Chapter 3

Univariate Data Analysis

Univariate data analysis studies univariate financial time series, but ignoring the time series properties of data. Univariate data analysis studies also cross-sectional data. For example, returns at a fixed time point of a collection of stocks is a cross-sectional univariate data set.

A univariate series of observations can be described using such statistics as sample mean, median, variance, quantiles, and expected shortfalls. These are covered in Section 3.1.

The graphical methods are explained in Section 3.2. Univariate graphical tools include tail plots, regression plots of the tails, histograms, and kernel density estimators. We use often tail plots to visualize the tail parts of the distribution, and kernel density estimates to visualize the central part of the distribution. The kernel density estimator is not only a visualization tool but also a tool for estimation.

We define univariate parametric models like normal, log-normal, and Student models in Section 3.3. These are parametric models, which are alternatives to the use of the kernel density estimator.

For a univariate financial time series it is of interest to study the tail properties of the distribution. This is done in Section 3.4. Typically the distribution of a financial time series has heavier tails than the normal distributions. The estimation of the tails is done using the concept of the excess distribution. The excess distribution is modeled with exponential, Pareto, gamma, generalized Pareto, and Weibull distributions. The fitting of distributions can be done with a version of maximum likelihood. These results prepare us to quantile estimation, which is considered in Chapter 8.

Central limit theorems provide tools to construct confidence intervals and confidence regions. The limit theorems for maxima provide insight into the estimation of the tails of a distribution. Limit theorems are covered in Section 3.5.

Section 3.6 summarizes the univariate stylized facts.

3.1 Univariate Statistics

We define mean, median, and mode to characterize the center of a distribution. The spread of a distribution can be measured by variance, other centered moments, lower and upper partial moments, lower and upper conditional moments, quantiles (value-at-risk), expected shortfall, shortfall, and absolute shortfall.

We define both population and sample versions of the statistics. In addition, we define both unconditional and conditional versions of the statistics.

3.1.1 The Center of a Distribution

The center of a distribution can be defined using the mean, the median, or the mode. The center of a distribution is an unknown quantity that has to be estimated using the sample mean, the sample median, or the sample mode. The conditional versions of theses quantities take into account the available information. For example, if we know that it is winter, then the expected temperature is lower than the expected temperature when we know that it is summer.

3.1.1.1 The Mean and the Conditional Mean

The population mean is called the expectation. The population mean can be estimated by the arithmetic mean. The conditional mean is estimated using regression analysis.

The Population Mean

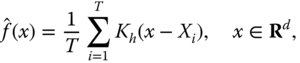

The population mean (expectation) of random variable ![]() , whose distribution is continuous, is defined as

, whose distribution is continuous, is defined as

where ![]() is the density function of

is the density function of ![]() .1 Let

.1 Let ![]() be an explanatory random variable (random vector). The conditional expectation of

be an explanatory random variable (random vector). The conditional expectation of ![]() given

given ![]() can be defined by

can be defined by

where ![]() is the conditional density.2

is the conditional density.2

The population mean of random variable ![]() , whose distribution is discrete with the possible values

, whose distribution is discrete with the possible values ![]() , is defined as

, is defined as

The conditional expectation can be defined as

The Sample Mean

Given a sample ![]() from the distribution of

from the distribution of ![]() , the mean

, the mean ![]() can be estimated with the sample mean (the arithmetic mean):

can be estimated with the sample mean (the arithmetic mean):

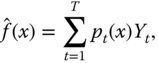

Regression analysis studies the estimation of the conditional expectation. In regression analysis, we observe values ![]() of the explanatory random variable (random vector), in addition to observing values

of the explanatory random variable (random vector), in addition to observing values ![]() of the response variable. Besides linear regression there exist various nonparametric methods for the estimation of the conditional expectation. For example, in kernel regression the arithmetic mean in (3.4) is replaced by a weighted mean

of the response variable. Besides linear regression there exist various nonparametric methods for the estimation of the conditional expectation. For example, in kernel regression the arithmetic mean in (3.4) is replaced by a weighted mean

where ![]() is a weight that is large when

is a weight that is large when ![]() is close to

is close to ![]() and small when

and small when ![]() is far away from

is far away from ![]() . Now

. Now ![]() is an estimate of the conditional mean

is an estimate of the conditional mean ![]() , for

, for ![]() . Kernel regression and other regression methods are described in Section 6.1.2.

. Kernel regression and other regression methods are described in Section 6.1.2.

The Annualized Mean

The return of a portfolio is typically estimated using the arithmetic mean and it is expressed as the annualized mean return. Let ![]() be observed stock prices, sampled at equidistant time points. Let

be observed stock prices, sampled at equidistant time points. Let ![]() ,

, ![]() , be the net returns. Let the sampling interval be

, be the net returns. Let the sampling interval be ![]() . The annualized mean return is

. The annualized mean return is

For the monthly returns ![]() . For the daily returns

. For the daily returns ![]() , because there are about 250 trading days in a year. Sampling of prices and several definitions of returns are discussed in Section 2.1.2.

, because there are about 250 trading days in a year. Sampling of prices and several definitions of returns are discussed in Section 2.1.2.

The Geometric Mean

Let ![]() be the observed stock prices and let

be the observed stock prices and let ![]() ,

, ![]() , be the gross returns. The geometric mean is defined as

, be the gross returns. The geometric mean is defined as

The logarithm of the geometric mean is equal to the arithmetic mean of the logarithmic returns:

Note that ![]() is the cumulative wealth at time

is the cumulative wealth at time ![]() when we start with wealth 1. Thus,

when we start with wealth 1. Thus,

3.1.1.2 The Median and the Conditional Median

The median can be defined in the case of a continuous distribution function of a random variable ![]() as the number

as the number ![]() satisfying

satisfying

Thus, the median is the point that divides the probability mass into two equal parts. Let us define the distribution function ![]() by

by

When ![]() is continuous, then

is continuous, then

In general, covering also the case of discrete distributions, we can define the median uniquely as the generalized inverse of the distribution function:

The conditional median is defined using the conditional distribution function

where ![]() is a random vector taking values in

is a random vector taking values in ![]() . Now we can define

. Now we can define

where ![]() .

.

The sample median of observations ![]() can be defined as the observation that has as many smaller observations as larger observations:

can be defined as the observation that has as many smaller observations as larger observations:

where ![]() is the ordered sample and

is the ordered sample and ![]() is the largest integer smaller or equal to

is the largest integer smaller or equal to ![]() . The sample median is a special case of an empirical quantile. Empirical quantiles are defined in (8.21)–(8.23).

. The sample median is a special case of an empirical quantile. Empirical quantiles are defined in (8.21)–(8.23).

3.1.1.3 The Mode and the Conditional Mode

The mode is defined as an argument maximizing the density function of the distribution of a random variable:

where ![]() is the density function of the distribution of

is the density function of the distribution of ![]() . The density

. The density ![]() can have several local maxima, and the use of the mode seems to be interesting only in cases where the density function is unimodal (has one local maximum). The conditional mode is defined as an argument maximizing the conditional density:

can have several local maxima, and the use of the mode seems to be interesting only in cases where the density function is unimodal (has one local maximum). The conditional mode is defined as an argument maximizing the conditional density:

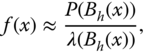

A mode can be estimated by finding a maximizer of a density estimate:

where ![]() is an estimator of the density function

is an estimator of the density function ![]() . Histograms and kernel density estimators are defined in Section 3.2.2.

. Histograms and kernel density estimators are defined in Section 3.2.2.

3.1.2 The Variance and Moments

Variance and higher order moments characterize the dispersion of a univariate distribution. To take into account only the left or the right tail we define upper and lower partial moments and upper and lower conditional moments.

3.1.2.1 The Variance and the Conditional Variance

The variance of random variable ![]() is defined by

is defined by

The standard deviation of ![]() is the square root of the variance of

is the square root of the variance of ![]() . The conditional variance of random variable

. The conditional variance of random variable ![]() is equal to

is equal to

The conditional standard deviation of ![]() is the square root of the conditional variance.

is the square root of the conditional variance.

The Sample Variance

The sample variance is defined by

where ![]() is a sample of random variables having identical distribution with

is a sample of random variables having identical distribution with ![]() , and

, and ![]() is the sample mean.3

is the sample mean.3

The Annualized Variance

The sample variance and the standard deviation of portfolio returns are typically annualized, analogously to the annualized sample mean in (3.5). Let ![]() be the observed stock prices, sampled at equidistant time points. Let

be the observed stock prices, sampled at equidistant time points. Let ![]() ,

, ![]() , be the net returns. Let the sampling interval be

, be the net returns. Let the sampling interval be ![]() . The annualized sample variance of the returns is

. The annualized sample variance of the returns is

where ![]() . For the monthly returns

. For the monthly returns ![]() . For the daily returns

. For the daily returns ![]() , because there are about 250 trading days in a year. Sampling of prices and several definitions of returns are discussed in Section 2.1.2.

, because there are about 250 trading days in a year. Sampling of prices and several definitions of returns are discussed in Section 2.1.2.

3.1.2.2 The Upper and Lower Partial Moments

The definition of the variance of random variable ![]() can be generalized to other centered moments

can be generalized to other centered moments

for ![]() . The variance is obtained when

. The variance is obtained when ![]() . The centered moments take a contribution both from the left and the right tail of the distribution. The lower partial moments take a contribution only from the left tail and the upper partial moments take a contribution only from the right tail. For example, if we are interested only in the distribution of the losses, then we use the lower partial moments of the return distribution, and if we are interested only in the distribution of the gains, then we use the upper partial moments. The upper partial moment is defined as

. The centered moments take a contribution both from the left and the right tail of the distribution. The lower partial moments take a contribution only from the left tail and the upper partial moments take a contribution only from the right tail. For example, if we are interested only in the distribution of the losses, then we use the lower partial moments of the return distribution, and if we are interested only in the distribution of the gains, then we use the upper partial moments. The upper partial moment is defined as

where ![]() ,

, ![]() , and

, and ![]() . The lower partial moment is defined as

. The lower partial moment is defined as

When ![]() has density

has density ![]() , we can write

, we can write

For example, when ![]() , then

, then

so that the upper partial moment is equal to the probability that ![]() is greater or equal to

is greater or equal to ![]() , and the lower partial moment is equal to the probability that

, and the lower partial moment is equal to the probability that ![]() is smaller or equal to

is smaller or equal to ![]() . For

. For ![]() and

and ![]() the partial moments are called the upper and lower semivariance of

the partial moments are called the upper and lower semivariance of ![]() . For example, the lower semivariance is defined as

. For example, the lower semivariance is defined as

The square root of the lower semivariance can be used to replace the standard deviation in the definition of the Sharpe ratio, or in the Markowitz criterion.

The sample centered moments are

where ![]() is the sample mean. The sample upper and the sample lower partial moments are

is the sample mean. The sample upper and the sample lower partial moments are

For example, when ![]() we have

we have

where

3.1.2.3 The Upper and Lower Conditional Moments

The upper conditional moments are the moments conditioned on the right tail of the distribution and the lower conditional moments are the moments conditioned on the left tail of the distribution. The upper conditional moment is defined as

and the lower conditional moment is defined as

where ![]() and

and ![]() is a target rate.

is a target rate.

The sample lower conditional moment is

where ![]() is defined in (3.18). Note that in (3.17) the sample size is the denominator but in (3.20) we have divided with the number of observations in the left tail.

is defined in (3.18). Note that in (3.17) the sample size is the denominator but in (3.20) we have divided with the number of observations in the left tail.

We can condition also on an external variable ![]() and define conditional on

and define conditional on ![]() versions of both upper and lower moments, and upper and lower conditional moments.

versions of both upper and lower moments, and upper and lower conditional moments.

3.1.3 The Quantiles and the Expected Shortfalls

The quantiles are applied under the name value-at-risk in risk management to characterize the probability of a tail event. The expected shortfall is a related measure for a tail risk.

3.1.3.1 The Quantiles and the Conditional Quantiles

The ![]() th quantile is defined as

th quantile is defined as

where ![]() and

and ![]() is the distribution function of

is the distribution function of ![]() . The value-at-risk is defined in (8.3) as a quantile of a loss distribution. For

. The value-at-risk is defined in (8.3) as a quantile of a loss distribution. For ![]() ,

, ![]() is equal to

is equal to ![]() , defined in (3.6). In the case of a continuous distribution function, we have

, defined in (3.6). In the case of a continuous distribution function, we have

and thus it holds that

where ![]() is the inverse of

is the inverse of ![]() . The

. The ![]() th conditional quantile is defined replacing the distribution function of

th conditional quantile is defined replacing the distribution function of ![]() with the conditional distribution function of

with the conditional distribution function of ![]() :

:

where ![]() and

and ![]() is the conditional distribution function of

is the conditional distribution function of ![]() .

.

The empirical quantile is defined as

where ![]() is the ordered sample and

is the ordered sample and ![]() is the smallest integer

is the smallest integer ![]() . We give equivalent definitions of the empirical quantile in Section 8.4.1. Chapter 8 discusses various estimators of quantiles and conditional quantiles.

. We give equivalent definitions of the empirical quantile in Section 8.4.1. Chapter 8 discusses various estimators of quantiles and conditional quantiles.

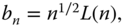

3.1.3.2 The Expected Shortfalls

The expected shortfall is a measure of risk that aggregates all quantiles in the right tail (or in the left tail). When ![]() has a continuous distribution function, then the expected shortfall for the right tail is

has a continuous distribution function, then the expected shortfall for the right tail is

where ![]() . Thus, the

. Thus, the ![]() th expected shortfall is the conditional expectation under the condition that the random variable is larger than the

th expected shortfall is the conditional expectation under the condition that the random variable is larger than the ![]() th quantile. The term “tail conditional value-at-risk” is sometimes used to denote the expected shortfall. In the general case, when the distribution of

th quantile. The term “tail conditional value-at-risk” is sometimes used to denote the expected shortfall. In the general case, when the distribution of ![]() is not necessarily continuous, the expected shortfall for the right tail is defined as

is not necessarily continuous, the expected shortfall for the right tail is defined as

The equality of (3.24) and (3.25) for the continuous distributions is proved in McNeil et al. (2005, lemma 2.16). In fact, denoting ![]() ,

,

where ![]() and we use the fact that

and we use the fact that ![]() .4 Finally, note that

.4 Finally, note that ![]() for continuous distributions.

for continuous distributions.

The expected shortfall for the left tail is

When ![]() has a continuous distribution function, then the expected shortfall for the left tail is

has a continuous distribution function, then the expected shortfall for the left tail is

This expression shows that in the case of a continuous distribution function, ![]() is equal to the expectation that is taken only over the left tail, when the left tail is defined as the region that is on the left side of the

is equal to the expectation that is taken only over the left tail, when the left tail is defined as the region that is on the left side of the ![]() th quantile of the distribution. Note that the expected shortfall for the left tail is related to the lower conditional moment of order

th quantile of the distribution. Note that the expected shortfall for the left tail is related to the lower conditional moment of order ![]() and target rate

and target rate ![]() :

:

where the lower conditional moment ![]() is defined in (3.19).5

is defined in (3.19).5

The expected shortfall for the right tail, as defined in (3.24), can be estimated from the data ![]() by

by

where ![]() and

and ![]() , with, for example,

, with, for example, ![]() or

or ![]() . When the expected shortfall is for the left tail, as defined by (3.26), then we define the estimator as

. When the expected shortfall is for the left tail, as defined by (3.26), then we define the estimator as

where ![]() with, for example,

with, for example, ![]() or

or ![]() .

.

3.2 Univariate Graphical Tools

We consider sequence ![]() of real numbers, and assume that the sequence is a sample from a probability distribution. We want to visualize the sequence in order to discover properties of the underlying distribution. We divide the graphical tools to those that are based on the empirical distribution function and the empirical quantiles, and to those that are based on the estimation of the underlying density function. The distribution function and quantiles based tools give more insight about the tails of the distribution, and the density based tools give more information about the center of the distribution.

of real numbers, and assume that the sequence is a sample from a probability distribution. We want to visualize the sequence in order to discover properties of the underlying distribution. We divide the graphical tools to those that are based on the empirical distribution function and the empirical quantiles, and to those that are based on the estimation of the underlying density function. The distribution function and quantiles based tools give more insight about the tails of the distribution, and the density based tools give more information about the center of the distribution.

A two-variate data can be visualized using a scatter plot. For a univariate data there is no such obvious method available. Thus, visualizing two-variate data may seem easier than visualizing univariate data. However, we can consider many of the tools to visualize univariate data to be scatter plots of points

where ![]() is a mapping that attaches a real value to each data point

is a mapping that attaches a real value to each data point ![]() . Thus, in a sense we visualize univariate data by transforming it into a two-dimensional data.

. Thus, in a sense we visualize univariate data by transforming it into a two-dimensional data.

3.2.1 Empirical Distribution Function Based Tools

The distribution function of the distribution of random variable ![]() is

is

The empirical distribution function can be considered as a starting point for several visualizations: tail plots, regression plots of tails, and empirical quantile functions. We use often tail plots. Regression plots of tails have two types: (1) plots that look linear for an exponential tail and (2) plots that look linear for a Pareto tail.

3.2.1.1 The Empirical Distribution Function

The empirical distribution function ![]() , based on data

, based on data ![]() , is defined as

, is defined as

where ![]() , and

, and ![]() means the cardinality of set

means the cardinality of set ![]() . Note that the empirical distribution function is defined in (8.20) using the indicator function. An empirical distribution function is a piecewise constant function. Plotting a graph of an empirical distribution function is for large samples practically the same as plotting the points

. Note that the empirical distribution function is defined in (8.20) using the indicator function. An empirical distribution function is a piecewise constant function. Plotting a graph of an empirical distribution function is for large samples practically the same as plotting the points

where ![]() are the ordered observations. Thus, the empirical distribution function fits the scheme of transforming univariate data to two-dimensional data as in (3.29).

are the ordered observations. Thus, the empirical distribution function fits the scheme of transforming univariate data to two-dimensional data as in (3.29).

Figure 3.1 shows empirical distribution functions of S&P 500 net returns (red) and 10-year bond net returns (blue). The monthly data of S&P 500 and US Treasury 10-year bond returns is described in Section 2.4.3. Panel (a) plots the points (3.31) and panel (b) zooms to the lower left corner, showing the empirical distribution function for the ![]() smallest observations; the empirical distribution function is shown on the range

smallest observations; the empirical distribution function is shown on the range ![]() , where

, where ![]() is the

is the ![]() th empirical quantile for

th empirical quantile for ![]() . Neither of the estimated return distributions dominates the other: The S&P 500 distribution function is higher at the left tail but lower at the right tail. That is, S&P 500 is more risky than the 10-year bond. Note that Section 9.2.3 discusses stochastic dominance: a first return distribution dominates stochastically a second return distribution when the first distribution function takes smaller values everywhere than the second distribution function.

. Neither of the estimated return distributions dominates the other: The S&P 500 distribution function is higher at the left tail but lower at the right tail. That is, S&P 500 is more risky than the 10-year bond. Note that Section 9.2.3 discusses stochastic dominance: a first return distribution dominates stochastically a second return distribution when the first distribution function takes smaller values everywhere than the second distribution function.

Figure 3.1 Empirical distribution functions. (a) Empirical distribution functions of S&P 500 returns (red) and 10-year bond returns (blue); (b) zooming at the lower left corner.

3.2.1.2 The Tail Plots

The left and right tail plots can be used to visualize the heaviness of the tails of the underlying distribution. A smooth tail plot can be used to visualize simultaneously a large number of samples. The tail plots are almost the same as the empirical distribution function, but there are couple of differences:

- 1. In tail plots we divide the data into the left tail and the right tail, and we visualize separately the two tails.

- 2. In tail plots the

-axis shows the number of observations and a logarithmic scale is used for the

-axis shows the number of observations and a logarithmic scale is used for the  -axis.

-axis.

Tail plots have been applied in Mandelbrot (1963), Bouchaud and Potters (2003), and Sornette (2003).

The Left and the Right Tail Plots

The observations in the left tail are

where ![]() is the

is the ![]() th empirical quantile for

th empirical quantile for ![]() . For the left tail plot we choose the level

. For the left tail plot we choose the level

Thus, the smallest observation has level one, the second smallest observation has level two, and so on. Note that ![]() is often called the rank of

is often called the rank of ![]() . The left tail plot is the two-dimensional scatter plot of the points

. The left tail plot is the two-dimensional scatter plot of the points ![]() ,

, ![]() , when the logarithmic scale is used for the

, when the logarithmic scale is used for the ![]() -axis.

-axis.

The observations in the right tail are

where ![]() is the

is the ![]() th empirical quantile for

th empirical quantile for ![]() . We choose the level of

. We choose the level of ![]() as the number of observations larger or equal to

as the number of observations larger or equal to ![]() :

:

Thus, the largest observation has level one, the second largest observation has level two, and so on. The right tail plot is the two-dimensional scatter plot of the points ![]() ,

, ![]() , when the logarithmic scale is used for the

, when the logarithmic scale is used for the ![]() -axis.

-axis.

The left tail plot can be considered as an estimator of the function

where ![]() is the underlying distribution function and

is the underlying distribution function and ![]() . Indeed, for the level in (3.32) we have that

. Indeed, for the level in (3.32) we have that ![]() . The right tail plot can be considered as an estimator of the function

. The right tail plot can be considered as an estimator of the function

where ![]() . For the level in (3.33) we have that

. For the level in (3.33) we have that ![]() .

.

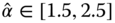

Figure 3.2 shows the left and right tail plots for the daily S&P 500 data, described in Section 2.4.1. Panel (a) shows the left tail plot and panel (b) shows the right tail plot. The black circles show the data points. The ![]() -axis is logarithmic. The colored curves show the population versions (3.34) and (3.35) for the Gaussian distribution (red) and for the Student distributions with degrees of freedom

-axis is logarithmic. The colored curves show the population versions (3.34) and (3.35) for the Gaussian distribution (red) and for the Student distributions with degrees of freedom ![]() (blue).6 We can see that for the left tail Student's distribution with degrees of freedom

(blue).6 We can see that for the left tail Student's distribution with degrees of freedom ![]() gives the best fit, but for the right tail degrees of freedom

gives the best fit, but for the right tail degrees of freedom ![]() gives the best fit.

gives the best fit.

Figure 3.2 Left and right tail plots. (a) The left tail plot for S&P 500 returns; (b) the right tail plot. The red curve shows the theoretical Gaussian curve and the blue curves show the Student curves for the degrees of freedom ν = 3–6.

A left tail plot and a right tail plot can be combined into one figure, at least when both the left and the right tails are defined by taking the threshold to be the sample median ![]() (see Figures 14.24(a) and 14.25(a)).

(see Figures 14.24(a) and 14.25(a)).

Smooth Tail Plots

Figure 3.3 shows smooth tail plots for the S&P 500 components data, described in Section 2.4.5. Panel (a) shows left tail plots and panel (b) shows right tail plots. The gray scale image visualizes with one picture all tail plots of the stocks in the S&P 500 components data. The red points show the tail plots of S&P 500 index, which is also shown in Figure 3.2. Note that the ![]() -axes have the ranges

-axes have the ranges ![]() and

and ![]() , so that the extreme observations are not shown. Note that instead of the logarithmic scale of

, so that the extreme observations are not shown. Note that instead of the logarithmic scale of ![]() -values

-values ![]() , we have used values

, we have used values ![]() on the

on the ![]() -axis. We can see that the index has lighter tails than most of the individual stocks.

-axis. We can see that the index has lighter tails than most of the individual stocks.

Figure 3.3 Smooth tail plots. The gray scale images show smooth tail plots of a collection of stocks in the S&P 500 index. The red points show the tail plots of the S&P 500 index. (a) A smooth left tail plot; (b) a smooth right tail plot.

In a smooth tail plot we make an image that simultaneously shows several tail plots. Let us have ![]() stocks and

stocks and ![]() returns for each stock. We draw a separate left or right tail plot for each stock. Plotting these tail plots in the same figure would cause overlapping, and we would see only a black image. That is why we use smoothing. We divide the

returns for each stock. We draw a separate left or right tail plot for each stock. Plotting these tail plots in the same figure would cause overlapping, and we would see only a black image. That is why we use smoothing. We divide the ![]() -axis to 300 grid points, say. The

-axis to 300 grid points, say. The ![]() -axis has

-axis has ![]() grid points. Thus, we have

grid points. Thus, we have ![]() pixels. For each

pixels. For each ![]() -value we compute the value of a univariate kernel density estimator at that

-value we compute the value of a univariate kernel density estimator at that ![]() -value. Each kernel estimator is constructed using

-value. Each kernel estimator is constructed using ![]() observations. This is done for each

observations. This is done for each ![]() rows, so that we evaluate

rows, so that we evaluate ![]() estimates at 300 points. See Section 3.2.2 about kernel density estimation. We choose the smoothing parameter using the normal reference rule and use the standard Gaussian kernel. The values of the density estimate are raised to the power of 21 before applying the gray scale.

estimates at 300 points. See Section 3.2.2 about kernel density estimation. We choose the smoothing parameter using the normal reference rule and use the standard Gaussian kernel. The values of the density estimate are raised to the power of 21 before applying the gray scale.

3.2.1.3 Regression Plots of Tails

Regression plots are related to the empirical distribution function, just like tail plots, but now the data is transformed so that it lies on ![]() , both in the case of the left tail and in the case of the right tail. We use the term “regression plot” because these plots suggest fitting linear regression curves to the data. We distinguish the plot for which exponential tails looks linear and the plot for which Pareto tails look linear.

, both in the case of the left tail and in the case of the right tail. We use the term “regression plot” because these plots suggest fitting linear regression curves to the data. We distinguish the plot for which exponential tails looks linear and the plot for which Pareto tails look linear.

Plots which Look Linear for an Exponential Tail

Let the original observations be ![]() . Let

. Let ![]() be a threshold. We choose

be a threshold. We choose ![]() to be an empirical quantile

to be an empirical quantile ![]() for some

for some ![]() :

: ![]() for

for ![]() , where

, where ![]() are the ordered observations. Let

are the ordered observations. Let ![]() be the left tail and

be the left tail and ![]() be the right tail, transformed so that the observations lie on

be the right tail, transformed so that the observations lie on ![]() :

:

For the left tail ![]() for

for ![]() and for the right tail

and for the right tail ![]() for

for ![]() . Let us denote by

. Let us denote by ![]() either the left tail or the right tail. Denote

either the left tail or the right tail. Denote

Let

be the empirical distribution function, based on data ![]() . Note that in the usual definition of the empirical distribution function we divide by

. Note that in the usual definition of the empirical distribution function we divide by ![]() , but now we divide by

, but now we divide by ![]() because we need that

because we need that ![]() , in order to take the logarithm of

, in order to take the logarithm of ![]() . Denote

. Denote

Assume that the data is ordered:

We have that

The regression plot that is linear for exponential tails is a scatter plot of the points7

Figure 3.4 shows scatter plots of points in (3.36). We use the S&P 500 daily data, described in Section 2.4.1. Panel (a) plots data in the left tail with ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue). Panel (b) plots data in the right tail with

(blue). Panel (b) plots data in the right tail with ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue).

(blue).

Figure 3.4 Regression plots which are linear for exponential tails: S&P 500 daily returns. (a) Left tail with  (black),

(black),  (red), and

(red), and  (blue); (b) right tail with

(blue); (b) right tail with  (black),

(black),  (red), and

(red), and  (blue).

(blue).

The data looks linear for exponential tails and convex for Pareto tails. The exponential distribution function is ![]() for

for ![]() , where

, where ![]() . The exponential distribution function satisfies

. The exponential distribution function satisfies

Plotting the curve

for ![]() and for various values of

and for various values of ![]() shows how well the exponential distributions fit the tail. The Pareto distribution function for the support

shows how well the exponential distributions fit the tail. The Pareto distribution function for the support ![]() is

is ![]() for

for ![]() , where

, where ![]() ; see (3.74). The Pareto distribution function satisfies

; see (3.74). The Pareto distribution function satisfies

Plotting the curve

for ![]() and for various values of

and for various values of ![]() shows how well the Pareto distributions fit the tail.8

shows how well the Pareto distributions fit the tail.8

Figure 3.5 shows how parametric models are fitted to the left tail, defined by the ![]() th empirical quantile with

th empirical quantile with ![]() . We use the S&P 500 daily data, as described in Section 2.4.1. Panel (a) shows fitting of exponential tails: we show functions (3.37) for three values of parameter

. We use the S&P 500 daily data, as described in Section 2.4.1. Panel (a) shows fitting of exponential tails: we show functions (3.37) for three values of parameter ![]() . Panel (a) shows fitting of Pareto tails: we show functions (3.38) for three values of parameter

. Panel (a) shows fitting of Pareto tails: we show functions (3.38) for three values of parameter ![]() . The middle values of the parameters are the maximum likelihood estimates, defined in Section 3.4.2.

. The middle values of the parameters are the maximum likelihood estimates, defined in Section 3.4.2.

Figure 3.5 Fitting of parametric families for data that is linear for exponential tails. The data points are from left tail of S&P 500 daily returns, defined by the  th empirical quantile with

th empirical quantile with  . (a) Fitting of exponential distributions; (b) fitting of Pareto distributions.

. (a) Fitting of exponential distributions; (b) fitting of Pareto distributions.

Plots which Look Linear for a Pareto Tail

Let

For the right tail we assume that ![]() and for the left tail we assume that

and for the left tail we assume that ![]() . Let us denote by

. Let us denote by ![]() either the left tail or the right tail. Denote

either the left tail or the right tail. Denote

Assume that the data is ordered: ![]() The regression plot that is linear for Pareto tails is a scatter plots of the points

The regression plot that is linear for Pareto tails is a scatter plots of the points

Figure 3.6 shows scatter plots of points in (3.39). We use the S&P 500 daily data, described in Section 2.4.1. Panel (a) plots data in the left tail with ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue). Panel (b) plots data in the right tail with

(blue). Panel (b) plots data in the right tail with ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue).

(blue).

Figure 3.6 Regression plots which are linear for Pareto tails: S&P 500 daily returns. (a) Left tail with  (black),

(black),  (red), and

(red), and  (blue); (b) right tail with

(blue); (b) right tail with  (black),

(black),  (red), and

(red), and  (blue).

(blue).

The data looks linear for Pareto tails and concave for exponential tails. The exponential distribution function for the support ![]() is

is ![]() for

for ![]() , where

, where ![]() . The exponential distribution function satisfies

. The exponential distribution function satisfies

Plotting the curve

for ![]() and for various values of

and for various values of ![]() shows how well the exponential distributions fit the tail. The Pareto distribution function for the support

shows how well the exponential distributions fit the tail. The Pareto distribution function for the support ![]() is

is ![]() for

for ![]() , where

, where ![]() . The Pareto distribution function satisfies

. The Pareto distribution function satisfies

Plotting the curve

for ![]() and for various values of

and for various values of ![]() shows how well the Pareto distributions fit the tail.

shows how well the Pareto distributions fit the tail.

Figure 3.7 shows how parametric models are fitted to the left tail, defined by the ![]() th empirical quantile with

th empirical quantile with ![]() . We use the S&P 500 daily data, described in Section 2.4.1. Panel (a) shows fitting of exponential tails: we show functions (3.37) for three values of parameter

. We use the S&P 500 daily data, described in Section 2.4.1. Panel (a) shows fitting of exponential tails: we show functions (3.37) for three values of parameter ![]() . Panel (a) shows fitting of Pareto tails: we show functions (3.38) for three values of parameter

. Panel (a) shows fitting of Pareto tails: we show functions (3.38) for three values of parameter ![]() . The middle values of the parameters are the maximum likelihood estimates, defined in Section 3.4.2.

. The middle values of the parameters are the maximum likelihood estimates, defined in Section 3.4.2.

Figure 3.7 Fitting of parametric families for data that is linear for Pareto tails. The data points are from left tail of S&P 500 daily returns, defined by the  th empirical quantile with

th empirical quantile with  . (a) Fitting of exponential distributions; (b) fitting of Pareto distributions.

. (a) Fitting of exponential distributions; (b) fitting of Pareto distributions.

3.2.1.4 The Empirical Quantile Function

The ![]() th quantile of the distribution of the random variable

th quantile of the distribution of the random variable ![]() is defined in (3.21) as

is defined in (3.21) as

where ![]() and

and ![]() is the distribution function of

is the distribution function of ![]() . The empirical quantile can be defined as

. The empirical quantile can be defined as

where ![]() is the empirical distribution function, as defined in (3.30); see (8.21). Section 8.4.1 contains equivalent definitions of the empirical quantile.

is the empirical distribution function, as defined in (3.30); see (8.21). Section 8.4.1 contains equivalent definitions of the empirical quantile.

The quantile function is

For continuous distributions the quantile function is the same as the inverse of the distribution function. The empirical quantile function is

where ![]() is the empirical quantile. A quantile function can be used to compare return distributions. A first return distribution dominates a second return distribution when the first quantile function takes higher values everywhere than the second quantile function. See Section 9.2.3 about stochastic dominance.

is the empirical quantile. A quantile function can be used to compare return distributions. A first return distribution dominates a second return distribution when the first quantile function takes higher values everywhere than the second quantile function. See Section 9.2.3 about stochastic dominance.

Plotting a graph of the empirical quantile function is close to plotting the points

where ![]() are the ordered observations.

are the ordered observations.

Figure 3.8 shows empirical quantile functions of S&P 500 returns (red) and 10-year bond returns (blue). The monthly data of S&P 500 and US Treasury 10-year bond returns is described in Section 2.4.3. Panel (a) plots the points (3.41) and panel (b) zooms at the lower left corner, showing the empirical quantile on the range ![]() . Neither of the estimated return distributions dominates the other: The S&P 500 returns have a higher median and higher upper quantiles, but they have smaller lower quantiles. That is, S&P 500 is more risky than 10-year bond.

. Neither of the estimated return distributions dominates the other: The S&P 500 returns have a higher median and higher upper quantiles, but they have smaller lower quantiles. That is, S&P 500 is more risky than 10-year bond.

Figure 3.8 Empirical quantile functions. (a) Empirical quantile functions of S&P 500 returns (red) and 10-year bond returns (blue); (b) zooming to the lower left corner.

3.2.2 Density Estimation Based Tools

We describe both histograms and kernel density estimators.

3.2.2.1 The Histogram

A histogram estimator of the density of ![]() , based on identically distributed observations

, based on identically distributed observations ![]() , is defined as

, is defined as

where ![]() is a partition on

is a partition on ![]() and

and

is the number of observations in ![]() . The partition is a collection of sets

. The partition is a collection of sets ![]() that are (almost surely) disjoint and they cover the space of the observed values

that are (almost surely) disjoint and they cover the space of the observed values ![]() .9

.9

Figure 3.9(a) shows a histogram estimate using S&P 500 returns. We use the S&P 500 monthly data, described in Section 2.4.3. The histogram is constructed from the data ![]() ,

, ![]() , where

, where ![]() are the monthly gross returns. Panel (b) shows a histogram constructed from the historically simulated pay-offs of the call option with the strike price 100. The histogram is constructed from the data

are the monthly gross returns. Panel (b) shows a histogram constructed from the historically simulated pay-offs of the call option with the strike price 100. The histogram is constructed from the data ![]() ,

, ![]() . Panel (a) includes a graph of a kernel density estimate, defined in (3.43). The histogram in panel (b) illustrates that a histogram is convenient to visualize the density of data that is not from a continuous distribution; for this data the value 0 has a probability about 0.5.

. Panel (a) includes a graph of a kernel density estimate, defined in (3.43). The histogram in panel (b) illustrates that a histogram is convenient to visualize the density of data that is not from a continuous distribution; for this data the value 0 has a probability about 0.5.

Figure 3.9 Histogram estimates. (a) A histogram of historically simulated S&P 500 prices. A graph of kernel density estimate is included. (b) A histogram of historically simulated call option pay-offs.

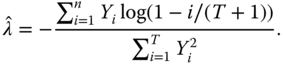

3.2.2.2 The Kernel Density Estimator

The kernel density estimator ![]() of the density function

of the density function ![]() of random vector

of random vector ![]() , based on identically distributed data

, based on identically distributed data ![]() , is defined by

, is defined by

where ![]() is the kernel function,

is the kernel function, ![]() , and

, and ![]() is the smoothing parameter.10

is the smoothing parameter.10

We can also take the vector smoothing parameter ![]() and

and ![]() . The smoothing parameter of the kernel density estimator can be chosen using the normal reference rule:

. The smoothing parameter of the kernel density estimator can be chosen using the normal reference rule:

for ![]() , where

, where ![]() is the sample standard deviation for the

is the sample standard deviation for the ![]() th variable; see Silverman (1986, p. 45). Alternatively, the sample variances of the marginal distributions can be normalized to one, so that

th variable; see Silverman (1986, p. 45). Alternatively, the sample variances of the marginal distributions can be normalized to one, so that ![]() .

.

Figure 3.10(a) shows kernel estimates of the distribution of S&P 500 monthly net returns (blue) and of the distribution of US 10-year bond monthly net returns (red). The data set of monthly returns of S&P 500 and US 10-year bond is described in Section 2.4.3. Panel (b) shows kernel density estimates of S&P 500 net returns with periods of 1–5 trading days (colors black–green). We use S&P 500 daily data of Section 2.4.1 to construct returns for the different horizons.

Figure 3.10 Kernel density estimates of distributions of asset returns. (a) Estimates of the distribution of S&P 500 monthly returns (blue) and of US 10-year bond monthly returns (red); (b) estimates of S&P 500 net returns with periods of 1–5 trading days (colors black–green).

3.3 Univariate Parametric Models

We describe normal and log-normal distributions, Student distributions, infinitely divisible distributions, Pareto distributions, and models that interpolate between exponential and polynomial tails. We consider also the estimation of the parameters, in particular, the estimation of the tail index.

3.3.1 The Normal and Log-normal Models

After defining the normal and log-normal distributions, we discuss how the central limit theorem can be used to justify that these distributions can be used to model stock prices.

3.3.1.1 The Normal and Log-normal Distributions

A univariate normal distribution can be parameterized with the expectation ![]() and the standard deviation

and the standard deviation ![]() . When

. When ![]() is a random variable with a normal distribution we write

is a random variable with a normal distribution we write

The density of the normal distribution ![]() is

is

where ![]() . The parameters

. The parameters ![]() and

and ![]() can be estimated by the sample mean and sample standard deviation.

can be estimated by the sample mean and sample standard deviation.

When ![]() , then it is said that

, then it is said that ![]() has a log-normal distribution, and we write

has a log-normal distribution, and we write

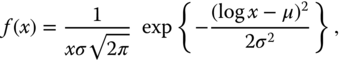

The density function of a log-normal distribution is

where ![]() . Thus, log-normally distributed random variables are positive (almost surely). The expectation of a log-normally distributed random variable

. Thus, log-normally distributed random variables are positive (almost surely). The expectation of a log-normally distributed random variable ![]() is

is

For ![]() ,

, ![]() . Given observations

. Given observations ![]() from a log-normal distribution, the parameters

from a log-normal distribution, the parameters ![]() and

and ![]() can be estimated using the sample mean and sample standard deviation computed from the observations

can be estimated using the sample mean and sample standard deviation computed from the observations ![]() .

.

Note that a linear combination of log-normal variables is not log-normally distributed, but a product of log-normally distributed random variables is log-normally distributed, because a linear combination of normal variables is normally distributed.

3.3.1.2 Modeling Stock Prices

We can justify heuristically the normal distribution for the differences of stock prices using the central limit theorem. The central limit theorem can also be used to justify the log-normal model for the gross returns (which amounts to a normal model for the logarithmic returns). Let us consider time interval ![]() and let

and let ![]() for

for ![]() , so that

, so that ![]() is an equally spaced sample of stock prices, where

is an equally spaced sample of stock prices, where ![]() and

and ![]() . The time interval between the sampled prices is

. The time interval between the sampled prices is ![]() .

.

- 1. Normal model. We may write the price at time

,

,  , as

, as

- If the price increments

are i.i.d. with expectation

are i.i.d. with expectation  and variance

and variance  , then an application of the central limit theorem gives the approximation11

, then an application of the central limit theorem gives the approximation11

- where

, and

, and  . Equation (3.47) defines the Gaussian model for the asset prices. Under the normal model we have

3.48

. Equation (3.47) defines the Gaussian model for the asset prices. Under the normal model we have

3.48

- where

is a random variable that has the standard normal distribution.

is a random variable that has the standard normal distribution. - 2. Log-normal model. We may write the asset price at time

,

,  , as

, as

- If

are i.i.d. with expectation

are i.i.d. with expectation  and variance

and variance  , then an application of the central limit theorem gives the approximation12

, then an application of the central limit theorem gives the approximation12

- where

- This is equivalent to saying that

is log-normally distributed with parameters

is log-normally distributed with parameters  and

and  :

:

- Equation (3.50) defines the log-normal model for the asset prices. Under the log-normal model we have

3.52

- where

is a random variably that has the standard normal distribution.

is a random variably that has the standard normal distribution.

Parameter ![]() in (3.51) is called the annualized mean of the logarithmic returns and parameter

in (3.51) is called the annualized mean of the logarithmic returns and parameter ![]() is called the annualized volatility. For the daily data

is called the annualized volatility. For the daily data ![]() and for the monthly data

and for the monthly data ![]() , when we take

, when we take ![]() .

.

Figure 3.11 shows estimates of the densities of stock price ![]() using the data of S&P 500 daily prices, described in Section 2.4.1. In panel (a)

using the data of S&P 500 daily prices, described in Section 2.4.1. In panel (a) ![]() , which equals 20 trading days, and in panel (b)

, which equals 20 trading days, and in panel (b) ![]() years. The normal density is shown with black and the log-normal density is shown with red. We take

years. The normal density is shown with black and the log-normal density is shown with red. We take ![]() , and for the purpose of fitting a normal distribution for the price increments we change the price data to

, and for the purpose of fitting a normal distribution for the price increments we change the price data to ![]() . For the normal model the estimate

. For the normal model the estimate ![]() is the sample mean and

is the sample mean and ![]() is the sample standard deviation of the daily increments. Then we arrive at the distribution

is the sample standard deviation of the daily increments. Then we arrive at the distribution

where ![]() . For the log-normal model the estimate

. For the log-normal model the estimate ![]() is the sample mean and

is the sample mean and ![]() is the sample standard deviation of the logarithmic daily returns. Then we arrive at the distribution

is the sample standard deviation of the logarithmic daily returns. Then we arrive at the distribution

The log-normal density is skewed to the left and the right tail is heavier than the left tail. The normal density is symmetric with respect to the mean.

Figure 3.11 Normal and log-normal densities. Shown are a normal density (black) and a log-normal density (red) of the distribution of the stock price  , when

, when  . In panel (a)

. In panel (a)  , which equals 20 trading days, and in panel (b)

, which equals 20 trading days, and in panel (b)  years.

years.

Log-normally distributed random variables take only positive values, but normal random variables can take negative values. Note, however, that the tail of the normal distribution is so thin that the probability of negative values can be very small. Thus, the positivity of log-normal distributions is not a strong argument in favor of their use to model prices.

The Gaussian model for the increments of the stock prices was used by Bachelier (1900). The continuous time limit of the log-normal model is the Black–Scholes model, that is used in option pricing. The log-normal model is applied in (14.49) to derive a price for options. A log-normal distribution allows for greater upside price movements than downside price movements. This leads to the fact that in the Black–Scholes model 105 call has more value than 95 put when the stock is at 100. See Figure 14.4 for the illustration of the asymmetry.

3.3.2 The Student Distributions

The density of the standard Student distribution with degrees of freedom ![]() is given by

is given by

for ![]() , where the normalization constant is equal to

, where the normalization constant is equal to

and the gamma function is defined by ![]() for

for ![]() . When

. When ![]() follows the Student distribution with degrees of freedom

follows the Student distribution with degrees of freedom ![]() , then we write

, then we write

3.3.2.1 Properties of Student Distributions

Let ![]() . If

. If ![]() then

then ![]() and

and ![]() . If

. If ![]() , then

, then

We have that ![]() only when

only when ![]() . In fact, a Student density has tails

. In fact, a Student density has tails

as ![]() .13 Thus, Student densities have Pareto tails, as defined in Section 3.4.

.13 Thus, Student densities have Pareto tails, as defined in Section 3.4.

We can consider three-parameter location-scale Student families. When ![]() , then

, then ![]() follows a location-scale Student distribution, and we write14

follows a location-scale Student distribution, and we write14

Note that for ![]() ,

, ![]() but

but ![]() is not the variance of

is not the variance of ![]() . Instead,

. Instead,

When ![]() , then the Student density approaches the Gaussian density. Indeed,

, then the Student density approaches the Gaussian density. Indeed, ![]() , as

, as ![]() , since

, since ![]() , when

, when ![]() .

.

A student distributed random variable ![]() can be written as

can be written as

where ![]() , and

, and ![]() has

has ![]() -distribution with degrees of freedom

-distribution with degrees of freedom ![]() . Thus, Student distributions belong to the family of normal variance mixture distributions (scale-mixtures of normal distribution), as defined in Section 4.3.3.

. Thus, Student distributions belong to the family of normal variance mixture distributions (scale-mixtures of normal distribution), as defined in Section 4.3.3.

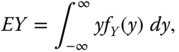

3.3.2.2 Estimation of the Parameters of a Student Distribution

Let us observe ![]() from a Student distribution

from a Student distribution ![]() with the density function

with the density function ![]() . The maximum likelihood estimates are maximizers of the likelihood over

. The maximum likelihood estimates are maximizers of the likelihood over ![]() ,

, ![]() , and

, and ![]() . Equivalently, we can minimize the negative log-likelihood. Assuming the independence of the observations, the negative log-likelihood is equal to

. Equivalently, we can minimize the negative log-likelihood. Assuming the independence of the observations, the negative log-likelihood is equal to

We apply the restricted maximum likelihood estimator that minimizes

over ![]() and

and ![]() , where

, where ![]() is the sample mean.

is the sample mean.

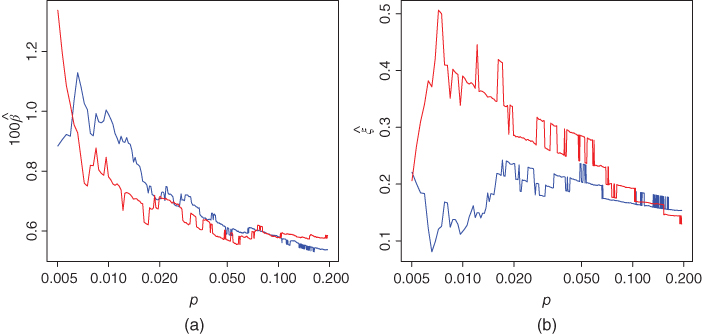

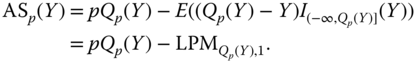

Figure 3.12 studies how the return horizon affects the maximum likelihood estimates for the Student family. We consider the data of daily S&P 500 returns, described in Section 2.4.1. The data is used to consider return horizons up to 40 days. Panel (a) shows the estimates of parameter ![]() as a function of return horizon in trading days. Panel (b) shows the estimates of

as a function of return horizon in trading days. Panel (b) shows the estimates of ![]() as a function of the return horizon. We see that the estimates are larger for the longer return horizons but there is fluctuation in the estimates.

as a function of the return horizon. We see that the estimates are larger for the longer return horizons but there is fluctuation in the estimates.

Figure 3.12 Parameter estimates for various return horizons. The maximum likelihood estimates of (a)  and (b)

and (b)  as a function of the return horizon in trading days.

as a function of the return horizon in trading days.

Figure 3.13 shows the estimates of the degrees of freedom and the scale parameter for each series of daily returns in the S&P 500 components data, described in Section 2.4.5. We get an individual estimate of ![]() and

and ![]() for each stock. Panel (a) shows a kernel density estimate and a histogram estimate of the distribution of

for each stock. Panel (a) shows a kernel density estimate and a histogram estimate of the distribution of ![]() . Panel (b) shows the estimates of the distribution of

. Panel (b) shows the estimates of the distribution of ![]() .16 The maximizers of the kernel estimates (modes) are indicated by the blue lines. The most stocks has

.16 The maximizers of the kernel estimates (modes) are indicated by the blue lines. The most stocks has ![]() , but the estimates vary as

, but the estimates vary as ![]() .

.

Figure 3.13 Distribution of estimates  and

and  . (a) A kernel density estimate and a histogram of the distribution of

. (a) A kernel density estimate and a histogram of the distribution of  ; (b) the estimates of the distribution of

; (b) the estimates of the distribution of  . The maximizers of the kernel estimates are indicated by the blue lines.

. The maximizers of the kernel estimates are indicated by the blue lines.

3.4 Tail Modeling

The normal, log-normal, and Student distributions provide models for the complete return distribution. These models assume that the return distribution is approximately symmetric. We consider an approach where the left tail, the right tail, and the central area are modeled and estimated separately. There are at least two advantages with this approach:

- 1. We may better estimate distributions whose left tail is different from the right tail. For example, it is possible that the distribution of losses is different from the distribution of gains.

- 2. We may apply different estimation methods for different parts of the distribution. For example, we may apply nonparametric methods for the estimation of the central part of the distribution and parametric methods for the estimation of the tails.

In risk management, we are mainly interested in the estimation of the left tail (the probability of losses). In portfolio selection, we might be interested in the complete distribution.

A semiparametric approach for the estimation of the complete return distribution estimates the left and the right tails of the distribution using a parametric model, but the central region of the distribution is estimated using a kernel estimator, or some other nonparametric density estimator. It is a nontrivial problem to make a good division of the support of the distribution into the area of the left tail, into the area of the right tail, and into the central area.

3.4.1 Modeling and Estimating Excess Distributions

We model the left and the right tails of a return distribution parametrically. The estimation of the parameters can be done using maximum likelihood, or by a regression method, for example.

3.4.1.1 Modeling Excess Distributions

Let ![]() be a parameterized family of density functions whose support is

be a parameterized family of density functions whose support is ![]() . This family will be used to model the tails of the density

. This family will be used to model the tails of the density ![]() of the returns.

of the returns.

To estimate the right tail, we assume that the density function ![]() of the returns satisfies

of the returns satisfies

for some ![]() , where

, where ![]() is the

is the ![]() th quantile of the return density:

th quantile of the return density: ![]() , and the probability

, and the probability ![]() satisfies

satisfies ![]() .17 To estimate the left tail we assume that the density function

.17 To estimate the left tail we assume that the density function ![]() of the returns satisfies

of the returns satisfies

for some ![]() , where

, where ![]() is the

is the ![]() th quantile of the return density:

th quantile of the return density: ![]() , and

, and ![]() .

.

The assumptions can be expressed using the concept of the excess distribution with threshold ![]() . Let

. Let ![]() be the distribution function of the returns and let

be the distribution function of the returns and let ![]() be the density function of the returns. Let

be the density function of the returns. Let ![]() be the return. Now

be the return. Now ![]() . The distribution function of the excess distribution with threshold

. The distribution function of the excess distribution with threshold ![]() is

is

The density function of the excess distribution with threshold ![]() is

is

Thus, the assumption in (3.57) says that

for some ![]() . Limit theorems for threshold exceedances are discussed in Section 3.5.2.

. Limit theorems for threshold exceedances are discussed in Section 3.5.2.

Figure 3.14 illustrates the definition of an excess distribution. Panel (a) shows the density function of ![]() -distribution with degrees of freedom five. The green, blue, and red vectors indicate the location of quantiles

-distribution with degrees of freedom five. The green, blue, and red vectors indicate the location of quantiles ![]() for

for ![]() ,

, ![]() , and

, and ![]() . Panel (b) shows the right excess distributions for

. Panel (b) shows the right excess distributions for ![]() . The choice of the threshold

. The choice of the threshold ![]() affects the goodness-of-fit, and this issue will be addressed in the following sections.

affects the goodness-of-fit, and this issue will be addressed in the following sections.

Figure 3.14 Excess distributions. (a) The density function of  -distribution with degrees of freedom five. The green, blue, and red vectors indicate the location of quantiles

-distribution with degrees of freedom five. The green, blue, and red vectors indicate the location of quantiles  for

for  ,

,  , and

, and  . (b) The right excess distributions for

. (b) The right excess distributions for  .

.

3.4.1.2 Estimation

Estimation is done by first identifying the data coming from the left tail, and the data coming from the right tail. Second, the data is transformed onto ![]() . Third, we can apply any method of fitting parametric models.

. Third, we can apply any method of fitting parametric models.

Identifying the Data in the Tails

We choose threshold ![]() of the excess distribution to be an estimate of the

of the excess distribution to be an estimate of the ![]() th quantile. For the estimation of the left tail we need to estimate the

th quantile. For the estimation of the left tail we need to estimate the ![]() th quantile for

th quantile for ![]() , and for the estimation of the right tail we need to estimate the

, and for the estimation of the right tail we need to estimate the ![]() th quantile for

th quantile for ![]() . The data in the left tail and the right tail are

. The data in the left tail and the right tail are

where ![]() are estimates of a lower and an upper quantile, respectively. We use the empirical quantile to estimate the population quantile. Let

are estimates of a lower and an upper quantile, respectively. We use the empirical quantile to estimate the population quantile. Let ![]() be the sample from the distribution of the returns, and let

be the sample from the distribution of the returns, and let ![]() be the ordered sample. The empirical quantile is

be the ordered sample. The empirical quantile is

where ![]() is the integer part of

is the integer part of ![]() . See Section 3.1.3 and Chapter 8 for more information about quantile estimation. Now the data in the left tail and the right tail can be written as

. See Section 3.1.3 and Chapter 8 for more information about quantile estimation. Now the data in the left tail and the right tail can be written as

The Basic Principle of Fitting Tail Models

Assume that we have an estimation procedure for the estimation of the parameter ![]() of the family

of the family ![]() ,

, ![]() . The family consists of densities whose support is

. The family consists of densities whose support is ![]() , and it is used to model the left or the right part of the density, as written in assumptions (3.58) and (3.57). We need a procedure for the estimation of the parameter

, and it is used to model the left or the right part of the density, as written in assumptions (3.58) and (3.57). We need a procedure for the estimation of the parameter ![]() in model (3.58), or the parameter

in model (3.58), or the parameter ![]() in model (3.57). We apply the estimation procedure for estimating

in model (3.57). We apply the estimation procedure for estimating ![]() using data

using data

Maximum Likelihood in Tail Estimation

We use the method of maximum likelihood for the estimation of the tails under the assumptions (3.57) and (3.58). We write the likelihood function under the assumption of independent and identically distributed observations, but we apply the maximum likelihood estimator for time series data. Thus, the method may be called pseudo maximum likelihood. Time series properties will be taken into account in Chapter 8, where quantile estimation is studied using tail modeling. The likelihood is maximized separately using the data in the left tail and in the right tail.

The family ![]() ,

, ![]() , models the excess distribution. The maximum likelihood estimator for the parameter of the left tail is

, models the excess distribution. The maximum likelihood estimator for the parameter of the left tail is

where ![]() for

for ![]() and

and ![]() has support

has support ![]() . The maximum likelihood estimator for the parameter of the right tail is

. The maximum likelihood estimator for the parameter of the right tail is

where ![]() for

for ![]() .

.

3.4.2 Parametric Families for Excess Distributions

We describe the following one- and two-parameter families:

- 1. One-parameter families. The exponential and Pareto distributions.

- 2. Two-parameter families. The gamma, generalized Pareto, and Weibull distributions.

Furthermore, we describe a three parameter family which contains many one- and two-parameter families as special cases.

The exponential distributions have a heavier tail than the normal distributions. The Pareto distributions have a heavier tail than the exponential distributions, but an equally heavy tail as the Student distributions. The Pareto densities have polynomial tails, the exponential densities have exponential tails, and the gamma densities have densities whose heaviness is between the Pareto and the exponential densities.

3.4.2.1 The Exponential Distributions

The exponential densities are defined as

where ![]() is the scale parameter. The parameter

is the scale parameter. The parameter ![]() is called the rate parameter. The distribution function and the quantile function are

is called the rate parameter. The distribution function and the quantile function are

The expectation and the variance are

where ![]() is a random variable following the exponential distribution.

is a random variable following the exponential distribution.

Maximum Likelihood Estimation: Exponential Distribution

When we observe ![]() , which are i.i.d. with exponential distribution, then the maximum likelihood estimator is18

, which are i.i.d. with exponential distribution, then the maximum likelihood estimator is18

Regression Method: Exponential Distribution

Regression plots were shown in Figures 3.4 and 3.5. We study further the regression method for fitting an exponential distribution.

For exponential distributions the logarithm of the survival function ![]() is a linear function, which can be used to visualize data and to estimate the parameter of the exponential distribution (see Section 3.2.1). Let

is a linear function, which can be used to visualize data and to estimate the parameter of the exponential distribution (see Section 3.2.1). Let ![]() be a sample from an exponential distribution and assume

be a sample from an exponential distribution and assume ![]() Let

Let ![]() be the empirical distribution function, based on the observations

be the empirical distribution function, based on the observations ![]() , defined as

, defined as ![]() . The empirical distribution function is defined in (3.30), but we modify the definition so that the divisor is

. The empirical distribution function is defined in (3.30), but we modify the definition so that the divisor is ![]() instead of

instead of ![]() . We use the facts that (for the ordered data)

. We use the facts that (for the ordered data)

Thus,

The least squares estimator of ![]() is19

is19

Now we can write

where

Thus, more weight is given to the observations in the extreme tails.20

Figure 3.15 shows the fitting of regression estimates for the S&P 500 daily returns, described in Section 2.4.1. Panel (a) considers the left tail and panel (b) the right tail. The tails are defined by the ![]() th empirical quantiles for

th empirical quantiles for ![]() /

/![]() (blue),

(blue), ![]() /

/![]() (green), and

(green), and ![]() /

/![]() (red). We also show the fitted linear regression lines.

(red). We also show the fitted linear regression lines.

Figure 3.15 Exponential model for S&P 500 daily returns: Regression fits. Panel (a) considers the left tail and panel (b) the right tail. We show the regression data and the fitted regression lines for  /

/ (blue),

(blue),  /

/ (green), and

(green), and  /

/ (red).

(red).

3.4.2.2 The Pareto Distributions

We define first the class of Pareto distributions with the support ![]() , where

, where ![]() . The class of Pareto distributions with support

. The class of Pareto distributions with support ![]() is obtained by translation.

is obtained by translation.

The Pareto distributions are parameterized by the tail index ![]() . Parameter

. Parameter ![]() is taken to be known, but in the practice of tail estimation

is taken to be known, but in the practice of tail estimation ![]() is used to define the tail area and

is used to define the tail area and ![]() chosen by a quantile estimator. The density function is

chosen by a quantile estimator. The density function is

where ![]() is the tail index. The distribution function and the quantile function are

is the tail index. The distribution function and the quantile function are

Pareto Distributions as Excess Distributions

Assumption (3.57) says that the excess distribution is modeled with a parametric distribution whose support is ![]() . The density function of a Pareto distribution can be moved by the translation

. The density function of a Pareto distribution can be moved by the translation ![]() to have the support

to have the support ![]() , which gives the density function21

, which gives the density function21

Now we could consider ![]() as the scaling parameter, which leads to the two-parameter Pareto distributions, which are called the generalized Pareto distributions, and defined in (3.82) and (3.84).

as the scaling parameter, which leads to the two-parameter Pareto distributions, which are called the generalized Pareto distributions, and defined in (3.82) and (3.84).

Maximum Likelihood Estimation: Pareto Distribution

When ![]() follows the Pareto distribution with parameters

follows the Pareto distribution with parameters ![]() and

and ![]() , then

, then ![]() follows the exponential distribution with scale parameter

follows the exponential distribution with scale parameter ![]() . Indeed,

. Indeed, ![]() and thus

and thus ![]() . We observed in (3.67) that scale parameter

. We observed in (3.67) that scale parameter ![]() of the exponential distribution can be estimated with

of the exponential distribution can be estimated with ![]() . Thus, the maximum likelihood estimator of

. Thus, the maximum likelihood estimator of ![]() is

is

The maximum likelihood estimator of the shape parameter ![]() of the Pareto distribution is22

of the Pareto distribution is22

We are more interested in estimating ![]() , since it appears in the quantile function.

, since it appears in the quantile function.

Regression Method: Pareto Distribution

Regression plots were shown in Figures 3.6 and 3.7. We study further the regression method for fitting a Pareto distribution.

Let us consider the estimation of the tail index ![]() and the inverse

and the inverse ![]() . The basic idea is that the logarithm of the distribution function

. The basic idea is that the logarithm of the distribution function ![]() or the logarithm of the survival function

or the logarithm of the survival function ![]() are linear in

are linear in ![]() : From (3.78) we get that

: From (3.78) we get that ![]() , and from (3.79) we get that

, and from (3.79) we get that ![]() .

.

Let ![]() be a sample from a Pareto distribution and assume

be a sample from a Pareto distribution and assume

Let ![]() be the empirical distribution function, based on the observations

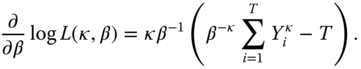

be the empirical distribution function, based on the observations ![]() , defined as