7Solutions for case studies

Solution to case 1: Depreciation and advance payments

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 15 minutes |

Keywords:

Acquisition costs, depreciation and impairment, reversal of impairment, advance payments

The carpenter Karl Dach needs a new van. The van will be delivered on 18 January 20X1, payable within 1 week with a 1% discount or within 4 weeks net. Karl does not use the discount, so the van costs €28,800 net. For transfer and registration, the dealer charges €400 net. The useful life is estimated to be 5 years. The resale value after 5 years for the used vehicle is estimated at roughly €3,000.

1. Calculate the depreciation and prepare the depreciation schedule according to the straight line (linear) method. Assume that Karl uses all usual options!

Acquisition costs (€):

| Purchase price | 28,800 |

| + Transfer and registration | 400 |

| = Acquisition costs | 29,200 |

The residual value cannot be used for the financial accounting because it can be estimated only roughly (due to the principle of prudence, a reliable and precise estimation is necessary). Thus, the basis for the depreciation is the acquisition costs. With a useful life of 5 years the linear depreciation amounts to €5,840/year. Because the acquisition takes place in January it is common practice to start with the depreciation at the beginning of January, i.e. include January completely. The full annual depreciation is also used in the first year.

Tab. 7.1: Solution to case 1 1.

2. At the beginning of 20X2, Karl Dach upgrades the car with a navigation system for €2,000.What effect does this have on the depreciation schedule?

The navigation system improves the usability of the car, so the costs are subsequent acquisition costs that increase the remaining book value in January 20X2 and afterwards the annual depreciation.

Tab. 7.2: Solution to case 1 2.

3. Continuation of 2: Assume that, due to new emission regulations, the market value of a comparable (used) vehicle decreases to €6,000 on 31 December 20X2. What value must be recognized in the balance sheet on 31 December 20X2 and what are the values on the following closing dates? Why?

Because the value of the van decreases due to a new legal regulation, a permanent decrease in value is probable. Therefore, the car must be impaired to the lower market value (§ 253 sect. 3): the moderate lower-of-cost-or-market principle.

The new regulation or case gives no indication that the useful life is or should be reduced. Therefore, the depreciation continues for the remaining useful life based on the new remaining book value after impairment.

Tab. 7.3: Solution to case 1 3.

4. Continuation of 3: At the beginning of December 2016, Karl Dach receives an offer from a car dealer in Eastern Europe to buy the car for €16,000. To reinforce his offer, the dealer pays €8,000 in advance in mid-December. Karl agrees and the deal is finalized in January.

How is the advance payment recognized in the balance sheet? At what value is the car recognized in the balance sheet on 31 December 2016?

The advance payment is recognized separately from the non-current assets: If Karl is unable to deliver the van according to the contract, the car dealer will request that the advance payment be returned (and is entitled to do so):

| Debit bank | 8,000 | |

| Credit received advance payments | 8,000 |

Because of the explicit and then binding offer the reason for the impairment no longer exists. Thus, the impairment must be reversed (§ 253 sect. 5). The ceiling for the reversal stems from the historic costs, i.e. the acquisition costs reduced by the original depreciation (as if no impairment had occurred).

The historic costs at the end of 20X3 are 12.680 € (see 2). This results in a reversal of impairment of €8,680 at the end of 20X3 (see 3).

Tab. 7.4: Solution to case 1 4.

The planned sale has no further effect on the accounting (apart from the reversal of impairment). The realization principle must be applied (§ 252 sect. 1 no. 4), i.e. any proceeds and gain from the sale are to be realized if and when they are realized (if and when the sales price becomes a receivable; in the actual situation, this is typically the case after handing over the car and car documents).

Solution to case 2: Accounting policy of Victoria AG

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 30 minutes |

Keywords:

production costs, goodwill, measurement of participations/financial assets, self-generated intangible non-current assets, measurement of inventories, disagio, provisions.

Victoria AG is a mid-sized company that is specialized on production of industrial components. The company had to face high revenue decreases in 20X1 but does not want to report a loss because of an upcoming rating. Therefore, any accounting options or margins of estimation/judgement should be used in the way of a progressive/aggressive accounting policy to report the highest net result possible. Explain your accounting of the following transactions of Victoria AG, and name the relevant legal regulations according to the Commercial Code and, if necessary, the balance sheet item.

1. Based on the bad revenue situation, the finished products in stock increased significantly compared to the previous year. The following data for the products on stock are known:

–Material for production €20,000 €

–Storage costs for material €2,000

–Hourly wages of production workers €40,000

–Overtime premiums production workers €5,000

–Depreciation on production machines €8,000

–Voluntary pension benefits for administration employees €14,000

–Storage costs of finished products €6,000

–Costs of company day care centre €10,000

–Costs of research department €12,000

–Idle time costs because of continuous low orders €16,000

Production costs as basis for measurement of the company’s own products are defined in § 255 sect. 2 and 3:

–The minimum values are the direct and indirect costs for materials and for production as well as the proportionate depreciation of the production machines.

–For the maximum values, voluntary social benefits and proportionate administrative costs are added.

–Costs of distribution and sales or research are not allowed to be included.

–Idle time costs may not be included because the usual production conditions, in particular a standard use of the production capacity, must be assumed.

To report as high a profit as possible, the finished products should be measured using the maximum value of production costs.

2. Victoria AG has acquired the operating business of Bastian GmbH for €250,000; legal and economic integration is complete. The book value of the net assets at acquisition time was €100,000. The inventories are recognized at €20,000,which is €10,000 below market value. The warehouse is fully depreciated, whereas the market value amounts to €80,000. Does this result in goodwill?

If a business is acquired, goodwill results from a purchase price that is higher than the acquired net assets. Relevant for the calculation are the net assets at time value, not at book value:

| Purchase price | 250,000 | |

| − | Book value of net assets | − 100,000 |

| − | Hidden reserves inventory | − 10,000 |

| − | Hidden reserves warehouse | − 80,000 |

| = | Goodwill | 60,000 |

Goodwill must be recognized (§ 246 sect. 1) and amortized over its useful life. To report as high a net profit as possible, the useful life should be estimated to be as long as possible.

3 .Victoria AG has owned a 30% share of Jonas AG for 3 years. The shares are recognized at their acquisition costs of €200,000. The net profit of Jonas AG was a constant €30,000 during that time, an increase in the near future cannot be expected. The relevant discount rate is 6%.

This is a question of subsequent measurement of shares. If a permanent decrease in value exists, an impairment to the lower value must be recognized (§ 253 sect. 3).

The imputed value of the shares can be calculated by the present value of a perpetual annuity because the expected profits remain constant at €30,000.

where

PV = present value of perpetual annuity

A = annuity

i = discount rate

The value of the complete business of Jonas AG is €500,000, the proportionate value of 30% of the shares is therefore €150,000. An impairment of €50,000 must be recognized because the decrease in value is probably permanent (otherwise it must be explained why this decrease is assumed to be only temporary).

4. In 20X1 a new patent for an innovative production process was developed and registered. The direct costs attributable to the patent are €40,000, the proportionate indirect costs of the research and development department amount to €60,000.

An accounting option exists for non-current intangible assets that are internally generated (§ 248 sect. 2); to use this option, a clear distinction between research and development costs is necessary because only the development costs can be recognized (§ 255 sect 2), whereas research costs are prohibited from being recognized. This can be assumed here, because the direct costs of the patent and corresponding indirect costs are given.

On that basis, an option exists to recognize the patent at €100,000. To report as high a profit as possible, that option should be used.

In the tax balance sheet, a recognition is prohibited for this kind of asset. Therefore, a recognition in the commercial balance sheet results in a deferred tax liability that partially offsets the increase in the profit.

5. The crude oil on stock developed as follows in 20X1:

Tab. 7.5: Solution to case 2 5. Development of crude oil stock.

| Crude oil in barrels | €/barrel | |

| Opening balance | 100,000 | 48 |

| Purchase 5 May 20X1 | 100,000 | 56 |

| Purchase 7 July 20X1 | 300,000 | 68 |

| Purchase 9 Sept. 20X1 | 200,000 | 62 |

| Total use | 400,000 |

Calculate the value of the use of oil and of the closing balance according to LIFO and periodic average. Which method should be used based on the intention of the accounting policy?

First, the total value of the opening balance and purchases must be calculated:

Tab. 7.6: Solution to case 2 5. Development of crude oil stock – total values.

The closing balance is calculated as follows:

| Closing balance | = Opening balance + Purchases − Use = 100,000 barrels + 600,000 barrels − 400,000 barrels = 300,000 barrels |

LIFO = Last in, first out

LIFO is a measurement method that assumes a specific sequence of use: LIFO assumes that the amounts purchased last are used first; that means the unused amounts (in stock) are the oldest ones:

A total of 400,000 barrels were used, according to LIFO:

| from the last purchase: | 200,000 barrels × €62/barrel = €12,400,000 |

| from the second last purchase: | 200,000 barrels × €68/barrel = €13,600,000 |

| Total value of use: | €26,000,000 |

| Average price per barrel: | €65/barrel |

Measurement of closing balance of 300,000 according to LIFO:

| from opening balance: | 100,000 barrels × €48/barrel = €4,800,000 |

| from the first purchase: | 100,000 barrels × €56/barrel = €5,600,000 |

| from the second purchase: | 100,000 barrels × €68/barrel = €6,800,000 |

| Total value of closing balance | €17,200,000 |

| Average price per barrel | €57.33/barrel |

Periodic average: In this method, an average of the opening balance and all purchases is calculated. This average is used to measure all uses and the closing balance:

This results in a value of the closing balance of 300,000 barrels ×€61.71/barrel = €18,513,000.

This results in a use value of 400,000 barrels ×61,71 €/barrel ≈ €24,687,000.261

With regard to the intention to report as high a profit as possible, the closing balance should be measured using the periodic average.

What values are acceptable in the balance sheet if the replacement costs on closing date are

(a) €66.30/barrel or

(b) €60/barrel?

For current assets, the strict lower-of-cost-or-market principle must be applied, i.e. even only temporary decreases in value must be impaired (§ 255 sect. 4). In case (a), the market price is €66.30/barrel, so no changes need to be made because both valuations are below market price. In case (b), with a market value of €60/barrel, the closing balance must be impaired to €60/barrel if the periodic average is used; this results in an impairment of €513,000 (= €1.71/barrel ×300,000 barrels) to a market value of €18,000,000.

6. Victoria AG has machinery that was not maintained properly because of a bad liquidity situation. As of the closing date, it is not foreseeable when the maintenance will be done. The cost estimates range from €60,000 to €100,000.

Provisions for omitted maintenance must be recognized if the maintenance is executed within 3 months (§ 249 sect. 1 sent. 2).

The maintenance could be scheduled in such a way that no provision needs to be recognized because so far there are no detailed ideas when to do it, e.g. by scheduling it in May 20X2 (this is not a formal but a factual accounting option).

7. On 1 January 20X1, a long-term loan with a volume of €500,000 was taken out, with the following details: outpayment 95%, term 10 years, nominal interest 5%, full repayment at end.

The amount paid out is 95% below the amount that must be repaid, i.e. this is a disagio.

For a disagio there exists an accounting option (§ 250 sect. 3):

–recognition as interest expense in first period or

–recognition as deferred expense and distribution over loan term.

With regard to the intention to report as high a profit as possible, the disagio should be recognized as a deferred expense and distributed over time.

Solution case 3: Accounting policy of Bits and Pieces GmbH

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 20 minutes |

Keywords:

provisions, measurement of financial assets, acquisition costs and exchange rate losses, depreciation, deferred items

Bits and Pieces GmbH is a company that produces and sells gift items. The head of accounting, Mr. C. Orrect, is preparing the financial statements as of 31 December 20X1 in March 20X2.

Explain the recognition and measurement under the Commercial Code for the following transactions of Bits and Pieces GmbH. Name the relevant legal regulations and whether there are any options or margins for estimation/judgement. Options and margins of estimation should be used in such a way that net profit is minimized.

1. Mr. C. Orrect discovered in December 20X1 that the roof of the production building is leaking; he reported the leak immediately to the executive board. The cheaper estimate of costs is €11,900 (including VAT), the more expensive €23,800 (including VAT). The executive board decides that the maintenance will be done in the following year; the exact schedule is open.

A provision for omitted maintenance must be recognized if it is done within 3 months (§ 249 sect. 1). Nevertheless, there exists a factual accounting option because the timing of the maintenance can be chosen according to the accounting effect.

With the intention of reporting a profit as low as possible, the provision should be recognized and the maintenance should be scheduled for the first quarter. Because there are two plausible estimates, the higher one should be chosen (this also depends on the decision of management); but note that only net values can be recognized as a provision, i.e. €20,000 provision for omitted maintenance.

2. Based on the good financial and profitability situation of the company, during 20X1 C. Orrect acquired 500 shares of a listed blue chip company for a total of €20,000; this is considered a long-term investment. On the closing date the quoted share price is €30, but financial analysts are very optimistic about the future development of the company and its share price.

Based on the foregoing data, the acquisition costs per share are €40/share (€20,000/500 shares). The market price on the closing date is, at €30/share, significantly below that; but financial analysts remain optimistic about the future, so at that point in time this decrease in value is likely to be temporary.

For non-current financial assets there exists an accounting option: temporary decreases can be impaired but do not have to be (§ 253 sect. 3 sent. 4).

With regard to the intention to report as low a profit as possible, the shares should be impaired by €5,000 to the lower market value.

3. The procurement department received merchandise with a value of US$10,000 from an American supplier on 1 December 20X1. C. Orrect recognizes the goods on the same day at an exchange rate of US$1 = €0.6 €. The executive board wants to fully use the supplier credit of 6 weeks. On the closing date the exchange rate is US$1 = €0.8.

The measurement of the merchandise remains unchanged (acquisition costs = original value of payable, i.e. US$10,000 × €0.6/US$ = €6,000). Subsequent changes in the exchange rate are not part of the acquisition costs.

The trade payable must be increased to the higher market value based on the imparity principle (here: higher-of-cost-or-market principle): Recognition of an exchange rate loss of €2,000 to increase the payable (value of payable at closing date: US$10,000 × €0.8/US$ = €8,000).

There are no options in this case.

4. At the beginning of 20X1, a new production machine was acquired for €48,000 and recognized in the balance sheet item “machines”. So far it has not been depreciated because there are no historical values for this kind of machine. The head of production estimates a useful life between 10 and 15 years assuming constant and continuous usage.

Because a machine is an asset with a definite useful life, its acquisition costs must be depreciated over the useful life (§ 253 sect. 3).

However, the useful life must be estimated, in particular when the user has no experience with this kind of asset.

With linear depreciation (based on constant usage) the annual amount is between €4,800 and €3,200.

With regard to the intention to report as low a profit as possible, the machine should be depreciated using the shorter useful life, i.e. it should be depreciated faster at an annual amount of €4,800.

5. According to the information of the producer of the machine, a general overhaul will be necessary after 4 years. The costs for this measure in year 20X4 will probably be €20,000.

It is not possible to recognize a provision. All reasons for provisions are named in § 249 as a definitive list. Therefore, the measurement of the machine remains unchanged (apart from the annual depreciation). Whether or not subsequent acquisition costs will be incurred after a successful general overhaul (because of a substantial improvement or increase in useful life) must be decided in 20X4 and will be relevant for accounting then.

6. Bits and Pieces GmbH signed a sales contract with Light and Sound GmbH on 12 October 20X1 to produce and deliver a light organ (delivery date 30 March 20X2, fixed price of €60,000). The start of production is scheduled for January 20X2. Head of accounting C. Orrect was on holidays when the offer was calculated and signed and realizes now that his apprentice forgot to include the wages for the production workers in the calculation. The direct costs for material and production already amount to €70,000; in addition, indirect costs can be attributed to the light organ: €3,000 for material and €2,000 for production.

This is a pending transaction: Bits and Pieces GmbH has not delivered the light organ, nor has Light and Sound GmbH paid for it. Nevertheless, a loss is expected from the future fulfilment of the contract:

| Sales price | €60,000 | |

| − | Direct costs | −€70,000 |

| − | Indirect costs | −€5,000 |

| = | Expected loss | −€15,000 |

For onerous contracts, a provision must be recognized (§ 249 sect. 1). Possibilities for estimation exist only in the definition of the production costs, but not in the specific case here: Direct and indirect costs of material and production must be included.

7. For a new warehouse, a monthly rent of €5,000 is charged from 1 December 20X1 onwards. So far, no rent has been paid because of minor defects, which the landlord must fix. Nevertheless, the building is used. The rental contract states that the rent must be paid 3 months in advance.

Defects of or in a rented asset justify only to a slight and specific extent the right to reduce rent payments, in particular when the rented asset can be used. Thus, the minor defects here do not justify reduced payments.

Based on the principle of completeness, the complete payable (3 months at €5,000 each, i.e. in total €15,000) must be recognized. Based on the matching principle, only 1 month is reported as expense and 2 months in the next reporting period as deferred expenses (§ 250 sect. 1): Rental expense in 20X1 amounts to €5,000, deferred expense to €10,000.

Solution to case 4: Accounting for inventories

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 15 minutes |

Keywords:

measurement of inventories, lower-of-cost-or-market principle, closing-date principle

Bob Coal is managing director of Drilling Equipment Trading GmbH and supplies production companies with twist drills and diamond abrasive blocks. In autumn, he buys from an insolvent company first-class twist drills for €100,000 and diamond abrasive blocks for €200,000.

1. In March of the following year he prepares his financial statements:

–The price for twist drills increased, so that he has good arguments that the acquired drills could have been sold by 31 December for at least €120,000.

–Crises in Russia and Africa have led to significant price pressure for diamond abrasive blocks. The value of his blocks drops to €98,000 on 31 December, in February of the following year the market value is only €88,000. Bob Coal keeps the blocks because he thinks the prices will recover sometime in the future.

At what values do the products have to be recognized under the Commercial Code? Why? Is there a difference to German tax law? Is there an effect on the income statement?

Twist drills:

In this case, the realization principle must be applied (§ 252 sect. 1 no. 4), i.e. the gain may be recognized only if and when it is realized. On 31 December, the twist drills are still measured at their acquisition costs of €100,000. In addition, the acquisition cost principle is valid here as well: The acquisition costs are the upper limit of measurement for any asset (§ 253 sect. 1).

There is no effect on the income statement and no difference to German tax law.

In this case, the imparity principle must be applied (see above), i.e. losses must be recognized if and when they are probable, even if not realized. On that basis, the strict lower-of-cost-or-market principle is the more detailed rule for current assets (§ 253 sect. 4). Therefore, the blocks must be impaired to the lower market value of €98,000. The even lower value of February cannot be used due to the closing-date principle (§ 252 sect. 1 no. 3).

There is an additional expense (the impairment) of €102,000 in the income statement. Under German tax law only permanent decreases in value may be impaired. Therefore, the tax treatment depends on the judgement of whether or not the decrease is permanent and, if it is considered permanent, whether the impairment option is used.

2. Continuation of question 1: In the following summer the price for the diamond abrasiveblocks rises again to €150,000 and stays there until the end of the year. Nevertheless Bob Coal does not want to sell below his acquisition costs. How are the abrasive blocks recognized in the following financial statements and why? Is there an effect in the income statement (only Commercial Code)?

If the reasons for an impairment no longer exist, the impairment must be reversed (§ 253 sect. 5). Because the market price increased again, the impairment must be reversed partially to €150,000. The reversal of an impairment is an income in the income statement, i.e. income of €52,000 due to reversal of impairment.

Hints

If there exist measurement differences between the commercial balance sheet and the tax balance sheet, this may result in deferred taxes. In the current case of the diamond abrasive blocks, an impairment is necessary in the commercial balance sheet. Because a permanent decrease in value is not probable (the market prices increased again in the following year but did not recover completely), the impairment is probably not tax deductible. This is a temporary difference because it will reverse over time – at the latest, when the blocks are sold. Because the assets are valued lower in the commercial balance sheet, this will result in a deferred tax asset; for deferred tax assets in individual financial statements, there exists an accounting option (§ 274 sect. 1), i.e. the deferred tax asset can be recognized, but it does not have to be recognized.

Solution Case 5: Accounting for intangible assets

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 10 minutes |

Keywords:

recognition of intangible assets, definition of production costs, deferred taxes

The champagne winery Wochenheim AG has developed a new technology for producing champagne that is free of alcohol; the new technology should be used from the beginning of 20X1 until the end of 20X5. The technology was patented at the end of 20X0. In the context of the innovation the following costs were incurred:

| – | Personnel expenses, research department: | €500,000 |

| – | Operational expenses, research department (e.g. material): | €200,000 |

| – | Personnel expenses, development department: | €750,000 |

| – | Operational expenses, development department (e.g. material): | €300,000 |

The R&D-Department worked only on this technology.

The company is a large corporation; its effective tax rate is 30%.

(a) What accounting options exist for this new technology in the commercial balance sheet as of 31 December 20X0? Explain the different options briefly and journalize the possible entries.

This is an internally generated, intangible, non-current asset. For assets of this kind there exists an accounting option for the commercial balance sheet, i.e. the expenses for development (not for research) can be recognized as an asset (§ 248 sect. 2 and § 255 sect. 2a) or they remain expenses in the income statement.

If the technology is recognized as an asset, it must be amortized over the useful life, i.e. here probably 4 years.

Journal entry for recognition:

| Debit internally generated, intangible, non-current assets | 1,050,000 | |

| Credit own work capitalized | 1,050,000 |

(b) What accounting options exist for this new technology in the tax balance sheet as of 31 December 20X0? Explain the different options briefly and journalize possible entries.

In the tax balance sheet, there is no recognition option, i.e. research and development expenses are always expenses in the income statement of the period.

(c) What must be considered in this context for the commercial balance sheet as of 31 December 20X0 in addition? Explain briefly the possible consequences and journalize possible entries.

If the recognition option is not used, there are no differences between commercial and tax balance sheet: Nothing to consider.

If the recognition option is used, there exists a temporary difference between commercial and tax balance sheet; the difference is temporary because it will even out either by amortization or sale – at any rate, after a certain period of time, the commercial balance sheet and tax balance sheet will be in line again; the result is a deferred tax liability:

| Tax rate | × | Temporary difference | = | Deferred tax (here: liability) | |

| 30% | × | €1,050,000 | = | €315,000 | |

Corresponding to the amortization of the patent over time, the deferred tax liability is reduced/reversed. In addition, there is a restriction for profit distribution: The amount recognized as an asset minus the deferred tax liability may not be paid out as dividends: €1,050,000 − €315,000 = €735,000. Only profits in excess of this level may be distributed to the shareholders (§ 268 sect. 8).

Case study 6: Accounting policy

| Category: | Knowledge/Application/Analysis |

| Time to solve: | 15 minutes |

Keywords:

accounting policy, acquisition costs, provisions, measurement of non-current assets, measurement of current assets

Explain and argue for the following transactions if there exist any legal or factual accounting options or margins of judgement. Show as well how the use of any options or margins of judgement can affect the net result or the equity ratio:

(a) Acquisition costs

According to § 255 sect. 1, acquisition costs are defined as:

| + Purchase price |

| − Purchase price reductions (trade or cash discounts, rebates) |

| + Incidental acquisition costs |

| + Subsequent acquisition costs |

| = Acquisition costs |

All costs must be directly attributable to the acquisition (direct costs) and must be incurred until the acquired asset is ready to use (except subsequent acquisition costs – as implied by the name). Subsequent acquisition costs are incurred later but increase the usage potential of the asset or improve the asset substantially – but they are not an asset themselves. There are no legal accounting options but factual options, e.g. whether or not a cash discount is used or how a certain service is invoiced so it can or cannot be attributed to a specific acquisition (e.g. a security check can be invoiced or reported for each checked facility separately or summed up).

In addition, an estimation is necessary in different areas, e.g.

–at what point in time an asset is ready for use and

–whether a transaction is subsequent acquisition costs or just maintenance.

The higher the acquisition costs are (i.e. if factual options are used to increase the acquisition costs), the higher the net result typically is in the period of acquisition. The later the asset is ready for use, the later the depreciation or amortization starts and thus the higher the net profit in the period of acquisition. There is no clear effect on the equity ratio because this depends on the financing of the acquisition.

(b) Provisions

All reasons for recognizing a provision are listed in § 249; there are no legal options. Factual options exist for the provisions for omitted maintenance and waste disposal: They must be recognized if they are done within 3 months (maintenance) or 12 months (waste disposal); otherwise, they are prohibited. Thus, the scheduling influences the recognition.

Because provisions are uncertain liabilities, there are significant margins of judgement: Reason, amount and timing are uncertain and the settlement amount must be estimated. These estimations can be used for accounting policy; the limits are the GAAP (in particular the principle of correctness), i.e. arbitrary values that cannot be verified and understood by a third party are not allowed.

Recognition of provisions creates an additional liability and additional expenses and thus reduces net profit. In consequence, the equity ratio is reduced (this is a transaction purely on the credit side of the balance sheet).

(c) Impairment of non-current financial assets

For non-current assets in general, the moderate lower-of-cost-or-market principle must be applied, i.e. impairment must be done only if a presumably permanent decrease in value occurs; for temporary decreases in value, an impairment is not allowed. But there exists an accounting option for non-current financial assets: According to § 253 sect. 3, a non-current financial asset may be impaired even if the decrease in value is only temporary.

Margins of judgement exist in particular if no market prices are available, i.e. the value of a financial asset cannot be derived from a market price, e.g. from a stock exchange, but must be calculated using valuation models. The basic data and methods used for the valuation models typically require a lot of estimation, and so the result can be affected; typical examples are the discount rates used or the amount and timing of future cash flows that must be estimated.

All else being equal, an additional impairment or a higher impairment leads to a lower net profit and to a lower equity ratio.

(d) Measurement simplifications for current assets Several accounting options exist:

–The general principle is individual measurement (§ 252 sect. 1).

–A constant-value approach is possible for raw materials (§ 240 sect. 3).

–Group measurement for similar inventories or other moveable assets with similar value (§ 240 sect. 4): Apart from the option to group items, there exists the option to choose between a periodic average or a moving average as the basis for the initial measurement.

– Cost formulas (sequence of consumption) can be used for similar inventories (§ 256): Apart from the option to group items, there exists the option to choose between FIFO and LIFO.

All methods are equivalent, i.e. can be used alternatively, if the legal requirements are met.

Specific margins of judgement do not exist in this context.

The effect on the net results depends on the method chosen and on the development of the asset prices, i.e. there is no general rule on whether a method increases or decreases the net results. There is no clear effect on the equity ratio because this depends on the financing of the acquisition.

Hint

There exist substantial accounting options or margins of judgement in connection with other topics concerning the measurement of current assets, in particular:

–definition of production costs: whether or not optional elements are included;

–subsequent measurement (measurement simplifications are relevant for initial measurement), i.e. the strict lower-of-cost-or-market principle at the closing date. For inventories and receivables, substantial estimates are necessary. For inventories a net realizable value must be calculated, i.e. a possible sales price minus any costs incurred until sale. For receivables, any expected losses must be estimated to recognize a valuation allowance.

But these topics were not addressed in this exercise.

Solution to case 7: Consolidated financial statements (1)

| Category: | Knowledge/Application |

| Time to solve: | 15 minutes |

Keywords:

consolidation methods, consolidated financial statements

The Wine & Champagne Group consists of a parent company, Riesling AG, located in Deidesheim in Rhineland-Palatia, and Distribution GmbH located in Pforzheim.

The parent company (PC) recognized, apart from the shares in affiliated companies of €300,000, other assets of €700,000. The PC has a capital structure of 50% equity and 50% liabilities.

The subsidiary (SUB) recognizes equity of €80,000 and liabilities of €320,000. Its assets include a piece of land with a book value of €100,000 (fair value at acquisition by the PC of €200,000).

(a) Which consolidation methods do you know?

Full consolidation (§§ 300)

Proportional consolidation (§ 310)

At-equity consolidation (recognition as associated company, § 312)

(b) Prepare the balance sheets of the PC and the SUB.

Tab. 7.7: Solution to case 7 – balance sheet parent company.

Tab. 7.8: Solution to case 7 – balance sheet subsidiary.

(c) Prepare the consolidated balance sheet and journalize the necessary entries.

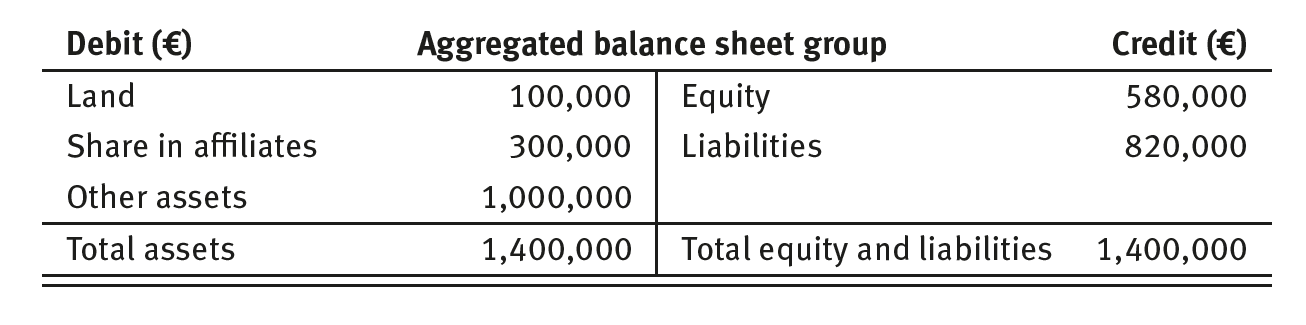

Step 1: Preparation of an aggregated balance sheet

Aggregated balance sheet of the Wine & Champagne Group (€), column form

Tab. 7.9: Solution to case 7 – aggregated balance sheet (column form).

Tab. 7.10: Solution to case 7 – aggregated balance sheet (account form).

Step 2: Capital (equity) consolidation

Offsetting shares in affiliates with equity of subsidiary (€):

| Debit equity | 80,000 | |

| Debit asset difference | 220,000 | |

| Credit shares in affiliates | 300,000 |

Step 3: Allocation of asset difference

Allocation of asset difference to revalued assets and liabilities as well as goodwill (purchase price allocation):

| Debit land | 100,000 | |

| Debit goodwill | 120,000 | |

| Credit asset difference | 220,000 |

Step 4: Preparation of consolidated balance sheet (integration of steps 2 and 3 in step 1)

Tab. 7.11: Solution to case 7 – consolidated balance sheet.

Solution to case 8: Consolidated financial statements (2)

| Category: | Knowledge/Application |

| Time to solve: | 15 minutes |

Keywords:

Consolidation methods, consolidated financial statements

Snow AG acquired the shares of Ski GmbH on 31 December 20X1 for €2million to be able in the future to offer not only ski clothes but also ski equipment. The purchase price was paid on 31 December 20X1.

Preliminary balance sheet of Snow AG of 31 December 20X1 prior to acquisition of Ski GmbH:

Tab. 7.12: Solution to case 8 – balance sheet of Snow AG prior to acquisition.

Balance sheet of Ski GmbH from 31 December 20X1:

Tab. 7.13: Solution to case 8 – balance sheet of Ski GmbH.

Additional information about the financial statements of Ski GmbH:

–The non-current assets include a fully depreciated machine that the company will continue to use; its reproduction value amounts to €200,000 at the acquisition date.

–The equity includes the full net profit of €80,000 for the business year 20X1.

–Provisions: pension provisions of €100,000 have not been recognized yet.

–Ski GmbH sells its products largely under the brand name „Solo“, which was created by the company itself. Industry experts estimate the brand value at €500,000.

(a) Prepare the consolidated financial statements and do the capital consolidation (equity). What are the corresponding journal entries?

All values in T€.

Step 1: Recognition of acquired shares

| Debit shares in affiliates | 2,000 | |

| Credit cash | 2,000 |

This results in the following adjusted balance sheet of Snow AG:

Tab. 7.14: Solution to case 8 – balance sheet of Snow AG after acquisition.

Step 2: Preparation of aggregated balance sheet for the group

Preparation of an aggregated balance sheet by adding up the corresponding items of the individual balance sheets.

In T€, PC = parent company, SUB = subsidiary

Tab. 7.15: Solution to case 8 – aggregated balance sheet (column form).

In addition, in account form:

Tab. 7.16: Solution to case 8 – aggregated balance sheet (account form).

Step 3: Calculation of asset difference (capital/equity consolidation)

Calculation of asset difference between purchase price for shares and acquired equity:

| Debit equity | 400 | |

| Debit asset difference | 1,600 | |

| Credit shares in affiliates | 2,000 |

Step 4: Allocation of asset difference

Allocation of asset difference to revalued assets and liabilities as well as goodwill (as residual); this is called purchase price allocation:

| Debit non-current assets (tangible assets) | 200 | |

| Debit non-current assets (brand) | 500 | |

| Debit goodwill | 1,000 | |

| Credit liabilities (pension provision) | 100 | |

| Credit asset difference | 1,600 |

Step 5: Integration of steps 3 and 4 in aggregated balance sheet

Tab. 7.17: Solution to case 8 – consolidated balance sheet.

(b) In what case is a purchase price allocation in the individual financial statements necessary?

If a business is acquired through the acquisition of all assets and liabilities, but not a legal entity, i.e. if a so-called asset deal occurs, the goodwill must be recognized in the individual financial statements (including the purchase price allocation); see § 246 sect. 1 sent. 4.