Chapter 16

Quadratic and Local Quadratic Hedging

Quadratic hedging was introduced in Sections 13.1.3 and 15.1. In quadratic hedging we find the best approximation of the option in the sense of the mean-squared error. Quadratic hedging is related to the idea of statistical arbitrage: The fair price is defined as such price that makes the probability of gains and losses small for the writer of the option.

Quadratic hedging makes it possible to price and hedge options in a completely nonparametric way. In quadratic hedging we can derive prices and hedging coefficients without any modeling assumptions, making only some rather weak assumptions about square integrability and about a bounded mean–variance trade-off. There are many ways to implement quadratic hedging nonparametrically. We use kernel estimation in our implementation.

Let ![]() be the discounted payoff of an European option. For example, for a call option

be the discounted payoff of an European option. For example, for a call option ![]() . In quadratic hedging the mean-squared hedging error

. In quadratic hedging the mean-squared hedging error

is minimized among strategies ![]() and among the initial investment

and among the initial investment ![]() . The terminal value of the gains process is defined by

. The terminal value of the gains process is defined by

where ![]() is the discounted price vector. The problem resembles least-squares linear regression, where

is the discounted price vector. The problem resembles least-squares linear regression, where ![]() is the response variable,

is the response variable, ![]() are the explanatory variables,

are the explanatory variables, ![]() is the intercept, and

is the intercept, and ![]() are the regression coefficients. However, now we have a time series setting, where the “explanatory” variable

are the regression coefficients. However, now we have a time series setting, where the “explanatory” variable ![]() is observed at time

is observed at time ![]() . We can use the knowledge of the observed values of

. We can use the knowledge of the observed values of ![]() in choosing

in choosing ![]() . In the usual linear regression all regression coefficients are chosen at the same time:

. In the usual linear regression all regression coefficients are chosen at the same time: ![]() .

.

Quadratic hedging in discrete time is explained in monographs Föllmer and Schied (2002, p. 393), Bouchaud and Potters (2003), and Černý (2004b). Earlier studies include Föllmer and Schweizer (1989), Bouchaud and Sornette (1994), Schweizer (1994), and Schäl (1994). Early continuous time studies include Föllmer and Sondermann (1986) and Duffie and Richardson (1991).

We study quadratic hedging and pricing in three steps: first for the one period model, then for the two period model, and finally the formulas are given for the general multiperiod model. The multiperiod model contains as special cases the one and two period models, but we think that it is helpful to study the one and two period models separately, because in these models the formulas are more transparent and notationally more convenient than in the multiperiod model. The generalization from the two period model to the multiperiod model is straightforward.

Local quadratic hedging simplifies the minimization problem of quadratic hedging, and it can achieve easier computations. In the one period model quadratic hedging and local quadratic hedging are equivalent, but in the multiperiod models they are different.

The price and the hedging coefficients of quadratic hedging do not have a closed-form expression, but only a recursive definition. This recursive definition can be used in computations, but the implementation is not trivial. We implement only the local quadratic hedging and pricing. We need to estimate various conditional expectations. We estimate the conditional expectations using historical simulation: The time series of previous returns is used to construct a large number of price sequences, and conditional expectations are estimated as sample means over price sequences. The observed volatility is used as the conditioning variable. Separate methods are used for the case of independent and dependent increments.

We evaluate quadratic hedging by studying the distribution of the hedging errors. The distribution should be concentrated around zero as well as possible. The main observation is that even the simplest setting of local quadratic hedging with independent increments leads to a distribution of the hedging errors that is better concentrated around zero than the distribution of the hedging errors when Black–Scholes hedging with GARCH(![]() ) volatility is used.

) volatility is used.

Section 16.1 studies global quadratic hedging and pricing. Section 16.2 studies local quadratic hedging and pricing. Section 16.3 studies implementations of local quadratic hedging.

16.1 Quadratic Hedging

The exact solution for quadratic hedging can be given using backward induction. We present the solution in three steps: first for the one period model, second for the two period model, and third for the general model.

16.1.1 Definitions and Assumptions

We recall the notation from Section 13.2, and in particular from Section 13.2.2. We assume that there is only one risky asset: ![]() . The price process of the riskless bond is denoted by

. The price process of the riskless bond is denoted by ![]() . We choose

. We choose

where ![]() . The notation is a short hand for

. The notation is a short hand for ![]() , where

, where ![]() is the time between two steps, expressed in fractions of a year, and

is the time between two steps, expressed in fractions of a year, and ![]() is the annual interest rate. The time series of prices of the risky asset is denoted by

is the annual interest rate. The time series of prices of the risky asset is denoted by ![]() . The complete price vector is denoted by

. The complete price vector is denoted by

A trading strategy is

where the values ![]() and

and ![]() express the quantity of the bond and the risky asset held between

express the quantity of the bond and the risky asset held between ![]() and

and ![]() .

.

16.1.1.1 Wealth and Value Processes

The wealth at time 0 is ![]() , and after that

, and after that

Under the condition of self-financing the wealth at time ![]() was written in (13.5) as

was written in (13.5) as

where ![]() .

.

The discounted price process is defined by

We denote ![]() . The value process was defined in (13.8) as

. The value process was defined in (13.8) as

Under the condition of self-financing the value at time ![]() can be written as

can be written as

where ![]() .

.

The gains process is defined as

For a self-financing strategy

16.1.1.2 Quadratic Hedging

We use the terms “quadratic hedging” and “global quadratic hedging” to mean the same thing. The term “global quadratic hedging” is used when a distinction to “local quadratic hedging” is emphasized. We use the term “quadratic price” to mean the price that is implied by quadratic hedging.

Let ![]() be the value of an European option. For example,

be the value of an European option. For example, ![]() . Let

. Let ![]() . A quadratic strategy

. A quadratic strategy ![]() is a minimizer of

is a minimizer of

over ![]() and over self-financing strategies

and over self-financing strategies ![]() . We obtain the quadratic price

. We obtain the quadratic price

In the general case the quadratic price is ![]() , but in our case

, but in our case ![]() . The bond coefficients

. The bond coefficients ![]() are determined from the equations

are determined from the equations

as noted in (13.9). The complete quadratic hedging strategy, which includes both the quantities of bond and stock, is given by

16.1.1.3 Mean Self-Financing

We have defined quadratic hedging as a hedging strategy that minimizes the mean-squared error among self-financing strategies. It is also possible to define a version of quadratic hedging where the mean-squared error is minimized among so-called mean self-financing strategies. We consider this approach only in Section 16.2.3, where local quadratic hedging without self-financing is discussed.

The self-financing condition in (13.4) states that

We can dispose the restriction to the self-financing strategies, and assume only that the strategies are mean self-financing. Assumption

is equivalent with

Let us make the mean self-financing assumption

where

Note that if we define the cumulative cost process by

where

then

Schäl (1994) considers quadratic hedging in discrete time with mean self-financing strategies. The definition of mean self-financing in continuous time was given in Föllmer and Sondermann (1986).1

We noted that the equality ![]() in (16.2) holds only for self-financing strategies. Nevertheless, it is possible to minimize the mean-squared error

in (16.2) holds only for self-financing strategies. Nevertheless, it is possible to minimize the mean-squared error

over strategies ![]() , which are not necessarily self-financing. Note that

, which are not necessarily self-financing. Note that ![]() .

.

We have that

Under the condition (16.5) of mean self-financing we have that

Thus,

Thus, the term “variance optimal hedging” can be used in this case. Also,

and it is natural to call ![]() the fair price.

the fair price.

16.1.1.4 Assumptions

We have to assume the square integrability of the relevant terms:

The assumptions can be written as ![]() and

and ![]() . In addition, we have to restrict ourselves to the square integrable trading strategies. That is, the value and the gains processes are assumed to satisfy

. In addition, we have to restrict ourselves to the square integrable trading strategies. That is, the value and the gains processes are assumed to satisfy

We say that the bounded mean–variance trade-off holds if

![]() -almost surely, for

-almost surely, for ![]() , where

, where ![]() is a constant. Föllmer and Schied (2002, Theorem 10.39, p. 395) consider the existence and uniqueness of a quadratic hedging strategy. They show that with

is a constant. Föllmer and Schied (2002, Theorem 10.39, p. 395) consider the existence and uniqueness of a quadratic hedging strategy. They show that with ![]() risky assets the bounded mean–variance trade-off guarantees the existence of a quadratic strategy (which they call a variance-optimal strategy). The strategy is unique up to modifications in the set

risky assets the bounded mean–variance trade-off guarantees the existence of a quadratic strategy (which they call a variance-optimal strategy). The strategy is unique up to modifications in the set ![]() .

.

16.1.2 The One Period Model

We consider the pricing of an European option in the single period model. In the single period model the underlying security has value ![]() at the beginning of the period and value

at the beginning of the period and value ![]() at the expiration of the option. The price

at the expiration of the option. The price ![]() is a fixed number and

is a fixed number and ![]() is a random variable. At time zero the option price is

is a random variable. At time zero the option price is ![]() . The value of the European option at the expiration is denoted by

. The value of the European option at the expiration is denoted by ![]() . For example, in the case of a call option

. For example, in the case of a call option ![]() , where

, where ![]() is the strike price. In the single period model the option is hedged only once (at time 0).

is the strike price. In the single period model the option is hedged only once (at time 0).

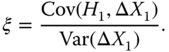

16.1.2.1 Pricing in the One Period Model

In the one period model

We want to find ![]() and

and ![]() minimizing

minimizing

This is the population version of a linear least-squares regression with the explanatory variable ![]() and the response variable

and the response variable ![]() . We obtain the solutions2

. We obtain the solutions2

and

The hedging coefficient can be written as

because constant ![]() can be removed from the covariance and the variance, and the discounting factors of the nominator and denominator cancel each other. Note that for a call option

can be removed from the covariance and the variance, and the discounting factors of the nominator and denominator cancel each other. Note that for a call option ![]() and for a put option

and for a put option ![]() .3

.3

We see that the quadratic price

is obtained by subtracting a correction term from the expected value of the payoff of the option.

The value process is useful in the multiperiod model, but in the single period model we can use the wealth process as well. We can use the following equivalent formulation. The initial wealth is ![]() . This amount is invested in the bank account. The amount

. This amount is invested in the bank account. The amount ![]() is borrowed at the risk-free rate and this money is invested in stock, so that there are

is borrowed at the risk-free rate and this money is invested in stock, so that there are ![]() stocks in the portfolio. The value of the portfolio at time 1 is

stocks in the portfolio. The value of the portfolio at time 1 is

We want to find values of ![]() and

and ![]() that minimize

that minimize

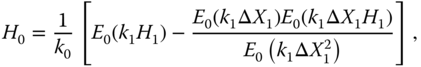

16.1.2.2 Scatter Plots of Stock Price Differences and Option Payoffs

Figure 16.1 shows a scatter plot of points ![]() together with linear fits. We use the daily data of S&P 500 prices, described in Section 2.4.1.

together with linear fits. We use the daily data of S&P 500 prices, described in Section 2.4.1.

We take ![]() and

and ![]() , where

, where ![]() are the gross returns of S&P 500 over 10 trading days. Values

are the gross returns of S&P 500 over 10 trading days. Values ![]() are the payoffs of call options with strike price

are the payoffs of call options with strike price ![]() , and the expiration time 10 trading days. In panel (a)

, and the expiration time 10 trading days. In panel (a) ![]() , and in panel (b)

, and in panel (b) ![]() . The green lines show the least-squares linear fit

. The green lines show the least-squares linear fit ![]() , where

, where ![]() and

and

where we use the sample means, variances, and covariances. The red lines show the linear fit ![]() , where

, where ![]() is the Black–Scholes price, and

is the Black–Scholes price, and ![]() is the Black–Scholes delta. The volatility is estimated by the sample standard deviation. We see that when

is the Black–Scholes delta. The volatility is estimated by the sample standard deviation. We see that when ![]() , there is hardly any difference between the least-squares fit and the Black–Scholes fit. When

, there is hardly any difference between the least-squares fit and the Black–Scholes fit. When ![]() , then the least-squares hedging coefficient is higher than the Black–Scholes delta.

, then the least-squares hedging coefficient is higher than the Black–Scholes delta.

Figure 16.1 Linear approximations of call payoffs. We show scatter plots of  for (a)

for (a)  and (b)

and (b)  . The green curves show the least-squares fit and the red curves show the Black–Scholes fit.

. The green curves show the least-squares fit and the red curves show the Black–Scholes fit.

16.1.2.3 Pricing in the One Period Model Continued

We derive the solution (16.10), (16.11) in a different way. The different way of deriving the solution is such that it can be generalized to multiperiod models. Furthermore, it helps us to find the equivalent martingale measure and the hedging error.

We need to find ![]() and

and ![]() minimizing

minimizing

where ![]() and

and ![]() . We can write

. We can write

For a fixed ![]() the minimizer over

the minimizer over ![]() is

is

We have that

where we denote

and

We see from (16.17) that the mean-squared error is minimized by choosing ![]() . Equation (16.16) implies that the optimal hedging coefficient is

. Equation (16.16) implies that the optimal hedging coefficient is

where ![]() is defined in (16.18). The formulas (16.18) and (16.19) are equivalent with the formulas (16.10) and (16.11).4

is defined in (16.18). The formulas (16.18) and (16.19) are equivalent with the formulas (16.10) and (16.11).4

Note that formulas (16.18) and (16.19) define ![]() in terms of

in terms of ![]() , whereas (16.10) and (16.11) define

, whereas (16.10) and (16.11) define ![]() in terms of

in terms of ![]() .

.

16.1.2.4 The Martingale Measure in the One Period Model

Let us assume that our one period model is arbitrage-free. Theorem 13.1 implies that there exists an equivalent martingale measure. Theorem 13.2 implies that any arbitrage-free price can be written as an expected value ![]() for some equivalent martingale measure

for some equivalent martingale measure ![]() . Let us find the martingale measure

. Let us find the martingale measure ![]() , which is implied by the quadratic hedging.

, which is implied by the quadratic hedging.

The density of ![]() with respect to the underlying physical measure is obtained from (16.18) as

with respect to the underlying physical measure is obtained from (16.18) as

where

and

Now, we have found a measure ![]() such that

such that

Note that in our notation ![]() .

.

The Martingale Measure for S&P 500 in the One Period Model

Let us estimate the equivalent martingale measure associated with quadratic hedging using S&P 500 daily data of Section 2.4.1.

A time series of increments ![]() is not approximately stationary when the time series covers a long time period; see Figure 5.2. The time series of gross returns is nearly stationary, even when the time series extends over a long time period; see Figure 2.1(b). Thus, we can use historical simulation to create a time series of increments from the excess gross returns.

is not approximately stationary when the time series covers a long time period; see Figure 5.2. The time series of gross returns is nearly stationary, even when the time series extends over a long time period; see Figure 2.1(b). Thus, we can use historical simulation to create a time series of increments from the excess gross returns.

We take the interest rate ![]() . We consider a one-step model with the step of 20 days. The excess gross return is equal to the net return

. We consider a one-step model with the step of 20 days. The excess gross return is equal to the net return

Now,

Let

be the increment. Our S&P 500 data provides a sample of identically distributed observations ![]() from the distribution of

from the distribution of ![]() . We use non-overlapping increments.

. We use non-overlapping increments.

Let us estimate the density

of the martingale measure with respect to underlying physical measure of ![]() . The estimate is

. The estimate is

where ![]() and

and ![]() are estimates of

are estimates of ![]() and

and ![]() in (16.21), obtained by replacing the expectations and variances by sample averages and sample variances.

in (16.21), obtained by replacing the expectations and variances by sample averages and sample variances.

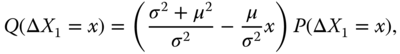

The underlying physical density of ![]() with respect to the Lebesgue measure can be estimated using the kernel estimate

with respect to the Lebesgue measure can be estimated using the kernel estimate ![]() of (3.43). The density of the martingale measure with respect to the Lebesgue measure can be estimated as

of (3.43). The density of the martingale measure with respect to the Lebesgue measure can be estimated as

Figure 16.2(a) shows the estimate ![]() of the density of the martingale measure with respect to the physical measure (dark green). The red curve shows the case of the Esscher measure and the blue curve the case of the Black–Scholes measure. The blue curve shows the density of the risk-neutral log-normal density with respect to the estimated physical measure. These are taken from Figure 13.1. Panel (b) shows the density

of the density of the martingale measure with respect to the physical measure (dark green). The red curve shows the case of the Esscher measure and the blue curve the case of the Black–Scholes measure. The blue curve shows the density of the risk-neutral log-normal density with respect to the estimated physical measure. These are taken from Figure 13.1. Panel (b) shows the density ![]() (dashed dark green) and

(dashed dark green) and ![]() (solid dark green). We show also the physical density (solid blue) and the risk-neutral density (dashed blue) in the Black–Scholes model.

(solid dark green). We show also the physical density (solid blue) and the risk-neutral density (dashed blue) in the Black–Scholes model.

Figure 16.2 Martingale measure in the one period model. (a) The density of the quadratic martingale measure with respect to the physical measure (dark green), Esscher measure (red), and Black–Scholes measure (blue). (b) The kernel density estimate of the physical measure (solid dark green), and the corresponding quadratic martingale measure (dashed dark green). The log-normal physical measure and the corresponding risk-neutral log-normal density are depicted as solid blue and dashed blue curves, respectively.

The Martingale Measure in the One Period Binomial Model

Let us study the one period binomial model, as defined in Section 14.2.1. In this model at time 0 the stock has value ![]() , and at time 1 the stock can take values

, and at time 1 the stock can take values ![]() and

and ![]() , where

, where ![]() . The probability of the up movement is

. The probability of the up movement is ![]() and the probability of the down movement is

and the probability of the down movement is ![]() with

with ![]() . Let us denote

. Let us denote

We have that

From (16.20) we obtain that the martingale measure ![]() satisfies

satisfies

where ![]() ,

, ![]() , and

, and ![]() or

or ![]() . We have that

. We have that

and

Thus,

which is equal to the martingale measure already derived in (14.18). In fact, the binomial model is a complete model and there is only one equivalent martingale measure.

16.1.3 The Two Period Model

We consider pricing and hedging of an European option in the two period model. The general multiperiod model is considered in Section 16.1.4, and this presentation includes the two period model as a special case. However, we think that it is easier to read the presentation of the multiperiod model when the two period model is presented first.

In the two period model the underlying security takes values ![]() ,

, ![]() , and

, and ![]() . The price

. The price ![]() is a fixed number and

is a fixed number and ![]() and

and ![]() are random variables. The option is written at time 0, and it expires at time 2. Hedging is done at times 0 and 1 by choosing the hedging coefficients

are random variables. The option is written at time 0, and it expires at time 2. Hedging is done at times 0 and 1 by choosing the hedging coefficients ![]() and

and ![]() . The value of the European option at the expiration is denoted by

. The value of the European option at the expiration is denoted by ![]() . For example, in the case of a call option

. For example, in the case of a call option ![]() , where

, where ![]() is the strike price.

is the strike price.

16.1.3.1 An Introduction to the Minimization Problem

The minimization problem can be solved either using the value process or by using the wealth process. The use of the value process is more convenient.

The Minimization Using the Value Process

In the two period model the value process and the discounted contingent claim are defined as

where ![]() ,

, ![]() ,

, ![]() , and

, and ![]() . We want to find

. We want to find ![]() minimizing

minimizing

Notation ![]() means the unconditional expectation with respect to the underlying measure

means the unconditional expectation with respect to the underlying measure ![]() , and we denote by

, and we denote by ![]() , the conditional expectation, with respect to sigma-algebra

, the conditional expectation, with respect to sigma-algebra ![]() :

:

Unlike in the one period model this minimization problem cannot be considered as a usual population version of a linear least squares regression. We can consider ![]() and

and ![]() as explanatory variables and

as explanatory variables and ![]() as the response variables, but now intercept

as the response variables, but now intercept ![]() and coefficient

and coefficient ![]() are chosen at time 0, and coefficient

are chosen at time 0, and coefficient ![]() is chosen at time 1. In the usual regression problem all parameters are chosen at time 0.

is chosen at time 1. In the usual regression problem all parameters are chosen at time 0.

The minimization problem can be solved in the following way. First, we find ![]() minimizing

minimizing

Let the minimizer be ![]() . The notation indicates that the minimizer depends on

. The notation indicates that the minimizer depends on ![]() and

and ![]() . Second, we find

. Second, we find ![]() and

and ![]() minimizing

minimizing

The Minimization Using the Wealth Process

The wealths at times 0, 1, and 2 are

where ![]() ,

, ![]() ,

, ![]() ,

, ![]() ,

, ![]() , and

, and ![]() . We want to find

. We want to find ![]() so that

so that

is minimized, under the self-financing constraints. The minimization problem can be solved in the following way. First, we find ![]() minimizing

minimizing

under the self-financing constraint

Let the minimizer be ![]() . The notation indicates that the minimizer depends on

. The notation indicates that the minimizer depends on ![]() . Second, we find

. Second, we find ![]() minimizing

minimizing

We can now see why it is easier to solve the problem using the value process: It is possible to apply unconstrained minimization when the value process is used.

16.1.3.2 Solving the Minimization Problem

Let us solve the problem of minimizing (16.22). We have that

Since

the minimizer over ![]() is

is

We have that

where we denote

and

It holds that

Similar calculations which lead to (16.23) show that the minimizer over ![]() is

is

Finally, we have to find ![]() minimizing

minimizing

The minimizer over ![]() is

is

where

Indeed, similar calculations which lead to (16.24) show that

where

We can summarize the results in the following proposition.

Note that hedging at time 1 is not done by coefficient ![]() in (16.23). Instead, at time 1 we consider the one period model between times 1 and 2, and choose the hedging coefficient of the one period model, as in (16.16).

in (16.23). Instead, at time 1 we consider the one period model between times 1 and 2, and choose the hedging coefficient of the one period model, as in (16.16).

16.1.3.3 The Martingale Measure in the Two Period Model

Let us find the martingale measure ![]() , which is implied by the quadratic hedging. We have to find such measure

, which is implied by the quadratic hedging. We have to find such measure ![]() that the option price is the discounted expectation with respect to the measure

that the option price is the discounted expectation with respect to the measure ![]() :

:

We obtain from (16.25) and (16.27) that the density of ![]() with respect to the underlying physical measure

with respect to the underlying physical measure ![]() is

is

where

In fact,

which can be written as

where we use the notation ![]() .

.

When the increments are independent, then the martingale measure ![]() is defined by the density

is defined by the density

where

and

compare this to ![]() and

and ![]() as defined in (16.21).

as defined in (16.21).

A Martingale Measure for S&P 500 in the Two Period Model

Let us estimate the equivalent martingale measure associated with quadratic hedging using S&P 500 daily data of Section 2.4.1. Let us consider a two-step model with two steps of 10 days. We take interest rate ![]() . Let

. Let

be the increments. Our S&P 500 data provides a sample of identically distributed observations from the distribution of ![]() . We use non-overlapping increments.

. We use non-overlapping increments.

Let us estimate the density

of martingale measure ![]() with respect to the physical measure

with respect to the physical measure ![]() .

.

First, we have to estimate ![]() and

and ![]() using nonparametric regression. Let us denote

using nonparametric regression. Let us denote

Let ![]() and

and ![]() be the kernel regression estimates.5

Then, we obtain the estimate of

be the kernel regression estimates.5

Then, we obtain the estimate of ![]() as

as

The estimate of ![]() is

is

Second, we have to estimate ![]() ,

, ![]() , and

, and ![]() . The estimates

. The estimates ![]() ,

, ![]() , and

, and ![]() are the sample averages. Then, we obtain the estimate of

are the sample averages. Then, we obtain the estimate of ![]() as

as

The estimate of ![]() is

is

Now, we have obtained the estimate

The density of the martingale measure with respect to the Lebesgue measure can be estimated as

where ![]() is a two-dimensional kernel density estimate of the underlying physical measure of

is a two-dimensional kernel density estimate of the underlying physical measure of ![]() . The kernel density estimator is defined in (3.43).

. The kernel density estimator is defined in (3.43).

When the returns are assumed to be independent, then we use the estimate

where

and ![]() and

and ![]() are the sample versions of

are the sample versions of

In the sample versions we replace the means and variances with the sample means and sample variances.

Figure 16.3 shows estimates of the density of the quadratic martingale measure with respect to the physical measure. In panel (a) we show estimate (16.28), which does not assume independence, and in panel (b) we show estimate (16.29), which assumes independence. In our setting regression estimation is difficult, and assuming independence leads to a more stable result. It is clear that the regression estimation could be improved by applying separate methods for the prediction of the first moment ![]() and for the second moment

and for the second moment ![]() .

.

Figure 16.3 The quadratic martingale measure: Two period model. Estimates of the density of the quadratic martingale measure with respect to the physical measure. (a) Increments are not assumed independent. (b) Increments are assumed to be independent.

16.1.4 The Multiperiod Model

We have derived the optimal hedging coefficient and the fair price in the mean-squared error sense for the two period model in Section 16.1.3. It is straightforward to generalize the results from the two period model to a general multiperiod model. The hedging coefficients and the fair price are derived using dynamic programming (backward induction).

16.1.4.1 Pricing in the Multiperiod Model

Let ![]() be the value process of a self-financing portfolio:

be the value process of a self-financing portfolio:

where

and ![]() . We want to find

. We want to find ![]() minimizing

minimizing

where ![]() is the discounted value of the derivative at the expiration.6

is the discounted value of the derivative at the expiration.6

When ![]() minimize (16.31), then we say that

minimize (16.31), then we say that ![]() is the fair price in the mean-squared error sense and

is the fair price in the mean-squared error sense and ![]() is the optimal hedging coefficient in the mean squared error sense. The coefficients

is the optimal hedging coefficient in the mean squared error sense. The coefficients ![]() are needed to derive

are needed to derive ![]() in our backward induction, but they do not equal the optimal hedging coefficients at times

in our backward induction, but they do not equal the optimal hedging coefficients at times ![]() . Instead, at time

. Instead, at time ![]() we need to make a new calculation of coefficients, say

we need to make a new calculation of coefficients, say ![]() , where

, where ![]() is the optimal hedging coefficient at time

is the optimal hedging coefficient at time ![]() .

.

The following theorem is proved in Černý (2004b, Section 13.4), where ![]() , so that the number of risky assets is allowed to be larger than one. Černý (2004a) is an article with the same result, and Bertsimas et al. (2001) contains a similar kind of result. A similar kind of proof can be found in Schäl (1994), who considers the case of mean self-financing strategies. The case of independent increments was considered by Wolczyńska (1998) and Hammarlid (1998).

, so that the number of risky assets is allowed to be larger than one. Černý (2004a) is an article with the same result, and Bertsimas et al. (2001) contains a similar kind of result. A similar kind of proof can be found in Schäl (1994), who considers the case of mean self-financing strategies. The case of independent increments was considered by Wolczyńska (1998) and Hammarlid (1998).

The Minimal Hedging Error

The proof implies that the minimal hedging error is given by ![]() , defined recursively in (16.36). Indeed, from (16.35) and (16.37), we obtain that

, defined recursively in (16.36). Indeed, from (16.35) and (16.37), we obtain that

The Hedging Coefficients

The proof implies that the sequence of quadratic hedging coefficients is given by

where ![]() . The coefficient

. The coefficient ![]() is applied at time 0, and the coefficients

is applied at time 0, and the coefficients ![]() will not be applied, because at time

will not be applied, because at time ![]() , we need to construct a model of

, we need to construct a model of ![]() periods.

periods.

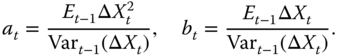

Excess Gross Returns and Quadratic Hedging

The formulas for the price and the hedging coefficient are written using the increment

We can write the formulas as well using the excess gross return

The formulas (16.32) and (16.34) can be written as

where ![]() and

and

The fair price in the mean-squared error sense is ![]() and the optimal hedging coefficient at time

and the optimal hedging coefficient at time ![]() is

is

Indeed, we can multiply by ![]() and divide by

and divide by ![]() both the nominators and the denominators, and these terms can be moved inside the conditional expectations

both the nominators and the denominators, and these terms can be moved inside the conditional expectations ![]() , because they are

, because they are ![]() -measurable.

-measurable.

16.1.4.2 The Martingale Measure

Let us assume that the model is arbitrage-free. Theorem 13.1 says that there exists an equivalent martingale measure. Let us find the martingale measure ![]() associated with quadratic hedging. According to Theorem 13.2 the martingale measure is such that the option price is the discounted expectation with respect to the measure:

associated with quadratic hedging. According to Theorem 13.2 the martingale measure is such that the option price is the discounted expectation with respect to the measure:

The density of ![]() with respect to the underlying physical measure is

with respect to the underlying physical measure is

where

In fact, (16.32) in Theorem 16.2 implies that

which can be written as

where we use the notation ![]() . We can derive a similar expression for the density using the excess gross returns

. We can derive a similar expression for the density using the excess gross returns ![]() instead of increments

instead of increments ![]() : we can apply (16.38).

: we can apply (16.38).

16.1.4.3 Simplifying Assumptions

We can simplify the price formula (16.32) and the hedging formula (16.34) making restrictive assumptions on the increments ![]() . These assumptions are the martingale assumption, the assumption of a deterministic mean–variance ratio, the assumption of independence, and the assumption of independence and identical distribution.

. These assumptions are the martingale assumption, the assumption of a deterministic mean–variance ratio, the assumption of independence, and the assumption of independence and identical distribution.

Similar simplifications can be made to the formulas (16.38) and (16.39) when the assumptions are made on the process ![]() of the gross returns.7

of the gross returns.7

Quadratic Hedging Under the Martingale Assumption

Let us assume that  is a martingale with respect to the underlying physical measure

is a martingale with respect to the underlying physical measure ![]() . Then,

. Then,

![]() -almost surely. Thus,

-almost surely. Thus,

Now, we have that ![]() , and

, and

This implies that the option price is the expected value:

The first hedging coefficient is

where ![]() , and

, and ![]() . The expression for

. The expression for ![]() is the same as in the one period model; see (16.19), (16.10), and (16.12). Using the rule of iterated expectations we can also write

is the same as in the one period model; see (16.19), (16.10), and (16.12). Using the rule of iterated expectations we can also write

We can derive the result easily without using Theorem 16.2. Indeed,

where ![]() . Under the martingale assumption,

. Under the martingale assumption,

Also,

Thus, we obtain a sum of similar one period optimizations as in (16.15).

Deterministic Mean–Variance Ratio

Let us denote

Let us assume that the ratio

is deterministic for ![]() . This assumption is made in Föllmer and Schied (2002, Proposition 10.40, p. 396) to derive an expression for the variance-optimal hedging strategy. Note that the mean–variance ratio was used in (16.7) to formulate a sufficient condition for the existence and uniqueness of the variance-optimal hedging strategy (the bounded mean–variance trade-off). Under the assumption of a deterministic mean–variance ratio it holds that

. This assumption is made in Föllmer and Schied (2002, Proposition 10.40, p. 396) to derive an expression for the variance-optimal hedging strategy. Note that the mean–variance ratio was used in (16.7) to formulate a sufficient condition for the existence and uniqueness of the variance-optimal hedging strategy (the bounded mean–variance trade-off). Under the assumption of a deterministic mean–variance ratio it holds that ![]() in (16.33) is deterministic. In fact, now

in (16.33) is deterministic. In fact, now ![]() , and

, and

That is,

Values ![]() are defined recursively for

are defined recursively for ![]() by

by

where we start at ![]() . The fair price in the mean-squared error sense is

. The fair price in the mean-squared error sense is ![]() and the optimal hedging coefficient is

and the optimal hedging coefficient is

Independent Increments

Let us assume that the increments of discounted prices

are independent. Assume that the sigma-algebras are generated by the price process: ![]() . Then, the independence of increments implies that the conditional expectations reduce to unconditional expectations, and

. Then, the independence of increments implies that the conditional expectations reduce to unconditional expectations, and

are deterministic. Thus, the ratio ![]() is deterministic, and we obtain the price and hedging formulas (16.40) and (16.41).

is deterministic, and we obtain the price and hedging formulas (16.40) and (16.41).

i.i.d. Increments

Let us assume that the increments of discounted prices ![]() are independent and identically distributed. Let us denote

are independent and identically distributed. Let us denote

We have that

The price and hedging formulas are obtained from (16.40) and (16.41). Values ![]() are defined recursively for

are defined recursively for ![]() by

by

where we start at ![]() . The fair price in the mean-squared error sense is

. The fair price in the mean-squared error sense is ![]() and the optimal hedging coefficient is

and the optimal hedging coefficient is

The density of the martingale measure ![]() with respect to the underlying physical measure is

with respect to the underlying physical measure is

where

16.2 Local Quadratic Hedging

Local quadratic hedging applies a much simpler recursive scheme for minimizing the quadratic hedging error than global quadratic hedging of Section 16.1. Local quadratic hedging solves the minimization only approximately. This numerical error could be compensated if a more accurate statistical estimation is possible.

Local quadratic hedging reduces the minimization of quadratic hedging error to a series of minimizations in one period models. Thus, in the one period model global and local quadratic hedging are identical. We introduce local quadratic hedging using the two period model, and after that cover the multiperiod model.

16.2.1 The Two Period Model

We introduce local quadratic hedging using the two period model. In the two period model the value process and the discounted contingent claim are defined as

where ![]() ,

, ![]() ,

, ![]() , and

, and ![]() .

.

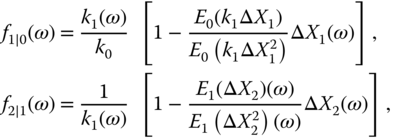

In local quadratic hedging the minimization is done in two steps.

- 1. First, we find

and

and  minimizing

minimizing

This is the population version of a linear least-squares regression with the response variable

and the explanatory variable

and the explanatory variable  . The minimizers are

. The minimizers are

- 2. Second, we find

and

and  minimizing

minimizing

This is the population version of a linear least-squares regression with the response variable

and the explanatory variable

and the explanatory variable  . The minimizers are

. The minimizers are

The minimization problems are easier to solve than in the case of global quadratic hedging. However, we are not able to minimize

but only to minimize it approximately.

We can write the price of the discounted contingent claim obtained by local quadratic hedging as

The first hedging coefficient ![]() can be written as

can be written as

The hedging coefficients ![]() and

and ![]() give the number of stocks in the hedging portfolio. The number of bonds

give the number of stocks in the hedging portfolio. The number of bonds ![]() and

and ![]() are obtained from the self-financing restrictions as in (16.3):

are obtained from the self-financing restrictions as in (16.3):

16.2.1.1 A Comparison to the Global Quadratic Hedging

To highlight the difference between the local and the global quadratic hedging, let us recall the global quadratic hedging of Section 16.1. In the global quadratic hedging we want to find ![]() minimizing

minimizing

The minimization problem can be solved in two steps. First, we find ![]() minimizing

minimizing

Let the minimizer be ![]() . The minimizer depends on

. The minimizer depends on ![]() and

and ![]() . Second, we find

. Second, we find ![]() and

and ![]() minimizing

minimizing

The quadratic price is ![]() .

.

16.2.1.2 The Martingale Measure

Let us study the martingale measure ![]() implied by the local hedging. The density of the martingale measure with respect to the physical measure

implied by the local hedging. The density of the martingale measure with respect to the physical measure ![]() is

is

where

with

for ![]() . The derivation of the martingale measure is given in (16.55) for the multiperiod model.

. The derivation of the martingale measure is given in (16.55) for the multiperiod model.

We can write the density in terms of the excess gross return. Namely,

where

and

for ![]() . This is possible, because the denominator and nominator can be multiplied by the square of

. This is possible, because the denominator and nominator can be multiplied by the square of ![]() , which is

, which is ![]() -measurable, and can be placed inside

-measurable, and can be placed inside ![]() .

.

A Martingale Measure for S&P 500: Two Steps

Let us estimate the equivalent martingale measure associated with quadratic hedging using S&P 500 daily data of Section 2.4.1. Let us consider a two-step model with two steps of 10 days. We choose interest rate ![]() . Let

. Let

be the price increments, where ![]() is the current time. When

is the current time. When ![]() runs through a long time period the observations are not stationary, but we can use our S&P 500 data to provide a sample of identically distributed observations of

runs through a long time period the observations are not stationary, but we can use our S&P 500 data to provide a sample of identically distributed observations of ![]() . We use non-overlapping increments. The observations are

. We use non-overlapping increments. The observations are

Let us estimate the density

of martingale measure ![]() with respect to the physical measure

with respect to the physical measure ![]() .

.

First, we have to estimate ![]() and

and ![]() using nonparametric regression. Let us denote

using nonparametric regression. Let us denote

Let ![]() and

and ![]() be the kernel regression estimates.8 Then, we obtain the estimates of

be the kernel regression estimates.8 Then, we obtain the estimates of ![]() and

and ![]() as

as

The estimate of ![]() is

is

Second, we have to estimate ![]() and

and ![]() . The estimates

. The estimates ![]() and

and ![]() are the sample averages. Then, we obtain the estimates of

are the sample averages. Then, we obtain the estimates of ![]() and

and ![]() as

as

The estimate of ![]() is

is

Now, we have obtained the estimate

The density of the martingale measure with respect to the Lebesgue measure can be estimated as

where ![]() is a two-dimensional kernel density estimate of the underlying physical measure of

is a two-dimensional kernel density estimate of the underlying physical measure of ![]() . The kernel density estimator is defined in (3.43).

. The kernel density estimator is defined in (3.43).

Figure 16.4 shows estimates of the density of the local quadratic martingale measure with respect to the physical measure. Panel (a) shows a contour plot and panel (b) shows a perspective plot.

Figure 16.4 A local quadratic martingale measure: Two period model. (a) A contour plot; (b) a perspective plot. Estimates of the density of the local quadratic martingale measure with respect to the physical measure.

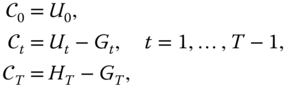

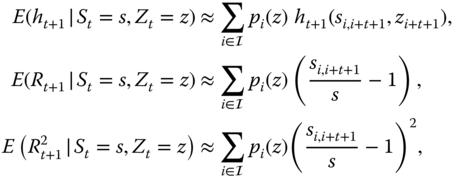

16.2.2 The Multiperiod Model

Let

be the discounted value of the derivative at the expiration. We define recursively values ![]() and

and ![]() ,

, ![]() , starting with the value

, starting with the value ![]() . Let

. Let ![]() and

and ![]() be the minimizers of

be the minimizers of

for ![]() , over

, over ![]() , where

, where

This is a conditional population least-squares linear regression problem with the response variable ![]() and the explanatory variable

and the explanatory variable ![]() . The problem is similar to the minimization problem in the one period model of Section 16.1.2, but now we are conditioning on

. The problem is similar to the minimization problem in the one period model of Section 16.1.2, but now we are conditioning on ![]() . The solutions are

. The solutions are

and

Value ![]() is the price suggested by local quadratic hedging and

is the price suggested by local quadratic hedging and ![]() is the hedging coefficient at time 0, which is suggested by local quadratic hedging.

is the hedging coefficient at time 0, which is suggested by local quadratic hedging.

We can write ![]() using the undiscounted prices

using the undiscounted prices ![]() and

and ![]() as

as

where

The price can be written as:9

The hedging coefficients can be written as10

When ![]() are independent, then

are independent, then

where ![]() , and the price is

, and the price is

Also, similarly as in (14.34), when ![]() are independent,

are independent,

where ![]() .

.

16.2.2.1 A Comparison to Black–Scholes

We compare the quadratic prices and hedging coefficients to the Black–Scholes prices and hedging coefficients. We assume the independence of increments and use formulas (16.49) and (16.50). We apply S&P 500 daily data of Section 2.4.1. The Black–Scholes prices and deltas are computed using the annualized standard deviation as the volatility.

Figure 16.5 compares quadratically optimal prices to Black–Scholes prices. Panel (a) shows the quadratically optimal prices (black) and the Black–Scholes prices (red) as a function of moneyness ![]() . Time to expiration is 20 trading days. Panel (b) shows the ratios of the quadratically optimal prices to the Black–Scholes prices as a function of moneyness. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green). We see from panel (b) that when the moneyness is less than one, then the quadratic prices are less than the Black–Scholes prices. When the moneyness is about 0.95, then increasing the time to expiration makes the ratio of the quadratic prices to the Black–Scholes prices increase.

. Time to expiration is 20 trading days. Panel (b) shows the ratios of the quadratically optimal prices to the Black–Scholes prices as a function of moneyness. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green). We see from panel (b) that when the moneyness is less than one, then the quadratic prices are less than the Black–Scholes prices. When the moneyness is about 0.95, then increasing the time to expiration makes the ratio of the quadratic prices to the Black–Scholes prices increase.

Figure 16.5 Call prices. (a) The quadratic prices (black) and the Black–Scholes prices (red) as a function of moneyness  . (b) The ratios of the quadratic prices to the Black–Scholes prices. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green).

. (b) The ratios of the quadratic prices to the Black–Scholes prices. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green).

Figure 16.6 compares quadratic hedging coefficients to Black–Scholes hedging coefficients. Panel (a) shows the quadratic hedging coefficients (black) and the Black–Scholes hedging coefficients (red) as a function of moneyness ![]() . Time to expiration is 20 trading days. Panel (b) shows the ratios of the quadratic hedging coefficients to the Black–Scholes hedging coefficients as a function of moneyness. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green). We see from panel (b) that when the moneyness is about one, then increasing the time to expiration makes the ratio of the quadratic hedging coefficient to the Black–Scholes hedging coefficient increase. When the moneyness is less than 0.95 and the time to expiration is 20 days, then the quadratic hedging coefficient is much larger than the Black–Scholes hedging coefficient.

. Time to expiration is 20 trading days. Panel (b) shows the ratios of the quadratic hedging coefficients to the Black–Scholes hedging coefficients as a function of moneyness. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green). We see from panel (b) that when the moneyness is about one, then increasing the time to expiration makes the ratio of the quadratic hedging coefficient to the Black–Scholes hedging coefficient increase. When the moneyness is less than 0.95 and the time to expiration is 20 days, then the quadratic hedging coefficient is much larger than the Black–Scholes hedging coefficient.

Figure 16.6 Hedging coefficients. (a) The quadratic hedging coefficients (black) and the Black–Scholes hedging coefficients (red) as a function of moneyness  . (b) The ratios of the quadratic hedging coefficients to the Black–Scholes hedging coefficients. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green).

. (b) The ratios of the quadratic hedging coefficients to the Black–Scholes hedging coefficients. Time to expiration is 20 days (black), 40 days (red), 60 days (blue), and 80 days (green).

16.2.2.2 Square Integrability

The local quadratic trading strategy needs to be square integrable, in the sense of assumption (16.6). The square integrability is studied in Föllmer and Schied (2002, Proposition 10.10, p. 377). In fact, in order to guarantee the satisfaction of (16.6), it is enough to assume

![]() -almost surely, for

-almost surely, for ![]() , for a constant

, for a constant ![]() . Condition (16.51) of the bounded mean–variance trade-off appeared already in (16.7), where it was stated to guarantee the existence of a global quadratic trading strategy. Denote

. Condition (16.51) of the bounded mean–variance trade-off appeared already in (16.7), where it was stated to guarantee the existence of a global quadratic trading strategy. Denote ![]() . Assumption (16.51) implies that

. Assumption (16.51) implies that ![]() Thus we have for the local quadratic hedging coefficients

Thus we have for the local quadratic hedging coefficients ![]() that

that

where we used for the first equality the law of the iterated expectations, and for the third inequality the Cauchy–Schwarz inequality. Thus, the square integrability of ![]() implies the square integrability of

implies the square integrability of ![]() , which implies the square integrability of

, which implies the square integrability of ![]() . The backward induction shows that the square integrability of

. The backward induction shows that the square integrability of ![]() implies the square integrability of

implies the square integrability of ![]() for

for ![]() , under assumption (16.51).

, under assumption (16.51).

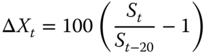

16.2.2.3 The Equivalent Martingale Measure

Let us find the equivalent martingale measure ![]() implied by the local quadratic hedging. The density of the martingale measure with respect to the physical measure

implied by the local quadratic hedging. The density of the martingale measure with respect to the physical measure ![]() is

is

where

with

In order that density ![]() is positive we have to assume that

is positive we have to assume that

![]() -almost surely on

-almost surely on ![]() . Otherwise,

. Otherwise, ![]() would be a signed measure and not a probability measure.

would be a signed measure and not a probability measure.

A Derivation of the Equivalent Martingale Measure

Let us show that

This follows because we can write

Now, we have

which can be written as

where we use the notation ![]() . Note that (16.56) implies that

. Note that (16.56) implies that

Characterizations of the Equivalent Martingale Measure

Measure ![]() in (16.52) can be characterized as a minimal martingale measure. Föllmer and Schied (2002, Definition 10.21, p. 382) define a minimal martingale measure to be such measure

in (16.52) can be characterized as a minimal martingale measure. Föllmer and Schied (2002, Definition 10.21, p. 382) define a minimal martingale measure to be such measure ![]() which is equivalent to

which is equivalent to ![]() ,

, ![]() , and such that every square integrable

, and such that every square integrable ![]() -martingale

-martingale ![]() which is strongly orthogonal to

which is strongly orthogonal to ![]() is also a

is also a ![]() -martingale. The strong orthogonality of

-martingale. The strong orthogonality of ![]() and

and ![]() means that

means that

![]() -almost surely, for

-almost surely, for ![]() .

.

Föllmer and Schied (2002, Theorem 10.22, p. 383) states that if ![]() is a minimal martingale measure, then (16.57) holds. Föllmer and Schied (2002, Corollary 10.28, p. 388) states that there exists at most one minimal martingale measure.

is a minimal martingale measure, then (16.57) holds. Föllmer and Schied (2002, Corollary 10.28, p. 388) states that there exists at most one minimal martingale measure.

Föllmer and Schied (2002, Theorem 10.30, p. 390) proves the existence and the uniqueness of a minimal martingale measure, and gives formula (16.58) for the density of the minimal martingale measure. Let us assume the condition (16.54) of positivity and the condition (16.51) of the bounded mean–variance trade-off. Then there exists a unique minimal martingale measure ![]() with density

with density

where ![]() and

and

with ![]() and

and

where ![]() is defined in (16.53), and

is defined in (16.53), and ![]() is the martingale part of the Doob decomposition of

is the martingale part of the Doob decomposition of ![]() . The Doob decomposition of

. The Doob decomposition of ![]() is

is

where ![]() is a martingale and

is a martingale and ![]() is predictable. The Doob decomposition is defined as

is predictable. The Doob decomposition is defined as

where ![]() ,

, ![]() , and

, and ![]() ; see Föllmer and Schied (2002, Proposition 6.1, p. 277).

; see Föllmer and Schied (2002, Proposition 6.1, p. 277).

Now we can show that the measure in (16.52) is the same as the minimal martingale measure in (16.58). Indeed,

and

16.2.3 Local Quadratic Hedging without Self-Financing

It is of interest to note that when we define a local quadratic hedging without self-financing, then the price will be the same, the hedging coefficients of the stocks will be the same, and only the hedging coefficients of the bonds will be different. A local quadratic hedging without self-financing can be defined in a similar way as the local quadratic hedging with self-financing, but we replace the value process with the wealth process.

16.2.3.1 Backward Induction

Let us consider the two period model with ![]() . Let us describe local quadratic hedging when the wealth process is used. The wealth at times 0, 1, and 2 is equal to

. Let us describe local quadratic hedging when the wealth process is used. The wealth at times 0, 1, and 2 is equal to

The self-financing condition would state that ![]() and

and ![]() should be chosen so that

should be chosen so that

In local quadratic hedging without self-financing we first find ![]() and

and ![]() minimizing

minimizing

This is the population version of a linear least-squares regression with the response variable ![]() and the explanatory variable

and the explanatory variable ![]() . The minimizers are

. The minimizers are

Let us denote

Term ![]() is obtained by “discounting” term

is obtained by “discounting” term ![]() . Second, we find

. Second, we find ![]() and

and ![]() minimizing

minimizing

This is the population version of a linear least-squares regression with the response variable ![]() and the explanatory variable

and the explanatory variable ![]() . The minimizers are

. The minimizers are

The optimal price in the local quadratic sense is

Term ![]() is obtained by “discounting” term

is obtained by “discounting” term ![]() . The price can be written as

. The price can be written as

The price is equal to the price which is obtained with the self-financing condition, as can be seen from (16.42). The first hedging coefficient can be written as

The hedging coefficient is equal to the hedging coefficient in (16.43), which is obtained with the self-financing restriction.

16.2.3.2 A Comparison with the Case of Self-Financing

We have seen that the price ![]() and the hedging coefficients

and the hedging coefficients ![]() and

and ![]() are the same whether the self-financing restriction is imposed or not. What about the coefficients

are the same whether the self-financing restriction is imposed or not. What about the coefficients ![]() and

and ![]() ? The quantities of the bonds are given by

? The quantities of the bonds are given by

The quantities can be compared to the quantities when the self-financing condition holds, given in (16.44) as

We see that ![]() are equal, but

are equal, but ![]() are different.11

are different.11

16.2.3.3 Mean Self-Financing

We have obtained a hedging strategy that is not self-financing, but it is mean self-financing, as defined in (16.5). Indeed,

because ![]() and

and ![]() since

since ![]() is

is ![]() -measurable and

-measurable and ![]() is

is ![]() -measurable.

-measurable.

16.3 Implementations of Local Quadratic Hedging

We have derived formulas for the quadratic price and the quadratic hedging coefficient. The formulas are not in a closed form but their application requires numerical methods. In addition, the formulas depend on the knowledge of the unknown data generating mechanism, and we need to use statistical methods to estimate the data generating mechanism.

We implement only the local quadratic hedging, both for the case when the increments are assumed to be independent, and for the case when the increments are assumed to be dependent.

Section 16.3.1 describes the basic setting of historical simulation. Section 16.3.2 describes numerical and statistical methods for the case of independent increments. Section 16.3.3 considers the case of dependent increments. Section 16.3.4 compares the implementations of quadratic pricing and hedging to some benchmarks.

16.3.1 Historical Simulation

To implement quadratic hedging we use historical simulation. Analogously, Monte Carlo simulation could be applied. In Monte Carlo simulation a statistical model is imposed, and sequences of observations are generated from the model. In historical simulation only the previous observations are used.

A similar type of implementation has been described in Potters et al. (2001), where price functions ![]() and hedging functions

and hedging functions ![]() are estimated using an expansion with basis functions, whereas we use kernel estimation. Also, we implement a method where the price function and the hedging function depend on volatility, so that they have the form

are estimated using an expansion with basis functions, whereas we use kernel estimation. Also, we implement a method where the price function and the hedging function depend on volatility, so that they have the form ![]() and

and ![]() .

.

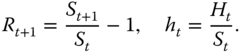

16.3.1.1 Generating Sequences of Observations

We denote the time series of observed historical daily prices by ![]() . The price

. The price ![]() is the current price. We construct

is the current price. We construct ![]() sequences of prices:

sequences of prices:

where

Each sequence consists of ![]() values, and the initial price in each sequence is

values, and the initial price in each sequence is ![]() .

.

We may choose to use less than ![]() sequences, to make computation faster. Note that

sequences, to make computation faster. Note that ![]() sequences are overlapping, so that the use of the all possible

sequences are overlapping, so that the use of the all possible ![]() sequences may not increase statistical accuracy much, as compared for using a lesser number of sequences. We may construct

sequences may not increase statistical accuracy much, as compared for using a lesser number of sequences. We may construct ![]() sequences of prices, and to get non-overlapping sequences we may choose

sequences of prices, and to get non-overlapping sequences we may choose ![]() , and choose index

, and choose index ![]() to take the values

to take the values ![]() , for

, for ![]() .

.

16.3.1.2 The State Variable

With sequence ![]() of prices there is an associated sequence

of prices there is an associated sequence ![]() of state variables. Each

of state variables. Each ![]() can be a vector. We have constructed sequences

can be a vector. We have constructed sequences ![]() , which all start at the current stock price

, which all start at the current stock price ![]() . The values of the state variables that correspond to sequence

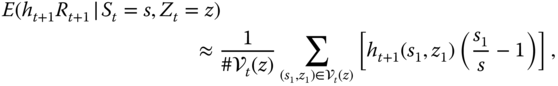

. The values of the state variables that correspond to sequence ![]() are

are

To utilize the information in the state variables, we use only those sequences ![]() that are such that at time

that are such that at time ![]() the value of the vector

the value of the vector ![]() of state variables is close to the current value

of state variables is close to the current value ![]() of the state variables. Let

of the state variables. Let ![]() be the collection of those times:

be the collection of those times:

where ![]() is the radius of the window, and

is the radius of the window, and ![]() is the Euclidean distance.

is the Euclidean distance.

For example, we can choose the state variable to be the logarithm of the current prediction of volatility:

where ![]() is estimated using the observed prices

is estimated using the observed prices ![]() . For instance, we can apply the GARCH(

. For instance, we can apply the GARCH(![]() ) volatility estimate.12Then

) volatility estimate.12Then ![]() is defined as

is defined as

where ![]() is the radius of the window. This is similar to the nonparametric GARCH-pricing in Section 15.3.

is the radius of the window. This is similar to the nonparametric GARCH-pricing in Section 15.3.

16.3.1.3 Heuristic Discussion

We want to solve a series of linear regression problems

for ![]() , where

, where ![]() . These regression problems are conditional on

. These regression problems are conditional on ![]() and

and ![]() . The solutions are functions

. The solutions are functions ![]() and

and ![]() , where

, where ![]() is the discounted value of the stock and

is the discounted value of the stock and ![]() is the value of the state variable. The sample version of the regression problem is

is the value of the state variable. The sample version of the regression problem is

where ![]() , and

, and ![]() .

.

In analogy, consider first the standard linear regression model

Assume we observe ![]() ,

, ![]() , from this model. Then,

, from this model. Then,

and we can estimate the constants ![]() and

and ![]() . Our setting resembles the model

. Our setting resembles the model

where ![]() is an additional random variable, and

is an additional random variable, and ![]() and

and ![]() are functions. Assume that we observe

are functions. Assume that we observe ![]() ,

, ![]() , from this model. Then

, from this model. Then

In order to estimate values ![]() and

and ![]() for a fixed

for a fixed ![]() we cannot use the standard linear regression, because there are no observations from model

we cannot use the standard linear regression, because there are no observations from model ![]() . Instead, we can estimate the functions

. Instead, we can estimate the functions ![]() and

and ![]() by localizing into the neighborhood of

by localizing into the neighborhood of ![]() . Let

. Let ![]() . Now, we can use linear regression for the observations

. Now, we can use linear regression for the observations

Note that we need to estimate functions ![]() and

and ![]() only at the points

only at the points ![]() and

and ![]() ,

, ![]() .

.

We need to estimate functions ![]() and

and ![]() of two arguments (where

of two arguments (where ![]() may be a vector). This can be done in two ways.

may be a vector). This can be done in two ways.

- 1. We can localize with respect to both

and

and  .

. - 2. We can estimate function

Now, it is possible to avoid localization with respect to

, make the localization only with respect to

, make the localization only with respect to  , and have available more observations to make the estimation. This is possible for certain

, and have available more observations to make the estimation. This is possible for certain  .

.

Estimation of (16.61) is done by changing model (16.60) to model

where

An estimate ![]() leads to estimate

leads to estimate

Now the localization with respect to ![]() is not necessary when

is not necessary when ![]() , since

, since ![]() . In this case we can ignore the current level of the trajectory of the stock price.

. In this case we can ignore the current level of the trajectory of the stock price.

16.3.2 Local Quadratic Hedging Under Independence

We apply the local quadratic hedging and assume independence of the increments. The hedging coefficients are given by the formula (16.49) as

where ![]() . The price is given by the formula (16.50) as

. The price is given by the formula (16.50) as

Here ![]() is the discounted payoff of the derivative,

is the discounted payoff of the derivative, ![]() , and

, and ![]() are the discounted prices of the risky asset.

are the discounted prices of the risky asset.

Let us assume for notational simplicity that the risk-free rate is zero, so that

The price ![]() involves only unconditional expectations, whereas hedging coefficients

involves only unconditional expectations, whereas hedging coefficients ![]() involve conditional expectations. In our implementation of the case of independent increments we make two simplifications, as compared to the previous heuristic discussion. First, the conditioning with respect to the state variable is done only at the time

involve conditional expectations. In our implementation of the case of independent increments we make two simplifications, as compared to the previous heuristic discussion. First, the conditioning with respect to the state variable is done only at the time ![]() of writing the option. Second, we do not need to move to the model (16.62), but we can handle the conditioning on the stock price

of writing the option. Second, we do not need to move to the model (16.62), but we can handle the conditioning on the stock price ![]() by renormalizing the tails of sequences

by renormalizing the tails of sequences ![]() so that they start with value

so that they start with value ![]() . This is possible because in the case of independent increments the intermediate values

. This is possible because in the case of independent increments the intermediate values ![]() for

for ![]() do not appear.

do not appear.

16.3.2.1 Unconditional Expectations

To estimate the unconditional expectations ![]() we apply sequences

we apply sequences ![]() in (16.59), where

in (16.59), where ![]() . These sequences give us the differences and the terminal values

. These sequences give us the differences and the terminal values

where ![]() . We estimate the unconditional expectations by

. We estimate the unconditional expectations by

16.3.2.2 Conditional Expectations

To estimate the hedging coefficients ![]() , when the stock price is

, when the stock price is ![]() , we renormalize the tails of the sequences. We define sequences such that the initial price is

, we renormalize the tails of the sequences. We define sequences such that the initial price is ![]() , and the number of observations in each sequence is

, and the number of observations in each sequence is ![]() , where

, where ![]() , that is, the length of the sequences is

, that is, the length of the sequences is ![]() . We define

. We define

where

![]() Now the initial price in each sequence is

Now the initial price in each sequence is ![]() .

.

We estimate the conditional expectations ![]() by applying sequences

by applying sequences ![]() in (16.63), where

in (16.63), where ![]() ,

, ![]() , and

, and ![]() . Each such sequence gives the differences and the terminal values

. Each such sequence gives the differences and the terminal values

The conditional expectations ![]() are estimated by

are estimated by

These estimates lead to the estimates of covariances and variances,13 and we obtain estimates of ![]() , which are used to produce an estimate of

, which are used to produce an estimate of ![]() .

.

16.3.2.3 Comparison to Black–Scholes

We compare prices and hedging coefficients of local quadratic hedging (with independence assumption) to the Black–Scholes prices and hedging coefficients.

Comparison to Black–Scholes Prices

Figure 16.7 shows the ratios of the locally quadratic prices (under independence) to the Black–Scholes prices as a function of the annualized volatility. In panel (a) moneyness is ![]() and in panel (b)

and in panel (b) ![]() . The smoothing parameter is

. The smoothing parameter is ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue). The time to expiration is 20 trading days.

(blue). The time to expiration is 20 trading days.

Figure 16.7 Call price ratios as a function of volatility. The ratios of the locally quadratic prices under independence to the Black–Scholes prices as a function of the annualized volatility. (a) Moneyness is  ; (b)

; (b)  . The smoothing parameter is

. The smoothing parameter is  (black),

(black),  (red), and

(red), and  (blue).

(blue).

Figure 16.8 shows the ratios of the locally quadratic prices to the Black–Scholes prices as a function of the moneyness ![]() . In panel (a) the time to expiration is

. In panel (a) the time to expiration is ![]() trading days, and in panel (b)

trading days, and in panel (b) ![]() . The annualized volatility is 0.1 (black), 0.2 (red), and 0.3 (blue). The smoothing parameter is

. The annualized volatility is 0.1 (black), 0.2 (red), and 0.3 (blue). The smoothing parameter is ![]() .

.

Figure 16.8 Call price ratios as a function of moneyness. The ratios of the locally quadratic prices under independence to the Black–Scholes prices as a function of moneyness  . (a)

. (a)  ; (b)

; (b)  . The annualized volatility is

. The annualized volatility is  (black),

(black),  (red), and

(red), and  (blue).

(blue).

Figure 16.9 shows the ratios of the locally quadratic prices to the Black–Scholes prices as a function of the smoothing parameter ![]() . In panel (a) moneyness is

. In panel (a) moneyness is ![]() and in panel (b)

and in panel (b) ![]() . The annualized volatility is 0.1 (black), 0.2 (red), and 0.3 (blue). Time to expiration is

. The annualized volatility is 0.1 (black), 0.2 (red), and 0.3 (blue). Time to expiration is ![]() trading days.

trading days.

Figure 16.9 Call price ratios as a function of the smoothing parameter. The ratios of the locally quadratic prices under independence to the Black–Scholes prices as a function of smoothing parameter  . (a) Moneyness is

. (a) Moneyness is  ; (b)

; (b)  . The annualized volatility is

. The annualized volatility is  (black),

(black),  (red), and

(red), and  (blue).

(blue).

Comparison to Black–Scholes Deltas

Figure 16.10 shows the ratios of the locally quadratic hedging coefficients (under independence) to the Black–Scholes deltas as a function of the annualized volatility. In panel (a) moneyness is ![]() and in panel (b)

and in panel (b) ![]() . The smoothing parameter is

. The smoothing parameter is ![]() (black),

(black), ![]() (red), and

(red), and ![]() (blue). The time to expiration is 20 trading days.

(blue). The time to expiration is 20 trading days.

Figure 16.10 Call hedging coefficient ratios as a function of volatility. The ratios of the locally quadratic hedging coefficients under independence to the Black–Scholes deltas as a function of the annualized volatility. (a) Moneyness is  ; (b)

; (b)  . The smoothing parameter is

. The smoothing parameter is  (black),

(black),  (red), and

(red), and  (blue).

(blue).

Figure 16.11 shows the ratios of the locally quadratic prices to the Black–Scholes prices as a function of the moneyness ![]() . In panel (a) time to expiration is