1. The Value of Supply Chain Network Design

What Is Supply Chain Network Design and Why Is It Important?

A firm’s supply chain allows it to move product from the source to the final point of consumption. Leading firms around the world, from large retailers to high-tech electronics manufacturers, have learned to use their supply chain as a strategic weapon. A supply chain is defined by the suppliers, plants, warehouses, and flows of products from each product’s origin to the final customer. The number and locations of these facilities is a critical factor in the success of any supply chain. In fact, some experts suggest that 80% of the costs of the supply chain are locked in with the location of the facilities and the determination of optimal flows of product between them. (This is similar to the notion from manufacturing that you lock in 80% of the cost to make a product with its design.) The most successful companies recognize this and place significant emphasis on strategic planning by determining the best facility locations and product flows. The discipline used to determine the optimal location and size of facilities and the flow through the facilities is called supply chain network design.

This book covers the discipline of supply chain network design. Sometimes it is referred to as network modeling because you need to build a mathematical model of the supply chain. This model is then solved using optimization techniques and then analyzed to pick the best solution. Specifically, we will focus on modeling the supply chain to determine the optimal location of facilities (warehouses, plants, lines within the plants, and suppliers) and the best flow of products through this facility network structure.

Here are four examples to illustrate the value of supply chain network design.

Often, we hear about firms acquiring or merging with another firm in the same industry to reduce the overall costs to operate both firms. That is, they justify the new combined company by determining that they can deliver the same or more products to the market at an overall lower cost. In firms that make or ship a lot of products, a large portion of the savings comes from the merger of the two supply chains. In such mergers, the savings often come from closing redundant plant and warehouse locations, opening new plants and warehouses, or deciding to use existing facilities to make or distribute different mixes of product. We have heard firms claim resultant supply chain savings from $40 million to $350 million over a period of a couple of years. With these kinds of savings, you can only imagine the pressure placed on the supply chain team to determine the new optimal supply chain structure after an acquisition or merger is announced.

Example #2

Often, a large firm will find that its supply chain no longer serves its business needs. In situations like this, the firm will have to transform its supply chain. It may have to close many facilities, open many new ones, and use facilities in a completely different way. For example, a retail firm may have to redesign their supply chain to serve their stores as well as their new online customer base in a more integrated approach. Or a large retailer may find that some of their product lines have grown significantly and the retailer needs new warehouses to manage this growth. If done right, this type of supply chain transformation can help reduce logistics and inventory costs, better respond to different competitive landscapes, and increase sales and profitability. We have even seen firms highlight this work in their annual reports, therefore showing the importance of this analysis to the firm as a whole.

Example #3

In the spring of 2011, we were working on a project for a global chemical company to help develop their long-term plan for their supply chain. This study was analyzing where they should locate new plants to serve a global customer base. The long-term project suddenly became extremely short-term when the CEO called the project team to inform them that within six hours they were closing their plant in Egypt due to political unrest. He also indicated there was no timeline for reopening the plant. The CEO immediately needed to know which of the existing plants should produce the products that were currently being manufactured in Egypt and how customer demand was going to be impacted. The team was quickly able to deliver the answers and minimize this supply chain disruption. As seen in this example, supply chain network design models can also be a great tool for identifying risks and creating contingency plans in both the short and long term.

As consumer behavior and buying patterns change, firms often want to bring their product to the market through different channels. For example, we worked with a consumer products company that wanted to analyze different channels such as selling through big-box retailers, selling through smaller retailers, selling direct online, and selling through distributors. This firm wanted to analyze different ways to bring their product to market and understand what the supply chain would need to look like for each of these cases. That is, they wanted to determine the optimal number and location of plants and warehouses. This would then be a key piece of information to help them determine their overall strategy.

Of course, the details of these studies can be a bit more complicated. As an example, take a minute to think through the possible supply chain for a tablet computer and compare that to the supply chain you envision for a candy bar.

The tablet supply chain faces specific challenges surrounding a time-sensitive delivery of the device for a very demanding high-tech customer market. The tablet maker must also determine how to best balance its partnerships with many contract manufacturers worldwide while still ensuring the highest quality end products. Finally, this supply chain must deal with the high costs for insurance, transport, and storage of these high-priced finished goods.

Conversely, when we shift our thoughts to the supply chain related to the candy bar, we must consider an entirely different set of challenges and objectives that the candy maker must face: government regulations that mandate different requirements for all stages of production paired with a strict shelf life of each unit produced. In addition, raw material costs, as well as costs tied to temperature control during transit and storage, add up. Major swings in demand due to seasonality or promotions also add the need for flexibility within their supply chain.

Despite their differences, both the tablet maker and candy bar maker must determine the best number and location of their suppliers, plants, and warehouses and how to best flow product through the facilities. And building a model using optimization is still the best way for both of them to determine their network design.

As the previous examples highlight, many different types of firms could benefit from network design and many factors go into the good design of the supply chain. Along with ever-growing complexity, the need to truly understand how all these requirements affect a company’s costs and performance is now a requirement. Using all these variables to prove out the optimal design configuration commonly saves companies millions of dollars each year.

As you would expect, a network design project can answer many types of questions such as these:

• How many warehouses should we have, where should they be, how large should they be, what products will they distribute and how will we serve our different types of customers?

• How many plants or manufacturing sites should we have, where should they be, how large should they be, how many production lines should we have and what products should they make, and which warehouses should they service?

• Which products should we make internally and which should we source from outside firms?

• If we source from outside firms, which suppliers should we use?

• What is the trade-off between the number of facilities and overall costs?

• What is the trade-off between the number of facilities and the service level? How much does it cost to improve the service level?

• What is the impact of changes in demand, labor cost, and commodity pricing on the network?

• When should we make product to best manage and plan for seasonality in the business?

• How do we ensure the proper capacity and flexibility within the network? To meet demand growth, do we need to expand our existing plants or build new plants? When do we need to add this capacity?

• How can we reduce the overall supply chain costs?

Being able to answer these questions in the optimal manner is important to the overall efficiency and effectiveness of any firm. Companies that have not evaluated their supply chain in several years or those that have a new supply chain through acquisitions can expect to reduce long-term transportation, warehousing, and other supply chain costs from 5% to 15%. Many of these firms also see an improvement in their service level and ability to meet the strategic direction of their company.

Although firms are happy to find 5% to 15% reduction in cost, it does highlight that your supply chain might have already missed out on significant savings you may have realized had you done the study a year ago (or two or more years ago). Some firms have realized this and now run this type of analysis on a more frequent basis (say, quarterly). This allows them to readjust their supply chain over time and keep their supply chain continually running in an optimal state while preventing costs from drifting upward.

The frequency of these studies depends on several factors. Historically, it has been customary to complete these analyses once every several years per business unit, because it was usual for business demographics and characteristics to change over this period of time. For some industries such as high-tech, the frequency was even higher because there may be higher volatility in customer demand, thereby requiring periodic reevaluation of the network. Any major events, such as mergers, acquisitions, or divestitures, should also trigger a network reevaluation study. As noted before, the savings from the optimization of the revised network typically represent a significant part of the savings that justify the merger or divestiture. A current trend we are seeing, however, is to do these studies even more frequently. Business demographics and characteristics are changing faster. In addition, the growth of the global supply chain is driving firms to cycle through studies as they go from region to region around the world. Also, firms are running the same models more frequently to stay on top of changes in their business by adjusting the supply chain. Some firms update these models several times throughout the year.

Determining the right supply chain design involves a lot of quantitative data as well as some nonquantitative considerations. We will discuss this in the rest of this chapter, as well as how we use mathematical optimization to sort through this quantitative data.

Quantitative Data: Why Does Geography Matter?

It should be clear by now that the supply chain network design problem is just as much about geography as it is about business strategy. The two cannot be separated.

Take these supply chain considerations for example:

• If you have a plant in the interior of China and some of your customers are in New York, you need to physically get the product out of China, across the ocean, and to New York.

• If you make wood products (like paper or boards), you can locate plants either close to the raw materials (forest areas) or close to your customers (usually located a significant distance away from the large forest areas).

• If you have a warehouse in Indianapolis, you are close to your customers in Chicago, but far away from customers in Miami. If the warehouse is in Atlanta, you are closer to Miami, but farther from Chicago.

• If you make a critical product only in Miami, a hurricane may shut down your operation, causing a loss of revenue.

As the examples highlight, decisions about the location of your facilities impact many aspects of your business and require you to make trade-offs. Specifically, geography drives the following:

• Transportation Cost—You need to move product from its original source to its final destination. The location of your facilities determines the distance you need to move product, which directly impacts the amount you spend on transportation. But, also, the location of your facilities determines your access to transportation infrastructure such as highways, airports, railheads, and ports. Finally, because of supply and demand, different locations may have different transportation rates.

• Service Level—Where you locate relative to your customers impacts the time it takes to get product to your customers. For some products, you can negate great distances by using overnight air freight. But this usually comes at a premium cost.

• Risk—The number and location of your facilities impacts risk. If you have just one location for a critical activity, there is always the risk that a fire, flood, some other natural disaster, a strike, or legal issues will shut down your operation. There is also political risk to consider. Your facility could get confiscated or shut down for political reasons, or the borders may shut down, isolating your facility.

• Local Labor, Skills, Materials, and Utilities—The location of your facilities also determines what you pay for labor, your ability to find the needed skills, the cost of locally procured materials (which is often directly related to the local labor costs), and the cost of your utilities.

• Taxes—Your facilities may be directly taxed depending on where they are located and the type of operations being performed. In addition, you also need to consider the tax implication of shipping product to and from your locations. In some industries, taxes are more expensive than transportation costs.

• Carbon Emissions—Locating facilities to minimize the distance traveled or the transportation costs often has the side benefit of reducing carbon emissions. In addition, if your facilities consume a lot of electricity, you can reduce your emissions by locating near low-emission power plants.

As the list highlights, geography matters. What makes this challenging is that the geography often pushes the solution in different directions at the same time. For example, it would be desirable to have a facility close to all the demand. However, demand is typically where people live. And it is usually very expensive, if not impossible, to locate a plant or warehouse in the middle of a major metropolitan area. So the desire to be close to customers pushes locations close to cities. The desire for cheap land and labor (and welcoming neighbors) pushes the best locations further from the city center. In global supply chains these decisions become even more extreme. In some cases it may make sense to service demand from a location on an entirely different continent.

In addition to geography, the next two sections will discuss the importance of warehouses and multiple plants to your supply chain as well.

Quantitative Data: Why Have Warehouses?

In this book, a warehouse represents a facility where firms store product or a location where product simply passes through from one vehicle to another. It can be called a distribution center, a mixing center, a cross dock, a plant-attached warehouse, a forward warehouse, a hub or central warehouse, a spoke or regional warehouse, or a host of other terms.

To understand how to optimally locate warehouses, it is important to discuss why warehouses exist. Wouldn’t it be much cheaper for companies to load the product only once, at the manufacturing location, and ship it directly to the customer? Stopping at a warehouse adds loading, unloading, and storage costs, not to mention the cost for two legs to transportation (one leg from the plant to the warehouse and one leg from the warehouse to the customer). In cases where you can ship directly from the plant, it is usually good to do so. Therefore, it is important to ask questions to see whether you can avoid warehouses altogether. But in most cases warehouses are needed in a supply chain for the following reasons:

• Consolidation of Products—Often, you will need to deliver a mix of different products to your customers and these products may come from various sources. A warehouse serves the useful function of bringing these products together so that you can then make a single shipment to a customer. This will be cheaper than having the products ship to the customers directly from each individual source of supply.

• Buffer Lead Time—In many cases, you will need to ship to your customers with lead time that is shorter than that which can be offered by shipping directly from the plant or supplier location. For example, you may promise to ship products to your customers the next day but your plants or suppliers may have a lead time of several weeks before they are able to make the product available to the customer. In this case, the warehouse holds product at a location closer to the customers in order to provide the next day transport promised each time an order is placed.

• Service Levels—Where you store the product and its proximity to the market where it will be consumed is also a measure of the service level the company can provide. The need to be close to customers can create the need for multiple warehouses. Overall cost versus service level is one of the most classic trade-offs in supply chain network design.

• Production Lot Sizes—Setting up and starting the production of a single product or group of similar products on a line can have a significant fixed cost associated with it. Therefore, production plans attempt to maximize the number of units of product made during each run. (This production amount is called a lot size.) Understandably, these lot sizes normally do not match the exact demand from the market at the time. This requires the extra units to be “stored” in warehouses until future demand requires them. Production lot sizes versus inventory storage costs is also a common supply chain design trade-off.

• Inventory Pre-Build—Some industries see huge spikes in the supply of raw materials (seasonal food harvests) or in the demand of finished goods (holiday retail shopping). In the case of raw material supply spikes, some firms must store these abundant raw materials until the time they will be needed for steady monthly production cycles. Other firms must immediately use these raw materials to produce finished goods that are not yet demanded. These additional finished goods must then be stored until demand in future time periods requires them. In the case of demand spikes, companies find themselves with insufficient production capacity to fulfill all orders during peak periods of demand. As a result, they must use their additional capacity during off-peak time periods to make finished-good units to be stored awaiting their use to fulfill the upcoming spikes in demand. The use of costly overtime production versus inventory storage costs is another common supply chain design trade-off.

• Transportation Mode Trade-offs—Having warehouses often allows you to take advantage of economies of scale in transportation. A warehouse can help reduce costs by allowing the shipment of products a long distance with an efficient (and lower cost) mode of transportation and then facilitating the changeover to a less efficient (and usually more expensive) mode of transportation for a shorter trip to the final destination (as opposed to shipping the entire distance on the less efficient mode).

It is also important to match up the preceding list of reasons for warehouses with the types of warehouses in the supply chain. A supply chain may have many types of warehouses to meet many different needs. Here are some common types of warehouses:

• Distribution Center—Typically refers to a warehouse where product is stored and from which customer orders are fulfilled. This is the most common and traditional definition of a warehouse. When a customer places an order, the distribution center will pick the items from their inventory and ship them to the customers. These types of facilities are also called mixing centers because they “mix” products from many locations so that your customers can place and receive an order from a single location. If a manufacturing company does not have this type of warehouse in the supply chain, customers may have to place several orders or receive several shipments from different locations depending on where each product they want is made.

• Cross-Dock—Usually refers to a warehouse that is simply a meeting place for products to move from inbound trucks to outbound trucks. The term simply means that products pass (or cross) from one loading dock (for inbound trucks) to another loading dock (for the outbound trucks). For example, in the case of a produce retailer with 50 stores, they may have a full truck of fresh peaches arriving at the inbound docks from a single supplier. The peaches are then removed from the truck and some are placed in each of the 50 waiting trucks on the outbound side, according to the relevant store demand. This happens for peaches as well as a host of other produce items. Basically full trucks arrive from a single supplier on the inbound side of the facility, and then transferred to multiple trucks on the outbound side of the facility resulting in fully loaded truckloads with a mix of product from each of the suppliers quickly sent on their way. The best-run cross-dock systems have all the inbound trucks arriving at approximately the same time so that product stays at the cross-dock for only a short period of time.

• Plant-Attached Warehouse—Refers to a warehouse that is attached to a manufacturing plant. Almost all plants have some sort of product storage as part of their operations. For some, it may simply be a small space at the end of the line where product is staged prior to being loaded onto a truck for shipment. In other cases, the warehouse can act as a storage point for product made at the plant or for products made at other plants. In this case, this warehouse acts like a distribution center co-located with the manufacturing facility. A major benefit of a plant-attached warehouse is the reduction of transportation costs because a product does not have to be shipped to another location immediately after it comes off the end of the line. When you have plant-attached warehouses, sometimes the standalone warehouses are called forward warehouses, meaning they are placed “forward” or out closer to customers.

• Hub Warehouse or Central Warehouse—Refers to a warehouse that consolidates products to be shipped to other warehouses in the system before moving on to customers. Different from cross-docks, the products are normally stored in these locations for longer periods of time before being used to fulfill demand. The other warehouses in the network are then typically called spokes or regional warehouses.

In practice, you will find many different names for warehouses. These names are most likely just different terms for what is described in the preceding list. In addition to the types of facilities, there are also needs for different temperature classes (frozen, refrigerated, or ambient), different levels of safety (hazardous or nonhazardous), and different levels of ownership (company owned, company leased, or the company uses a third-party facility).

As an interesting side note and to further illustrate the wide range of warehouse types we have experienced, we have even seen caves used as warehouses. Caves have the nice advantage of maintaining the same (relatively low) temperature and have prebuilt roofs. If you can get trucks into and out of them and have room to store products, caves also make great warehouses. Kansas City is probably the best-known location with cave warehouses.

Quantitative Data: Why Have Multiple Plants?

Similar to our use of the word “warehouse,” we are also going to use the term “plant” to broadly refer to locations where product is made or where it comes from. So a plant could be a manufacturing plant that produces raw material, components, or finished goods, or just does assembly. A plant could be owned by the firm, it could be a supplier, or it could be a third-party plant that makes products on behalf of the firm. These third-party plants are often called co-packers, co-manufacturers, or toll manufacturers (a term used for third-party manufacturers common in the chemical industry).

A plant can also contain multiple production lines. So, often we are determining not only the location of plants, but also the number and location of the production lines.

For companies that make products, the number and location of plants are important. For retailers and wholesalers however, the location of the suppliers is often beyond their scope of control.

Even for a firm that has only one product, the location of the plant can impact transportation costs and the ability to service customers. In some cases, the location of the plant is primarily driven by the need to have skills in the right place or the need to be next to the corporate headquarters. However, in most cases, there are choices for plant locations. An even more interesting choice is to determine whether you should locate multiple plants to make the same product—even when a single plant could easily handle all the demand.

When you have choices for where to put your plants or the option to have several plants, you must consider some of the same questions we did when locating warehouses. For example, factors that would drive you to have multiple plants making the same product include:

• Service Levels—If you need your plants to be close to customers, this will drive the need for multiple plants making the same product. This becomes especially important if your business does not use warehouses. In this case, your plants face the customer and their location can drive service levels.

• Transportation Costs—For producers of heavy or bulky products that easily fill up truckload capacities, you will want to be as close to your markets as possible. This may also drive the need for multiple warehouses.

• Economies of Scale—As a counterbalance to the benefits of transportation, you also want to factor in the economies of scale within production. As mentioned previously, the more you make of a given product at a single location, the lower the production cost per unit. This is driven by a reduction in production line setup time and costs and the benefit of being able to create a more focused manufacturing process. So while it may be ideal to have many production locations to minimize transportation cost, economies of scale in manufacturing suggest that fewer plants will be better.

• Taxes—In a global supply chain, it is often important to consider the tax implications of producing and distributing product from multiple or different locations.

• Steps in the Production Process—In a production process with multiple steps, you may need to decide where you should do various activities. For example, it can often be a good strategy to make product in bulk at a low-cost plant, ship it in bulk to another plant closer to the market to complete the conversion to a finished good.

As with the warehouses, a plant can also represent many types of facilities. A plant may represent any of the following:

• A Manufacturing or Assembly Site—This is a site that is owned by the firm that makes products. The products coming out of the plant could be raw materials, semifinished goods, or finished goods.

• A Supplier—This is a location that is not owned by the firm but supplies product to the firm. The products could again be raw material, semifinished goods, or finished goods. In the majority of cases, you have no control over where your suppliers are located. You may, however, be able to pick which supplier you will purchase from.

• Third-Party Manufacturing Site—This is a location similar to supplier plants, but these sites make product on behalf of the firm and are therefore treated more like the firms’ own plants than a raw material supplier. Many firms use third-party manufacturing sites because manufacturing may not be their core competency. Their competitive advantage comes from all other activities including the design, marketing, and/or final sale of the product. These third-party firms, typically called contract manufacturers, are widely used in the electronics industry. Other third-party firms, termed co-manufacturers, co-packers, or toll manufacturers, are used to simply supplement the capacity of the firm itself. These are quite common with consumer packaged goods like food and beverages or chemical companies.

As with warehouses, in practice, you will find many variations in terminology for plants and different types of manufacturing sites and suppliers serving roles similar to those mentioned previously.

Solving the Quantitative Aspects of the Problem Using Optimization

Because of the supply chain complexities and rich set of quantitative data we have discussed, mathematical optimization technology is the best way to sort through the various options, balance the trade-offs, determine the best locations for facilities, and support better decision making. The mathematical optimization relies on linear and integer programming.

One common misconception we see is that managers sometimes confuse having good data and a good reporting system with having an optimal supply chain. That is, they think that their investment in good data and reporting systems should equip them with the ability to complete network design analysis. (These systems are often called business intelligence systems.) But in reality, if your warehouses or factories are located in the wrong places, these reporting systems will not correct the situation or suggest new locations.

So although these systems do, in fact, generate good reports and allow managers to gain good insights, they do not lead to better designs for the supply chain. That is, they are not built to construct models of your supply chains to which you can apply mathematical optimization. At best, they may allow you to evaluate a small handful of alternatives, but in doing so, you have to define all the details of each of the alternatives. Optimization is a complementary, not competitive, technology that allows you to actually determine the best locations for your facilities. And you can let optimization do the heavy number crunching to determine the details of the alternatives (where to locate, what is made where, how product flows, which customer is served by which warehouse). And, in many cases, if the optimization is set up correctly, it will uncover ideas that you never thought about.

Of course, because these problems are of great strategic value to an organization and touch on many aspects of the business, there will be nonquantitative aspects you must consider. These nonquantifiable aspects are important and are discussed later in this chapter and throughout the book.

With all that said, solving the quantitative aspects of this problem with mathematical optimization is the key to coming up with the best answers. So, let’s start there.

To formulate a logical supply chain network model, you need to think about the following four elements:

• Objective

• Constraints

• Decisions

• Data

The objective is the goal of the optimization and the criteria we’ll use to compare different solutions. For example, the most common objective in strategic network design is to minimize cost. If our objective is to minimize cost, we can now compare two solutions and judge which one is better based on the cost. When the mathematical optimization engine is running, it searches for the solution with the lowest cost. So with this common example you can see that an optimization problem needs to have a quantifiable objective. It is important to point this out because we have encountered many situations in which supply chain managers say their objective is to “optimize their supply chain.” The appropriate response is to ask what exactly they want to optimize, or what criteria they will use to determine which of two solutions is better. For example, is the key criteria transportation cost, is it service, is it facilities costs, or something else? Later, we’ll discuss optimizing multiple objectives (as long as you can quantify them). And we will show methods for analyzing nonquantifiable factors such as risk and robustness, because these are also very important. But for now, we’ll start with one quantifiable objective. When we understand this one, we’ll be able to understand more detailed analysis later.

The constraints define the rules of a legitimate solution. For example, if you want to just minimize cost, it is probably best to not make any products, not ship anything, or have no facilities. A cost of zero is indeed the minimum; however, that’s clearly not realistic. So there are some logical constraints we must include such as the fact that you want to meet all the demand. There are also constraints that specify which products may be made where, how much production capacity is available, how close your warehouses must be to customers, and a variety of other details. In this step, you also want to be careful not to specify so many constraints that you prohibit the optimization from finding new and creative strategies.

The decisions (sometimes called decision variables) define what you allow the optimization to choose from. So in the optimization of the physical supply chain, the main decisions include how much product moves from one location to another, how many sites are picked, where those sites are, and what product is made in which location. But, certainly, there are other decisions as well. The allowable decisions cannot be separated from the constraints. For example, if you have existing warehouses, you may or may not be able to close some of these sites.

Finally, you must consider the data you have available to you. There may be factors you would like to consider in the optimization, but you do not have the data to support. In this case, you still need to figure out ways to make a good decision. This could include running multiple scenarios, considering approximate data, or adjusting the data you have. We will further discuss a variety of these techniques later in this text.

After you have thought about your problem in terms of the objective, constraints, decisions, and data, there are ways to translate this into a series of equations and then solve the problem using linear and integer programming techniques. This is also sometimes referred to as mixed integer programming (MIP)—the “mix” refers to a mix of linear and integer variables. We will cover what this means in more detail later in the book, and will also provide information on how these problems work. There are whole courses on MIP however, so we will cover the topic only as it relates to supply chain network design problems in this text.

One way to think about a MIP is to think of it as a series of steps that are influenced by the objective, the constraints, and the decision variables. That is, during the steps, the objective steers the solution to more favorable costs and avoids less favorable costs, the constraints set the rules and can prevent it from doing more of what it wants or can force it to do something that is not favorable to the objective, and the decision variables tell it what it is allowed to change. A nice benefit of MIPs is that they solve for all the decisions and consider all the constraints simultaneously. That is, this approach allows you to come up with the overall best solution for a given problem.

Data Precision Versus Significance: What Is the Right Level in Modeling?

The discussion about quantitative data brings us to a discussion about data accuracy.

The lessons we learned about significant digits in high-school chemistry will serve us well when doing network design studies.

We learned that measurements were only as accurate as the equipment that took the measurement, and we had to report it as such. And when we combined different measurements together in some equation, our answer could be reported only in terms of the measurement with the least amount of accuracy. This accuracy was expressed in the number of significant digits. For example, if we took one measurement and it was 3.2 units and added that to another measurement of 4.1578 units and added them together, our calculator would give us 7.3578 units. However, we have to report it as 7.4 units because the final answer can have at most two significant digits. To write it otherwise would give the answer a level of accuracy that just wasn’t true.

We often assume that more precise data is always better. However, as our lessons in significant digits taught us, we can be only as precise as our measurements allow. Keeping this concept in mind will serve you well when you are collecting data for your network design models as well.

The adage about bad data leading to bad results, “garbage in equals garbage out,” can sometimes just confuse. This adage does not mean that data needs to be precisely measured to a certain number of significant digits. It just means that the data has to be good enough for the decisions we are making.

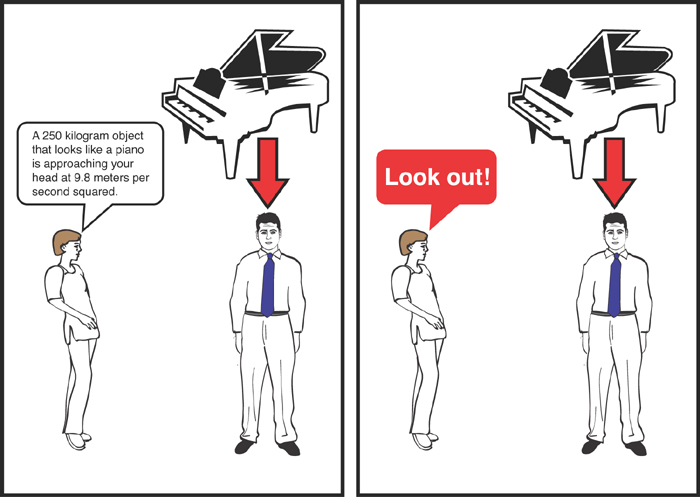

Other problems can result when the precision and detail of the data actually get in the way of making good decisions. The cartoon in Figure 1.1 highlights this point very well.

Figure 1.1. Precision Cartoon

In the cartoon, the extra precision on the left actually makes things worse for our poor analyst (who is about to be hit by a piano). The analyst has to spend too much time trying to understand the data and misses the opportunity to take the much-needed action of getting out of the way. In network modeling, our time horizon for making decisions is much longer, but the data is also much more complex. We have seen projects in which the extremely detailed analysis of data causes the project team to miss their opportunity to impact the supply chain in a positive way.

Our goal for collecting data for a network design model is to define the data needed with the right level of significance to make the relevant decisions. Our ultimate responsibility is to report the results with the right level of significance for the organization to make decisions. Our goal is not to ensure that every piece of data is significant to ten decimal places. Therefore it is really a waste of time and often a risk to our project’s success when we report data with more significance than is warranted.

Also keep in mind that when we are running a network design project, we are making decisions about the location of our plants and warehouses to support the business in the future. It is pointless to build a new warehouse to support last year’s business. Although you may start your analysis with historical data as a baseline (we’ll cover baseline in more detail in Chapter 8, “Baselines and Optimal Baselines”), you will eventually want to consider how this data might be different when considering it in a future state. Two specific elements with future uncertainty, for example, include:

• Demand Data—There will be uncertainty in future demand dependent on overall economic conditions, moves by competitors, success of your marketing programs, and so on.

• Transportation Costs—There can be a lot of variance in future prices of transportation dependent on the ever-fluctuating world market price of oil.

Based on the previous, we know our instruments for measuring future demand and transportation cost data are likely going to be inaccurate. Therefore we should consider using fewer significant digits when representing them in the model. If we get push-back to include more significant digits from other stakeholders in the project, we should remind ourselves that if we could accurately predict future demand or the future price of oil, we would benefit more by taking this knowledge to the financial markets.

In Chapter 4, “Alternative Service Levels and Sensitivity Analysis,” we will expand our discussion of this topic to include the use of sensitivity analysis and multiple scenarios to help make our best network design decisions despite this problem of uncertainty. That is, just because we don’t know the future demand or the future price of oil, doesn’t mean we can’t still come up with good solutions.

Often times, the problems we mentioned previously tempt teams into giving up on network design until they get better and more precise data. People get nervous about making decisions without enough significant digits or enough precision. There are two problems with this approach, though:

• You are fooling yourself that you are not making decisions. If you don’t do anything with your supply chain, you are making the decision that there is nothing you can do to improve the supply chain right now. And if you make decisions without any formal data collection and modeling, you are using the resource that is the most imprecise and has the fewest significant digits of all: your intuition.

• You are missing a chance to better understand your supply chain and understand what data you should be collecting. For example, a good practice that we have found is to make initial assumptions, run scenarios, and test those assumptions by varying the data by +/–10%, then +/–20%, and seeing what happens. These runs give you insight into your supply chain and show you the value of the data. For example, if the results are not sensitive to a particular data element, you do not have to spend much time refining that data element as you continue to build out your model.

Of course, when we are looking at the results and output data, we also want to keep our lessons in significant digits in mind. If our significant digits are valid only to the nearest million dollars, then a reported savings of $500,000 should not be considered.

The other concept to keep in mind when analyzing the output comes from introductory statistics. When you first learned about hypothesis testing, you were shown techniques for determining whether two different samples were statistically different from each other. For example, if you ran two marketing campaigns in two different markets and one market came back with average sales of $15,000 per store and the other with $17,500 per store, you could not immediately conclude that the second marketing campaign was better. In general, the higher the variability of the data in the sample size, the harder it is to claim that there is a statistical difference between the two samples.

Although we cannot apply this direct statistical test to our network design models, we can apply the concept. Because we already know that we have a lot of underlying variability in our data (such as future demand, future costs, and so on), we know that we need to show a fairly large savings from the current state to be comfortable with making the decision to implement the recommended change.

Typically, we look for savings of more than 5% to 10% compared to the current situation before we recommend a change. That is, when relocating facilities, if you find savings that reduce costs by 1% to 2% or change services levels by 2% to 3%, we would consider this not statistically different from the current state. When the savings are 15% to 25% however, you can be confident that you have found a statistically different solution.

Of course, you should be careful with this rule. You don’t need to completely disregard the value of relatively small improvements either. The key is to prevent the magnitude of the suggested change from swamping the size of the expected benefit. For example, you might study a $300 million supply chain that is already well rationalized, and only find $250,000 in savings. However, this 0.084% savings might be well worth the bother, if it could be realized by reassigning just two customers. In such a situation, you might think of the $250,000 as being proportionally quite large when compared to the total landed cost of serving these two wayward demand points.

As you go forward in this book and with projects for your company, these are important lessons that will serve you well.

Nonquantifiable Data: What Other Factors Need to Be Considered?

Our discussion up to this point has focused on the quantifiable aspects of the network design solution. However, there are other factors that you want to consider when making a final decision. Some of these factors do not lend themselves to being quantified and being considered directly within the optimization runs. This does not mean that our optimization runs are meaningless, nor does it mean that we should just ignore these factors.

It is important to run the optimization with as much quantifiable information as needed. You will want to run a variety of scenarios with different input data. This will then give you a range of potential solutions. From this range, you will then want to apply the consideration of the nonquantifiable aspects. For example, if closing existing facilities and opening new ones in new locations increases your political risk, you want to know whether that new configuration saves you $500,000 or $50 million. You will then be able to judge whether the extra risk is worth it.

We will discuss how you run different scenarios and create a range of possible solutions in future chapters. Some of the nonquantifiable factors you might then want to consider include the following:

• Firm’s Strategy—Your firm may value cost more than service or vice versa. For example, your firm may have a strategy of servicing the top customers at any expense or be committed to a local manufacturing strategy.

• Risk—For global supply chains, you need to worry about placing sites in politically unstable locations, port closures, and the added risk of extra distance between origins and destinations. There is also a risk when you have just a single location to make a given product or you have a supply chain that is currently at capacity and is not equipped to handle any unexpected extra demand.

• Disruption Cost—Firms realize that changes could cause significant disruption, leading to other costs like attrition, lost productivity, and unmet demand.

• Willingness to Change—Some firms may be more willing to change than others. This can impact the range of solutions you might want to implement. For example, for a firm that is not willing to change, they may be happy to give up savings in exchange for a minimal number of changes.

• Public Relations and Branding—This is especially important for firms with a highly visible brand. If one of these firms opens or closes a new facility (especially a manufacturing location), it can often make the news. These firms need to consider the public reaction and the impact on their brand.

• Competitors—A firm’s supply chain can be impacted by the competition. Sometimes it makes sense to be exactly where the competition is, and in other cases it makes sense to be where they are not.

• Union versus Non-Union—Some firms have strong policies on union affiliation or union contracts and want the locations chosen to reflect that.

• Tax Rebates—Although taxes can be modeled directly as a cost (as product crosses borders or tax jurisdictions), there can also be rebates for locating a facility in a particular location. This can be hard to quantify during the analysis, but it can be used for negotiating with the local tax authorities.

• Relationships with Trucking Companies, Warehousing Companies, and Other Supply Chain Partners—You may have supply chain partners (like trucking or warehouse providers) that you will not be able to work with in new locations. There is some value to keeping your existing partner relationships. You will need to consider who your new partners will be in the new configuration, or what you will need to do to get these new partners.

There are many more such factors. What is important to remember is that we are not just pushing the “run” button and coming up with the right answer. We want to run a variety of scenarios and then apply other criteria when finalizing the decision. When we finalize this decision, we can realize exactly how the quantifiable factors (cost and service) are impacted. This can help lead to discussions based on facts, data, and trade-offs (rather than gut-feel, intuition, and emotion).

Nonquantifiable Data: What Are the Organizational Challenges?

A supply chain study must span many different areas of an organization: sales, operations, logistics, finance, and IT.

The first challenge, aside from merely gathering all these people into the same room at the same time, is to understand and start to balance the different objectives that each group may have. As you can imagine, each of these groups operates with its own specific goals and these may directly conflict with each other. There are many examples of the various groups’ goals, so here are just a few related to what we’ll cover in this book:

• Sales Team—Place product as close to customers as possible (create many warehouses). Have small frequent shipments to customers (many small shipments or more frequent production runs at the plants).

• Operations Team (Production)—Produce large quantities of one product during each run in order to reduce machine downtime and changeover costs (creates a need for a lot of warehouse storage). Produce product in one location to maximize economies of scale.

• Operations Team (Warehousing)—Quickly move inventory through the warehouses (minimize storage costs). Minimize warehousing locations to reduce fixed and management costs.

• Logistics Team (Transportation)—Have large shipments on less costly modes of transportation (ocean, rail, or truckload).

• Finance Team—Have the least amount of money tied up in capital (low levels of inventory and operations requiring the least investment in warehousing and production locations). Incur the lowest costs tied to logistics (transportation, warehousing).

Understanding the different objectives of the different groups is important to any successful project.

The second challenge you have is collecting and validating data from all these different parts of the organization. The sales group must produce the appropriate historical demand data as well as dependable forecasts of sales in the future. The operations group will be needed to explain the costs, capabilities, and capacities of all the production and storage assets, as well as any related overhead and labor costs. The logistics group is also needed to provide not only current transportation rates but estimates of rates for new potential lanes resulting from a reorganized network. The finance department is depended on for comparing the output costs from the model to the costs within their financial statements for the same span of time. Doing this provides a validated starting point for the model and a baseline to which we can compare all future model scenarios and output. This data may lie in different systems as well, which only adds to your challenges and often requires IT help to sort out.

Data challenges also come when you are attempting to estimate data for the new potential locations and product flow paths. (Even though this data may be difficult to collect, this is often the whole point of a study—to consider new alternatives.) Transportation rates for new lanes, potential site costs, capacity, and capabilities, as well as the cost to shut down existing sites, must all be researched and calculated for consideration when we ask the model to make the best decision.

The third and final challenge comes after the modeling is done and you have come to the final decision. The final step of actually implementing the results can be a major challenge in and of itself. People in any company become very comfortable with a certain way of doing things. As a result, it is not always easy to get them to see the “big picture” and the value these changes will bring. Proper involvement from all of the previously mentioned teams within an organization throughout the entire project can assist with this, however, as each team understands the rules and constraints that they ensured were adhered to within the recommended solution. There are many great resources for you to learn about how to implement change like this in an organization, but this topic is beyond the scope of this book.

Making changes to a supply chain may also cause a temporary state of disruption. A supply chain cannot just stop at a moment in time and take on a new structure. It is often important to implement changes over a period of time to minimize the downtime and inconvenience that switching over operations may cause.

Despite all of this, however, the more network design projects that companies complete, the better they get at addressing these challenges. And, their future models and recommendations improve as a result. Based on the savings we see from firms that develop this capability, we can say with surety that it is well worth it!

Where Are We Going with the Book?

This book is organized to give you a set of building blocks to tackle any type of supply chain. We will start with very simple problems and build from there. This field is surprisingly deep however, and this book cannot cover every type of model to address every type of business that can benefit from modeling. We have found that advances in optimization technology and computing power have opened up new opportunities for answering different questions and using this technology for more and more decisions and we expect this to continue at an even faster pace in the years to come.

In fact, in just the past ten years, we have seen a dramatic increase in the complexity of models that people want to run and the frequency with which they want to run these models. This is a very positive trend as firms derive more and more value from these types of models.

To successfully deploy the more complex models and run them on a more frequent basis, we think it is critical that you understand the basic building blocks.

You will gain a lot of depth and insight from even the simplest problems. Then, later, as you tackle larger and more complex problems, the foundations you learned from the simple problems will continue to serve you well.

End-of-Chapter Questions

1. ABC Bottling Company’s sales have been expanding rapidly. Their single plant, which ships directly to customers, is now out of capacity. What factors should they consider when they decide whether to expand the existing plant or build another one? If they build another plant, what factors should they consider when they locate this plant?

2. A producer of dog food is trying to decide whether they should change the number and locations of their warehouses to better meet projected demand over the next three years. They do a study and determine that their transportation and warehousing costs will be $51 million if they stick with their current structure. They have determined that if they close two warehouses and open two new warehouses, their costs will drop to $50.5 million. Assume that all other costs stay the same. Should they make the change?

3. You need to set up a mathematical optimization model. Assume you are modeling a supply chain for a business with ten warehouses and 1,000 customers. If you set up the model to minimize cost, set the decision variables to decide which warehouse should serve which customers, and set up no constraints, why would you expect the minimal cost to come back as $0?

4. You are helping a firm determine their future transportation costs between their plant in Dallas and their warehouse in Atlanta. Your best estimate, with the data you have, is that the cost will be between $1.70 and $1.80 per mile. You decide to use $1.75 as your cost because it is the mid point. If you are asked to spend more time seeing whether the number should be closer to $1.70 or $1.80, what would be your argument against further refining this number?

5. A small medical supply company in Australia has just developed a never before seen product with major pre-release orders from around the globe already. This company will need more production capacity to support their forecasted sales for this new blockbuster product. If they simply expand their plant in Australia, they estimate that their production, transportation, and warehousing costs will be approximately $450 million (AUD). After a careful network design study, they have found two solutions that people in the company generally like.

a. Solution #1: Estimated cost of $375 million with a new large plant in China to supplement their existing plant in Australia.

b. Solution #2: Estimated cost of $385 million with three new smaller plants in China, Brazil, and Italy to supplement their plant in Australia. These plants would service their local regions.

(Assume the costs listed here include all the costs that are relevant.) What would be the best reasons for picking solution #1? For picking solution #2? Why is it important for this firm to consider other nonquantifiable factors when determining their best course of action for expansion?