4

Seemingly Unrelated Simple Linear Models

In this chapter, we consider an important class of models, namely, the seemingly unrelated simple linear models, belonging to the class of linear hypothesis, useful in the analysis of bioassay data, shelf‐life determination of pharmaceutical products, and profitability analysis of factory products in terms of costs and outputs, among other applications. In this model, as in the analysis of variance (ANOVA) model, ![]() independent bivariate samples

independent bivariate samples ![]() are considered such that

are considered such that ![]() for each pair

for each pair ![]() with fixed

with fixed ![]() .

.

The parameters ![]() and

and ![]() are the intercept and slope vectors of the

are the intercept and slope vectors of the ![]() ‐lines, respectively, and

‐lines, respectively, and ![]() is the common known variance. In this model, it is common to test the parallelism hypotheses

is the common known variance. In this model, it is common to test the parallelism hypotheses ![]() against the alternative hypothesis,

against the alternative hypothesis, ![]() . Instead, in many applications, one may suspect some of the elements of the

. Instead, in many applications, one may suspect some of the elements of the ![]() ‐vector may not be significantly different from

‐vector may not be significantly different from ![]() , i.e.

, i.e. ![]() ‐vector may be sparse; in other words, we partition

‐vector may be sparse; in other words, we partition ![]() and our suspects,

and our suspects, ![]() . Then, the test statistics

. Then, the test statistics ![]() tests the null hypothesis

tests the null hypothesis ![]() vs.

vs. ![]() . Besides this, the main objective of this chapter is to study some penalty estimators and the preliminary test estimator (PTE) and Stein‐type estimator (SE) of

. Besides this, the main objective of this chapter is to study some penalty estimators and the preliminary test estimator (PTE) and Stein‐type estimator (SE) of ![]() and

and ![]() when one suspects that

when one suspects that ![]() may be

may be ![]() and compare their properties based on

and compare their properties based on ![]() ‐risk function. For more literature and research on seemingly unrelated linear regression or other models, we refer the readers to Baltagi (1980), Foschi et al. (2003), Kontoghiorghes (2000, 2004), andKontoghiorghes and Clarke (1995), among others.

‐risk function. For more literature and research on seemingly unrelated linear regression or other models, we refer the readers to Baltagi (1980), Foschi et al. (2003), Kontoghiorghes (2000, 2004), andKontoghiorghes and Clarke (1995), among others.

4.1 Model, Estimation, and Test of Hypothesis

Consider the seemingly unrelated simple linear models

where ![]() ,

, ![]() an

an ![]() ‐tuple of 1s,

‐tuple of 1s, ![]() , and

, and ![]() ,

, ![]() is the

is the ![]() dimensional identity matrices so that

dimensional identity matrices so that ![]() .

.

4.1.1 LSE of  and

and

It is easy to see from Saleh (2006, Chapter 06) that the least squares estimator (LSE) of ![]() and

and ![]() are

are

and

respectively, where

4.1.2 Penalty Estimation of  and

and

Following Donoho and Johnstone (1994), Tibshirani (1996) and Saleh et al. (2017), we define the least absolute shrinkage and selection operator (LASSO) estimator of ![]() as

as

where ![]() with

with ![]() .

.

Thus, we write

where ![]() .

.

On the other hand, the ridge estimator of ![]() may be defined as

may be defined as

where the LSE of ![]() is

is  and restricted least squares estimator (RLSE) is

and restricted least squares estimator (RLSE) is  .

.

Consequently, the estimator of ![]() is given by

is given by

where ![]() and

and ![]() .

.

Similarly, the ridge estimator of ![]() is given by

is given by

4.1.3 PTE and Stein‐Type Estimators of  and

and

For the test of ![]() , where

, where ![]() , we use the following test statistic:

, we use the following test statistic:

where ![]() and the distribution of

and the distribution of ![]() follows a noncentral

follows a noncentral ![]() distribution with

distribution with ![]() degrees of freedom (DF) and noncentrality parameter

degrees of freedom (DF) and noncentrality parameter ![]() . Then we can define the PTE, SE, and PRSE (positive‐rule Stein‐type estimator)of

. Then we can define the PTE, SE, and PRSE (positive‐rule Stein‐type estimator)of ![]() as

as

respectively.

For the PTE, SE and PRSE of ![]() are

are

4.2 Bias and MSE Expressions of the Estimators

In this section, we present the expressions of bias and mean squared error (MSE) for all the estimators of ![]() and

and ![]() as follows.

as follows.

Next, we have the following theorem for the ![]() risk of the estimators.

risk of the estimators.

Under the assumption of Theorem 4.1, we have following ![]() ‐risk expressions for the estimators defined in Sections using the formula

‐risk expressions for the estimators defined in Sections using the formula

where ![]() and

and ![]() are the weight matrices.

are the weight matrices.

The ![]() risk of LSE is

risk of LSE is

when ![]() and

and

when ![]() .

.

The ![]() risk of RLSE is

risk of RLSE is

when ![]() and

and ![]() and

and

when ![]() and

and ![]() .

.

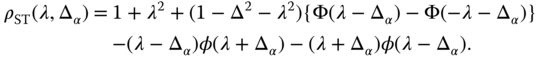

The ![]() risk of PTE is

risk of PTE is

where ![]() and

and

when ![]() ,

, ![]() ,

, ![]() and

and ![]() .

.

The ![]() risk of PRSE is

risk of PRSE is

where ![]() , and

, and ![]() .

.

The LASSO ![]() risk expression for

risk expression for ![]() is

is

The LASSO ![]() risk expression for

risk expression for ![]() is

is

where

The corresponding lower bound of the unweighted risk functions of ![]() and

and ![]() are, respectively,

are, respectively,

We will consider the lower bound of ![]() risk of LASSO to compare with the

risk of LASSO to compare with the ![]() risk of other estimators. Consequently, the lower bound of the weighted

risk of other estimators. Consequently, the lower bound of the weighted ![]() risk is given by

risk is given by

which is same as the ![]() risk of the ridge regression estimator (RRE).

risk of the ridge regression estimator (RRE).

The ![]() risk of RRE is

risk of RRE is

when ![]() and

and ![]() and

and

when ![]() ,

, ![]() .

.

4.3 Comparison of Estimators

In this section, we compare various estimators with respect to the LSE, in terms of relative weighted ![]() ‐risk efficiency (RWRE).

‐risk efficiency (RWRE).

4.3.1 Comparison of LSE with RLSE

Recall that the RLSE is given by ![]() . In this case, the RWRE of RLSE vs. LSE is given by

. In this case, the RWRE of RLSE vs. LSE is given by

which is a decreasing function of ![]() . So,

. So, ![]() .

.

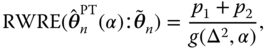

4.3.2 Comparison of LSE with PTE

The RWRE expression for PTE vs. LSE is given by

where

Then, the PTE outperforms the LSE for

Otherwise, LSE outperforms the PTE in the interval ![]() .

.

We may mention that ![]() is a decreasing function of

is a decreasing function of ![]() with a maximum at

with a maximum at ![]() , then decreases crossing the 1‐line to a minimum at

, then decreases crossing the 1‐line to a minimum at ![]() with a value

with a value ![]() , and then increases toward the 1‐line. This means the gains in efficiency of PTE is the highest in the interval given by Eq. (4.24) and loss in efficiency can be noticed outside it.

, and then increases toward the 1‐line. This means the gains in efficiency of PTE is the highest in the interval given by Eq. (4.24) and loss in efficiency can be noticed outside it.

The ![]() belongs to the interval

belongs to the interval

where ![]() depends on the size

depends on the size ![]() and given by

and given by

The quantity ![]() is the value

is the value ![]() at which the RWRE value is minimum.

at which the RWRE value is minimum.

4.3.3 Comparison of LSE with SE and PRSE

We obtain the RWRE as follows:

It is a decreasing function of ![]() . At

. At ![]() , its value is

, its value is ![]() ; and when

; and when ![]() , its value goes to 1. Hence, for

, its value goes to 1. Hence, for ![]() ,

,

Hence, the gains in efficiency is the highest when ![]() is small and drops toward 1 when

is small and drops toward 1 when ![]() is the largest. Also,

is the largest. Also,

So that,

We also provide a graphical representation (Figure 4.1) of RWRE of the estimators.

Figure 4.1 RWRE for the restricted, preliminary test, and Stein‐type and its positive‐rule estimators.

In the next three subsections, we show that the RRE uniformly dominates all other estimators, although it does not select variables.

4.3.4 Comparison of LSE and RLSE with RRE

First, we consider weighted ![]() ‐risk difference of LSE and RRE given by

‐risk difference of LSE and RRE given by

Hence, RRE outperforms the LSE uniformly. Similarly, for the RLSE and RRE, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

Therefore, RRE performs better than RLSE uniformly.

In addition, the RWRE of RRE vs. LSE equals

which is a decreasing function of ![]() with maximum

with maximum ![]() at

at ![]() and minimum 1 as

and minimum 1 as ![]() . So,

. So,

4.3.5 Comparison of RRE with PTE, SE, and PRSE

4.3.5.1 Comparison Between  and

and

Here, the weighted ![]() ‐risk difference of

‐risk difference of ![]() and

and ![]() is given by

is given by

Note that the risk of ![]() is an increasing function of

is an increasing function of ![]() crossing the

crossing the ![]() ‐line to a maximum and then drops monotonically toward the

‐line to a maximum and then drops monotonically toward the ![]() ‐line as

‐line as ![]() . The value of the risk is

. The value of the risk is ![]() at

at ![]() . On the other hand,

. On the other hand, ![]() is an increasing function of

is an increasing function of ![]() below the

below the ![]() ‐line with a minimum value 0 at

‐line with a minimum value 0 at ![]() and as

and as ![]() ,

, ![]() . Hence, the risk difference in Eq. (4.30) is nonnegative for

. Hence, the risk difference in Eq. (4.30) is nonnegative for ![]() . Thus, the RRE uniformly performs better than the PTE.

. Thus, the RRE uniformly performs better than the PTE.

4.3.5.2 Comparison Between  and

and

The weighted ![]() ‐risk difference of

‐risk difference of ![]() and

and ![]() is given by

is given by

Note that the first function is increasing in ![]() with a value 2 at

with a value 2 at ![]() ; and as

; and as ![]() , it tends to

, it tends to ![]() . The second function is also increasing in

. The second function is also increasing in ![]() with a value 0 at

with a value 0 at ![]() and approaches the value

and approaches the value ![]() as

as ![]() . Hence, the risk difference is nonnegative for all

. Hence, the risk difference is nonnegative for all ![]() . Consequently, RRE outperforms SE uniformly.

. Consequently, RRE outperforms SE uniformly.

4.3.5.3 Comparison of  with

with

The risk of ![]() is

is

where

and R(![]() ) is

) is

The weighted ![]() ‐risk difference of PR and RRE is given by

‐risk difference of PR and RRE is given by

where

Consider the ![]() (

(![]() ). It is a monotonically increasing function of

). It is a monotonically increasing function of ![]() . At

. At ![]() , its value is

, its value is ![]() ; and as

; and as ![]() , it tends to

, it tends to ![]() . For

. For ![]() , at

, at ![]() , the value is

, the value is ![]() ; and as

; and as ![]() , it tends to

, it tends to ![]() . Hence, the

. Hence, the ![]() ‐risk difference in (4.31) is nonnegative and RRE uniformly outperforms PRSE.

‐risk difference in (4.31) is nonnegative and RRE uniformly outperforms PRSE.

Note that the risk difference of ![]() and

and ![]() at

at ![]() is

is

because the expected value in Eq. (4.35) is a decreasing function of DF, and ![]() . The risk functions of RRE, PT, SE, and PRSE are plotted in Figures 4.2 and 4.3 for

. The risk functions of RRE, PT, SE, and PRSE are plotted in Figures 4.2 and 4.3 for ![]() ,

, ![]() , respectively. These figures are in support of the given comparisons.

, respectively. These figures are in support of the given comparisons.

4.3.6 Comparison of LASSO with RRE

Here, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

Hence, the RRE outperforms the LASSO uniformly.

Figure 4.2 Weighted  risk for the ridge, preliminary test, and Stein‐type and its positive‐rule estimators for

risk for the ridge, preliminary test, and Stein‐type and its positive‐rule estimators for  , and

, and  .

.

Figure 4.3 Weighted  risk for the ridge, preliminary test, and Stein‐type and its positive‐rule estimators for

risk for the ridge, preliminary test, and Stein‐type and its positive‐rule estimators for  , and

, and  .

.

4.3.7 Comparison of LASSO with LSE and RLSE

First, note that if we have for ![]() coefficients,

coefficients, ![]() and also

and also ![]() coefficients are zero in a sparse solution, then the “ideal” weighted

coefficients are zero in a sparse solution, then the “ideal” weighted ![]() ‐risk is given by

‐risk is given by ![]() . Thereby, we compare all estimators relative to this quantity. Hence, the weighted

. Thereby, we compare all estimators relative to this quantity. Hence, the weighted ![]() ‐risk difference between LSE and LASSO is given by

‐risk difference between LSE and LASSO is given by

Hence, if ![]() , the LASSO performs better than the LSE, while if

, the LASSO performs better than the LSE, while if ![]() the LSE performs better than the LASSO. Consequently, neither LSE nor the LASSO performs better than the other, uniformly.

the LSE performs better than the LASSO. Consequently, neither LSE nor the LASSO performs better than the other, uniformly.

Next, we compare the RLSE and LASSO. In this case, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

Hence, LASSO and RLSE are ![]() risk equivalent. And consequently, the LASSO satisfies the oracle properties.

risk equivalent. And consequently, the LASSO satisfies the oracle properties.

4.3.8 Comparison of LASSO with PTE, SE, and PRSE

We first consider the PTE vs. LASSO. In this case, the weighted ![]() ‐risk difference is given by

‐risk difference is given by

Hence, the LASSO outperforms the PTE when ![]() . But when

. But when ![]() , the LASSO outperforms the PTE for

, the LASSO outperforms the PTE for

Otherwise, PTE outperforms the LASSO. Hence, neither LASSO nor PTE outmatches the other uniformly.

Next, we consider SE and PRSE vs. the LASSO. In these two cases, we have weighted ![]() ‐risk differences given by

‐risk differences given by

and

Therefore, the LASSO outperforms the SE as well as the PRSE in the interval ![]() . Thus, neither SE nor the PRSE outperform the LASSO uniformly.

. Thus, neither SE nor the PRSE outperform the LASSO uniformly.

In Figure 4.4, the comparisons of LASSO with other estimators are shown.

Figure 4.4 RWRE for the LASSO, ridge, restricted, preliminary test, and Stein‐type and its positive‐rule estimators.

4.4 Efficiency in Terms of Unweighted  Risk

Risk

In the previous sections, we have made all comparisons among the estimators in terms of weighted risk functions. In this section, we provide the ![]() ‐risk efficiency of the estimators in terms of the unweighted (weight =

‐risk efficiency of the estimators in terms of the unweighted (weight = ![]() ) risk expressions for both

) risk expressions for both ![]() and

and ![]() .

.

4.4.1 Efficiency for

The unweighted relative efficiency of LASSO:

Note that the unweighted risk of LASSO and RLSE is the same. The unweighted relative efficiency of PTE:

The unweighted relative efficiency of SE:

where

The unweighted relative efficiency of PRSE:

The unweighted relative efficiency of RRE:

4.4.2 Efficiency for

The unweighted relative efficiency of LASSO:

Note that the unweighted risk of LASSO and RSLE is the same.

The unweighted relative efficiency of PTE:

The unweighted relative efficiency of SE:

where

The unweighted relative efficiency of PRSE:

The unweighted relative efficiency of RRE:

4.5 Summary and Concluding Remarks

In this section, we discuss the contents of Tables 4.1–4.9 presented as confirmatory evidence of the theoretical findings of the estimators. First, we note that we have two classes of estimators, namely, the traditional PTE and SE and the penalty estimators. The restricted LSE plays an important role due to the fact that LASSO belongs to the class of restricted estimators.

We have the following conclusions from our study.

- Since the inception of the RRE by Hoerl and Kennard (1970), there have been articles comparing RRE with PTE and the SE. From this study, we conclude that the RRE dominates the LSE, PTE, and the SE uniformly. The PRE dominates the LASSO estimator uniformly for

greater than 0. They are

greater than 0. They are  risk equivalent at

risk equivalent at  and at this point LASSO dominates all other estimators. The ridge estimator does not select variables but the LASSO estimator does. See Table 4.1 and graphs in Figure 4.5.

and at this point LASSO dominates all other estimators. The ridge estimator does not select variables but the LASSO estimator does. See Table 4.1 and graphs in Figure 4.5. - The RLSE and LASSO are

risk equivalent. Hence, LASSO satisfies “oracle properties.”

risk equivalent. Hence, LASSO satisfies “oracle properties.” - Under the family of “diagonal linear projection,” the “ideal”

risk of LASSO and subset rule (hard threshold estimator, HTE) are same and do not depend on the thresholding parameter (

risk of LASSO and subset rule (hard threshold estimator, HTE) are same and do not depend on the thresholding parameter ( ) under sparse condition. SeeDonoho and Johnstone (1994).

) under sparse condition. SeeDonoho and Johnstone (1994). - The RWRE of estimators compared to the LSE depends upon the size of

,

,  , and the divergence parameter,

, and the divergence parameter,  . LASSO/RLSE and RRE outperform all the estimators when

. LASSO/RLSE and RRE outperform all the estimators when  is 0.

is 0. - The LASSO satisfies the “oracle properties” and it dominates LSE, PTE, SE, and PRSE in the subinterval of

. In this case, with a small number of active parameters, the LASSO and HTE perform best followed by RRE as pointed out by Tibshirani (1996).

. In this case, with a small number of active parameters, the LASSO and HTE perform best followed by RRE as pointed out by Tibshirani (1996). - If

is fixed and

is fixed and  increases, the RWRE of all estimators increases; see Tables 4.6 and 4.7.

increases, the RWRE of all estimators increases; see Tables 4.6 and 4.7. - If

is fixed and

is fixed and  increases, the RWRE of all estimators decreases. Then, for a given

increases, the RWRE of all estimators decreases. Then, for a given  small and

small and  large, the LASSO, PTE, SE, and PRSE are competitive. See Tables 4.8 and 4.9.

large, the LASSO, PTE, SE, and PRSE are competitive. See Tables 4.8 and 4.9. - The PRE outperforms the LSE, PTE, SE, and PRSE uniformly. The PRE dominates LASSO and RLSE uniformly for

; and at

; and at  , they are

, they are  risk equivalent where

risk equivalent where  is the divergence parameter.

is the divergence parameter. - The PRSE always outperforms SE; see Tables 4.1–4.9.

Table 4.1 RWRE for the estimators.

| PTE | ||||||||

| LSE | RLSE/LASSO | 0.25 | SE | PRSE | RRE | |||

| 0 | 1 | 4.00 | 2.30 | 2.07 | 1.89 | 2.86 | 3.22 | 4.00 |

| 0.1 | 1 | 3.92 | 2.26 | 2.03 | 1.85 | 2.82 | 3.16 | 3.92 |

| 0.5 | 1 | 3.64 | 2.10 | 1.89 | 1.74 | 2.69 | 2.93 | 3.64 |

| 1 | 1 | 3.33 | 1.93 | 1.76 | 1.63 | 2.56 | 2.71 | 3.36 |

| 2 | 1 | 2.86 | 1.67 | 1.55 | 1.45 | 2.33 | 2.40 | 2.96 |

| 3 | 1 | 2.50 | 1.49 | 1.40 | 1.33 | 2.17 | 2.19 | 2.67 |

| 5 | 1 | 2.00 | 1.26 | 1.21 | 1.17 | 1.94 | 1.92 | 2.26 |

| 7 | 1 | 1.67 | 1.13 | 1.10 | 1.08 | 1.78 | 1.77 | 2.04 |

| 10 | 1 | 1.33 | 1.02 | 1.02 | 1.01 | 1.62 | 1.60 | 1.81 |

| 15 | 1 | 1.00 | 0.97 | 0.97 | 0.98 | 1.46 | 1.45 | 1.60 |

| 20 | 1 | 0.80 | 0.97 | 0.98 | 0.98 | 1.36 | 1.36 | 1.47 |

| 30 | 1 | 0.57 | 0.99 | 0.99 | 0.99 | 1.25 | 1.25 | 1.33 |

| 50 | 1 | 0.36 | 0.99 | 0.99 | 1.00 | 1.16 | 1.16 | 1.21 |

| 100 | 1 | 0.19 | 1.00 | 1.00 | 1.00 | 1.05 | 1.05 | 1.11 |

| 0 | 1 | 5.71 | 2.86 | 2.50 | 2.23 | 4.44 | 4.92 | 5.71 |

| 0.1 | 1 | 5.63 | 2.82 | 2.46 | 2.20 | 4.40 | 4.84 | 5.63 |

| 0.5 | 1 | 5.33 | 2.66 | 2.34 | 2.10 | 4.23 | 4.57 | 5.34 |

| 1 | 1 | 5.00 | 2.49 | 2.20 | 1.98 | 4.03 | 4.28 | 5.02 |

| 2 | 1 | 4.44 | 2.21 | 1.97 | 1.80 | 3.71 | 3.84 | 4.50 |

| 3 | 1 | 4.00 | 1.99 | 1.79 | 1.65 | 3.45 | 3.51 | 4.10 |

| 5 | 1 | 3.33 | 1.67 | 1.53 | 1.43 | 3.05 | 3.05 | 3.53 |

| 7 | 1 | 2.86 | 1.46 | 1.36 | 1.29 | 2.76 | 2.74 | 3.13 |

| 10 | 1 | 2.35 | 1.26 | 1.20 | 1.16 | 2.46 | 2.44 | 2.72 |

| 15 | 1 | 1.82 | 1.09 | 1.07 | 1.05 | 2.13 | 2.11 | 2.31 |

| 20 | 1 | 1.48 | 1.02 | 1.02 | 1.01 | 1.92 | 1.91 | 2.06 |

| 30 | 1 | 1.08 | 0.99 | 0.99 | 0.99 | 1.67 | 1.67 | 1.76 |

| 33 | 1 | 1.00 | 0.99 | 0.99 | 0.99 | 1.62 | 1.62 | 1.70 |

| 50 | 1 | 0.70 | 0.99 | 0.99 | 0.99 | 1.43 | 1.43 | 1.49 |

| 100 | 1 | 0.37 | 1.00 | 1.00 | 1.00 | 1.12 | 1.12 | 1.25 |

Figure 4.5 RWRE of estimates of a function of  for

for  and different

and different  .

.

Table 4.2 RWRE of the estimators for ![]() and different

and different ![]() ‐value for varying

‐value for varying ![]() .

.

| Estimators | ||||||||

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 5.00 | 3.33 | 2.00 | 1.43 | 3.33 | 2.50 | 1.67 | 1.25 |

| PTE ( |

2.34 | 1.98 | 1.51 | 1.23 | 1.75 | 1.55 | 1.27 | 1.09 |

| PTE ( |

2.06 | 1.80 | 1.43 | 1.19 | 1.60 | 1.45 | 1.22 | 1.07 |

| PTE ( |

1.86 | 1.66 | 1.36 | 1.16 | 1.49 | 1.37 | 1.18 | 1.06 |

| SE | 2.50 | 2.00 | 1.43 | 1.11 | 2.14 | 1.77 | 1.33 | 1.08 |

| PRSE | 3.03 | 2.31 | 1.56 | 1.16 | 2.31 | 1.88 | 1.38 | 1.10 |

| RRE | 5.00 | 3.33 | 2.00 | 1.43 | 3.46 | 2.58 | 1.71 | 1.29 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 1.43 | 1.25 | 1.00 | 0.83 | 0.83 | 0.77 | 0.67 | 0.59 |

| PTE ( |

1.05 | 1.01 | 0.95 | 0.92 | 0.92 | 0.92 | 0.92 | 0.94 |

| PTE ( |

1.03 | 1.00 | 0.95 | 0.93 | 0.94 | 0.93 | 0.94 | 0.95 |

| PTE ( |

1.02 | 0.99 | 0.96 | 0.94 | 0.95 | 0.95 | 0.95 | 0.97 |

| SE | 1.55 | 1.38 | 1.15 | 1.03 | 1.33 | 1.22 | 1.09 | 1.01 |

| PRSE | 1.53 | 1.37 | 1.15 | 1.03 | 1.32 | 1.22 | 1.08 | 1.01 |

| RRE | 1.97 | 1.69 | 1.33 | 1.13 | 1.55 | 1.40 | 1.20 | 1.07 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 0.45 | 0.43 | 0.40 | 0.37 | 0.16 | 0.16 | 0.15 | 0.15 |

| PTE ( |

0.97 | 0.97 | 0.98 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 |

| PTE ( |

0.98 | 0.98 | 0.99 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 |

| PTE ( |

0.98 | 0.99 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| SE | 1.17 | 1.12 | 1.04 | 1.00 | 1.06 | 1.04 | 1.01 | 1.00 |

| PRSE | 1.17 | 1.12 | 1.04 | 1.00 | 1.05 | 1.04 | 1.01 | 1.00 |

| RRE | 1.30 | 1.22 | 1.11 | 1.04 | 1.10 | 1.08 | 1.04 | 1.01 |

Table 4.3 RWRE of the estimators for ![]() and different

and different ![]() values for varying

values for varying ![]() .

.

| Estimators | ||||||||

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 10.00 | 6.67 | 4.00 | 2.85 | 6.67 | 5.00 | 3.33 | 2.50 |

| PTE ( |

3.20 | 2.84 | 2.31 | 1.95 | 2.50 | 2.27 | 1.93 | 1.68 |

| PTE ( |

2.70 | 2.45 | 2.07 | 1.80 | 2.17 | 2.01 | 1.76 | 1.56 |

| PTE ( |

2.35 | 2.17 | 1.89 | 1.67 | 1.94 | 1.82 | 1.63 | 1.47 |

| SE | 5.00 | 4.00 | 2.86 | 2.22 | 4.13 | 3.42 | 2.56 | 2.04 |

| PRSE | 6.28 | 4.77 | 3.22 | 2.43 | 4.58 | 3.72 | 2.71 | 2.13 |

| RRE | 10.00 | 6.67 | 4.00 | 2.86 | 6.78 | 5.07 | 3.37 | 2.52 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 2.86 | 2.50 | 2.00 | 1.67 | 1.67 | 1.54 | 1.33 | 1.18 |

| PTE ( |

1.42 | 1.36 | 1.25 | 1.17 | 1.08 | 1.06 | 1.02 | 0.99 |

| PTE ( |

1.33 | 1.29 | 1.20 | 1.14 | 1.06 | 1.04 | 1.02 | 0.99 |

| PTE ( |

1.27 | 1.23 | 1.17 | 1.11 | 1.04 | 1.03 | 1.01 | 0.99 |

| SE | 2.65 | 2.36 | 1.94 | 1.65 | 2.03 | 1.87 | 1.62 | 1.43 |

| PRSE | 2.63 | 2.34 | 1.92 | 1.64 | 2.01 | 1.85 | 1.60 | 1.42 |

| RRE | 3.38 | 2.91 | 2.28 | 1.88 | 2.37 | 2.15 | 1.82 | 1.58 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 0.91 | 0.87 | 0.80 | 0.74 | 0.32 | 0.32 | 0.31 | 0.30 |

| PTE ( |

0.97 | 0.97 | 0.97 | 0.97 | 1.00 | 1.00 | 1.00 | 1.00 |

| PTE ( |

0.98 | 0.98 | 0.98 | 0.98 | 1.00 | 1.00 | 1.00 | 1.00 |

| PTE ( |

0.99 | 0.98 | 0.98 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 |

| SE | 1.58 | 1.51 | 1.36 | 1.26 | 1.21 | 1.18 | 1.13 | 1.09 |

| PRSE | 1.58 | 1.50 | 1.36 | 1.25 | 1.21 | 1.18 | 1.13 | 1.09 |

| RRE | 1.74 | 1.64 | 1.47 | 1.34 | 1.26 | 1.23 | 1.18 | 1.13 |

Table 4.4 RWRE of the estimators for ![]() and different

and different ![]() values for varying

values for varying ![]() .

.

| Estimators | ||||||||

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 20.00 | 13.33 | 8.00 | 5.71 | 13.33 | 10.00 | 6.67 | 5.00 |

| PTE ( |

4.05 | 3.74 | 3.24 | 2.86 | 3.32 | 3.12 | 2.77 | 2.49 |

| PTE ( |

3.29 | 3.09 | 2.76 | 2.50 | 2.77 | 2.64 | 2.40 | 2.20 |

| PTE ( |

2.78 | 2.65 | 2.42 | 2.23 | 2.40 | 2.30 | 2.13 | 1.98 |

| SE | 10.00 | 8.00 | 5.71 | 4.44 | 8.12 | 6.75 | 5.05 | 4.03 |

| PRSE | 12.80 | 9.69 | 6.52 | 4.92 | 9.25 | 7.51 | 5.45 | 4.28 |

| RRE | 20.00 | 13.33 | 8.00 | 5.71 | 13.45 | 10.07 | 6.70 | 5.02 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 5.71 | 5.00 | 4.00 | 3.33 | 3.33 | 3.08 | 2.67 | 2.35 |

| PTE ( |

1.9641 | 1.8968 | 1.7758 | 1.6701 | 1.3792 | 1.3530 | 1.3044 | 1.2602 |

| PTE ( |

1.75 | 1.70 | 1.61 | 1.53 | 1.29 | 1.27 | 1.24 | 1.20 |

| PTE ( |

1.60 | 1.56 | 1.50 | 1.44 | 1.23 | 1.22 | 1.19 | 1.16 |

| SE | 4.87 | 4.35 | 3.59 | 3.05 | 3.46 | 3.20 | 2.78 | 2.46 |

| PRSE | 4.88 | 4.36 | 3.59 | 3.05 | 3.42 | 3.16 | 2.75 | 2.44 |

| RRE | 6.23 | 5.40 | 4.27 | 3.53 | 4.03 | 3.68 | 3.13 | 2.72 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 1.82 | 1.74 | 1.60 | 1.48 | 0.64 | 0.63 | 0.61 | 0.60 |

| PTE ( |

1.05 | 1.05 | 1.03 | 1.02 | 0.99 | 0.99 | 0.99 | 0.99 |

| PTE ( |

1.04 | 1.03 | 1.02 | 1.02 | 0.99 | 0.99 | 0.99 | 0.99 |

| PTE ( |

1.03 | 1.02 | 1.02 | 1.01 | 0.99 | 0.99 | 1.00 | 1.00 |

| SE | 2.41 | 2.2946 | 2.09 | 1.92 | 1.52 | 1.48 | 1.42 | 1.36 |

| PRSE | 2.41 | 2.29 | 2.08 | 1.91 | 1.52 | 1.48 | 1.42 | 1.36 |

| RRE | 2.65 | 2.50 | 2.26 | 2.06 | 1.58 | 1.54 | 1.47 | 1.41 |

Table 4.5 RWRE of the estimators for ![]() and different

and different ![]() values for varying

values for varying ![]() .

.

| Estimators | ||||||||

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 30.00 | 20.00 | 12.00 | 8.57 | 20.00 | 15.00 | 10.00 | 7.50 |

| PTE ( |

4.49 | 4.23 | 3.79 | 3.43 | 3.80 | 3.62 | 3.29 | 3.02 |

| PTE ( |

3.58 | 3.42 | 3.14 | 2.91 | 3.10 | 2.99 | 2.78 | 2.59 |

| PTE ( |

2.99 | 2.89 | 2.70 | 2.54 | 2.64 | 2.56 | 2.42 | 2.29 |

| SE | 15.00 | 12.00 | 8.57 | 6.67 | 12.12 | 10.09 | 7.55 | 6.03 |

| PRSE | 19.35 | 14.63 | 9.83 | 7.40 | 13.99 | 11.34 | 8.22 | 6.45 |

| RRE | 30.00 | 20.00 | 12.00 | 8.57 | 20.11 | 15.06 | 10.03 | 7.52 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 8.57 | 7.50 | 6.00 | 5.00 | 5.00 | 4.61 | 4.0000 | 3.53 |

| PTE ( |

2.35 | 2.28 | 2.16 | 2.05 | 1.63 | 1.60 | 1.55 | 1.50 |

| PTE ( |

2.04 | 1.99 | 1.91 | 1.83 | 1.49 | 1.47 | 1.43 | 1.39 |

| PTE ( |

1.83 | 1.79 | 1.73 | 1.67 | 1.39 | 1.37 | 1.34 | 1.31 |

| SE | 7.10 | 6.35 | 5.25 | 4.47 | 4.89 | 4.53 | 3.94 | 3.50 |

| PRSE | 7.17 | 6.41 | 5.28 | 4.50 | 4.84 | 4.48 | 3.91 | 3.47 |

| RRE | 9.09 | 7.90 | 6.26 | 5.19 | 5.70 | 5.21 | 4.45 | 3.89 |

| LSE | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| RLSE/LASSO | 2.73 | 2.61 | 2.40 | 2.22 | 0.97 | 0.95 | 0.92 | 0.89 |

| PTE ( |

1.15 | 1.14 | 1.13 | 1.11 | 0.99 | 0.99 | 0.99 | 0.99 |

| PTE ( |

1.11 | 1.10 | 1.09 | 1.08 | 0.99 | 0.99 | 0.99 | 0.99 |

| PTE ( |

1.08 | 1.08 | 1.07 | 1.06 | 0.99 | 0.99 | 0.99 | 0.99 |

| SE | 3.25 | 3.09 | 2.82 | 2.60 | 1.83 | 1.79 | 1.72 | 1.65 |

| PRSE | 3.23 | 3.08 | 2.81 | 2.59 | 1.83 | 1.79 | 1.72 | 1.65 |

| RRE | 3.55 | 3.37 | 3.05 | 2.79 | 1.90 | 1.86 | 1.78 | 1.71 |

Table 4.6 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| PTE | ||||||||

| LSE | RLSE/LASSO | 0.25 | SE | PRSE | RRE | |||

| 5 | 1.00 | 2.00 | 1.76 | 1.51 | 1.36 | 1.43 | 1.56 | 2.00 |

| 15 | 1.00 | 4.00 | 3.11 | 2.31 | 1.89 | 2.86 | 3.22 | 4.00 |

| 25 | 1.00 | 6.00 | 4.23 | 2.84 | 2.20 | 4.28 | 4.87 | 6.00 |

| 35 | 1.00 | 8.00 | 5.18 | 3.24 | 2.42 | 5.71 | 6.52 | 8.00 |

| 55 | 1.00 | 12.00 | 6.71 | 3.79 | 2.70 | 8.57 | 9.83 | 12.00 |

| |

||||||||

| 5 | 1.00 | 1.82 | 1.58 | 1.37 | 1.26 | 1.37 | 1.46 | 1.83 |

| 15 | 1.00 | 3.64 | 2.79 | 2.10 | 1.74 | 2.70 | 2.93 | 3.65 |

| 25 | 1.00 | 5.45 | 3.81 | 2.61 | 2.05 | 4.03 | 4.43 | 5.46 |

| 35 | 1.00 | 7.27 | 4.68 | 2.98 | 2.26 | 5.36 | 5.93 | 7.28 |

| 55 | 1.00 | 10.91 | 6.11 | 3.52 | 2.55 | 8.02 | 8.94 | 10.92 |

| |

||||||||

| 5 | 1.00 | 1.67 | 1.43 | 1.27 | 1.18 | 1.33 | 1.38 | 1.71 |

| 15 | 1.00 | 3.33 | 2.53 | 1.93 | 1.63 | 2.56 | 2.71 | 3.37 |

| 25 | 1.00 | 5.00 | 3.46 | 2.41 | 1.92 | 3.80 | 4.08 | 5.03 |

| 35 | 1.00 | 6.67 | 4.27 | 2.77 | 2.13 | 5.05 | 5.45 | 6.70 |

| 55 | 1.00 | 10.00 | 5.61 | 3.29 | 2.42 | 7.55 | 8.22 | 10.03 |

| |

||||||||

| 5 | 1.0000 | 1.00 | 0.93 | 0.95 | 0.96 | 1.15 | 1.15 | 1.33 |

| 15 | 1.00 | 2.00 | 1.47 | 1.26 | 1.17 | 1.94 | 1.92 | 2.28 |

| 25 | 1.00 | 3.00 | 1.98 | 1.54 | 1.35 | 2.76 | 2.75 | 3.27 |

| 35 | 1.00 | 4.00 | 2.44 | 1.77 | 1.50 | 3.59 | 3.59 | 4.27 |

| 55 | 1.00 | 6.00 | 3.27 | 2.16 | 1.73 | 5.25 | 5.28 | 6.26 |

Table 4.7 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| 5 | 1.00 | 1.43 | 1.33 | 1.23 | 1.16 | 1.11 | 1.16 | 1.43 |

| 15 | 1.00 | 2.86 | 2.41 | 1.94 | 1.67 | 2.22 | 2.43 | 2.86 |

| 25 | 1.00 | 4.28 | 3.35 | 2.46 | 2.00 | 3.33 | 3.67 | 4.28 |

| 35 | 1.00 | 5.71 | 4.17 | 2.86 | 2.23 | 4.44 | 4.92 | 5.71 |

| 55 | 1.00 | 8.57 | 5.54 | 3.43 | 2.53 | 6.67 | 7.40 | 8.57 |

| 5 | 1.00 | 1.33 | 1.23 | 1.15 | 1.10 | 1.09 | 1.13 | 1.35 |

| 15 | 1.00 | 2.67 | 2.22 | 1.80 | 1.56 | 2.12 | 2.27 | 2.67 |

| 25 | 1.00 | 4.00 | 3.08 | 2.29 | 1.87 | 3.17 | 3.41 | 4.00 |

| 35 | 1.00 | 5.33 | 3.84 | 2.66 | 2.10 | 4.23 | 4.57 | 5.34 |

| 55 | 1.00 | 8.00 | 5.13 | 3.21 | 2.40 | 6.33 | 6.89 | 8.00 |

| 5 | 1.00 | 1.25 | 1.15 | 1.09 | 1.06 | 1.08 | 1.10 | 1.29 |

| 15 | 1.00 | 2.50 | 2.05 | 1.68 | 1.47 | 2.04 | 2.13 | 2.52 |

| 25 | 1.00 | 3.75 | 2.85 | 2.13 | 1.77 | 3.03 | 3.20 | 3.77 |

| 35 | 1.00 | 5.00 | 3.56 | 2.49 | 1.98 | 4.03 | 4.28 | 5.01 |

| 55 | 1.00 | 7.50 | 4.77 | 3.02 | 2.29 | 6.03 | 6.45 | 7.52 |

| 5 | 1.00 | 0.83 | 0.87 | 0.92 | 0.94 | 1.03 | 1.03 | 1.13 |

| 15 | 1.00 | 1.67 | 1.32 | 1.17 | 1.11 | 1.65 | 1.64 | 1.88 |

| 25 | 1.00 | 2.50 | 1.78 | 1.44 | 1.29 | 2.34 | 2.34 | 2.70 |

| 35 | 1.00 | 3.33 | 2.20 | 1.67 | 1.44 | 3.05 | 3.05 | 3.53 |

| 55 | 1.00 | 5.00 | 2.98 | 2.05 | 1.67 | 4.47 | 4.50 | 5.19 |

Table 4.8 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| PTE | ||||||||

| LSE | RLSE/LASSO | 0.25 | SE | PRSE | RRE | |||

| 5 | 1.00 | 2.00 | 1.76 | 1.51 | 1.36 | 1.43 | 1.56 | 2.00 |

| 15 | 1.00 | 1.33 | 1.27 | 1.20 | 1.15 | 1.18 | 1.22 | 1.33 |

| 25 | 1.00 | 1.20 | 1.17 | 1.127 | 1.10 | 1.11 | 1.14 | 1.20 |

| 35 | 1.00 | 1.14 | 1.12 | 1.09 | 1.07 | 1.08 | 1.10 | 1.14 |

| 55 | 1.00 | 1.09 | 1.08 | 1.06 | 1.04 | 1.05 | 1.06 | 1.09 |

| 5 | 1.00 | 1.82 | 1.58 | 1.37 | 1.26 | 1.34 | 1.46 | 1.83 |

| 15 | 1.00 | 1.29 | 1.22 | 1.16 | 1.11 | 1.16 | 1.19 | 1.29 |

| 25 | 1.00 | 1.18 | 1.14 | 1.10 | 1.07 | 1.10 | 1.12 | 1.18 |

| 35 | 1.00 | 1.13 | 1.10 | 1.07 | 1.05 | 1.07 | 1.08 | 1.13 |

| 55 | 1.00 | 1.08 | 1.06 | 1.05 | 1.03 | 1.05 | 1.05 | 1.08 |

| 5 | 1.00 | 1.67 | 1.43 | 1.27 | 1.18 | 1.33 | 1.38 | 1.71 |

| 15 | 1.00 | 1.25 | 1.18 | 1.12 | 1.08 | 1.14 | 1.16 | 1.26 |

| 25 | 1.00 | 1.15 | 1.11 | 1.08 | 1.05 | 1.09 | 1.10 | 1.16 |

| 35 | 1.00 | 1.11 | 1.08 | 1.06 | 1.04 | 1.07 | 1.07 | 1.12 |

| 55 | 1.00 | 1.07 | 1.05 | 1.04 | 1.03 | 1.04 | 1.05 | 1.07 |

| 5 | 1.00 | 1.00 | 0.93 | 0.95 | 0.96 | 1.15 | 1.15 | 1.33 |

| 15 | 1.00 | 1.00 | 0.97 | 0.97 | 0.98 | 1.07 | 1.07 | 1.14 |

| 25 | 1.00 | 1.00 | 0.98 | 0.98 | 0.98 | 1.05 | 1.04 | 1.09 |

| 35 | 1.00 | 1.00 | 0.98 | 0.99 | 0.99 | 1.03 | 1.03 | 1.07 |

| 55 | 1.00 | 1.00 | 0.99 | 0.99 | 0.99 | 1.02 | 1.02 | 1.04 |

Table 4.9 RWRE values of estimators for ![]() and different values of

and different values of ![]() and

and ![]() .

.

| PTE | ||||||||

| LSE | RLSE/LASSO | 0.25 | SE | PRSE | RRE | |||

| 3 | 1.00 | 3.33 | 2.60 | 1.98 | 1.66 | 2.00 | 2.31 | 3.33 |

| 13 | 1.00 | 1.54 | 1.44 | 1.33 | 1.24 | 1.33 | 1.40 | 1.54 |

| 23 | 1.00 | 1.30 | 1.26 | 1.20 | 1.15 | 1.20 | 1.23 | 1.30 |

| 33 | 1.00 | 1.21 | 1.18 | 1.14 | 1.11 | 1.14 | 1.16 | 1.21 |

| 53 | 1.00 | 1.13 | 1.11 | 1.09 | 1.07 | 1.09 | 1.10 | 1.13 |

| 3 | 1.00 | 2.86 | 2.21 | 1.73 | 1.49 | 1.87 | 2.06 | 2.88 |

| 13 | 1.00 | 1.48 | 1.38 | 1.27 | 1.20 | 1.30 | 1.35 | 1.48 |

| 23 | 1.00 | 1.28 | 1.22 | 1.16 | 1.12 | 1.18 | 1.20 | 1.28 |

| 33 | 1.00 | 1.19 | 1.16 | 1.12 | 1.09 | 1.13 | 1.15 | 1.19 |

| 53 | 1.00 | 1.12 | 1.10 | 1.07 | 1.06 | 1.08 | 1.09 | 1.12 |

| 3 | 1.00 | 2.50 | 1.93 | 1.55 | 1.37 | 1.77 | 1.88 | 2.58 |

| 13 | 1.00 | 1.43 | 1.32 | 1.22 | 1.16 | 1.28 | 1.31 | 1.44 |

| 23 | 1.00 | 1.25 | 1.19 | 1.13 | 1.10 | 1.17 | 1.18 | 1.26 |

| 33 | 1.00 | 1.18 | 1.14 | 1.10 | 1.07 | 1.12 | 1.13 | 1.18 |

| 53 | 1.00 | 1.11 | 1.09 | 1.06 | 1.05 | 1.08 | 1.08 | 1.11 |

| 3 | 1.00 | 1.25 | 1.04 | 1.01 | 0.99 | 1.38 | 1.372 | 1.69 |

| 13 | 1.00 | 1.11 | 1.02 | 1.00 | 0.99 | 1.16 | 1.15 | 1.26 |

| 23 | 1.00 | 1.07 | 1.01 | 1.00 | 0.99 | 1.10 | 1.10 | 1.16 |

| 33 | 1.00 | 1.05 | 1.01 | 1.00 | 0.99 | 1.07 | 1.07 | 1.11 |

| 53 | 1.00 | 1.03 | 1.01 | 1.00 | 0.99 | 1.05 | 1.05 | 1.07 |

Problems

- 4.1 Show that the test statistic for testing

vs.

vs.  for unknown

for unknown  is

is

and also show that

has a noncentral

has a noncentral  with appropriate DF and noncentrality parameter

with appropriate DF and noncentrality parameter  .

. - 4.2

Determine the bias vector of estimators,

and

and  in Eqs. (4.15) and (4.17), respectively.

in Eqs. (4.15) and (4.17), respectively. - 4.3 Show that the bias and MSE of

are, respectively,

(4.46)

are, respectively,

(4.46)

and

(4.47)

- 4.4 Prove under usual notation that the RRE uniformly dominates both LSE and PTEs.

- 4.5 Verify that RRE uniformly dominates both Stein‐type and its positive‐rule estimators.

- 4.6 Prove under usual notation that the RRE uniformly dominates LASSO.

- 4.7

Show that the modified LASSO outperforms the SE as well as the PRSE in the interval