Objective 16-4 Mutual Funds and Other Opportunities

-

Describe the different types of mutual fund investments and other investment opportunities besides stocks, bonds, and mutual funds.

Mutual Funds

What is a mutual fund? A mutual fund is a means by which a group of investors pool money together to invest in a diversified set of investments. Suppose you want to invest in the stock market but, like Alex and Keri Young, you have only $3,000 to invest. After looking at possible investments, you realize that with $3,000, you can afford to buy stock in only one or two companies. You later learn that several of your friends have the same problem. So, as a group, you decide to pool your money and hire an expert to buy a portfolio of stocks. With this arrangement, each of you shares a proportional amount of the returns from the money you have invested as a group, as well as the expenses for the investment advice and other costs of investing. If you were to do that, you would have essentially created a mutual fund.

Why are mutual funds so popular? Mutual funds are the best kind of investment for those who have little to no experience in investing or who might not have a lot of money to create a well-diversified portfolio. There are many reasons why investing in mutual funds is a good strategy:

Diversification. The big advantage of investing in mutual funds is diversification. Mutual funds offer small investors a means to lower the risks associated with investments with a cost-effective way to invest in many different types of companies and investment products.

Professional management. Professional management is another advantage of mutual funds. Each mutual fund is managed by an investment professional. These professionals spend all their time researching, trading, and watching the investments that make up the funds they manage. This is likely more time than you would be able to spend if you created a similar portfolio on your own. Because their jobs depend on it, mutual fund managers have an incentive to try to ensure their funds perform at their best.

Liquidity. It is easy to sell mutual funds, so you can get to your money back quickly—usually within a day. Some mutual funds, primarily money market funds, offer check-writing privileges, so accessing your money is even easier.

Cost. It takes as little as $1,000 to invest in most mutual funds. Some (but not all) funds charge fees when you purchase or sell shares in the funds. We will discuss the costs of mutual funds in more detail later in the chapter.

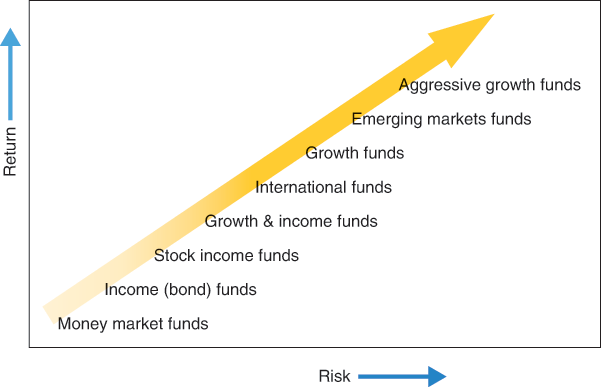

Risk-and-Return Relationships of Different Types of Mutual Funds

Are there different types of mutual funds? Each mutual fund has an investment objective that dictates the types of investments the fund can hold. There are three broad groupings of mutual funds and then many different subtypes under each grouping. The three main types of mutual funds in order of risk are money market funds, fixed-income funds (bonds), and equity funds (stocks). Additionally, there is a wide assortment of funds that specialize in international investments, such as global funds, foreign funds, country-specific funds, or emerging market funds. There are also sector funds that invest in companies from a particular industry sector, such as technology, automotive, banking, and health care. Finally, there are index funds that replicate the performance of some broad market indexes, such as the S&P 500 and Dow Jones Industrial Average. The investment objectives of each fund sets the types of individual investments the fund can hold. Therefore, because of the risk differences in the underlying investments, mutual funds have varying expected risks, and consequently expected returns relative to those risks. Figure 16.11 categorizes the different types of mutual funds relative to their risks and returns.

Figure 16.11

Risk and Return Relationship of Types of Mutual Funds

© Mary Anne Poatsy

What are money market funds? Money market funds are the least risky because they invest in short-term debt obligations, such as T-bills and certificates of deposit (CDs). Money market funds are popular because the interest rates they earn are often nearly double what interest-bearing checking or savings accounts earn. In addition, money market funds are liquid. You have quick access to your money, often simply by writing a check. Perhaps the only drawback of a money market fund over a traditional savings account is that the FDIC does not insure the funds. However, unlike many banks, to date, no money market fund has ever failed. Alternatively, you can invest in a money market savings account through a savings bank, and, as with all bank accounts, the money in that account is insured by the FDIC up to $250,000.

What are bond mutual funds? Bond mutual funds consist solely of bonds. Some bond funds are categorized by the type of bond, including municipal bond funds, corporate bond funds, and U.S. government bond funds. Alternatively, some bond funds are categorized by maturity, including long-term bond funds, short-term bond funds, and intermediate-term bond funds. Table 16.2 summarizes the various types of bond mutual funds.

Table 16.2

Types of Bond Mutual Funds

© Mary Anne Poatsy

The table shows the following information:

By Type:

Fund type: Municipal bond funds

Investment strategy: Invest in tax-exempt bonds issued by state and local governments. Some municipal bond funds are further specialized in bonds issued by a particular state.

Fund type: Corporate bond funds

Investment strategy: Invest in debt obligations from U.S. corporations.

Fund type: U.S. government bond funds

Investment strategy: Invest in U.S. Treasury or government securities.

By Term:

Short-term bond funds

Investment strategy: Invest in bonds with maturities less than two years, including T-bills, CDs, and commercial paper.

Intermediate-term bond funds

Investment strategy: Invest in bonds with maturities ranging between 2 and 10 years.

Long-term bond funds

Investment strategy: Invest in bonds with maturities greater than 10 years.

What are stock mutual funds? Stock mutual funds, sometimes referred to as equity funds, are funds that invest only in stocks. As Table 16.3 shows, similar to bond funds, stock mutual funds are broken down into various categories based on the types of companies they invest in. Growth funds invest primarily in companies that are in the growth phase, and value funds invest in stocks considered to have lower prices relative to the overall value of the companies that issued them. The size (or capitalization) of the companies they invest in is another way to categorize mutual funds. Large-cap funds invest in large companies, mid-cap funds invest in medium-size companies, and small-cap funds invest in small companies.

Table 16.3

Types of Stock Mutual Funds

© Mary Anne Poatsy

Are there funds that invest in both stocks and bonds? Blend (or balanced) funds invest in stocks, bonds, and sometimes money market funds to offer a mixture of safety, income, and modest appreciation. A type of balanced fund that is attractive to investors focusing on retirement planning are life cycle funds (also known as targeted or age-based funds). Life cycle funds invest in mutual funds from the same mutual fund family (such as Fidelity or Vanguard), and the mix of investments is managed to become more conservative as the fund approaches a target date—which often closely matches an investor’s anticipated retirement date. Many 401(k) plans offer life cycle funds. Although life cycle funds offer a convenient “hassle-free” retirement planning option, they are not a solution for everyone, especially those who have other types of investments in their portfolio.

What are index funds? Index funds have a portfolio that consists of investments that closely match the components of a market index such as the S&P 500 or the Barclays U.S. Aggregate Bond Index. Because the investments in an index fund are not as actively managed as those in a stock or bond mutual fund, index funds have lower operating expenses and often more favorable tax consequences, which are attractive to some investors.

How do I make money investing in mutual funds? You can make money investing in mutual funds through dividends, interest, capital gains, and fund appreciation. These investment earnings are similar to those generated by individual stock holdings, although they are controlled by the fund manager and distributed to the fund owners periodically. As fund managers adjust the holdings of the fund, they buy some securities and sell others. Capital gains and losses that are incurred through selling securities are passed on to the fund owners. Your mutual fund accumulates any dividends paid by the stocks and interest paid by the bonds held by the mutual fund and periodically distributes the earnings to fund owners. Finally, mutual funds are measured by the value of the individual holdings. This measure is the net asset value (NAV), which is calculated at the end of each trading day. The end-of-day NAV of a mutual fund consists of the combined closing values of the stocks in the fund. The NAV increases as the securities held by the fund increase in value. If you sell your mutual fund holding at a higher NAV than when you bought it, you will generate a capital gain.

What do I need to watch out for when investing in mutual funds? Although mutual funds can be a great way to begin investing, you still need to do your homework to understand exactly what you are investing in and how risky those investments are. You also have to consider what a fund costs to invest in because that will affect how much you make from the investment. Some mutual funds, referred to as load funds, charge additional costs (loads) that are rolled into the cost of the funds when you buy and sell them. The ultimate decision in buying a mutual fund should be based on its expected performance and the suitability to your investments needs. If you are given a choice of similar options, try to pick a no-load fund, a mutual fund that does not charge a fee for buying into the fund and selling out of it. Load funds have not shown to perform better than no-load funds, so why pay more for little or no extra benefit?

In addition to the transaction fees (the loads), you should also look at the ongoing expenses that funds charge investors. These expenses are comprised of management fees, administrative costs, and 12B-1 fees (advertising fees) represented by the expense ratio (or management expense ratio). Some funds charge much higher fees than others. For example, if the fund you invest in has a 1 percent expense ratio and earns an annual return of 4 percent, you will end up with only a 3 percent return (not including any loads). In other words, the expenses will eat up one-quarter of your annual earnings. Expense ratios for funds vary widely. Some fund expense ratios exceed 1 percent. Others funds, such as index funds, have far less.

It is also important to have a good understanding about who is managing the fund and the person’s success record. The same individual or group of managers often runs a fund for years. However, changes happen, so you will want to be aware of that fact.

What are exchange-traded funds? An exchange-traded fund (ETF) is a fund that holds a collection of investments like a mutual fund does but trades on an exchange like stocks do. The prices of ETFs change throughout the day as they are bought and sold, whereas the prices of mutual funds are determined only at the end of the trading day. Initially, ETFs gave investors a way to buy and sell a group of stocks that mirrors or that is representative of an index, such as the S&P 500. Since then, ETFs have developed into sophisticated investments that can be quite complex. Similar to mutual funds, an ETF holds a group of stocks rather than one or a few. However, ETFs often cost less because there is no need to pay investment managers to actively research and trade the stocks that make them up. Why? Because the ETFs are structured the same as the indexes they are mirroring.

In contrast, as you have learned, stocks within a mutual fund are traded, often resulting in capital gains that get passed onto the mutual fund’s investors. This doesn’t happen with ETFs, which makes them a low-cost way to diversify a portfolio, especially because there are a variety of ETFs like there are mutual funds. But like any investment, there are risks and other factors to consider when selecting an ETF.

Other Investment Opportunities

Besides stocks, bonds, and mutual funds, what else can I invest in? There are a couple of other types of investments beyond stocks, bonds, and mutual funds. These investments are often complicated and can carry additional risk. Generally, only advanced and knowledgeable investors tinker in these alternative investments. Options and futures fall into this category, as do commodities, real estate, and precious metals.

What is an option? An option is a contract that gives a buyer the right (but not the obligation) to buy (call) or sell (put) a particular security at a specific price on or before a certain date. It is similar to buying an insurance policy. Consider this example: Your uncle is selling a car you would love to buy but cannot quite afford yet. You decide to approach your uncle with a proposal: You will save your money, and at the end of three months, you will have the right to buy the car for $15,000. For accepting this offer, you will give your uncle $250 now. Over the course of the next three months, one of three situations could occur:

The car could be ranked one of the best cars on the market, increasing its value from $15,000 to $18,000. You buy the car for the agreed-on price of $15,000 and then sell the car for $18,000. Taking into consideration the $250 you paid your uncle for the option of buying the car, you net $2,750 ($18,000 – $15,000 – $250).

The car has a major defect, and its manufacturer has issued a recall to fix it. Now, you really don’t want to buy the car. Because you have only an option to buy the car, you are not obligated to purchase it, but you will still lose the $250 you paid for the option of buying it.

The car value’s stays at $15,000, and you buy the car for the agreed-on price of $15,000, plus the initial $250.

Options work similarly to this example. When you buy an option, you are paying for the opportunity to buy an asset under certain conditions. If things go wrong, you lose only the cost of the option. If things go right, you could profit. Options are complicated and can be risky. Don’t confuse option contracts with stock options your employer may offer as a benefit. The stock option from employers gives you the right to buy a specific number of shares of your company’s stock at a specific time at a set price. Stock options are used as incentives to retain and motivate employees and are discussed in Chapter 9.

What are futures? A futures contract is an agreement between a buyer and a seller to receive (or deliver) an asset sometime in the future at a specific price agreed on today. The difference between a futures contract and an options contract is that an option contract gives you the right to purchase the underlying asset; with a futures contract, you have an obligation to purchase the underlying asset. Usually, the underlying asset is a commodity, such as sugar, coffee, or wheat. For these commodities, a price is agreed upon before the actual goods are bought and sold. Futures markets also include the buying and selling of government bonds, foreign currencies, or stock market indexes.

If you hold the futures contract until it expires, you own the commodity. However, most holders of futures contracts rarely hold their contracts to expiration. Instead, the contracts are traded before expiring. If the price of the commodity increases before the contract’s expiration date, you make a profit. However, if the price decreases, you may lose money.