 |

| PTRE ( |

3.2041 | 2.8361 | 2.3073 | 1.9458 | 2.4964 | 2.2738 | 1.9310 | 1.6797 |

| PTRE ( |

2.6977 | 2.4493 | 2.0693 | 1.7926 | 2.1721 | 2.0143 | 1.7602 | 1.5648 |

| PTRE ( |

2.3469 | 2.1698 | 1.8862 | 1.6694 | 1.9413 | 1.8244 | 1.6295 | 1.4739 |

| SRE | 5.0000 | 4.0000 | 2.8571 | 2.2222 | 4.1268 | 3.4258 | 2.5581 | 2.0423 |

| PRSRE | 6.2792 | 4.7722 | 3.2234 | 2.4326 | 4.5790 | 3.7253 | 2.7140 | 2.1352 |

| RRRE | 10.0000 | 6.6667 | 4.0000 | 2.8571 | 6.7857 | 5.0704 | 3.3684 | 2.5225 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

3.0563 | 2.7190 | 2.2051 | 1.8390 | 1.7324 | 1.6186 | 1.4214 | 1.2598 |

| RRE ( |

3.1135 | 2.7720 | 2.2477 | 1.8695 | 1.7507 | 1.6372 | 1.4390 | 1.2740 |

| RRE ( |

3.3724 | 2.9625 | 2.3561 | 1.9393 | 1.8297 | 1.7019 | 1.4827 | 1.3060 |

| RRE ( |

3.4028 | 2.9797 | 2.3656 | 1.9433 | 1.8386 | 1.7076 | 1.4864 | 1.3079 |

| RLASSO | 2.8571 | 2.5000 | 2.0000 | 1.6667 | 1.6667 | 1.5385 | 1.3333 | 1.1765 |

| PTRE ( |

1.4223 | 1.3625 | 1.2595 | 1.1750 | 1.0788 | 1.0592 | 1.0254 | 0.9982 |

| PTRE ( |

1.3324 | 1.2864 | 1.2058 | 1.1385 | 1.0580 | 1.0429 | 1.0169 | 0.9961 |

| PTRE ( |

1.2671 | 1.2306 | 1.1660 | 1.1114 | 1.0437 | 1.0319 | 1.0114 | 0.9952 |

| SRE | 2.6519 | 2.3593 | 1.9363 | 1.6464 | 2.0283 | 1.8677 | 1.6170 | 1.4319 |

| PRSRE | 2.6304 | 2.3416 | 1.9237 | 1.6370 | 2.0082 | 1.8513 | 1.6059 | 1.4243 |

| RRRE | 3.3824 | 2.9139 | 2.2857 | 1.8848 | 2.3729 | 2.1514 | 1.8182 | 1.5808 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

0.9283 | 0.8946 | 0.8309 | 0.7729 | 0.3250 | 0.3207 | 0.3122 | 0.3036 |

| RRE ( |

0.9335 | 0.9002 | 0.8369 | 0.7782 | 0.3256 | 0.3215 | 0.3130 | 0.3044 |

| RRE ( |

0.9555 | 0.9195 | 0.8515 | 0.7901 | 0.3282 | 0.3239 | 0.3150 | 0.3062 |

| RRE ( |

0.9580 | 0.9211 | 0.8527 | 0.7908 | 0.3285 | 0.3241 | 0.3152 | 0.3063 |

| RLASSO | 0.9091 | 0.8696 | 0.8000 | 0.7407 | 0.3226 | 0.3175 | 0.3077 | 0.2985 |

| PTRE ( |

0.9747 | 0.9737 | 0.9731 | 0.9743 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9813 | 0.9808 | 0.9808 | 0.9820 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

0.9860 | 0.9857 | 0.9859 | 0.9870 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| SRE | 1.5796 | 1.4978 | 1.3623 | 1.2560 | 1.2078 | 1.1811 | 1.1344 | 1.0957 |

| PRSRE | 1.5775 | 1.4961 | 1.3612 | 1.2553 | 1.2078 | 1.1811 | 1.1344 | 1.0957 |

| RRRE | 1.7431 | 1.6408 | 1.4737 | 1.3442 | 1.2621 | 1.2310 | 1.1765 | 1.1309 |

Table 10.6 RWRE of the R‐estimators for ![]() and different

and different ![]() ‐values for varying

‐values for varying ![]() .

.

| Estimators | ||||||||

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

22.3753 | 14.6442 | 8.4349 | 5.8203 | 12.8002 | 9.8339 | 6.5821 | 4.8740 |

| RRE ( |

24.3855 | 15.6276 | 8.7997 | 6.0133 | 13.4302 | 10.2680 | 6.8022 | 5.0086 |

| RRE ( |

37.2461 | 19.5764 | 9.7789 | 6.3861 | 16.5880 | 11.8373 | 7.3729 | 5.2646 |

| RRE ( |

39.3232 | 20.0631 | 9.8674 | 6.4129 | 16.9876 | 12.0125 | 7.4229 | 5.2828 |

| RLASSO | 15.0000 | 10.0000 | 6.0000 | 4.2857 | 10.0000 | 7.5000 | 5.0000 | 3.7500 |

| PTRE ( |

3.7076 | 3.3671 | 2.8451 | 2.4637 | 2.9782 | 2.7592 | 2.4060 | 2.1337 |

| PTRE ( |

3.0508 | 2.8314 | 2.4758 | 2.2002 | 2.5244 | 2.3765 | 2.1279 | 1.9271 |

| PTRE ( |

2.6089 | 2.4579 | 2.2032 | 1.9968 | 2.2107 | 2.1051 | 1.9219 | 1.7688 |

| SRE | 7.5000 | 6.0000 | 4.2857 | 3.3333 | 6.1243 | 5.0891 | 3.8037 | 3.0371 |

| PRSRE | 9.5356 | 7.2308 | 4.8740 | 3.6755 | 6.8992 | 5.6069 | 4.0788 | 3.2054 |

| RRRE | 15.0000 | 10.0000 | 6.0000 | 4.2857 | 10.1163 | 7.5676 | 5.0323 | 3.7696 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

4.7273 | 4.2535 | 3.5048 | 2.9537 | 2.6439 | 2.4888 | 2.2123 | 1.9792 |

| RRE ( |

4.8104 | 4.3328 | 3.5663 | 3.0026 | 2.6697 | 2.5158 | 2.2366 | 2.0011 |

| RRE ( |

5.1633 | 4.5899 | 3.7172 | 3.0928 | 2.7751 | 2.6004 | 2.2951 | 2.0407 |

| RRE ( |

5.2015 | 4.6159 | 3.7298 | 3.0991 | 2.7861 | 2.6087 | 2.2999 | 2.0435 |

| RLASSO | 4.2857 | 3.7500 | 3.0000 | 2.5000 | 2.5000 | 2.3077 | 2.0000 | 1.7647 |

| PTRE ( |

1.7190 | 1.6538 | 1.5384 | 1.4395 | 1.2353 | 1.2113 | 1.1675 | 1.1287 |

| PTRE ( |

1.5642 | 1.5158 | 1.4286 | 1.3524 | 1.1806 | 1.1622 | 1.1285 | 1.0984 |

| PTRE ( |

1.4532 | 1.4159 | 1.3478 | 1.2873 | 1.1418 | 1.1273 | 1.1007 | 1.0768 |

| SRE | 3.7621 | 3.3545 | 2.7588 | 2.3444 | 2.7433 | 2.5307 | 2.1934 | 1.9380 |

| PRSRE | 3.7497 | 3.3433 | 2.7492 | 2.3362 | 2.7120 | 2.5044 | 2.1742 | 1.9237 |

| RRRE | 4.8058 | 4.1558 | 3.2727 | 2.7010 | 3.2022 | 2.9134 | 2.4706 | 2.1475 |

| RE | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| RRE ( |

1.4053 | 1.3603 | 1.2733 | 1.1925 | 0.4890 | 0.4834 | 0.4720 | 0.4604 |

| RRE ( |

1.4126 | 1.3683 | 1.2813 | 1.2004 | 0.4899 | 0.4845 | 0.4731 | 0.4616 |

| RRE ( |

1.4416 | 1.3930 | 1.3003 | 1.2145 | 0.4933 | 0.4875 | 0.4756 | 0.4637 |

| RRE ( |

1.4445 | 1.3953 | 1.3018 | 1.2155 | 0.4937 | 0.4878 | 0.4759 | 0.4638 |

| RLASSO | 1.3636 | 1.3043 | 1.2000 | 1.1111 | 0.4839 | 0.4762 | 0.4615 | 0.4478 |

| PTRE ( |

1.0081 | 1.0040 | 0.9969 | 0.9912 | 0.9999 | 0.9999 | 0.9999 | 1.0000 |

| PTRE ( |

1.0047 | 1.0018 | 0.9968 | 0.9928 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| PTRE ( |

1.0027 | 1.0006 | 0.9970 | 0.9942 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| SRE | 1.9969 | 1.8948 | 1.7215 | 1.5804 | 1.3630 | 1.3320 | 1.2759 | 1.2268 |

| PRSRE | 1.9921 | 1.8907 | 1.7185 | 1.5782 | 1.3630 | 1.3320 | 1.2759 | 1.2268 |

| RRRE | 2.1951 | 2.0705 | 1.8621 | 1.6951 | 1.4224 | 1.3876 | 1.3247 | 1.2698 |

Figure 10.2 RWRE for the modified RLASSO (MRLASSO), ridge, restricted, preliminary test and the Stein‐type and its positive rule estimators.

Figure 10.3 RWRE of R‐estimates of a function of  for

for  ,

,  , and different

, and different  .

.

Table 10.7 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| RRE | PTRE | |||||||||

| RE | 0.8 | 0.9 | MRLASSO | 0.15 | 0.2 | 0.25 | SRE | PRSRE | RRRE | |

| 7 | 1.0000 | 4.0468 | 4.1621 | 3.3333 | 2.6044 | 1.9787 | 1.6565 | 2.0000 | 2.3149 | 3.3333 |

| 17 | 1.0000 | 10.2978 | 10.5396 | 6.6667 | 4.3870 | 2.8361 | 2.1698 | 4.0000 | 4.7722 | 6.6667 |

| 27 | 1.0000 | 18.3009 | 18.7144 | 10.0000 | 5.7507 | 3.3671 | 2.4579 | 6.0000 | 7.2308 | 10.0000 |

| 37 | 1.0000 | 28.9022 | 29.4914 | 13.3333 | 6.8414 | 3.7368 | 2.6477 | 8.0000 | 9.6941 | 13.3333 |

| 57 | 1.0000 | 64.9968 | 66.2169 | 20.0000 | 8.4968 | 4.2281 | 2.8887 | 12.0000 | 14.6307 | 20.0000 |

| 7 | 1.0000 | 3.2295 | 3.3026 | 2.8571 | 2.2117 | 1.7335 | 1.4923 | 1.8733 | 2.0602 | 2.8846 |

| 17 | 1.0000 | 8.0048 | 8.1499 | 5.7143 | 3.7699 | 2.5211 | 1.9784 | 3.6834 | 4.1609 | 5.7377 |

| 27 | 1.0000 | 13.7847 | 14.0169 | 8.5714 | 4.9963 | 3.0321 | 2.2657 | 5.4994 | 6.2907 | 8.5938 |

| 37 | 1.0000 | 20.9166 | 21.2239 | 11.4286 | 5.9990 | 3.3986 | 2.4608 | 7.3167 | 8.4350 | 11.4504 |

| 57 | 1.0000 | 41.5401 | 42.0259 | 17.1429 | 7.5598 | 3.8998 | 2.7153 | 10.9521 | 12.7487 | 17.1642 |

| 7 | 1.0000 | 2.6869 | 2.7373 | 2.5000 | 1.9266 | 1.5541 | 1.3703 | 1.7725 | 1.8843 | 2.5806 |

| 17 | 1.0000 | 6.5476 | 6.6443 | 5.0000 | 3.3014 | 2.2738 | 1.8244 | 3.4258 | 3.7253 | 5.0704 |

| 27 | 1.0000 | 11.0584 | 11.2071 | 7.5000 | 4.4087 | 2.7592 | 2.1051 | 5.0891 | 5.6069 | 7.5676 |

| 37 | 1.0000 | 16.3946 | 16.5829 | 10.0000 | 5.3306 | 3.1162 | 2.3008 | 6.7542 | 7.5071 | 10.0662 |

| 57 | 1.0000 | 30.5579 | 30.8182 | 15.0000 | 6.7954 | 3.6170 | 2.5624 | 10.0860 | 11.3392 | 15.0649 |

| 7 | 1.0000 | 1.1465 | 1.1556 | 1.2500 | 1.0489 | 1.0088 | 0.9978 | 1.3829 | 1.3729 | 1.6901 |

| 17 | 1.0000 | 2.6666 | 2.6824 | 2.5000 | 1.6731 | 1.3625 | 1.2306 | 2.3593 | 2.3416 | 2.9139 |

| 27 | 1.0000 | 4.2854 | 4.3074 | 3.7500 | 2.2360 | 1.6538 | 1.4159 | 3.3545 | 3.3433 | 4.1558 |

| 37 | 1.0000 | 6.0123 | 6.0376 | 5.0000 | 2.7442 | 1.8968 | 1.5652 | 4.3528 | 4.3574 | 5.4019 |

| 57 | 1.0000 | 9.8282 | 9.8547 | 7.5000 | 3.6311 | 2.2844 | 1.7942 | 6.3514 | 6.4081 | 7.8981 |

Table 10.8 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| RRE | PTRE | |||||||||

| RE | 0.8 | 0.9 | MRLASSO | 0.15 | 0.2 | 0.25 | SRE | PRSRE | RRRE | |

| 3 | 1.0000 | 2.0072 | 2.0250 | 1.4286 | 1.3333 | 1.2292 | 1.1626 | 1.1111 | 1.1625 | 1.4286 |

| 13 | 1.0000 | 4.1385 | 4.1573 | 2.8571 | 2.4147 | 1.9458 | 1.6694 | 2.2222 | 2.4326 | 2.8571 |

| 23 | 1.0000 | 6.8094 | 6.8430 | 4.2857 | 3.3490 | 2.4637 | 1.9968 | 3.3333 | 3.6755 | 4.2857 |

| 33 | 1.0000 | 10.2779 | 10.3259 | 5.7143 | 4.1679 | 2.8587 | 2.2279 | 4.4444 | 4.9176 | 5.7143 |

| 53 | 1.0000 | 21.7368 | 21.7965 | 8.5714 | 5.5442 | 3.4283 | 2.5371 | 6.6667 | 7.4030 | 8.5714 |

| 3 | 1.0000 | 1.8523 | 1.8674 | 1.3333 | 1.2307 | 1.1485 | 1.1015 | 1.0928 | 1.1282 | 1.3462 |

| 13 | 1.0000 | 3.7826 | 3.7983 | 2.6667 | 2.2203 | 1.8009 | 1.5627 | 2.1255 | 2.2661 | 2.6733 |

| 23 | 1.0000 | 6.1542 | 6.1815 | 4.0000 | 3.0831 | 2.2860 | 1.8742 | 3.1754 | 3.4159 | 4.0057 |

| 33 | 1.0000 | 9.1562 | 9.1942 | 5.3333 | 3.8441 | 2.6619 | 2.0987 | 4.2270 | 4.5705 | 5.3386 |

| 53 | 1.0000 | 18.4860 | 18.5298 | 8.0000 | 5.1338 | 3.2133 | 2.4055 | 6.3313 | 6.8869 | 8.0050 |

| 3 | 1.0000 | 1.7196 | 1.7326 | 1.2500 | 1.1485 | 1.0873 | 1.0564 | 1.0781 | 1.1026 | 1.2903 |

| 13 | 1.0000 | 3.4830 | 3.4963 | 2.5000 | 2.0544 | 1.6797 | 1.4739 | 2.0423 | 2.1352 | 2.5225 |

| 23 | 1.0000 | 5.6140 | 5.6367 | 3.7500 | 2.8534 | 2.1337 | 1.7688 | 3.0371 | 3.2054 | 3.7696 |

| 33 | 1.0000 | 8.2554 | 8.2862 | 5.0000 | 3.5625 | 2.4906 | 1.9856 | 4.0350 | 4.2840 | 5.0185 |

| 53 | 1.0000 | 16.0828 | 16.1162 | 7.5000 | 4.7733 | 3.0225 | 2.2877 | 6.0331 | 6.4531 | 7.5174 |

| 3 | 1.0000 | 1.0930 | 1.0983 | 0.8333 | 0.8688 | 0.9169 | 0.9447 | 1.0263 | 1.0268 | 1.1268 |

| 13 | 1.0000 | 2.1324 | 2.1374 | 1.6667 | 1.3171 | 1.1750 | 1.1114 | 1.6464 | 1.6370 | 1.8848 |

| 23 | 1.0000 | 3.2985 | 3.3063 | 2.5000 | 1.7768 | 1.4395 | 1.2873 | 2.3444 | 2.3362 | 2.7010 |

| 33 | 1.0000 | 4.6206 | 4.6302 | 3.3333 | 2.2057 | 1.6701 | 1.4360 | 3.0520 | 3.0505 | 3.5267 |

| 53 | 1.0000 | 7.8891 | 7.8973 | 5.0000 | 2.9764 | 2.0491 | 1.6701 | 4.4745 | 4.4980 | 5.1863 |

Table 10.9 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| RRE | PTRE | |||||||||

| RE | 0.8 | 0.9 | MRLASSO | 0.15 | 0.2 | 0.25 | SRE | PRSRE | RRRE | |

| 7 | 1.0000 | 2.0384 | 2.0631 | 1.4286 | 1.3333 | 1.2292 | 1.1626 | 1.1111 | 1.1625 | 1.4286 |

| 17 | 1.0000 | 1.3348 | 1.3378 | 1.1765 | 1.1428 | 1.1028 | 1.0752 | 1.0526 | 1.0751 | 1.1765 |

| 27 | 1.0000 | 1.2136 | 1.2150 | 1.1111 | 1.0909 | 1.0663 | 1.0489 | 1.0345 | 1.0489 | 1.1111 |

| 37 | 1.0000 | 1.1638 | 1.1642 | 1.0811 | 1.0667 | 1.0489 | 1.0362 | 1.0256 | 1.0362 | 1.0811 |

| 57 | 1.0000 | 1.1188 | 1.1190 | 1.0526 | 1.0435 | 1.0321 | 1.0239 | 1.0169 | 1.0238 | 1.0526 |

| 7 | 1.0000 | 1.8080 | 1.8274 | 1.3333 | 1.2307 | 1.1485 | 1.1015 | 1.0928 | 1.1282 | 1.3462 |

| 17 | 1.0000 | 1.2871 | 1.2898 | 1.1429 | 1.1034 | 1.0691 | 1.0483 | 1.0443 | 1.0602 | 1.1475 |

| 27 | 1.0000 | 1.1879 | 1.1892 | 1.0909 | 1.0667 | 1.0450 | 1.0317 | 1.0291 | 1.0394 | 1.0938 |

| 37 | 1.0000 | 1.1462 | 1.1467 | 1.0667 | 1.0492 | 1.0334 | 1.0236 | 1.0217 | 1.0292 | 1.0687 |

| 57 | 1.0000 | 1.1081 | 1.1083 | 1.0435 | 1.0323 | 1.0220 | 1.0156 | 1.0144 | 1.0193 | 1.0448 |

| 7 | 1.0000 | 1.6244 | 1.6401 | 1.2500 | 1.1485 | 1.0873 | 1.0564 | 1.0781 | 1.1026 | 1.2903 |

| 17 | 1.0000 | 1.2427 | 1.2452 | 1.1111 | 1.0691 | 1.0418 | 1.0274 | 1.0376 | 1.0488 | 1.1268 |

| 27 | 1.0000 | 1.1632 | 1.1645 | 1.0714 | 1.0450 | 1.0275 | 1.0181 | 1.0248 | 1.0320 | 1.0811 |

| 37 | 1.0000 | 1.1292 | 1.1296 | 1.0526 | 1.0334 | 1.0205 | 1.0135 | 1.0185 | 1.0238 | 1.0596 |

| 57 | 1.0000 | 1.0976 | 1.0978 | 1.0345 | 1.0220 | 1.0136 | 1.0090 | 1.0122 | 1.0158 | 1.0390 |

| 7 | 1.0000 | 0.8963 | 0.9011 | 0.8333 | 0.8688 | 0.9169 | 0.9447 | 1.0263 | 1.0268 | 1.1268 |

| 17 | 1.0000 | 0.9738 | 0.9753 | 0.9091 | 0.9298 | 0.9567 | 0.9716 | 1.0130 | 1.0132 | 1.0596 |

| 27 | 1.0000 | 0.9974 | 0.9984 | 0.9375 | 0.9521 | 0.9707 | 0.9809 | 1.0086 | 1.0088 | 1.0390 |

| 37 | 1.0000 | 1.0092 | 1.0096 | 0.9524 | 0.9636 | 0.9778 | 0.9856 | 1.0064 | 1.0066 | 1.0289 |

| 57 | 1.0000 | 1.0204 | 1.0206 | 0.9677 | 0.9754 | 0.9851 | 0.9903 | 1.0043 | 1.0044 | 1.0191 |

Table 10.10 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| RRE | PTRE | |||||||||

| RE | 0.8 | 0.9 | MRLASSO | 0.15 | 0.2 | 0.25 | SRE | PRSRE | RRRE | |

| 3 | 1.0000 | 5.0591 | 5.1915 | 3.3333 | 2.6044 | 1.9787 | 1.6565 | 2.0000 | 2.3149 | 3.3333 |

| 13 | 1.0000 | 1.7676 | 1.7705 | 1.5385 | 1.4451 | 1.3286 | 1.2471 | 1.3333 | 1.3967 | 1.5385 |

| 23 | 1.0000 | 1.4489 | 1.4506 | 1.3043 | 1.2584 | 1.1974 | 1.1522 | 1.2000 | 1.2336 | 1.3043 |

| 33 | 1.0000 | 1.3296 | 1.3304 | 1.2121 | 1.1820 | 1.1411 | 1.1100 | 1.1429 | 1.1655 | 1.2121 |

| 53 | 1.0000 | 1.2279 | 1.2281 | 1.1321 | 1.1144 | 1.0898 | 1.0707 | 1.0909 | 1.1046 | 1.1321 |

| 3 | 1.0000 | 4.0373 | 4.1212 | 2.8571 | 2.2117 | 1.7335 | 1.4923 | 1.8733 | 2.0602 | 2.8846 |

| 13 | 1.0000 | 1.6928 | 1.6954 | 1.4815 | 1.3773 | 1.2683 | 1.1975 | 1.3039 | 1.3464 | 1.4851 |

| 23 | 1.0000 | 1.4147 | 1.4164 | 1.2766 | 1.2234 | 1.1642 | 1.1235 | 1.1840 | 1.2071 | 1.2784 |

| 33 | 1.0000 | 1.3078 | 1.3086 | 1.1940 | 1.1587 | 1.1183 | 1.0899 | 1.1319 | 1.1476 | 1.1952 |

| 53 | 1.0000 | 1.2155 | 1.2156 | 1.1215 | 1.1005 | 1.0759 | 1.0582 | 1.0842 | 1.0938 | 1.1222 |

| 3 | 1.0000 | 3.3589 | 3.4169 | 2.5000 | 1.9266 | 1.5541 | 1.3703 | 1.7725 | 1.8843 | 2.5806 |

| 13 | 1.0000 | 1.6240 | 1.6265 | 1.4286 | 1.3166 | 1.2169 | 1.1562 | 1.2786 | 1.3066 | 1.4414 |

| 23 | 1.0000 | 1.3822 | 1.3837 | 1.2500 | 1.1909 | 1.1349 | 1.0990 | 1.1700 | 1.1854 | 1.2565 |

| 33 | 1.0000 | 1.2868 | 1.2876 | 1.1765 | 1.1367 | 1.0979 | 1.0725 | 1.1223 | 1.1329 | 1.1808 |

| 53 | 1.0000 | 1.2033 | 1.2034 | 1.1111 | 1.0871 | 1.0632 | 1.0472 | 1.0783 | 1.0849 | 1.1137 |

| 3 | 1.0000 | 1.4331 | 1.4436 | 1.2500 | 1.0489 | 1.0088 | 0.9978 | 1.3829 | 1.3729 | 1.6901 |

| 13 | 1.0000 | 1.2259 | 1.2272 | 1.1111 | 1.0239 | 1.0044 | 0.9989 | 1.1607 | 1.1572 | 1.2565 |

| 23 | 1.0000 | 1.1671 | 1.1682 | 1.0714 | 1.0158 | 1.0029 | 0.9993 | 1.1017 | 1.0996 | 1.1576 |

| 33 | 1.0000 | 1.1401 | 1.1407 | 1.0526 | 1.0118 | 1.0022 | 0.9994 | 1.0744 | 1.0729 | 1.1137 |

| 53 | 1.0000 | 1.1139 | 1.1141 | 1.0345 | 1.0078 | 1.0015 | 0.9996 | 1.0484 | 1.0474 | 1.0730 |

Problems

- 10.1

Consider model (10.1) and prove that

- 10.2 Prove that

where

- 10.3 For the model (10.1), show that the test of the null‐hypothesis

vs.

vs.  , is given by

, is given by

where

,

,  , and

, and

- 10.4 Show that the ADR of

is given by

is given by

where

is the c.d.f. of chi‐square distribution with

is the c.d.f. of chi‐square distribution with  DF and noncentrality parameter

DF and noncentrality parameter  evaluated at

evaluated at  .

. - 10.5 Prove that the

of

of  is given by

is given by

where

- 10.6 Verify that

of

of  is given by

is given by

where

is given by (9.70).

is given by (9.70). - 10.7 Prove that the PTRE dominates the RE whenever

Otherwise, RE outperforms the PTRE in the given interval.

- 10.8 Show that modified RLASSO estimator dominates over PTRE whenever

Otherwise, PTRE will dominate the modified RLASSO estimator.

- 10.9 Derive the ADB and ADR of the shrinkage R‐estimators in (10.29), (10.30), and (10.36).

- 10.10 Derive the ADB and ADR of the shrinkage R‐estimators in (10.37), (10.38), and (10.39).

- 10.11 Consider a real data set, where the design matrix elements are moderate to highly correlated, then find the efficiency of the estimators using unweighted risk functions. Find parallel formulas for the efficiency expressions and compare the results with that of the efficiency using the weighted risk function. Are the two results consistent?