Chapter 8

Adding an Annuity

Bob has planned to talk Jane and June through the impact annuities can have, and the benefit and the cost alternatives. Shortly after they arrive, he loads data from his previous day’s research and says, “I found some annuity quotes for you.. But before we look at them, first let me explain why you might want an annuity.”

“Although the program uses conservative estimates for lifespan, there is no way to tell how long you will actually live. This means that no matter how many years’ spending we plan for, you could run out of money if you live too long.”

“That is, unless you buy an annuity. An annuity is the only source of income that you can’t outlive. The way it works is that you give a big chunk of money to the insurance company, and then they pay you every month as long as you are alive.27 So if you are concerned about outliving your income, an annuity is the solution. Does that sound like something you would like to hear about?”

Jane says, “Sure, I might as well know as much as possible about my options. Go ahead.”

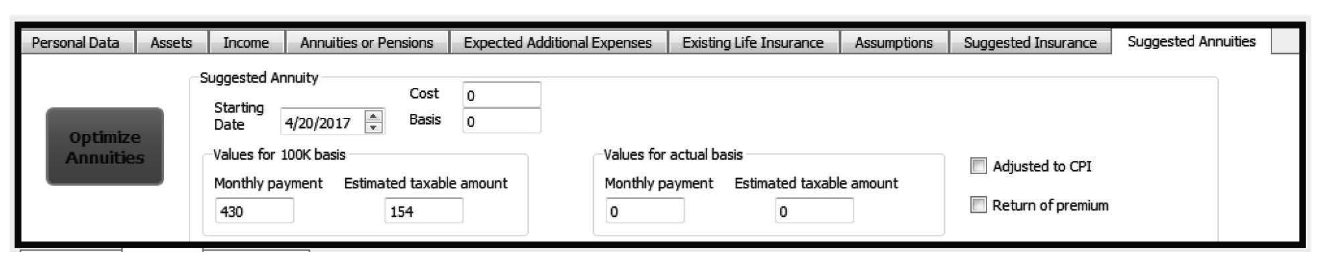

Bob continues, “OK, then here’s the ‘Suggested Annuities’ tab showing the first set of figures, for a ‘plain’ immediate annuity that pays out a fixed amount every month, starting 4/20/2017, and which keeps paying as long as either you or Jim is alive.” (See Figure 8.1.)

Bob continues, “You can see that so far we don’t have an actual monthly annuity payment, just the amounts that you could buy for $100,000, which are the numbers for ‘Monthly payment’ and ‘Estimated taxable amount’ in the ‘Values for 100K basis’ box.” (See Figure 8.2.)

Bob continues, “I found the ‘Monthly payment’ amount at immediateannuities.com by putting in $100,000 for the amount to be invested. The ‘Estimated taxable amount’ is calculated by the program, based on your ages and the amount of the payment. Clear so far?”

Jane says, “Not really. What does $100,000 have to do with my situation? That’s not how much my mother is thinking of giving me.”

Bob replies, “The way the program works is that I give it the amount of payment that $100,000 can buy just to get it started; this causes the program to try a number of different amounts to invest and sees which one provides the most sustainable spending. It’s like the way it searches for how much insurance you need to optimize sustainable spending, as we saw when we ran the insurance optimizer the other day. We can go over exactly how the annuity optimizer works tomorrow if you want to.”

Jane says, “Yes, let’s do that, but first show me what it does.”

Bob continues, “OK, the next thing I will need to know is roughly how much your mother is thinking of giving you. You said it would be cash, not stocks, right?”

Jane answers, “Yes, that’s what she had in mind. The amount she was thinking of is $500,000.”

Bob’s eyes light up and he says, “Well, that should improve your sustainable spending noticeably. First, here’s what your assets look like now, without that extra $500,000, and of course without any annuity purchase.” (See Figure 8.3.)

Bob continues, “Now let’s add $500,000 to your cash, which leaves it looking like this.” (See Figure 8.4.)

Jane says, “I don’t see anything different other than the new cash amount. Was something else supposed to happen?”

Bob answers, “No, until we tell the program to recalculate, it won’t make changes.”

He clicks the “Calculate” button, resulting in Figure 8.5.

Bob says, “So far, this is nothing new other than that since you have more money, you can spend about $16,000 more per year based on the extra money and the return on investment figures we have in the program now for your cash assets. Now let’s see what it suggests for an annuity. By using this Suggested Annuities tab, the program will optimize the amount of sustainable spending, just like always, and we can find out what the amount of the annuity should be.” He switches to the “Suggested Annuities” tab and clicks the “Optimize Annuities” button, producing the result in Figure 8.6.28

Bob says, “That didn’t make very much difference, only about $2,000 a year, but then we haven’t checked what effect changing the return and inflation assumptions might have. That might make a lot more difference, since the amount you get from a straight life annuity isn’t dependent on the market but is guaranteed.29 Let’s compare the results with and without the annuity if we assume that there is no inflation and no return from your portfolio assets.” He reloads the previous version of the data with the extra $500,000 in cash but without purchasing an annuity, sets the return and inflation assumptions to 0, then hits the “Calculate” button. (See Figure 8.7.)

Bob continues, “That really hurt the sustainable spending compared to the results with the more optimistic assumptions of 2% inflation and cash returns, and 7% portfolio returns. Now let’s see how the annuity version does with the zero assumptions.” He switches to the “Suggested Annuities” tab and hits the “Optimize Annuities” button. (See Figure 8.8.)

Bob says, “That makes a pretty big difference, over $9,000 a year, compared to the situation in which you don’t buy the annuity. So even though the annuity doesn’t make much difference if we use the optimistic assumptions, if the market isn’t cooperative, then you would do a lot better with the annuity than without it, although of course you would have $350,000 less in cash in the event that you needed a lot of cash for some reason.”

Jane responds, “OK, but what’s the chance that the market will have no return at all for the rest of my life? That doesn’t sound very likely.”

Bob replies, “I agree that doesn’t sound very likely to happen for the rest of your life, but the problem is what the experts call ‘sequence of returns risk.’ That is, if the market’s performance is bad right after you retire, you may use up your assets too fast and not have enough left when it recovers to benefit from that recovery. This program doesn’t model that particular situation directly, but what we can do is to set the yearly spending to the amount calculated with the optimistic assumptions, then change the assumptions back to no return and no inflation and see how fast you would run out of money.” He reloads the data with the optimistic assumptions and no annuity (as shown in Figure 8.5), then changes the assumptions to no returns and no inflation, turns on “Expert Mode” and checks “Manual Yearly Spending,” then hits the “Calculate” button. (See Figure 8.9.)

Bob continues, “This shows what would happen if you spent the ‘correct’ amount according to the prior optimistic assumptions, whereas in reality you got 0% inflation and 0% returns.30 If you did that, you would run out of assets in 2044, although you would still have $36,132 a year to spend after that. Now let’s see what happens if we buy the annuity using the optimistic assumptions but have adverse market results of 0% for inflation and returns.” (See Figure 8.10.)

Bob continues, “Note that this gives you an additional five years before you run out of assets (until 2049 rather than 2044), and also increases your continuing income (from Social Security and the annuity) by almost 50%, so you won’t have to go back to work at age 85. Of course, if this cost you a significant amount of income under the optimistic assumptions, I can see why you might not want to do it, even though it improves the results significantly with adverse results. But fortunately, the annuity performs slightly better than the nonannuity case even with the optimistic assumptions. So this seems like a pretty good way to reduce your dependence on market returns.”

“On the other hand, annuities have their downsides too. Your money is locked up so you can’t get at it. Current interest rates are low and might go up. If that happened, you could get more income if you waited to purchase an annuity. And you don’t have to worry about not being able to qualify for an annuity if you wait, as you do with life insurance, because the insurance company doesn’t ask for health information when selling an annuity as they do with life insurance. So there’s no big rush. What do you think?”

Jane answers, “Of course I’ll discuss it with Jim and see what he thinks, but I agree that I’d rather be safe than sorry. So, I think the annuity makes a lot of sense.”

Bob replies, “In the meantime, how about if we get together at 1 PM tomorrow to go over how the annuity optimizing feature of the program works?”

Jane and June both agree, so Bob closes down the program and his laptop.