Chapter 11

On the Estimation of the Distribution of Aggregated Heavy-Tailed Risks: Application to Risk Measures

Marie Kratz

ESSEC Business School, CREAR, Paris, France

AMS 2000 subject classification. 60F05; 62G32; 62G30; 62P05; 62G20; 91B30; 91G70.

11.1 Introduction

A universally accepted lesson of the last financial crisis has been the urgent need to improve risk analysis within financial institutions. Taking into account extreme risks is recognized nowadays as a necessary condition for good risk management in any financial institution and not restricted anymore to reinsurance companies. Minimizing the impact of extreme risks, or even ignoring them because of a small probability of occurrence, has been considered by many professionals and supervisory authorities as a factor of aggravation of the last financial crisis. The American Senate and the Basel Committee on Banking Supervision confirm this statement in their report. Therefore it became crucial to include and evaluate correctly extreme risks. It is our goal here, when considering a portfolio of heavy-tailed risks, notably when the tail risk is larger than 2, that is, when there is a finite variance. It is the case when studying not only financial assets but also insurance liabilities. It concerns life insurance as well, because of investment risks and interest rates; to have omitted them was at the origin of the bankruptcy of several insurance life companies as, for instance, Executive Life in the United States, Mannheimer in Germany, or Scottish Widows in the United Kingdom.

11.1.1 Motivation and Objective

When considering financial assets, because of a finite variance, a normal approximation is often chosen in practice for the unknown distribution of the yearly log returns, justified by the use of the central limit theorem (CLT), when assuming independent and identically distributed (i.i.d.) observations. Such a choice of modeling, in particular using light-tailed distributions, has shown itself grossly inadequate during the last financial crisis when dealing with risk measures because it leads to underestimating the risk.

Recently, a study was done by Furrer (2012) on simulated i.i.d. Pareto random variables (r.v.'s) to measure the impact of the choice and the use of the limiting distribution of aggregated risks, in particular for the computation of standard risk measures (value-at-risk or expected shortfall). In this study, the standard general central limit theorem (GCLT) (see, e.g., (Samorodnitsky and Taqqu, 1994)) is recalled, providing a limiting stable distribution or a normal one, depending on the value of the shape parameter of the Pareto r.v.'s. Then, considering Pareto samples of various sizes and for different values of the shape parameter, Furrer compared the distance between the empirical distribution and the theoretical limiting distribution; then computed the empirical value-at-risk (denoted VaR) and expected shortfall, called also tail value-at-risk (denoted ES or TVaR); and compared them with the ones computed from the limiting distribution. It appeared clearly that not only the choice of the limiting distribution but also the rate of convergence matters, hence the way of aggregating the variables. From this study, we also notice that the normal approximation appears really inadequate when considering aggregated risks coming from a moderately heavy-tailed distribution, that is, a Pareto with a shape parameter or tail index larger than 2, but below 4.

A few comments can be added to this study. First, the numerical results obtained in Furrer (2012) confirm what is already known in the literature. In particular, there are two main drawbacks when using the CLT for moderate heavy-tailed distributions (e.g., Pareto with a shape parameter larger than 2). On one hand, if the CLT may apply to the sample mean because of a finite variance, we also know that it provides a normal approximation with a very slow rate of convergence, which may be improved when removing extremes from the sample (see, e.g., (Hall, 1984)). Hence, even if we are interested only in the sample mean, samples of small or moderate sizes will lead to a bad approximation. To improve the rate of convergence, existence of moments of order larger than 2 is necessary (see, e.g., Section 3.2 in Embrechts et al. (1997) or, for more details, Petrov (1995)). On the other hand, we know that it has also been proved theoretically (see, e.g., (Pictet et al., 1998)) as well as empirically (see, e.g., (Dacorogna et al., 2001), Section 5.4.3) that the CLT approach applied to a heavy-tailed distributed sample does not bring any information on the tail and therefore should not be used to evaluate risk measures. Indeed, a heavy tail may appear clearly on high-frequency data (e.g., daily ones) but become not visible anymore when aggregating them in, for example, yearly data (i.e., short samples), although it is known, by Fisher theorem, that the tail index of the underlying distribution remains constant under aggregation. It is a phenomenon on which many authors insisted, as, for example, in Dacorogna et al. (2001). Figure 11.1 on the S&P 500 returns illustrate very clearly this last issue.

Figure 11.1 (a)  plot of the S&P 500 daily returns from 1987 to 2007, plotted against the Gaussian one (same scaling) that appears as a straight line. (b)

plot of the S&P 500 daily returns from 1987 to 2007, plotted against the Gaussian one (same scaling) that appears as a straight line. (b)  plot of the S&P 500 monthly returns from 1987 to 2007, plotted against the Gaussian one (same scaling) that appears as a straight line.

plot of the S&P 500 monthly returns from 1987 to 2007, plotted against the Gaussian one (same scaling) that appears as a straight line.

Based on these figures above, the ![]() plot of the S&P 500 daily returns from 1987 to 2007 helps to detect a heavy tail. When aggregating the daily returns into monthly returns, the

plot of the S&P 500 daily returns from 1987 to 2007 helps to detect a heavy tail. When aggregating the daily returns into monthly returns, the ![]() plot looks more as a normal one, and the very few observations appearing above the threshold of

plot looks more as a normal one, and the very few observations appearing above the threshold of ![]() , such as the financial crises of 1998 and 1987, could almost be considered as outliers, as it is well known that financial returns are symmetrically distributed.

, such as the financial crises of 1998 and 1987, could almost be considered as outliers, as it is well known that financial returns are symmetrically distributed.

Now, look at Figure 11.2. When adding data from 2008 to 2013, the ![]() plot looks pretty the same, that is, normal, except that another “outlier” appears ... with the date of October 2008! Instead of looking again on daily data for the same years, let us consider a larger sample of monthly data from 1791 to 2013.1 With a larger sample size, the heavy tail becomes again visible. And now we see that the financial crisis of 2008 does belong to the heavy tail of the distribution and cannot be considered anymore as an outlier. So we clearly see the importance of the sample size when dealing with moderately heavy tails to estimate the risk. Thus we need a method that does not depend on the sample size, but looks at the shape of the tail.

plot looks pretty the same, that is, normal, except that another “outlier” appears ... with the date of October 2008! Instead of looking again on daily data for the same years, let us consider a larger sample of monthly data from 1791 to 2013.1 With a larger sample size, the heavy tail becomes again visible. And now we see that the financial crisis of 2008 does belong to the heavy tail of the distribution and cannot be considered anymore as an outlier. So we clearly see the importance of the sample size when dealing with moderately heavy tails to estimate the risk. Thus we need a method that does not depend on the sample size, but looks at the shape of the tail.

Figure 11.2 (a)  plot of the S&P 500 monthly returns from 1987 to 2013, plotted against the Gaussian one (same scaling) that appears as a straight line. (b)

plot of the S&P 500 monthly returns from 1987 to 2013, plotted against the Gaussian one (same scaling) that appears as a straight line. (b)  plot of the S&P 500 monthly returns from 1791 to 2013, plotted against the Gaussian one (same scaling) that appears as a straight line.

plot of the S&P 500 monthly returns from 1791 to 2013, plotted against the Gaussian one (same scaling) that appears as a straight line.

The main objective is to obtain the most accurate evaluation of the distribution of aggregated risks and of risk measures when working on financial data under the presence of fat tail. We explore various approaches to handle this problem, theoretically, empirically, and numerically. The application on log returns, which motivated the construction of this method, illustrates the case of time aggregation, but the method is general and concerns any type of aggregation, for example, of assets.

After reviewing briefly the existing methods, from the GCLT to extreme value theory (EVT), we will propose and develop two new methods, both inspired by the work of Zaliapin et al. (2005) in which the sum of ![]() i.i.d. r.v.'s is rewritten as the sum of the associated order statistics.

i.i.d. r.v.'s is rewritten as the sum of the associated order statistics.

The first method, named Normex, answers the question of how many largest order statistics would explain the divergence between the underlying moderately heavy-tailed distribution and the normal approximation, whenever the CLT applies, and combines a normal approximation with the exact distribution of this number (independent of the size of the sample) of largest order statistics. It provides in general the sharpest results among the different methods, whatever the sample size is and for any heaviness of the tail.

The second method is empirical and consists of a weighted normal approximation. Of course, we cannot expect such a sharp result as the one obtained with Normex. However it provides a simple tool allowing to remain in the Gaussian realm. We introduce a shift in the mean and a weight in the variance as correcting terms for the Gaussian parameters.

Then we will proceed to an analytical comparison between the exact distribution of the Pareto sum and its approximation given by Normex before turning to the application of evaluating risk measures.

Finally a numerical study will follow, applying the various methods on simulated samples to compare the accuracy of the estimation of extreme quantiles, used as risk measures in solvency calculation.

In the rest of the chapter, with financial/actuarial applications in mind, and without loss of generality, we will use power law models for the marginal distributions of the risks such as the Pareto distribution.

11.1.2 Preliminaries

11.1.2.1 Main notation

![]() will denote the integer part of any nonnegative real

will denote the integer part of any nonnegative real ![]() such that

such that ![]() .

.

Let ![]() be the probability space on which we will be working.

be the probability space on which we will be working.

Let ![]() and

and ![]() denote, respectively, the cumulative distribution function (cdf) and the probability density function (pdf) of the standard normal distribution

denote, respectively, the cumulative distribution function (cdf) and the probability density function (pdf) of the standard normal distribution ![]() and

and ![]() and

and ![]() the cdf and pdf of the normal distribution

the cdf and pdf of the normal distribution ![]() with mean

with mean ![]() and variance

and variance ![]() .

.

Let ![]() be a random variable (r.v.) Pareto (type I) distributed with shape parameter

be a random variable (r.v.) Pareto (type I) distributed with shape parameter ![]() , pdf denoted by

, pdf denoted by ![]() and cdf

and cdf ![]() defined by

defined by

and probability density function (pdf) denoted by ![]() .

.

Note that the inverse function ![]() of

of ![]() is given by

is given by

Recall that for ![]() ,

, ![]() and for

and for ![]() ,

, ![]() .

.

We will consider i.i.d. Pareto r.v.'s in this study and denote by ![]() the Pareto sum

the Pareto sum ![]()

![]() being an

being an ![]() -sample with parent r.v.

-sample with parent r.v. ![]() and associated order statistics

and associated order statistics ![]() .

.

When dealing with financial assets (market risk data), we define the returns as

![]() being the daily price and

being the daily price and ![]() representing the aggregation factor.

representing the aggregation factor.

Note that we can also write

In what follows, we will denote ![]() by

by ![]() .

.

Further comments or questions

-

Is it still worth considering i.i.d. r.v.'s, whereas most recent research focus on dependent ones?

Concerning the i.i.d. condition, note that this study fills up a gap in the literature on the sum of i.i.d. moderate heavy r.v.'s (see, e.g., (Feller, 1966); (Hahn et al., 1991), and (Petrov, 1995)). Moreover, in our practical example of log returns (the motivation of this work), the independence condition is satisfied (see, e.g., (Taylor, 1986); (Dacorogna et al., 2001)) and hence is not a restriction in this case of time aggregation.

Another theoretical reason comes from the EVT; indeed we know that the tail index of the aggregated distribution corresponds to the one of the marginal with the heaviest tail and hence does not depend on considering the issue of dependence.

Finally, there was still mathematically a missing “brick” when studying the behavior of the sum of i.i.d. r.v.'s with a moderately heavy tail, for which the CLT applies (for the center of distribution!) but with a slow convergence for the mean behavior and certainly does not provide satisfactory approximation for the tail. With this work, we aim at filling up the gap by looking at an appropriate limit distribution.

-

Why considering Pareto distribution?

It is justified by the EVT (see, e.g., (Leadbetter et al., 1983); (Resnick, 1987), and (Embrechts et al., 1997)). Indeed recall the Pickands theorem (see (Pickands, 1975) for the seminal work) proving that for sufficiently high threshold

, the generalized Pareto distribution (GPD)

, the generalized Pareto distribution (GPD)  (with tail index

(with tail index  and scale parameter

and scale parameter  ) is a very good approximation to the excess cdf of a r.v.

) is a very good approximation to the excess cdf of a r.v.  defined by

defined by  :

:

if and only if the distribution of

is in the domain of attraction of one of the three limit laws. When considering risks under the presence of heavy tail, it implies that the extreme risks follow a GPD with a positive tail index (called also extreme value index)

is in the domain of attraction of one of the three limit laws. When considering risks under the presence of heavy tail, it implies that the extreme risks follow a GPD with a positive tail index (called also extreme value index)  , which corresponds to say that the risks belong to the Fréchet maximum domain of attraction (see, e.g., (Galambos, 1978); (Leadbetter et al., 1983); (Resnick, 1987), or (Embrechts et al., 1997)). In particular, for

, which corresponds to say that the risks belong to the Fréchet maximum domain of attraction (see, e.g., (Galambos, 1978); (Leadbetter et al., 1983); (Resnick, 1987), or (Embrechts et al., 1997)). In particular, for  ,

,for some constant

. It is then natural and quite general to consider a Pareto distribution (with shape parameter

. It is then natural and quite general to consider a Pareto distribution (with shape parameter  ) for heavy-tailed risks.

) for heavy-tailed risks.A natural extension would then be considering r.v.'s with other distributions belonging to the Fréchet maximum domain of attraction.

- A last remark concerns the parameter

that we consider as given in our study. A prerequisite, when working on real data, would be to estimate

that we consider as given in our study. A prerequisite, when working on real data, would be to estimate  . Recall that there are various ways to test the presence of a heavy tail and to estimate the tail index, for example, the Hill estimator (see (Hill, 1975)) or the

. Recall that there are various ways to test the presence of a heavy tail and to estimate the tail index, for example, the Hill estimator (see (Hill, 1975)) or the  -estimator (see (Kratz and Resnick, 1996)) (see also (Huston McCulloch, 1997); (Beirlant et al., 2004); (Resnick, 2006), and references therein). We will not provide an inventory of the methods, except a brief recall in the next section of an important empirical EVT method used for estimating the heaviness of the tail. Let us also mention a test, easy to use in practice, for the existence of fat tails, namely, the scaling law (see (Dacorogna et al., 2001), Section 5.5). It consists of comparing the two plots, for

-estimator (see (Kratz and Resnick, 1996)) (see also (Huston McCulloch, 1997); (Beirlant et al., 2004); (Resnick, 2006), and references therein). We will not provide an inventory of the methods, except a brief recall in the next section of an important empirical EVT method used for estimating the heaviness of the tail. Let us also mention a test, easy to use in practice, for the existence of fat tails, namely, the scaling law (see (Dacorogna et al., 2001), Section 5.5). It consists of comparing the two plots, for  and 2, respectively, of

and 2, respectively, of  ,

,  ; if the scaling exponent for

; if the scaling exponent for  is larger than for

is larger than for  , then it is a sign of the existence of a fat tail. For financial data, there are numerous empirical studies that show the existence of fat tail and that the shape parameter is between 2 and 4 for developed markets (see, e.g., (Jansen and De Vries, 1991); (Longin, 1996); (Müller et al., 1998); (Dacorogna2 et al., 2001); (Dacorogna et al., 2001), and references therein).

, then it is a sign of the existence of a fat tail. For financial data, there are numerous empirical studies that show the existence of fat tail and that the shape parameter is between 2 and 4 for developed markets (see, e.g., (Jansen and De Vries, 1991); (Longin, 1996); (Müller et al., 1998); (Dacorogna2 et al., 2001); (Dacorogna et al., 2001), and references therein).

11.2 A Brief Review of Existing Methods

Limit theorems for the sum of i.i.d. r.v.'s are well known. Nevertheless, they can be misused in practice for various reasons such as a too small sample size, as we have seen. As a consequence, it leads to wrong estimations of the risk measures for aggregated data. To help practitioners to be sensitive to this issue, we consider the simple example of aggregated heavy-tailed risks, where the risks are represented by i.i.d. Pareto r.v.'s. We start by reviewing the existing methods, from the GCLT to EVT, before applying them on simulated Pareto samples to show the pros and cons of those methods.

11.2.1 A GCLT Approach

- For sake of completeness, let us recall the GCLT (see, e.g., (Samorodnitsky and Taqqu, 1994); (Nolan, 2012)), which states that the properly normalized sum of a large number of i.i.d. r.v.'s belonging to the domain of attraction of an

-stable law may be approximated by a stable distribution with index

-stable law may be approximated by a stable distribution with index  (

( ).

).

- It applies in our specific case where we consider i.i.d. Pareto r.v.'s with shape parameter

and we can identify the normalizing constants. We have

11.4

and we can identify the normalizing constants. We have

11.4

with

Note that the tail distribution of

satisfies (see (Samorodnitsky and Taqqu, 1994)):11.6

satisfies (see (Samorodnitsky and Taqqu, 1994)):11.6

11.2.2 An EVT Approach

When focusing on the tail of the distribution, in particular for the estimation of the risk measures, the information on the entire distribution is not necessary, hence the alternative of the EVT approach.

Recall the Fisher–Tippett theorem (see (Fisher and Tippett, 1928)) which states that the limiting distribution for the rescaled sample maximum can only be of three types: Fréchet, Weibull, and Gumbel. The three types of extreme value distribution have been combined into a single three-parameter family ((Jenkinson, 1955); (von Mises, 1936); 1985) known as the generalized extreme value (GEV) distribution given by

with ![]() (scale parameter),

(scale parameter), ![]() (location parameter), and

(location parameter), and ![]() (tail index or extreme value index). The tail index

(tail index or extreme value index). The tail index ![]() determines the nature of the tail distribution:

determines the nature of the tail distribution:

![]() : Fréchet,

: Fréchet, ![]() : Gumbel,

: Gumbel, ![]() : Weibull.

: Weibull.

Under the assumption of regular variation of the tail distribution, the tail of the cdf of the sum of i.i.d. r.v.'s is mainly determined by the tail of the cdf of the maximum of these r.v.'s. Indeed, we have the following lemma.

It applies of course to Pareto r.v.'s.

Combining (11.8) with the GEV limiting distribution in the case of ![]() -Pareto r.v.'s provides that the tail distribution of the rescaled sum

-Pareto r.v.'s provides that the tail distribution of the rescaled sum ![]() of Pareto r.v.'s is asymptotically Fréchet:

of Pareto r.v.'s is asymptotically Fréchet:

where ![]() is defined as in (2.1).

is defined as in (2.1).

11.3 New Approaches: Mixed Limit Theorems

An alternative approach to the GCLT one has been proposed by Zaliapin et al. (see (Zaliapin et al., 2005)) when the Pareto shape parameter satisfies ![]() , a case where the variance of the Pareto r.v.'s

, a case where the variance of the Pareto r.v.'s ![]() does not exist. The neat idea of the method is to rewrite the sum of the

does not exist. The neat idea of the method is to rewrite the sum of the ![]() 's as the sum of the order statistics

's as the sum of the order statistics ![]() and to separate it into two terms, one with the first

and to separate it into two terms, one with the first ![]() order statistics having finite variance and the other as the complement

order statistics having finite variance and the other as the complement

They can then treat these two subsums separately. Even if not always rigorously developed in this paper, or, say, quite approximative, as we will see later, their method provides better numerical results than the GCLT does for any number of summands and any quantile. Nevertheless, there are some mathematical issues in this paper. One of them is that the authors consider these two subsums as independent. Another one is that they approximate the quantile of the total (Pareto) sum with the direct summation of the quantiles of each subsum, although the quantiles are not additive. For the case ![]() , they reduce the behavior of the sum arbitrarily to the last two upper order statistics.

, they reduce the behavior of the sum arbitrarily to the last two upper order statistics.

Another drawback of this method would be, when considering the case ![]() , to remain with one sum of all terms with a finite variance, hence in general with a poor or slow normal approximation.

, to remain with one sum of all terms with a finite variance, hence in general with a poor or slow normal approximation.

We are mainly interested in the case of a shape parameter larger than 2, since it is the missing part in the literature and of practical relevance when studying market risk data, for instance. For such a case, the CLT applies because of the finiteness of the second moment, but using it to obtain information on something else than the average is simply wrong in presence of fat tails, even if in some situations (e.g., when working on aggregated data or on short samples), the plot of the empirical distribution fits a normal one. The CLT only concentrates on the mean behavior; it is equivalent to the CLT on the trimmed sum (i.e., ![]() minus a given number of the largest order statistics (or tail)) (see (Mori, 1984)), for which the rate of convergence improves (see, e.g., (Hahn et al., 1991); (Hall, 1984)).

minus a given number of the largest order statistics (or tail)) (see (Mori, 1984)), for which the rate of convergence improves (see, e.g., (Hahn et al., 1991); (Hall, 1984)).

Inspired by Zaliapin et al.'s paper, we go further in the direction of separating mean and extreme behaviors in order to improve approximations, for any ![]() , and we build two alternative methods, called Normex and the weighted normal limit, respectively. It means to answer rigorously the question of how many largest order statistics

, and we build two alternative methods, called Normex and the weighted normal limit, respectively. It means to answer rigorously the question of how many largest order statistics ![]() ,

, ![]() would explain the divergence between the underlying distribution and the normal approximation when considering a Pareto sum with

would explain the divergence between the underlying distribution and the normal approximation when considering a Pareto sum with ![]() or the stable approximation when considering a Pareto sum with

or the stable approximation when considering a Pareto sum with ![]() .

.

Both methods rely initially on Zaliapin et al.'s approach of splitting the Pareto sum into a trimmed sum to which the CLT applies and another sum with the remaining largest order statistics. The main idea of the two methods is to determine in an “optimal way” (in order to improve at most the distribution approximation), which we are going to explain, the number ![]() that corresponds to a threshold when splitting the sum of order statistics into two subsums, with the second one constituted by the

that corresponds to a threshold when splitting the sum of order statistics into two subsums, with the second one constituted by the ![]() largest order statistics. We will develop these methods under realistic assumptions, dropping in particular Zaliapin's et al.'s assumption of independence between the two subsums. Our two methods differ from each other in two points:

largest order statistics. We will develop these methods under realistic assumptions, dropping in particular Zaliapin's et al.'s assumption of independence between the two subsums. Our two methods differ from each other in two points:

- The way of selecting this number

.

. - The way of evaluating the sum determined by the

largest order statistics, which is of course related to the choice of

largest order statistics, which is of course related to the choice of

Our study is developed on the Pareto example, but its goal is to propose a method that may be applied to any heavy-tailed distribution (with positive tail index) and to real data, hence this choice of looking for limit theorems in order to approximate the true (and most of the time unknown) distribution.

11.3.1 A Common First Step

11.3.1.1 How to fit for the best mean behavior of aggregated heavy-tailed distributed risks?

Let us start by studying the behavior of the trimmed sum ![]() when writing down the sum

when writing down the sum ![]() of the i.i.d.

of the i.i.d. ![]() -Pareto r.v.'s (with

-Pareto r.v.'s (with ![]() ),

), ![]() , as

, as

Much literature, since the 1980s, has been concerned with the behavior of trimmed sums by removing extremes from the sample; see, for example, Hall (1984), Mori (1984), and Hahn et al. (1991).

The main issue is the choice of the threshold ![]() , in order to use the CLT but also to improve its fit since we want to approximate the behavior of

, in order to use the CLT but also to improve its fit since we want to approximate the behavior of ![]() by a normal one.

by a normal one.

We know that a necessary and sufficient condition for the CLT to apply on ![]() is to require the summands

is to require the summands ![]() ,

, ![]() , to be

, to be ![]() -r.v.'s. But we also know that requiring only the finitude of the second moment may lead to a poor normal approximation, if higher moments do not exist, as occurs, for instance, with financial market data. In particular, including the finitude of the third moment provides a better rate of convergence to the normal distribution in the CLT (Berry–Esséen inequality). Another information that might be quite useful to improve the approximation of the distribution of

-r.v.'s. But we also know that requiring only the finitude of the second moment may lead to a poor normal approximation, if higher moments do not exist, as occurs, for instance, with financial market data. In particular, including the finitude of the third moment provides a better rate of convergence to the normal distribution in the CLT (Berry–Esséen inequality). Another information that might be quite useful to improve the approximation of the distribution of ![]() with its limit distribution is the Fisher index, defined by the ratio

with its limit distribution is the Fisher index, defined by the ratio ![]() , which is a kurtosis index. The skewness

, which is a kurtosis index. The skewness ![]() of

of ![]() and

and ![]() measures the closeness of the cdf

measures the closeness of the cdf ![]() to

to ![]() . Hence we will choose

. Hence we will choose ![]() based on the condition of existence of the fourth moment of the summands of

based on the condition of existence of the fourth moment of the summands of ![]() (i.e., the first

(i.e., the first ![]() order statistics).

order statistics).

The following Edgeworth expansion involving the Hermite polynomials ![]() points out that requiring the finitude of the fourth moments appears as what we call the “optimal” solution (of course, the higher order moments exist, the finer the normal approximation becomes, but it would imply too strong conditions and difficult to handle). If

points out that requiring the finitude of the fourth moments appears as what we call the “optimal” solution (of course, the higher order moments exist, the finer the normal approximation becomes, but it would imply too strong conditions and difficult to handle). If ![]() denotes the cdf of the standardized

denotes the cdf of the standardized ![]() defined by

defined by ![]() , then

, then

uniformly in ![]() , with

, with

The rate of convergence appears clearly as ![]() whenever

whenever ![]() ,

, ![]() .

.

Note that in our Pareto case, the skewness and the excess kurtosis are, respectively,

Therefore we set ![]() (but prefer to keep the notation

(but prefer to keep the notation ![]() so that it remains general) to obtain what we call an “optimal” approximation. Then we select the threshold

so that it remains general) to obtain what we call an “optimal” approximation. Then we select the threshold ![]() such that

such that

which when applied to our case of ![]() -Pareto i.i.d. r.v.'s (using (11.17)) gives

-Pareto i.i.d. r.v.'s (using (11.17)) gives

This condition allows then to determine a fixed number ![]() as a function of the shape parameter

as a function of the shape parameter ![]() of the underlying heavy-tailed distribution of the

of the underlying heavy-tailed distribution of the ![]() 's but not of the size

's but not of the size ![]() of the sample. We can take it as small as possible in order to fit for the best both the mean and tail behaviors of

of the sample. We can take it as small as possible in order to fit for the best both the mean and tail behaviors of ![]() . Note that we look for the smallest possible

. Note that we look for the smallest possible ![]() to be able to compute explicitly the distribution of the last upper order statistics appearing as the summands of the second sum

to be able to compute explicitly the distribution of the last upper order statistics appearing as the summands of the second sum ![]() . For this reason, based on condition (11.12), we choose

. For this reason, based on condition (11.12), we choose

Let us summarize in Table 11.1 the necessary and sufficient condition on ![]() (for

(for ![]() ) to have the existence of the

) to have the existence of the ![]() th moments for the upper order statistics for

th moments for the upper order statistics for ![]() , respectively, using (11.12) written as

, respectively, using (11.12) written as ![]() .

.

Table 11.1 Necessary and sufficient condition on ![]() for having

for having ![]() ,

, ![]()

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

We deduce the value of the threshold ![]() satisfying (11.13) for which the fourth moment is finite according to the set of definition of

satisfying (11.13) for which the fourth moment is finite according to the set of definition of ![]() : We notice from Table 11.2 that we would use Zaliapin et al.'s decomposition only when

: We notice from Table 11.2 that we would use Zaliapin et al.'s decomposition only when ![]() . When considering, as they do,

. When considering, as they do, ![]() , we would rather introduce the decomposition

, we would rather introduce the decomposition ![]() , with

, with ![]() varying from 2 to 5 depending on the value of

varying from 2 to 5 depending on the value of ![]() , to improve the approximation of the distribution of

, to improve the approximation of the distribution of ![]() , if we omit the discussion on their conditions.

, if we omit the discussion on their conditions.

Table 11.2 Value of ![]() for having up to

for having up to ![]()

| ]2,4] | |||||||

| 7 | 6 | 5 | 4 | 3 | 2 | 1 |

11.3.1.2 Some properties of order statistics for Pareto random variables

First we apply known results on distribution of order statistics (see, e.g., (David and Nadaraja, 2003)) when considering Pareto distributions. Next we compute conditional distributions of order statistics, as well as conditional moments, to apply them to the Pareto case.

-

Distribution of Pareto order statistics

For

-Pareto r.v.'s, the pdf

-Pareto r.v.'s, the pdf  of

of  (

( ) and the pdf

) and the pdf  of the order statistics

of the order statistics  ,

,  (

( ), with

), with  , are expressed, respectively, as

, are expressed, respectively, asand, for

,

,When considering successive order statistics, for

, for

, for  ,

,  , with

, with  , we obtain

, we obtainMoments of

-Pareto order statistics satisfy (see also, e.g., (Zaliapin et al., 2005); Theorem 1)

-Pareto order statistics satisfy (see also, e.g., (Zaliapin et al., 2005); Theorem 1)and, for

,

,

-

Conditional distribution of order statistics. Application to Pareto r.v.'s

Now straightforward computations lead to new properties that will be needed to build Normex. We express them in the general case (and labeled), with the notation

and

and  , and then for Pareto r.v.'s.

, and then for Pareto r.v.'s.We deduce from (11.14) and (11.15) that the pdf of

given

given  , for

, for  , is, for

, is, for  ,

,and that the joint pdf of

given

given  , for

, for  , is, for

, is, for  ,

,Using (11.14) and (11.16) provides, for

,

,Then we can compute the first conditional moments. We obtain, using (11.18) and the change of variables

,11.22

,11.22

For

, via (11.19) and the change of variables

, via (11.19) and the change of variables  and

and  , it comes

, it comesMoreover, the joint conditional distribution of

given

given  , for

, for  , denoted by

, denoted by  , or

, or  when no ambiguity exists, is, for

when no ambiguity exists, is, for  ,11.24

,11.24

from which we get back the well-known result that

are independent of

are independent of  and

and  when

when  and

and  are given and that the order statistics form a Markov chain.

are given and that the order statistics form a Markov chain.

11.3.2 Method 1: Normex—A Mixed Normal Extreme Limit

(see (Kratz, 2014))

11.3.2.1 A conditional decomposition

Whatever the size of the sample is, because of the small magnitude of ![]() , we are able to compute explicitly the distribution of the last upper order statistics appearing as the summands of the second sum

, we are able to compute explicitly the distribution of the last upper order statistics appearing as the summands of the second sum ![]() defined in (11.10). The choice of

defined in (11.10). The choice of ![]() allows also to obtain a good normal approximation for the distribution of the trimmed sum

allows also to obtain a good normal approximation for the distribution of the trimmed sum ![]() . Nevertheless, since

. Nevertheless, since ![]() and

and ![]() are not independent, we decompose the Pareto sum

are not independent, we decompose the Pareto sum ![]() in a slightly different way than in (11.10) (but keeping the same notation), namely,

in a slightly different way than in (11.10) (but keeping the same notation), namely,

and use the property of conditional independence (recalled in Section 11.1.2) between the two subsums ![]() and

and ![]() conditional on

conditional on ![]() (for

(for ![]() ).

).

Then we obtain the following approximation of the distribution of ![]() , for

, for ![]() (i.e., when the

(i.e., when the ![]() th moment of the

th moment of the ![]() largest order statistics does not exist).

largest order statistics does not exist).

Comments

- The distribution

can also be expressed as

can also be expressed as

and, for

where the convolution product

can be numerically evaluated using either the recursive convolution equation

can be numerically evaluated using either the recursive convolution equation  , for

, for  , (it will be fast,

, (it will be fast,  being small) and

being small) and  or, if

or, if  , the explicit expression (12) (replacing

, the explicit expression (12) (replacing  by

by  ) given in Ramsay (2006).

) given in Ramsay (2006). - Note that we considered i.i.d. Pareto r.v.'s only as an example to illustrate our method intended to be extended to unknown distributions using the CLT for the mean behavior and heavy-tailed distributions of the Pareto type for the tail. Since the exact distribution of the Pareto sum

of i.i.d. Pareto r.v.'s is known, we will be able to judge about the quality of the approximation proposed in Theorem 11.2 when comparing

of i.i.d. Pareto r.v.'s is known, we will be able to judge about the quality of the approximation proposed in Theorem 11.2 when comparing  with the exact distribution of

with the exact distribution of  . We will then compare the respective associated risk measures.

. We will then compare the respective associated risk measures. - Finally recall the following result by Feller (see 1966) on the convolution closure of distributions with regularly varying tails, which applies in our Pareto example but may also be useful when extending the method to distributions belonging to the Fréchet maximum domain of attraction.

Note that this lemma implies the result given in (11.7), and as a consequence in the Pareto case, we have

11.3.2.2 On the quality of the approximation of the distribution of the Pareto sum

To estimate the quality of the approximation of the distribution of the Pareto sum ![]() , we compare analytically the exact distribution of

, we compare analytically the exact distribution of ![]() with the distribution

with the distribution ![]() defined in Theorem 11.2. It could also be done numerically, as, for instance, in Furrer (2012) with the distance between two distributions

defined in Theorem 11.2. It could also be done numerically, as, for instance, in Furrer (2012) with the distance between two distributions ![]() and

and ![]() defined by

defined by ![]() , with

, with ![]() . We will proceed numerically only when considering the tail of the distributions and estimating the distance in the tails through the VaR measure (see Section 11.4.3). When looking at the entire distributions, we will focus on the analytical comparison mainly for the case

. We will proceed numerically only when considering the tail of the distributions and estimating the distance in the tails through the VaR measure (see Section 11.4.3). When looking at the entire distributions, we will focus on the analytical comparison mainly for the case ![]() (with some hints for the case

(with some hints for the case ![]() ). Note that it is not possible to compare directly the expressions of the VaR corresponding to, respectively, the exact and approximative distributions, since they can only be expressed as the inverse function of a cdf. Nevertheless, we can compare the tails of these two distributions to calibrate the accuracy of the approximative VaR since

). Note that it is not possible to compare directly the expressions of the VaR corresponding to, respectively, the exact and approximative distributions, since they can only be expressed as the inverse function of a cdf. Nevertheless, we can compare the tails of these two distributions to calibrate the accuracy of the approximative VaR since

Moreover, we will compare analytically our result with a normal approximation made on the entire sum (and not the trimmed one) since, for ![]() , the CLT applies and, as already noticed, is often used in practice.

, the CLT applies and, as already noticed, is often used in practice.

Since Normex uses the exact distribution of the last upper order statistics, comparing the true distribution of ![]() with its approximation

with its approximation ![]() simply comes back to the comparison of the true distribution of

simply comes back to the comparison of the true distribution of ![]() i.i.d. r.v.'s with the normal distribution (when applying the CLT). Note that, when extending Normex to any distribution, an error term should be added to this latter evaluation; it comes from the approximation of the extreme distribution by a Pareto one.

i.i.d. r.v.'s with the normal distribution (when applying the CLT). Note that, when extending Normex to any distribution, an error term should be added to this latter evaluation; it comes from the approximation of the extreme distribution by a Pareto one.

Suppose ![]() . Applying the CLT gives the normal approximation

. Applying the CLT gives the normal approximation ![]() , with

, with ![]() and

and ![]() , where in the case of a Pareto sum,

, where in the case of a Pareto sum, ![]() , and

, and ![]() . We know that applying the CLT directly to

. We know that applying the CLT directly to ![]() leads to nonsatisfactory results even for the mean behavior, since, for any

leads to nonsatisfactory results even for the mean behavior, since, for any ![]() , the quantity

, the quantity ![]() , involving the third moment of

, involving the third moment of ![]() and appearing in the error (11.11) made when approximating the exact distribution of

and appearing in the error (11.11) made when approximating the exact distribution of ![]() by a normal one, is infinite for any

by a normal one, is infinite for any ![]() . The rate of convergence in

. The rate of convergence in ![]() is reduced to

is reduced to ![]() . When

. When ![]() , even if the rate of convergence improves because

, even if the rate of convergence improves because ![]() , we still have

, we still have ![]() (because the fourth moment of

(because the fourth moment of ![]() does not exist), which means that we cannot get a rate of order

does not exist), which means that we cannot get a rate of order ![]() .

.

Now let us look at the rate of convergence when approximating ![]() with

with ![]() .

.

Considering the exact distribution of the Pareto sum ![]() means taking, at given

means taking, at given ![]() and for any

and for any ![]() ,

, ![]() with

with ![]() i.i.d. r.v.'s with parent r.v.

i.i.d. r.v.'s with parent r.v. ![]() with finite

with finite ![]() th moment and pdf

th moment and pdf ![]() defined, for

defined, for ![]() , by

, by

Let us look at the three first moments of ![]() . The direct dependence is on

. The direct dependence is on ![]() (and

(and ![]() ) and indirectly on

) and indirectly on ![]() since

since ![]() . We have

. We have

(note that ![]() , for any

, for any ![]() that we consider, and any

that we consider, and any ![]() ) and

) and

using the expressions of ![]() and

and ![]() given in Theorem 11.2. A straightforward computation of the third centered moment of

given in Theorem 11.2. A straightforward computation of the third centered moment of ![]() provides

provides

where ![]() denotes the antiderivative of the function

denotes the antiderivative of the function ![]() , that is, if

, that is, if ![]() ,

,

whereas, if ![]() ,

,

and, if ![]() ,

,

For simplicity, let us look at the case ![]() and consider the Berry–Esséen inequality. For

and consider the Berry–Esséen inequality. For ![]() , we would use the Edgeworth expansion, with similar arguments as developed later. Various authors have worked on this type of Berry–Esséen inequality, in particular to sharpen the accuracy of the constant appearing in it. In the case of Berry–Esséen bounds, the value of the constant factor

, we would use the Edgeworth expansion, with similar arguments as developed later. Various authors have worked on this type of Berry–Esséen inequality, in particular to sharpen the accuracy of the constant appearing in it. In the case of Berry–Esséen bounds, the value of the constant factor ![]() has decreased from 7.59 by Esséen (1942) to 0.4785 by Tyurin (2010), to 0.4690 by Shevtsova (2013) in the i.i.d. case, and to 0.5600 in the general case. Note also that these past decades, much literature ((Stein, 1972, 1986); (Chen and Shao, 2004); (Cai, 2012); (Pinelis, 2013), etc.) has been dedicated to the generalization of this type of inequality, such as the remarkable contribution by Stein.

has decreased from 7.59 by Esséen (1942) to 0.4785 by Tyurin (2010), to 0.4690 by Shevtsova (2013) in the i.i.d. case, and to 0.5600 in the general case. Note also that these past decades, much literature ((Stein, 1972, 1986); (Chen and Shao, 2004); (Cai, 2012); (Pinelis, 2013), etc.) has been dedicated to the generalization of this type of inequality, such as the remarkable contribution by Stein.

We can propose the following bound.

Note that ![]() depends on the two parameters

depends on the two parameters ![]() and

and ![]() . We represent this function on a same plot for a given value of

. We represent this function on a same plot for a given value of ![]() but for various values of

but for various values of ![]() , namely,

, namely, ![]() , and 1000, respectively, to compare its behavior according to the parameter

, and 1000, respectively, to compare its behavior according to the parameter ![]() . Then we repeat the operation for different

. Then we repeat the operation for different ![]() , namely, for

, namely, for ![]() , respectively (Figure 11.3).

, respectively (Figure 11.3).

Figure 11.3 Plots of the function  defined in (11.35), for various

defined in (11.35), for various  , at given

, at given  . (a) Case

. (a) Case  . (b) Case

. (b) Case  . (c) Case

. (c) Case  .

.

We observe that the bound ![]() is an increasing then decreasing function of

is an increasing then decreasing function of ![]() , with a maximum less than

, with a maximum less than ![]() , which is decreasing with

, which is decreasing with ![]() and

and ![]() . The

. The ![]() -coordinate of the maximum is proportional to

-coordinate of the maximum is proportional to ![]() , with the proportion decreasing with

, with the proportion decreasing with ![]() . The interval on the

. The interval on the ![]() -axis for which the error is larger than

-axis for which the error is larger than ![]() has a small amplitude, which is decreasing with

has a small amplitude, which is decreasing with ![]() .

.

We show in Table 11.3 the values of the coordinates ![]() of the maximum of

of the maximum of ![]() computed on R for

computed on R for ![]() and

and ![]() (corresponding to aggregating weekly returns to obtain yearly returns), 100, 250 (corresponding to aggregating daily returns to obtain yearly returns), 500, 1000, respectively.

(corresponding to aggregating weekly returns to obtain yearly returns), 100, 250 (corresponding to aggregating daily returns to obtain yearly returns), 500, 1000, respectively.

Table 11.3 Coordinates ![]() of the maximum of

of the maximum of ![]() (defined in (11.35)), as a function of

(defined in (11.35)), as a function of ![]() and

and ![]()

| 52 | 101 | 4.9 | 86 | 4.9 | 78 | 4.9 |

| 100 | 196 | 4.6 | 166 | 4.6 | 150 | 4.6 |

| 250 | 494 | 4.2 | 417 | 4.1 | 376 | 4.0 |

| 500 | 990 | 3.9 | 834 | 3.7 | 751 | 3.5 |

| 1000 | 1984 | 3.6 | 1667 | 3.3 | 1501 | 3.0 |

Hence the result of Proposition 11.2.

Indeed, we have

Note that the Berry–Esséen inequality has been proved by Petrov to hold also for probability density functions (see (Petrov, 1956) or (Petrov, 1995)). It has been refined by Shevtsova (2007), and we will use her result to evaluate ![]() . We need to go back to the pdf of the standardized sum

. We need to go back to the pdf of the standardized sum ![]() of i.i.d. r.v.'s with pdf

of i.i.d. r.v.'s with pdf ![]() , which can be expressed as

, which can be expressed as

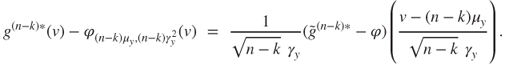

It is straightforward to show by induction that

Then, since ![]() , we can write

, we can write

Since we consider a sum of ![]() i.i.d. r.v.'s

i.i.d. r.v.'s ![]() (

(![]() ) with parent r.v.

) with parent r.v. ![]() having a finite

having a finite ![]() th moment, we obtain via (Petrov, 1956) and (Shevtsova, 2007) that there exists a constant

th moment, we obtain via (Petrov, 1956) and (Shevtsova, 2007) that there exists a constant ![]() such that

such that

where ![]() is defined in (11.34).

is defined in (11.34).

Hence, combining (11.36) and (11.37) gives

from which we deduce that

As in the case ![]() (Proposition 11.2), this bound could be computed numerically.

(Proposition 11.2), this bound could be computed numerically.

11.3.3 Method 2: A Weighted Normal Limit

In this method, we go back to the first decomposition (11.10) of ![]() and use limit theorems for both terms

and use limit theorems for both terms ![]() and

and ![]() instead of proceeding via conditional independence and considering a small given

instead of proceeding via conditional independence and considering a small given ![]() . It means that we need to choose

. It means that we need to choose ![]() as a function of

as a function of ![]() such that

such that ![]() as

as ![]() for the approximation of the distribution of

for the approximation of the distribution of ![]() via its limit to be relevant.

via its limit to be relevant.

First we consider a normal approximation for the trimmed sum ![]() , which implies some conditions on the threshold

, which implies some conditions on the threshold ![]() (see (Csörgö et al., 1986)). We need to select a threshold

(see (Csörgö et al., 1986)). We need to select a threshold ![]() such that

such that

Note that the condition (11.12) will be implied by the condition ![]() . Hence, for this method,

. Hence, for this method, ![]() does not depend directly on the value of

does not depend directly on the value of ![]() .

.

We can then enunciate the following.

Note that ![]() is chosen in such a way that

is chosen in such a way that ![]() is finite. The case

is finite. The case ![]() corresponds to the one developed in Zaliapin et al. (but with a different set of definition for

corresponds to the one developed in Zaliapin et al. (but with a different set of definition for ![]() ).

).

Let us turn now to the limit behavior of the partial sum ![]() . The main idea of this method relies on using an estimation (involving the last order statistics) of the expected shortfall

. The main idea of this method relies on using an estimation (involving the last order statistics) of the expected shortfall ![]() of

of ![]() defined for an

defined for an ![]() -Pareto r.v. by

-Pareto r.v. by ![]() ,

, ![]() being the confidence level (see Section 11.4.1), in order to propose an approximation for the second term

being the confidence level (see Section 11.4.1), in order to propose an approximation for the second term ![]() . So it implies to assume

. So it implies to assume ![]() , that is,

, that is, ![]() .

.

Let us recall the following result (see (Acerbi and Tasche, 2002) for the proof or (Embrechts et al., 1997)) that we are going to use.

In other words, expected shortfall at confidence level ![]() can be thought of as the limiting average of the

can be thought of as the limiting average of the ![]() upper order statistics from a sample of size

upper order statistics from a sample of size ![]() from the loss distribution.

from the loss distribution.

Now we can enunciate the main empirical result.

Comments

- This result is interesting since it shows that, even if we want to consider a normal approximation, there must be a correction based on

and the number of extremes that we considered, such that both the mean and the variance become larger than the ones of

and the number of extremes that we considered, such that both the mean and the variance become larger than the ones of  .

. - With the final approximation being normal, its tail distribution is light; hence we do not expect a priori an evaluation of the VaR as accurate as the one provided by Normex, but better than the normal one applied directly on

. The light tail should still lead to an underestimation of the VaR, but certainly not as gross as the one when applying directly the CLT, because of the correcting term expressed in terms of the ES.

. The light tail should still lead to an underestimation of the VaR, but certainly not as gross as the one when applying directly the CLT, because of the correcting term expressed in terms of the ES. - We will compare numerically not only the tail approximation with the exact one but also the modified normal approximation with the normal one made directly on

.

. - To obtain a good fit requires a calibration of

. Numerically, it appeared that the value

. Numerically, it appeared that the value  provides a reasonable fit, for any

provides a reasonable fit, for any  and any

and any  . It is an advantage that

. It is an advantage that  does not have to be chosen differently, depending on these parameters

does not have to be chosen differently, depending on these parameters  and

and  , in order to keep the generality of the method. The next research step will consist in the analytical evaluation of this method and to generalize it, if possible, to any

, in order to keep the generality of the method. The next research step will consist in the analytical evaluation of this method and to generalize it, if possible, to any  .

.

11.4 Application to Risk Measures and Comparison

11.4.1 Standard Risk Measures Based on Loss Distribution

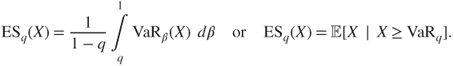

Variance and standard deviation were historically the dominating risk measures in finance. However, they require the underlying distribution to have a finite second moment and are appropriate for symmetric distributions. Because of this restricted frame, they have often been replaced in practical applications by VaR, which was, until recently, the most popular downside risk measure in finance. VaR started to be criticized for a number of different reasons. Most important are its lack of the subadditivity property and the fact that it completely ignores the severity of losses in the far tail of the loss distribution. The coherent risk measure expected shortfall was introduced to solve these issues. Two years ago, ES has been shown not to be elicitable (Gneiting, 2012). Hence the search, meantime, of coherent and elicitable alternatives, as, for instance, expectiles (Bellini et al., 2013); (Ziegel, 2014). Properties of these popular risk measures, like coherence, comonotonic additivity, robustness, and elicitability, as well as their impact on important issues in risk management like diversification benefit and capital allocation, have been discussed in a recent paper (Emmer et al., 2015).

Here we are going to consider only the risk measures used in solvency calculations (the other risk measures would be treated in the same way), namely, the value-at-risk, denoted VaR, and the expected shorfall (named also tail value-at-risk) ES (or TVaR), of an r.v. ![]() with continuous cdf

with continuous cdf ![]() (and inverse function denoted by

(and inverse function denoted by ![]() ):

):

- The value-at-risk of order

of

of  is simply the quantile of

is simply the quantile of  of order

of order  ,

,  :

:

- If

, the expected shortfall (ES) at confidence level

, the expected shortfall (ES) at confidence level  is defined as

is defined as

We will simplify the notation of those risk measures writing ![]() or

or ![]() when no confusion is possible.

when no confusion is possible.

Note that, in the case of an ![]() -Pareto distribution, analytical expressions of those two risk measures can be deduced from (11.2), namely,

-Pareto distribution, analytical expressions of those two risk measures can be deduced from (11.2), namely,

Recall also that the shape parameter ![]() totally determines the ratio

totally determines the ratio ![]() when we go far enough out into the tail:

when we go far enough out into the tail:

Note that this result holds also for the GPD with shape parameter ![]() .

.

When looking at aggregated risks ![]() , it is well known that the risk measure ES is coherent (see (Artzner et al., 1999)). In particular it is subadditive, that is,

, it is well known that the risk measure ES is coherent (see (Artzner et al., 1999)). In particular it is subadditive, that is,

whereas VaR is not a coherent measure, because it is not subadditive. Indeed many examples can be given where VaR is superadditive, that is,

see, e.g., Embrechts et al., (2009), Daníelsson et al., (2005).

In the case of ![]() -Pareto i.i.d. r.v.'s, the risk measure VaR is asymptotically superadditive (subadditive, respectively) if

-Pareto i.i.d. r.v.'s, the risk measure VaR is asymptotically superadditive (subadditive, respectively) if ![]() (

(![]() , respectively).

, respectively).

Recently, numerical and analytical techniques have been developed in order to evaluate the risk measures VaR and ES under different dependence assumptions regarding the loss r.v.'s. It certainly helps for a better understanding of the aggregation and diversification properties of risk measures, in particular of noncoherent ones such as VaR. We will not review these techniques and results in this report, but refer to Embrechts et al. (2013) for an overview and references therein. Let us add to those references some recent work by Mikosch and Wintenberger (2013) on large deviations under dependence which allows an evaluation of VaR. Nevertheless, it is worth mentioning a new numerical algorithm that has been introduced by Embrechts et al., (2013), which allows for the computation of reliable lower and upper bounds for the VaR of high-dimensional (inhomogeneous) portfolios, whatever the dependence structure is.

11.4.2 Possible Approximations of VaR

As an example, we treat the case of one of the two main risk measures and choose the VaR, since it is the main one used for solvency requirement. We would proceed in the same way for the expected shortfall.

It is straightforward to deduce, from the various limit theorems, the approximations ![]() of the VaR of order

of the VaR of order ![]() of the aggregated risks,

of the aggregated risks, ![]() , that is, the quantile of order

, that is, the quantile of order ![]() of the sum

of the sum ![]() defined by

defined by ![]() . The index

. The index ![]() indicates the chosen method, namely, (i) for the GCLT approach, (ii) for the CLT one, (iii) for the max one, (iv) for the Zaliapin et al.'s method, (v) for Normex, and (vi) for the weighted normal limit. We obtain the following:

indicates the chosen method, namely, (i) for the GCLT approach, (ii) for the CLT one, (iii) for the max one, (iv) for the Zaliapin et al.'s method, (v) for Normex, and (vi) for the weighted normal limit. We obtain the following:

11.4.3 Numerical Study: Comparison of the Methods

Since there is no explicit analytical formula for the true quantiles of ![]() , we will complete the analytical comparison of the distributions of

, we will complete the analytical comparison of the distributions of ![]() and

and ![]() given in Section 11.3.2.2, providing here a numerical comparison between the quantile of

given in Section 11.3.2.2, providing here a numerical comparison between the quantile of ![]() and the quantiles obtained by the various methods seen so far.

and the quantiles obtained by the various methods seen so far.

Nevertheless, in the case ![]() , we can compare analytically the VaR obtained when doing a rough normal approximation directly on

, we can compare analytically the VaR obtained when doing a rough normal approximation directly on ![]() , namely,

, namely, ![]() , with the one obtained via the shifted normal method, namely,

, with the one obtained via the shifted normal method, namely, ![]() . So, we obtain the correcting term to the CLT as

. So, we obtain the correcting term to the CLT as

11.4.3.1 Presentation of the study

We simulate ![]() with parent r.v.

with parent r.v. ![]()

![]() -Pareto distributed, with different sample sizes, varying from

-Pareto distributed, with different sample sizes, varying from ![]() (corresponding to aggregating weekly returns to obtain yearly returns) through

(corresponding to aggregating weekly returns to obtain yearly returns) through ![]() (corresponding to aggregating daily returns to obtain yearly returns) to

(corresponding to aggregating daily returns to obtain yearly returns) to ![]() representing a large size portfolio.

representing a large size portfolio.

We consider different shape parameters, namely, ![]() , respectively. Recall that simulated Pareto r.v.'s

, respectively. Recall that simulated Pareto r.v.'s ![]() 's (

's (![]() can be obtained simulating a uniform r.v.

can be obtained simulating a uniform r.v. ![]() on

on ![]() and then applying the transformation

and then applying the transformation ![]() .

.

For each ![]() and each

and each ![]() , we aggregate the realizations

, we aggregate the realizations ![]() 's (

's (![]() ). We repeat the operation

). We repeat the operation ![]() times, thus obtaining

times, thus obtaining ![]() realizations of the Pareto sum

realizations of the Pareto sum ![]() , from which we can estimate its quantiles.

, from which we can estimate its quantiles.

Let ![]() denote the empirical quantile of order

denote the empirical quantile of order ![]() of the Pareto sum

of the Pareto sum ![]() (associated with the empirical cdf

(associated with the empirical cdf ![]() and pdf

and pdf ![]() ) defined by

) defined by

Recall, for completeness, that the empirical quantile of ![]() converges to the true quantile as

converges to the true quantile as ![]() and has an asymptotic normal behavior, from which we deduce the following confidence interval at probability a for the true quantile:

and has an asymptotic normal behavior, from which we deduce the following confidence interval at probability a for the true quantile: ![]() , where

, where ![]() can be empirically estimated for such a large

can be empirically estimated for such a large ![]() . We do not compute them numerically:

. We do not compute them numerically: ![]() being very large, bounds are close.

being very large, bounds are close.

We compute the values of the quantiles of order ![]() ,

, ![]() (

(![]() indicating the chosen method), obtained by the main methods, the GCLT method, the Max one, Normex, and the weighted normal method, respectively. We do it for various values of

indicating the chosen method), obtained by the main methods, the GCLT method, the Max one, Normex, and the weighted normal method, respectively. We do it for various values of ![]() and

and ![]() . We compare them with the (empirical) quantile

. We compare them with the (empirical) quantile ![]() obtained via Pareto simulations (estimating the true quantile). For that, we introduce the approximative relative error:

obtained via Pareto simulations (estimating the true quantile). For that, we introduce the approximative relative error:

We consider three possible order ![]() :

: ![]() ,

, ![]() (threshold for Basel II) and

(threshold for Basel II) and ![]() (threshold for Solvency 2).

(threshold for Solvency 2).

We use the software R to perform this numerical study, with different available packages. Let us particularly mention the use of the procedure Vegas in the package R2Cuba for the computation of the double integrals. This procedure turns out not to be always very stable for the most extreme quantiles, mainly for low values of ![]() . In practice, for the computation of integrals, we would advise to test various procedures in R2Cuba (Suave, Divonne, and Cuhre, besides Vegas) or to look for other packages. Another possibility would be implementing the algorithm using altogether a different software, as, for example, Python.

. In practice, for the computation of integrals, we would advise to test various procedures in R2Cuba (Suave, Divonne, and Cuhre, besides Vegas) or to look for other packages. Another possibility would be implementing the algorithm using altogether a different software, as, for example, Python.

11.4.3.2 Estimation of the VaR with the various methods

All codes and results are obtained for various ![]() and

and ![]() are given in Kratz (2013) (available upon request) and will draw conclusions based on all the results.

are given in Kratz (2013) (available upon request) and will draw conclusions based on all the results.

We start with a first example when ![]() to illustrate our main focus, when looking at data under the presence of moderate heavy tail. We present here the case

to illustrate our main focus, when looking at data under the presence of moderate heavy tail. We present here the case ![]() in Table 11.4.

in Table 11.4.

Table 11.4 Approximations of extreme quantiles (95%; 99%; 99.5%) by various methods (CLT, Max, Normex, weighted normal) and associated approximative relative error to the empirical quantile ![]() , for n = 52, 100, 250, 500 respectively, and

, for n = 52, 100, 250, 500 respectively, and ![]()

| 95% | 103.23 | 104.35 | 102.60 | 103.17 | 109.25 |

| 1.08 | 5.83 | ||||

| 99% | 119.08 | 111.67 | 117.25 | 119.11 | 118.57 |

| 0.03 | |||||

| 99.5% | 128.66 | 114.35 | 127.07 | 131.5 | 121.98 |

| 2.21 | |||||

| 95% | 189.98 | 191.19 | 187.37 | 189.84 | 197.25 |

| 0.63 | 3.83 | ||||

| 99% | 210.54 | 201.35 | 206.40 | 209.98 | 209.74 |

| 99.5% | 222.73 | 205.06 | 219.14 | 223.77 | 214.31 |

| 0.47 | |||||

| 95% | 454.76 | 455.44 | 446.53 | 453.92 | 464.28 |

| 0.17 | 2.09 | ||||

| 99% | 484.48 | 471.5 | 473.99 | 483.27 | 483.83 |

| 99.5% | 501.02 | 477.38 | 492.38 | 501.31 | 490.98 |

| 0.06 | |||||

| 95% | 888.00 | 888.16 | 872.74 | 886.07 | 900.26 |

| 0.02 | 1.38 | ||||

| 99% | 928.80 | 910.88 | 908.97 | 925.19 | 927.80 |

| 99.5% | 950.90 | 919.19 | 933.23 | 948.31 | 937.89 |

Let us also illustrate in table 11.5 the heavy tail case, choosing, for instance, ![]() , which means that

, which means that ![]() . Take, for example,

. Take, for example, ![]() respectively, to illustrate the fit of Normex even for small samples. Note that the weighted normal does not apply here since

respectively, to illustrate the fit of Normex even for small samples. Note that the weighted normal does not apply here since ![]() .

.

Table 11.5 Approximations of extreme quantiles (95%; 99%; 99.5%) by various methods (GCLT, Max, Normex) and associated approximative relative error to the empirical quantile ![]() , for

, for ![]() , respectively, and for

, respectively, and for ![]()

| 95% | 246.21 | 280.02 | 256.92 | 245.86 |

| 13.73 | 4.35 | |||

| 99% | 450.74 | 481.30 | 455.15 | 453.92 |

| 6.78 | 0.97 | 0.71 | ||

| 99.5% | 629.67 | 657.91 | 631.66 | 645.60 |

| 4.48 | 0.31 | 2.53 | ||

| 95% | 442.41 | 491.79 | 456.06 | 443.08 |

| 11.16 | 3.09 | 0.15 | ||

| 99% | 757.82 | 803.05 | 762.61 | 761.66 |

| 5.97 | 0.63 | 0.51 | ||

| 99.5% | 1031.56 | 1076.18 | 1035.58 | 1032.15 |

| 4.33 | 0.39 | 0.06 |

11.4.3.3 Discussion of the results

- Those numerical results are subject to numerical errors due to the finite sample of simulation of the theoretical value, as well as the choice of random generators, but the most important reason for numerical error of our methods resides in the convergence of the integration methods. Thus, one should read the results, even if reported with many significant digits, to a confidence we estimate to be around 0.1% (also for the empirical quantiles).

- The Max method overestimates for

and underestimates for

and underestimates for  ; it improves a bit for higher quantiles and

; it improves a bit for higher quantiles and  . It is a method that practitioners should think about when wanting to have a first idea on the range of the VaR, because it is very simple to use and costless in terms of computations. Then they should turn to Normex for an accurate estimation.

. It is a method that practitioners should think about when wanting to have a first idea on the range of the VaR, because it is very simple to use and costless in terms of computations. Then they should turn to Normex for an accurate estimation. - The GCLT method (

) overestimates the quantiles but improves with higher quantiles and when

) overestimates the quantiles but improves with higher quantiles and when  increases.

increases. - Concerning the CLT method (

), we find out that:

), we find out that:

- The higher the quantile, the higher the underestimation; it improves slightly when

increases, as expected.

increases, as expected. - The smaller

, the larger the underestimation.

, the larger the underestimation. - The estimation improves for smaller-order

of the quantile and large

of the quantile and large  , as expected, since, with smaller order, we are less in the upper tail.

, as expected, since, with smaller order, we are less in the upper tail. - The VaR estimated with the normal approximation is almost always lower than the VaR estimated via Normex or the weighted normal method. The lower

and

and  , the higher the difference with Normex.

, the higher the difference with Normex. - The difference between the VaR estimated by the CLT and the one estimated with Normex appears large for relatively small

, with a relative error going up to 13%, and decreases when

, with a relative error going up to 13%, and decreases when  becomes larger.

becomes larger.

- The higher the quantile, the higher the underestimation; it improves slightly when

- With the Weighted Normal method (

), it appears that:

), it appears that:

- The method overestimates the 95% quantile but is quite good for the 99% one. In general, the estimation of the two upper quantiles improve considerably when compared with the ones obtained via a straightforward application of the CLT.

- The estimation of the quantiles improve with increasing n and increasing

.

. - The results are generally not as sharp as the ones obtained via Normex, but better than the ones obtained with the max method, whenever

.

.

- Concerning Normex, we find out that:

- The accuracy of the results appears more or less independent of the sample size

, which is the major advantage of our method when dealing with the issue of aggregation.

, which is the major advantage of our method when dealing with the issue of aggregation. - For

, it always gives sharp results (error less than 0.5% and often extremely close); for most of them, the estimation is indiscernible from the empirical quantile, obviously better than the ones obtained with the other methods.

, it always gives sharp results (error less than 0.5% and often extremely close); for most of them, the estimation is indiscernible from the empirical quantile, obviously better than the ones obtained with the other methods. - For

, the results for the most extreme quantile are slightly less satisfactory than expected. We attribute this to a numerical instability in the integration procedure used in R. Indeed, for very large quantiles (

, the results for the most extreme quantile are slightly less satisfactory than expected. We attribute this to a numerical instability in the integration procedure used in R. Indeed, for very large quantiles ( %), the convergence of the integral seems a bit more unstable (due to the use of the package Vegas in R), which may explain why the accuracy decreases a bit and may sometimes be less than with the Max method. This issue should be settled using other R-package or software.

%), the convergence of the integral seems a bit more unstable (due to the use of the package Vegas in R), which may explain why the accuracy decreases a bit and may sometimes be less than with the Max method. This issue should be settled using other R-package or software.

- The accuracy of the results appears more or less independent of the sample size

- We have concentrated our study on the VaR risk measure because it is the one used in solvency regulations both for banks and insurances. However, the expected shortfall, which is the only coherent measure in presence of fat tails, would be more appropriate for measuring the risk of the companies. The difference between the risk measure estimated by the CLT and the one estimated with Normex would certainly be much larger than what we obtain with the VaR when the risk is measured with the expected shortfall, pleading for using this measure in presence of fat tails.

11.4.3.4 Normex in practice

From the results we obtained, Normex appears as the best method among the ones we studied, applicable for any ![]() and

and ![]() . This comparison was done on simulated data. A next step will be to apply it on real data.

. This comparison was done on simulated data. A next step will be to apply it on real data.

Let us sketch up a step-by-step procedure on how Normex might be used and interpreted in practice on real data when considering aggregated heavy-tailed risks.

We dispose of a sample ![]() , with unknown heavy-tailed cdf having positive tail index

, with unknown heavy-tailed cdf having positive tail index ![]() . We order the sample as

. We order the sample as ![]() and consider the aggregated risks

and consider the aggregated risks ![]() that can be rewritten as

that can be rewritten as ![]() .

.

- Preliminary step: Estimation of

, with standard EVT methods (e.g., Hill estimator (Hill, 1975)),

, with standard EVT methods (e.g., Hill estimator (Hill, 1975)),  -estimator (Kratz and Resnick, 1996); (Beirlant et al., 1996)), etc.); let

-estimator (Kratz and Resnick, 1996); (Beirlant et al., 1996)), etc.); let  be denoted as an estimate of

be denoted as an estimate of  .

. - Define

with

with  (see (11.13)); the

(see (11.13)); the  largest order statistics share the property of having a

largest order statistics share the property of having a  th infinite moment, contrary to the

th infinite moment, contrary to the  first ones. Note that

first ones. Note that  is independent of the aggregation size.

is independent of the aggregation size. - The

first order statistics and the

first order statistics and the  last ones being, conditionally on

last ones being, conditionally on  , independent, we apply the CLT to the sum of the

, independent, we apply the CLT to the sum of the  first order statistics conditionally on

first order statistics conditionally on  and compute the distribution of the sum of the last