c) Reference

Beck’scher Bilanzkommentar, § 266, nos. 69–82 and § 271

Coenenberg et al., 2016 (1), p. 250

Exercise 13: Deferred tax assets

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Name at least three transactions that result in deferred tax assets.

b) Solution

- Recognition of a provision for onerous contracts. Under the Commercial Code, recognition is mandatory; under German tax law, it is forbidden.

- Higher measurement of (pension) provisions under the Commercial Code than under German tax law, e.g. because of discounting of provisions according to the Commercial Code with an interest rate that is lower than the 6% applicable under tax law.

- Use of the option to expense a disagio fully in the first period according to the Commercial Code, whereas a recognition as deferred expenses according to the matching principle is mandatory under German tax law.

- Use of higher depreciation under the Commercial Code, e.g. declining balance method, which is currently not allowed under German tax law.

- Tax losses carried forward if they are expected to be used in the next 5 years.

c) Hints

To the extent that the recognition and measurement criteria in the Commercial Code and German tax law are not identical, deferred taxes are used to correct the measurement of taxes under the Commercial Code. Theoretically, the result before taxes under the Commercial Code multiplied by the tax rate should be identical to the tax expense or income (both current and deferred) presented in the income statement.

Deferred tax assets are expected future tax relief, i.e. the result under the Commercial Code is today reduced by expenses that will be tax deductible in the future. In consequence, today’s result under German tax law is higher than under the Commercial Code, and therefore current taxes are higher than would be expected when looking at the result according to the Commercial Code. This situation can be corrected for corporations if the recognition option (§ 274) is used. Recognition of deferred tax liabilities is mandatory.

A good way to remember what kind of difference will turn into what kind of deferred tax is the following matrix. If you remember one square, all the other possibilities can be derived because the adjacent squares lead to the opposite result.

The rules for deferred taxes are specified in § 274 and are therefore applicable only for corporations.

d) References

Bacher, Chapter 3.3.5

Beck’scher Bilanzkommentar, § 274

Coenenberg et al., 2016 (1), p. 495

Exercise 14: Internally generated intangible assets

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

A company has developed a new production technique. The development costs are €160,000 and are included as expenses in the income statement. This production technique was patented and approved. The company likes to use the production technique in its own production department (beginning in January of the next year).

How could this transaction be accounted for? How will the profit at the closing date be influenced by recognition (and amortization) in the next 4 years (neglect deferred taxes)? Assume a useful life of 4 years and linear/straight-line amortization.

b) Solution

§ 248 sect. 2

§ 255 sect. 2a

The Commercial Code offers a recognition option for self-produced intangible assets that are non-current: These assets can be recognized as assets but do not have to be (§ 248 sect. 2).

| patent | intangible asset |

| developed by company | internally generated |

| used in production | non-current (no intention to sell patent) |

A recognition is possible only if the development costs can be clearly distinguished from research costs (§ 255 sect. 2a); this is the case here, so a recognition as non-current intangible asset would be possible.

The effects of a recognition look as follows:

Tab. 5.47: Solution to exercise 14.

| Effect on net result | Comment | |

| Year 0 | +160,000 | Recognition of asset |

| Year 1 of use | −40,000 | Amortization in year 1 |

| Year 2 of use | −40,000 | Amortization in year 2 |

| Year 3 of use | −40,000 | Amortization in year 3 |

| Year 4 of use | −40,000 | Amortization in year 4 |

| Sum | 0 |

For simplicity a partial amortization of Year 0 is neglected.

c) Hints

Note that the sum of the annual effects is 0. Using the accounting option affects the results of individual periods, but for the total period it is always neutral, i.e. if you increase your profit today, you will reduce your profit in upcoming periods (and vice versa).

d) References

Bacher, Chapter 3.3.1.1

Beck’scher Bilanzkommentar, § 248, nos. 10–46

Coenenberg et al., 2016 (1), p. 180

Exercise 15: Depreciation methods

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

Name briefly and precisely the most important advantages of both the linear depreciation method and the declining balance method.

Advantages of linear depreciation:

–It satisfies current tax requirements if the useful life is identical for commercial and tax balance sheet. In that case, no additional tax calculations are necessary and no deferred taxes exist.

–It is easy to calculate and to understand.

–It assumes a continuous use of the asset, which is often the most plausible assumption if better information is not available.

Advantages of declining balance depreciation:

–It represents better a disproportionate decrease in value at the beginning of the useful life (e.g. after purchase of a company car).

–It is better suited to keep the total expenses of an investment constant; over time maintenance expenses, for example, typically increase and can be compensated by the decreasing depreciation.

–It transfers tax payments to the future if tax deductible (currently, for new investment not the case in Germany).

c) References

Jung, p. 1043

Exercise 16: Depreciation methods

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

A car is bought on 15 January 20X1 and will probably be used for 5 years or 200,000 km. The acquisition costs amount to €40,000. The mileage is distributed as follows:

| Year 1 | 35,000 km |

| Year 2 | 25,000 km |

| Year 3 | 30,000 km |

| Year 4 | 65,000 km |

| Year 5 | 45,000 km |

Compare the development of the depreciation for linear, declining balance (30%) and performance-oriented depreciation.

The depreciation schedules look as follows (all values in €):

Tab. 5.48: Solution to exercise 16 – linear depreciation.

Tab. 5.49: Solution to exercise 16 – declining balance depreciation.

The corresponding linear depreciation is calculated as the remaining book value at the beginning divided by the remaining useful life (i.e. for year 2: 28,000 / 4 = 7,000). When this corresponding linear depreciation is larger than the declining balance depreciation, you must switch to linear (in this example in period 3: 6,533 > 5,880).

Tab. 5.50: Solution to exercise 16 – performance-oriented depreciation.

The annual depreciation is calculated by multiplying the initial acquisition costs (€40,000) with the performance as a percentage (i.e. percentage of annual performance (for year 1: 35,000 km) and total performance (200,000 km)). The total amount depreciated is always the same: 40,000. But the distribution over the reporting periods varies substantially.

c) References

Bacher, Chapter 3.3.1.1

Coenenberg et al., 2016 (1), p. 155

5.4Exercises on current assets

Exercise 17: Inventories

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Gert Glitz is a jeweller in Pforzheim and at a summer auction purchases gold for €100,000 and diamonds for €50,000. In spring of the following year he prepares his balance sheet. The price for gold increased, so that he could have sold his gold for €120,000 on 31 December. Unfortunately, the diamonds are of minor quality. Their market value decreases continuously: on 31 December they are valued at €40,000, and in February of the following year they are worth only €30,000. How will the gold and diamonds be valued on 31 December in the commercial and the tax balance sheets? Give reasons for your answer.

§ 252 sect. 1 no. 4

§ 253 sect. 4

Because Gert Glitz is a jeweller, it can be assumed that gold and diamonds are current assets for him, i.e. he plans to use them for his own production and wants to sell the related products to customers.

Measurement of the gold:

The value remains at the acquisition costs of €100,000 on the closing date. This corresponds to the realization principle as one part of the principle of prudence: Gains may be recognized only if they are realized. Due to the principle of congruence, this applies to the tax balance sheet as well.

Measurement of the diamonds:

The diamonds must be recognized at the lower market value; this corresponds to the imparity principle as the other part of the principle of prudence. For current assets any decrease in value at the closing date must be recognized as an expense (strict lower-of-cost-or-market principle). In addition, we must apply the closing date principle, i.e. the market conditions on the closing date are relevant. According to this principle, the diamonds must be recognized at €40,000. The even lower value in February can only be used in the following financial statements (if still relevant). If this decrease in value is considered permanent, it can be recognized for tax purposes as well. Only temporary decreases in value must not be recognized for tax purposes.

c) References

Bacher, Chapter 3.3.1.2

Coenenberg et al., 2016 (1), p. 215

Exercise 18: Inventories (2)

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

What methods can be used for the initial measurement of acquired inventories according to the Commercial Code? Explain the methods briefly.

b) Solution

§ 240 sect. 3 and 4

§ 256

Acquired inventories must be measured by their acquisition costs. The basic principle to be applied is individual measurement (each part separately). Because this is not practical for large quantities, the following simplifications are possible if they are in line with GAAP:

1. Group measurement of similar inventories:

–Periodic average

The periodic average is calculated using only one average per reporting period: The total value of all additions and the opening balance is divided by the total amount of all additions and the opening balance. This average is applied to all withdrawals/consumptions and the closing balance.

–Moving average

After each new addition a new average is calculated: The total value of the addition and assets in stock divided by the total amount of addition and assets in stock. This average is used for all withdrawals/consumptions until the next addition. To do this properly, you need precise information about the timing of additions and withdrawals.

–Last in, first out (LIFO)

Under LIFO, it is assumed that the inventories acquired last are used first. Thus, to measure the closing balance, you need to take the oldest additions (including the opening balance).

–First in, first out (FIFO)

Under FIFO, it is assumed that the inventories acquired first (or the opening balance) are used first. Thus, to measure the closing balance you need to use the newest/latest additions.

2. Constant-value approach for raw materials and similar items:

Raw materials and other materials (i.e. not finished or unfinished products) may be recognized at a constant value under strict conditions. Then you can retain the value of the prior year and show all acquisitions directly as expenses.

c) Hints

Conditions for group measurement:

The inventories must be similar. Similarity means similar in kind (e.g. screwdrivers of different sizes) or function (e.g. screws and nails can both be used to fix two things together).

This approach can also be used for moveable non-current assets or moveable current assets other than inventories if they are similar in kind (see above) or similar in value. Similar in value is interpreted as belonging to the same category of asset with a price difference of less than 20%.

Conditions for the constant-value approach:

Raw materials and tangible non-current assets can be measured at a constant value if

–their value is of minor importance,

–their structure fluctuates only slightly and

–they are continuously being used and replaced.

An example could be nails and screws for a roofer (if business does not grow and working processes do not change). Another example (for non-current assets) are cutlery, table linen or bed sets for a hotel.

d) References

Bacher, Chapter 3.3.1.2

Coenenberg et al., 2016 (1), p. 215

Exercise 19: Inventories (3)

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Ride-a-Bike GmbH makes bicycles for children. At the balance sheet date the company has 1,800 identical steering bars on stock, which are from different purchases in the business year. It is not possible to allocate the individual parts to the different purchases. Records show the following information:

| Opening balance | 1 January 20X1: | 1,400 pcs to €48 per piece |

| Increase | 10 April 20X1 | 2,000 pcs to €45 per piece |

| Increase | 15 September 20X1 | 3,500 pcs to €43 per piece |

| Increase | 10 December 20X1 | 2,800 pcs to €46 per piece |

| Total decrease: | 7,900 pcs |

- What is the balance sheet amount if the weighted periodic average is used?

- What other calculation methods are allowed under the Commercial Code? Calculate the book values according to those. What calculation method would you choose if you wanted to show as high a profit as possible?

- What measurement methods are allowed under German tax law?

b) Solution

§ 240 sect. 4

§ 256

Tab. 5.51: Solution to exercise 18.

1If the periodic average is used, one average is calculated for the whole year: All increases and the opening balance are summed up and the total value is divided by the the total amount. This results in an average of €45/pc. This average is applied to the consumption and the closing balance. Thus, the value of the consumption is €355,500 and the value of the closing balance is €81,000.

2.According to Commercial Code, LIFO and FIFO can also be applied (if in line with the GAAP).

When applying LIFO, it is assumed that the latest increases are used first, i.e. the oldest items are still on stock. This results in a value of 85,200: the total amount of the closing balance is 1,800 pc., of which 1,400 pc. are from the opening balance with a value of €67,200, and the remaining 400 pc. are from increase 1 with a value of €18,000. Thus, the total value is €85,200.

When applying FIFO, it is exactly the converse, i.e. it is assumed that the newest items are still on hand: Thus, the closing balance is measured using the price of increase 3, i.e. 1,800 pc. at €46/pc., that is €82,800.

To show as high a profit as possible, the assets should be measured as high as possible, i.e. LIFO should be used.

3.According to tax law, periodic average and LIFO are possible (LIFO only if the real sequence of consumption does not contradict LIFO).

c) Hints

The moving average could be used from a legal perspective, but it cannot be used in practice here because the exact timing of the consumption/usage of the parts is not known.

For accounting policy, you must keep in mind that these simplifications apply only to the initial measurement. If the market value at year end is lower, the lower value must be recognized (independently of the method chosen for the initial measurement – strict lower-of-cost-or-market principle).

Bacher, Chapter 3.3.1.2

Coenenberg et al., 2016 (1), p. 213

Exercise 20: Inventories (4)

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

A carpenter has a steady business. His total assets amount to €100,000, of which €3,000 is for glues and colours.

At the closing date of 31 December 20X1 he wants to simplify the preparation of his financial statements, and he wants to use the constant-value approach for the glues and colours.

Is that possible? What is the consequence?

b) Solution

§ 240 sect 3.

The constant-value approach can be used if

| –it is applied to (raw) materials: | that is the case here |

| –the materials are of minor importance: | 3% of total assets are in general considered minor |

| –the materials are continuously replaced: | unknown |

| –the materials fluctuates in value and composition only slightly: | unknown |

The first two criteria are fulfilled. The two additional criteria need to be fulfilled as well; only if all criteria are fulfilled can the constant-value approach be used.

If the constant-value approach is used, the consequence is that for these assets a constant value is used, i.e. the book value no longer changes and acquisitions of new material are directly shown as expenses.

c) Hints

The constant-value approach is also a simplification for stock taking because a physical stock taking must be done only after 3 years, not every year.

d) References

Beck’scher Bilanzkommentar, § 240, nos. 71–126

Coenenberg et al., 2016 (1), p. 222

Exercise 21: Measurement of receivables

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Maria Heilig owns a wholesaling business for statues of saints and other devotional items. On 31 December 20X1, her trade receivables amount to €520,625. The following specific information is available:

–An “Italian” shop for “original relics” in Hamburg owes her €11,900 (gross). The invoices have been returned to sender “address unknown”. Who the owner of the shop has been cannot be clarified. Her lawyer recommends that Maria not attempt any additional legal enforcement because it will very probably not be successful and generate additional costs.

–The customer, Hillbilly GmbH, filed for insolvency. At the moment it is unclear what the insolvency rate will be. Her lawyer estimates that she will receive 40% of the original receivable of €7,140.

–Customer Meier lost all his private belongings in gambling and is currently in a closed section of a psychiatric hospital. It is very improbable that he will pay his invoice total of €2,380.

–In recent years, the tax authorities have accepted a general valuation allowance of 2%.

In March 20X2, Maria prepares her financial statements. What will be the value of the receivables in the balance sheet? What will be the amount of valuation allowance in the income statement?

b) Solution

§ 253 sect. 4

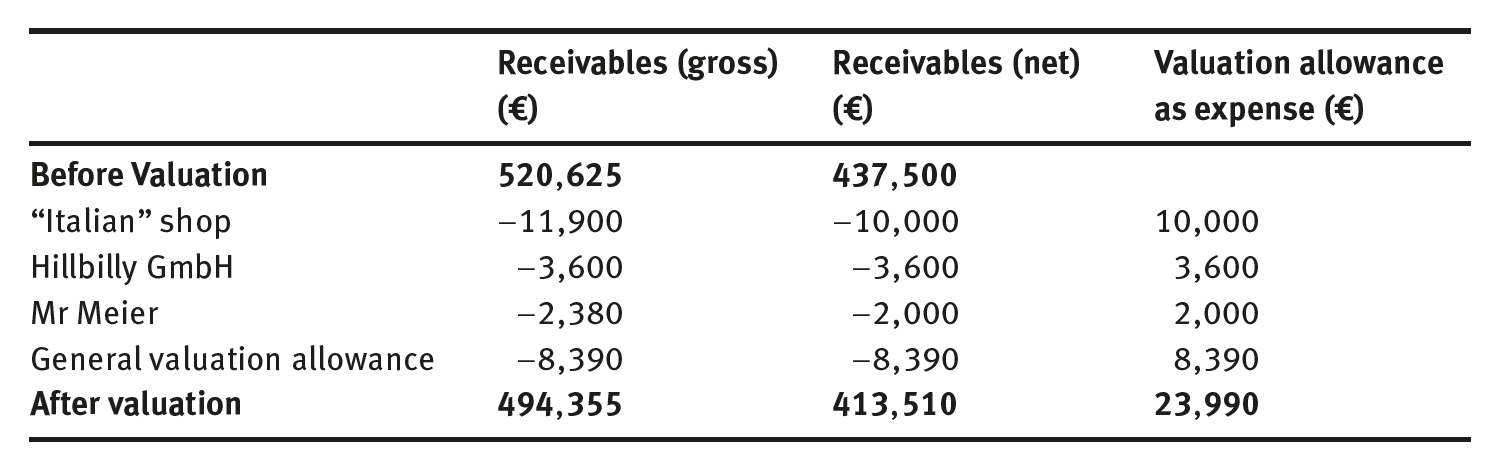

Tab. 5.52: Solution to exercise 20.

The measurement of receivables according to German laws follows a three-step approach:

1. Specific valuation allowances take into account individual risks of receivables:

(a) A complete loss is expected and very probable: The corresponding VAT may be corrected, i.e. valuation allowance based on the gross value.

(b) Only a partial loss is expected: Valuation is based on the net receivable; no correction of the VAT is allowed.

2. A general valuation allowance takes into account the general risk of receivables and is based on past experience. It may be based only on the net receivables for which no specific valuation allowance has been recognized (otherwise the valuation allowances would double).

For the “Italian” shop and Mr Meier, a complete loss of the receivable is very probable; therefore 100% of the receivable (including the VAT) is deducted.

For Hillbilly GmbH, only a partial loss is probable: Mariawill receive 40%, i.e. she will lose 60%; therefore 60% of the net receivable are deducted.

A general valuation of 2% of all receivables for which no specific valuation allowance has been recognized:

| Net value of receivables | 437, 500 |

| –Receivable “Italian” shop | −10, 000 |

| –Receivable Hillbilly GmbH | −6, 000 |

| –Receivable Meier | −2, 000 |

| Net value of receivables without specific valuation allowance | 419,500, of which 2%: 8,390. |

Therefore, the receivables shown in the balance sheet on 31 December 20X1 amount to €494,355. The valuation allowances recognized in the income statement amount to €23,990.

c) References

Bacher, Chapter 3.3.1.2

Beck’scher Bilanzkommentar, § 253, nos. 558–608

Coenenberg et al., 2016 (1), p. 256

5.5Exercises on equity

Exercise 22: Accounting for equity

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

Explain how capital increases of a corporation are accounted for. What do partial payment and agio mean in this context?

b) Solution

§ 272 sect. 1 and 2

The equity of a corporation is split into shares that have a nominal value (for a stock company the nominal value of all shares must be identical). The subscribed capital is the sum of the nominal value of all shares.

If the equity of a company is increased, this is often done by issuing new shares. The nominal value of these new shares is added to the subscribed capital. If the investors who buy the new shares pay in more than the nominal value, i.e. they pay an agio or a premium, this agio is recognized as capital reserve.

Under German company law, it is possible to found a corporation with only partial payment of subscribed capital.

The minimum equity of a limited liability company (GmbH) is €25,000. Of this €25,000, 50% must be paid in upon founding of the company. The rest can be called up later by the company.

The minimum equity of a stock company (AG) is €50,000, of which 25% must paid in when founding the company.

Nevertheless, the shareholders of the company are required to pay in the complete subscribed capital in the case of insolvency. Thus, in the financial statements the subscribed capital is reported with the complete amount, and the part that has not been paid in and is not called up is deducted, i.e. the effectively paid-in or called-up capital is calculated openly in the balance sheet and called “Paid-in/called-up capital”.

For an agio, partial payment is not possible. If the company is founded with partial payment of the nominal capital, a possible agio must always be paid in full.

c) References

Bacher, Chapter 3.3.2

Beck’scher Bilanzkommentar, § 272

Coenenberg et al., 2016 (1), p. 331

Exercise 22: Accounting for equity

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

What is the difference between capital reserves and revenue reserves in accounting and in financing?

b) Solution

§ 272 sect. 2 and 3

A capital reserve is an additional capital contribution of shareholders that does not increase the nominal capital (and therefore typically does not increase voting rights). It often occurs together with a capital increase if an agio is paid. The nominal value of the capital increase increases the subscribed capital, while the agio, i.e. the additionally paid-in capital, increases the capital reserves.

Revenue reserves are profits of either the current period or former periods that are kept in the company and formally transferred to the revenue reserves, i.e. they are not paid out as dividends or other form of profit distribution.

From a financing perspective, a change of capital reserves is external financing because there is cash flow from the outside to the company. On the other hand, revenue reserves are internal financing because the additional capital is generated by the business process of the company.

c) References

Bacher, Chapter 3.3.2

Beck’scher Bilanzkommentar, § 272

Coenenberg et al., 2016 (1), p. 331

Exercise 23: Accounting for a company’s own shares

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

The price for shares of High Tech AG decreased in recent months. Therefore, the executive board decided to purchase company shares to stabilize the price. On 31 December 20X1 the equity was shown as follows:

| Subscribed capital | €100 million |

| Capital reserves | €800 million |

| Revenue reserves | €600 million |

On 30 November 20X2, the company buys one million shares with a nominal value of €1/share for a total price of €12 million. How does this transaction have to be shown in the balance sheet as of 31 December 20X2?

On 15 January 20X3 the company is able to sell the shares again for a price of €15 million. How should this be accounted for in the upcoming balance sheet?

b) Solution

§ 272 sect. 1a and 1b

Tab. 5.53: Solution to exercise 23.

If a corporation acquires its own shares (typically it is a listed stock company that purchases its own shares on a stock exchange, but the logic applies to any acquisition by a company of its own shares), the value of these shares must be deducted openly from equity.

More precisely: The acquired nominal amounts must be deducted from subscribed capital, and any agio that has been paid must be deducted from revenue reserves (see column 3, “acquisition”).

If the shares are sold again, the original deduction must be reversed. If an additional gain is made, this gain is shown as capital reserve (because it has been paid in additionally by third parties; see column 5, “resale”).

c) Hints

The presentation of a company’s own shares as financial assets would be misleading: On the one hand, there is an asset because the shares could be sold again and – usually – were acquired against cash. On the other hand, equity would be overstated in doing this: To the extent the company acquired its own shares, the company belongs to itself; in the case of insolvency, not all equity would be available for creditors because the shares would be worthless. Therefore, to present the value of equity that is available to third parties, the company’s own shares are netted with equity.

Any expenses incurred during the acquisition are not treated as an incidental acquisition cost but as expenses from the period.

d) References

Beck’scher Bilanzkommentar, § 272, nos. 131–150

Coenenberg et al., 2016 (1), p. 358

5.6Exercises on provisions

Exercise 24: Important differences between provisions and debt

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

What is the difference between a provision and a debt in accounting? Give one example for each case.

b) Solution

§ 249

Provisions are liabilities, i.e. they are based on an obligation to a third party (e.g. customers, suppliers, employees). Unlike debt, they are uncertain to some extent: The reason or the settlement amount can be uncertain (or both). Nevertheless, the obligation and its fulfilment must be probable.

Examples for provisions

Pension provision: A company promises employees (all or only some) to pay additional retirement benefits. There is a lot of uncertainty in this promise: Which employees will reach retirement within the company? What is their salary at that time? What will the retirement benefit be in the future (based on, for example, price changes or salary increases)? Nevertheless, it is probable that there will be future payments, and therefore a provision must be recognized.

Warranty provision: Some products of a company may be faulty or damaged. In that case, customers will make use of warranty services. Insofar as the expenses incurred by the warranty services are probable and predictable, a provision for warranties must be recognized.

Examples for debt

Bank loan: The loan agreement with the bank states clearly what the obligation is and how and when it must be fulfilled. There is very little uncertainty – thus, it is a debt, not a provision.

Trade payables: When a company receives an invoice from a supplier and it has received the goods or services, there is very little uncertainty regarding what amount must be paid and when.

c) Hints

The obligation to recognize provisions results from the realization principle and the imparity principle: Probable and predictable losses must be recognized when known, not when realized (i.e. as early as possible). If there is a concrete connection from future expenses to a past event, the realization principle (matching principle) requires the recognition of a provision for uncertain liabilities. If future expenses are not covered by future income, but cannot be avoided because of an existing contract, a provision for onerous contracts must be recognized; it is based on the imparity principle. Apart from provisions for uncertain liabilities and onerous contracts, § 249 requires the recognition of another category of provisions: In two specific circumstances, expense provisions must be recognized:

–If necessary maintenance was omitted and is brought up to date within 3 months or

–if necessary waste disposal was omitted and is brought up to date within 12 months, a provision must be recognized. In contrast to the provisions for uncertain liabilities or for onerous contracts, there exists no outside obligation in these cases; whether or not the maintenance or the waste disposal is brought up to date is a decision of company management.

d) References

Bacher, Chapter 3.3.3.2

Beck’scher Bilanzkommentar, § 249

Coenenberg et al., 2016 (1), p. 429

Exercise 25: Recognition of provisions

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Please determine in which of the following cases is the recognition of a provision required by the Commercial Code, and classify the type of provision.

- Due to the strong increase in demand for ITL Care i5 computers, in October a dealer orders 10,000 units at €1,000 per unit; delivery will occur in January. In December the next-generation model ITL Care i6 surprisingly appears on the market, so the sales prices for the acquired units decrease to €500 per unit. How does the dealer account for that at the balance sheet date? What happens if the computers were delivered in November, but not sold?

- A car producer sold 10,000 cars in the last business year. The revenue from the sales was €500 million. Based on past experience, the company must calculate on the basis of 2% usage of guarantee services. How does the company account for this at the balance sheet date?

- A production machine of producer X needs urgent maintenance, but the maintenance was neglected due to the currently high order volume. Producer X came to an agreement with craftsman Y that Y will maintain the machine for a fixed price of €800. Y can do the maintenance after the balance sheet date. How should X account for that?

§ 249

1.A purchase contract exists, but neither the buyer nor the seller has fulfilled his obligations, so the transaction is pending. Usually, pending transactions are not accounted for, with one exception: If a loss is expected to be realized on this transaction, then the loss must be recognized already now as a provision for onerous contracts.

In the current case, the dealer expects a loss of €500 per unit because of the decreased sales price. Therefore, he must recognize a provision for onerous contracts in the amount of €5 million.

If the computers were already delivered and in stock, the transaction is no longer pending. The computers are recognized as assets (merchandise) with their acquisition costs and must be revalued to the lower market price at year end (strict lower-of-cost-or-market principle). In this case, the value of the computers must be reduced to €5 million by an impairment. The effect on the income statement is identical, but the balance sheet position is different (reduction of an asset instead of increase in a provision). An additional provision could be recognized only if the expected loss is greater than the value of the corresponding assets (which is not the case here).

2.Expected warranty services are a typical case for a provision for an uncertain liability. A car producer expects, based on experience, that in the future 2% of current sales will be used for warranty services. Therefore, he must recognize a provision for uncertain liabilities (more specifically, for warranty services) of 2% of the current sales, or €10 million.

3.The maintenance of the machine should have been done earlier but was neglected. If the maintenance is done by the craftsman within the first quarter after the closing date, it must be recognized as a provision. If it is done later, a recognition is prohibited.

c) Hints

In the last case, a factual accounting option exists: Depending on the timing (within the first quarter, after the first quarter) it is a recognition requirement or prohibition. If the timing is flexible, it can be used for accounting policy. But keep in mind that the correctness can be checked easily afterwards – thus, if this is to be used for the accounting policy, the timing must be precise and kept constant.

d) References

Bacher, Chapter 3.3.3.2

Beck’scher Bilanzkommentar, § 249

Coenenberg/Haller/Schultze, p. 429

Exercise 26: Discounting of provisions

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

Customers of a production company were not satisfied with the quality of the products and claimed damages. The company does not accept the claims and seeks a legal decision in court; nevertheless, the company expects that it will probably have to pay €12 million in damages in about 3 years after closing date (the decision of the court in all instances will take that amount of time).

The German central bank published the following rates according to § 253 sect. 2:

What is the value of the provision at the closing date? What is the value 1 year later assuming that nothing has changed (same settlement amount and same interest rates)?

b) Solution

§ 253 sect. 2

At closing date

The expected settlement amount must be discounted for 3 years by the corresponding interest rate:

The value to be recognized is €11,374,647, i.e. the effect of discounting is €625,353.

One year later

The maturity is reduced by 1 year because settlement is now expected in 2 years, and the interest rate must be adjusted according to the changed maturity. The increase must be shown as interest expense because it stems from the changes in maturity and interest rate (if there were any changes in the settlement amount, these would be recognized as operating expenses or income); the corresponding journal entry is as follows:

| Debit interest expense | 273,293 | |

| Credit provision | 273,293 |

c) References

Beck’scher Bilanzkommentar, § 253, nos. 180–190

Coenenberg et al., 2016 (1), p. 434

5.7Exercises on debt

Exercise 27: Presentation of tax liabilities

| Category: | Knowledge/Application |

| Time to solve: | 5 minutes |

a) Exercise

A company must recognize a tax liability of €100,000 at the closing date. How is this transaction presented in the three cases? What is the exact balance sheet item in each case and the recognized amount?

- The company has paid €80,000 in advance and has filed its tax return, but the final tax assessment by the tax authorities remains open.

- The company has paid €80,000 in advance and the tax assessment was received (100 T€); the amount is due in the middle of January.

- The company has paid €140,000 in advance and has filed its tax return.

b) Solution

§ 266

- This results in a tax provision of €20,000 because the final assessment of the tax authorities is open; there is some uncertainty that the assessed amount could be lower or higher than the tax return.

- This results in a tax payable of €20,000, shown as “other payables, to tax authorities”, because the exact amount and timing are known.

- This results in a tax receivable of €40,000, shown as “other receivables” because a refund is expected from the tax authorities.

c) References

Beck’scher Bilanzkommentar, § 247 and § 266

Exercise 28: Accounting for a disagio

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Your company needs a loan of €100,000 for an investment. Your bank offers a loan at a 7% annual interest rate. As an alternative, it offers a low-rate variant (5% interest) with a discount of 6%, i.e. outpayment is 94%. The term of the loan is 3 years and is to be repaid in full at the end of the term. You choose the discount alternative; the outpayment is in early January.

How can this loan be accounted for (under the Commercial Code and German tax law)? What is the interest expense in each year and in total?

b) Solution

§ 250 sect. 3

Commercial Code

§ 250 sect. 3 provides an accounting option for a disagio: It can be recognized as an expense in the first period or be recognized as a deferred expense and be distributed over the term of the loan.

Expense in first period

Values in €

| Outpayment: Debit bank | 94,000 | |

| Interest expense | 6,000 | |

| Credit bank loan | 100,000 | |

| End of year 1: Debit interest expense | 5,000 | |

| Credit bank | 5,000 | |

| End of year 2: Debit interest expense | 5,000 | |

| Credit bank | 5,000 | |

| End of year 3: Debit interest expense | 5,000 | |

| Bank loan | 100,000 | |

| Credit bank | 105,000 |

Thus, in the first year €11,000 in interest expense are recognized, and in the two following years only €5,000, in total €21,000.

Recognition of deferred expense

| Outpayment: | Debit bank | 94,000 | |

| Deferred expense | 6,000 | ||

| Credit bank loan | 100,000 | ||

| End of year 1: | Debit interest expense | 5,000 | |

| Credit bank | 5,000 | ||

| Debit interest expense | 2,000 | ||

| Credit deferred expense | 2,000 |

Thus, using the deferred expenses, the interest expenses are spread equally over all periods (€7,000 each), again in total €21,000.

Tax law:

Only the second alternative is acceptable.

c) Hints

The effects of any accounting options are neutral when you look at the total period: In total €21,000 of interest were paid over 3 years, just the distribution between the years varies. The use of accounting options does not produce additional profits or gains; it can only influence the accounting for these profits and gains and in particular when they must be shown.

Only if an accounting option is tax deductible and results in lower tax payments today and higher tax payments in the future can there be a positive interest effect (more liquidity today, i.e. more interest income or less interest expense) that is not neutral, but an additional profit.

d) References

Bacher, Chapter 3.3.3

Beck’scher Bilanzkommentar § 250

Coenenberg et al., 2016(1), p. 477

5.8Exercises on deferred items and deferred taxes

Exercise 29: Accounting for deferrals and accruals

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

When is the recognition of a deferral or an accrual necessary? Give an example for each possible case.

§ 250 and § 252 sect. 1 no. 5

Deferrals and accruals must be recognized when payment (cash in-/ outflow or proceeds/expenditure) and received or rendered service occur in different reporting periods and must refer to a specific time period. This is a consequence of accrual accounting (in contrast to cash accounting), which requires income and expenses to be recognized when they occur (and not when they are paid).

Four cases can be distinguished:

Cash outflow/expenditure now, expense in next period: In this case, a deferred expense must be recognized (if an asset is acquired, the asset is recognized; here we are discussing services we will receive and that cannot be recognized as an asset). A typical example is prepaid rent or prepaid insurance premiums.

Cash inflow/proceeds now, income the next period: In this case a deferred income must be recognized. A typical example is prepaid rent when the landlord receives payment in advance.

Deferrals are also called transitory items because they are recognized in the balance sheet, even if they are not an asset or a liability, just to shift the expense and income to the correct period in the future.

Expense now, cash outflow/expenditure in next period: In this case, the expense must be recognized now (must be accrued now) and a corresponding other liability is recognized. A typical example is when rent is paid at the end of the rental period or when interest is paid at the end of the borrowing period.

Income now, cash inflow/proceeds in next period: In this case, the income must be recognized now (must be accrued now) and a corresponding other receivable is recognized. A typical example is when rent is received at the end of the rental period.

Accruals are also called anticipative items because the income or expenses are recognized before payments are due (i.e. shifted to the current period).

c) References

Bacher, Chapter 3.3.4

Beck’scher Bilanzkommentar, § 250 and § 252, nos. 51–54

Coenenberg et al., 2016 (1), p. 477

Exercise 30: Accounting for deferrals and accruals

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

Identify the balance sheet positions, on 31 December 20X1, of the following transactions and journalize them:

- Advanced payments (paid) for rental expenses of the year 20X2 of €12,000.

- Received advance payment of €34,000 for delivery in 20X2.

- An amount of €25,000 must be paid for delivered raw material supplies.

- Taking out a loan from a bank at a nominal amount of €100,000, 90% of which is paid out.

- Received lease payments of €300 for the first quarter of 20X2.

- The rent for a storage building used last year was not paid until now (€15,000). On 30 November 20X1 the company no longer used this storage building.

- A bond was issued with a volume of €1 million. The interest of 4% must paid at the end of each quarter. The payment for the last quarter of 20X1 was made on 3 January 20X2.

b) Solution

§ 250 and § 252 sect. 1 no. 5

1.Deferred expenses of €12,000

| Debit deferred expenses | 12,000 | |

| Credit rental expenses or bank | 12,000 |

Whether rental expenses or the bank is used as the credit entry depends on the status of the accounting: If the payment was already journalized as rental expenses, then the rental expenses must be corrected. If this is the first entry of the transaction, then the payment must be recognized, i.e. bank is the credit entry.

2.Received advance payments of €34,000

| Debit bank | 34,000 | |

| Credit received advance payments | 34,000 |

An advance payment for a delivery does not refer to a specific time period, so it must be recognized as regular liability, because the customer will probably claim it back if the company is not able to deliver the products (§ 266).

3.Made advance payments of €25,000

| Debit paid advance payments | 25,000 | |

| Credit bank | 25,000 |

See answer 2. As these advance payments relate to inventories, they will be shown as a subitem of inventories (§ 266).

4.According to § 250 sect 3, there exist options for a disagio.

Alternative 1: full recognition of the disagio as interest expense

| Debit bank | 90,000 | |

| Interest expense | 10,000 | |

| Credit bank loan | 100,000 |

Alternative 2: Recognition as deferred expense

| Debit bank | 90,000 | |

| Deferred expense | 10,000 | |

| Credit bank loan | 100,000 |

5.Deferred income of €300

| Debit rental income/bank | 300 | |

| Credit deferred income | 300 |

See answer 1.

6.Trade payable of €15,000

| Debit rental expense | 15,000 | |

| Credit trade payable | 15,000 |

This is not a deferral or accrual because everything has already happened. The building was used and the rent should have been paid. Because that did not happen, a liability must be recognized.

7.Other liability of €10,000

| Debit interest expense | 10,000 | |

| Credit other liability | 10,000 |

This is a typical accrual: The money borrowed through the bond is available and used by the company, so the benefits of the money are recognized in the reporting period. The matching principle requires recognizing expenses corresponding to the income, i.e. the interest of the money used must be recognized, even if payment occurs in the next period.

c) References

Bacher, Chapter 3.3.4

Beck’scher Bilanzkommentar, § 250 and § 252, nos. 51–54

Coenenberg et al., 2016 (1), p. 477

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

In the balance sheet of Karlsruhe Beteiligungs GmbH, a provision for onerous contracts in the amount of €100,000 is recognized. The income tax rate at the time the difference will even out (trade tax, corporation tax, solidarity surcharge) is 30%.

- Is there a temporary difference?

- Does this result in deferred tax assets or liabilities?

- What is the amount of the deferred taxes?

- Do any options exist regarding the accounting for deferred assets in this case?

- How is the use or reversal of the provision accounted for if a deferred tax asset has been recognized?

b) Solution

- Yes. A provision for onerous contracts must be recognized according to the Commercial Code and is forbidden under German tax law. Thus, there is a difference. The difference will even out: Either the loss is realized, in which case it will be taxed as well, or the provision needs to be reversed because it is no longer necessary. Therefore, it is a temporary difference.

- Deferred tax assets. The loss was already recognized as an expense in the commercial balance sheet but will be tax deductible only when it occurs in the future. Therefore, the future tax payments will be too low compared to the result in the commercial income statement. A deferred tax asset can correct this future tax relief (lower future tax payments).

- A deferred tax asset or liability is calculated by multiplying the temporary difference by the applicable tax rate:

€100,000 temporary difference × 30% tax rate = €30,000 deferred tax asset. - For deferred tax assets there exists an accounting option, i.e. the asset can be recognized or not; a partial recognition is not possible.

- When the provision is used or reversed, there is no longer any temporary difference: In the case of use, the loss was realized and is tax deductible. In the case of reversal, there was no loss, but because of the reversal there is no longer any provision.

Because the temporary difference no longer exists, the resulting deferred tax asset must be reversed as well.

c) References

Bacher, Chapter 3.3.5

Beck’scher Bilanzkommentar, § 274

Coenenberg et al., 2016 (1), p. 495

5.9Exercises on income statement and cash flow statement

Exercise 32: Income statement

| Category: | Knowledge |

| Time to solve: | 5 minutes |

a) Exercise

Explain the differences between the total-cost format and cost-of-sales format.

b) Solution

§ 275

According to § 275, two alternative formats for the preperation of the income statement are possible for corporations. Partnerships and sole proprietorships have no specific formats but can use any structure that satisfies GAAP (the concepts of § 275 can be viewed as best practices, which are often used by partnerships or sole proprietorships as well, but often with less detail).

Total-cost format

In the total-cost format, the change in inventory, i.e. the increase or decrease in finished and unfinished products, is reported as a separate income item. The expenses are structured according to the type of expense, e.g. material expenses, personnel expenses, depreciation and amortization.

Cost-of-sales format

In the cost-of-sales format, the change in inventory is netted with the cost of goods sold, i.e. this income or expense is not shown separately. In addition, the expenses are structured according to the functional area in which they occur, e.g. cost of goods sold, distribution costs, research and development costs, administrative costs.

c) Hints

The net result is necessarily the same in both formats. The differences concern only the way the information is presented, not the substance of the transaction.

For example, personnel expenses in the total-cost format include all personnel expenses of the company: e.g. for production, for distribution, for administration, whereas, for example, the distribution costs according to the cost-of-sales format include all material and personnel expenses as well as depreciation that were incurred for the distribution department (marketing, sales and sales logistics).

d) References

Bacher, Chapter 3.4

Beck’scher Bilanzkommentar, § 275

Coenenberg et al., 2016 (1), p. 531

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

For a company the following information is available:

What does the income statement look like according to the total-cost format and according to the cost-of-sales format?

b) Solution

§ 275

Total-cost format (values in T€):

–The change in inventory is shown as a separate income item.

–The structure of expenses accords with the kind of expense (i.e. in lines).

| Sales revenue | 20,000 |

| Change of inventory | 500 |

| Material expenses | −2,000 |

| Salaries and wages | −7,000 |

| Depreciation | −5,000 |

| Operating profit | 6,500 |

Cost-of-sales format (values in T€):

–The change in inventory is netted with cost of good sold.

–The structure of expenses accords with the functional area (i.e. in columns).

| Sales revenue | 20,000 |

| Costs of goods sold | −8,500 |

| Gross profit | 11,500 |

| Distribution costs | −3,000 |

| Administration costs | −2,000 |

| Operating Profit | 6,500 |

Bacher, Chapter 3.4

Beck’scher Bilanzkommentar, § 275

Coenenberg et al., 2016 (1), p. 531

Exercise 34: Cash flow statement

| Category: | Knowledge/Application |

| Time to solve: | 10 minutes |

a) Exercise

- What is an expense? Give an example of an expense that is also a cash outflow and an example of an expense that is not a cash outflow.

- How is the operating cash flow calculated (using the indirect method)? Explain the basic logic, not the full detail schedule.

- What is the cash flow from financing if

–cash at the beginning of the period is 2,500

–operatingcashflowis3,300

–investment cash flow is − 1.250 and

–cash at the end of the period is 3.075?

b) Solution

DRS 21

1.An expense is a decrease in net assets, i.e. a decrease in equity caused by the operations of the company and not an external cash outflow. An expense is not necessarily at the same time a cash outflow.

Expense and cash outflow are identical, for example, for received services that are paid for in cash or for wages or salaries paid for in the same reporting period.

Expense and cash outflow are not identical, for example, for depreciation (cash outflow occurred when the asset was acquired or produced) or when a service is purchased on credit.

2.The indirect method means that the cash flow statement is calculated from the balance sheet and income statement and not directly from the cash flows of the company.

The indirect method calculates the operating cash flow as follows (general method):

Net profit

| + Depreciation, amortization, impairment (minus any reversals) |

| + Increase in provisions (minus any decreases) |

| − Increase in net working capital (plus any decreases) |

| = Cash flow from operating activities |

3.The general formula for the cash flow statement is as follows: Cash at beginning of period

| + Cash flow from operating activities |

| + Cash flow from investing activities |

| + Cash flow from financing activities |

| = Cash at end of period |

| Rearranging we get | |

| Cash at end of period | +3,075 |

| − Cash at beginning | −2,500 |

| − Cash flow from operating activities | −3,300 |

| − Cash flow from investing activities | +1,250 |

| = Cash flow from financing activities | = −1,475 |

c) References

DRS 21

Coenenberg et al., 2016 (1), p. 818

Exercise 35: Cash flow statement

| Category: | Knowledge/Application |

| Time to solve: | 15 minutes |

a) Exercise

Example AG shows the following balance sheet and income statement for the business year 20X1 (values in €):

Tab. 5.56: Exercise 35 balance sheet.

In the change in non-current assets are included – apart from the depreciation – expenditures for investments of €130,000 and proceeds from the disposal of assets of €40,000.

The change in bank loans results from proceeds of €70,000 due to new loans and repayments of €20,000. In addition, a dividend of €70,000 was paid for the previous year.

The balance sheet items inventories, trade receivables, bank loans and trade payables do not include any changes that are non-cash-oriented.

Tab. 5.57: Exercise 35 income statement.

| Values in € | 1 Jan. 20X1–31 Dec. 20X1 |

| Sales revenue | 940,000 |

| Material expenses | −300,000 |

| Personnel expenses | −340,000 |

| Depreciation / Amortization | −50,000 |

| Net result of other expenses / income | −50,000 |

| Financial result | −70,000 |

| Tax expenses | −40,000 |

| Net result | 90,000 |