5Exercises on individual topics with solutions

5.1Bookkeeping and basic terms

Exercise 1: Basic accounting terms

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

You are working in the accounting team of a company at the end of March 20X1. Classify the different transactions as cash in-/outflow, expenditures/proceeds, income/expenses or output/cost. Neglect VAT.

- Delivery of 3,000 kg of raw material for €8/kg on credit.

- Cash sale of goods that were produced in March for €12,000.

- Payment of wages and salaries from bank account of €16,700 for March plus a payment of €3,300 for February.

- Payment of receivables of about €25,000.

- Sale of a used machine for €26,800 on credit. The book value of the machine is €21,800.

- Overdue notice from raw material supplier. The management decides to pay in April.

- Purchase and storage of low-value goods in cash of €5,000.

- Receipt of an invoice of around €700 from tax consultant. The consulting was conducted in early March.

- Sale and invoicing of goods produced in March worth €48,000; the customer paid €40,000 in advance. The balance is paid in March.

- Donation of €300 to church in cash.

- For the company owner an imputed salary of €8,000/month is recognized.

b) Solution

See next page.

c) Hints

Hint for 1: Because the raw materials have not been used (so far), this is only an expenditure, not an expense.

Hint for 3: The late payment for February is just a cash outflow because it was an expenditure, expense and cost in February (even if not paid).

Hint for 5: Selling non-current assets will usually not be output because it is not the primary goal of the company; in rare cases selling of non-current assets could be part of the business model, i.e. it is done on a regular, planned basis. Then this transaction could be included in output.

Tab. 5.1: Solution to exercise 1.

Hint for 7: For simplicity, low-value goods are often directly expensed (i.e. expense and cost in brackets); from a theoretical perspective this is just cash outflow and expenditure.

Hint for 9: Because €40,000 was paid in advance, the cash inflow is only €8,000; nevertheless, this advance payment was not proceeds because no change in net financial assets occurred (increase in cash and corresponding increase in liabilities, thus net effect 0).

d) References

Coenenberg et al., 2016 (2), p. 12

Jung, p. 1028

Wöhe/Döring, p. 643

Exercise 2: Basic accounting terms

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

The company you are working for buys a new company car. Explain all numbered transactions corresponding to Figure 5.1 below and give an example (e.g. field 1 is a transaction that is a cash outflow but not an expenditure).

b) Solution

Cell 1: Cash outflow, but not an expenditure

The company bought the car in the previous reporting period on credit. This results in an expenditure in the previous period, but not in a cash outflow. In the current period, the payment is made. This is a cash outflow, but not an expenditure: cash decreases, but debt decreases as well – in total, net financial assets do not change.

Another example is an advance payment that is paid to the car dealer. Cash is reduced, but a corresponding receivable is recognized (if the car dealer cannot deliver the car, the advance payment will be called back). Therefore, no change in financial assets occurred (i.e. no expenditure).

Cell 2: Cash outflow and expenditure

This is a purchase in cash, that is, the car is bought and paid for immediately. Cash is reduced, receivables and debt are unchanged, so net financial assets decrease as well.

Cell 3: No cash outflow, but expenditure

This is a purchase on credit in the current period. No changes in cash and receivables, but an increase in debt; therefore, this is an expenditure and will result in a cash flow (when paid).

Cell 4: Expenditure, no expense

An expense is a decrease in net assets; in the context of the purchase of a car, it is the depreciation of the car. In the first year, only a part of the initial expenditure is expensed (assuming a longer useful life). Therefore, the part of the expenditure that is not expensed in the first year is the remaining book value.

Cell 5: Expenditure and expense

This is the depreciation of the first year, which was also an expenditure.

Cell 6: No expenditure, but expense

This is the depreciation in all subsequent periods. The expenditure occurred in the first period, but the depreciation continues until the end of the useful life.

This part is particularly important to understand because it will be used for the preparation of a cash flow statement.

This is a theoretical case, because under current laws it is (in this context) not possible. If there were a purely tax-induced higher depreciation that is included in the financial accounting (which is currently not the case), it might not be included in cost accounting because it might distort the figures.

Another theoretical example could be that the car is not used for operating purposes (it is owned by the company but used by a charity organization – similar to a donation).

Cell 8: Expense and cost

This is the depreciation when (which is the usual case) the car is used for company purposes.

Cell 9: Cost, but not expense

These are imputed costs not included in financial accounting. A typical example would be additional depreciation based on replacement costs: If the company expects the price on a car replacement after the car’s useful life to be higher than the acquisition costs, it wants to include these expected additional expenditures in the current cost accounting (which is used, for example, to define minimum prices for price negotiations).

c) References

Coenenberg et al., 2016 (2), p. 12

Jung, p. 1028

Wöhe/Döring, p. 643

Exercise 3: Balance sheet

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Calculate from the following inventory the net assets and prepare the balance sheet!

| In T€, on 31 December | X0 |

| Land | 575 |

| Bank loans | 300 |

| Machines | 125 |

| Inventories | 400 |

| Trade receivables | 100 |

| Bank/cash | 50 |

| Trade payables | 350 |

| Other payables | 75 |

Calculation of net assets:

Now the figures need to be rearranged to produce a balance sheet: All assets on the debit side, equity and all liabilities on the credit side:

Tab. 5.2: Solution to exercise 3 – balance sheet.

c) References

Coenenberg et al., 2016 (2), p. 61

Jung, p. 1032

Exercise 4: Asset accounts

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Post the following transactions to the account “trade receivables” (in Euros):

| Opening balance | 7,500 |

| Sale to customer on credit | 15,500 |

| Bank transfer by customer | 12,000 |

| Cash payment by customer | 1,000 |

What is the closing balance? Close the account assuming no other transactions occurred.

b) Solution

The opening balance of an asset account is on the debit side. The sale increases the receivables and must be posted on the debit side, whereas the bank transfer and the cash payment reduce the receivables (because they are settled) and are thus posted on the credit side.

Tab. 5.3: Solution to exercise 4 – trade receivables.

After posting the transactions the account is not balanced: the sum of debit entries is larger than the sum of all credit entries, i.e. the account has a debit balance. At year end this is called the closing balance. To close the account, this balance must be transferred to the closing balance sheet with the following journal entry:

| Debit balance sheet | 10,000 | |

| Credit trade receivables | 10,000 |

This results in the following balanced account:

Tab. 5.4: Solution to exercise 4 – closed account.

Note:

For an asset account, the opening balance is typically on the debit side and the closing balance is typically on the credit side.

c) References

Coenenberg et al., 2016 (2), p. 95

Weygandt et al., 2013, p. 52

Exercise 5: Liability accounts

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

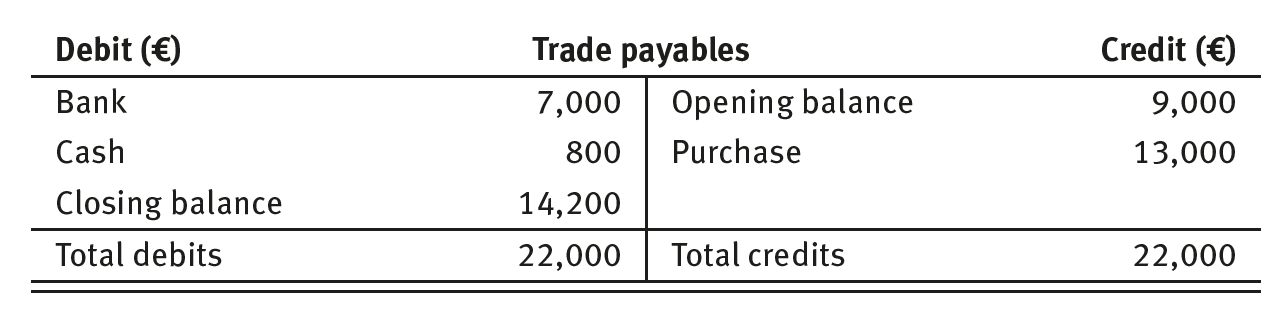

Post the following transactions to the account “trade payables” (in Euros):

| Opening balance | 9,000 |

| Purchase from supplier on credit | 13,000 |

| Bank transfer to supplier | 7,000 |

| Cash payment to supplier | 800 |

What is the closing balance? Close the account assuming no other transactions occurred.

b) Solution

The opening balance of a liability account is on the credit side. The purchase increases the payables and must be posted on the credit side, whereas the bank transfer and the cash payment reduce the payables (because they are settled) and are thus posted on the debit side.

Tab. 5.5: Solution to exercise 5 – liability account.

After posting the transactions the account is not balanced: the sum of debit entries is smaller than the sum of all credit entries, i.e. the account has a credit balance. At year end this is called the closing balance. To close the account, this balance must be transferred to the closing balance sheet with the following journal entry:

| Debit trade payables | 14,200 | |

| Credit balance sheet | 14,200 |

This results in the following balanced account:

Tab. 5.6: Solution to exercise 5 – closed account.

For a liability account, the opening balance is typically on the credit side and the closing balance is typically on the debit side.

c) References

Coenenberg et al., 2016 (2), p. 95

Weygandt et al., 2013, p. 52

Exercise 6: Accounting procedures

| Category: | Knowledge/Application |

| Time to solve: | 15 minutes |

a) Exercise

Split the following balance sheet into asset and liability accounts (i.e. open the accounts), journalize and post the transactions. Finally, close the accounts and prepare the closing balance sheet (ignore VAT).

Tab. 5.7: Solution to exercise 6 – opening balance.

Transactions to be posted:

- Purchase of a machine on credit for €15,000.

- Transfer of trade payables in a medium-term loan; volume €8,000.

- Purchase of inventories with cash for €1,000.

- Payment of a supplier invoice by bank transfer: €9,000.

b) Solution

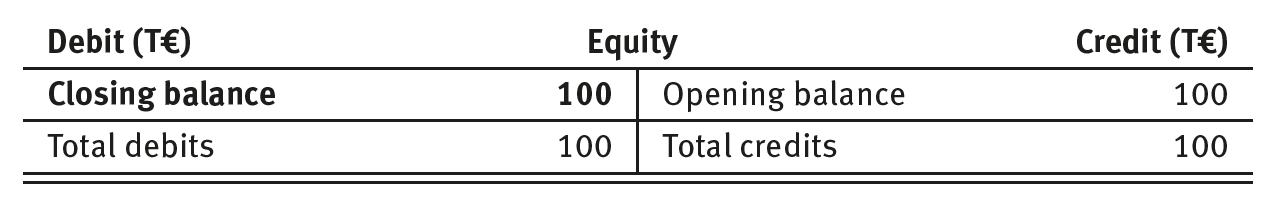

Step 1: Opening of accounts

Opening an account means transferring the opening balance from the opening balance sheet to the individual account260:

Tab. 5.8: Solution to exercise 6 – opening of accounts (1).

| Debit (T€) | Tangible assets | Credit (T€) | |

| Opening balance | 125 | ||

Tab. 5.9: Solution to exercise 6 – opening of accounts (2).

| Debit (T€) | Inventory | Credit (T€) | |

| Opening balance | 50 | ||

Tab. 5.10: Solution to exercise 6 – opening of accounts (3).

| Debit (T€) | Bank | Credit (T€) | |

| Opening balance | 100 | ||

Tab. 5.11: Solution to exercise 6 – opening of accounts (4).

| Debit (T€) | Cash | Credit (T€) | |

| Opening balance | 25 | ||

Tab. 5.12: Solution to exercise 6 – opening of accounts (5).

| Debit (T€) | Equity | Credit (T€) | |

| Opening balance | 100 | ||

Tab. 5.13: Solution to exercise 6 – opening of accounts (6).

| Debit (T€) | Loans | Credit (T€) | |

| Opening balance | 80 | ||

Tab. 5.14: Solution to exercise 6 – opening of accounts (7).

| Debit (T€) | Trade payables | Credit (T€) | |

| Opening balance | 120 | ||

Step 2: Journalizing and posting

The journal entries for the transactions are as follows:

| 1. Debit tangible assets | 15 T€ | |

| Credit trade payables | 15 T€ | |

| 2. Debit trade payables | 8 T€ | |

| Credit loans | 8 T€ | |

| 3. Debit inventory | 1 T€ | |

| Credit cash | 1 T€ | |

| 4. Debit trade payables | 9 T€ | |

| Credit bank | 9 T€ |

Posting these entries to the accounts leads to:

Tab. 5.15: Solution to exercise 6 – posting to accounts (1).

| Debit (T€) | Tangible assets | Credit (T€) | |

| Opening balance | 125 | ||

| Transaction 1 | 15 | ||

Tab. 5.16: Solution to exercise 6 – posting to accounts (2).

| Debit (T€) | Inventory | Credit (T€) | |

| Opening balance | 50 | ||

| Transaction 2 | 1 | ||

Tab. 5.17: Solution to exercise 6 – posting to accounts (3).

| Debit (T€) | Bank | Credit (T€) | |

| Opening balance | 100 | Transaction 4 | 9 |

Tab. 5.18: Solution to exercise 6 – posting to accounts (4).

| Debit (T€) | Cash | Credit (T€) | |

| Opening balance | 25 | Transaction 3 | 1 |

Tab. 5.19: Solution to exercise 6 – posting to accounts (5).

| Debit (T€) | Loans | Credit (T€) | |

| Opening balance | 80 | ||

| Transaction 2 | 8 | ||

Tab. 5.20: Solution to exercise 6 – posting to accounts (6).

This leads to the following balances:

| Tangible assets: | Debit balance | 140 T€ | |

| Inventory: | Debit balance | 51 T€ | |

| Bank: | Debit balance | 91 T€ | |

| Cash: | Debit balance | 24 T€ | |

| Equity: | Credit balance | 100 T€ | (unchanged) |

| Loans: | Credit balance | 88 T€ | |

| Trade payables: | Credit balance | 118 T€ |

Step 3: Closing the accounts and preparing the closing balance sheet

At year end, the closing balances are transferred back to the closing balance sheet by the following closing journal entries:

| 1. Debit closing balance | 140 T€ | ||

| Credit tangible assets | 140 T€ | ||

| 2. Debit closing balance | 51 T€ | ||

| Credit inventory | 51 T€ | ||

| 3. Debit closing balance | 91 T€ | ||

| Credit bank | 91 T€ | ||

| 4. Debit closing balance | 24 T€ | ||

| Credit cash | 24 T€ | ||

| 5. Debit equity | 100 T€ | ||

| Credit closing balance | 100 T€ | ||

| 6. Debit loans | 88 T€ | ||

| Credit closing balance | 88 T€ | ||

| 7. Debit trade payables | 118 T€ | ||

| Credit closing balance | 118 T€ |

The closed accounts look as follows:

Tab. 5.21: Solution to exercise 6 – closing of accounts (1).

Tab. 5.22: Solution to exercise 6 – closing of accounts (2).

Tab. 5.23: Solution to exercise 6 – closing of accounts (3).

Tab. 5.24: Solution to exercise 6 – closing of accounts (4).

Tab. 5.25: Solution to exercise 6 – closing of accounts (5).

Note in this case that the opening balance equals the closing balance because there were no transactions.

Tab. 5.26: Solution to exercise 6 – closing of accounts (6).

Tab. 5.27: Solution to exercise 6 – closing of accounts (7).

This results in the following closing balance sheet:

Tab. 5.28: Solution to exercise 6 – closing balance.

c) References

Coenenberg et al., 2016 (2), p. 95

Weygandt et al., 2013, p. 52

Exercise 7: Income and expense accounts

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Journalize the following transactions (neglect VAT):

| 1. | Rendering of services on credit: | €200,000. |

| 2. | Bank transfer of wages and salaries: | €135,000. |

| 3. | Bank transfer of insurance premiums: | €4,500. |

| 4. | Incoming bank transfer for a sublet office: | €800. |

| 5. | Transfer of monthly rent for a warehouse: | €2,500. |

This results in the following journal entries (values in €:)

| 1. | Debit trade receivables | 200,000 | |

| Credit sales revenue | 200,000 | ||

| 2. | Debit wages and salaries | 135,000 | |

| (or: Personnel expenses) | |||

| Credit bank | 135,000 | ||

| 3. | Debit insurance expenses | 4,500 | |

| Credit bank | 4,500 | ||

| 4. | Debit bank | 800 | |

| Credit rental income | 800 | ||

| 5. | Debit rental expenses | 2,500 | |

| Credit bank | 2,500 |

c) Hints

Recall that income is defined as an increase in net assets, i.e. of equity. Equity increases require a credit entry, so income is recorded on the credit side. Conversely, expenses are defined as a decrease in equity, which is recorded on the debit side. Thus, expenses are entered on the debit side.

d) References

Coenenberg et al., 2016 (2), p. 107

Weygandt et al., 2013, p. 52

Exercise 8: Income and expense accounts (2)

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

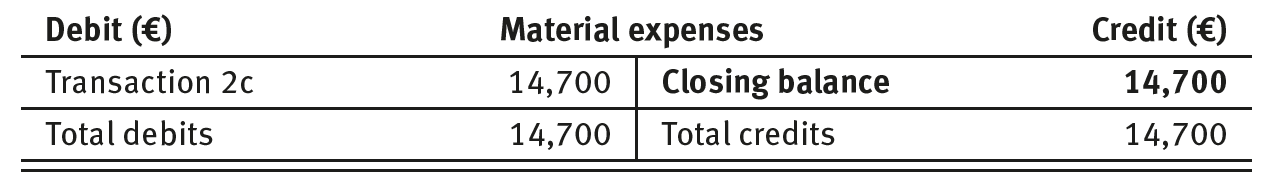

Journalize the following transactions of an automotive supplier that produces steel springs (neglect VAT).

- Purchase of steel bars for €25,000 and other materials for €800; both purchases are on credit.

- Requisition of these materials from storage for production of steel springs.

- Bank transfer of wages and salaries of €15,000.

- Sale of finished products for €75,000 on credit.

Close the income and expense accounts and post the change in equity. Does the company make a profit or a loss?

The journal entries are as follows (values in €):

| 1. | Debit raw materials Credit trade payables | 25,800 | 25,800 |

| 2. | Debit material expenses Credit raw materials | 25,800 | 25,800 |

| 3. | Debit salaries and wages Credit bank | 15,000 | 15,000 |

| 4. | Debit trade receivables Credit sales revenue | 75,000 | 75,000 |

Assuming no other transactions occurred, the closing balances are debit balances for material expenses (€25,800) and salaries and wages (€15,000) and a credit balance for sales revenue (€75,000). This results in the following closing entries:

| 1. | Debit income statement Credit material expenses | 25,800 | 25,800 |

| 2. | Debit income statement Credit salaries and wages | 15,000 | 15,000 |

| 3. | Debit sales revenue Credit income statement | 75,000 | 75,000 |

The income statement shows as a consequence a credit balance:

| Sales revenue | 75,000 | (credit) |

| − Material expenses | 25,800 | (debit) |

| − Salaries and wages | − 15,000 | (debit) |

| = profit | 34,200 | (credit) |

The income statement shows a credit balance because the sum of the credit entries is larger than the sum of the debit entries, i.e. all income entries are larger than all expense entries; thus, the company makes a profit of 34,200 €. This profit increases equity (recall that equity is reported on the credit side and therefore credit entries increase equity); the entry is as follows:

| Debit income statement | 34,200 | |

| Credit equity | 34,200 |

c) References

Coenenberg et al., 2016 (2), p. 107

Weygandt et al., 2013, p. 52

Exercise 9: Selling and purchasing with VAT

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Journalize the following transactions.

- Purchase of raw materials on credit for €25,000 in total.

- Sale of products for €35,000 net against direct bank transfer.

- Reception of an invoice from the tax consultant of €1,500 net.

- Invoicing of service fees of a total of €4,500.

- Received advance payment of a customer of €11,900.

- Made advance payment of €15,000 to a supplier.

b) Solution

This results in the following journal entries (values in €):

Hint

If the total amount is €25,000, it includes the VAT (assuming the regular rate of 19%). To calculate the net amount, the total must be divided by 1.19 (119%). The corresponding input tax is calculated by multiplying the net amount by 0.19 (19%).

Hint

On the one hand, advance payments are subject to VAT (if the underlying transaction is subject to VAT), thus only the net value is recorded in the advance payment account. On the other hand, this is a pure balance sheet transaction, i.e. a received advance payment is a liability, because the customer could request the money back if the company does not fulfil the sales contract (consequently, a paid advance payment is a receivable because the company will request the money back if the supplier does not fulfil the purchase contract).

c) References

Coenenberg et al., 2016 (2), p. 138

Exercise 10: Discounts

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercises

Journalize the following transactions:

- Purchase of merchandise for €18,000 net. The supplier grants a cash discount of 1% that is used.

- Sale of products on credit for €7,500 net. The company grants a cash discount of 2% to the customer. The customer uses the discount.

b) Solution

Values in €

c) References

Coenenberg et al., 2016 (2), pp. 152 and 155

Exercise 11: Comprehensive exercise on accounting procedures

| Category: | Knowledge/Application |

| Time to solve: | 20 minutes |

a) Exercise

A company submits the following balance sheet at the beginning of the business year:

Tab. 5.29: Solution to exercise 11 – opening balance.

The following transactions occur:

- Purchase of a new machine on credit: €27,500 net.

- Purchase of raw materials on credit: €15,000 net; a cash discount of 2% is offered and used. After a couple of days, all of the material is used for production.

- Payment of interest for loans: €5,000.

- Taking out a new loan: €30,000.

- Sale of products for €45,000 net on credit; a cash discount of 2% is offered and used.

Questions

(a) Open accounts.

(b) Journalize transactions.

(c) Post transactions to accounts and close all accounts.

b) Solution

Values in €

(a) The opening balances are transferred to the accounts; see the detailed accounts in (c).

(b) Journal entries:

Note that only the real acquisition costs (€15,000 initial purchase price minus the cash discount of €300) can be expensed.

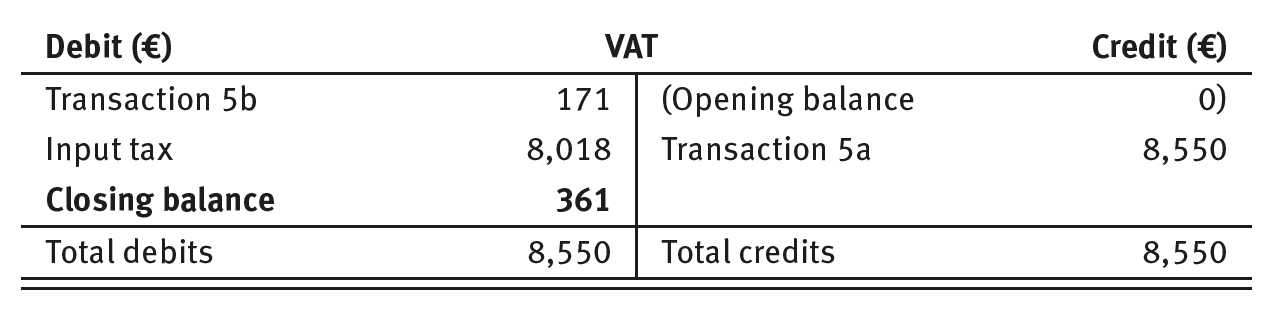

(c) Posting and closing of accounts

The accounts, including the posting of the transactions and the closing balances, look as follows:

Tab. 5.30: Solution to exercise 11 – posting and closing of accounts (1).

Tab. 5.31: Solution to exercise 11 – posting and closing of accounts (2).

Tab. 5.32: Solution to exercise 11 – posting and closing of accounts (3).

Tab. 5.33: Solution to exercise 11 – posting and closing of accounts (4).

Tab. 5.34: Solution to exercise 11 – posting and closing of accounts (5).

Note that the account input tax is closed to the account VAT because the balance is lower than the balance on the VAT account (i.e. in total it is a liability).

Tab. 5.35: Solution to exercise 11 – posting and closing of accounts (6).

For the profit, see the income statement below.

Tab. 5.36: Solution to exercise 11 – posting and closing of accounts (7).

Tab. 5.37: Solution to exercise 11 – posting and closing of accounts (8).

Tab. 5.38: Solution to exercise 11 – posting and closing of accounts (9).

Tab. 5.39: Solution to exercise 11 – posting and closing of accounts (10).

Tab. 5.40: Solution to exercise 11 – posting and closing of accounts (11).

Tab. 5.41: Solution to exercise 11 – posting and closing of accounts (12).

Note that all income and expense accounts are closed to the income statement:

Tab. 5.42: Solution to exercise 11 – posting and closing of accounts (13).

Note that the income statement is closed to equity (see above). This results in the following closing balance sheet:

Tab. 5.43: Solution to exercise 11 – closing balance.

c) References

Coenenberg et al., 2016 (2), p. 95

5.2Exercises on fundamental concepts and GAAP

Exercise 1: Generally Accepted Accounting Principles

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

The GAAP contain the principle of comparability. Explain this principle. What is its purpose?

b) Solution

§ 252 sect. 1 no. 1 and 6,

additionally for corporations and partnerships according to § 264a:

§ 265 sect. 1, § 284 sect. 2 no. 3

The principle of comparability has as its purpose ensuring that the information in the financial statements is comparable to the information in the earlier financial statements.

The rules described in what follows for corporations apply also to partnerships that do not have at least one natural person as general partner (§ 264a).

Commparability must be distinguished further in:

Formal comparability

Comparability in presentation: The structure of the financial statements of a corporation must be retained unless there are good reasons for not doing so; good reasons are typically that the true and fair view is improved. For corporations the detailed structures of §§ 266, 275 must be applied; any changes in the structure must be explained in the notes.

Substantial comparability

Measurement methods must be retained, corporations must present deviations in the notes with additional explanations of how the changes affect the asset, financial state and performance situation of the company.

c) References

Bacher, Chapter 3.2.1

Beck’scher Bilanzkommentar, §§ 252, 265 and 284

Coenenberg et al., 2016 (1), p. 38

Exercise 2: Generally Accepted Accounting Principles

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

The following transactions violate the GAAP. Please name the relevant principles in detail!

Example: When measuring assets, one machine is measured by its liquidation (breakup) value.

Violation of the going concern principle!

Several provisions are grouped together and measured in sum:

Violation of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . !

The trade receivables are netted with the trade payables:

Violation of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . !

Expenses are always recognized when they are paid:

Violation of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . !

On the closing date, inventories are measured at their acquisition cost because lower market values are considered temporary:

Violation of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . !

b) Solution

Several provisions are grouped together and measured in sum:

Violation of the principle of individual measurement!

§ 252 sect. 1 no. 3

If not specifically allowed, any asset or liability must be measured separately from all others.

The trade receivables are netted with the trade payables:

Violation of the principle of no offsetting!

§ 246 sect. 2 sent. 1

Assets and liabilities must be reported separately; only under rare circumstances is netting acceptable.

Expenses are always recognized when they are paid:

Violation of the principle of accrual basis!

§ 252 sect. 1 no. 5

Income and expenses are reported on an accrual basis, not a cash basis, i.e. income or expenses are recognized if and when they occurs, not when paid.

On the closing date, inventories are measured at their acquisition cost because lower market values are considered temporary:

Violation of the principle of prudence/imparity principle (strict lower-of-cost-or-market principle)!

§ 252 sect. 1 no. 4

Losses must be recognized if they are probable. For current assets this is applied as the strict lower-of-cost-or-market principle, which means that any decrease in value must be recognized. This is true even if the decrease in value is only temporary.

c) References

Bacher, Chapter 3.2.1

Beck’scher Bilanzkommentar, see the named §§ in the solution

Coenenberg et al., 2016 (1), p. 38

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Singleholiday.com GmbH has the following data:

| 20X1 | 20X2 | |

| Balance Sheet Total Assets (in million €) | 4,100 | 6,500 |

| Sales Revenue (in million €) | 8,100 | 12,750 |

| Average number of employees | 50 | 50 |

- Can the company use size-dependent simplifications for the 20X2 financial statements?

- What would happen if the company showed the same data in 20X3 as in 20X2?

- What would happen if the company had placed a listed bond?

b) Solution

§ 267

- Singleholiday.com GmbH is a corporation, i.e. if applicable it could use size-dependent simplifications. The criteria for a medium-sized company according to § 267 are fulfilled in 20X2 (total assets > €6,000 million and sales revenue > €12,000 million), but only for 1 year. Therefore, the company is still classified as small and can use the corresponding simplifications.

- Now the company fulfils the criteria for a medium-sized company in two consecutive years and is therefore classified as medium-sized.

- A capital-market-oriented company is treated as a large company, independently of any size criteria. A company is capital market oriented if it has shares, bonds or other securities that are listed on a stock exchange.

c) References

Bacher, Chapter 2.1

Beck’scher Bilanzkommentar, § 267

Coenenberg et al., 2016 (1), p. 28

Exercise 5: Acquisition and production costs

| Category: | Knowledge |

| Time to solve: | 10 minutes |

a) Exercise

Describe similarities and important differences between acquisition costs and production costs. Name the different components that must, may or need not be included.

b) Solution

§ 255 sect. 1, 2, 2a and 3

Acquisition costs and production costs are both measures of the initial valuation of assets. Whereas acquisition costs are used for acquired assets, production costs are used for assets produced by the company itself.

Acquisition costs include any costs that are directly attributable to the acquisition of the asset until the acquired asset is ready for use. Production costs include also the direct costs of production, but also indirect costs.

Detailed definition of acquisition costs:

Purchase price

| − Discounts and rebates |

| + Incidental acquisition costs |

| + Subsequent acquisition costs |

| = Acquisition costs of asset |

Only values net of VAT are included in the acquisition costs.

Detailed definition of production costs:

| Direct material costs |

| + A fair part of indirect material costs |

| + Direct manufacturing costs |

| + A fair part of indirect manufacturing costs |

| + Special direct costs of manufacturing |

| + A fair part of depreciation of non-current assets used in production |

| = Minimum value of production costs |

| + A fair part of general administrative costs (optional) |

| + A fair part of voluntary social security and employee benefits (optional) |

| + Borrowing costs for the production process (optional only if a direct link to the |

| specific production process exists) |

| = Maximum value of production costs |

Not to be included are research costs and sales and distribution costs.

Bacher, Chapter 3.2.2.4

Beck’scher Bilanzkommentar, § 255

Coenenberg et al., 2016 (1), p. 95

Exercise 6: Acquistion costs

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Import AG purchases a stable, stationary crane for the unloading of containers. The crane costs €595,000 including VAT. Included in this amount are service costs for the first year after installation of €7,140, costs for test runs including the used materials of €4,640. For transport, Drive Inn GmbH charged €5,950 including VAT. The transportation risk was borne by Import AG itself. The controlling department posted imputed costs of €8,120 for this. For the evaluation of several technical facilities, an expert, Dr. Weiß, charged €3,940 including VAT. For a security check and acceptance of the crane, TÜV charged €9,520 including VAT. For installation and electrical connection, Import AG received invoices from other service companies totaling €10,000 net. The invoiced purchasing price was paid by Import AG in accordance with the sales contract after deducting a 10% discount.

What acquisition costs of the crane must be recognized?

b) Solution

§ 255 sect. 1

Tab. 5.45: Solution to exercise 6.

c) Hints

The precise calculation of acquisition costs can be a quite difficult and time-consuming task in real life – particularly when large and complex assets, such as ships, (large) buildings and powerplants, are acquired.

d) References

Bacher, Chapter 3.2.2.4

Beck’scher Bilanzkommentar, § 255

Coenenberg et al., 2016 (1), p. 95

Exercise 7: Revenue recognition

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

On the basis of what criteria can it be judged whether or not a revenue or gain has been realized or whether or not a receivable already exists?

b) Solution

Based on the realization principle, income or revenue can be recognized only when realized. To put that in concrete terms, four criteria must be fulfilled:

- A contract exists: There exists a legally binding agreement. In legal terms, there are no specific requirements concerning the form of the agreement for most cases, a purely oral or an implicit agreement is sufficient; because of the lack of evidence, this is usually not best practice.

- Goods delivered/services rendered: The seller or service provider fulfilled all his obligations completely, so that the buyer now owes payment.

- Risks have been transferred: In case of moveable goods, the goods must be at the disposal of the buyer or a transfer of risk must have occurred, i.e. the risk of accidental loss or destruction must have been transferred to the buyer.

- The contract can be billed: If the contract defines additional conditions about the delivery of a good or the rendering of services (e.g. succesful test run of a machine), they must be fulfilled before payment is due, and all the additional conditions must be met before revenue is realized.

c) Hints

German accounting follows the “completed-contract method”: As the name implies, a contract must be completed before revenue can be recognized. In international accounting other recognition principles, e.g. percentage of completion, are acceptable and used.

The exact definition of transfer of risk is particularly important for exporting or importing transactions over long distances because of the transportation risk. Therefore, the International Chamber of Commerce in Paris edited the so-called Incoterms that clearly define the conditions of delivery for a contract. Within the conditions of delivery, the definition of the transfer of risk is an essential element.

d) References

Bacher, Chapter 3.2.1

Beck’scher Bilanzkommentar, § 252 no. 44

5.3Exercises on non-current assets

Exercise 8: Definition of non-current assets

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

Define the term non-current assets. In which way or to what extent can a company influence the classification of assets as non-current?

b) Solution

§ 247 sect. 2

All assets that are intended to serve a business continuously must be classified as non-current. Thus, classification depends on the business purpose of each asset. To the extent the company can and wants to influence this purpose (subjectively, depending on its individual intentions), the classification can be influenced. For example, an acquired piece of land can be split into two parts, where one part is used continuously for the business and is therefore reported as a non-current asset, whereas the other part can be sold on short notice and so is classified as a current asset. Whether the piece of land is split up and one part is sold depends on the wishes and decision of the company.

c) References

Bacher, Chapter 3.2.1.1

Beck’scher Bilanzkommentar, § 247 sect. 2 nos. 350–361

Coenenberg et al., 2016 (1), p. 138

Exercise 9: Structure of non-current assets

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

What is the structure of non-current assets? Give two practical examples of each category.

b) Solution

§ 266 sect. 2 A

The typical structure according to § 266 is as follows:

–Intangible assets, such as patents, software, licences or goodwill.

–Tangible assets, such as land and buildings, machines, vehicles or office equipment.

–Financial assets, such as shares in or loans to affiliated companies, participations and loans to them, other long-term loans.

The legal structure requires further details for each category.

c) Hints

This structure is mandatory for corporations. Sole proprietorships and partnerships do not have a specific legal requirement to detail non-current assets (§ 247 sect. 1); nevertheless this structure is commonly used by them as well.

Advance payments are reported corresponding to the asset that has been paid for in advance, i.e. if the company pays in advance for a software, that will be classified as non-current, and the advance payment is reported as an intangible asset (in a separate line item of the intangible assets).

d) References

Bacher, Chapter 3.2.1.1

Beck’scher Bilanzkommentar, § 266, nos. 59–82

Coenenberg et al., 2016 (1), p. 138

| Category: | Knowledge |

| Time to solve: | 10 minutes |

a) Exercise

Is goodwill an asset? Explain your judgement briefly and explain the rules for measuring goodwill in the commercial balance sheet and in the tax balance sheet.

b) Solution

Recognition in commercial balance sheet § 246 sect. 1 sent. 4

Measurement in commercial balance sheet § 253 sect. 1 sent. 1 and 2

Recognition in tax balance sheet § 5 sect. 2 EStG

Measurement in tax balance sheet § 6 sect. 1 no. 1 EStG, § 7 sect. 1 sent. 3 EStG

There is a distinction between acquired goodwill and internally generated goodwill.

For internally generated goodwill, a recognition is prohibited by both the Commercial Code and German tax law. Internally generated goodwill comes into existence during the usual course of business by creating an organization for the business, a customer base or the quality or experience of employees. It does not fulfil the recognition criteria for an asset (see below).

Acquired goodwill is the difference between the consideration for a purchased business and the identifiable net assets acquired; a bit informal: if you pay more for a business than you can identify as assets and liabilities, this premium is goodwill.

Acquired goodwill does not fulfil the general recognition criteria as an asset but is treated like an asset with a definite useful life. The general recognition criteria are as follows:

Economic benefit: This is fulfilled usually because goodwill represents the future profit potential of the acquired business that cannot be attributed to individual assets or liabilities.

Separate measurability: This is fulfilled, and the value can be measured as the difference between the value of the acquired business (purchase price/consideration) and the acquired net assets.

Independent marketability: This cannot be fulfilled because goodwill cannot be sold independently of its business.

Commercial Code: According to § 246 sect. 1 sent. 4, acquired goodwill is treated as an asset with a definite useful life and must be measured according to the general rules of § 253 sect. 3, i.e. it must be amortized over its useful life. If a presumably permanent decrease in value occurs, an additional impairment to the lower fair value is mandatory. If the reasons for an earlier impairment no longer exist, the lower value must be kept, i.e. there is no reversal of impairment for acquired goodwill. The latter is a difference from all other assets.

German tax law: Acquired goodwill must be recognized according to § 5 sect. 2 EStG andmust be amortized over 15 years according to § 7 sect. 1 sent. 3 EStG. As for all assets, an impairment option exists if a permanent decrease in value occurs.

c) Hints

The estimated useful life of goodwill must be explained in notes (§ 285 no. 13).

If – applicable only in rare cases – the useful life of goodwill cannot be estimated, 10 years must be used (§ 253 sect 3 sent. 3 and 4).

If the useful life applied according to the Commercial Code differs from the 15 years that must be used under German tax law (which will usually be the case), this will result in temporary differences, which may result in deferred taxes. If the useful life according to the Commercial Code is shorter, this results in a deferred tax asset; if the useful life according to the Commercial Code is longer (which can hardly be the case), it would result in a deferred tax liability.

If goodwill appears in consolidated financial statements, i.e. due to a share deal, no deferred taxes are recognized (§ 306 sent. 3).

d) References

Bacher, Chapter 3.1.1 and Chapter 3.3.1.1

Beck’scher Bilanzkommentar, § 246, nos. 82 and 83 as well as § 253, nos. 671–676

Coenenberg/Haller/Schultze, p. 184

Exercise 11: Goodwill

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Akquise AG acquires the business of Target GmbH with all assets and liabilities for a purchase price of €500,000 (asset deal). Target GmbH reports assets with a book value of €800,000 and equity of €100,000. The following information is additionally available:

–land: hidden reserves of €120,000,

–internally generated brand with a fair value of €250,000.

–After acquisition the legal department of Target GmbH will no longer be needed. The expected severance payments amount to €200,000.

Prepare the balance sheet of Target GmbH before acquisition.

How is the asset deal to be recognized in the books of Akquise AG? Show the journal entry for the integration of the transaction (one debit or credit item per line).

§ 246 sect. 1 sent. 4

Balance sheet of Target GmbH before acquisition:

Tab. 5.46: Solution to exercise 11.

Calculation of goodwill:

| Purchase price | 500 T€ | |

| Minus net assets at time value, i.e. | ||

| Assets | 800 T€ | |

| + Hidden reserve in land | 120 T€ | |

| + Internally generated brand | 250 T€ | |

| − Liabilities | 700 T€ | |

| − Provision for severance payments | 200 T€ | |

| = Net assets at time value | +270 T€ | |

| = Goodwill (purchase price − net assts | +230 T€ |

Journal entry:

c) References

Bacher, chapters 3.1.1 and 3.3.1.1

Coenenberg et al., 2016 (1), p. 184

Exercise 12: Presentation of non-current financial assets

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

Describe briefly in key words the differences between the following balance sheet items:

–Shares in affiliated companies

–Participations

–Non-current securities

b) Solution

§ 271

Shares in affiliated companies

Affiliated companies are companies that are consolidated within the same consolidated financial statements. They are controlled by the parent company that owns the shares or one controls the other (§ 290). An investment must be reported here if a controlling interest exists in another company depending on the specific legal form, e.g. common stock for a stock company.

Shares in affiliated companies typically represent a majority of voting rights.

Participations

Participations are shares of companies (s.a.), in which the reporting company has a substantial interest, but no control, e.g. because it does not hold the majority of voting rights. Nevertheless the shares are intended to serve as a permanent connection among the businesses.

Participations typically represent voting rights of 20 up to 49.9% – so substantial influence is given, but no control.

Non-current securities

Securities that are intended to continuously serve the business, i.e. are held long term, are reported in this item. It is essential that the claims be securitized and, therefore, tradeable. Equity instruments, such as shares, and debt instruments, such as bonds, are reported in this item. But an instrument is reported here only if it is tradeable and cannot be classified as being related to affiliated companies (shares in affiliated companies or borrowings to affiliated companies) or to participations (participations or borrowings to participations), i.e. if the voting rights usually do not exceed 20%.