3.1.6Equity

From an accounting point of view, equity equals net assets, i.e. it is the residual of assets and liabilities. From a legal perspective, equity defines on the one hand the claims of shareholders on the company; on the other hand it defines what is liable to creditors in case of insolvency. A third perpective is the controlling view: How much of the equity was paid in from the outside (i.e. individual claims of shareholders on the company, in particular voting rights) and how much was earned and retained in the company (i.e. can be claimed by the shareholders)?

For proprietorships and partnerships, there are no specific requirements regarding how to report equity; the GAAP, in particular the principle of clarity and transparency, must be fulfilled. Because these legal forms have at least one natural person that is fully personally liable, further regulation is not considered necessary.

Corporations, on the other hand, have limited liability, and more detailed information is required: The reporting of equity is twofold: on the one hand, subscribed capital and capital reserves, which have been paid in from outside, and on the other hand, revenue reserves, retained earnings and net profit/loss which have been earned by the company.

3.1.6.1Subscribed capital and capital reserves Subscribed capital

Subscribed capital is capital that is liable to creditors. For corporations, it is registered in the company register. It is recognized at its nominal value (§ 268 sect. 1).

Under German company law, corporations can be founded with only partial payment of the subscribed capital:

Tab. 3.9: Minimum capital requirements.

| Minimum capital | Minimum payment | |

| Stock company | €50,000 | Min. 25% |

| (Aktiengesellschaft AG) | (§ 7 AktG) | (§ 36a sect. 1 AktG) |

| Limited liability company | €25,000 | Min. 50%* |

| (Gesellschaft mit beschränkter Haftung GmbH) | (§ 5 GmbHG) | (§ 7 sect. 2 GmbHG) |

* To be more precise: For each share at least 25% must be paid in (i.e. the ratio can be different for each share), but in total for all shares 50% of the minimum capital must be reached.

If this option for partial payment is used, shareholders are nevertheless personally liable for the money that has not been paid in so far. For a creditor on the other hand, it is important to know both: the total amount of subscribed capital and the amount that is at the moment available to the company because if it becomes necessary to obtain the portion that has not been paid in so far, the legal enforcement will take more time and usually increase expenses.

Thus, the Commercial Code prescribes reporting in the balance sheet both the subscribed capital and the amount that has not been paid in and was not called up (§ 272 sect. 1)132:

Example

A stock company is founded with the minimum capital of €50,000; the shareholders agree to pay in only 50% of that, and they do so. The reporting is as follows (figures in Euros):

Tab. 3.10: Example of partial payment (1).

| A. | Equity | |

| 1.Subscribed capital | 50,000 | |

| − Not paid-in and not called-up capital | 25,000 | |

| Called-up capital | 25,000 |

If additional capital is called up by the company, but not yet paid in, it is recognized as being receivable from shareholders (i.e. as an asset and increased equity; § 272 sect. 1).

Let us continue the example:

Assume the shareholders decide to call up additional capital of €10,000 but do not pay until the closing date. The reporting changes as follows:

Tab. 3.11: Example of partial payment (2).

| A. | Equity | ||

| 1. | Subscribed capital | 50,000 | |

| − Not paid-in and not called-up capital | 15,000 | ||

| Called-up capital | 35,000 | ||

Capital reserves

Capital reserves are any additional payments by shareholders in equity that do not increase the subscribed capital.

The most common case is the issuance of new shares for a price that is higher than the nominal value; this excess price is called agio. The agio is completely recognized in the capital reserves.

An agio can be combined with partial payment of subscribed capital, but the agio must always be paid in fully (§ 36a sect. 1 AktG).133 Capital reserves are measured at their nominal value.

Special topic: Acquisition and sale of own shares

A corporation can acquire and later resell its own shares. Legally, this is not restricted to listed shares, but this is the most common case. For stock companies, in most cases the acquisition is limited to 10% of total issued shares (§ 71 sect. 2 AktG).

For the acquisition and sale of its own shares, specific rules must be observed:

–When a company acquires its own shares, the nominal value of these shares must be deducted from the subscribed capital, and the difference between the nominal value and the acquisition cost must be deducted from the revenue reserves. Incidental acquisition costs are expenses from the period (§ 272 sect. 1a).134

–If the shares are resold, the deductions are reversed. If a gain is realized (i.e. sales price is higher than acquisition price), this gain is recognized in the capital reserves. A loss remains as a reduction in revenue reserves. Costs for the sale are expenses from the period (§ 272 sect. 1b).135

3.1.6.2Revenue reserves and retained earnings

Revenue reserves are profits of a company that are formally transferred to revenue reserves to be retained within the company (§ 272 sect. 3). They are measured at their nominal value.136

Revenue reserves are affected by the point in time when the shareholders decide how to use the profit:

–No decision about use of profit

Shareholders have not decided how to use the profit until the preparation of the financial statements. The categories of equity look as follows (this is the structure of § 266):

Tab. 3.12: Presentation of equity given no decision about the use of profit.

| A. | Equity | ||

| I. | Subscribed capital | ||

| II. | Capital reserves | ||

| III. | Revenue reserves | ||

| 1. | Legal reserves | ||

| 2. | Reserves for shares of a controlling entity | ||

| 3. | Statutory reserves | ||

| 4. | Other revenue reserves | ||

| IV. | Profit/loss carry forward | ||

| V. | Net profit/loss of year | ||

–Decision on total use of profit (§ 268, sect. 1)

When financial statements are prepared, the shareholders may have already decided that the complete profit will either be paid out as a dividend or allocated to revenue reserves; no funds will remain. Then the categories of equity look as follows: There are no profit/loss carry forward and net profit/loss for the year because the money is completely allocated.137

Tab. 3.13: Presentation of equity given total use of profit.

| A. | Equity | ||

| I. | Subscribed capital | ||

| II. | Capital reserves | ||

| III. | Revenue reserves | ||

| 1. | Legal reserves | ||

| 2. | Reserves for shares of a controlling entity | ||

| 3. | Statutory reserves | ||

| 4. | Other revenue reserves | ||

–Decision on the partial use of profit (§ 268 sect. 1)

When the financial statements are prepared, the shareholders may have decided already that a part of profit (and/or profit carried forward) is either paid out as dividend or allocated to the revenue reserves, but there is an amount left. This remaining amount is aggregated and recognized as “retained earnings”.138

Tab. 3.14: Presentation of equity given partial use of profit.

| A. | Equity | ||

| I. | Subscribed capital | ||

| II. | Capital reserves | ||

| III. | Revenue reserves | ||

| 1. | Legal reserves | ||

| 2. | Reserves for shares of a controlling entity | ||

| 3. | Statutory reserves | ||

| 4. | Other revenue reserves | ||

| IV. | Retained earnings | ||

Presentation

If the equity of a corporation is more than offset by losses, the excess losses (i.e. those losses not covered by the equity) must be reported on the asset side as “Losses not covered by equity” (§ 268 sect. 3).139

If equity is presented given a partial use of profit, the different components of retained earnings must be reported in the balance sheet or in the notes (§ 268 sect. 1).

Stock companies must extend the income statement by the following items to reconcile net profit/loss with retained earnings (if applicable; § 158 AktG); the reconciliation can be carried out in the notes as well:

| Net profit/loss of the period | |

| ± | Profit/loss carry forward |

| + | Transfers from capital reserves |

| + | Transfers from revenue reserves |

| − | Transfers to revenue reserves |

| − | Profit distributions |

| = | Retained earnings |

An additional category of equity according to IFRS is other comprehensive income (OCI). Changes in the value of assets or liabilities that should not affect the income statement are directly recognized in OCI (IAS 1.82A). This is not possible according to the Commercial Code.

3.1.7Provisions

In the first part of this section, the general approach to accounting for provisions is explained. In the second part, the specific topics concerning provisions for pensions and similar obligations are explained.

3.1.7.1Accounting for provisions

Recognition

Provisions are uncertain liabilities. The uncertainty may relate to the reason or the amount of the obligation. Because of the principle of completeness, uncertain liabilities need to be included in financial statements if they are probable. Probable means, typically, that there are more arguments for its existence than against.140

The principle of individual measurement must be applied as much to provisions as to any other assets and liabilities. On the other hand, if there are many similar transactions that might result in future expenses, for example product warranties, the only way to measure them reasonably and effectively is to group them together; this is acceptable because the group measurement (§ 240 sect 4.) can be applied to provisions as well.141

The recognition of a provision (or its increase) results in an expense in the current period, but not in an expenditure or cash outflow because payment will be made in the future (similar to depreciation or amortization).

§ 249 defines all reasons for the recognition of a provision; for any other reason, a provision may not be recognized (§ 249 sect. 2; see Figure 3.3).

Provisions for uncertain liabilities (§ 249 sect. 1 sent. 1)

Any liability that is uncertain, but probable in reason or amount, must be recognized. There is no legal recognition option, but a factual one: If the probability is estimated too low, a recognition is not possible.142

Uncertain liabilities include not only legal but also constructive obligations, which are obligations that arise from past behaviour that cannot be avoided by a company.143 Uncertain liability implies, nevertheless, that a liability already exists, meaning a past event results in an obligation in the future. Due to the matching principle (as part of the realization principle), expenses need to be recognized corresponding to the income, meaning if a past event (e.g. sale of a product) resulted in income and will probably result in future expenses (e.g. warranty services), these expenses should be recognized in the same period as the income or in the earliest period when they become probable.144

Typical examples for provisions for uncertain liabilities are

–provisions for litigation,

–provisions for (legal) warranty services,

–provisions for taxes,

–provisions for pensions (see below).

Provisions for warranty service without legal obligation (§ 249 sect. 1 no. 2)

These obligations are partially included in the provisions for uncertain liabilities as long as a constructive obligation exists. With this specific regulation, warranty services without legal obligation and without constructive obligation must also be recognized as provisions. The legislator wanted to make sure that any provision for warranty services will be tax deductible (because of the principle of congruence).145

Provisions for onerous contracts (§ 249 sect. 1 sent. 1)

Whereas a provision for uncertain liabilities is recognized for the uncertain effects of a past event, a provision for an onerous contract is recognized for an expected future loss of a pending transaction. A pending transaction is one in which none of the parties has fulfilled its obligations (e.g. under a sales contract, the seller has not delivered the products and the buyer has not paid). Usually, pending transactions are not accounted for because it is assumed that the assets or services exchanged are at least of equal value, i.e. no loss will be incurred. Sometimes, even if the transaction is still pending, a loss may be expected when the contract is fulfilled; this situation is called an onerous contract. Because of the imparity principle, a loss must be recognized when it becomes probable; thus, a provision for onerous contracts must be recognized in such a case.146

Pending transactions and, in consequence, onerous contracts can occur in all areas of business:147

Provisions for omitted maintenance or waste disposal (§ 249 sect. 1 no. 1)

So far, all provisions have been external obligations, i.e. obligations to a third party. In two specific cases, only internal obligations must be recognized as well: If maintenance was omitted, meaning it would have been necessary but was not carried out, and if it is made up within 3 months after the closing date, the upcoming maintenance expense must be recognized as provision.148

Because of the explicit time limit, a factual recognition option exists here: If the omitted maintenance is scheduled within 3 months, it must be recognized. If it is scheduled later, it is not allowed to be recognized.

The same logic applies to omitted waste disposal that is made up within 12 months.149

Initial measurement

According to § 253 sect. 1, provisions are measured with the settlement amount necessary to fulfil the obligation based on reasonable commercial assessment. This implies150

–a necessity to estimate; the estimation of a range is possible; nevertheless, deliberate over- or undervaluations are not allowed;

–an estimation of the complete settlement amount. One’s own potential claims or receivables may not be deducted, but must be recognized as assets if they fulfil the recognition criteria;

–the estimation of future price and cost developments, i.e. the settlement amount must be estimated for the time of settlement.

In addition, long-term provisions must be discounted to the present value using a 7-year-average market rate congruent with the term of the provision. This rate is published monthly by the German central bank (§ 253 sect. 2).151

Subsequent measurement

If the estimate for the settlement amount changes, the measurement of the provision must be adjusted (increase and decrease).152

Changes in the term of the provision or in the interest rates will lead to changes in the present value. The corresponding changes must be reported as interest income or expense in the income statement (§ 277 sect. 5).

If the reasons for a provision no longer exist, it must be reversed (§ 249 sect. 2).

Presentation

Corporations must present a split of “other provisions” in the notes if they are material (§ 285 no. 12).153

IDW RS HFA 4 “Zweifelsfragen zum Ansatz und zur Bewertung von Drohverlustrückstellungen” – Specific questions about the recognition and measurement of provisions for onerous contracts.

IDW RS HFA 34 “Einzelfragen zur handelsrechtlichen Bilanzierung von Verbindlichkeitsrückstellungen” – Specific questions about the accounting for provisions for uncertain liabilities according to the Commercial Code.

IDW RH HFA 1.009 “Rückstellungen für die Aufbewahrung von Geschäftsunterlagen sowie für die Aufstellung, Prüfung und Offenlegung von Abschlüssen und Lageberichten nach § 249 Abs. 1” – Provisions for storage of documents and for preparation, auditing and publication of financial statements and management reports according to § 249 sect. 1.

Important differences to German tax law

The recognition of provisions for onerous contracts is prohibited under tax law (§ 5 sect. 4a EStG).

Long-term provisions must be discounted at a discount rate of 5.5% – independent of any market situations (§ 6 sect. 1 no. 3a EStG).

Expected future price or cost increases may not be included in the settlement amount; the calculation of the settlement amount must be based on current conditions (§ 6 sect. 1 no. 3a EStG).

Important differences to IFRS

IAS 37 defines the general accounting for provisions, but there are specific rules in other standards, for example IAS 19 for employee benefits. Provisions for internal obligations (omitted maintenance or waste disposal, warranty services without obligation) cannot be recognized (IAS 37.14). For provisions in connection with restructuring, specific criteria for recognition exist (IAS 37.72).

Some transactions that are typically classified as provisions according to the Commercial Code are classified as accruals (and, in consequence, debt, according to IAS 37.11), for example non-invoiced audit fees for current financial statements or holiday leave not taken are reported as provision according to the Commercial Code, but as accrual according to IFRS. Long-term provisions must be discounted at a market-oriented pre-tax rate that reflects the risks of the provision (IAS 37.45 and 47) if the effect of discounting is material.

3.1.7.2Specifics for pension provisions

Recognition

A company can use different ways to grant its employees retirement benefits in the future:154

–Defined contribution plans, where the employer must pay certain contributions but does not guarantee a specific retirement benefit. This is the case if, for example, the employer pays insurance premiums on behalf of its employees. These contributions paid are expenses from the given period; no provision is recognized.

–Pension trusts: An independent organization guarantees a certain retirement benefit. The employer pays defined contributions. If the employer is not liable for retirement benefits (in case the pension trust cannot fulfil its obligations), this is treated as an expense from the given period. If the employer is liable for a defined level of retirement benefits, this is called an indirect pension agreement.

–Direct pension agreements: The employer promises to pay its employees defined retirement benefits directly; this is an uncertain liability and must be recognized as provision.

The accounting for pension provisions has changed over time; due to the long term of the provisions, the transitional rules remain relevant in some cases:155

–Direct pension agreements granted before 1 January 1987: recognition option according to Art. 28 sect. 1 EGHGB.

–Direct pension agreements granted on or after 1 January 1987: recognition requirement (§ 249 sect. 1).

–Indirect pension agreements: These are contingent liabilities and need not be recognized (see subsequent discussion in Chapter 3.1.9). In addition, there exists a recognition option whereby, even if such liabilities change from contingent to effective, they do not have to be recognized (Art. 28 sect. 1 EGHGB).

§ 246 sect. 2 requires that assets be deducted from the pension provision (so-called plan assets) if

–these assets are not accessible to creditors and

–these assets serve only the purpose of fulfilling liabilities of pensions or similar obligations.

If the value of the assets is higher than the provision, a specific balance sheet item “asset surplus from netting” must be used (§ 266 sect. 2).156

Initial and subsequent measurement

A provision must be recognized at its settlement amount based on reasonable commercial assessment (as any other provision). The Commercial Code does not prescribe a specific measurement method. This implies that

–trends in salary and pension development,

–employeefluctuationand

–probabilities of employee mortality or invalidity

must be taken into account and that the value must be discounted. If an employee has already retired, the present value of future payments is recognized.157 If the employee is working for the company and will retire sometime in the future, the provision is accumulated because it is assumed that the employee will earn the retirement benefits over time. This means that the present value of the future retirement benefits is distributed over the working time of the employee. The methods differ in how this distribution is done in detail:158

–Partial-value method: The present value is distributed over the employee’s entire working life (even if the retirement benefits were granted later). Typically, this results in a higher one-time expense at the beginning if the start of work for the company differs from the date of granting of retirement benefits.

–Current-value method: The present value is distributed over the time period from the granting of retirement benefits until retirement.

–Projected unit credit method (IAS 19): Only that part of the present value that corresponds to the work history (i.e. has already been earned) is discounted to the closing date.

Any change in the value of the provision must be recognized as an expense (or, in the rare circumstances of a decrease, as an income).

The discount rate is a 10-year average corresponding to the remaining term of the provision; for simplification purposes a remaining term of 15 years can be assumed (§ 253 sect. 2). The discount rate is published by the German central bank.159

If plan assets are used, they must be measured at their fair value, even if the value increases above the acquisition costs (§ 253 sect. 1). This is an explicit contradiction of the realization principle; to make sure, these gains above the acquisition costs cannot be paid out as dividend; a profit distribution restriction exists for them (§ 268 sect. 8).160

Corporations must report in the notes the measurement method used and the actuarial assumptions applied, for example discount rate, salary trends and mortality probabilities (§ 285 no. 24).161

Further readings

IDW RS HFA 3 “Handelsrechtliche Bilanzierung von Verpflichtungen aus Altersteilzeitregelungen” – Accounting for partial retirement obligations according to the Commercial Code.

IDW RS HFA 30 “Handelsrechtliche Bilanzierung von Altersversorgungsverpflichtungen” – Accounting for retirement obligations according to the Commercial Code.

IDW ERS HFA 30 “Handelsrechtliche Bilanzierung von Altersversorgungsverpflichtungen” – Accounting for retirement obligations according to the Commercial Code – draft version.

Important differences to German tax law

§ 6a EStG defines the recognition and measurement for pension provisions:

–A pension provision may be recognized only for employees who are at least 27 years old.

–The partial value method must be applied.

–A discount rate of 6% must be used.

Important differences to IFRS

IAS 19 defines recognition and measurement for pension provisions:

–If an obligation is a defined benefit plan, it must be recognized (no option for indirect obligations).

–The projected unit credit method must be applied.

–The discount rate must reflect the interest rate of high-quality corporate bonds (if those are not available, then of government bonds).

–Changes in actuarial assumptions (i.e. actuarial gains and losses) are recognized in other comprehensive income, that is, directly in equity, not in the income statement.

3.1.8Debt/payables

Recognition

Debt and payables are certain liabilities (in contrast to provisions as uncertain liabilities). They are recognized if the general recognition criteria are fulfilled. If debt is taken on with a disagio, meaning the outpayment amount is lower than the repayment amount, then § 250 sect. 3 provides a recognition option: The disagio can be recognized in the first period completely as an interest expense or it is recognized as a deferred expense and distributed over the term of the debt.162 If debt is taken on with an agio, the agio must always be recognized as deferred income and distributed over the term of the debt.163

Initial measurement

Debt is measured using the settlement amount (253 sect. 1). Debt that is repaid in annuities is measured at the present value of the future payments. The discount rate applicable is a 7-year average corresponding to the term of the obligation; as a simplification a term of 15 years can be assumed (§ 253 sect. 2). Other long-term debt (except with repayment in annuities) is not discounted.164

Subsequent measurement

The higher-of-cost-or-market principle must be applied, i.e. if the value of a debt or payable increases, this increase must be recognized as an expense, whereas a decrease in value is only recognized when it is realized (§ 252 sect. 1 no. 4).165

Presentation

Corporations may deduct openly the received advance payments on orders (§ 266 sect. 3 C.3) from inventories166 if the advance payment is for inventories; this results in a reduction of total assets and (all else being equal) an improved equity ratio.

In addition, corporations must report:167

–All debt with a term of less than 1 year for each balance sheet item (in the balance sheet or in the notes; § 268 sect. 5);

–All debt with a term of more than 1 year for each balance sheet item (in the balance sheet or in the notes; § 268 sect. 5);

–All debt with a term of more than 5 years for each balance sheet item (in the notes; § 285 no. 1.a);

–All debt that is collateralized by mortgages, pledged assets or similar rights for each balance sheet item with a description of the collateral used (in notes; § 285 no. 1.b);

–All debt that comes into existence legally after the closing date if the amount is material (in the balance sheet or in the notes; § 268 sect. 5).

Typically, all these details are aggregated in one table reported in the notes.

If a disagio is recognized as a deferred expense, a corporation must report the corresponding amount separately in the balance sheet or in the notes (§ 268 sect. 6).168

Further readings

IDW RS HFA 22 “Zur einheitlichen oder getrennten handelsrechtlichen Bilanzierung strukturierter Finanzinstrumente” – Aggregated or separated accounting for structured financial instruments according to the Commercial Code.

Important differences to German tax law

The principle for measuring debt under tax law is different: All debt must be discounted at 5.5% (like long-term provisions) except if (§ 6 sect. 1 no. 3 EStG)

–it is short term (i.e. less than 1 year),

–it carries interest itself or

–itisanadvancepayment.

A disagio may not be recognized as interest in the first period but must always be recognized as deferred expenses and then distributed over the term of the debt.

Important differences to IFRS

See remarks on financial instruments in Chapter 3.1.4.

3.1.9Contingent liabilities

Contingent liabilities are obligations that are currently not an economic burden (i.e. their fulfilment is not probable at the moment), but they may become a liability depending on future events. Typical examples are as follows:

–Collateral for third-party liabilities: As long as the third party fulfils its obligations, the collateral is not used and therefore there is no liability; but if the third party fails to fulfil its obligations, the provider of the collateral must fulfil the obligation on its own; under this condition, the collateral becomes a liability;

–Guarantees for a third party;

–Guarantees for a bill of exchange or a cheque.

Recognition

Contingent liabilities are not recognized in the balance sheet (§ 251).

Presentation

All companies must report the total of contingent liabilities “below” the balance sheet (because they need not prepare notes). Contingent assets or receivables may not be offset from contingent liabilities (§ 251).169

Corporations must report the contingent liabilities in the notes (§ 268 sect. 7)170:

–Split up into the different categories of contingent liabilities,

–Contingent liabilities related to pension provisions or affiliated or associated companies must be reported separately.

Further readings

IDW RH HFA 1.013 “Handelsrechtliche Vermerk- und Berichterstattungspflichten bei Patronatserklärungen” – Necessary reporting about letters of comfort according to the Commercial Code.

3.1.10Specific topics

3.1.10.1Deferrals and accruals

Recognition

Deferrals and accruals must be recognized if the recognition of an expense or income and the corresponding payment or remuneration differ. This follows the principle of completeness and the accrual basis.

Deferrals

Expenditures before the closing date must be recognized as deferred expenses if they correspond to expenses for a certain time after the closing date (§ 250 sect. 1). This is necessary in order to report the expenses in the period in which they occur.

It is important that the time, typically a time period, of the expenses is known and reliably fixed, for example based on a contract; a fixed minimum period is considered

sufficient, but a simple estimate is not. Otherwise, a recognition as a deferred expense is not possible and the expenditure is recognized as an expense of the current period (based on the imparity principle).171

Typical examples are

–prepaid rent,

–prepaid interest,

–prepaid insurance premiums or taxes if the tax is paid for a period of time, such as a vehicle tax.

For deferred income, basically the same deliberations apply. Proceeds before the closing date must be recognized as deferred income if they correspond to income for a certain time after the closing date (§ 250 sect. 2). Based on the realization principle, deferred income is recognized more easily even if the time period is not defined but could be defined, meaning deferred income must be recognized if it is obvious that a part of the proceeds is not income from the current period.172

Accruals

Accrued receivables or liabilities must be recognized if income or an expense was incurred in the current period but the corresponding proceeds or expenditures will occur in the future (see Figure 3.6).

Typical examples are

–rent that is paid at the end of the rental period,

–interest that is paid at the end of the borrowing period.

Initial measurement

There are no specific measurement rules.

Subsequent measurement

The deferred items must be reversed to the extent that the expense or income is realized.

Presentation

No specific requirements.

3.1.10.2Deferred taxes

Recognition

Deferred taxes arise if the value of a balance sheet item in the commercial balance sheet differ from the value in the tax balance sheet. The consequence is that the tax that must be paid (a so-called current tax) will not match the pre-tax profit in the commercial income statement, i.e. depending on the kind of difference, the current tax is relatively too high or too low. Corporations must recognize deferred tax liabilities and have an option to recognize deferred tax assets (§ 274).

Example

Recall the accounting option for internally generated, non-current, intangible assets: Assume a company recognizes a internally generated software that will be used for its own internal organization (value 100 T€, useful life of 4 years); in the tax balance sheet such an asset may not be recognized. Therefore, we have a difference, more precisely a temporary difference, because the difference will even out as the software is amortized. Let us assume there are no other differences between the commercial and tax balance sheet; the applicable tax rate is 30% and the pre-tax profit before recognition is in both cases 200 T€. For simplicity, it is assumed there is no amortization in the first year.

Situation without deferred taxes, year 1173:

Tab. 3.15: Example of deferred taxes (1).

The additional income of 100 in the commercial income statement may not be recognized in the taxable profit. On the other hand, the current tax is based on the taxable profit of 200 T€: that results in a tax rate of 30% in a current tax expense of 60 T€. This is recognized in the commercial income statement. Thus, the effective tax rate shown in the commercial income statement is 60/300 = 20%, which is too low.

In the following years, the situation changes as follows (all else remains equal; only the amortization of the software must be recognized):

Tab. 3.16: Example of deferred taxes (2).

Because the software could not be recognized in the tax balance sheet, the amortization is not allowed to reduce the taxable profit. Thus, the current tax does not change. In the commercial balance sheet, the effective tax rate is now too high: 60/175 = 34.3%.

Comparing the two years we see that in year 1 the company reports too little taxes (compared to the commercial pre-tax profit) and in the subsequent years the company reports too high taxes. This can be offset by a deferred tax liability that is recognized when recognizing the software and reversed corresponding to its amortization. This deferred tax liability is calculated by applying the tax rate to the difference between the commercial and tax balance sheet.

Situation with deferred tax, year 1

Tab. 3.17: Example of deferred taxes (3).

In consequence, the effective tax rate shown is 90/300 = 30%, as expected.

In the subsequent years, the effect reverses because the deferred tax liability is reversed:

Tab. 3.18: Example of deferred taxes (4).

In consequence, the effective tax rate shown is again 52.5/175 = 30%, as expected.

As in the example, a deferred tax liability reflects a future tax burden, i.e. in the future the current tax is too high compared to the commercial values.

On the other hand, a deferred tax asset reflects a future tax relief, i.e. in the future the current tax is too low compared to the commercial values.

As in the example, the deferred tax is calculated by multiplying the applicable tax rate by the difference between the commercial and tax balance sheet, but only temporary differences are used. Temporary differences are differences that will reverse over time (not necessarily on a scheduled basis like a difference in depreciation, but at a certain point in time, such as by a sale). Permanent differences cannot be basis for a deferred tax calculation. The Commercial Code applies the temporary concept like IFRS.174

A future tax relief exists

–if assets in the commercial balance sheet are valued lower than in the tax balance sheet or

–if liabilities in the commercial balance sheet are valued higher than in the tax balance sheet.

This results in a deferred tax asset.

A future tax burden exists (conversely)

–if assets in the commercial balance sheet are valued higher than in the tax balance sheet or

–if liabilities in the commercial balance sheet are valued lower than in the tax balance sheet.

This results in a deferred tax liability.

In overview:

Tax loss carry forwards that also represent a future tax relief can serve as the basis for deferred tax assets if they can be recovered within 5 years, i.e. if in the next 5 years sufficient taxable profit will be generated (§ 274 sect. 1 sent. 4).

For deferred tax assets there exists a recognition option; for deferred tax liabilities recognition is mandatory.175

Typical examples of transactions that result in deferred taxes according to German GAAP and German tax laws are given in the following table:176

Tab. 3.19: Examples of deferred tax assets and liabilities.

| Commercial balance sheet | Tax balance sheet |

| Resulting in an optional deferred tax asset | |

| Recognition of a provision for onerous contracts | Recognition prohibited |

| Discounting of provisions with a discount rate of lower than 5.5% (6% for pension provisions) | Discounting with 5.5% (6% for pension provisions) mandatory |

| Recognition of a disagio as direct expense | Recognition of a disagio as deferred expense mandatory |

| Amortization of a goodwill with a useful life of less than 15 years | Amortization of 15 years mandatory |

| Impairment of an asset for only temporary decreases in value (financial assets or current assets) | Impairment prohibited |

| Tax loss carry forward | Not applicable |

| Resulting in a deferred tax liability | |

| Recognition of internally generated, non-current, intangible assets | Recognition prohibited |

| Discounting of provisions with a discount rate of higher than 5.5% (6% for pension provisions) | Discounting with 5.5% (6% for pension provisions) mandatory |

Initial measurement and subsequent measurement

As mentioned earlier, a deferred tax asset or liability is calculated by multiplying the temporary differences between commercial and tax balance sheet by the applicable tax rate (on an item-by-item basis). The applicable tax rate is the one that will probably be valid when the difference reverses, i.e. enacted but not yet applicable changes in the tax law must be taken into account. Deferred tax assets or liabilities are not discounted. If a future tax relief or burden can no longer be expected, the corresponding deferred tax must be reversed.177

For one legal entity, usually either a deferred tax asset or a deferred tax liability is reported. In § 274 sect. 1 a presentation option is included, i.e. it is possible to report deferred tax assets and liabilities separately.178

Important differences to IFRS

IAS 13 follows the same concept. Material differences will result primarily from differences in balance sheet items.

3.1.10.3Hedge accounting

Hedge accounting is a fairly new topic in the Commercial Code; it was first implemented in 2009. Before that it was accepted practice under restrictive conditions, but a legal regulation was lacking.179

The principle of prudence and the realization and the imparity principle derived from it necessitate a regulation for hedge accounting: If, for example, a company plans to offset changes in value in a specific asset with a financial instrument, without hedge accounting any gains (e.g. of the financial instrument) may not be recognized until realized (realization principle), whereas the corresponding losses (e.g. of the asset) must be recognized (imparity principle). This would lead to an inappropriate and misleading reporting.

§ 254 states that companies can aggregate underlying transactions with financial instruments to a valuation unit for the purpose of offsetting opposite changes in value or cash flow due to similar risks. For the valuation unit certain measurement rules do not apply to the extent and for the time that the changes in value or in the cash flows offset each other.

This should be interpreted as an option, i.e. hedge accounting can be used, but does not have to be used; other opinions (i.e. a requirement of hedge accounting) exist.180

Underlying transactions181

§ 254 states that the following underlying transactions can be part of a valuation unit:

–assets; this excludes goodwill or contingent assets;

–liabilities; this excludes equity or contingent liabilities;

–pendingtransactions;

–expected transactions that have a high probability, i.e. so-called anticipating hedges are explicitly included.

Underlying transactions can be aggregated with financial instruments to a valuation unit (if all conditions are met). The term financial instruments is not defined in the Commercial Code. A financial instrument can be viewed as any contractual arrangement that gives one party a claim to cash or cash equivalents and the other party an obligation to pay cash or cash equivalents or that leads to an equity instrument of the latter party. This includes, typically, for example, receivables of any kind, debt and payables of any kind, securities, moneymarket instruments and financial derivatives. Commodity derivatives are explicitly included (§ 254 sent. 2).182

Hedge relationship

A valuation unit may be created only if the purpose of the financial instruments is to offset similar risks of the underlying transaction. This implies183

–a dedicated hedge intention of the company, which should be documented;

–similar risks of the underlying and the financial instrument, for example interest, currency, default or other risks are relevant for both;

–micro and macro/portfolio hedges are acceptable;

–the development of the financial instrument will probably offset changes in value or changes in cash flows of the underlying transaction (prospective effectivity);

–partial hedging of amounts or times seems acceptable;

–the hedge relationship is (retrospectively) effective; but the Commercial Code does not prescribe specific methods or thresholds to measure effectivity.

Documentation

§ 254 does not require a specific document for the closing date, nor is the documentation necessary to create the valuation unit. Nevertheless, based on general documentation principles and to give the necessary information for the notes (see below), it is necessary to prepare solid documentation of

–the underlying transactions and the financial instruments of a valuation unit,

–the hedge intention for creating the valuation unit,

–the prospective effectivity of the hedge and

–the retrospective effectivity of the hedge.184

Accounting for hedges

For the valuation unit the following measurement rules are applied differently:

–principle of individual measurement (§ 252 sect. 1 no. 3);

–principle of prudence, realization and imparity principle (§ 252 sect. 1 no. 4);

–acquisition or production cost as ceiling for assets (§ 253 sect. 1);

–impairment of assets (§ 253 sects. 3 and 4);

–recognition of provision for onerous contracts (§ 249 sect. 1).

Theses rules are not applied to each part of the valuation unit (underlying transactions and financial instruments) individually but to the combination of the parts to the extent that a hedge relationship exists and is effective.

The Commercial Code does not prescribe a specific accounting method. For the effective part of a hedge, the recommended method is the net hedge presentation method: Unrealized gains and losses are not recognized because they offset each other (“freezing method”). Other methods are possible under certain conditions. The ineffective part of a hedge must be treated according to the usual rules.185

Notes

Corporations must furnish additional information if they use hedge accounting (§ 285 no. 23):

a)Description of valuation units:

–Atwhat values are assets, liabilities, pending transactions or high-probability transactions included;

–in what kinds of valuation units; possible categories are micro hedge, macro hedge and portfolio hedge;

–to hedge against what risks;

–as well as the amount of risks hedged with the valuation units; this is the amount of impairment of an asset or the higher valuation of a liability that has not been recognized because of the hedge accounting.186

b)Explanation of hedged risks

Why, to what extent and for what risks do changes in value or changes in cash flows offset each other, including the methods of measuring? Possible methods for a micro hedge are the critical term match method or, for complex hedges, statistical correlations or sensitivity analysis, as well as the dollar offset method or the hypothetical derivative method.187

c)Explanation of transactions expected to occur with a high probability that are included in valuation units.

This information can be given in the notes or in the management report.

Further readings

IDW RS HFA 35 “Handelsrechtliche Bilanzierung von Bewertungseinheiten” – Accounting for valuation units according to the Commercial Code.

Important differences to German tax law

Whereas the accounting in the commercial balance sheet is in general the basis for the tax balance sheet, different views exist about specific topics of hedge accounting because of the rather new rules and so far lacking court decisions.188

Important differences to IFRS

IAS 39 (and the new IFRS 9) defines the possibilities and necessities for hedge accounting.

Current standard IAS 39189

Underlying transactions for hedge accounting can be (IAS 39.78)

–assets or liabilities,

–firm or expected transactions or

–a net investment in a foreign operation.

To aggregate several underlying transactions and to hedge the risk for this portfolio is possible only under restrictive conditions (IAS 39.83–84).

The intention of a hedge can be to hedge the fair value of the underlying transaction (i.e. the values recognized in the balance sheet) or to hedge future cash flows.

Hedging instruments can only be financial derivatives that can be expected to offset the fair value or cash flow changes of the underlying transaction (IAS 39.9).

Formal requirements for a hedge accounting are:

–At inception the hedging instrument is formally assigned to the hedge and the hedge relationship is documented.

–The hedge is highly effective.

–In case of a cash flow hedge for a future transaction, this future transaction must be very probable, and changes of its cash flows may impact profit or loss.

–The effectivity of the hedge relation must be able to be measured reliably.

–The effectivity of the hedge relation must be monitored continuously and must be highly effective for the whole term. An effectivity of 80–125% is explicitly required.

Measurement of a fair-value hedge (IAS 39.89)

Underlying transaction and hedging instrument are measured at fair value; if the hedge is effective, the changes should offset each other and are recognized in the income statement.

Measurement of a cash flow hedge (IAS 39.95)

With a cash flow hedge, future cash flows are hedged, i.e. there is no corresponding item in the balance sheet that should be offset. Therefore, the effective part of a cash flow hedge is recognized directly in equity (other comprehensive income); only the ineffective part is recognized in the income statement.

New standard IFRS 9190

The general approach remains the same but is intended to be more focused on the risk management of the company (IFRS 9.6.1.1). Two substantial differences are described below.

The range of 80–125% to measure effectivity was eliminated, but an economic relationship is required; this relationship exists if the values of the underlying transaction and the hedging instrument generally move in opposite directions because of the same risk that is hedged (IFRS 9.B6.4.4).

If an equity instrument that is recognized as fair value through profit and loss is hedged in a fair-value hedge, all changes in value are recognized in other comprehensive income.

3.1.10.4Accounting for leases

To give an overview, this chapter presents mainly the perspective of the lessee.

The Commercial Code contains no specific rules for accounting for leases. Based on the principle of completeness (§ 246 sect. 1), i.e. that all assets and liabilities that belong economically to a company must be included in financial statements, any lease contract must be analysed from the point of view of who owns the leased assets economically.

In practice, the classification rules developed for tax purposes (so-called leasing orders) are used for the commercial balance sheet as well.

Explanation of different terms:

Tab. 3.20: Relevant terms in accounting for leases.

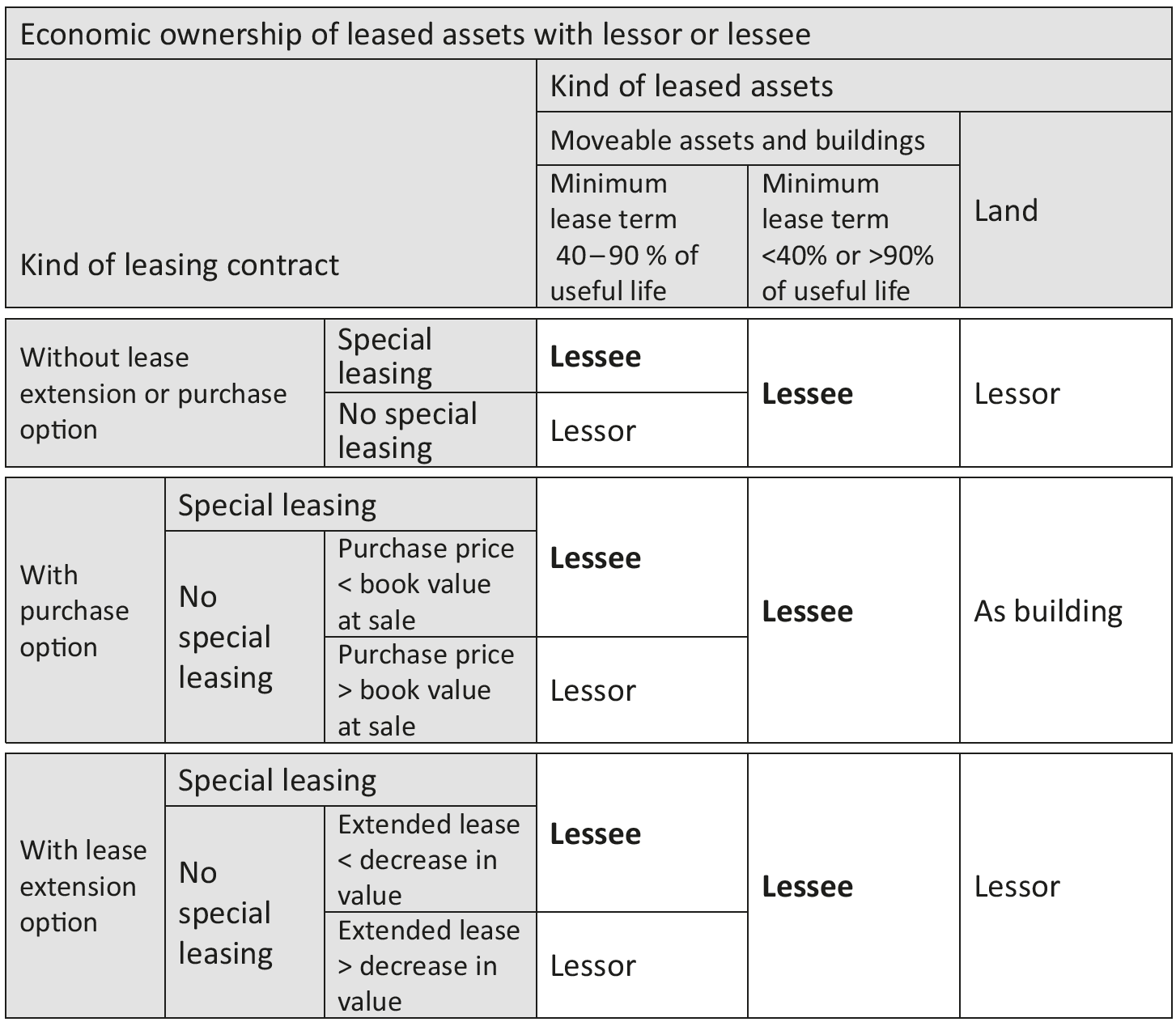

For full amortization contracts, the economic ownership of the leased assets can be derived from the following figure:191

Useful life refers to the useful life used in the depreciation tables for tax purposes.

The decrease in the value of moveable assets is calculated using the remaining book value and the remaining useful life, i.e. the depreciation for the remaining period. For buildings, 75% of the regular market lease is used.

For partial amortization contracts of moveable assets, it is assumed that the term of the lease contracts is also between 40 and 90% of the useful life of the leased asset. For partial amortization contracts, additional clauses may be agreed to reach a full amortization.193

1.Put option of lessor

The lessor has a put option at the end of the minimum lease term. If the lessee does not want to extend the contract after the minimum lease term, the lessor can execute the put option and the lessee must purchase the asset for a predefined price.

Whereas the lessee has the risk of a decrease in value at the end of lease term, the lessor has the chance of an increase in value at his discretion. For that reason economic ownership is always assumed to be with the lessor.

2.Distribution of sales proceeds

In this kind of contract, the leased asset is sold at the end of the minimum lease term by the lessor to a third party. If the sales proceeds do not cover the outstanding amortization of the contract, i.e. total costs of the lessor minus all payments of the lessee, the lessee must cover this outstanding amortization. If the sales proceeds are higher than the outstanding amortization, the excess amount is distributed between lessor and lessee.

If the lessor receives at least 25%, i.e. the lessee receives at most 75%, economic ownership is with the lessor because he still participates substantially in the increase in value. If the lessor receives less than 25%, economic ownership is with the lessee.

3.Cancellation right of lessee and partial netting of sales proceeds

In this kind of contract, the lessee has the right to cancel the contract after a minimum lease term. The lessee must cover the outstanding amortization, but 90% of the sales proceeds of the leased assets are deducted. If the sales proceeds are higher than the outstanding amortization, the lessor receives the complete proceeds.

The lessor is the economic owner in this case because he participates completely in any increases in value.

If the minimum lease term is above 90%, economic ownership is with the lessee; otherwise it is with the lessor.194

The categorization of partial amortization contracts for land and buildings is

similar:195

- If the minimum lease term is above 90% of the useful life or, in the case of a lease extension option, the lease rate of the extension is less than 75% of the market lease rate, then the building is under the economic ownership of the lessee (otherwise it is under the economic ownership of the lessor).

- If the minimum lease term is above 90% of the useful life or, in the case of a purchase option, the option price is below the remaining book value, then the building is under the economic ownership of the lessee (otherwise it is under the economic ownership of the lessor).

- If there are additional obligations for the lessee in favour of the lessor in combination with a lease extension or purchase option, then the building is under the economic ownership of the lessee.196

Land is in the aforementioned cases always classified according to the building.

This is a rather casuistic approach. If a contract cannot be classified in these categories, the general criteria of economic ownership must be applied.

Accounting for leases197

If the economic ownership of a leased asset is with the lessor, the lessee recognizes the lease payments as an expense of the period.

If the economic ownership of a leased asset is with the lessee, the lessee must recognize the asset in his balance sheet. The asset is recognized with its acquisition costs, which are usually calculated as the present value of the lease payments of the minimum lease term. The present value is recognized as a liability of the lease contract as well; typically it is reported as “trade payables”. The asset is depreciated over its useful life. The regular lease payments are split into interest and repayment. The interest portion is recognized as an interest expense, whereas the repayment is deducted from the lease liability.198

Current standard: IAS 17

IAS 17.4 defines a lease agreement as one in which the lessor transfers the right of use of a certain asset to the lessee for a certain time against one or more payments. Lease agreements may be

–finance leases: the majority of risks and rewards of the asset are transferred to the lessee,

–operating leases: any lease agreement that is not a finance lease.

More specifically, a lease agreement is assumed to be a finance lease (IAS 17.10) if

–legal ownership is transferred at the end of the lease term;

–the lease agreement includes a favourable purchase option;

–the lease term covers the majority of the economic life of the asset, even if legal ownership is not transferred;

–at the beginning of the lease agreement, the present value of the minimum lease payments amounts to at least nearly the fair value of the leased assets;

–it is special leasing (see above).

These assumptions are preliminary and may be contradicted.

For an operating lease, the lessee recognizes the lease payments as an expense from the period, but they need to be distributed in a straight-line manner (IAS 17.33).

For a finance lease, the lessee recognizes a lease asset and lease liability; at the beginning of the lease agreement both amount to the fair value of the leased assets or, if lower, the present value of the minimum lease payments (IAS 17.20). The leased asset is depreciated or amortized according to IAS 16 or IAS 38, and the lease payments are split into an interest portion and a repayment of the lease liability (IAS 17.25–27).

New standard: IFRS 16

This new standard must be applied to reporting periods beginning on or after 1 January 2019. The new standard must be applied to all lease agreements, with certain exceptions, in particular licences of intellectual property and similar rights (IFRS 15 and IAS 38), leases in exploration industries and leases of biological assets (IAS 41).

From the lessee perspective, a uniform approach is used: all leases must be accounted for according to the use-of-rights approach unless

–the lease is short term (a minimum lease term of less than 12 months; IFRS 16.5) or

–the leased goods are of low value (IFRS 16.5).

A precise definition of low-value goods is missing, but some indicators are given:199

–The value must be determined on an absolute basis, not based on materiality for the company (IFRS 16.B4).

–The value must be assessed as if the asset were new (even if it is not), i.e. an asset that is currently of low value but was not when it was new does not qualify as a low-value asset (IFRS 16.B3 and B6).

–If the intention is to sublet the asset, it does not qualify as being of low value (IFRS 16.B7).

–Examples may be tablet or personal computers, small items of office furniture or telephones (IFRS 16.B8).

If a lease is included in a contract, this lease needs to be accounted for separately; several leases in one lease agreement must be separated as well (IFRS 16.9–16). The lessee must recognize a rights-of-use asset and a lease liability at the beginning of the lease agreement. The lease liability is the present value of the minimum lease payments; the rights-of-use asset corresponds to the lease liability plus incidental costs of the lease agreement minus any incentives at the beginning (IFRS 16.22–28). The rights-of-use asset is then measured at cost (IAS 16) unless the revaluation approach is used or the fair-value approach is used for investment property (IFRS 16.29–35, IAS 40.33). The lease liability is increased according to the interest effect and decreased by the lease payments (IFRS 16.36).